"Come for the tool, fight for the network" is a classic strategy for guiding social networks. It's designed to solve a tricky problem: how do you convince people to join your network when no one connects with you?

One approach is to build a stand-alone tool and let people use the product. Over time, as more and more people use the single-player tool, you add social features like likes, comments, follows, etc., that seed the defensive network.

Today, with the rise of creator-centric platforms, that mantra is evolving into: “Come take creators, stay for the web” Creator-centric platforms realize that no matter where creators go, audiences and Attention will follow. As a result, platforms bootstrap their networks by attracting top creators. "

Market entry strategies can generally be summarized as:

Attract top creators with compelling features and/or wallets

creators bring their audience

Add functionality to retain creators and their long-term audience.

It’s no secret that creator-centric platforms like Instagram, TikTok, Snap, Spotify, Only Fans, Substack, and Thriller (LOL) offer huge bags to attract top creators and their audiences.

But this pattern has several problems:

It's hard to live sustainably unless you're a top creator

Creator payouts are determined by an opaque process.

Content and social graphs are rarely portable across platforms.

In my work with Mirror, I think a lot about how to build products that put more power back into the hands of creators and their audiences. But we are not a "company" in the traditional sense. Instead, we are building a creator-centric protocol. We work with creators to understand their needs, write smart contracts, deploy them to the Ethereum network, create interfaces to access those smart contracts, and aim to develop a new type of network to help creators solve their problems.

A decentralized protocol is not a social network. They are cryptoeconomic networks.

Instead of "come for the creators, come for the network", I think the mantra for creator-centric protocols will be more like "come for the creators, come for the economy".

That's the difference.

A social network is:

Shareholder-owned (tends towards financial firms, executives, board directors and early employees)

Governed by shareholders (in practice, governance is usually controlled by the board of directors, CEO, and sometimes active investors)

Most code is private.

Data is secured by the company's engineering group

Over time, the web has become global.

A cryptoeconomic network is:

community owned

open source

open source

Security through distributed consensus, encryption, and public/private key pairs

Global from day one

Is the cryptoeconomic network perfect? of course not.

But the point is that a creator-focused protocol will be more like the internet's native economy than a traditional social network. No more rigid hierarchies, top-down product development, opaque payment schemes, taxes without representation, or walled gardens.

The creator-focused protocol will have community-led decision boards, native protocol tokens for governance, value capture and utility, decentralized authorization procedures, universal creator revenue, open developer ecosystem, pseudonymous groups, Degen Investment Club, Manners Politicians and more.

A few years ago, this might have sounded like another cryptic narrative of idealism, and it never will. Actually work in practice. But it is already happening. Since 2018, DEVI protocols such as Uniswap, Complex, and AAVE have won billions in treasury bills, launched protocol tokens, and begun experimenting with community-led projects such as grants.

Over the next few years, I think creator-centric protocols will reach a similar scale.

But to achieve this, an iterative approach is usually required. Similar to how social networks start out looking like toys but eventually evolve into something serious, protocols need to go through their own natural selection process.

I think a successful creator-centric protocol will go through three phases:

Phase 1: Creator Mode

The second stage: org. model

Phase Three: The Protocol Economy

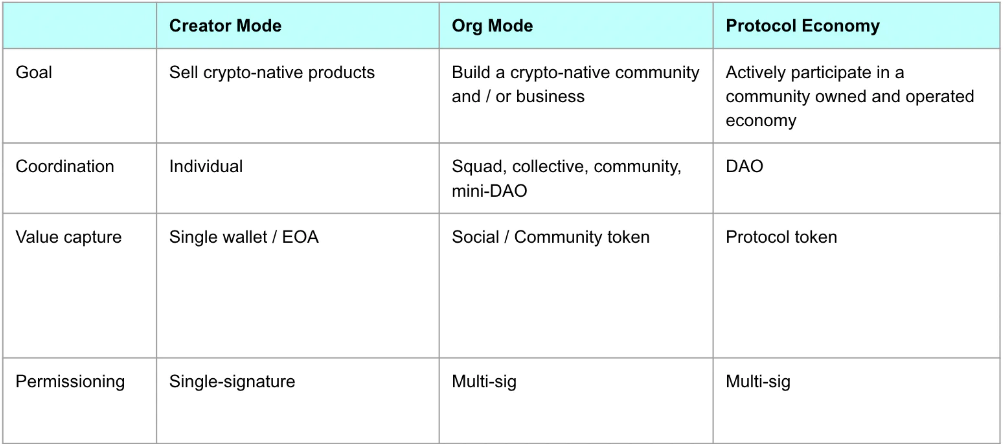

image description

Three Phases of a Creator-Centric Protocol

With a decentralized protocol, "come for the creators, come for the network" becomes "come for the creators, come for the economy". Creators will have ownership in the internet economy they are building. They will be incentivized to hype other creators. Invest in communities, direct traffic. provide support. Fans, curators, and community leaders do the same.

