On January 20th, the online live broadcast of "The Game Breaker - Exploring the Way of Polkadot's DeFi Value Capture with Minterest" co-hosted by Odaily and Minterest was successfully held. (Click to enter the live broadcast room:https://play.yunxi.tv/pages/549cafe8a9ac442e988a3281efaee669?openId=oY3Tsvmr8xQ5lHwP-dBiH8Zn7J4k#/)

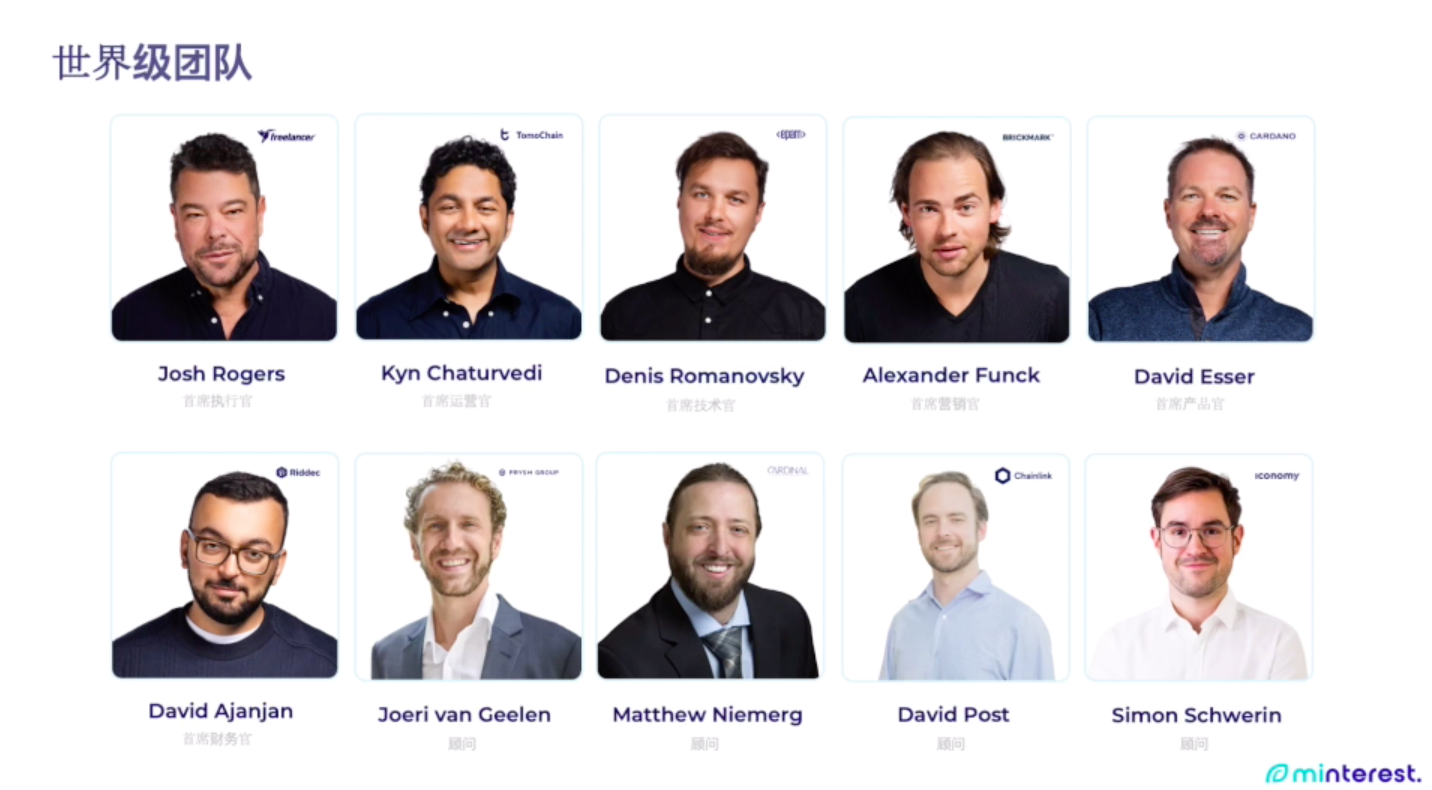

Josh Rogers, CEO and Founder of Minterest, attended the event and gave a keynote address. Josh Rogers said that Minterest is composed of a world-class management team. He has 25 years of entrepreneurial experience and promoted the listing of many start-up companies; the rest of the core members have rich experience in traditional finance, technology, encrypted blockchain and other fields . Currently, the entire team is close to 50 people.

