Original source: Decrypt

Original Compilation: Mary Liu

Original source: Decrypt

Original Compilation: Mary Liu

DAO is a kind of Internet community that emerges around encrypted projects or unified financial goals that cannot be achieved by one person. Their original intention may be as simple as crowdfunding to buy an expensive piece of art. In other cases, the DAO operates more like a members-only club, with users having to purchase specific NFTs to gain access to the organization. All actions in the DAO are incentivized by governance tokens that grant holders access to exclusive events or voting rights.

Regardless of form and purpose, DAOs are starting to have a major impact on mainstream culture, whether it's art, sports, crowdfunding, or finance. Here is a roundup of the 11 most interesting DAOs of 2021, in no particular order.

secondary title

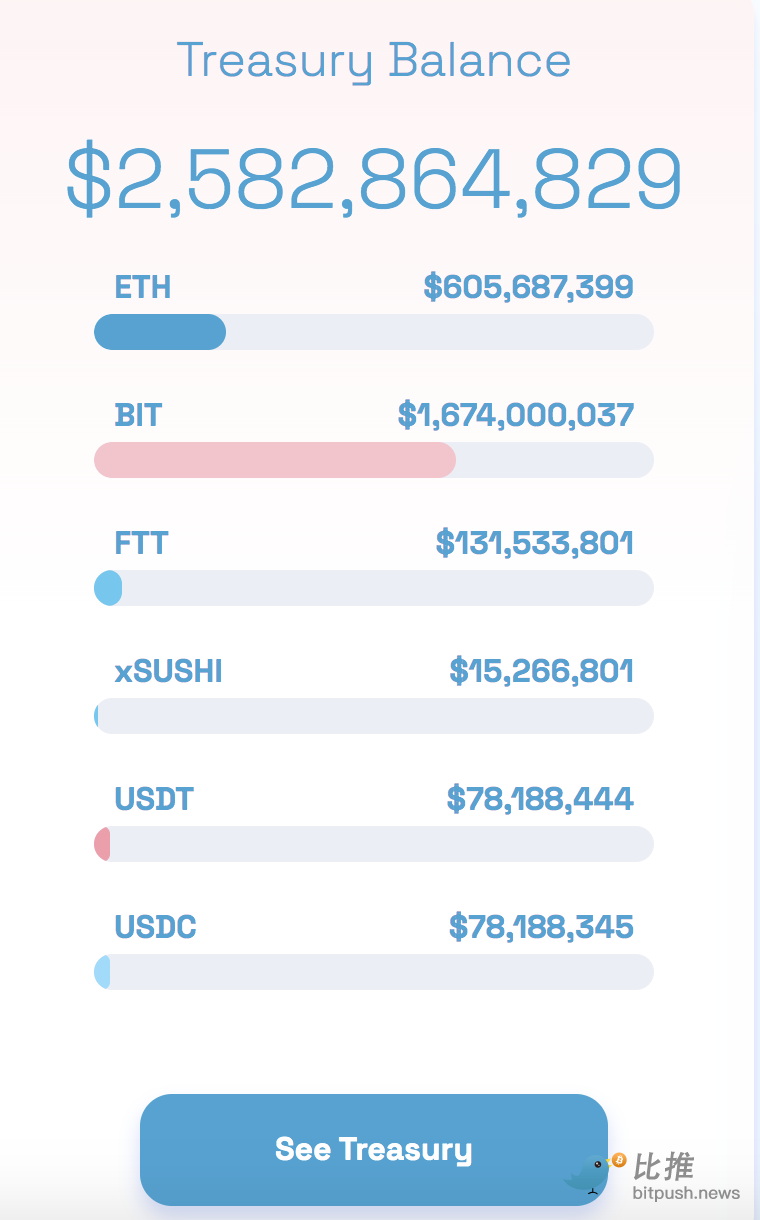

1. BitDAO

BitDAO is a unique beast in the DAO ecosystem. Not only has it managed to amass over $2.5 billion in funding through continued large-scale financing, it has also attracted big-name investors including Peter Thiel, Alan Howard and Founders Fund.

