In the third quarter of 2025, the crypto market entered a critical turning point, shaped by volatility, innovation, and regulatory clarity. Mainstream currencies saw strong gains, compliance boundaries became increasingly clear, and security risks became more frequent, driving a dramatic reshaping of the industry landscape and fostering new growth amidst turbulence.

Amid this transformation, LBank stands out with its unique advantage in 100x coin mining, strengthening its leading position in high-potential assets and reshaping the crucial role of exchanges in crypto adoption. To delve deeper into the strategic layout behind this and its outlook on the industry's future, Odaily interviewed Czhang, Head of LBank Labs and LBank Partner.

Q1: Could you please introduce your role at LBank and briefly explain what LBank has achieved in this highly competitive market?

Czhang: I'm currently the head of LBank Labs and a partner at LBank. My primary focus is on the platform's overall investment strategy, project incubation system, and innovation initiatives. LBank is no longer just a platform for early-stage crypto project trading; it's become a key enabler of the discovery and growth of high-quality projects.

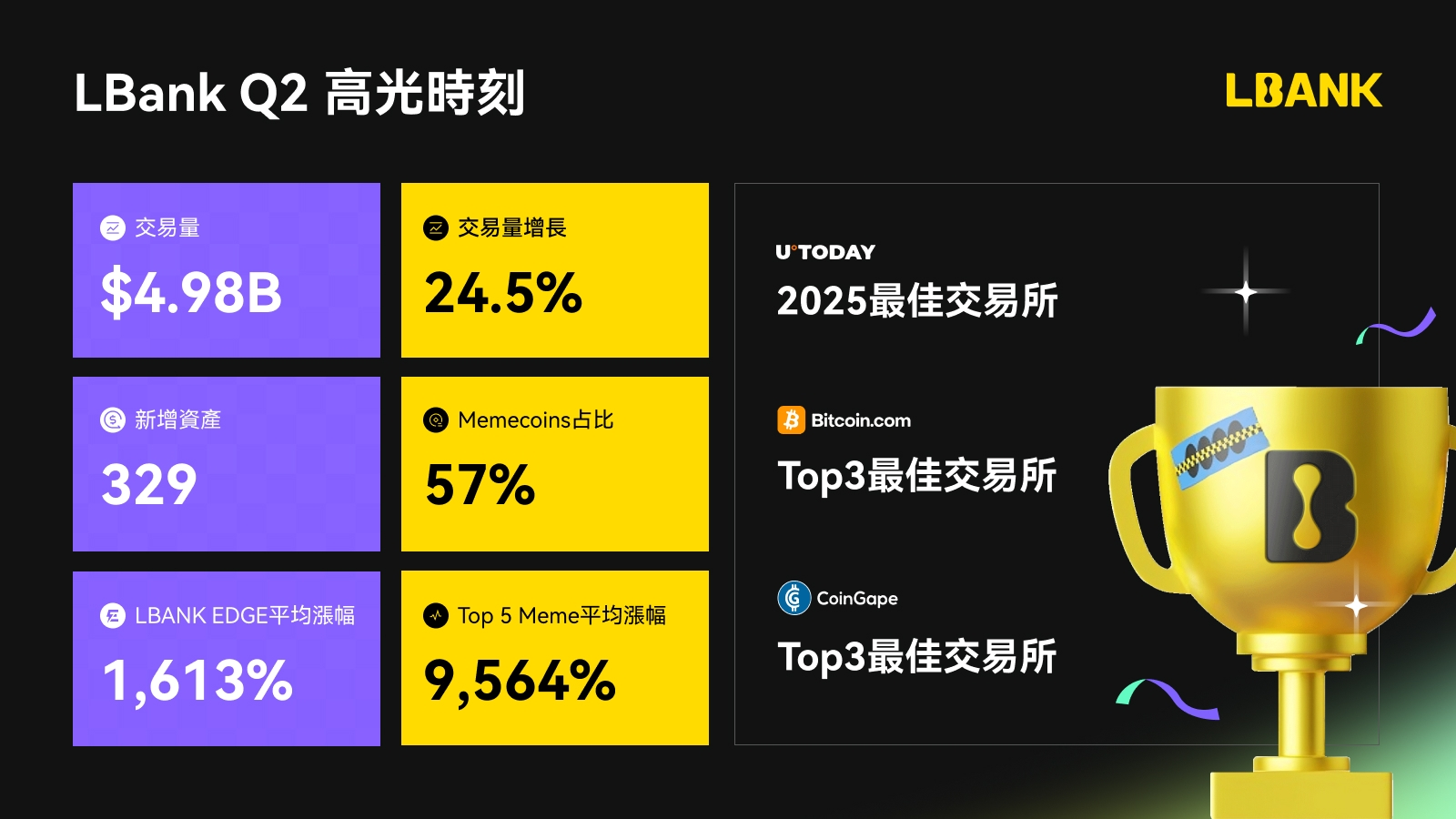

