Original title: "Ethereum Vault Big Player: Dismantling The Ether Machine's Midas Touch and the Key Drivers Behind It"

Author: Zz, ChainCatcher

The Ether Machine (ETHM), an Ethereum treasury strategy firm, announced on August 4th that it had increased its holdings by another 10,605 ETH, bringing its total holdings to 345,362, valued at approximately $1.27 billion. This was the company's second major increase in holdings in less than two weeks since its IPO.

ETHM, a company focused on Ethereum investment, announced in July that it would ring the bell on the Nasdaq, initially planning to issue 400,000 ETH with a market capitalization of nearly $1.6 billion. At the end of July, the company had already increased its holdings by 15,000 ETH.

The Ether Machine's aggressive expansion comes at a critical time when many listed companies are scrambling to acquire ETH. With the increasingly clear regulatory framework, more and more listed companies are incorporating ETH into their asset allocation.

Armed with $1.6 billion in ammunition, it enters the Ethereum DAT arms race

The Ethereum treasury market has become a must-fight for institutions. The listing of ETHM completely ignited this competition—in just two weeks, the entire market landscape has undergone tremendous changes.

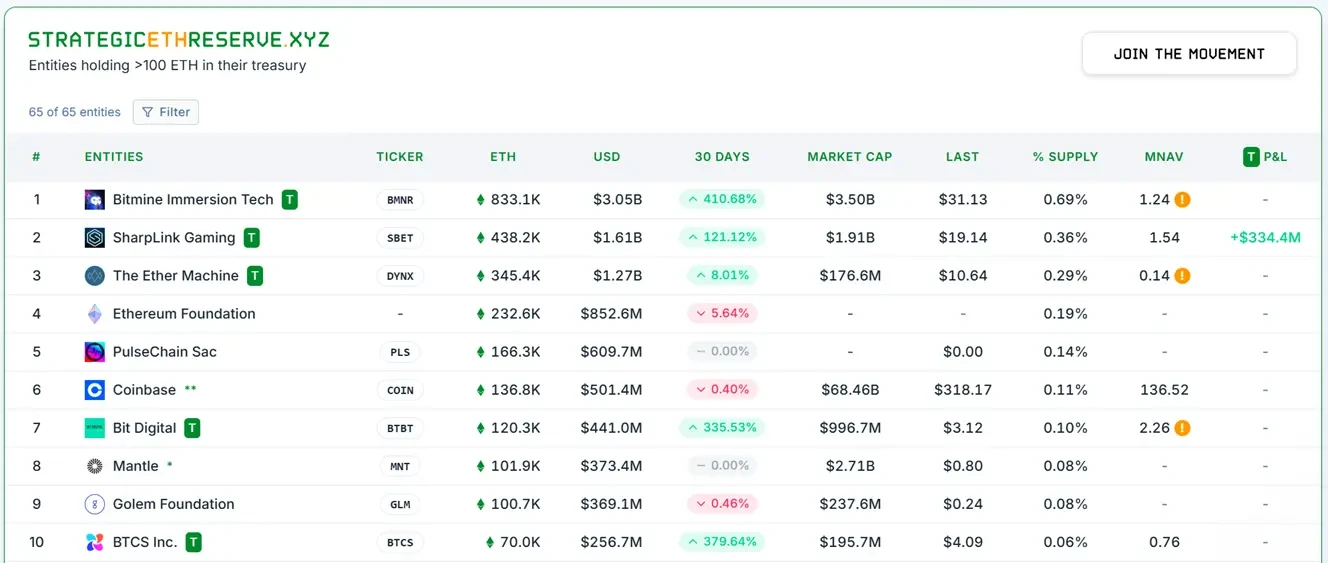

According to official reports, when ETHM announced its IPO on July 21st, BitMine and SharpLink held only 300,000 and 280,000 ETH reserves, respectively, both below ETHM's planned initial holdings of 400,000. However, by August 5th, BitMine's holdings had soared to 833,000 ETH (market cap $3 billion), a 177% increase, placing it first. SharpLink, not to be outdone, ranked second with a 78% increase in reserves reaching 498,000 ETH (market cap $1.8 billion), according to Nansen on-chain data. The company has publicly announced its goal of reaching one million ETH. Even former Bitcoin miner Bit Digital pivoted, accumulating 120,000 ETH.

