Original post by Tarun Chitra, Founder and CEO, Gauntlet

As the size of the DeFi and NFT communities grows enormously, how decentralized protocols are governed becomes even more important. One of the most pressing challenges facing these communities now and in the years to come is addressing governance—that is, managing collective decision-making to optimize funding and operations.

Governance, however, entails substantial coordination costs because of the need to involve network participants in voting on every decision. These coordination costs can be drastically reduced by a new type of decentralized network - DAO (Decentralized Autonomous Organization). In a DAO, smart contracts enable participants to govern in a cooperative manner.

In a brand new network like DAO,People come together with aligned motivations and common interests, no single leader or single point of failure, and run almost entirely by code.Many new decentralized protocols are being built using this structure, and many DAOs to date have been active in open finance-based systems, but are also increasingly buying and trading NFT art and other collectibles in the cultural network of the product. In many ways, DAOs can be seen as a combination of investment banks, corporations, and social clubs, with cryptographic commitments binding these roles together.

Despite being called a "decentralized autonomous organization", theDAOs are usually not fully autonomous- Someone needs to create a decision-making framework to ensure that the DAO is governed in an efficient manner and economically incentivizes network participants to participate so that the DAO can grow and thrive.

DAOs creators and participants encounter many questions: What decisions need to be made? What financial incentives are available? Under what conditions should DAOs be formed? What are the main governance tasks currently required? What tools can be used to help with governance?

Before we answer these questions, let's ask another question - how did we get here? - and briefly discusses the development of DAOs. This will allow us to understand how decentralized structures have formed and changed over the past five years, helping to explain why economic incentives are a key factor in the coming era of governance of DAOs.

01. Early experiments paving the way for modern DAOs

In 2016, this kind of Internet-native organization appeared for the first time in the world. The most famous early DAOs were called "The DAO, a collective investment vehicle that aims to be a rationalist form of crowdfunding, a decentralized venture fund, and shows for the first time how such a decentralized organization that runs through code can Self-governance. Participants provide ETH to the DAO and receive DAO tokens, which represent the holder's economic interest and voting rights in The DAO.

The dream of The DAO is to allow any participant - no matter how big or small their coffers are to the treasury - to earn handsome returns in the Ethereum ecosystem(Editor's Note: Anyone can promote their ideas and projects to The DAO community, and potentially receive investment funds from The DAO, and anyone holding the DAO tokens can vote on the investment plan. If the project profit, DAO token holders will be rewarded). However, a critical smart contract vulnerability resulted in funds being siphoned from The DAO contracts by attackers, which in turn caused the term DAO to fall out of favor, sparking the so-called "DAO Winter, which coincided with the post-2017 bear market.

Security QuestionSecurity Question, because no DAO network can function, let alone grow, if users fear their funds will disappear. First, Ethereum competitors such as Tezos promise a more secure smart contract programming language, making it easier for developers to avoid The DAO's problems. At the same time, there are many experiments on Ethereum, such as Aragon, dxDAO, Kleros and Moloch. These DAO implementations brought better programming standards and a new token distribution mechanism to the space.

As security concerns dwindle, the biggest common problem with early DAOs is that theyAt that time, it was impossible to find an incentive model that would encourage voters to participate in DAO affairs. Without the participation of voters with the expertise needed to make informed decisions, DAO governance will stagnate.

02. The rise of economic incentives

In recent yearsDeFiThe rise of (decentralized finance) has opened the door to more sophisticated open financial systems and tools that do not rely on banks and other traditional systems. With the rise of DeFi, newDeFi DAOsare starting to emerge that use economic incentives to encourage people to participate in these systems.

These incentives, and the way they build on top of each other, have become key to DAO governance. Without economic incentives, network members have no reason to devote their time, money, and energy to these networks, to vote on governance proposals to improve these networks, or to care whether these networks continue to grow and succeed.

Below are several types of incentives and some key events in their formation to help readers understand how we got here, when DAOs are needed, how critical incentives are to governance, and how effective Strategies for governing DAOs.

