Original title: "7 charts reveal the current state of DeFi: Fluid leads the DEX war, USDe rewrites the stablecoin landscape"

Compiled by Tim, PANews

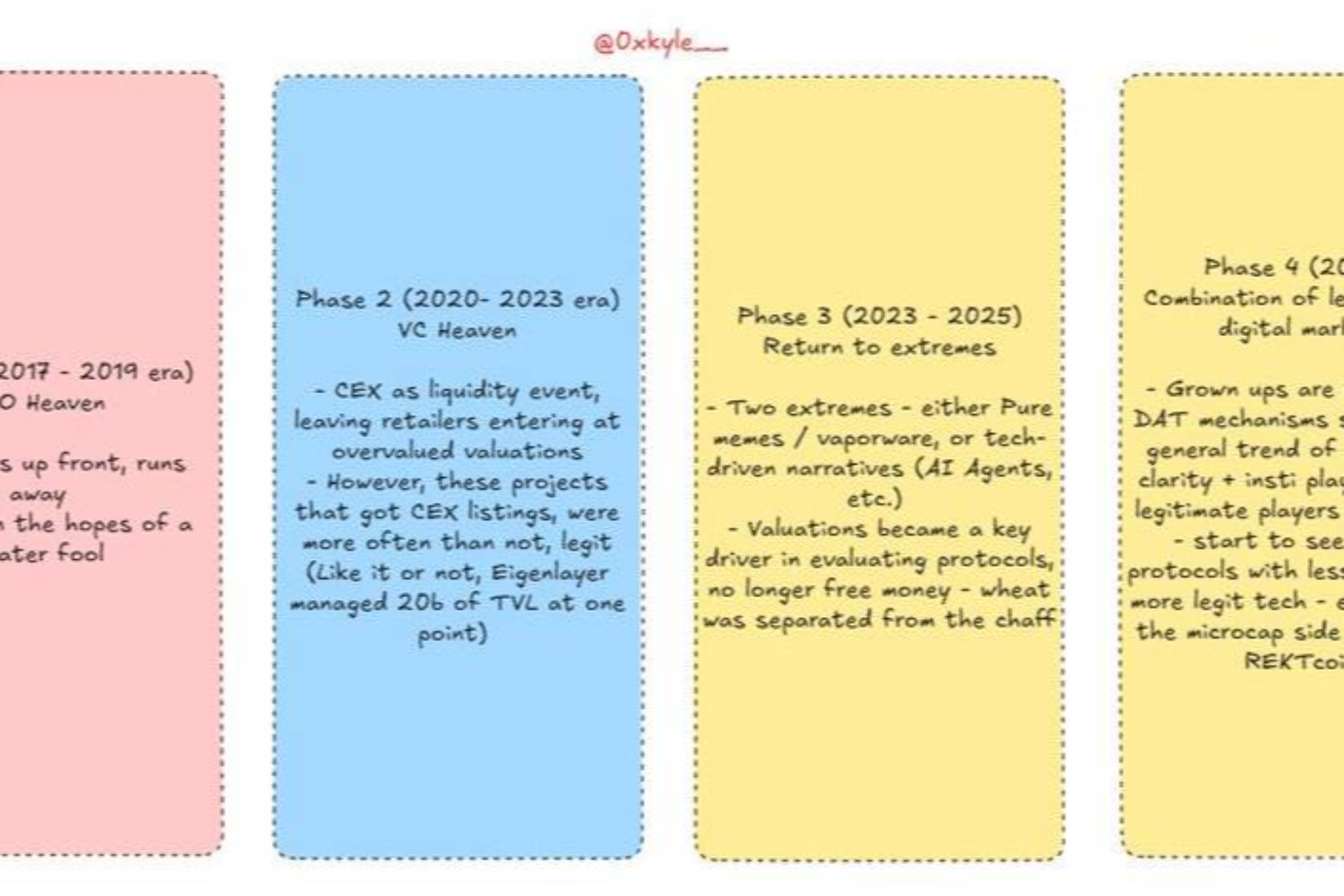

2025 to date has been a very friendly year for DeFi.