Regarding the original intention of the project, Josh Rogers said that the design purpose of the Minterest protocol is to be as fair as possible to achieve value sharing. Specifically, Minterest designed three ways to capture value: interest income, flash loan income, and liquidation fee income. The Minterest protocol will automatically repurchase MNT native tokens in the market with surplus income, and then distribute these tokens to pledge users participating in protocol governance, which is quite different from the current mainstream lending protocols in the market.

In this way, the greater the liquidity in the Minterest protocol, the more funds used for repurchase, the higher the token price; the higher the token price, the more liquidity will be attracted to the protocol, Create a self-reinforcing "snowball effect". Liquidity drives token prices, and token prices drive liquidity at the same time, and the snowball will get bigger and bigger.

"We've created a very unique new protocol that has strong network effects - the kind of network effects that usually happen to traditional companies, like Facebook, but I haven't seen anything like this in the DeFi and cryptocurrency markets, This means Minterest is able to outperform the competition.”

The following is a shorthand summary of Josh Rogers' speech:

Hi, my name is Josh Rogers and I am the CEO and Founder of Minterest. Thank you all so much for taking the time to join us today.

Before officially introducing Minterest, I would like to give you a little background on our team. After all, the success of a project depends not only on the project itself, but also on the people who set up the project.

(1) World-class management team

My entrepreneurial experience goes back 25 years - I started companies in the late 90's. At the time, I founded the world's first peer-to-peer telecommunications company and raised $30 million. In the late 90s, that was a lot of money. I also ran a public company in Australia where I built the world's first micro-content charging engine.

We also contribute to the reality show"big brother"The second quarter made the world's first content monetization, and participated in a large number of market operations in the first decade of this century, which is when the market and e-commerce solutions really emerged.

I did a lot of work in Asia, and I actually had an office in Tokyo with the team at the time, and we did a lot of work. Through the Asia platform, we hope to grow globally beyond the Asian market.

I am also a founding shareholder, principal advisor and builder of Freelancer. Freelancer is the world's largest marketplace for freelancers. I am also the founding director and shareholder of Australia's largest hospitality app "HeyYou". Rebecca Campbell is the founder of this company, and she is also the leading technology expert in Australia. She approached me on day one of starting the company and became a great friend; I spent seven years guiding her through the project from start to finish.

I've done a lot of similar jobs over the past 25 years, heavily involved in a range of different startups. Now, I'm turning my focus to my new project - Minterest, which I'm very proud of because I have a group of super capable team members.

Our COO is Kyn Chaturved. Kyn is from TomoChain, the largest blockchain project in Vietnam, where he was the chief business development officer. Kyn also has a remarkable background in startups, especially in games, having run a well-known game studio in India.

We also have people like Denis Romanovsky on our team. Denis is our Chief Technology Officer, a very capable individual who has worked for some of the world's largest corporations, specializing in financial solutions. Denis was responsible for building two lending protocols, the current one is Minterest written in Solidity; before that, we actually built Minterest in Substrate. For some reasons, we chose to switch to Solidity, which Denis will introduce in detail in the next video.

Our Chief Marketing Officer is Alex Funck, who also has a remarkable background in startups and digital marketing. Alex is a top curated marketing solutions specialist with the ability to build and manage top-notch marketing teams, which is what he does with our team now

Another member is David Esser, who was in charge of product development at Cardano and has 20 years of experience in online product development; our chief financial officer is David Ajanjan... There are other important members, so I won't introduce them one by one here. Currently, we have 35 full-time employees, plus part-time and consulting teams, the total number of people is close to 50.