But how do we get there?

secondary title

Phase 1: Creator Mode

In creator mode, the goals are:

"Helping creators generate on-chain revenue by selling native crypto products."

Helping creators generate on-chain revenue is a great first step for several reasons:

Convincing creators to use a cryptographic protocol is worth the extra time

Get the creator's audience to download the wallet and get into ETH

It provides the basis for future on-chain experiments.

In terms of deciding what to build, I like Li Jin's framework for the creator life cycle. There are four stages:

create something

Monetization

Monetization

Manage and grow your business

Today, crypto’s killer feature for creators is making money through NFTs. Over time, I think crypto will get better at other stages, like helping creators build their audience through token rewards and enabling new content formats. But right now, as a creator-focused protocol, your best bet is to help creators make money (given all the interest, activity, and novel use cases surrounding NFTs).

At Mirror, we've built tools that focus on phases one and three of the creator lifecycle: creating something and making money.

Our founder/CEO Dennis realized that all creative work has a story to tell, and long-form writing is one of the best ways to do that. So over the past few months, the team has built a crypto-native release stack for creators to tell their stories. Here are a few components:

Decentralized identity using ENS. When you sign up for The Mirror, you also sign up for the Anse domain using your key. This ens domain is basically a self-hosted twitter username. This is your social and economic identity. Soon, we added the ability to accept tips to ENS domains and route funds to other ENS domains on the mirror.

Decentralized storage using Arweave. All posts on Mirror are signed by your key and stored in a digest on Arweave. We plan to build a tool where people can click a button to export all their articles on Mirror and easily migrate to another publishing tool if they want.

Markdown edit. While it's still early days, the long-term vision is to have a block-based editor with a similar concept. You will be able to embed encrypted versions of crowdfunding funds, auctions and global payments in your posts as easily as possible.

At The Mirror, we are also aware that creative work requires capital to sustain itself. With this in mind, we have also built a suite of smart contracts and a web application to help creators fund and monetize their work. Some examples include:

Token crowdfunding fund. Withdraw ETH from anyone in the world with a wallet. An author recently raised $50 million for an upcoming novel. Crowdsourced funds are tokenized by issuing ERC 20 tokens to anyone who contributes ETH to the crowdfund. Crowdfunding creators can then link revenue from NFT sales to the crowdfunding fund contract, and token holders can redeem their tokens for a portion of the sale. This is called a sponsorship + ownership model.

Reserve the auction. There are many ways to sell NFTs, but reserve auctions are fast becoming the best price discovery mechanism. And they're fun. As an NFT seller, you set the minimum price and auction period. Once the lowest bid is hit, it starts a clock based on the duration set by the seller. If bids come in within the last 15 minutes, the clock will be reset to 15 minutes. Mario from the all-rounder recently sold for $45,000 with a visualization of the value of the NFT auctioned by Jack Butcher.

Revenue split. In web2, if you cite someone in your post by linking to their twitter profile or sub-stack, you're getting their attention. It is then up to another person to turn the attention into cash. But if you can financially reward anyone in the world, directly at The Mirror, we recently deployed a revenue split contract that allows you to use any Ethereum address to split sales. This feature brought NFT sales to $5k with 16 contributors.

Building an agreement during the Creator mode phase is difficult because you don't have much information. Also, passwords are notoriously difficult to use. Creators are used to smooth the onboarding flow. Not signing messages through Metamask, paying gas bills, and waiting 5 minutes for a transaction to be confirmed on-chain.

However, we see each experiment as an opportunity to learn something new about the market and incorporate it back into product development. Here are a few principles we used to guide us during this initial phase:

Start a feature with a specific use case, then generalize it.

