Key Takeaways

- The global cryptocurrency market capitalization is $3.77 trillion, down 9.38% from $4.16 trillion last week. As of press time, US Bitcoin spot ETFs have seen a cumulative net inflow of approximately $54.18 billion, with a net outflow of $643 million this week. US Ethereum spot ETFs have seen a cumulative net inflow of approximately $9.49 billion, with a net inflow of $154 million this week.

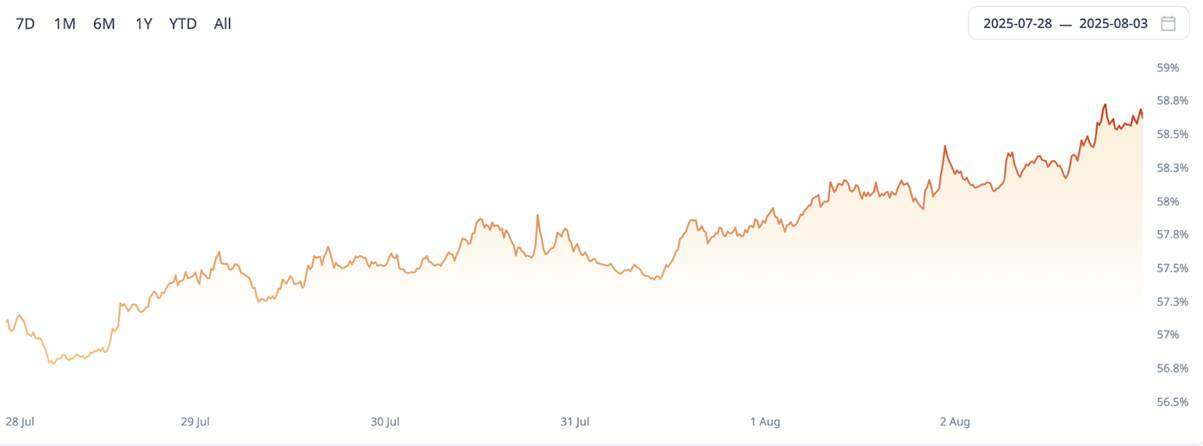

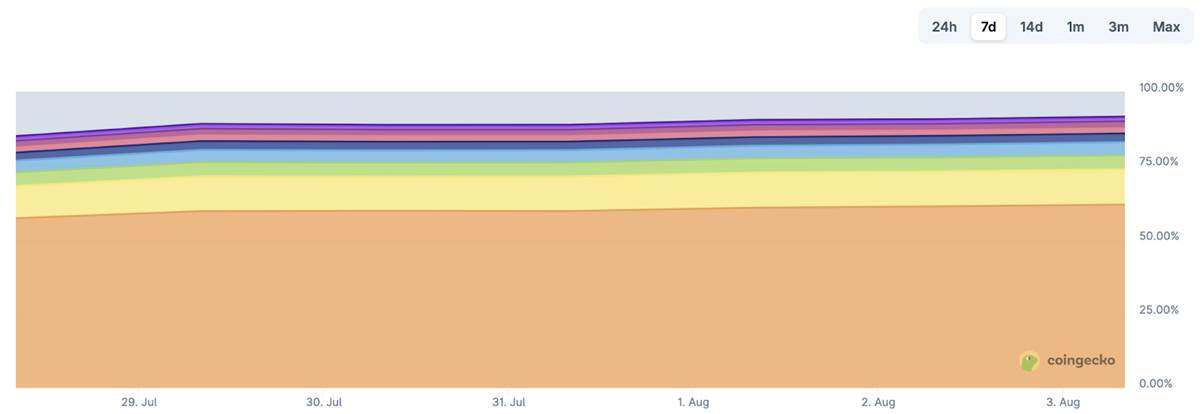

- The total market value of stablecoins is US$274 billion, of which USDT has a market value of US$163.9 billion, accounting for 59.81% of the total market value of stablecoins; followed by USDC with a market value of US$64.2 billion, accounting for 23.43% of the total market value of stablecoins; and DAI with a market value of US$5.36 billion, accounting for 1.96% of the total market value of stablecoins.