I'm proud to say that we've assembled a very strong world-class management team who will continue to drive Minterest to leaps and bounds in the future.

(2) Three value capture methods of Minterest

How did Minterest start?

Minterest was born during the COVID-19 pandemic in early 2020. I was on vacation in Zanzibar and was stranded there for four months due to the air ban due to the pandemic, so I spent a lot of time delving into various blockchain models, which eventually led to the birth of Minterest. Starting in September 2020, Denis was the first to join the team; we have been building the project since then with a lot of energy.

Minterest is a large, pure-play lending project that provides a tokenized money market. Unlike the average DeFi startup, Minterest has a high level and scale.

There are currently two major leaders in the lending protocol space, Compound and Aave. Minterest is not designed to compete for market share from these two companies, but to help other DeFi protocols expand their market share.

To do that, you have to have a model that is extremely capital efficient, meaning it delivers a very high APY. In fact, Minterest also has the highest long-term APY in DeFi; in doing so, it leapfrogs its competitors. In this talk, I will introduce more related content, for now it is just an overview.

On the other hand, the Minterest team is backed not just by those who are involved in the business on a daily basis, but also by some of the best investors in the industry - we went through a very intensive funding process, initially with our private investors.

I'm proud to say that if you browse our website and dig into the backgrounds of our investors, you'll find that these are some of the best investors in the business who have invested in some of the biggest names in the business. Today, they are not only our investors, but also deeply involved in supporting our business, and they have established a very friendly cooperative relationship with each other. All of these prove that Minterest is a very high-quality project.

When people talk about lending protocols, the most important thing is value capture. Some protocol is good, but it does not generate money and does not have any profit, so how should it ensure continuous development, and ensure that it develops with users and keeps pace with the times? You must know that this time dimension is not only one month or a few months, but to create and maintain real value year after year. Minterest is designed based on this idea.

I'm a designer, and my forte is designing businesses that generate strong network effects, which is exactly what Minterest was designed to do. As shown above, Minterest captures value in three ways, one of which is unique.

The first is "interest income". When you look at lending protocols, Aave and Compound are good examples. When you look at those lending agreements, it’s important to note that their income comes from what’s called a “spread.” Simply put, "interest spread" is the difference between the borrower paying the money and the lender receiving the money, and this difference actually constitutes a kind of interest rate income - usually obtained by the supporters of the project, including the development of the project By.

This means that the operator or the team behind the project is extracting the profits of the agreement, which is also the norm in the current lending market. Minterest is determined to change the status quo of the industry, we will capture these fees and transmit value to all protocol users.

The second is "flash loan income". When flash loans happen on the protocol, like they earn some transaction fees on Aave, these fees are quite substantial. Minterest will also launch flash loans in the future, and we will also capture those "flash loan revenues" and distribute them to users.

The third is the "automatic liquidation fee". Taking Aave and Compounding as examples, when the user's account assets are under-collateralized, the system will initiate liquidation and sell the user's collateral to balance the debt repayment capacity. In fact, this kind of liquidation is always done by a third-party liquidation agency. They are giant whales with a lot of liquidity and can always observe the agreement; when an undercollateralization event occurs, they can buy out the loan at a discount below the market price The liquidator's collateral is liquidated, and the price difference between them is the liquidator's income.

This model is working very well now, but the problem is that the current liquidation volume in the lending market is hundreds of millions, and the liquidators get hundreds of millions of dollars in income. The fee income they receive is unreasonable relative to the value they create.

What Minterest does is a completely different thing, we built our own automated liquidation process, the protocol will execute the entire liquidation process without human involvement. This means that the protocol will be in charge of liquidation fees, and value will not leak out; it also means that Minterest has become the most profitable protocol in the industry, because of its ability to not only capture interest income and flash loan income, it also captures losses from the protocol. revenue, as well as revenue lost from other agreements, we'll capture that.

(3) Repurchase tokens with agreement income

So what are we going to do with the money? The Minterest protocol will buy back its own tokens. We will use the operating surplus of the agreement to automatically repurchase MNT native tokens in the market, and then issue these tokens to pledged users participating in the protocol governance. This is very different from the current mainstream lending agreements in the market.

