This article comes fromdecrypt & coindesk, by Kate Irwin & Danny Nelson

Odaily Translator |

Odaily Translator |

If you’re thinking of lending your own “boring ape” BAYC, now may be the time to keep your eyes peeled, as NFT lending service provider BendDAO is going through an unprecedented liquidity crisis.

BendDAO is an NFT liquidity protocol based on a decentralized point-to-pool, and it is also a new NFT lending economic model that combines DeFi and NFT. Through BendDAO, lenders can provide ETH liquidity to the lending pool to earn interest. Borrowers can use NFT as collateral to borrow ETH in the lending pool instantly. The NFT floor price is used as the price feed data of the NFT collateral price, and the borrower can obtain up to 40% of the NFT "floor price" loan in the form of ETH.

According to the design mechanism of BendDAO, if the floor price of relevant digital collectibles drops to a certain level, the platform will force it to be auctioned. The liquidation level is determined by the "health factor" of lending supported by the platform. When the value of this indicator is lower than 1 , the token automatically enters a 48-hour liquidation protection state, and the owner can choose to pay off the debt and recover the NFT; if the user fails to clear the loan, the NFT will be auctioned and the highest bidder will get it. If no one participates in the auction, BendDAO will have to wait for the borrower to repay the debt at some point in the future, or after the market price rises, some liquidators appear to participate in the auction debt, and during this period NFT can only be placed on the platform, according to According to BendDAO, they only experienced temporary floating losses, but the problem is obviously not limited to this——

secondary title

Will BendDAO trigger an NFT liquidity crisis?

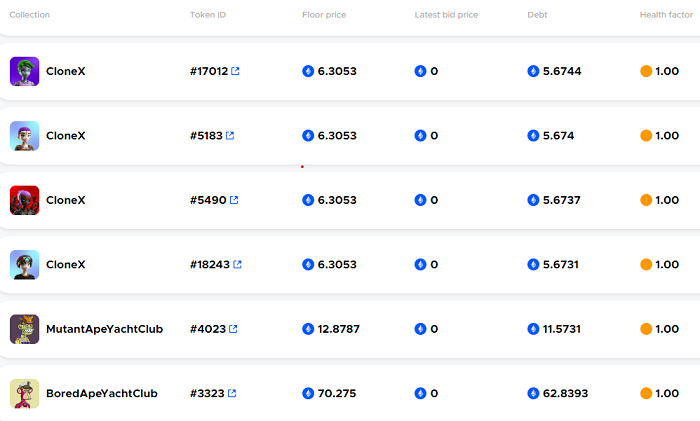

BendDAO stipulates that bids in liquidation auctions must be at least 95% of the reserve price. Although this helps to curb the risk of death spirals, it will cause depositors to be trapped in NFTs (bad debts) that may fall in value, which means that as NFT holders, no ETH can Borrowing, so there will be a "run" because no one wants to be in debt that is not fully backed. If we look at BendDAO's health factor alert list, we will find that a large number of BAYC-supported debt health factor indicators have approached the threshold 1, as shown in the figure below:

So, when these NFTs are liquidated on the BendDAO platform, what will happen? There are mainly the following:

1. No one bids within 48 hours, and the borrower pays to redeem the NFT;

2. No one bids within 48 hours, and the borrower has not repaid, so we can only continue to wait for the borrower to repay or the liquidator to bid;

3. If someone bids within 48 hours, the borrower redeems the NFT and pays the penalty amount to the first bidder;

4. Someone bids within 48 hours, the borrower has not repaid the debt, and the auction participant with the highest price will get the NFT;

Of course, if the NFT floor price rises, the health factor on the BendDAO platform will automatically return to above the liquidation threshold. At this time, although the NFT will not be liquidated, the borrower still needs to pay a penalty.