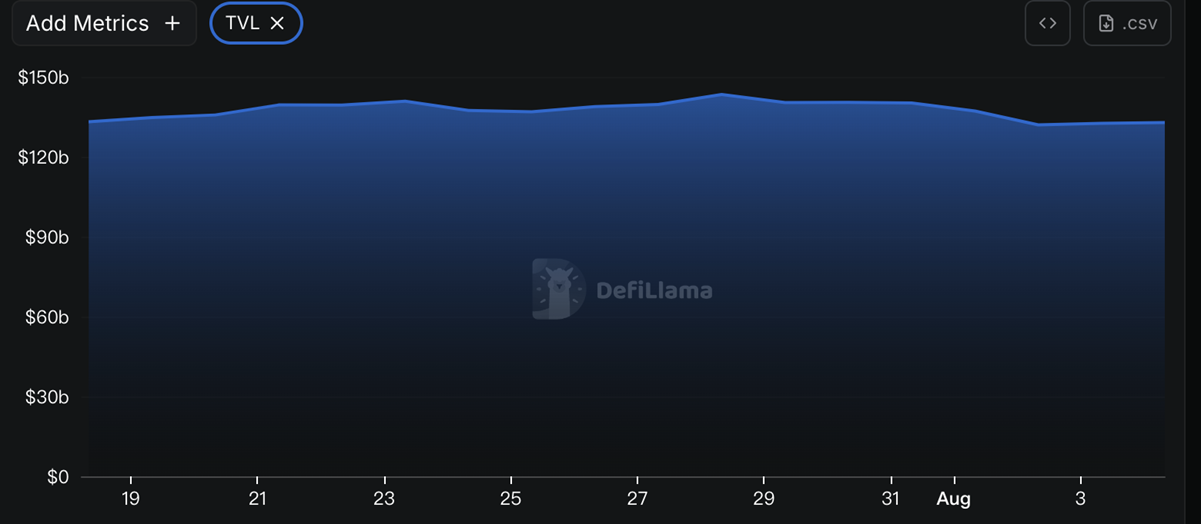

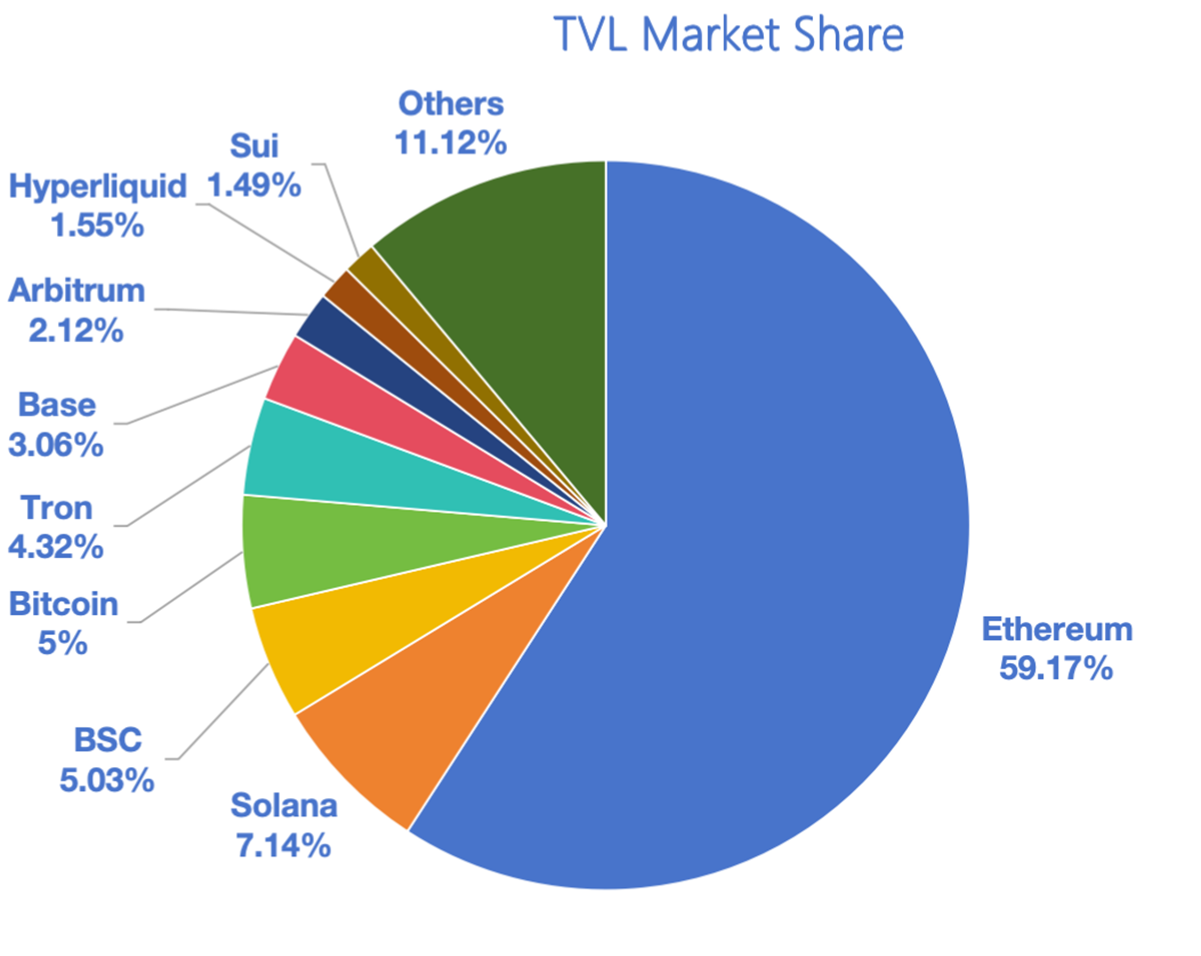

- According to DeFiLlama, the total DeFi TVL reached $132.9 billion this week, down 7.19% from $143.2 billion last week. Breaking down the TVL by public chain, the three chains with the highest TVL are Ethereum (59.17%), Solana (7.14%), and BSC (BNBChain) (5.03%).

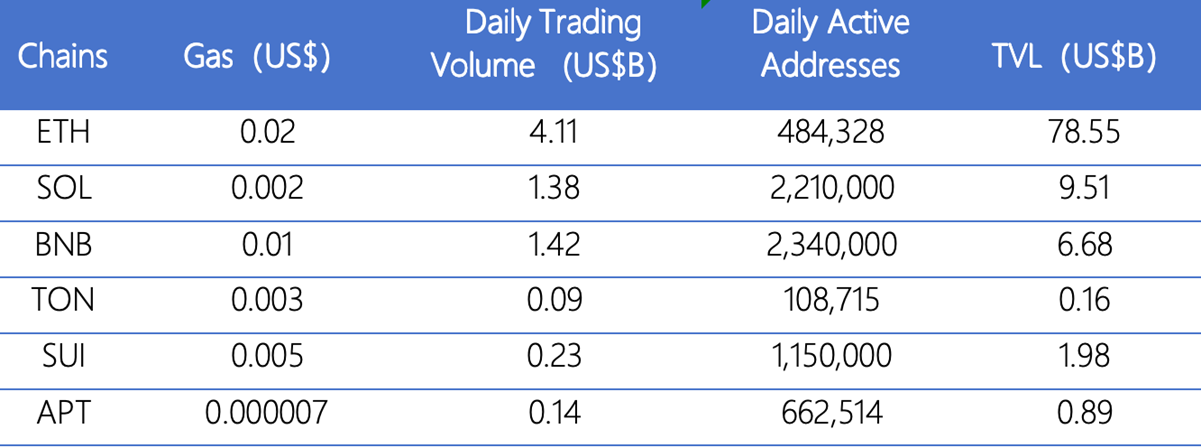

- On-chain data shows that, with the exception of Ethereum and Toncoin, which saw slight increases in daily transaction volume, all other public chains saw a downward trend. BNBChain and Sui saw the most significant declines, dropping 71.9% and 60.9% respectively compared to last week. Transaction fees for Toncoin and Sui fell 70% and 37.5% respectively, respectively, while Aptos saw a 40% increase. Fees for the remaining public chains remained relatively stable. Daily active addresses for BNBChain and Sui increased by 25.1% and 20.4% respectively, while the remaining public chains remained stable. TVL (TVL) for all public chains, with Toncoin remaining flat, showed a downward trend, with Sui seeing the most significant drop of 13.9%.

