Produced by Odaily

Editor | Hao Fangzhou

Produced by Odaily

The trading volume of top exchanges is expected to further increase;

Exchange Weekly Trends

Exchange Weekly Trends

On February 23, Beijing’s Chainsmap monitoring system found that the 1,547 bitcoins related to the giant whale account that were stolen on the 22nd had partially flowed into dozens of addresses on more than a dozen exchanges. There will be legal issues in determining the ownership of bitcoins mixed with other sources.

On February 22, the trading volume of FTX hit a record high, and the average daily trading volume in February increased by 55.8% compared with January. BitMEX has a similar trend, and its trading volume is still more than 6 times higher than FTX. Average daily trading volume on BitMEX rose by about 33% in February.

On February 21st, Chain.info listed the BTC balance on the chain of the trading platform last week. Coinbase, Huobi, and Binance ranked the top three in terms of the BTC balance on the chain. Among them, Coinbase has 968,600, Huobi has 378,800, Binance has 248,300, and the three trading platforms have a total of 1,595,800, accounting for 8.75% of the current total BTC circulation of 18,229,500.

On February 21, due to economic factors, the encrypted exchange Tradesatoshi will be shut down on March 1.

On February 21, Huobi will launch HT leveraged trading at 18:00 on February 24.

On February 21, crypto derivatives exchange FTX sought to raise $15 million at a valuation of $1 billion.

Exchange data statistics

Exchange data statistics

source:

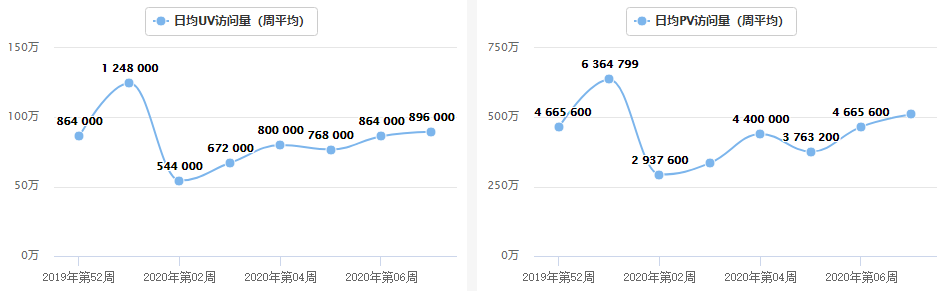

source:Alexa

According to statistics from Alexa, the Binance website UV (unique visitors) this week was 896,000/day, up 3.7% from last week; meanwhile, PV (page views) was 5,107,200/day, up 9.4% from last week. Binance, as the leading exchange in the encryption world, occupies most of the market traffic, which shows that the overall market traffic has increased recently.

source:

source:Dapptotal

(Note: According to the statistics of Dapptotal combined with the historical price trend of BTC, it is found that the number of active users of DEX users is positively correlated with the price. In December 2017, the price of BTC reached a peak of 120,000 US dollars, while the number of Dex users reached a peak of 9340; in April 2018 -The price of BTC picked up again in May, and the number of active users of DEX also picked up again; therefore, the number of users of DEX can be used as a reference indicator to judge the market trend, but in the transaction volume and number of transactions counted by Dapptotal, the research institute found that its trend There is no high correlation between the number of users and the price of BTC, so the number of users is intercepted as a reference indicator).

(Note: According to the statistics of Dapptotal combined with the historical price trend of BTC, it is found that the number of active users of DEX users is positively correlated with the price. In December 2017, the price of BTC reached a peak of 120,000 US dollars, while the number of Dex users reached a peak of 9340; in April 2018 -The price of BTC picked up again in May, and the number of active users of DEX also picked up again; therefore, the number of users of DEX can be used as a reference indicator to judge the market trend, but in the transaction volume and number of transactions counted by Dapptotal, the research institute found that its trend There is no high correlation between the number of users and the price of BTC, so the number of users is intercepted as a reference indicator).

source:

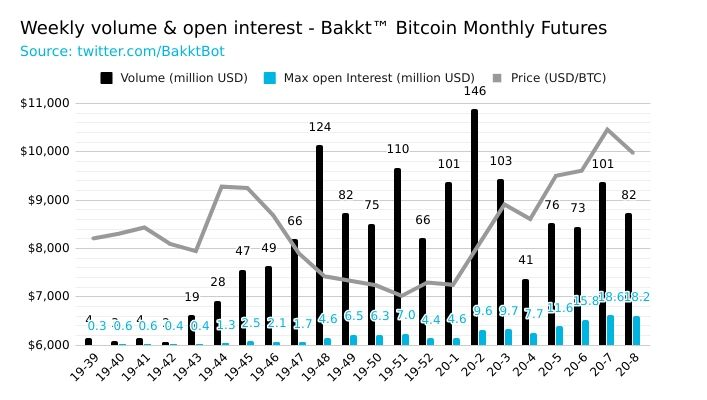

source:Bakkt Volume Bot

secondary title

Among them, the green line is the price trend of BTC, the blue line is the price trend of BNB, and the orange line is the price trend of HT.

source:tradingview

Among them, the green line is the price trend of BTC, the blue line is the price trend of BNB, and the orange line is the price trend of HT.

This week, the price of BTC is dominated by callbacks. The trend of BNB and BTC is relatively similar, while that of HT is stronger.

source:

source:aicoin

analyst point of view

analyst point of view

Exchange traffic picks up

Recently, whether it is from the website traffic of Binance or the trading volume of various exchanges (especially the trading volume of derivatives), its growth has been obvious. It is expected that with the arrival of BTC block reward halving, the traffic of exchanges will increase It will further increase, which will be reflected in the price of the platform currency.

The decline of platform currency is generally smaller than that of mainstream currency with production reduction

In the past week, the three major platform tokens performed well. In the case of a general correction in the market, HT and OKB took the lead in rebounding, indicating that when the market improves, the platform token sector will continue to be strong.