Contributors: MakerDAO RWA (Real Assets) Working Group

Summary

Summary

secondary title

Define Reality Assets

In this article, real world assets (Real World Assets) refer to assets from the physical world that are mapped to the encrypted world through claims on the underlying assets (in tokens or other forms). Tokens can be either homogeneous or non-homogeneous. Generally speaking, such tokens are less liquid and the market price cannot be used for liquidation. If the token is liquid and the price is valid, it falls into the crypto-like collateral category (which can be financed through an over-collateralized Maker vault).

The underlying real assets (loans, private equity, notes, etc.) are packaged in the securitized SPV and graded: at least one priority and one inferior. The priority is an interest-bearing (fixed or floating) loan. The inferior part is the equity part, which captures the price difference between the cash flow created by the underlying asset and the cash flow received by the priority holder. Priorities have priority over assets. In this sense, priority is overcollateralized. Maker only considers priority tiers for inclusion.

With the existence of inferior grades, Maker can obtain a higher guarantee of value than the original loan.

secondary title

Key factor

This section highlights key factors when considering real-world assets and how they differ from native digital assets.

MakerDAO KYC and Contract Execution

A frequently discussed theme is that MakerDAO is not a legal entity and therefore cannot execute contracts and enforce them in court. And some real-world asset tokens must only be owned by wallets that are whitelisted after KYC. However, according to US law, it can be achieved through an agreement between a MIP and MakerDAO.

On the other hand, the Maker Protocol (also known as the Dai Credit System) is a smart contract over which even MakerDAO has limited control. Vaults cannot enforce any contracts that are not code.

Some solutions:

Trust in third parties: If Maker is also a member of the lender, it can be said that other lenders have an incentive to trigger contract execution. Makers will also benefit from it.

Establishing a Maker Legal Entity: A limited liability entity can be established whose sole owner is MakerDAO. Or use a trust company to represent MakerDAO's interests.

Liquidation

Due to the complexity and low liquidity of the underlying assets, it is unlikely to be liquidated through auctions in a short period of time. For example, in the MIP13c3-SP4 proposal, any liquidation action needs to be notified 12 hours in advance.

Regarding liquidation fees, this is also not common in the real world. The bottom tier investors are unlikely to accept insuring the top tier investors and paying liquidation fees in case of liquidation (the bottom tier investors have already lost money).

There are currently some solutions:

For very short-term loan portfolios, one way (MIP22) to deal with underlying asset default is to require redemption when the value of the collateral falls below a standard. Assuming that letting other assets in the portfolio mature is a better strategy than liquidating all assets at once.

It is recommended to liquidate instantly on an asset-by-asset basis. In addition, it is also possible to prevent the mortgage rate from being too low by adding additional principal, within a certain warning range.

Price Feeds and Oracles

Reliable price feeds are difficult to obtain because the underlying real assets are not tradable or have scarce liquidity.

Model-based price feeds should take into account market-wide factors (yield curves, credit spreads) as well as portfolio specifics (underlying company financials). For example, non-payment records can be used to discount the underlying asset, and redemption requests from other investors may indicate that there is a problem.

MIP21c3 proposes a liquidation oracle that requires manual triggering of MKR governance executive votes.

Monetary Policy in Real Assets

Real assets are likely to have a specific stable rate, rather than based on the base rate + risk premium. To be competitive, the interest rate is either fixed for a given real asset investment (Maker offers a fixed rate), or derived from a real world formula (like LIBOR 3M + 375bps). This has implications for interest rates on Dai's exchange rate and peg. If real assets account for 50% of Dai collateral at a certain stage, the vault interest rate for encrypted asset mortgages needs to be greatly increased to ensure the same result.

For example, in the MIP13c3-SP4 proposal, the suggested maximum rate is Wall Street Prime + 100 bps as a cap. Loans are due with 12 months advance notice. This would delay the impact of monetary policy.

emergency shutdown

secondary title

Realization of Real Assets

This part will introduce the implementation scheme of introducing real assets into the Maker system and the evaluation scheme of important reference factors defined above.

Centrifuge/ConsolFreight Accounts Receivable Financing Case

The Centrifuge protocol is the underlying infrastructure of Tinlake. A set of smart contracts are built on the basis of Centrifuge. Tinlake uses NFT asset pools to connect partners, operators, investors and users of Centrifuge's global financial supply chain in the open market. NFT is an on-chain representation of off-chain irreplaceable assets, covering royalties, accounts receivable, warehouse receipts, mortgages, etc., and can be used as collateral in DeFi lending agreements.