Let's see how the lending protocol attracts liquidity now. Usually, lending agreements will give users native tokens as a reward for their participation in liquidity provision. This is also how Minterest implements, we will distribute MNT tokens fairly to borrowers and lenders to let them participate. It is worth noting, however, that other protocols do not have a buyback process.

Take Compound as an example. In May last year, the price of Compound’s token was about $180, and now it is about $200. There is no major change. But the reality is that the liquidity of protocols like Compound has increased from $100 million to tens of billions of dollars, and so has Aave. The success of the protocol is not reflected in the token price.

From our point of view, this is insane and would never happen on Minterest. Because the more liquidity the Minterest protocol attracts and the more fee income it earns, it will have more money to repurchase its own tokens and distribute them to users, thereby increasing the price of the tokens; the price rise also means As the tokens issued to users become more valuable, the protocol becomes more attractive, attracting more people to deposit liquidity here, and then forming a positive cycle.

Briefly explain the operating principle: the greater the liquidity in the agreement, the more funds used for repurchase, the higher the price of the pass; the higher the price of the pass, the more liquidity will be attracted to the agreement, So this self-reinforcing "snowball effect" occurs. Liquidity drives token prices, and token prices drive liquidity at the same time, and the snowball will get bigger and bigger.

All in all, we have created a very unique new protocol with strong network effects - the kind of network effects that usually happen to traditional companies, such as Facebook, but I have not seen such a situation in DeFi and cryptocurrency markets , which means Minterest is able to outcompete its peers.

The benefits that Minterest users can obtain, in addition to the interest obtained from the market, also have the value of these release rewards, and we have actually increased the total rate of return - we provide users with MNT tokens that are repurchased by the agreement as their long-term participation rewards. We also do something else, giving users loyalty rewards - the longer you stake, the greater the percentage of protocol buybacks you receive, with month-to-month increases up to five years in duration.

Of course, one can unstake at any time. There is no time limit on staking, and people can withdraw their MNT tokens at any time and leave the protocol immediately; but when they do, they also lose their loyalty reward, which is called switching cost.

Many platforms have introduced such measures to encourage people to stake their tokens and stay on the platform, thereby reducing the circulating supply; if they stay, they will retain and increase the loyalty reward over time.

(4) Extreme details, serving users

In addition to the above mentioned, Minterest has a lot of unique details, one of which is the "user panel".

In DeFi, people often do not have detailed information that enables them to manage their own risk profile. The most common one at the moment is the “traffic light system,” where when people borrow a certain amount, you can see green lights, yellow lights, and red lights—green for safe, yellow for neutral, and red for unsafe. But I really don't know what these mean.

So inside of Minterest, we're building a really neat user panel. All data is visualized so people can understand exactly their risk profile. It also has a user warning function, which can truly serve users; each user can also customize the setting panel, so it is actually a portfolio analysis tool.

Although other protocols focus on making money from liquidation, Minterest's purpose is not that: we are committed to serving DeFi users, and do our best to provide users with data and information to help them avoid liquidation.

I also want to mention our "automatic liquidation process", which is quite complicated. Automatic liquidation itself is part of the principles and values of our protocol - the Minterest protocol is designed to be as fair as possible.

Regarding liquidation, usually people will lose a large part of their collateral when they are liquidated. The main reason is to ensure that the liquidator always provides sufficient liquidity through generous rewards, but this method will undoubtedly cause users to suffer excessive losses. One of the key points of Minterest's internal liquidation process is that we do not liquidate an excess of users' collateral - the protocol liquidates as much as the user loses.

We need to be clear that the protocol is to serve users, not to weaken people's economic capabilities. We are in the business of supporting people's financial future, giving them the best return possible, and liquidation is a vital part of that.

(5) Holding NFT to participate in the test

One more thing I want to talk about is our Minterest NFT, which represents the 100 most influential people in blockchain. Our NFTs are not designed to be collectibles - of course if people want to collect them, we'd be happy too. We have invited a group of world-class illustrators. A portrait of the top 100 most influential figures in the blockchain field has been drawn, and Satoshi Nakamoto is the first.

