DeFi is using blockchain technology to revolutionize traditional finance, making funds more open, transparent and free to flow. As an innovator in the DeFi field, Maker will focus on introducing real assets as Dai collateral in the next 1-3 years, which is crucial for the large-scale application of DeFi into the real economy.

The assets currently submitted for application on the Maker official forum include real estate, national debt, supply chain finance, gold and commodity indexes, etc. We will introduce these assets one by one:

New Silver - Real Estate Mortgage 🏠

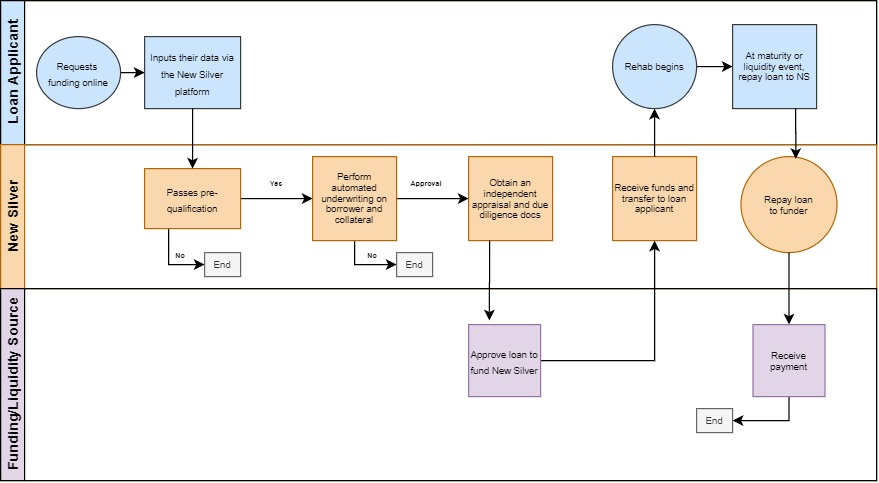

Founded in 2018, New Silver mainly provides fixed-amount mortgage loan services for US real estate. New Silver's proprietary technology automates loan origination and improves underwriting efficiency, using data to reduce the risk of loan defaults.

New Silver used the Centrifuge protocol to realize asset tokenization (NS-DROP), cooperated with the Maker Foundation for the first time in the summer of 2019, and issued the first real estate mortgage Dai as a pilot.

Detailed application information 👉:https://forum.makerdao.com/

PAX Gold - Tokenized Gold 🌟

digital gold"digital gold", but there is still an order of magnitude gap compared with gold's market value of nearly 8 trillion US dollars. Introducing the gold asset itself into DeFi will undoubtedly greatly improve the stability and liquidity of Dai, and expand the boundaries of cryptocurrencies.

PAX Gold (PAXG) is an ERC20 gold token issued by Paxos Trust Company on Ethereum. Paxos is the first chartered trust cryptocurrency company to be granted regulation by the New York State Department of Financial Services.

The underlying assets of PAXG are London standard delivery gold bars approved by the London Bullion Market Association (LBMA). Users can purchase PAXG through the PAXOS official website, and each PAXG corresponds to one ounce of gold hosted by Paxos. At present, PAXG has a market value of 56 million US dollars.

Detailed application information 👉:

PAXG has passed the audition of Dai collateral assets in June, and the Maker risk team is further evaluating PAXG:

Arca - Treasury Fund 💵

National debt is the most accepted and largest collateral category in the world. How to bring national debt assets to DeFi?

Arca is an investment management company focusing on digital assets and blockchain technology. Its Arca U.S. Treasury Bond Fund is the first digital asset trading fund of this type to be registered with the U.S. Securities and Exchange Commission (SEC).

Arca issues digital securities on the Ethereum public chain in the form of ArCoin. Users can invest in low-volatility assets by purchasing ArCoin, including 1-year, 2-10-year and 10-year U.S. government bonds.

Compared with traditional financial assets, ArCoin's KYC holders can transfer point-to-point in real time. Second, transactions and audits can be tracked and audited on the Ethereum blockchain in real time by anyone. Additionally, the entire process does not require an intermediary broker.

