secondary title

What is GameFi

Financial aspects have never been more intertwined with the gaming industry thanks to the rise of blockchain technology. Blockchain games are also called decentralized games, namely GameFi - Game (game) + DeFI (decentralized finance).

Blockchain, digital art, and NFT are gradually infiltrating all aspects of our lives, and the entertainment industry is one of them. NFT games based on blockchain technology are rapidly revolutionizing the traditional gaming experience, attracting more and more gamers.

secondary title

History of GameFi

In November 2017, a blockchain-based pet raising game, CryptoKitties, the originator of blockchain games, attracted the attention of users. CryptoKitties took up more than 15% of the Ethereum network within a few hours of its launch, contributed nearly 30% of the transaction volume of ETH, and even directly caused the congestion of the entire Ethereum network; The needs and enthusiasm of the blockchain game market.

At its peak, a CryptoKitties even sold for millions of dollars, but after the bubble burst, CryptoKitties fell to the bottom. In the following 18 and 19 years, blockchain games have entered an era of barbaric growth, with gamblers entering the game regardless of cost, and inferior project parties waving sickles with exaggerated gimmicks. The exaggerated bubble of "blockchain games" finally entered a cooling-off period in Q2 of 2019 - such an unhealthy development model cannot last long, after all, under the mood of "getting rich" who still has the heart to play games or develop games Woolen cloth?

I have always used the term "blockchain game" before, because GameFi was originally defined as GameFinance, which was proposed by the Chief Strategy Officer of MixMarver at the Wuzhen Conference at the end of 2019, that is, games with financial attributes. Later, when DeFi appeared, YFI founder AC said: DeFi's future attributes will be more gamified, and GameFi is widely called Game (game) + DeFI (decentralized finance).

So far, the concept of Game+DeFi+NFT has been recognized by users. But it doesn’t seem to be a particularly healthy model to just rely on hype to change hands, and the “Play to Earn” (earn while playing) economic model pioneered by Axie Infinity solves this very well. The "Play to Earn" model is considered to be one of the cores of GameFi, and it is still emulated by the entire GameFi field until now.

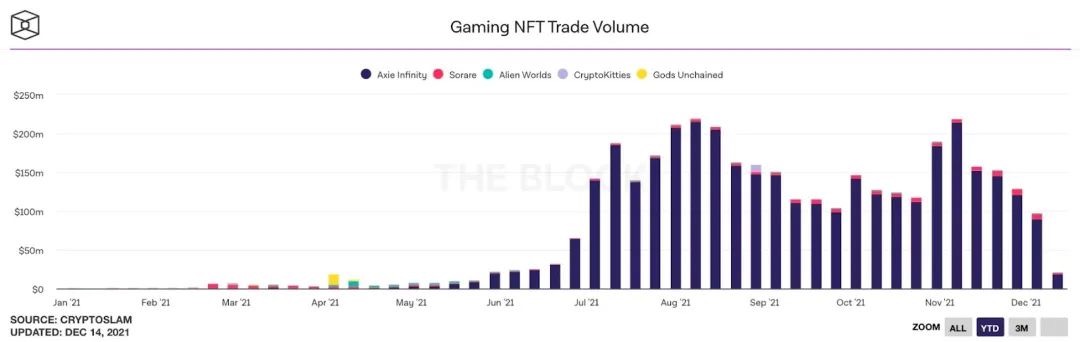

While the uptrend has faded in recent months, popular titles such as Axie Infinity, DeFi Kingdoms, Pegaxy, MOBOX, and Bomb Crypto continue to see transaction volumes in the millions per day.

secondary title

How GameFI Empowers Traditional Games

The biggest pain point of traditional games is that players are in a weak position and have no dominance. The equipment and armed characters that players have worked so hard to build may be discarded after a version update; developers can increase the number of props at any time, and the props in the hands of players can also become worthless. In addition, players can only be consumers, and they have always been consumers-even if they use third-party platforms to sell items for profit, there is no stability. As strong as V God, he also angrily deleted the game after protesting that Blizzard's version update was fruitless.