So far, our go-to-market strategy at The Mirror has relied on working with creators on a very specific experiment they want to run. It usually starts with them asking us if it's possible to do something. We iteratively figured out a reasonable solution that could be implemented within a few weeks while still achieving their goals. We then implement the feature, reflect on the learnings, and continue to work with creators to iterate on the experience until we feel confident releasing it to all of our members. Cryptography is so new that most creators don't know how to use it to achieve their goals. These experiments provide a form of documentation for creators to understand what is possible.

Optimize security, institutional design, composability, and gas efficiency of smart contracts.

As an engineer building cryptographic protocols, the first thing you need to realize is that writing smart contracts is a whole different game than any other kind of programming. If you are a good software engineer, you can quickly learn how to write a basic smart contract. but this requires

Years to build secure, composable, efficient smart contracts that unlock useful functionality. By far the biggest competitive advantage a protocol can have is a world-class team of smart contract engineers. I find it difficult to build a genuine and innovative protocol. While I'm far from world-class myself, I've been lucky enough to work with some world-class smart contract engineers. The four things I noticed they excel at are: safety, mechanical design, composability, and gas efficiency. Don't settle until you've found a smart contract engineer who's good at these skills.

listen to the ski instructor

Use heavily guarded motorboats to limit downside risk.

Our crowdfunding fund is capped at 25 ETH (currently about $55,000). Although we take great precautions before deploying contracts to mainnet, the risk of a bug is always not zero. There are safeguards like funding limits to ensure that people don't turn their life savings into random crowdfunding funds and get REKT because of a loophole in the contract. No dino.

Over the past few months, we've learned a lot about what creators want and how passwords can help them build stronger communities. One of the most common feedback we receive is that creators want to build a sustainable recurring revenue business using native crypto tools. At the same time, they want to ensure their communities have the opportunity to share in the benefits.

secondary title

The second stage: org mode

in the organization. mode, the goal is to:

"Helping creators and communities build sustainable crypto-native businesses."

Creator Mode is about selling crypto-native products. Org. mode is about building crypto-native communities and businesses.

It's a bit like the difference between an independent artist and a record label. As an independent artist, you are responsible for producing, distributing, posting on streaming platforms, booking live concerts, selling merch, and more. Also, once you're registered to a record label, many implementation details are abstracted away so you can focus more of your time on creative work. Record tags plug you into the system which makes it easier to produce, distribute, monetize and grow. For a creator-centric protocol, I think the transition from Creator mode to Org. The schema looks similar (minus the bad logging transactions).

But what is the business model for creators? One way is to connect the value to an ERC 20 token. Today, the majority of revenue generated by creator-focused protocols goes to EOAs (e.g., individual wallets). It is then up to the individuals themselves to reallocate the funds, if any.

Ogg, though. The model is to build a private indigenous community with sustainable business. We can get inspiration from the DEVI protocol to understand how to design such a system.

Here's the basic mechanism:

Issue ERC 20 tokens. Distribution methods can include crowdsales, "fair launches", airdrops to anyone who meets specified criteria, schemes for active participants in liquidity mining, or any combination of the above.

Develop chain income streams. For the DEVI protocol, this is usually a transaction fee. For creators and communities, this can include selling 1/1 split/open edition NFTs, collecting NFTs, accessing communities, digital lands, crowdfunding funds, consulting services, programmable subscriptions, and more.

Provide on-chain revenue to treasury contracts. Sales generated by the community flow to a chain of treasury contracts. The treasury is controlled by a multipurpose wallet that submits transactions based on community governance.

Funds are redistributed through community governance. If the society is optimizing for long-term growth, they may vote for the “buy-back” strategy of the Treasury to buy back tokens on the open market and use them to fund community growth initiatives. Alternatively, the community can optimize short-term liquidity by offering dividends to token holders.

Creator/community in most cryptos is not as sophisticated as Defi protocols because the tools don't exist yet. At best, they might have stitched together a bunch of disparate tools. However, there is still a lot to long for.

financing

financing

Monetization

Monetization

marketing automation

product analysis

In web 3, there is also a set of tools that need to be improved:

governance

On-chain analysis

governance

Finance Department Management

Token Reward Program

Shopify makes it easy for anyone to create, manage, and scale an eCommerce store. Aimed at creator-centric protocols, the Org model is to make it easier for creators to create, manage and scale a cryptographically native community or business.

