Original title: "Bottom-up: An article to understand how community DAOs achieve value capture through self-government", author Dong Xun

By Hugh Ragsdale Source: Messari

Social media is clearly a canary in Web 2.0 in terms of heralding the modern future of community. Twitter and Facebook amplify the growth of digital tribes, but also extract most of the value from those tribes. Moving to Web 3.0, digital communities are upgraded by introducing native units (tokens). The first instances of community tokens revolved around popular celebrities (such as EDM artist RAC). Whether it's an off-the-shelf social media platform or a well-known career, at first, digital communities need a central group to build upon.

secondary title

1 Community DAO: A New Digital Organism

Community DAOs like BanklessDAO, PleasrDAO, and Friends with Benefits (FWB) flip the script. Community DAO does not decide the spirit of the community and acquire value by the parent organization, but self-organizes, formulates its own guiding principles, and generates/acquires its own value. Just as children grow into adults, so do digital communities.

The origin of community DAO is the further adaptation of human beings to cloud social life.

Community DAOs are usually initiated by netizens who share common passions, skills or values, and they are cultural Schelling points (or called focal points). Holding community DAO tokens represents loyalty to the digital tribe, and the status that comes with it. Holding community tokens represents something about their online holders. The members of BanklessDAO are very different netizens from the members of Friends with Benefits. The former is focused on advocating for DeFi growth and the Bankless mission, while the latter may seek curated cultural and offline networking opportunities.

secondary title

2 Community DAO: an independent value engine

In a community DAO environment, access is a scarce resource. It is the fuel that runs the engine. The emphasis people place on access is both a cause and an effect of the power of communities. In short: the community drives the value of capture, which creates a need for inclusivity and further cements the size and strength of the community.

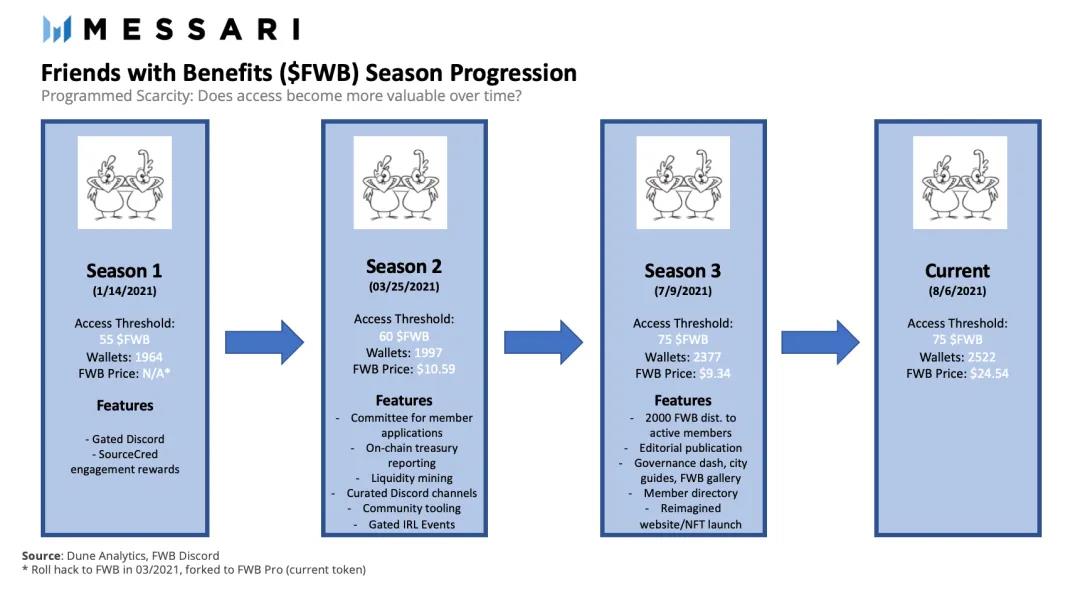

In decoding the specific association between community strength and access value, we can look at FWB's hierarchical progression model. Friends with Benefits (FWB) lives on Discord as both a provider of content and a hive of community. When the first season launched, members needed 50 FWB tokens to gain access to the discord. As the community grows in size, so do the barriers to access and associated perks. Season 3 kicked off a few weeks ago and requires 75 FWBs to get in.