BitDAO is now expected to start investing in DeFi projects, launching grants, or token swaps for financial diversification. But for now the treasury will remain idle, BitDAO contributor and spokesperson Kevin Rose wrote: "A priority for the BitDAO community is to create tools that will enable the DAO treasury to participate in staking, lending, etc. BitDAO is building an autonomous entity (AE) Ecosystem, partly funded by BitDAO Treasury and bringing together some of the best partners to help develop Web3 across art, entertainment, finance and technology.”

At first glance, all of these goals seem like standard fodder for traditional venture funds. But as a decentralized organization with tokens (BIT), only token holders can make proposals and vote on their execution.

secondary title

2. BeetsDAO

Created by: Jordan Garbis, Sasha Rosewood

What: A collective focus on buying music-based NFTs

BeetsDAO is a 58-person community born out of the larger EulerBeats NFT community, which brings together all the fans who are fascinated by music-based NFTs. At its core, BeetsDAO, like some other DAOs, is pooling funds primarily for group investments. But in some use cases, it's also responsible for creating new art and music.

In March, The DAO purchased four rare EulerBeats Enigma NFTs, algorithmically generating audio files. A month later, the group organized the creation, release and sale of the “Nyan Dogg” NFT, a collaboration between the original Nyan Cat artist and Snoop Dogg. Nyan Dogg made nearly $250,000.

secondary title

3. ConstitutionDAO

Central figure: Julian Weisser

Despite failing to win Sotheby's auction of an extremely rare copy of the U.S. Constitution, ConstitutionDAO managed to introduce the concept of a DAO into mainstream culture. It revealed the power of community organizing and the speed at which DAOs can raise money, showed how crypto groups can have a real impact in the world, and inspired several similar projects (such as the Krause House DAO looking to buy an NBA franchise).

About 3 weeks after ConstitutionDAO's failed auction, its native token, PEOPLE, hit an all-time high after the project shut down operations -- and it's crazy like a meme coin. Yet the PEOPLE tokens are of little use, as the DAO's leader states: "These tokens have no rights, governance or utility other than being redeemable for ETH at a ratio of 1,000,000:1 from smart contracts held in Juicebox" .

secondary title

4. Decentraland DAO

Who: MANA and LAND holders

What it is: In the metaverse, a decentralized "town planning committee"

Why it was founded: Someone had to decide whether virtual mall developers should be funded

The Decentraland DAO is akin to a cross between a homeowners association and a town planning committee. The main difference: Everyone has voting rights based on how much virtual property they own, rather than relying on elected representatives, which means some actual vote counts for proposals may appear low. A proposal to allow land management through the content management system dclconnect passed with 48 votes to one. But the 10,125,615 voting power (VP) behind the yes vote actually represents a huge stake in the virtual world.

Although that virtual land only covers about 9 square miles in the real world, sales have been impressive. Its native currency, MANA, had a market capitalization of $4.3 billion as of Monday. At the end of November, Tokens.com purchased 116 pieces of virtual land (equivalent to 6,090 square feet of physical land, about the size of 1.3 basketball courts) for a total of 618,000 MANA (Decentraland’s native token) through virtual real estate company Metaverse Group, Worth nearly $2.5 million.

secondary title

5. FriendsWithBenefitsDAO

Who: Trevor McFredries

What it is: Members-only crypto social club

Why: FOMO (fear of missing out: phobia of missing out)!

FriendsWithBenefits, or FWB for short, may look like a tokenized membership club, but it's asking fundamental questions about the accumulation of value within social networks. Specifically, how can Web3 technology make platforms like Spotify or Facebook less bad?

When you purchase five tokens, you will gain exclusive access to different community-driven events and gain access to FWB's urban initiatives, which are creating different FWB hubs (or sub-DAOs) in New York, London and Los Angeles .

