This article comes from Bankless, the original author: William M. Peaster, compiled by Odaily translator Katie Ku.

This article comes from

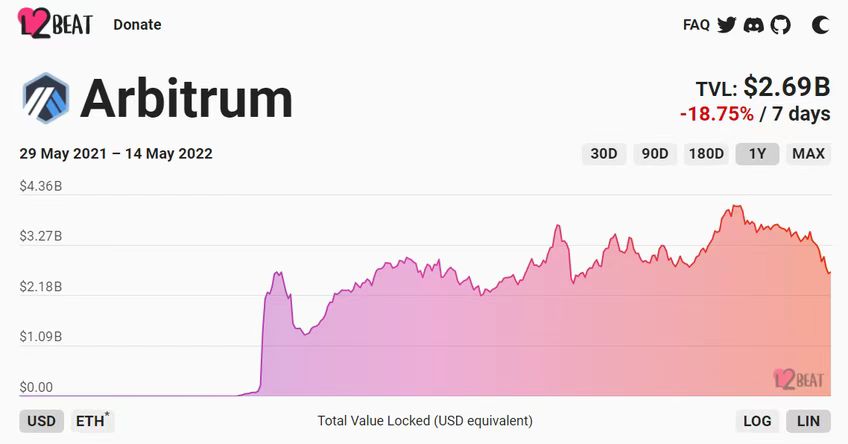

Layer 2 will see an influx of projects and users in the coming months.

A few weeks ago, Optimism announced the details of the airdrop. zkSync has confirmed their tokens on the official website. We have already witnessed two of the four major Layer 2 (Arbitrium, Optimism, StarkNet, and zkSync) issuing tokens. Next the turntable will turn to Arbitrium and StarkNet. While nothing has been confirmed, it’s likely that both protocols will use their own native tokens in the future. Now that airdrops are a standard part of token issuance, how do you ensure you qualify for the next big airdrop if Arbitrium launches a token?

secondary title

Preparing for the Arbitrium Airdrop

In April 2022, Offchain Labs, the creator of Arbitrum, announced an 8-week initiative, inviting users to participate in top projects in the Layer 2 ecosystem and win free minted NFTs. I speculate that the participants of this project may be on the list of users for future Arbitrum token airdrops. If you have tried Layer2 before, or Offchain Labs has taken snapshots (or multiple times), then using Arbitrium in the near future may be the lucky winner of an Arbitrium token airdrop, or increase your token allocation.

There is also the dApp layer to consider. There are no start-up projects on Arbitrium that have launched their own native tokens, so below I will introduce some tips for using Arbitrium, the basics of the Arbitrium Odyssey initiative, and some Arbitrium dApps.

secondary title

Arbitrum Airdrop Basic Strategy

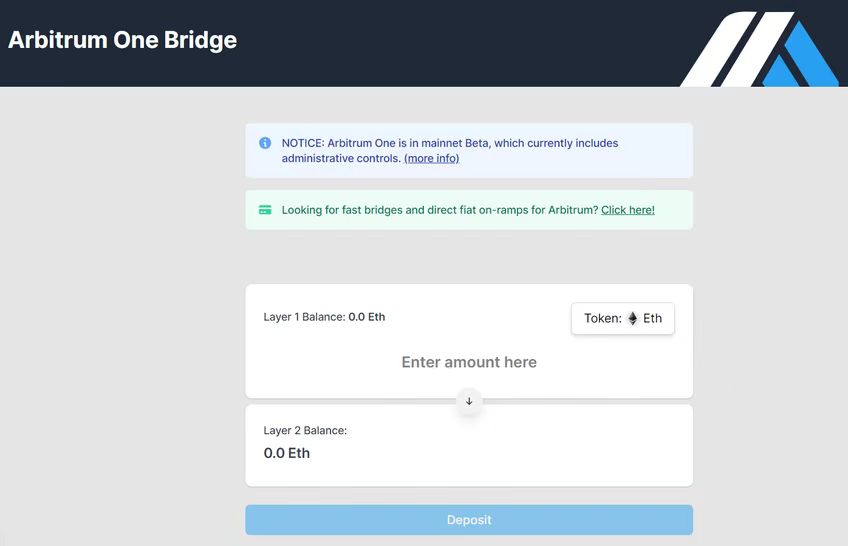

First, you have to transfer funds to Arbitrum and use the network.