Tinlake uses an SPV model that allows lenders to invest in two different tiers: the priority tier issues a token called DROP, and the inferior tier issues a token called TIN. Priorities have lower/stable yields and take less risk, while inferior grades have higher yields/more volatile returns and have a higher risk of loan default, thus forming a pair of priority protection of.

Chart

Chart

ConsolFeight parameters

TIN ratio: 10-20%

DROP APR: 4-7%

Underlying Loan APR: 9-12%

Expected Maker DROP credit limit: 5 million

Vault Settings

Mortgage and issue to the designated whitelist address (ConsolFreight SPV)

Liquidation Line: 100% (not the actual liquidation line, but the fact that margin vault holders cannot lend more Dai than the value of their collateral)

The actual liquidation will be performed by the risk team on the CF-DROP risk assessment. SPV net value needs to be > 105-110% DROP collateral value.

Stable rate follows DROP APR (4-7%)

The initial debt ceiling is 1 million dollars, and every increase of 1 million dollars requires the risk team to reassess the underlying asset portfolio and pass it in the form of an executive vote. The target debt ceiling is five million.

issued

issued

redemption

redemption

to liquidate

to liquidate

If any terms are not met, the risk group can initiate liquidation. The liquidation will be based on the MIP22 proposal. Consol Freight will have a notice cycle for the underlying assets to mature for liquidation (90 days), and most loans will mature in the short term.

MakerDAO can also initiate a redemption request before the maturity date, setting the debt ceiling to zero, and liquidating within a certain notice period.