As a creator-focused protocol, I think it's useful to hone in on specific use cases, provide the tools needed to succeed, and scale from there. For mirroring, a few examples could include:

Publication DAOS. Most communication products today are optimized for stand-alone mode. a writer. This offers benefits such as autonomy and more financial advantages (if you're already established). But the single-player mode also has some drawbacks, such as a greater workload and the challenge of coming up with a consistent growth strategy. A publication DAO could share the workload, help authors get assigned, and share the financial benefits fairly through transparent revenue distribution. Here's a detailed example of what a publishing DAO might look like.

investment club. As we've seen with R/Wallboard and $Doge, people love investing together. That's part of the fun. Some collective action. Over the past few months, investment clubs have emerged to coordinate and manage valuable NFT collections. Rakuten is a decentralized investment club, an NFT established on twitter via Pule. Most recently, Rakuten launched an epic bidding war for Edward Snowden. The first NFT they ended up winning at 2,224 ETH (about $4.7 million today). Investment clubs are also known as curators and I believe they will be one of the most important stakeholders in the emerging crypto economy. In the past, curators like Vogue, Hype Beast, and TechCrunch decided what was and wasn't cool. $Whale, Seed Club, $FWB, and Fireblade will specialize in outstanding vertical products and invest in the most promising creators, communities, and projects.

Decentralized grant programs. In Web 2, almost every creator-focused platform has a creator empowerment program. TikTok, Snap, Only Fans, Substack in web2, these programs are a smart way to acquire top creators, get their audience on your platform, and retain them over time. The problem is that these grant programs are opaque, cash-based and have little to no equity. I think funding projects for web3 will look very different. DEVI Protocol Uniswap, Forex, and AAVE have started experimenting with their own funding schemes, and I'm excited to see how they develop. For a creator-centric protocol, a grants program could work like this: creators apply for grants on a public forum, community members contribute ETH to a pool and receive ERC 20 tokens, and contributors spend their ERC 20 to vote on which creators should receive funding, after a certain amount of time the top x creators share this pool and are rewarded with protocol tokens so they can have skins in the game. There are a lot of kinks to be ironed out here, but the general idea is to make the process more transparent and give creators more ownership over their work. Now it seems like every creator starts their own VC fund. In web3, I can see an evolution of this model where top creators start funding projects and allow their communities to decide how the funds are allocated.

Creator-focused protocols have been iterating on the Creator model for the past year. I think the next couple of years will be a transition to building Org-enabled tools.

secondary title

Phase Three: The Protocol Economy

In the protocol economy phase, the goals are to:

“Building a protocol that is owned and operated by the community with minimal involvement from the initial development team. Current development is driven by a community-led committee with creators, curators, collectors and an ecosystem of developers active participation."

The protocol economy is what separates web3 protocols from web2 companies. One of my favorite programs to learn is Eager. Insiders describe it as a multicellular organism, not a corporation. There is no board of directors. There is no CEO. No VCs. There is no human resources department. Instead, it started as a single open source project, which evolved into a "donor collective".

But, is it? Actually working? Only time will tell, but so far they've coordinated to make really difficult decisions without blowing up the community. For example, community members recently voted to raise the protocol’s (previously sacred) token supply cap to fund protocol development. They also propose one of the most complex decentralized governance systems in all of cryptography. (I highly recommend reading this and this to learn about their culture). Today, their endowment -- $YFI -- has a market cap of $1.4 billion. Not bad for a project that started ten months ago as a one-person open source project.

While FINN is a fully decentralized protocol from day one, even if we take a phased approach like the one outlined so far, we can still learn a lot. DEVI protocols like Uniswap and Compound have taken a phased approach, but have begun to gradually decentralize over the past few months. They have incorporated best practices from projects such as ISUN and developed their own learning methodologies as they transition into the protocol economy.

At this stage, here are a few key elements that creator-centric protocols may need to consider:

sourcesource). Sometimes protocol tokens are switched from one function to another through community governance. For example, FISN’s protocol token, $YFI, was initially considered a currency. YFI holders receive dividends, and many community members are fascinated by the price action. However, some community members realized that these funds might be put to better use by paying core contributors to improve the protocol. So society voted to increase the token supply cap and redirect more treasury funds to core donors rather than speculative warrant holders. With this change, protocol tokens move from currency to capital. In the protocol economy, tokens may be more than just "numbers going up." It can be a vehicle for change throughout the protocol. money and capital. For creator-centric protocols, this capital can be used to share more benefits with the creator. This will align incentives and bring longer-term growth to the protocol. Eventually, you may see deal structures similar to employee compensation plans at startups. There can be a token lock-up period and vesting schedule. Frankly, I think platforms should reward top creators the same way they reward top employees.