Source: Strategic ETH Reserve (SBET data has not yet been updated)

This frenzied surge in holdings confirms Standard Chartered Bank's prediction: Treasury firms have already acquired over 1% of ETH's circulating supply, a proportion that could soar to 10%. A multi-billion dollar arms race is escalating.

Amidst this fierce competition, The Ether Machine emerged as a rising star, leveraging its dual advantages of capital and strategy. First, its initial capital of nearly $1.6 billion provided ample ammunition— Andrew Keys personally invested $645 million in ETH, while Pantera Capital and other institutions pledged over $800 million in funding. However, this wasn't enough to propel it to the top of the pack.

A more crucial advantage lies in its differentiated approach. While competitors are frantically hoarding coins to gain market share, ETHM has already boosted its yield to 4-5.5% through a combination of restaking and DeFi protocols. In a low-interest environment, this stable, high yield has become a key factor in attracting institutional funds.

4-5.5% annualized yield: Deconstructing ETHM’s Midas Touch

To understand how The Ether Machine achieves an annualized return of 4-5.5%, you need to understand its core positioning - "Ether generation company."

This concept can be compared to the oil economy: traditional crypto investments are like buying crude oil and hoarding it, waiting for prices to rise; while The Ether Machine chooses to become an "oil company" and let the assets themselves generate cash flow.

Keys and his team discovered that ETH is not just an asset but also a tool for production. Through the EigenLayer protocol, staked ETH achieves multiple benefits: it not only provides security for the Ethereum mainnet but also provides services for oracles, cross-chain bridges, and other protocols, each of which generates additional revenue.

Just like a bank deposit not only earns interest, but also allows you to "work" and earn extra income. EigenLayer's $16.591 billion in total locked value demonstrates the appeal of this model, and The Ether Machine has become one of the largest institutional participants in the ecosystem.

In addition to re-staking income, the company also earns returns by participating in DeFi protocols. When the basic ETH staking income is only about 3%, this combined strategy increases the total return to 4-5.5%.

At this point, ETH has transformed from a static asset "waiting to appreciate" to a productive asset "continuously creating value".

ETHM is not the next MicroStrategy

The market always likes to find benchmarks. When The Ether Machine emerged, almost everyone was asking the same question: "Is this the next MicroStrategy?"

"Perhaps people tend to use yesterday's framework to understand today's innovations."

Indeed, on the surface, both companies are doing the same thing - holding large amounts of crypto assets as listed companies. But if you look deeper, you will find that they are two completely different approaches.

MicroStrategy's logic is straightforward. It issues bonds to buy Bitcoin, betting that rising prices will cover the interest. But the efficiency of this model is plummeting. In 2021, MicroStrategy generated one basis point of return for shareholders for every 12.44 BTC it acquired. By July 2025, it would require 62.88 BTC to achieve the same result. While the scale has increased fivefold, the efficiency has dropped to one-fifth.

In contrast, The Ether Machine takes a different approach. Through staking and DeFi participation, ETH generates approximately 5% annualized cash flow every day. No need to wait for price increases or pray for a bull market—this is real income, not just paper wealth.

The fundamental difference lies in the nature of the assets: Bitcoin is digital gold, whose value lies in scarcity and consensus, while Ethereum is digital infrastructure, whose value lies in its ability to support the operation of the entire ecosystem.

We can now trace our history back to the MicroStrategy era and see that we are experiencing the third phase of the evolution towards crypto treasury:

Phase 1: Pioneer Dividend Period (2020-2023) MicroStrategy, which was not optimistic at the time, proved that listed companies can obtain premiums by holding crypto assets.

Phase 2: Model Replication (2024-2025): Success attracts imitators. SharpLink's stock price surged 4,000% before plummeting 70%. Marathon Digital and Riot Platforms followed suit, but with limited success, the simple hoarding model exposed risks.

The third stage: model evolution period (2025-) The new model represented by The Ether Machine - not hoarding assets, but operating assets to create diversified sources of income.

However, achieving this evolution from hoarding assets to operating assets is by no means easy. It requires not only a deep understanding of the crypto world but also experience in navigating the maze of traditional financial compliance.

The four key operators behind the behemoth

When the chairman of The Ether Machine described his team as the "Ethereum Avengers," he wasn't kidding. This group of well-connected "Avengers" is attempting to reshape the landscape of institutional crypto investing.