And the P2E model pioneered by Axie, which has changed the situation in which players can only be consumers in traditional games. In the P2E mode, chain game players can not only play games, but also bypass the third party to obtain actual income and ask for returns from the market—all of which are determined entirely by the market rather than centralized game companies. Traditional games are just games, and the identities of players and investors are separated; while P2E makes chain game players change their identities, they can be players, participants, and investors.

secondary title

The Heart of the GameFi Project - Take Axie Infinity and Wolf Game as Examples

Axie Infinity - a good economic model is the key to the continuity of the project

Axie Infinity (hereinafter referred to as Axie) is a blockchain game that was launched in 2018. The game type is somewhat similar to Pokémon Battle.

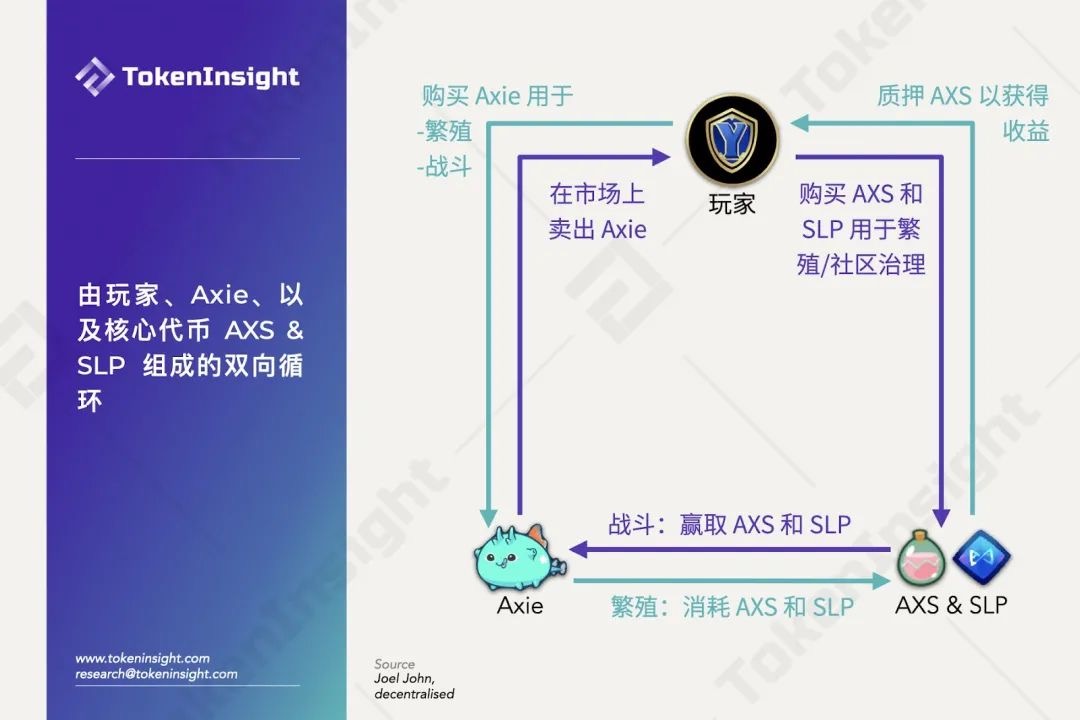

Axie has two kinds of tokens: SLP and AXS. The economy under the blessing of dual tokens is also more stable, and its utility is as follows:

image description

Image source: TokenInsight

If players want to obtain Axie NFT, they need to consume AXS and SLP; so the demand for Axie NFT ultimately drives the demand for AXS and SLP. On the contrary, by playing against players in the game, the winner can get AXS and SLP. Therefore, if the player's demand for Axie NFT is created, it is the key to the sound development of the Token economy. Moreover, the two tokens, AXS and SLP, can be traded directly through the trading platform and are easy to cash out, which has also inspired the enthusiasm of many players.