ArCoin is applying to be Dai's collateral, detailed application information 👉:

https://forum.makerdao.com/t/arca-arcoin-mip6-collateral-onboarding-application/3544

Harbor - Supply Chain Finance 🚚

The global supply chain finance has a total market value of 10 trillion US dollars. As a liquidity agent for enterprises, the introduction of DeFi into the supply chain can more efficiently solve the capital flow problem of enterprises. Three supply chain finance solutions are currently applying to be Dai collateral.

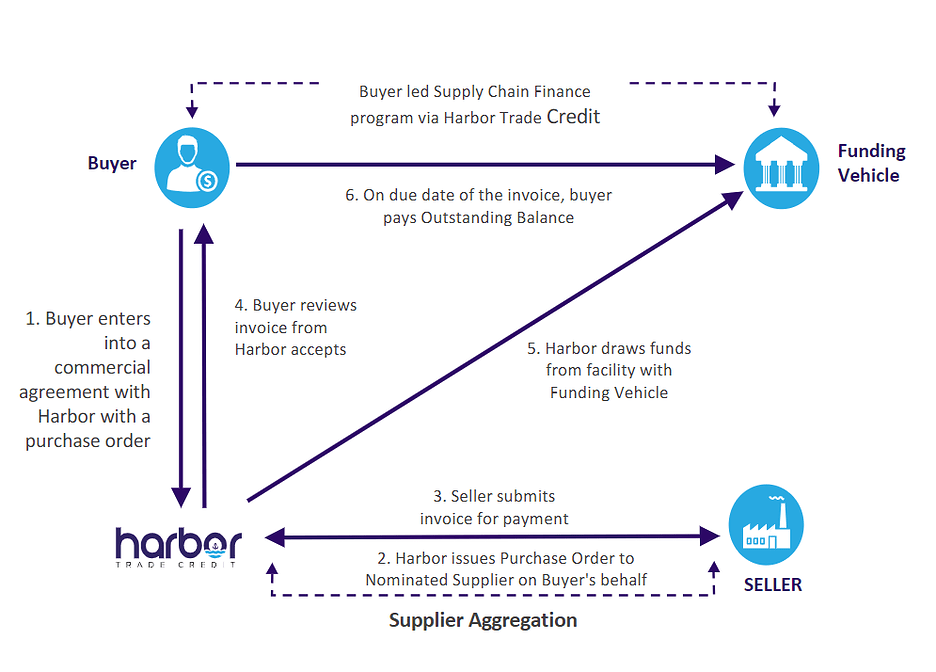

Harbor is a fintech company founded in 2018, focusing on supply chain finance (SCF) and working capital turnover solutions. Harbor's accounts receivable solution allows buyers to access liquidity on credit and pay suppliers in a timely manner. Harbor's purpose-built technology platform not only reduces costs and streamlines workflows, but also enables better supplier and procurement management.

The Harbor Trade Credit launched by Harbor adopts the Centrifuge protocol to initiate asset tokenization (HTC-DROP), and is expected to accumulate a capital scale of about 25 million US dollars in the next year.

Detailed application information 👉:https://forum.makerdao.com/

ShuttleOne - Supply Chain Finance🚚

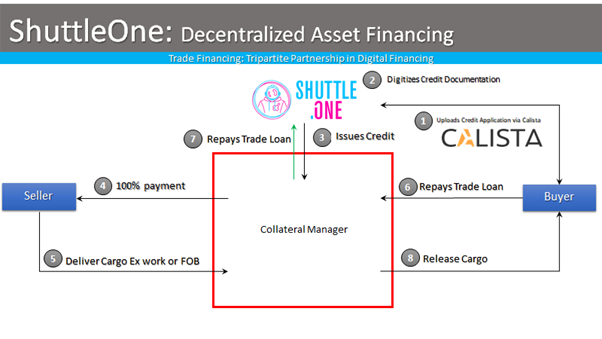

ShuttleOne is a digital asset and blockchain infrastructure company headquartered in Singapore, mainly providing remittance, micro-loan and trade financing services to government agencies and enterprises in Southeast Asia.

