Produced by Odaily

Editor | Hao Fangzhou

Produced by Odaily

DEX traffic drops significantly;

Exchange Weekly Trends

Exchange Weekly Trends

On March 28, FTX CEO responded to Binance’s delisting of leveraged tokens: USDT-denominated leveraged token trading pairs will be launched to compensate users.

On March 27, the Monetary Authority of Singapore (MAS) officially announced the list of exempt companies for payment service business licenses. The entities on the list have obtained licenses and operating rights for specific payment services or digital currency-related payment services during the exemption period. Singaporean entities including Alibaba, Alipay, Amazon and other large institutions are on the list. Regarding the exemption license for digital currency-related payment services, nearly 200 companies including Huobi (Singapore subsidiary FEU), Binance, OKCoin, BitStamp, Bixin, Coinbase, CoinCola, TenX, Upbit, Pionex, IXX, etc. Legally operate in an exempt state before a license is issued.

On March 27, Huobi Futures officially launched perpetual contracts.

On March 27, Binance Research Institute participated in the joint construction of the "Lingang Blockchain Technology Industry Research Institute".

On March 27, Glassnode, an on-chain analysis company, tweeted that in the recent period, there has been a large outflow of bitcoin from cryptocurrency exchanges, causing the bitcoin transaction balance of these exchanges to drop to the lowest level in about eight months.

On March 26, data: Tether recently issued a total of 540 million USDT, 96.44% of which flowed into Huobi, Bitfinex and Binance.

On March 26, trading volumes and account registrations on the Japanese exchange Bitbank soared after “Black Thursday,” suggesting that retail investors were buying on dips.

On March 26, CryptoDiffer: Gate.io ranked fourth in the world in terms of revenue growth in February, and ranked first among domestic exchanges.

On March 25, ErisX, a U.S.-compliant cryptocurrency exchange, temporarily waived spot transaction fees.

On March 24th, data: Binance’s 24-hour Bitcoin futures trading volume exceeded BitMEX, ranking among the top three.

Exchange data statistics

Exchange data statistics

source:

source:Alexa

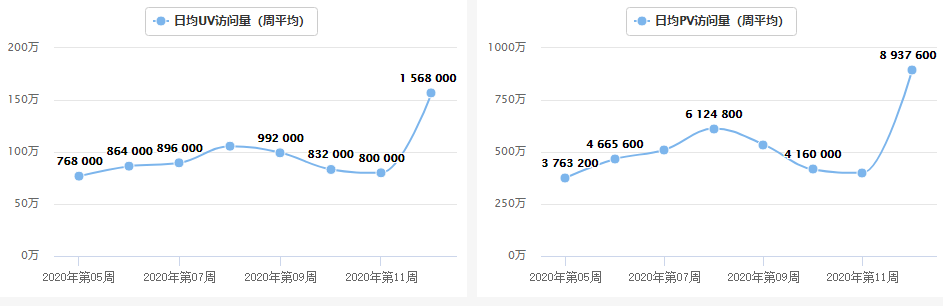

According to Alexa statistics, the Binance website UV (unique visitors) this week was 1.568 million/day, an increase of 96% from last week; at the same time, PV (page views) was 8.93 million/day, a decrease of 123% from last week. As the leading exchange in the encryption world, Binance accounts for most of the market traffic, which shows that the overall market traffic has picked up recently.

source:

source:Dapptotal

According to Dapptotal data, the total number of active users of decentralized exchanges on March 29 was 2,390 (including more than 20 decentralized exchanges such as IDEX, Tokenlon, and Uniswap), compared to 5,350 active users on June 26, 2019 The peak value dropped by 45.4%, and the number of active users dropped from last week.

Note: According to the statistics of Dapptotal combined with the historical price trend of BTC, it is found that the number of active users of DEX users is positively correlated with the price. In December 2017, the price of BTC reached a peak of 120,000 US dollars, and the number of users of Dex reached a peak of 9340; in April and May of 2018, the price of BTC rebounded again, and the number of active users of DEX also rebounded again; therefore, the number of users of DEX can be used as a judgment A reference indicator for market trends, but in the transaction volume and number of transactions counted by Dapptotal, the research institute found that its trend is not as high as the correlation between the number of users and the price of BTC, so the number of users is intercepted as a reference indicator。

source:

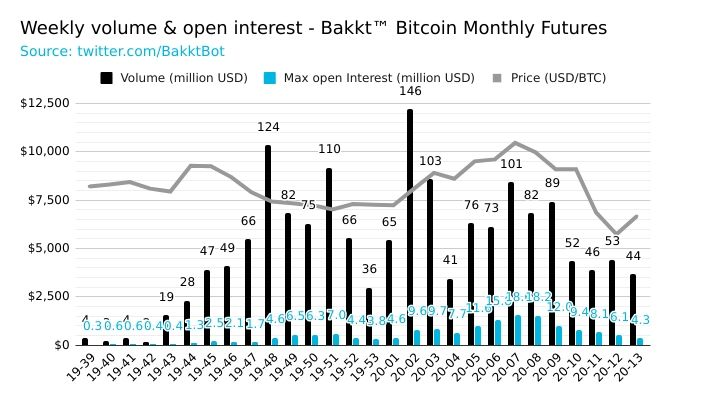

source:Bakkt Volume Bot

secondary title

source:

source:tradingview

Among them, the green line is the price trend of BTC, the blue line is the price trend of BNB, and the orange line is the price trend of HT.

The trend of Bitcoin and platform currency is relatively similar this week, and it is expected that the market will still fluctuate in a wide range in the future.

source:

source:aicoin

analyst point of view

analyst point of view

Leveraged tokens may be a "fake product"

The volatility of virtual assets is relatively high. In recent days, Bitcoin and mainstream currencies have fluctuated by 20% within a day. Although leveraged tokens (automatically set to 3x leverage or 10x leverage) have the function of automatically reducing and increasing positions, once they experience 1-2 fluctuations of more than 20%, they will face a huge retracement. Judging from the long-term trend since the listing of leveraged tokens, no matter whether it is bullish or bearish, its intrinsic value has dropped by more than 95% compared with when it was first launched. Binance even delisted all leveraged tokens this week. It shows that the safety of this product still needs to be further verified.