1) Growth Incentives

In June 2020, an important development occurred, the on-chain lending protocolCompoundDecentralization is achieved, and the core developers of the protocol hand over the operation and ownership of the protocol to the community. Unlike previous DAOs, Compound’s governance DAO puts community members in control of the protocol’s reserve assets, which are generated by charging borrowers fees. For an on-chain protocol, these cash flows were (at the time) the highest revenue generated by the protocol.

Compound proposes a novel token distribution model(Editor's note, also known as liquidity mining), designed to both incentivize capital (liquidity) growth within the protocol and provide users with better loan pricing. The model involves the continuous distribution of Compound's native token, COMP, to users who provide liquidity to or take out loans from the protocol. Every user of Compound instantly becomes a stakeholder in the protocol, and some of them become active contributors and voters.

These economic incentives are crucial in controlling key parameters such as margin requirements and lending rates. The way Compound is distributed provides a glimpse into the dream of decentralization, where protocol users control the protocol (and its cash flow). With the Compound protocol having billions of dollars in assets and collateral to govern, the basic setup for a new kind of DAO is set - participants have clear reasons to use their time, assets, and votes to act in the best interest of the protocol , because the growth and success of the network can benefit them personally.

2) Yield Farming

By distributing governance tokens to protocol users, rather than just to investors and development teams, this creates a design space for many new models to emerge. The first is to create various incentives on the protocol, also known as "yield farming". Yield farming occurs when users are rewarded for lending, staking, or providing other forms of asset liquidity in the form of some token that represents ownership of the protocol itself. Reward recipients can either accumulate the ownership and hope that the value of the agreement will grow, or they can sell the rewards in the open market, so that their own income farming behavior can generate compound interest and increase their own income. Imagine if every time you made a deposit, the big banks gave you a fraction of their stock - it would make you more willing to deposit, which is good for both you and the bank.

For example, users of Compound can obtain some form of income by locking their capital in the agreement (that is, using assets as collateral to perform lending transactions in the agreement) and earning designated DAO governance tokens. That is to say, assets are used as collateral in the agreement to trade through lending) and earn designated DAO governance tokens to achieve some form of income. In this way, Compound is able to use COMP tokens to incentivize protocol growth and create a user base for the protocol that is incentivized to vote and contribute to the protocol as these benefits attract more users.

As developers realize they can use this "yield farming" approach to attract capital to new DeFi protocols, there has been a liquidity race throughout the summer of 2020 to drive DeFi through DAO governance token distribution Protocol Development. The catalyst for growth in the DeFi space last summer was DeFi yield aggregatorsYearn Finance(YFI), which through its "fair distribution" (that is, all yield tokens are distributed to liquidity providers, not to the protocol developers), has changed the narrative in the DeFi field from "venture-funded sponsored projects” to “community-funded projects”. When Yearn Finance launched and saw rapid growth, many competitors launched clones and knockoffs of the protocol, promising slight improvements, but more importantly, new DAO governance tokens.

Yearn Finance demonstrates that the commitment to governance alone can lead to protocol adoption. Its use of a "fair distribution" model, and the use of initial token distributions to target desirable future users, has since become commonplace.

3) Retroactive Airdrop

Several new protocols have built on these incentive models to further incentivize users. A prominent example is airdrops, the delivery of tokens to current or former users' wallets to spread awareness, build (protocol) ownership, or retroactively reward early adopters. For example, a decentralized exchange protocolUniswapThe launched UNI tokens are distributed retroactively to all users who have used the Uniswap protocol. The airdrop netted some early users tens of millions of dollars worth of UNI.

What's more, airdrops and token offerings proved to be an effective capital (liquidity) protection weapon, quickly becoming a must for new DeFi protocols seeking to gain market share. The increase in token issuance also brings changes in governance rights - early users, unaware that their participation will bring them governance rights, start owning a large portion of protocol governance rights, thereby driving a more decentralized protocol governance.