Third-party developer ecosystem. In a protocol economy, the initial development team cannot unilaterally change the protocol. Instead, the protocol will need to use a suite of tools to create a ✨thriving✨ developer ecosystem. These include: audited/well-tested smart contracts, documentation describing the overall system, subgraphs for querying on-chain data, SDK's for integrating smart contracts, grant programs to fund new projects, bug bounties for improving the protocol, and access to A clear path to technical support. A key difference between web2 and web3 is that on-chain data is public. So you can see creator-focused protocols have dozens or hundreds of different front-end clients built by third-party teams. These clients will use logic and data from the protocol's smart contracts, but can also combine them with other protocols' smart contracts to create something entirely new. Just like the content and algorithms of Instagram, TikTok, Twitter, YouTube, etc. are public. You can combine and mix functions like crazy. There could be an app specifically to help creators finance new projects based on their online earnings. Or maybe there is a market to help with collagen across different protocols. A lot of crazy things can happen here.

A committee of community leaders. And when I say committees, I don’t mean those useless committees inside big corporations that meet just to get free pizza every month. I'm talking small, focused teams, well-defined KPIs, domain expertise, and skin in the game. Then again, "Desire" seems to be the lead here. Over the past few months, they've noticed several teams emerge organically. Operations teams, development teams, budget control teams, brainpower teams, to name a few. As a result, community members proposed to create an official "Yam Team". Each yTeam has the right to make decisions regarding its field. Whether it's how to spend the budget, determine a development roadmap, or come up with new plans for agricultural production. Who would have thought that a decentralized protocol would have so many structures? This reminds me of one of my favorite people, Vitalik who said: "To me, the purpose of passwords is never to remove the need for all trust, rather, the purpose of passwords is to give people access to both passwords and economics." building blocks, thereby giving people more choice.Community-led committees are chosen by their peers and are an important force in moving the agreement forward.

Community Benefit Program. One of the most common arguments against web2-focused platforms is that they take up more than they pay for. In a way, their acquisition rate can be seen as taxation without representation. Of course, web2 platforms provide key services such as distribution, content creation tools, payment processing, and more. But the key question is, are they receiving more than they are giving? ? Who decides? In web3, the decision rests in the hands of the community. In the DEVI protocol economy, the most common community welfare program is the grant program. Top-tier protocols allocate around $1 million per quarter to projects they deem beneficial to the ecosystem. For a creator-centric protocol, I thought it might be interesting to have some creator-specific community benefit programs. Things like this generally include creator income, smart contract risk insurance, automated wealth management services, P2P zero-interest loans, etc. This is the area of development that I'm most excited to see. I'm sure creator-centric communities are going to come up with some crazy, creative collective bargaining schemes to make sure they're not only successful as individuals, but successful as well.

secondary title

closed mind

While we've gone through three phases - Creator Mode, Ogg. Patterns and Protocol Economics - In a certain order, it is still important to start thinking about end states from very early in protocol development. Who do you hire. The people you attract as first customers and community members. What it says on your website copy. Early decisions can affect your ability to pass other stages.

So how does "come for the creator, stay for the economy" end up in practice?

Years from now, I imagine people flocking to a creator-focused protocol because one of their favorite creators recently joined. As they build their reputation on the protocol, they may be eligible to claim a monthly salary from the Treasury, quit their job, and become a full-time content creator. Or they want to deposit their passwords into the community's automated wealth management system. Or, they may have raised an investment fund from the Protocol Treasury based on their reputation as a curator. In a mature creator-centric protocol, I believe there will be such opportunities for creators, curators, community leaders, developers, protocol politicians, and passive consumers.

They come for the creators but stay for the economy.

On the face of it, they are governed by protocol tokens. On a deeper level, they are bound together by the desire to succeed. The heart and soul of these economies is not an invisible hand driven by self-interest. . Instead, it’s Feathered Dinosaur, a community leader whose mission is to “unite and harmonize collective intelligence.” It's because Rabbit ships the code like his life depends on it. It's the bag holders who donate 10% of their earnings to the protocol, funding future development.

This is a new type of economy.