The story begins at ConsenSys, the melting pot of the Ethereum ecosystem. There, Andrew Keys and David Merin first met. At the time, they had no idea they would become so deeply connected to one of the world's leading financial institutions.

In 2017, during the post-ICO "crypto winter," the industry was filled with despair. Just as everyone was fleeing, Andrew Keys was using Ethereum to knock on the doors of Microsoft and JPMorgan Chase.

"They looked at Andrew Keys like he was a lunatic peddling perpetual motion machines."

But he didn't give up. He faced repeated rejections and explanations until his suspicions slowly turned to curiosity. Ultimately, he founded the Enterprise Ethereum Alliance (EEA), bringing the word "Ethereum" to the table of a Fortune 500 company for the first time.

At the same time, David Merin drove commercial transformation within ConsenSys and led over $700 million in financing and mergers and acquisitions.

During countless late-night discussions, the two realized that what stands between traditional finance and the crypto world is not only prejudice, but also a real compliance gap.

"Countless institutions have shown interest in Ethereum, but have ultimately been deterred by a lack of credible investment vehicles."

This pain point prompted them to make a bold decision: to stop being just "evangelists" and to personally take action to build a regulated financial vehicle.

Keys' first move shocked everyone—he invested over $600 million worth of his own ether (ETH) as an initial investment. "If I don't believe in it myself, how can I get others to believe in it?"

His all-in approach showed everyone his determination. In a later CNBC interview, he explicitly stated, "I'd rather have an iPhone than a landline." This metaphor aptly explains his singular bet on Ethereum.

Then, the team assembled. They found Darius Przydzial, a "two-faced man" who had managed traditional risk at Fortress and was a core contributor to the DeFi protocol Synthetix. His mission was clear: to strike gold while also staying alive in the wild west of DeFi.

To ensure technical security, Tim Lowe, with twenty years of experience in banking-grade systems, joined the team. Finally, the arrival of Jonathan Christodoro, a PayPal director and former Icahn Capital executive, provided the final endorsement of the company's governance structure.

Things weren't always smooth sailing within the team. The traditional finance faction advocated for conservatism and stability, while the crypto-native faction favored radical innovation. After numerous fruitless meetings, Keys finally made the final decision: "We're not choosing sides; we want to be the bridge connecting both sides."

This sentence has become the unchanging core concept of The Ether Machine.

Vitalik’s call: We shouldn’t pursue large institutional capital at full speed

If the idealism centered on technology and community represented by the Ethereum Foundation constitutes the first lifeline of ETH, then what we are witnessing today is the natural evolution and handover of this lifeline: when EF gives way to capital, ETH's second lifeline has already begun.

This new lifeline doesn't necessarily deviate from its original intention, but it will undoubtedly lead Ethereum into more complex and complex waters. The question is, what will Ethereum become in this process? What risks will it face?

The primary concern is technical risk: smart contract vulnerabilities and staking penalties can lead to a 100% loss of ETH. Coupled with weeks-long unlocking periods, liquidity becomes a luxury. When a single entity controls a large amount of ETH, are we strengthening Ethereum or changing its nature?

Subsequently, community opinion became sharply divided. A comment from @azuroprotocol accurately captured this anxiety: from "building a decentralized Ethereum" to "selling 400,000 ETH to businesses," it ultimately evolved into "Web 3 becoming Wall Street 2.0."

Even Vitalik once warned: "We should not pursue large institutional capital at full speed." Now, when 70% of the staked ETH is concentrated in a few pools, are his concerns becoming a reality?

At the same time, "Who cares about decentralization when prices are rising?" @agentic_t summed up the core dilemma facing the community. While 4%-5.5% staking returns may seem tempting, history tells us that any excess returns will eventually be wiped out by arbitrageurs.

Similarly, while Keys believes Ethereum has become the biggest beneficiary of the GENIUS Act, and that a regulatory spring seems to have arrived, what happens after that spring? When the policy winds shift, will these institutional efforts become targets of regulation?

A sign of maturity, or the end of ideals?

Perhaps every successful technology will eventually become institutionalized. The internet, mobile payments, and social media have all gone through this process.

As Ethereum is transforming from an experiment for idealists to an investment product considered by Wall Street, is this a sign of maturity or a deviation from its original intention?

Time will give the answer.