- Innovative projects to watch: Omni Exchange is a cross-chain decentralized trading platform dedicated to breaking down the barriers to asset trading between different blockchain networks; Honeypop DEX is a decentralized automated market maker (AMM) protocol deployed on Scroll. It is completely permissionless and aims to become the core liquidity hub in the chain ecosystem, providing efficient and open trading and liquidity services to users and projects; Breeze is a revenue engine built on Solana, designed to quickly integrate native revenue functionality into any mobile application.

Table of contents

Key Takeaways

1. Total cryptocurrency market capitalization/Bitcoin market capitalization ratio

2. Panic Index

3.ETF inflow and outflow data

4. ETH/BTC and ETH/USD exchange rates

5. Decentralized Finance (DeFi)

6. On-chain data

7. Stablecoin Market Cap and Issuance

2. Hot money trends this week

1. This week’s top five VC and Meme coins with the highest growth

2. New Project Insights

3. New Industry Trends

1. Major industry events this week

2. Big events coming up next week

1. Market Overview

1. Total cryptocurrency market capitalization/Bitcoin market capitalization ratio

The total market value of global cryptocurrencies is US$3.77 trillion, down 9.38% from US$4.16 trillion last week.

Data source: CryptoRank

As of press time, Bitcoin ’s market capitalization is $2.27 trillion, accounting for 60.02% of the total cryptocurrency market capitalization. Meanwhile, stablecoins’ market capitalization is $274 billion, accounting for 7.26% of the total cryptocurrency market capitalization.

Data source: coingeck

2. Panic Index

The cryptocurrency fear index is at 65, indicating greed.

Data source: coinglass

3.ETF inflow and outflow data

As of press time, the U.S. Bitcoin spot ETF has accumulated a total net inflow of approximately US$54.18 billion, with a net outflow of US$643 million this week; the U.S. Ethereum spot ETF has accumulated a total net inflow of approximately US$9.49 billion, with a net inflow of US$154 million this week.

Data source: sosovalue

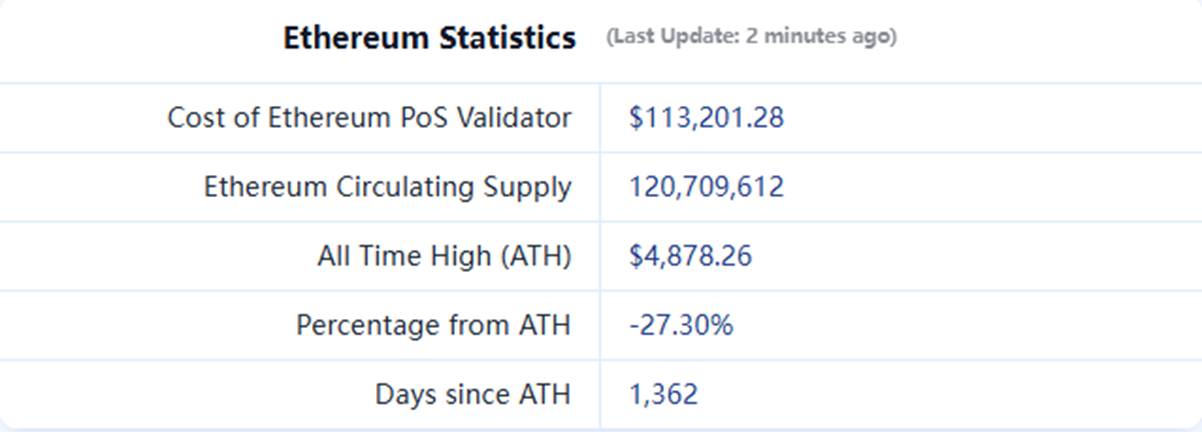

4. ETH/BTC and ETH/USD exchange rates

ETHUSD: Current price is $3,537, historical high is $4,878, down about 27.3% from the high.