However, if players overproduce Axie NFT regardless of cost, and there are not enough new players to offset the output of Token, it may cause the price of Token to drop. Therefore, the official has also made various attempts to increase the reproduction cost of Axie NFT, in order to maintain the balance of supply and demand and the stability of the game. Of course, the game also involves elements such as land, and the gameplay and details are various. I won’t elaborate here, and you can understand it yourself.

In short, there are three keys to the success of Axie Infinity: one is the initial selection of the right market and target users; the second is due to its pioneering P2E model and high-quality token economic model; the third is the traffic of the YGG Game Association push and other factors.

By the way, the GameFi game guild refers to users (or communities) participating in GameFi to make profits in a group way, and most of them are managed in the way of DAO. The trade union is also a good "intermediary" between GameFi and players. It can mine high-quality GameFi and guide players to make profits. It has a great influence on the GameFi market and is even called a "promoter".

Wolf Game once became the focus of the market in November 21, reaching a transaction volume of 3000w+ US dollars.

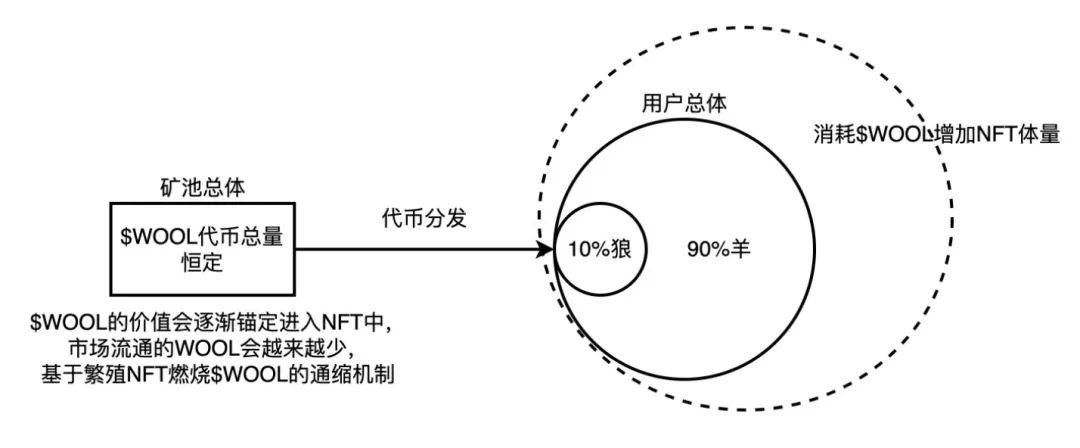

image description

Data source: nftgo.io

Also, sheep and wolves can also stake, which makes the gameplay even more exciting. The sheep can release the Stake after accumulating 20,000 WOOL tokens, and there is a 50% probability that 100% of the Wool will be taken away when the Stake is released, but there is also a 50% probability that the wolf will snatch it all.

image description

Image source: mirror

The gameplay of the game is very simple, but how the player chooses is a difficult problem. Sell Wool or breed a new NFT? ——Although there is a probability of being snatched away; get 80% of the income stably, or pursue higher income? —although the risks are greater.

With high returns and fresh gameplay, everyone can be a gambler. In the frenzied Fomo mood, the popularity of Wolf Game has also reached its peak - the floor price of OpenSea has reached nearly 5 ETH. Later, new elements such as land and farmers were added to expand the gameplay, so I won’t elaborate here.

The reason for Wolf Game's soaring skyline is simple, that is, the "wealth effect". The first batch of players who entered the game earned a lot of money, and then spread it to the surrounding users crazily. Many players have already invested in the market before they understand the logic - because the payback cycle and possible profits are too exaggerated. Many users are still worried about taking orders and waiting to see. profit.