Our regulatory environment has shifted from a hostile stance under Gary Gensler’s SEC to the crypto-friendly landscape we have today, and by almost every metric, DeFi adoption is increasing.

So I thought it was time to take a closer look at these 7 charts on the state of DeFi.

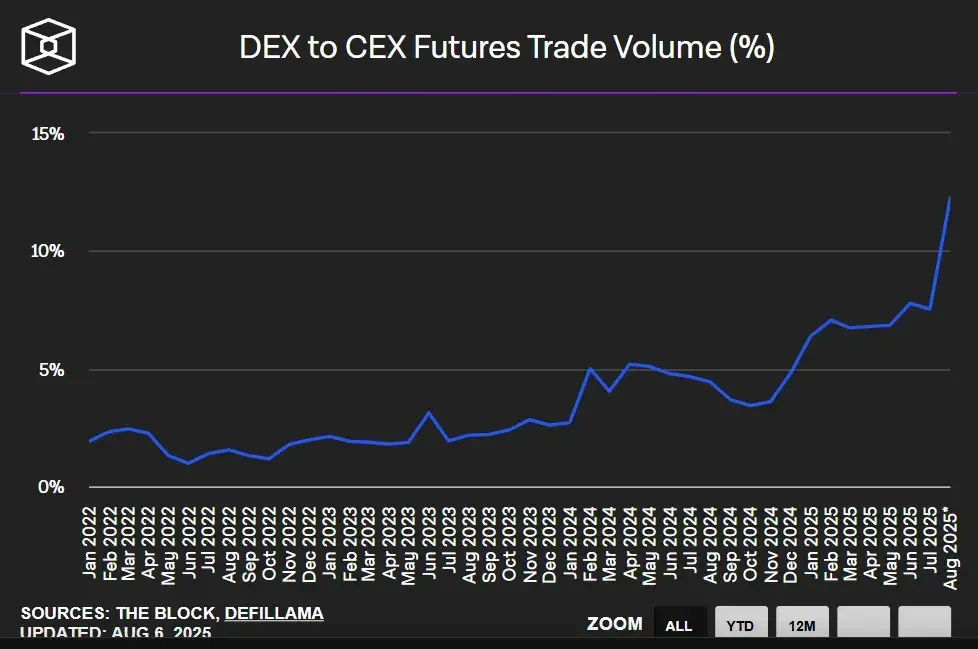

The transaction volume from decentralized exchanges to centralized exchanges is reaching new highs

Source: The Block

Although the progress is slow, the trend is clear: decentralized exchanges are constantly eroding the market share of centralized exchanges.

In June 2022, perpetual DEXs held a mere 0.98% market share in the derivatives space. Three years later, this figure has grown 11-fold.

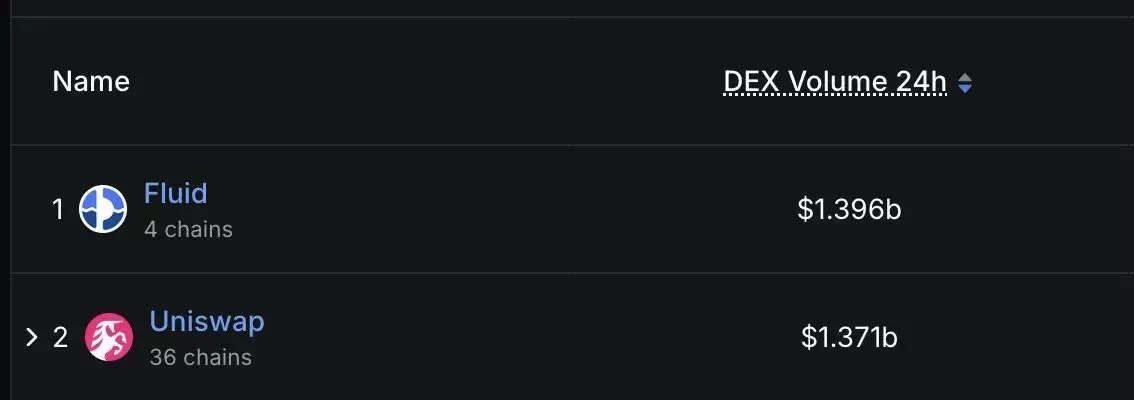

Fluid is the fastest growing DEX

Source: DeFiLlama

It is reported that less than a year after Fluid went online, its daily trading volume once surpassed Uniswap, the leading DEX on Ethereum.