Using the Arbitrum One Bridge may be a great opportunity for new users to get an airdrop of Arbitrum tokens.

We recommend that you:

1. Add the Arbitrum network to the wallet through Chainlist;

3. Search Arbitrum One Portal, find a Dapp, and invest funds, such as Balancer liquidity pool.

The airdrop of Optimism OP tokens will involve multiple users, and regular use of cross-chain bridges such as Hop Protocol can be considered. Alternate some Layer 2 activities back and forth between Arbitrum and Optimism etc. This may increase the probability of getting more OP and Arbitrum native tokens.

secondary title

Preparing for the Arbitrium Odyssey Initiative

The Arbitrium Odyssey may involve future retrospective Arbitrium token offerings. This is for sure at the moment, and following the project for 2 months will be extra points for getting more token airdrops.

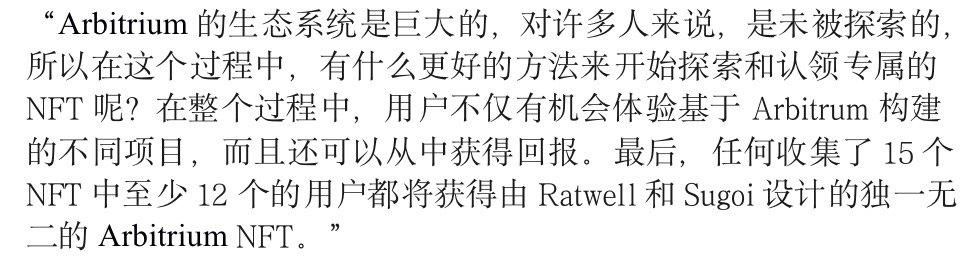

What is an Odyssey?

Odyssey is an initiative that allows users to earn free Mint NFTs designed by Tubby Cats NFT artists Ratwell and Sugoi. In exchange, users can try out certain projects on Arbitrium for certain weeks. Offchain Labs explained:

The dApps that will be included in the program have been decided by snapshot voting. The Odyssey initiative will begin this month with the following schedule:

Week 1: Bridge Week

Week 2: Yield Protocol and Hashflow

Week 3: Aboard Exchange and TofuNFT

Week 4: Uniswap and Apex

Week 5: 1inch and Izumi/Yin Finance

Week 6: Dodo and Swapr

Week 7: TreasureDAO and BattleflyWeek 8: Ideamarket and SushiDuring the show,

The first week will reward users for trying one of the nearly 20 Arbitrium-compatible cross-chain bridges live today. Users who try the cross-chain bridge with the most traffic this week will also receive additional NFT rewards.

Offchain Labs has not yet announced the official release date of Odyssey, which is scheduled for mid-May. Follow the Arbitrum Twitter account or join the Discord for the latest news.

secondary title

12 Arbitrum dApps worth watching without a token

There are currently some dApps that provide Arbitrum support, but have not issued coins yet. Whether the following projects will launch token economic strategies, or whether these strategies will be centered on Arbitrum, you can consider trying it early on Layer 2 in the near future.

The following dApps are recommended:

Across — L1 and L2 two-way cross-chain protocol

Risk Harbor — Web3 Risk Management Marketplace

Cozy Finance — DeFi Deposit Insurance Protocol

Zapper — Web3 asset management platform

Zerion — Popular Web3 asset management platform

Slingshot — L2 decentralized exchange

Gnosis Safe — multi-signature transaction solution

Hashflow — Cross-chain exchange protocol

Volmex — protocol for creating implied volatility derivatives (not available to US users)

Orbiter Finance — Cross-Rollup Cross-Chain Protocol (TVL is relatively small)