ETHBTC: Currently at 0.030841, the historical high is 0.1238.

Data source: ratiogang

5. Decentralized Finance (DeFi)

According to data from DeFiLlama, the total TVL of DeFi this week was US$132.9 billion, down 7.19% from US$143.2 billion last week.

Data source: defillama

Divided by public chains, the three public chains with the highest TVL are Ethereum chain accounting for 59.17%; Solana chain accounting for 7.14%; and BSC (BNBChain) chain accounting for 5.03%.

Data source: CoinW Research Institute, defillama

Data as of August 3, 2025

6. On-chain data

Layer 1 related data

The main analysis is based on daily transaction volume, daily active addresses, and transaction fees. The current Layer 1 data includes ETH, SOL, BNB, TON, SUI, and APT.

Data source: CoinW Research Institute, defillama, Nansen

Data as of August 3, 2025

- Daily Trading Volume and Fees: Daily trading volume and fees are core indicators of public chain activity and user experience. This week, with the exception of Ethereum and Toncoin, which saw slight increases in daily trading volume, all other public chains experienced an overall downward trend. BNBChain and Sui saw the most significant declines, dropping 71.9% and 60.9%, respectively, compared to last week. Transaction fees on Toncoin and Sui fell 70% and 37.5%, respectively, compared to last week, while Aptos saw a 40% increase. Transaction fees on other public chains remained relatively stable.

- Daily Active Addresses and TVL: Daily active addresses reflect the level of participation and user stickiness in a public chain's ecosystem, while TVL reflects user trust in the platform. In terms of daily active addresses, BNBChain saw a 25.1% increase compared to last week, while Sui saw a 20.4% decrease. The remaining public chains remained stable. In terms of TVL, with the exception of Toncoin, which remained flat, the remaining public chains showed a downward trend, with Sui seeing the most significant drop, down 13.9%.

Layer 2 related data

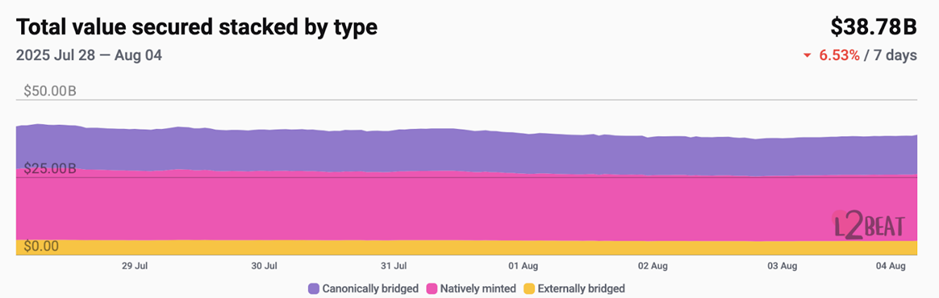

- According to L2Beat data, the total TVL of Ethereum Layer2 is US$38.78 billion, a decrease of 6.53% from US$41.67 billion last week.

Data source: L2Beat

Data as of August 3, 2025

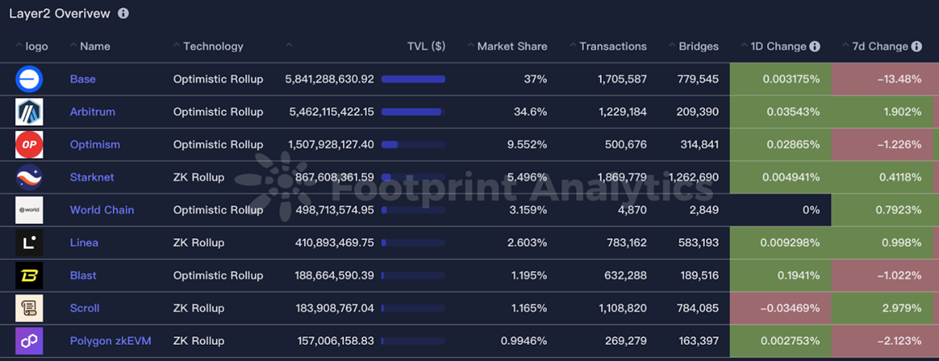

- Base and Arbitrum occupy the top position with 37% and 34.6% market share respectively. This week, Base still ranks first in the TVL of Ethereum Layer2.

Data source: footprint

Data as of August 3, 2025

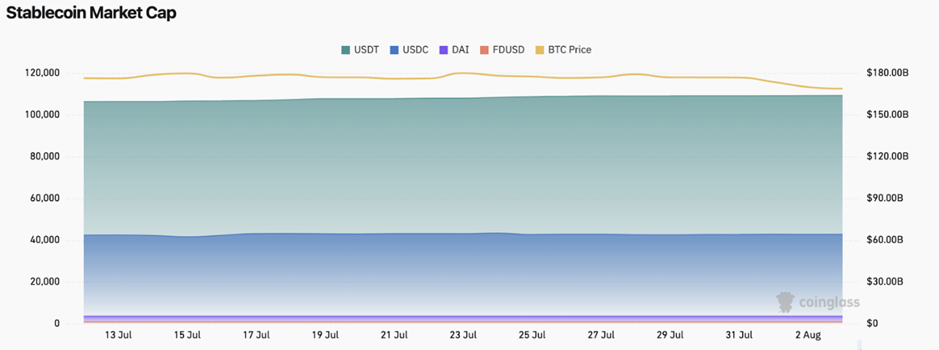

7. Stablecoin Market Cap and Issuance

According to Coinglass data, the total stablecoin market capitalization is $274 billion. USDT's market capitalization is $163.9 billion, accounting for 59.81% of the total stablecoin market capitalization. USDC is second at $64.2 billion, accounting for 23.43% of the total stablecoin market capitalization. DAI's market capitalization is $5.36 billion, accounting for 1.96% of the total stablecoin market capitalization.

Data source: CoinW Research Institute, Coinglass

Data as of August 3, 2025

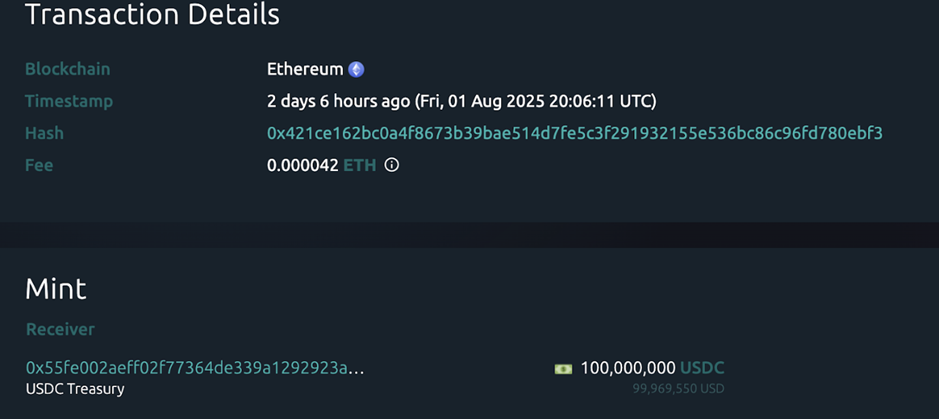

According to Whale Alert data, USDC Treasury issued a total of 1.45 billion USDC this week, and Tether Treasury issued a total of 1 billion USDT. The total amount of stablecoins issued this week was 2.45 billion, a decrease of about 28.19% from the total amount of stablecoins issued last week of 3.412 billion.