Those who attend FWB's third season can benefit from some added perks like a closed IRL (in real life) event, premium substack content, and a curated city guide. One of those perks is undoubtedly exclusivity, as access gradually becomes more and more scarce.

BanklessDAO is an extension of the mission preached through the Bankless newsletter and podcast: financial freedom and sovereignty over your assets. Although BanklessDAO pursues a different goal than FWB, it employs a similar approach to access. Only after receiving 35,000 BANK tokens, members can fully enter the DAO's Discord. Once in, member benefits include corporate wellness programs and dedicated NFT giveaways.

secondary title

3 How Tokens Enhance Network Effects

Community DAOs evolve in much the same way other cryptoeconomic protocols evolve. They typically bootstrap themselves through subsidies and accelerate network growth by distributing tokens to individuals with some commitment to the network. This is similar to Web 2.0's "lightning scaling" strategy, or taking losses in the short term to foster long-term adoption.

Forefront (FF) is a DAO resource aggregator and FWB both distribute tokens to members who accomplish goals on behalf of the community. Goals range from short promotional blog posts to designing POAP (Proof of Attendance Protocol) badges for events to building Discord bots.

Such one-time contributions may seem mundane, but these commitments add up over time. As community identities materialize and member benefits expand, the value of potential nodes as part of the community grows. Community tokens appreciate in value as demand for access to the DAO increases. As the token value rises, insiders are further incentivized to improve utility and content within the network to attract new members.

If members can effectively expand the social dynamics of a community DAO, outsiders will be attracted to the network and utility. Community DAO network effects may be stronger than Web2 network effects. The Web2 network extracts value from an otherwise potentially symbiotic growth ecosystem. This value is not reinvested, but captured by the platform, exiting the system. Token-based communities enhance the network effect of the ecosystem by distributing value from the platform to community members. DAOs governed by token holders are able to reap the fruits of their labor and continue to build the infrastructure needed for growth.

secondary title

4 Valuation of community tokens and DAOs

The fringe nature of community tokens such as FWB makes such tokens difficult to value. As communities grow or become "inorganic," the inherent value of exclusivity is diminished. To that end, while DeFi protocols like Compound seek institutional capital, the adoption of these community tokens by institutional investors is not necessarily a logical or desirable end state.

Even with access to a community's Discord, the nature of these digital communities can be elusive. How can an investor synthesize the thousands of threads in the community Discord into a discourse on the long-term growth and profitability potential of a community token? How to quantify the sum of creativity and productivity of the entire community? At this stage, discounted cash flow models are hardly applicable, and most traditional valuation indicators are not applicable.

But this is the case for most fledgling for-profit organizations, web or otherwise. As community DAOs mature, they experiment with projects, some of which generate revenue. The Bankless BED Index currently charges a management fee. FWB can monetize its web3 ticketing app. Other community DAOs sell members' NFTs and transfer part of the proceeds to the treasury. Whether through in-house designed products or the sale of treasury assets, the coffers of successful communities swell.

In order for the token to hold value in the long run, these profits need to be distributed in some way. Community DAOs may avoid distributing profits directly to token holders in the near to medium term. From a regulatory perspective, it may be more palatable to have a programmatic token burn mechanism in place.

A potentially more beneficial path for both parties is to return value to shareholders through implicit privileges. Communities can subsidize goods and services based on the number of tokens members own. Some of these digital guilds (communities) can start to provide services on par with existing institutions, making exclusive access very valuable. In any case, the Community DAO will be as decentralized as possible by collapsing the central functionality. By returning the ecosystem to its members, DAOs simultaneously reinforce community pride and reduce the likelihood of regulators marking their community tokens as securities.

This article is from The Way of DeFi, reproduced with authorization.

This article is from The Way of DeFi, reproduced with authorization.