Wolf Game can be described as the pinnacle of GameFi Fomo emotions, and the popularity comes and goes quickly.

secondary title

challenges and problems

It is true that Game Fi has received more and more attention, but it is also facing its own problems: lack of game innovation, poor user experience, low playability, weak story, single application, and high participation threshold. If there is no good solution, these problems are likely to affect the game's entry into the mainstream market and fail to form a healthy ecosystem.

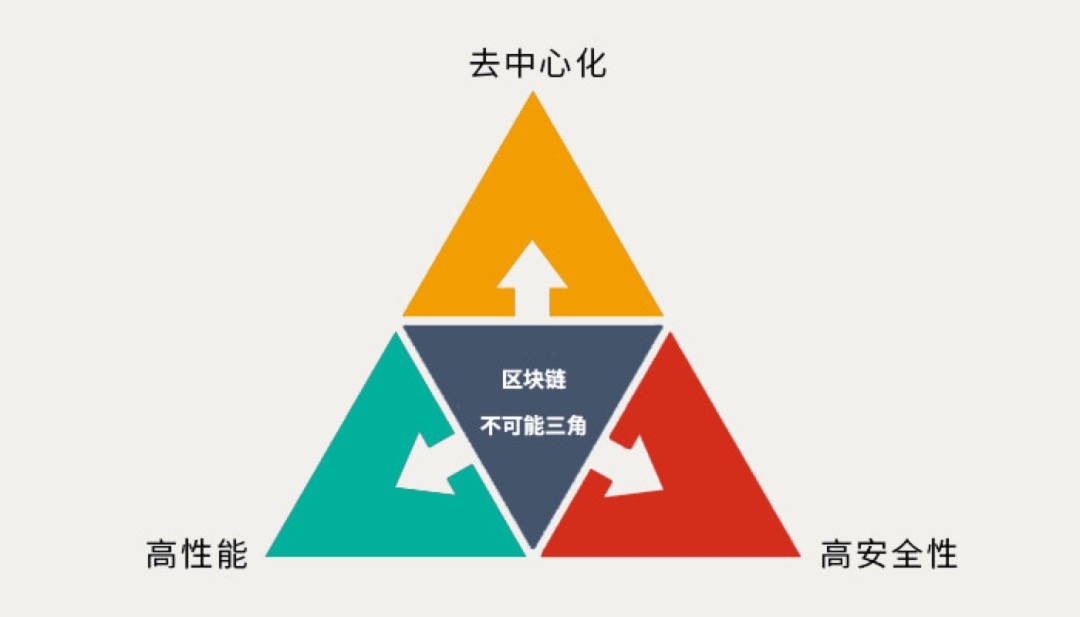

We all know that the blockchain has an impossible triangle, namely: perfect decentralization, extremely high processing efficiency, and excellent security, and it is impossible to achieve all three.

Similarly, GameFi currently has an impossible triangle - playability, ease of use, profitability,

Right now:

1. Highly playable and easy-to-learn games with poor profitability;

2. Games that are easy to use and highly profitable, but poor in playability;

3. Games with strong profitability and high playability are not easy to learn;

secondary title

future

future

The development of GameFi is inseparable from NFT, but even NFT is currently in its early stages—such as the Token circle in 2013 and 2014. GameFi is more like the game field in the 1980s. At that time, the computer game industry experienced its first major growth pains, and honest business publishers appeared in the market together with profiteers who established today and ran away tomorrow. The fact that certain games can be copied from existing arcade machines, and the relatively low cost of publishing PC games has encouraged the release of many inferior games. GameFi, which has financial attributes, is even more barbaric than it was at the time.

Many believe that GameFi is also driving the development of Web3 - the DeFi function of the game is already a prelude to Web3. In the long run, people's lifestyles in Web3 will change greatly, and so will games; in the short term, what kind of new gameplay will GameFi have, which will be more financial? Gameplay? Or open a window to the Metaverse? We will wait and see.

NFT Labs provides relevant information only and does not constitute any investment advice.