Data source: Whale Alert

Data as of August 3, 2025

2. Hot money trends this week

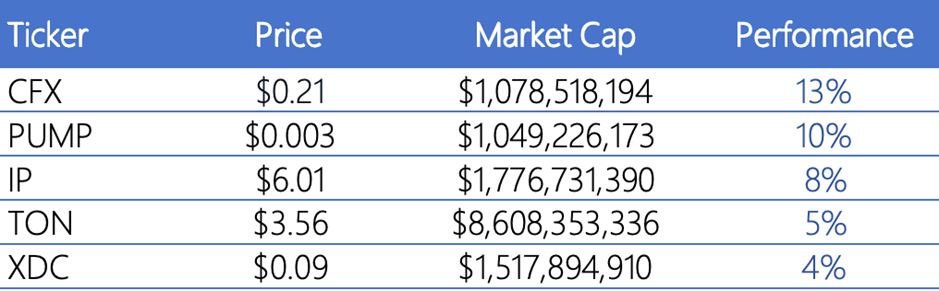

1. This week's top five VC and Meme coins

Top five VC coins with the highest growth in the past week

Data source: CoinW Research Institute, coinmarketcap

Data as of August 3, 2025

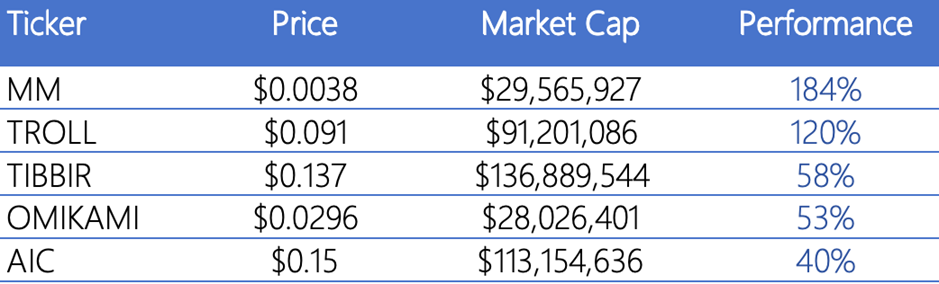

Top 5 Meme Coins with the Most Gains in the Past Week

Data source: CoinW Research Institute, coinmarketcap

Data as of August 3, 2025

2. New Project Insights

- Omni Exchange is a cross-chain decentralized trading platform dedicated to breaking down the barriers to asset trading between different blockchain networks. Leveraging multi-chain infrastructure, Omni provides efficient and secure decentralized trading and liquidity aggregation solutions for the Web3 ecosystem, enabling seamless cross-network asset exchange and liquidity sharing.

- Honeypop DEX is a decentralized automated market maker (AMM) protocol deployed on Scroll. It is completely permissionless and aims to become the core liquidity hub in the chain ecosystem, providing efficient and open trading and liquidity services to users and projects.

- Breeze is a revenue engine built on Solana, designed to quickly integrate native revenue functionality into any mobile app. With just a few lines of code, developers can add a non-custodial, secure, and fast revenue sharing mechanism to their apps, unlocking new business models without changing the user experience. Breeze has received support from the Solana ecosystem, including Turnkey, and is committed to making revenue integration simple, lightweight, and plug-and-play.

3. New Industry Trends

1. Major industry events this week

- Solana's liquidity management platform, Meteora, has released a points query website. The first quarter snapshot was taken on June 30th. Meteora's second quarter activities are underway, and users can earn fees and receive points for providing liquidity in the second quarter LP incentive program.

- Ethereum's L2 network, Linea, has announced airdrop details, distributing 9% of the total token supply to users who receive LXP. Snapshots and Sybil filtering have been completed. 10% will be used to reward early contributors, and 1% will be allocated to strategic builders. An airdrop eligibility checker will be available soon, including thresholds and multipliers. Ecosystem liquidity rewards will be distributed separately from the 75% ecosystem fund, independent of user airdrops. This fund has a 10-year vesting period and is focused on long-term ecosystem development. The remaining 12% of circulating tokens will be used for exchange liquidity and other purposes. Linea will also announce the design of the native yield bridge and the timeline for the TGE.

- Fetch.ai and ICP have officially launched the NextGen Agents Hackathon, a joint initiative with ICP, with a $300,000 prize pool. The event encourages developers to build autonomous AI agents based on the Fetch.ai ecosystem and connect to ICP's decentralized blockchain infrastructure. The winning team will directly advance to the 2025 World Computer Hacker League competition.