ShuttleOne has partnered with Global eTrade Services (GeTS), a global supply chain platform, to use its e-logistics product CALISTA to tokenize freight orders (CAT) for trade financing on Ethereum. In the first half of 2020, ShuttleOne has provided more than US$300,000 in trade financing to more than 30 merchants in Southeast Asia and China.

CAT is applying to be Dai’s collateral, detailed application information 👉:

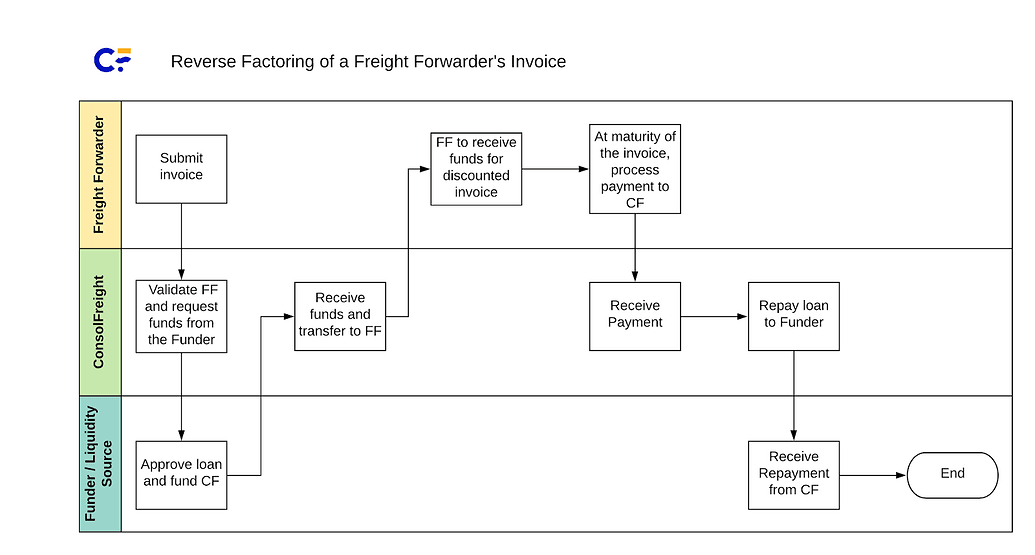

ConsolFreight - Supply Chain Finance 🚚

ConsolFreight is a technology solution company established in 2016, dedicated to helping freight forwarders improve the liquidity of operating funds and realize the digitization of logistics business. ConsolFreight cooperates with the Maker Foundation to use Dai to provide efficient and fast supply chain financing solutions to international trade service providers. The first batch of 250,000 Dai was piloted in May 2019.

ConsolFreight uses the Centrifuge protocol to tokenize the assets of freight forwarding bills (CF-DROP), and is applying for Dai as collateral (the first batch of 5 million US dollars is expected), detailed application information👉:

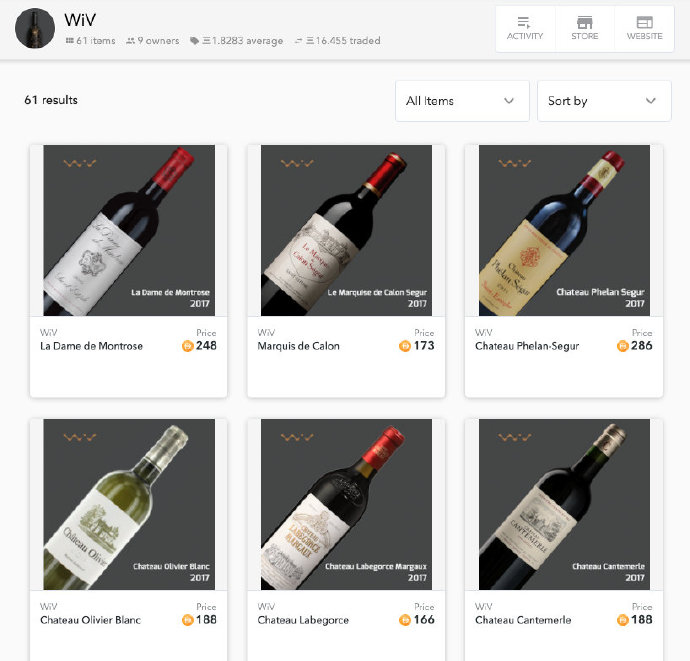

WiV - Wine Commodity Index 🍷

Commodity index is a kind of tangible bond assets with a history of hundreds of years. How can it glow with new vitality under the technological trend of DeFi?