Fluid DEX V 2 is about to launch, and I wouldn’t be surprised if Fluid ultimately wins the DEX battle on Ethereum.

In terms of capital efficiency, V 2 is expected to be much higher than V 1.

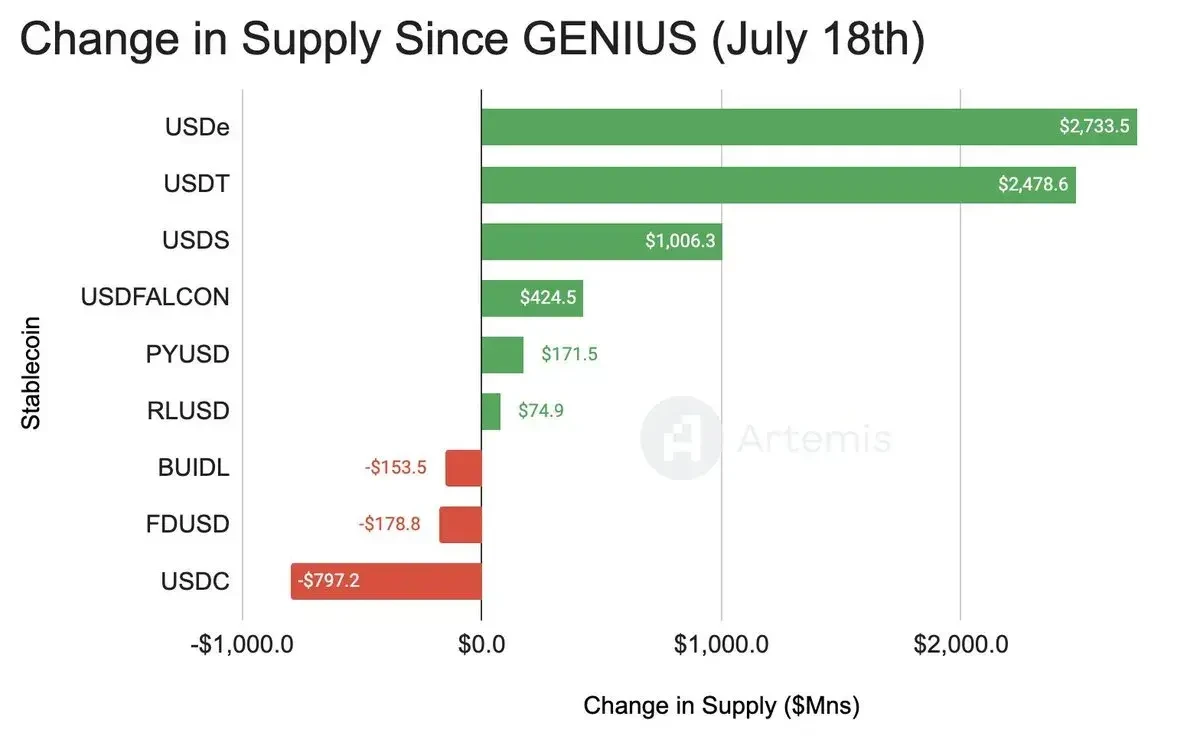

Interest-earning stablecoins topped the capital inflow list for the first time

Source: Artemis

Recently, Ethena's stablecoin USDe surpassed the two major stablecoins USDT and USDC in two-week net inflow for the first time.

Why is this change so important?

USDT and USDC have long led the market in the stablecoin sector, but now crypto-native solutions are emerging to challenge their dominance.

My prediction is that Resolv, Ethena, and Falcon Finance will continue to grow exponentially in the coming months.

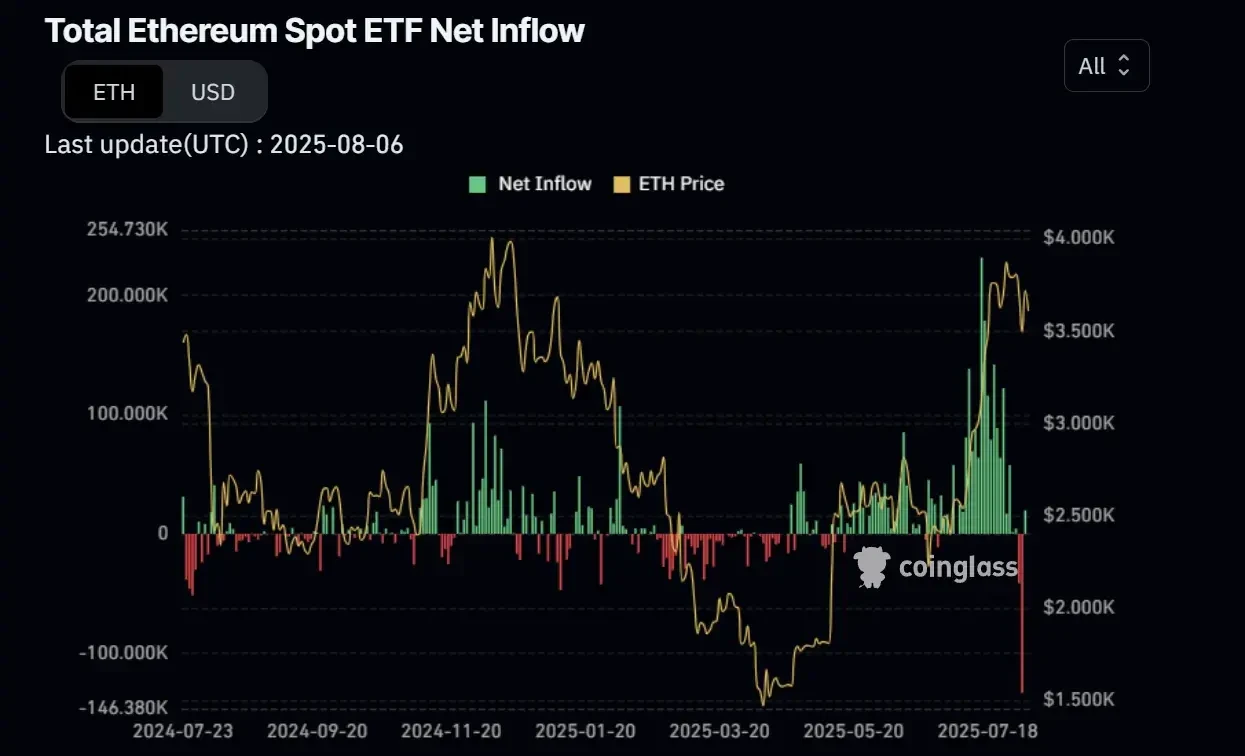

Spot Ethereum ETFs Perform Well, But Rally Is Slowing

Source: Coinglass

After several weeks of continuously breaking the record high for daily inflows, the Ethereum spot ETF recently recorded the largest single-day outflow on record.

The reason may be that some traditional financial giants have already taken profits.

However, if we take a macro view, the past two months have been the best performance period for spot Ethereum ETFs to date.

DeFi is approaching AI’s mind share

Source: Kaito

For over a year now, AI has been leading in mindshare.

But this is changing, with interest in DeFi more than tripling over the past few months, while interest in meme coins has plummeted.

Fundamentals become important again.

Projects with token buyback programs will outperform in 2025

Source: Dexu AI

This marks the beginning of the market's preference for tokens with solid fundamentals. The subcategories of protocols conducting token buybacks include Hyperliquid, PumpFun, Maple, EtherFi, Kaito, AAVE, and other projects.

Exchange BTC reserves continue to decline

Source: Crypto Quant

Since February 2024 (shortly after the launch of the first Bitcoin spot ETFs in the United States), exchange BTC reserves have continued to decline, a trend that is the exact opposite of the previous bull market.

During this cycle, the inflow of funds into Bitcoin ETFs and the purchasing demand generated by crypto asset reserve companies had a huge positive impact on BTC prices.

To sum up, the above are all the data charts to be presented in this issue.