- SIA Nexx, a decentralized AI agent platform, has launched its multi-agent platform for investment and trading. Users on the waiting list can now experience a smarter and more efficient AI agent interaction experience after completing verification. Multi-agent platforms for more scenarios will be launched soon. Additionally, SIA points interaction rules have been released simultaneously. Users who use SIA Agents can earn points and participate in subsequent activities.

- Ethena is listed on TON, offering 20% APY (including 12% basic tsUSDe APY + 10% TON APY). In addition, APY increases can also be obtained on STON.Fi, Fiva Protocol, Eva Protocol and Affluent, with a cap of 10,000 tsUSDe.

2. Big events coming up next week

- dYdX Grants Ltd., a wholly-owned subsidiary of the dYdX Foundation, is applying for $8 million in DYDX funding from the dYdX Chain Community Treasury to launch and operate a new grant program, expected to run for 12 to 18 months. This program aims to further support developers, researchers, and contributors within the dYdX ecosystem while improving overall operational efficiency and cost-effectiveness. Following community feedback, the on-chain governance proposal officially launched on August 4th.

- Rice Robotics will launch its RICE token on TokenFi Launchpad on August 5th, aiming to build a decentralized data marketplace for AI robots and promote the tokenization and DePIN expansion of robot data. The presale totaled $750,000, representing 10% of the total supply (1 billion), with a valuation of $7.5 million. Partners include BNB Chain, DWF Labs, and Floki. RICE tokens will be used to incentivize data contributions, subscriptions to AI models, and participation in platform governance, while also achieving deflation through fee buybacks. Rice's indoor delivery robots have been deployed at SoftBank's Tokyo headquarters, 7-Eleven Japan, and other locations. Earlier this year, the company secured $7 million in Pre-A funding from institutions including Alibaba Entrepreneurs Fund.

- Solana Mobile announced that its second smartphone, the Seeker, will begin shipping on August 4, 2025, alongside the launch of its native token, SKR. As the core asset of the Solana mobile ecosystem, SKR will be distributed directly to participating developers and users, aiming to incentivize community building and application growth.

3. Important investment and financing last week

- RD Technologies has completed a US$40 million Series A2 funding round from investors including Hongshan and Hivemind Capital. RD Technologies is an innovative fintech company dedicated to promoting trust, stability, and efficient payments. Its core products include the Hong Kong dollar-backed stablecoin HKDR and the licensed stored value payment tool RD Wallet. The company aims to empower the development of the Hong Kong and global Web3 economies by combining digital currencies with compliant financial instruments, supporting local, offshore, and overseas businesses in achieving efficient, multi-currency, cross-border financial transactions. (July 30, 2025)

- Stable has completed its seed funding round, raising $28 million from investors including Hack VC, Bitfinex, Castle Island, and Franklin Templeton. Launched by Bitfinex and Tether, Stable is a Layer 1 blockchain platform that uses USDT as its native gas, enabling free peer-to-peer transfers. The chain supports running smart contracts directly on stablecoins, offering a gas-free user experience, native fiat currency integration, bridgeless cross-chain functionality via USDT0, a compliance architecture, and prioritized execution channels. It aims to provide a stable, efficient, and convenient infrastructure for Web3 applications. (July 31, 2025)

- Billions Network has secured $30 million in funding from investors including Coinbase Ventures, Liberty City Ventures, Polychain, and Polygon. Billions Network is a network platform focused on digital identity verification, aiming to build a future where humans and AI can trust each other. The platform leverages zero-knowledge proof technology to provide a scalable and secure verification mechanism for both human and AI identities. It also forms the foundation of Sam Altman's crypto project, World, which focuses on the central role of trusted identity in the era of crypto and AI. (July 31, 2025)

Reference Links:

1.Breeze, https://x.com/usebreezebaby

2.Honeypop, https://x.com/honeypop_app

3.Omni Exchange, https://x.com/Omni_Exchange

4.Billions, https://x.com/billions_ntwk

5.Stable, https://x.com/stable

6.RD Technologies, https://x.com/RD_Technologies