Retroactive airdrops became a tool to increase token distribution and active user participation in governance.

03. Cultural DAO & Game Guild

The development of the aforementioned economic incentives has contributed to the exponential growth of DeFi protocols in 2020. But in addition to DeFi DAOs, other types of DAOs are emerging, with different cultures, incentive models, and governance structures. Recently, we have seen the rise of DAOs whose token distribution model is not tied to protocol usage or participation the way DeFi DAOs are.

These are collector DAOs, groups of people who collectively decide to buy art or other digital items. One example isPleasrDAO, this DAO organization was formed after pplpleasr (Emily Yang) created a commemorative video for the launch of Uniswap V3 (I am a founding member of PleasrDAO). The video is regarded as an iconic art that captures the spirit of DeFi in 2020, and the video was minted as an NFT (non-fungible token) and auctioned, and the proceeds were used for charity. The auction, and the collective spirit surrounding the artwork, eventually pushed some longtime DeFi developers and entrepreneurs to create PleasrDAO to buy art.

The progress brought about by PleasrDAO is aNFTs are fragmentedunique mechanism, which makes collective ownership of individual artworks more feasible. This vision portrays PleasrDAO as an art museum, just like MoMa (Museum of Modern Art), except that all artworks in the PleasrDAO museum can be collectively owned by funders.

image description

Above: Several artworks from the production artwork Autoglyphs series

FingerprintsDAO and PleasrDAO utilize their DAO governance tokens to manage their treasuries, execute asset sales (including proceeds from NFT fragmentation), and asset management. DAO token holders are entitled to vote on these events, and in many cases the results of these votes are algorithmically enforced directly on-chain using DeFi protocols such as Fractional or Uniswap.

Since the token distribution of such Collector DAOs is not tied to protocol usage or participation in the same way as DeFi DAOs, and the economic incentives are generally not as aligned as DeFi DAOs, this may cause early DAO organizers of this type to take on more and more burdens. The greater the obligation to keep the DAO running effectively, and the complex dynamic relationship among DAO members. This kind of challenge is specific to cultural DAOs, and builders in this field should use different types of governance decisions to keep DAOs running effectively.

One strategy for Collector DAOs is to hire full-time engineers and product managers, who can be directly incentivized through the DAO governance token (while ensuring that this organizational structure maintains the DAO's decentralized governance and operations). By ensuring that those who work for the DAO receive an increasing share of the DAO's assets, a stable balance can be created between early token holders and those involved in the day-to-day management of the DAO.

The last type of DAO is the gaming guild, which has its own culture, incentive model, and governance structure. This is the DAOized version of a gaming tribe (a clan of players). These decentralized unions collectively own game items and/or collectibles (NFTs) and share the rights to use them and proceeds from their sale.

earn while playingearn while playing"Mechanism can encourage cooperative strategies and revenue sharing between players. These mechanisms make game guilds more like DeFi DAOs, that is, participation in the network can be rewarded and can also improve the prospects of the network, but the governance of the network is not so dependent on pure economic indicators, but more on game performance and social metrics. These DAOs are worth watching because as they evolve, they may find new mechanisms to increase their own decentralization in ways that no other DAOs have used.

04. When do you need a DAO

The general growth of DAOs and the massive success of some of the most innovative DAOs has inevitably led to the perception that DAO structures are needed to enable growth and drive robust network participation. In times of heightened sentiment, market forces make it easy to think that every organization, community or project needs a DAO, as we saw with the rise of Crypto tokens during the ICO (Initial Coin Offering) boom of 2017.

But that's not necessarily true.DAOs work best when the governance burdens associated with management, security, and risk can be reduced more quickly than the natural increase in coordination costs due to requiring members to participate in every decision-making.This is why it is important for protocol builders to assess the true goals of the organization when deciding whether to form a DAO.

Common governance areas for all DAOs include:

Ownership and management of collective assets. A DAO's treasury and balance sheet should function like a decentralized corporation, considering assets and liabilities, liquidity, revenue, and where to allocate financial resources.

asset risk management. Volatility, prices and other market conditions require constant monitoring.

Asset curation. From the art collected to the collateral for lending, all DAO assets should benefit from a goal and process around curation.

A DAO should only be formed and formed when it is clear that the community needs all of these areas of governance.

It's important to note that while a DAO may only focus on a subset of these activities, it does need to provide all three. For example, suppose a cultural DAO owns an asset from which the DAO suddenly has an opportunity to earn income. If the DAO had previously completely ignored risk management (e.g., focused only on asset curation), it would be selling the asset. There will be challenges in asset risk management from time to time.

image description

Above: The NFT based on the DogeCoin (Dogecoin) prototype image was purchased by PleasrDAO at a price of 1696 ETH, and then PleasrDAO fragmented the NFT through the Fractional Art platform and minted 17 billion DOG tokens representing the ownership of the NFT (ERC-20), and auctioned 20% of the total amount of tokens (nearly 3.4 million DOG tokens) on the decentralized fundraising platform Miso. PleasrDAO still retains ownership of the majority of DOG tokens.

The lesson of the PleasrDAO case is that,first level title

05. Three key areas of governance

secondary title

1) Collective asset management

All DAOs have some initial capital consisting of governance tokens held by the DAO smart contract and assets used to purchase governance tokens. For example, if a DAO initially minted 1,000 governance tokens and sold 500 of them to the founding member for 100 ETH, the DAO's initial treasury would consist of 500 governance tokens and 100 ETH.

secondary title

2) Risk management

Since a DAO's balance sheet usually consists of risky assets, it is particularly important to manage the DAO's currency exposure to secure funding for future operations. Many DeFi DAOs and NFT DAOs have coffers of hundreds of millions or billions of dollars in assets that are used to fund development and audits, provide insurance in the event of underlying protocol failure, and spend on user growth and acquisitions. To achieve these goals, DAOs need to manage their treasury to meet specific metrics or key performance indicators (KPIs), such as, “Can we survive a 95% drop in the price of these assets?” earning X% interest on assets, can we still buy high-value NFTs?”

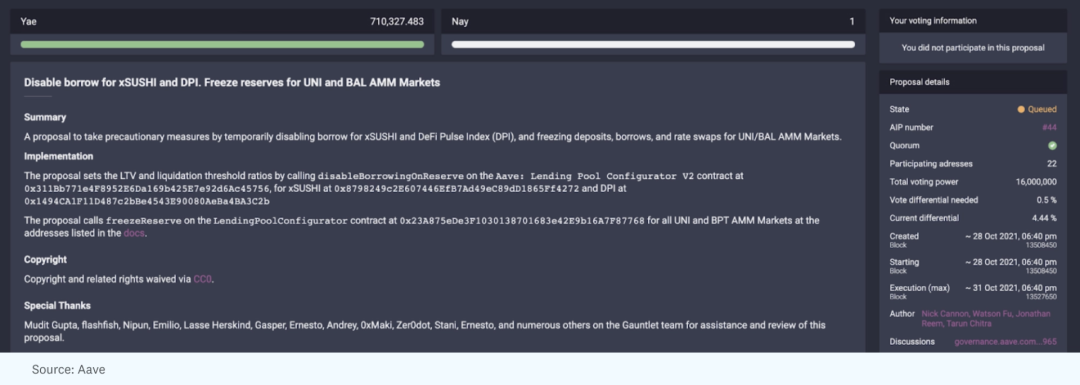

image description

Above: A proposal by Gauntlet in Aave governance that proposes banning certain types of borrowing to reduce risk

There are three key governance factors at play here -A community capable of detecting potential risks in a timely manner, modeling to assess the true nature of that threat, and a governance process ready to make necessary changessecondary title

3) Asset Curation

The most natural place to do asset curation is in NFT collectible DAOs, such as PleasrDAO. These DAOs inherently act as curators of art and culture, while using the DAO governance tokens to vote on the addition or removal of assets.

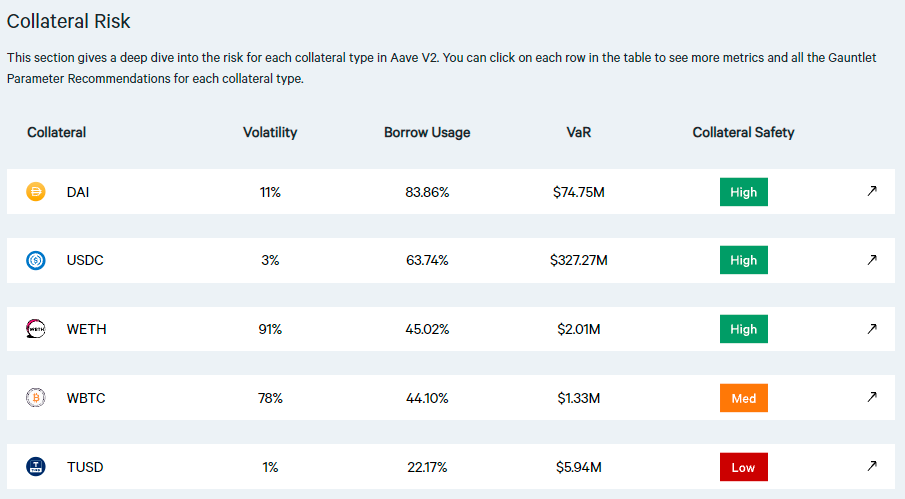

However, DeFi DAOs also often face this problem. While some DeFi DAOs mechanisms (such as Uniswap) allow people (liquidity providers) to add assets in a permissionless manner (that is, anyone can use a brand new asset to create a trading pool), others use leverage mechanisms. DeFi DAOs do not allow people to do this. In particular, lending protocols like Aave and Compound use governance to decide which assets can be added or removed, because many parameters must be chosen for each asset, including margin requirements, interest rate curves, insurance costs, etc., and these decisions It is critical to the security of the protocol.

Let's provide a simple example of what can go wrong. Suppose we mint a new asset, TarunCoin, and I hold the entire supply of that coin. Now suppose I create a lending pool that allows me to borrow 100% of its value by staking TarunCoin. If I control the USD price of TarunCoin (for example, through a Uniswap pool, I am the only liquidity provider of this liquidity pool), then I can make the market value of TarunCoin very high (say 100 million US dollars), and then use TarunCoin to Borrow $100 million. However, since TarunCoin has almost no liquidity, it is inevitable that my loan will default and those borrowers will suffer losses.

first level title

06. How to run the DAO

secondary title

1) Use governance tools

First, quantitative tools emerged to allow the community to visualize the risk of a DAO (and possibly related protocols) against market conditions, and allow DAO members to understand what it would mean to vote to lower collateral/margin requirements or raise interest rates. This adds overall transparency to the risks posed by the DAO treasury and allows the community to update the composition of the treasury to meet specific KPIs.

For example, the billions of dollars in assets held by lending protocol Aave and Compound vaults effectively act as an insurance backing for the underlying lending protocol. For example, if there is a large-scale price fluctuation, causing a large number of loan defaults, causing losses to the lenders in the protocol, these DAOs can use their treasury to cover the losses of the lenders (for example, DAI in the Compound protocol liquidation event).

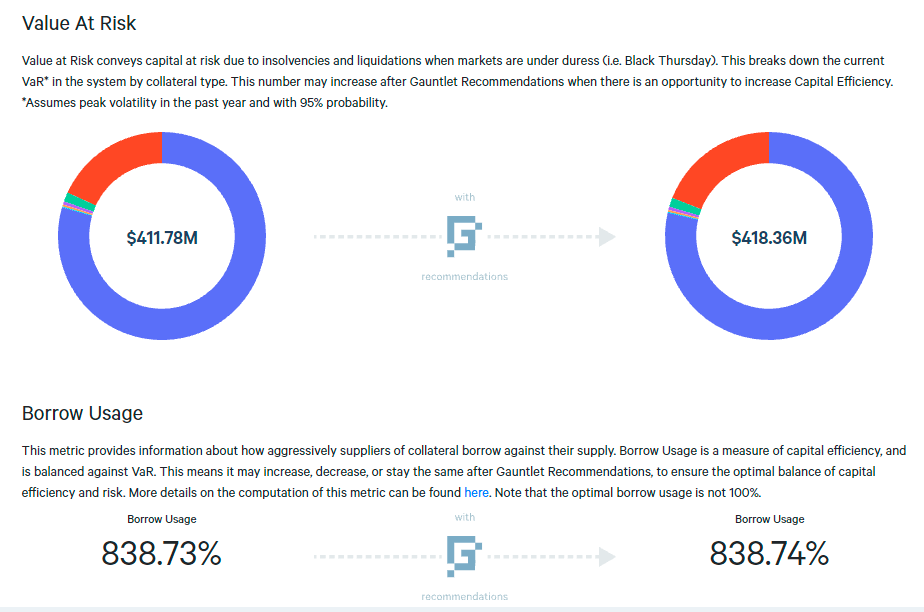

image description

Screenshot source: https://gov.gauntlet.network/aave

The goal of these tools and services is to allow the community of DAOs to expand to larger and more diverse groups of people. Due to the composability of smart contracts, protocols become increasingly complex and intertwined, making governance increasingly difficult for each new member. This in turn makes it harder for new members to join DAOs and participate in a meaningful way.

By helping users easily explain the complex behavior hidden in DAOs, visualization helps to better onboard new members. Tools, for example, allow all members to understand what they are voting on without needing to understand the underlying technical complexities. Each DAO tool or service can then specialize in providing illustrative, easy-to-understand dashboards that reflect the health of the DAO from a technical, financial, and community perspective.

secondary title

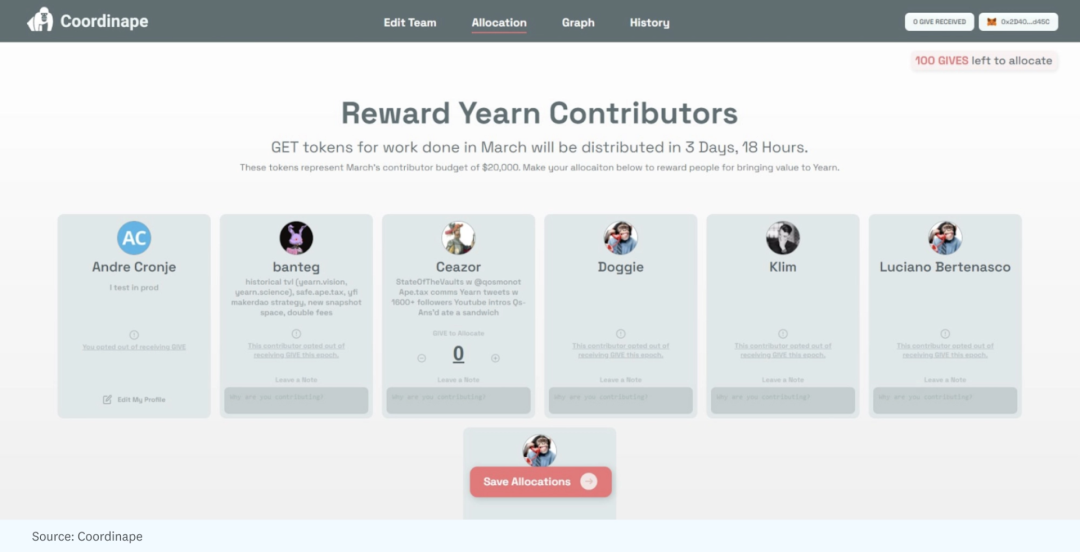

2) Divide the DAO into smaller "subgroups"

