Fidelity Digital Assets, a subsidiary of asset management giant Fidelity, released its Bitcoin investment thesis "Bitcoin First" in January 2022.

Once an investor decides to invest in digital assets, the next question becomes: "Which one needs to invest in?".

Of course, Bitcoin is the most recognized and earliest digital asset, but there are hundreds of other digital assets in this ecosystem.

One of investors' primary concerns about bitcoin is that, as the first digital asset, it could be vulnerable to innovation from rivals (as in the MySpace and Facebook story). Another concern surrounding bitcoin investing is whether it offers the same potential returns or upside as some of the newer, smaller digital assets.

In the report, Fidelity makes the following key points:

Bitcoin should be understood as a monetary commodity that functions as a store of value asset in an increasingly digital world, which is one of the core concepts of investing in Bitcoin.

Bitcoin is fundamentally different from other digital assets. As a monetary commodity, we have found no other digital asset to be better than Bitcoin, because Bitcoin is the safest, most decentralized, and most sound digital asset, and any "improvement" of other digital assets will inevitably face trade-offs.

The success of the Bitcoin network and all other digital asset networks are not necessarily mutually exclusive. Instead, other parts of the digital asset ecosystem can serve different needs, or solve certain problems that Bitcoin simply cannot.

Bitcoin should be evaluated differently from other projects (non-Bitcoin projects).

Bitcoin should be viewed as an entry point for traditional asset allocators to hold exposure to digital assets.

secondary title

Why Bitcoin is a Monetary Good

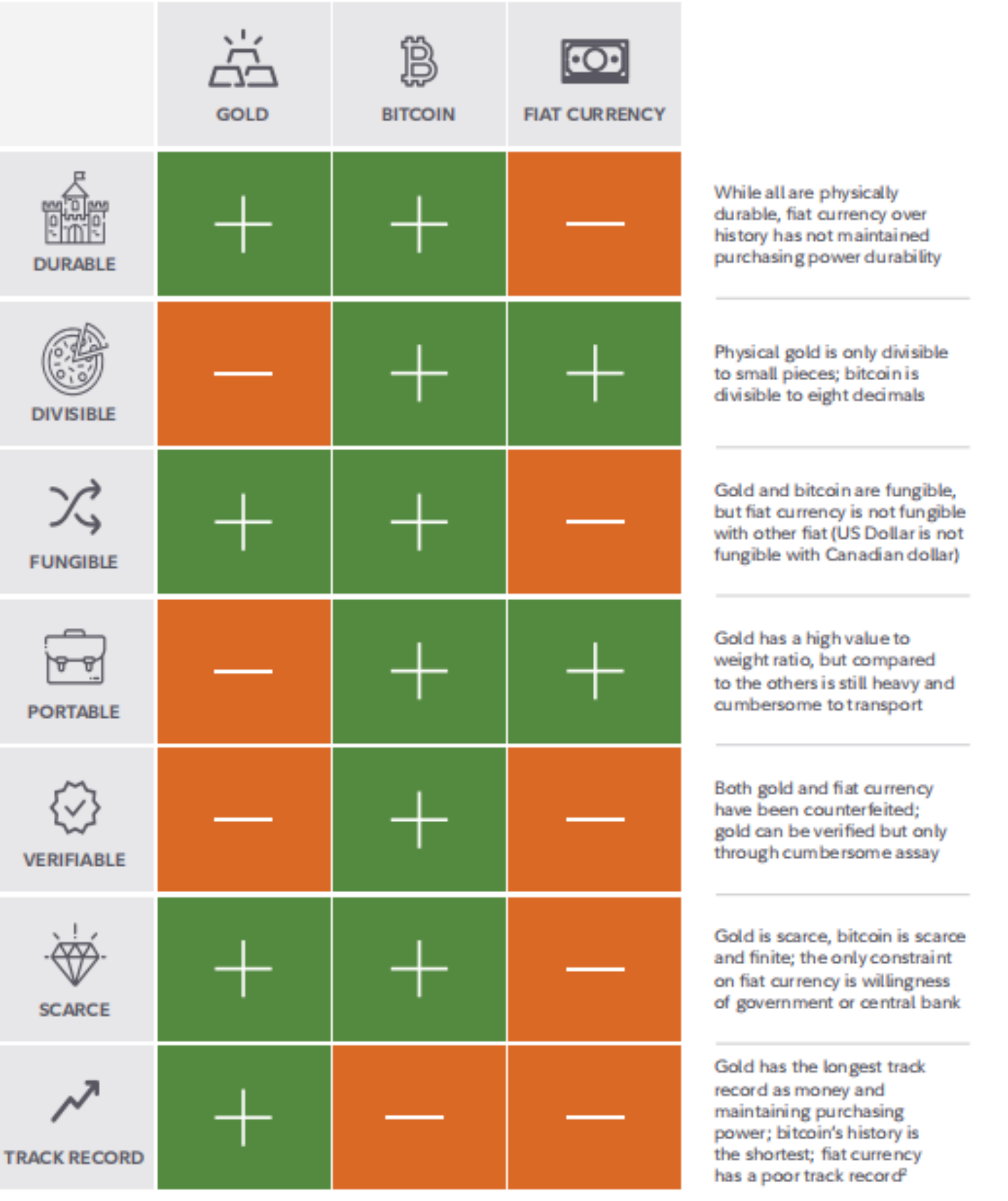

Bitcoin has many of the best qualities of money, combining the scarcity and durability of gold with the ease, storage, and transferability of fiat (and even improving upon it).

