Author | Qin Xiaofeng

secondary title

Produced | Odaily

1. Overall overview

1. Overall overview CryptonewsAccording to OKLink data, the current Ethereum 2.0 deposit contract address has received 89,568 ETH, which is 17.08% from the minimum requirement of 524,288 ETH to start the Ethereum 2.0 genesis block. Foreign media

2. Ecology and technology

2. Ecology and technology

1. Technological progress

1. Technological progress

According to OKLink data, the current Ethereum 2.0 deposit contract address has received 89,568 ETH, which is 17.08% from the minimum requirement of 524,288 ETH to start the Ethereum 2.0 genesis block.

Foreign media CryptonewsForeign media

(2) V God: The initial fine of ETH2.0 is reduced to 1/3 to 1/4 of Medalla

Pyrmont, the ETH 2.0 public testnet, will launch on November 18. According to previous reports, the ETH 2.0 test network Medalla test network was launched on August 4, with more than 20,000 verifiers. As of press time, this number has climbed to 71,000. However, participation in Medalla is capped at 70%. Pyrmont will not be like Medalla, which will start with 100,000 validators run by client teams and gradually open up to participants, the developers said. The developer stated, “We will require people to only run a small number of validators each. This is to allow people in the queue to get on and off at any time, while also reducing the risk of unknowns. We have not yet decided whether Pyrmont will live long."(AMBCrypto)

2. Voice of the Community

Ethereum core developer Danny Ryan tweeted that the Ethereum Foundation is launching a fund to provide funding for community Ethereum 2.0 pledge-related projects, such as creating tools, documentation, and resources to improve the pledge and validator experience. Anyone can participate in the Ethereum 2.0 Pledge Community Funding Round for free. Ideas and projects at four levels (idea stage, concept level, semi-finished products, and fleshing out projects) are welcome. The deadline for project proposals is December 22.

3. Project trends

Skymarch Entertainment reached strategic cooperation with blockchain game developer Enjin

(2) Chainlink's verifiable random function is launched and has been adopted by the lottery game

(3) Gemini develops the "wFIL" service to make the token FIL available on Ethereum

(4) Indian encryption exchange CoinDCX launches ETH Staking service

The DeFi lending protocol Aave announced that it has released the Aave v2 version on the Ethereum Kovan test network. This version has a new design architecture, and has upgraded the protocol, UI and UX, and added some new features and tools. Currently, users can test Aave v2 on the Kovan test network for free without spending real assets. The relevant code is currently undergoing four audits, and the audit results will be released before the main network is launched. Additionally, Aave’s ongoing bug bounty program offers up to $250,000.

4. Borrowing

Defipulse4. Borrowing

The data shows that last week, the value of locked-up collateral on the chain rose from US$12.006 billion to US$13.621 billion, a week-on-week increase of 13.45%; the previous week (10.26-11.1) had a net increase of US$872 million, and last week it had a net increase of US$1.615 billion, an increase of 85.2% month-on-month %.

image description

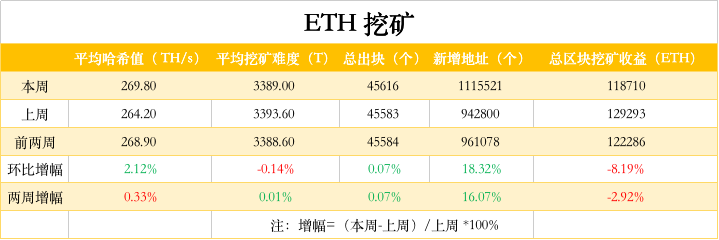

5. Mining

(data from etherchain.org)