image description

Source of the above picture: https://coordinape.com/

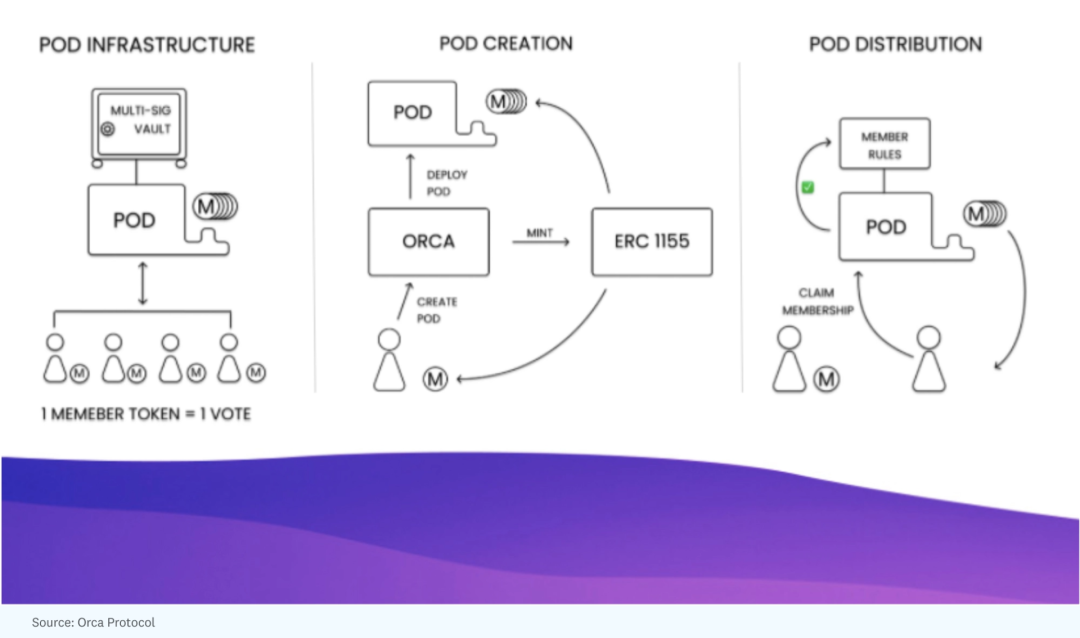

image description

secondary title

3) Hire employees

One final note on DAO governance:Once a DAO has a large enough community and assets, it must hire people who can dedicate their energies to maintaining, communicating, and managing the DAO.However, DAOs must be careful not to create any "active participants" on whom token holders may depend to drive the value of the underlying token. Therefore, decentralization must be considered when adding service providers.

DAOs that fail to hire full-time developers, community managers, and other staff often find themselves at crossroads as their assets dry up or they need help. The once-hot DeFi protocol will lose momentum as the DAO treasury dries up, and no DAO member will think they have enough motivation to ensure the operation of the protocol (such as through protocol improvements or asset reallocation).

While PleasrDAO has a committee (much like a company's board of directors) to help guide the long-term direction of the DAO, a few key contributors ensured that the DAO's launch, funding, and curation were executed flawlessly. In this way, DAOs can often also draw on best practices from regular organizations (companies).

***

Coordinating efforts to form decentralized Internet organizations with assets can sometimes be seen as the "wild west" of uncharted territory. But many of the problems and solutions found in traditional systems can inform and guide DAOs as they are stress-tested over centuries and adapted to this new DAO domain. In many ways, learning from the history of past and recent DAOs may help new builders find and adapt ideas for future online institutions.

Thanks to John Morrow (Gauntlet), Nick Cannon (Gauntlet), Julia Rosenberg (Orca), John Sterlacci (Orca)Luiz Ramalho (FingerprintDAO), Jamis Johnson (PleasrDAO), and Robert Leshner (Compound) for constructive feedback and comments on this article.