These NFTs are not only visually eye-catching, they are actually valuable in use. They actually deliver economic benefits when you use the protocol. Holders of these NFTs receive a much higher release of tokens from the protocol than non-holders.

We have 12 different levels of NFT, taking Satoshi Nakamoto as an example, it provides users with the opportunity to increase the amount released by 50% within three years. If a user has a very large amount of liquidity and participates in Minterest, the benefits are very considerable.

How to get these NFTs? NFT is issued as a reward for Minterest financing and LBP (Liquidity Boot Pool), and is available for trading; at the same time, NFT also provides its users with the right to early participate in Minterest's private release.

In fact, Minterest will go through a two-stage launch. The first phase is a private launch, and the only people who can participate in this phase are Minterest NFT holders. The total number of NFT issuances is 3,000, their validity period ranges from 3 months to 3 years, and the release rate increases from 20% to 50%.

Of course, participation in the private launch phase is limited as the available liquidity is also limited. But it also means that during this period, more tokens are issued as rewards to protocol participants than those who cannot participate in private releases.

Why do we do this? We are ostensibly building a private community that allows us to run the entire protocol through a full feature cycle, which takes about five weeks.

So the non-public release is going to be at least five weeks, maybe longer, and we can stretch that out to about eight weeks. This means that non-public release participants, the holders of NFTs and people who deposited liquidity during this period, will receive very, very good APY.

Now you can visit our website and take a look at these NFTs. The quality of these NFT images is very high, which I am personally very proud of.

Like I said earlier, these NFTs are very valuable for those who provide liquidity and use the Minterest protocol. So the top 3000 people in our upcoming LBP will get these NFTs; if you don't want to use NFTs to participate in the event, you can also sell them to those who need them.