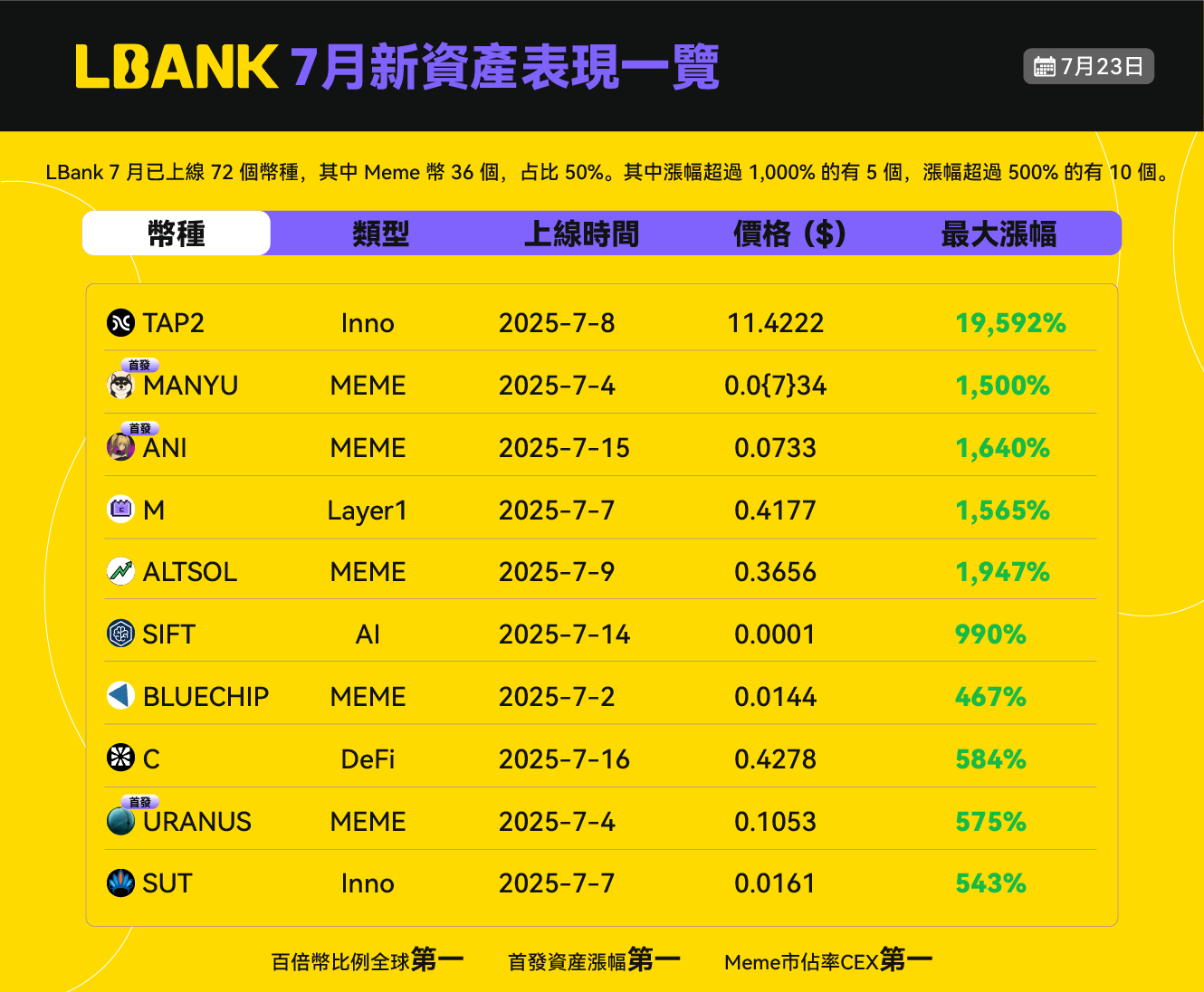

Currently, LBank boasts over 15 million users and an average daily trading volume of $4.98 billion (a 24.5% quarter-over-quarter increase in Q2 2025), steadily growing into a key hub for 100x-per-coin projects. This success is inseparable from our "rapid listing mechanism" and project discovery strategy tailored to the needs of retail investors. LBank has never positioned itself as a "follower," but rather as one of the first to embrace the next wave.

Q2: In the current highly competitive centralized exchange (CEX) landscape, what are the differentiated advantages of LBank?

Czhang: In this market where “the slow ones get eliminated”, LBank’s core advantage lies in its speed and ability to discover 100x-yielding coins.

First, we launched the "LBANK EDGE" zone, focusing on high-risk, high-return assets such as USELESS (up +7,485%) and LAUNCHCOIN (up +15,194%). These projects often secure early listing opportunities before the market even notices them, giving them a head start. Simultaneously, we also integrated and launched "xStock," a groundbreaking and innovative platform that supports trading of crypto-to-stock assets like $MSTRX and $CRCLX, successfully tapping into the growth dividend of the US stock market.