It's also worth noting that, like other monetary commodities, Bitcoin is not a company, it pays no dividends and has no cash flow. Therefore, the value of Bitcoin has the ability to better meet the characteristics of monetary goods than traditional alternatives.

Is Bitcoin's Value Driven by Scarcity

Not only is Bitcoin scarce, Bitcoin’s current inflation rate of 1.8% is about the same as gold’s current inflation rate. Bitcoin can be provably finite, there will only be 21 million Bitcoins (Bitcoin’s decentralization shows that no digital asset has an immutable monetary policy like Bitcoin. In other words, Bitcoin Monetary policy is probably considered the most credible.

Is the Bitcoin network censorship resistant

Since no individual, business, or government owns or controls the Bitcoin network, it is extremely censorship-resistant. Additionally, the Bitcoin network has no geographic boundaries, making it difficult for a nation-state to exercise control or regulation over the network and the Bitcoin Core code itself.

To summarize Fidelity’s logic in believing that Bitcoin is a valuable monetary commodity:

1. The monetary good is worth more than its utility or consumption value. While Bitcoin’s payment network certainly has utility value, people also ascribe a monetary premium to Bitcoin tokens.

2. One of the main reasons investors see Bitcoin as valuable is its scarcity. Its fixed supply is why it has the ability to be a store of value.

3. The scarcity of Bitcoin is underpinned by its decentralization and censorship-resistant properties.

secondary title

Why Bitcoin Has the Potential to Become a Major Monetary Commodity

Bitcoin Network Effects Are Very Powerful

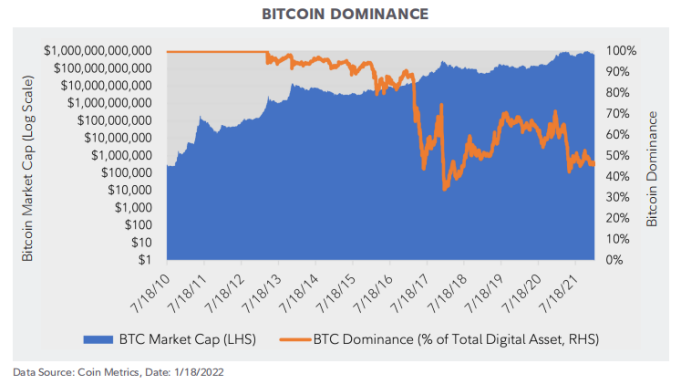

Bitcoin had a first-mover advantage as the first-ever truly scarce digital asset and has maintained it. Note that while Bitcoin’s dominance, or its market capitalization as a percentage of the entire digital asset ecosystem, has declined from 100% to approximately 50%, this is not due to its shrinking size, but rather the rest of the ecosystem growing.

Bitcoin’s first-mover advantage makes it less of a competitor for its primary use case as a monetary asset and store of value, and creates a very different return for Bitcoin investors. Many of the risky arguments about Bitcoin’s demise in the past are now gone, and the Bitcoin network is getting stronger every day as more users, miners, and infrastructure are built.

Money networks also have a kind of reflexivity. People watch other people join a currency network, which motivates them to join. This phenomenon can be seen in the rapid development of payment platforms such as PayPal and Venmo.

In the case of Bitcoin, the reflective property is even more pronounced, as it includes not only passive asset holders, but also miners who actively improve the security of the network. As more and more people view Bitcoin as having superior monetary properties and choose to store their wealth in Bitcoin, demand will increase. This in turn leads to higher prices (especially if supply is inelastic).

The Lindy Effect and Bitcoin's Antifragile Properties

The Lindy Effect, also known as Lindy's Law, is the theory that the longer something survives that does not perish well, the more likely it will survive in the future.

For example, a Broadway play that has been running for 10 years may run for another 10 years, compared to a Broadway play that has only been running for 1 year and may run for another 10 years.