legal contract enforcement

Representative of Maker

6s trust model case

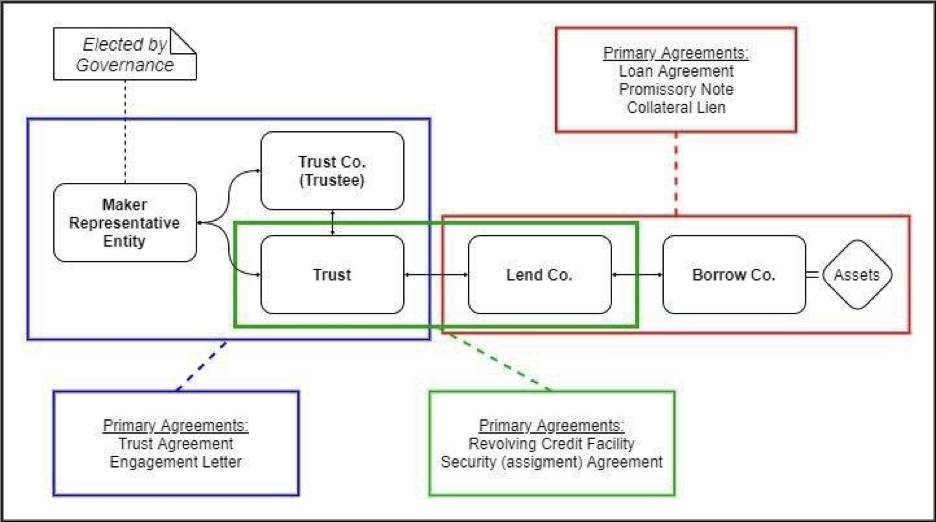

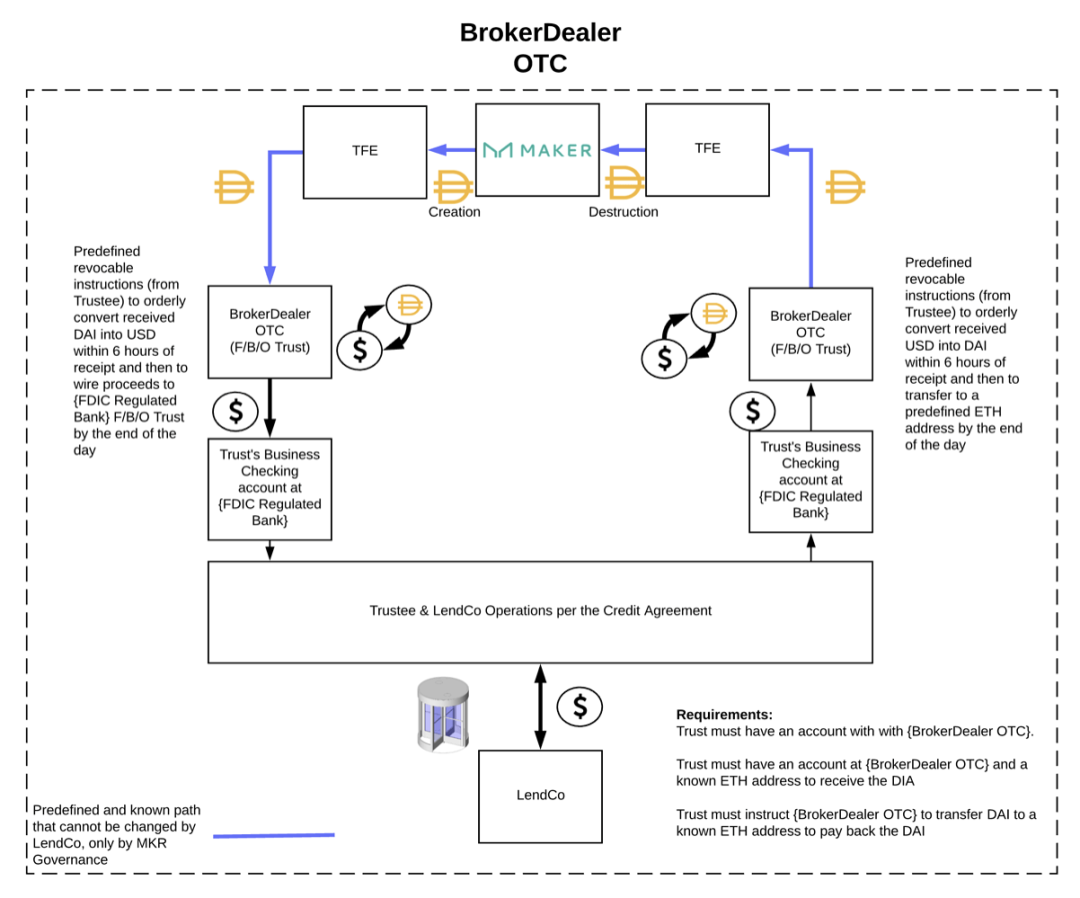

6S Capital LLC is a U.S.-based asset securitization origination company that cooperates with several commercial real estate companies to provide long-term lease financing. 6S Capital Partners LLC is an SPV under the management of 6S Capital LLC. The SPV is divided into priority and inferior. The priority is to lend Dai from the Maker agreement in the form of claims, and the inferior is composed of other external investors. MakerDAO will secure interest in the lending process through the regulated Wilmington Trust.

6s token parameters

Loan amount: 15 million

Interest rate: 3%

SPV capital adequacy ratio: 30%

Mortgage and issuance to designated whitelist addresses (LendCo/Trust)

Cash flow

Cash flow

1. Issuing Dai to TFE (Tax Fabvorable Entity)

TFE lends Dai to trust companies

2. The trust company converts Dai into USD through dealers

3. The trust company borrows US dollars to LendCo (the lending entity)

4. LendCo executes the lease loan and subsequently repays the trust company loan, or recapitalizes for a new round of transactions

5. LendCo repays the trust company in USD, and the trust company repays TFE Dai

6. TFE returns Dai to the vault

Other case models

UPRETS.io is a real estate digital securities issuance platform. It mainly provides technical solutions to share and digitize real estate assets. Different from the above real bond assets, UPRETS issues standardized securities, holding digital securities, and correspondingly owns the ownership of real estate funds, thus owning the ownership of real estate and the right to future rental income. UPRETS provides technical issuance services for East River Bay Phase I Digital Securities (OST-1) to be traded on Equities-SME (small and medium-sized board) of MERJ, a licensed stock exchange in Seychelles. Currently UPRETS is trying to issue digital securities on Ethereum and apply for inclusion in the Maker mortgage pool.

Next step

Next step

At present, the inclusion of Dai collateral in 6s trust leasing financing loans has entered the governance voting stage, and an executive vote will be held within 30 days. If the executive vote is passed, Maker will issue the first batch of 15 million Dai credit lines.

This will be an important milestone for DeFi to connect real assets and achieve large-scale applications.

Voting address and related introduction:https://vote.makerdao.com/polling/QmSqXVUQ#poll-detail