In terms of user growth and retention, LBank has completely reshaped its user incentive mechanism by launching a "90-day points-based loyalty program," closely linking platform rewards with user activity, further enhancing user stickiness and flexibly responding to the ongoing changes in the current CEX industry landscape.

On the security front, we always adhere to the "zero tolerance" principle and have established a long-term strategic partnership with CertiK to comprehensively enhance the platform's response and defense capabilities against external security threats.

It can be said that speed, innovation and trust constitute the three core moats of LBank in the CEX high-speed competition track.

Q3: As the head of LBank Labs, what core factors do you value most when evaluating investment projects?

Czhang: We are very cautious in project evaluation, focusing on three core dimensions:

- Sustainable economic model: The project must have a clear long-term value creation path, not just short-term speculative growth;

- Disruptive Innovation: We support teams that build infrastructure or reshape user experience in DeFi, RWA, or other emerging sectors.

- Strong execution: Whether the founding team has the professional capabilities and the execution ability to push projects to fruition under high-pressure environments is an important and non-negotiable criterion in our evaluation.

We also comprehensively consider a project's token economics, community engagement, and regulatory compliance to ensure its long-term resilience and flexibility. Our investment goal isn't to blindly chase short-term trends, but to firmly empower the builders who truly have the potential to shape the future of Web 3.

Q4: The United States recently passed two landmark encryption bills. How do you think they will affect the future development direction of the industry?

Czhang: The introduction of these bills marks a milestone in the crypto industry's transition from a "regulatory vacuum" to an institutional framework that supports innovation. They are not only policy tools, but also a clear signal to the world that crypto is gradually moving from a marginal industry to the core of the global financial system.

This regulatory clarity has significantly lowered the barrier to institutional participation, particularly driving compliance and significantly increasing trading activity in the stablecoin sector. Previously viewed as a major obstacle to crypto development, regulation is now becoming an accelerator for industry maturity, paving the way for blockchain technology to reshape global financial infrastructure.

Q5: July 30, 2025, marks the 10th anniversary of Ethereum. What's driving ETH's rebound? What are your thoughts on its future development?

Czhang: Bitcoin is "digital gold" and symbolizes the storage of value; while Ethereum is becoming the core of the global financial infrastructure and settlement layer.

ETH's current resurgence is the result of a combination of institutional adoption and underlying structural upgrades. On the one hand, the Ethereum Foundation's governance reforms have rebuilt market confidence; on the other hand, the continued inflow of funds into spot ETFs and the increasing number of companies adding ETH to their financial reserves have further solidified its market position as an institutional asset.

At the same time, the optimization of the staking mechanism has effectively reduced the market supply of ETH and enhanced its price resilience. Currently, ETH has stabilized above its MA 7 (daily moving average), showing strong technical and fundamental performance.

Looking ahead, Ethereum will continue to serve as the core underlying infrastructure of Web 3, providing solid support for DeFi, asset tokenization (RWA), and a scalable ecosystem. It is not only the carrier of innovation in the past decade, but will also be the fundamental force for crypto transformation in the next decade.

Q6: Large traditional financial institutions like JPMorgan Chase and Citigroup are accelerating their deployment of stablecoins and RWAs (real-world asset tokenization). What is the driving force behind this institutional influx?

Czhang: This is not only a trend, but also represents that the global financial structure is undergoing a profound reconfiguration.

The implementation of the GENIUS Act provides a clear, compliant path for institutional capital to enter the crypto market and sends a positive signal that regulators are embracing innovation. Currently, the total market capitalization of stablecoins has exceeded $265 billion, demonstrating unprecedented efficiency and certainty in cross-border payments and on-chain liquidity.

The battle for dominance over RWAs (real-world assets) and the underlying infrastructure of digital currencies has fully unfolded. Whether it's traditional financial giants or agile crypto natives, whoever can first complete their strategic layout will have the potential to control the core discourse of future global asset flows and value transfers.

Q7: MicroStrategy's Bitcoin reserve strategy has inspired imitations from companies like Japan's Metaplanet. Is this model suitable for wider enterprise adoption?

Czhang: MicroStrategy's strategy is a classic example of Bitcoin investment—it leverages the capital market's leverage mechanism to amplify Bitcoin's price gains, creating a positive cycle of "buying Bitcoin—pushing up the stock price—refinancing—and continuing to buy," with a significant self-reinforcing effect. However, this isn't a universal model applicable to all companies. Its success relies heavily on several prerequisites: a favorable market cycle, cheap financing, and the company's strong tolerance and unwavering belief in highly volatile assets.

For most companies, this strategy also implies higher liquidity risk, greater regulatory uncertainty, and potential market drawdown pressure. Therefore, it is more of an "outlier paradigm" suitable for specific types of companies (such as technology or crypto companies with strong balance sheets and extremely high risk appetite) rather than a widely replicable leverage template.