Those with 75 tokens will have exclusive access to the project's main Discord channel. So for "just" almost $6,000, you can buy full access to one of the most exclusive clubs in cryptocurrency.

secondary title

6. LexDAO

Who: Legal Engineer

What: Legally minded engineer who also likes crypto

Why: Turn Legal Services Into Code

So what is it? This is a group of “legal engineering professionals” — some of whom are lawyers by profession — who want to build tools that blockchain projects can use to replace basic and often inaccessible expensive legal services. For example, The DAO's LexLocker is an escrow system for holding deposits upon delivery of goods or services without relying on banks or other third parties. The group even proposed a way to provide an arbitration service, with decisions made through a multisig panel of LexDAO legal engineers.

When they're not building new tools, members of The DAO share legal thoughts on controversies surrounding blockchain projects on their blogs. Their latest opinion: jurors in deep argument 50 ETH Kleros Doge case got it wrong.

secondary title

7. MakerDAO

Who: MKR token holders

What it is: DeFi's largest central bank and creator of the largest decentralized stablecoin DAI

Why: Bringing Real-World Assets to Crypto

The project's DAO is now entering a new dimension in the crypto industry: joining Real World Assets (RWA). On June 7, holders of the platform’s governance token, MKR, voted to start using tokenized versions of shipping invoices, agricultural real estate, short-term trade receivables and income-based loans for small businesses. Those proposals eventually passed along with several others with the help of Centrifuge, which tokenizes non-crypto assets and posts them as collateral on platforms like Maker. The partnership began in early 2019, but only recently has it gained a lot of traction.

There are now over $48 million in DAI backed by real-world assets. “These and other real-world assets have the potential to add hundreds of millions of dollars in collateral,” said Centrifuge CEO Lucas Vogelsang. The prospect of this move is certainly exciting, but it also raises a question: Can a stablecoin still be decentralized if the majority of its collateral comes from real-world, fully seizeable assets?

secondary title

8. Mirror

Who: Writers and early WRITE token holders

What it is: Decentralized blogging platform

Mirror has elements of Medium, Substack, and Kickstarter. Its original slogan was: "Write like always, publish like never before". When it launches in February, users will only gain access by placing in the top 10 in a weekly WRITE competition where existing members will vote for aspiring members; each week the best contestants will receive a WRITE token Coins, which they can mint in exchange for blogs hosted by Mirror. In October, Mirror reversed course and opened up the platform to anyone, though custom domains are still only available by winning WRITE contests.

When publishing on Mirror, authors have the option to turn their posts into NFTs that fans can buy; Emily Segal is crowdfunding her next novel through Mirror. In June, Mirror added collaborative publishing tools and the ability to create media DAOs.

secondary title

9. PleasrDAO

Who: NFT artists and collectors

What it is: A fan of digital artist pppleasr

Why: Decentralized Art Appreciation!

The DAO was originally formed in March, purchasing an NFT of an animated Uniswap ad from artist Pplpeasr for $525,000, and quickly expanded beyond Pplpleasr art. The team paid $5.5 million for an NFT sold by Edward Snowden, at the time the fourth-highest-selling NFT of all time, and bought it from pharmaceutical tycoon Martin Shkreli for $4 million Wu-Tang Clan's solo album "Shaolin Past".

PleasrDAO also spent $4 million to purchase the Dogecoin original avatar NFT that has swept the entire encryption field, and acquired the Ross Ulbricht Genesis Collection for $6.3 million.

secondary title

10. Raid Guild

Who: Freelance builders and designers

What it is: Web3 marketing and design agencies available for hire

Why: Profit Funds Development of Web3 Open Source Tools

If you're not into the Dungeons & Dragons genre, don't let the design put you off, and if you're a D&D fan: rejoice! You must like this theme very much.

The group provides consulting, design, full-stack development and marketing services. Projects in their portfolio include WrapETH, which wraps Ether or xDAI in ERC-20 tokens for transactions, and Smart Invoice (currently in beta), which allows payers and payees to lock funds in a contract and Funds are released after the terms of the contract are met.

secondary title

11. Uniswap DAO

Who: Uniswap users

What it is: A community-controlled DeFi utility

Why: Improve DeFi Governance

Since launching its governance token in September 2020, the industry's most popular decentralized exchange has become a highly influential DAO.