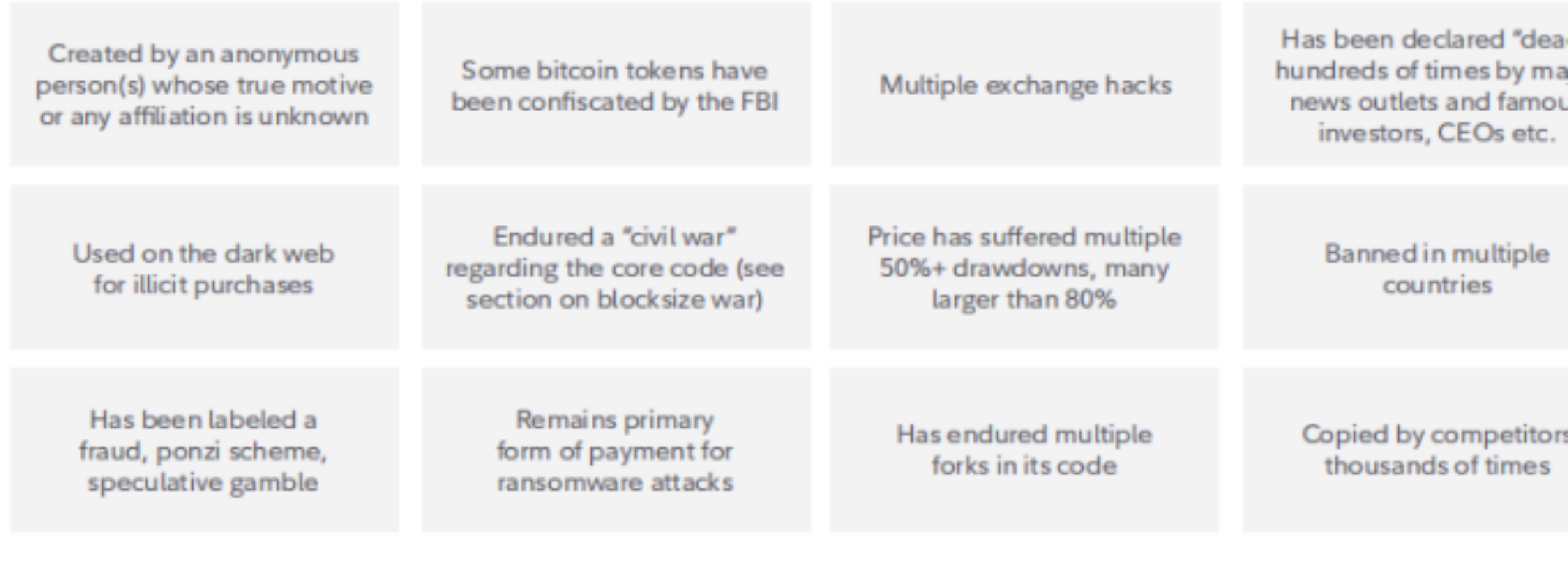

We believe the same applies to Bitcoin. Every minute, hour, day, and year that Bitcoin survives increases its chances of surviving in the future because it gains more trust and weathers more shocks. It's also worth noting that this is closely related to antifragile properties, where something becomes more robust or stronger every time the system is attacked or subjected to some form of stress .

Bitcoin's anti-fragility features, the following are some negative events encountered by Bitcoin:

Risk Analysis of Bitcoin

Nation-state attacks and protocol vulnerabilities are two of Bitcoin's most notable cyber risks.

protocol flaw

Potential vulnerabilities in any code are always a current threat. This problem can be mitigated by keeping specific software simple and conducting thorough reviews of the code. In the case of bitcoin, considering bitcoin has been around longer than any other project, has a simplified code, and now has a $1 trillion bounty for anyone who can exploit it, it's arguably The protocol least likely to encounter major vulnerabilities.

country attack

Another valid risk to the Bitcoin proposition is that great powers could oppose the growth of the digital asset ecosystem. The geopolitical landscape thus far makes proper regulation of these assets far more likely than making them illegal. In any case, Bitcoin is the best position to defend against coordinated attacks because it prioritizes decentralization.

secondary title

Impact Analysis of Bitcoin Return on Investment Status

Bitcoin investment returns are driven by two powerful forces: the growth of the digital asset ecosystem and the potential instability of the traditional macroeconomic environment. These returns are likely to be driven in an easier, less risky manner, and with greater certainty than most other digital assets.

Growth of the Digital Asset Ecosystem

The legitimacy and importance of digital assets is further enhanced as money moves across the asset class. While other coins benefit from indirect money flowing into the space, Bitcoin is the easiest way to benefit from this growth. As discussed earlier, Bitcoin has no competitors in terms of being recognized as a superior store of value asset, which means that its current stronghold as the "currency" of the ecosystem poses little threat. “The growth associated with all digital asset building is largely bullish for Bitcoin.

Potential instability of the traditional macro environment

Policy as a way to provide support for sustained economic growth may raise concerns about the overall stability of the financial system and the economic self-sustainability. The accumulation of these policies has led to unprecedented levels of global sovereign debt. Historically, leverage has pushed financial systems into fragility.

in conclusion

in conclusion

Traditional investors often apply a technology investment framework to Bitcoin, leading to the conclusion that Bitcoin, as a preconceived technology, can easily be replaced by better technology, or with lower returns.

However, as we've said here, Bitcoin's first technological breakthrough was not as a superior payment technology, but as a superior form of money. As a monetary commodity, Bitcoin is unique. Therefore, not only do we believe that investors should consider Bitcoin first in order to understand digital assets, but they should consider Bitcoin first and separate it from all other digital assets.

This article is the Chinese translation of the report, organized by Blockchain World. For the complete Chinese translation, please go to the official account: MyBlockWorld to reply to the message Fidelity.