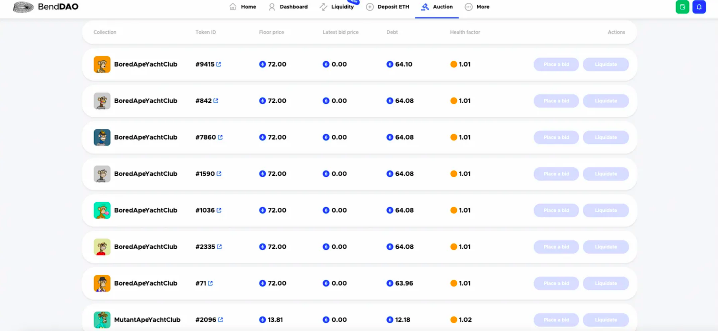

On August 18, Twitter user Cirrus pointed out that a large number of Bored Ape Yacht Club NFTs used as collateral were close to BendDAO's liquidation point (a locked NFT with a health factor of less than 1 would trigger liquidation). According to the BendDAO health factor alert list data, there are currently 26 BAYCs with a health factor of less than 1.1 for the first time ever, and many of them are in serious danger of liquidation.

Immediately afterwards, BendDAO announced today that it will liquidate BAYC with auction number #533 for the first time. The bid must be greater than 95% of the NFT floor price. If the lot is not sold in the end, the platform will bear the floating loss or the borrower will repay the debt in the future . The current BAYC floor price is 71.71 ETH. There are currently no bids.

As a result, concerns about the potential liquidation impact of the NFT market opened up on Twitter today. Among them, a Twitter user named Naimish Sanghvi expressed concern about one of the issues, that is, after entering the liquidation, what if no one wants to buy these liquidated NFTs? What if the floor price gradually reaches zero? The answers to these questions are shocking, even frightening. Naimish Sanghvi also contributed his own answer.

secondary title

BendDAO and NFT liquidation

BendDAO is the first NFT liquidity protocol based on a decentralized peer-to-pool. Users deposit ETH into BendDAO pools and earn interest on them, and these pools are then used to meet the loan needs of NFT holders.

When NFT holders mortgage their NFT, they can borrow ETH worth 30-40% of the NFT floor price at a good interest rate. These funds are lent from the pool, so the interest earned is distributed to the liquidity providers.

But what happens if the price of the locked NFT plummets and reaches a point of liquidation?

Suppose an NFT is mortgaged, its floor price at that time was 10 ETH, and the user mortgaged 4 ETH with it. Assuming that the interest that users need to pay is 10%, then users can get their NFT back after paying 4.4 ETH.

BendDAO uses health factor indicators to determine when NFTs should be liquidated.

Health factor = (floor price * liquidation threshold) / (debt + interest)

If the floor price of the above NFT reaches 4.4 ETH, the health factor will be

HF = (4.4 * 90%)/4.4 = 0.9 (or<1)

secondary title

What is NFT Liquidation Fear?

Currently, $57 million (30,430 ETH) worth of NFTs are being used as collateral on BendDAO. Meanwhile, the floor prices of BAYC and MAYC are falling.

At the time of writing, BAYC's floor price is 72. And a large number of BAYC NFTs are mortgaged when the floor price is 125 ETH. Thus, at 72 ETH, the health factor of a locked NFT is dangerously close to 1. If they fall below that value, or if the floor price drops to 65 ETH, many NFTs may be at risk of liquidation.

There is currently an auction for BAYC #533 that is being liquidated, however, it has not received any bids. What happens if no one buys the auctioned NFT?

Due to the sheer number of NFTs held on BendDAO, the stakes can be high. According to some accounts, about 3% of BAYC is actually staked on the platform. A sharp drop in the floor price may cause several liquidations to occur suddenly.

secondary title

Is there any chance that no one will buy the auctioned NFT?

Let's break this problem into two parts.

1. If there are bidders, how do you ensure that BendDAO does not lose money when the NFT price drops?

Our expectation is that these blue chip NFTs never get too low or drop to zero. At all times, the bid must be higher than the debt. Therefore, as long as there is a bidder, the bid will be higher than the reserve price and the total debt, so in theory, BendDAO will not lose money.

2. However, in reality, what if the auction is over with no bids? Here's what BendDAO has to say.

"In this case, the platform only has temporary floating losses and no actual losses. Either the borrower will repay the debt at a certain time in the future, or after the market price recovers, some liquidators will participate in the auction debt."

BendDAO expects that there will always be a day when the NFT market will recover.

However, NFTs are not known for their liquidity. Especially in NFTs worth thousands of dollars, demand is almost always driven by belief or quick arbitrage opportunities. The incentive for anyone to buy or bid on these NFTs in auctions is not always great.

Because your bid must be more than 95% of the reserve price and higher than the debt amount. But, between these two values, what if there is not much room for arbitrage to make money?

So it seems entirely reasonable that while there will be many auctions, it will likely end without any bids. The auction doesn't start until the first bid is made, so there could be several NFTs in limbo at a given point in time if the price is unfavorable. This should scare liquidity providers. At the end of the day, funds lent against NFTs that will not be sold belong to the LP. Therefore, simply believing that the market will recover is not a good option in my opinion. There is no denying that BendDAO has created a beautiful product. But we cannot ignore the potential risks it brings.