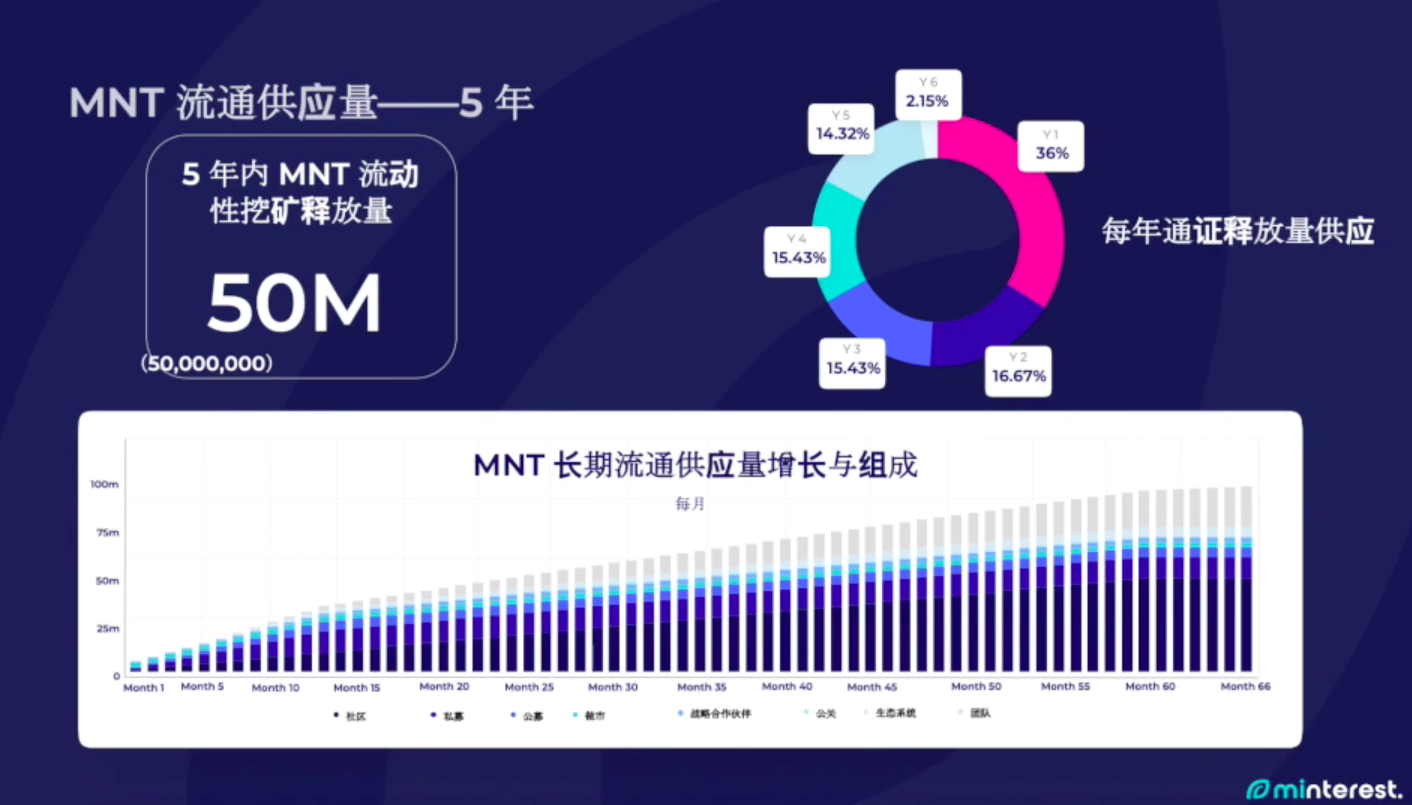

Regarding the circulation data of MNT tokens, you can go through the website (https://minterest.com/nft-gallery) to view, and the following picture also introduces the relevant situation:

The key to our control of circulating supply is that all of our investor tokens are released within the first 12 months. We completed a private round with private investors who invested in the protocol; we have an upcoming LBP and community event. All these tokens will be fully unlocked within the first 12 months.

So while we have a circulating supply of 100 million tokens issued over a five and a half year period, this is not the case during the initial 12-month cycle. Judging from Minterest's valuation figures, this is indeed a big problem, but we are still willing to go public to the end and provide you with transparent data.

One more thing, we have launched our Chinese website, welcome everyone to visit. Our Chinese white paper will be released this week, and our technical documents will also be released in Chinese. We will support our Chinese community and provide as many Chinese materials as possible. These are in progress.

You have seen that we now have a Chinese Telegram channel, and our Discord will be upgraded this week, and we will build a Chinese channel in it, so stay tuned, and welcome any questions.

first level title

Q & A session

In the Q&A session of the event, the host selected five audience members to ask questions, and Josh Rogers answered as follows:

Community users: What currencies does Minterest support for lending, and what other similar products are there?

Josh Rogers:We support common tokens, such as wrapped ETH, stable coins, and DOT after launch. Basically, in the initial stage, tokens with more depth and liquidity will be supported, such as DOT, USDT, and USDC. As the investment portfolio grows step by step, more tokens will be supported.

Community users: Compared with similar projects, what advantages does Minterest have, or can you talk about its own characteristics?

Josh Rogers:Minterest is a pure lending protocol, and the lending protocols are basically those leaders, such as Compound, Aave, MakerDAO, etc. The original intention of Minterest is to become the top lending protocol, directly competing with the top lending protocols mentioned above. The original intention of Minterest was to bring an updated economic model to this field and bring new benefits to users.

Any time we build a new platform, the first thing we need to think about is to build a successful network effect, otherwise we will not be able to compete in this industry. The current network effect established by these industry leaders relies on very strong liquidity. If you have a lot of liquidity, you can attract a lot of users. Minterest has set up a very unique mechanism, the buyback mechanism. As the liquidity of Minterest increases, the value of its tokens will also increase, and the APY of users will also increase. This is where Minterest is very different from previous products in the industry.

There is an automatic liquidation mechanism in the Minterest agreement, which will keep all the income generated by the agreement in the agreement. Using these MNT tokens, this process will increase the value of the token itself. Minterest will use 100% of the value of revenue to buy back its own original tokens, and give these tokens back to users to create value for users. This is very unique and sets us apart from the competition.