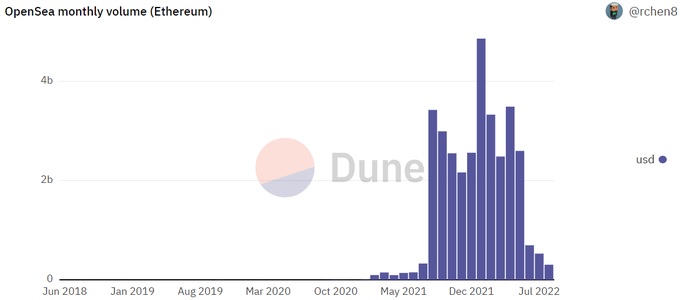

The problem now is that the liquidity of the NFT market is very poor. For example, the monthly trading volume of the NFT market OpenSea has reached its lowest point in the past 12 months (as shown in the figure below), and the entire market simply cannot support the large influx of BendDAO in a short period of time. Clearing transactions, so much so that the entire NFT market can feel the knock-on effect of Bored Apes' massive loan liquidation on BenderDAO. Not only that, the liquidation of NFT is more complicated than alternative assets such as ETH. When using ETH as collateral, when the user's debt reaches the liquidation threshold, the asset has enough liquidity to be simply sold in the market, but NFT also needs to bid People bid to buy.

Since BAYC is one of the most important projects in the entire NFT market, when cascade liquidation occurs on BAYC, it will inevitably have a wider impact, and the consequence may be the collapse of the entire NFT market.

secondary title

Can BendDAO escape death?

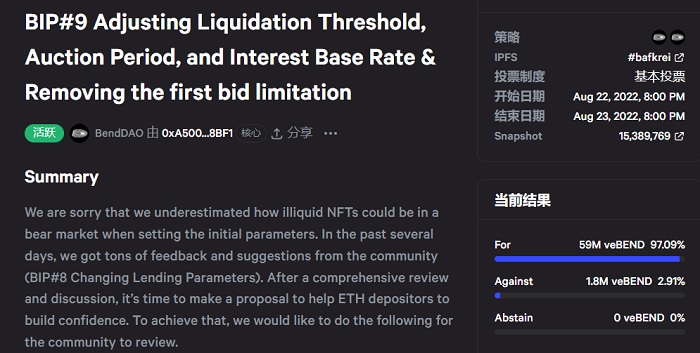

On August 22, BendDAO co-founder @CodeInCoffee revealed on social media that the community has released a new proposal BIP#9, which aims to solve the liquidity crisis by modifying some parameters, including:

1. Adjust the liquidation threshold to 70%, the specific steps are as follows:

Updated to 85% at 12:00 UTC on August 30th

Updated to 80% at 12:00 UTC on September 6th

Updated to 75% at 12 noon UTC on September 13th

Updated to 70% at 12 noon UTC on September 20th

2. Adjust the auction time to 4 hours;

3. Shorten the 48-hour protection window to 4 hours to improve the liquidity of the auction;

4. Cancel the limit of 95% of the floor price for the bidder's first bid;

5. Adjust the base interest rate to 20%, aiming to allow more ETH depositors to earn more interest and prompt more NFT holders to repay ETH.

The voting will end at 8:00 pm on August 23rd. Currently, the approval rate is 97.09%, and the opposition rate is 2.91%.

BendDAO emphasized in a statement that short-term fluctuations in NFT floor prices are normal. The blue-chip NFT consensus was not built in a day, and there will be no crisis of large-scale collapse in a short period of time. But the question is, will things really go the way BendDAO expects? Trouble mounts when no one is willing to bid at the price of an NFT auctioned by BendDAO. There is no doubt that BendDAO seriously underestimated the liquidity problem of NFT in the bear market. From the new proposal released, it can be seen that they obviously do not want to hold the "boring ape JPEG" with less liquidity, but desire to have more Liquid ETH.

In fact, at the beginning of the design, BendDAO did take into account the impact of the short-term sharp fluctuations in NFT prices, which is why they introduced the "health factor", but they did not seem to expect that the bear market would last for such a long time, let alone The NFT floor price fluctuates so much (BAYC floor price has fallen from a peak of 154 ETH to below 70 ETH).

BendDAO tried to release the liquidity of the NFT market as much as possible through a set of mechanisms, but in the end it was trapped by "liquidity". Now this NFT lending platform is in a critical moment of life and death. If the market picks up and the floor price of blue-chip NFT rebounds, BendDAO It may be possible to escape from death; but if the wave of BendDAO liquidation starts and no one takes over, then a death spiral will come, triggering a greater liquidity crisis in the NFT market.