etherchain.org3. Secondary market

3. Secondary market

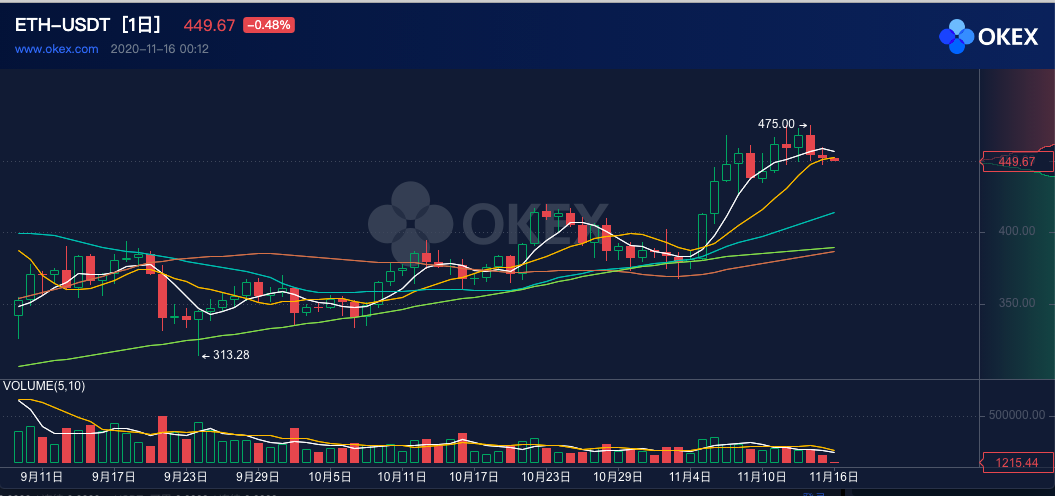

1. Spot market

According to OKEx market data, the price of ETH once rose to 475 USDT last week, and closed at 451.86 USD during the week, a month-on-month decrease of 1%.

image description

image description

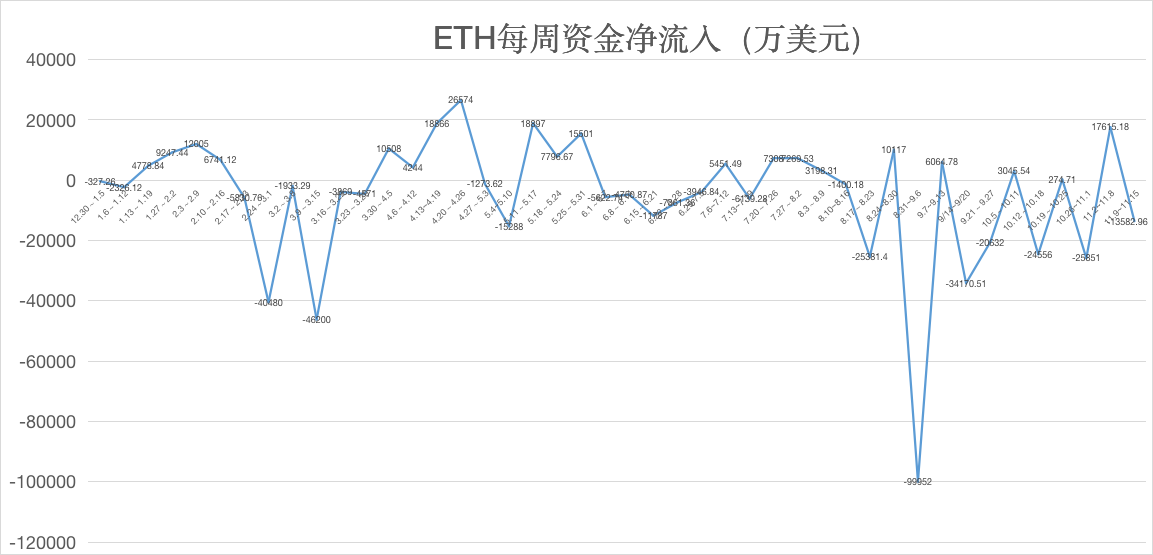

2. Fund flow

(data from BiNuNiu)

(data from BiNuNiu)

In terms of funds, the largest net inflow last week was close to 100 million US dollars (Wednesday), and the largest net outflow was close to 80 million US dollars, and there were five days of outflow of funds, and profit taking began to be cashed out.

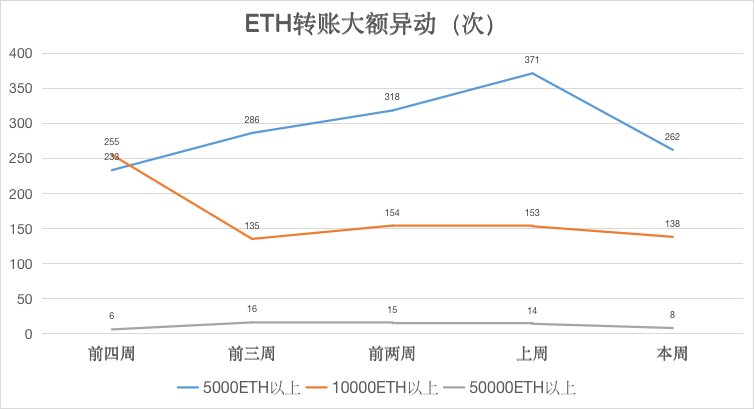

(data from Tokenview)

(data from Tokenview)

Tokenview dataIt shows that the number of transfers on the chain increased slightly last week, and the number of large-value transfers of "above 5,000 ETH", "above 10,000 ETH" and "above 50,000 ETH" decreased by 29.38%, 9.8%, and 42.86% month-on-month. The frequency is greatly reduced.

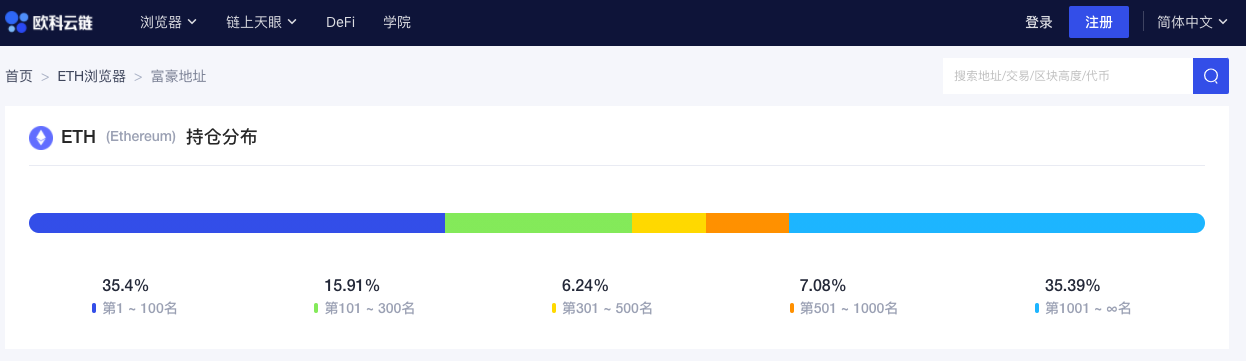

OKlink dataIt shows that the current top 300 ETH holdings hold a total of 51.31% of ETH, an increase of 0.17% month-on-month; the entire position distribution presents an oval structure, and the proportions of each part are: 1st to 100th, accounting for 35.4%, a month-on-month increase 0.05; 101st to 300th, accounting for 15.91%, up 0.12% from the previous month; 301st to 500th, accounting for 6.24%, down 0.07% from the previous month; 501st to 1000th, accounting for 7.08%, down 0.07% from the previous month; After 1001, accounting for 35.39%, a month-on-month increase of 0.02%.

4. News

4. News

(1) ETH 2.0 is hot, beware of fund fraud by using this concept

Recently, Ethereum released the ETH 2.0 deposit contract. Odaily noticed that a fund project called Ethfund (Ethereum Fund), under the banner of Ethereum 2.0, wantonly collected money. In the publicity, the project claimed that V God, the founder of Ethereum, invested 3,000 ETH, but in fact the payee was not the relevant address of this project, and the screenshot of the chat was also suspected to be PS synthesis; in addition, the Ethereum Fund and the Ethereum Foundation (The Ethereum Foundation) Foundation) is not associated in any way. The project requires users to send ETH to a specific contract address, and claims to be able to obtain more than 200% of the income; encourages users to develop offline, and obtain additional income by pulling people; the project itself does not have a clear profit model, but only with new user funds Repay the old users, the capital disk model of tearing down the east wall to make up for the west wall. Odaily hereby reminds investors to stay away and carefully identify similar projects.

(2) Infura Ethereum API service was interrupted, and multiple trading platforms and wallets were affectedInfuraAPI service provider for Ethereum and IPFS on November 11

Said that its Ethereum mainnet API service was temporarily interrupted, and the team is investigating and working hard to restore service functions.

In addition, several Twitter users pointed out that Binance, Upbit, Bithumb and other trading platforms are suspected of suspending ETH and ERC20 token deposit and withdrawal services. The Ethereum light wallet MetaMask has abnormal balance display and data delay.

Many people are worried that Ethereum will fork because of this. Vitalik denied this statement in the Chinese community and said that the network is fine. Regarding the suspension of services by Ethereum API provider Infura, Bitfinex CTO and Tether CTO Paolo Ardoino commented that the exchange should run its own Ethereum node.then,Infura issued a statement stating

, the root cause of the failure was traced to multiple components in the infrastructure that were locked to an old stable version of the go-ethereum client that encountered a critical consensus error at block 11234873. This affects several Geth versions, including 1.9.9 and 1.9.13. Components running 1.9.19 and later are not affected. After the incident is resolved, a postmortem will be shared.

(3) OKLink: The circulation of DAI exceeds 1 billion pieces

(4) Ethereum 2.0 deposit contract address received 83 other tokens