Community users: The long-term high MNT reward sounds like the biggest feature of Minterest. Over time, users will earn MNT as a reward for their input into the protocol's governance process. If the protocol users and revenue decrease under the unoptimistic assumptions, will the rewards decrease accordingly and become unattractive?

Josh Rogers:First of all, as I just said, Minterest will build a strong network effect, which will make the snowball roll, and the snowball will get bigger and bigger. We can look at the example of Facebook by analogy, from a small snowball to bigger and bigger. Often when we use a social media, such as WeChat, it does not mean how easy it is to use, but because everyone around us uses it, so a network effect/flywheel effect is formed. The more people enter this ecosystem, the more benefits this ecosystem will create and attract more people to participate.

Whenever we build a platform, there must be a start-up phase, through a mechanism, to make this protocol/product start to run. In my 25 years of entrepreneurial experience, I have done this many times, and I will use the previous experience to build Minterest.

Back to the audience's question, you can look at Compound and Aave, there is almost no big difference between the token price a year ago and now. The growth of liquidity can speak to the success of the protocol, but its success is not reflected in the price of tokens. But this kind of thing will not happen on the Minterest protocol, because as long as there is new liquidity coming in, we can have the ability to carry out more borrowing and generate more income, and we can repurchase Minterest’s native MNT certificate. As the circulation of tokens decreases, the price will rise, and at the same time, the value returned to users will increase, and more users will continue to be attracted, and the so-called snowball effect will continue to roll.

This viewer is right to ask the question, if liquidity is reduced, it will be less attractive. However, the original intention of Minterest’s design is to make this snowball roll during the startup phase, because its mechanism is to buy back MNT tokens and return them to our users. This is different from other protocols. Design can ensure that this network effect continues to run.

Community user: Black swan incidents caused by hackers are emerging one after another. In terms of security, how does Minterest guarantee it?

Josh Rogers:Usually in the DeFi protocol, such loopholes or hackers occur because they do not use good oracle services. Once they obtain price information from a single source, it is very easy to be manipulated and used by hackers.

The oracle service platform that Minterest mainly uses is Chainlink, and David Post, the general manager of Chainlink, also gave a brief speech just now. Chainlink is the largest service provider in this industry, and Aave also uses Chainlink's services. At present, Aave has not encountered such a vulnerability attack incident. One of the key factors is that they also use Chainlink's services. The mechanism used by Chainlink is a completely decentralized oracle service mechanism, which will obtain token price information from every market segment and exchange, and the cost of being attacked will be very high. It's like you need to collect all five rings like Thanos to do such a thing.

From the very beginning of Minterest’s establishment, security has been our most important and top-level consideration. We have hired three security companies to audit our code (it is not convenient to announce), and now we are also conducting a very large and important audit. , because Moonbeam will start to go online in the first quarter. Next, there are two very important security companies that will audit our code. We spent more than 700,000 US dollars on security audits, and we spent a lot of energy and money to ensure our security.

Community users: What is Minterest's current product progress and next marketing plan?

Josh Rogers:First of all, Minterest has a very large marketing team. This team consists of 13 people, of which 7 are full-time employees, plus 6 permanent permanent part-time employees. Next, Minterest’s ambassador program will be released, including in the Chinese community. I hope everyone can actively participate, which is also part of our agreement release strategy. As we mentioned earlier, we want to start from the snowball effect/network effect to raise everyone's awareness of Minterest and increase its presence in the market. The agreement is currently scheduled to be released in March, and everything is proceeding according to our schedule.

The agreement could have been released earlier, but we still hope to complete all audits and release according to our schedule while ensuring the security of the agreement as much as possible. We have completed the preliminary private placement and management, and next week we will distribute community tokens, including activities at the start of liquidity. After the protocol goes live in March, the token code will be listed next. Because we need to complete the setting of this token function, we will need to use these tokens to complete protocol participation, pledge, and voting governance in the future.