WiV Technology specializes in designing blockchain-based asset management technology for wine producers and is based in London, Oslo and Singapore. WiV Technology has created a wine commodity tokenization platform to truly and securely trade commodity assets and convert them into financial instruments. In 2019, WiV Technology was awarded an Excellence Award by the European Union's Horizon 2020 programme. In February this year, WiV Technology partnered with OpenSea to launch a trading and clearing marketplace for WiV ERC721 tokens.

WiV Technology launches a tokenized Wine Commodity Index Fund (WiV) on Ethereum for trading and investing in premium wines. Each tokenized wine is held in safe custody with Unique Asset Custody Limited under the laws of England and Wales and is fully insured. EY is its technology and audit partner.

WiV is applying to be Dai's collateral, detailed application information 👉:

Paperchain - Tokenized Music Streaming 🎵

Internet streaming services have become the mainstream mode of music consumption, with a global market value of more than 100 billion US dollars. The combination with DeFi has the opportunity to bring convenience and contract guarantees to the music streaming industry.

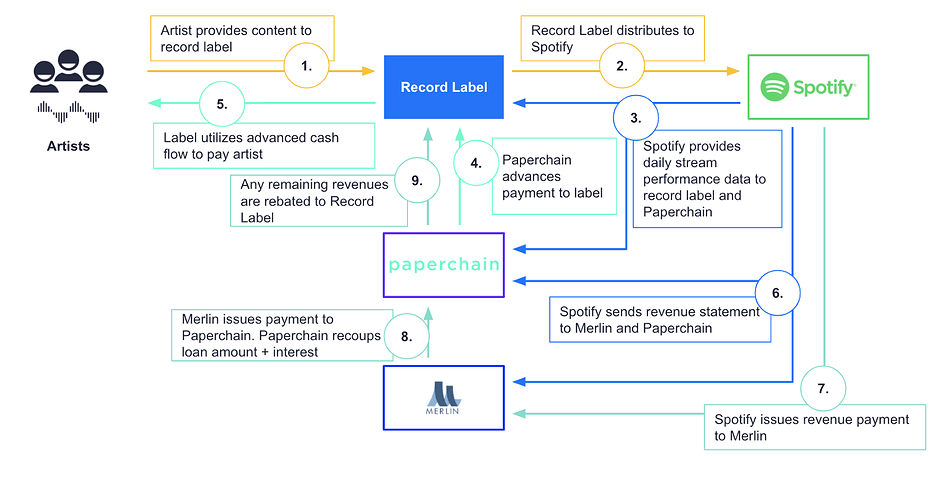

PaperChain is a technology company that provides streaming data analysis services for musicians. It evaluates the creations of musicians on mainstream streaming platforms such as Spotify, Apple and YouTube, and helps them obtain more copyright income. Now, PaperChain uses the Centrifuge protocol to realize the tokenization of music streaming data (PC-DROP). With the help of the DeFi lending protocol, it can conduct credit evaluation and guarantee for the revenue of musicians and labels, and help music creators earn 1% per month. costs to obtain income in advance.

At the London DeFi Summit in October 2019, PaperChain cooperated with the Maker Foundation to demonstrate the advance payment of 60,000 Dai to a music label on the Spotify platform through the Tinlake financial application. The entire process took less than 30 minutes, the transaction cost was less than $3, 45 days earlier than expected, and the interest rate was reduced by 80%. PaperChain expects to exceed $2 million in funding needs per month in the future. learn more:

https://www.chainnews.com/articles/302779387874.htm

PC-DROP is applying for Dai collateral, detailed application information 👉: