Original author: TRACER

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Ethan ( @ethanzhang_web3 )

Editor's Note: August opened with another surge in the crypto market: Bitcoin weakened in the short term, altcoins generally retreated 20%-30%, and single-day liquidations exceeded $1.5 billion. Trump is being blamed as the primary driver of this volatility. From new tariffs and escalating geopolitical tensions to reversals in macroeconomic data and the Federal Reserve's inaction, the market has once again been gripped by a surge in fear. Meanwhile, rumors of Trump secretly selling crypto assets have exacerbated market panic, triggering a new chain reaction. In this article, the author analyzes macroeconomic data and capital flows to offer a counter-concept: a short-term correction could be an opportunity for long-term investment, and a true "second wave of the bull market" may be brewing.

Note: The views expressed in this article clearly reflect a positional perspective and are not intended to be investment advice. Odaily Planet Daily reminds readers to consider the analysis rationally and make prudent decisions based on their own circumstances.

Original content

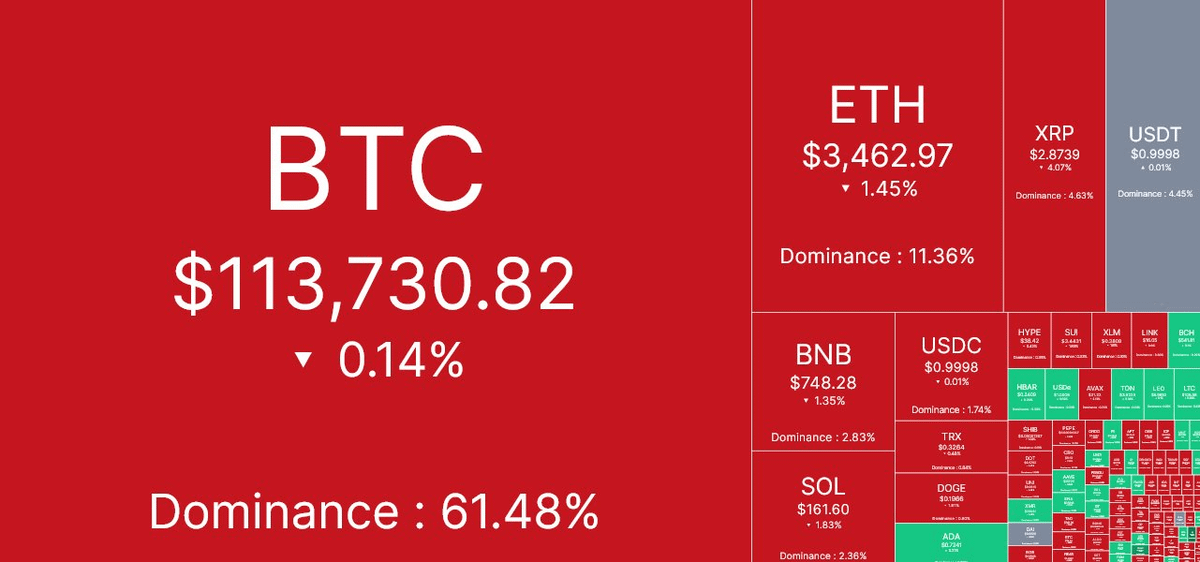

Market optimism dissipated, and adjustments quietly arrived . Bitcoin fell 9% from its historical high, and altcoins generally fell back 20%-30% .

In early August, the market was suddenly hit by a massive sell-off, with over $1.5 billion liquidated in a single day. The core question is: Are the causes of this decline serious? And how should we respond?

The core trigger of this pullback is the latest move of US President Trump :

- New tariff policy proposals;

- Elevated geopolitical uncertainty;

- Macroeconomic data is full of contradictions.

First, let's focus on the tiresome "new tariff proposals." Over 66 countries have been added to the list of potential tariff increases—and the same old routine persists . Each time, it feels like a repeat of the same old story, even giving the impression of market manipulation.

However, the US government clearly will not risk a recession just for these tariffs.

We have seen market pullbacks triggered by this type of manipulation many times. Retail investors often interpret such news as significant negative news and overreact .

Think about it, how many times have similar tariff threats been announced, and how many times have the market hit new highs afterward?

So don't worry too much about it, it's a cliché .

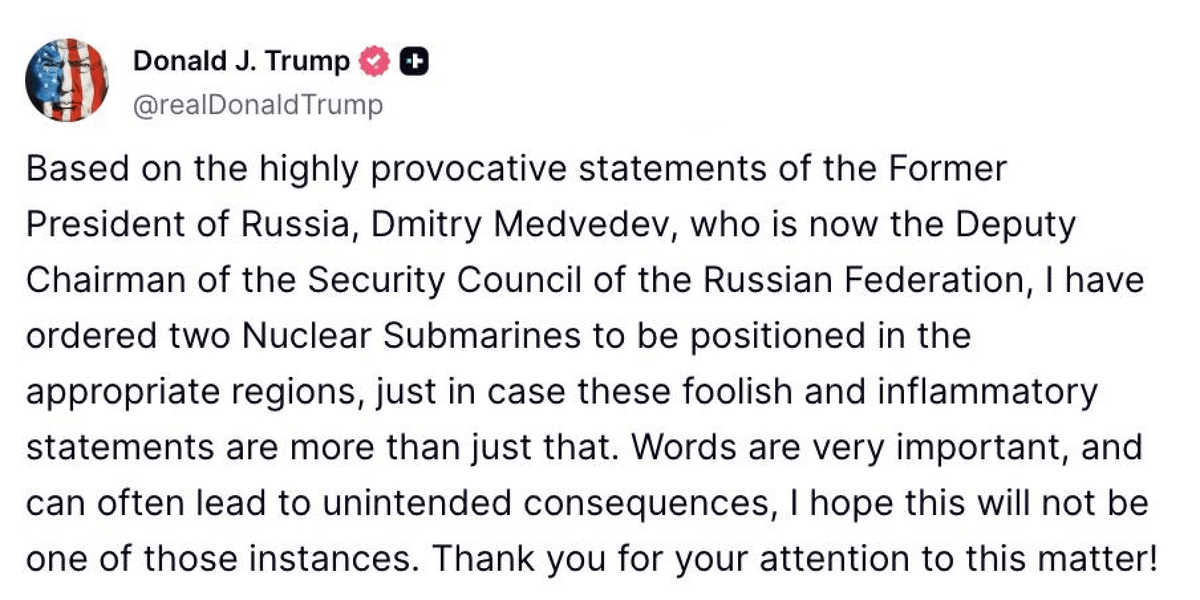

Besides tariffs, a recent surge in geopolitical risks has also heightened anxiety . The trigger: the US announcement that it would deploy two nuclear submarines near Russia . Is this cause for concern? Absolutely .

But think calmly: Does anyone really think a nuclear war will break out in 2025? This is more likely a "pressure tactic" intended to push the negotiation process forward .

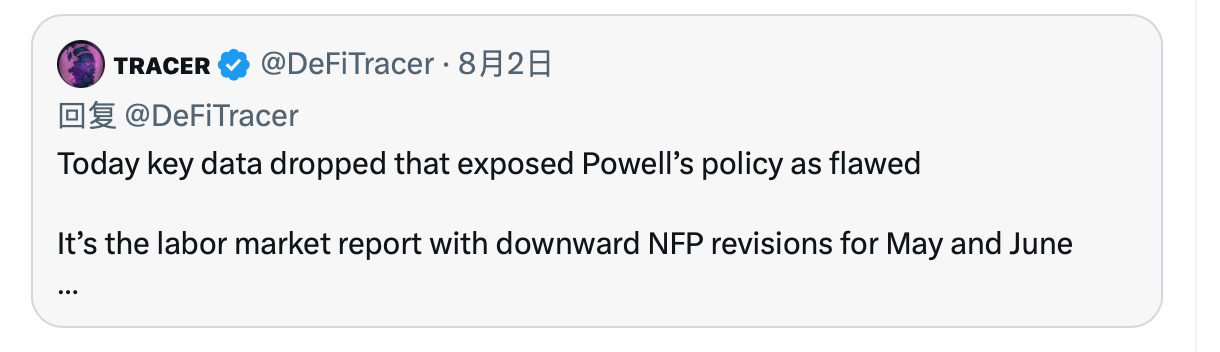

However, what really worries US economic decision makers (such as the Federal Reserve) is the confusing labor market macro data .

The market's previous bet on a "Federal Reserve policy shift" (interest rate cut) was dashed .

More importantly, the non-farm payroll (NFP) data for May and June was revised downward by nearly 10 times, which seriously shook the market's confidence in the reliability of overall macroeconomic data .

Ultimately, multiple factors combined to create a powerful "combination punch" :

- Interest rates remain high;

- Signs of an economic cooling are growing.

These combined factors led to a significant decline in institutional investor demand this week . Bitcoin spot ETFs even saw net outflows for the first time .

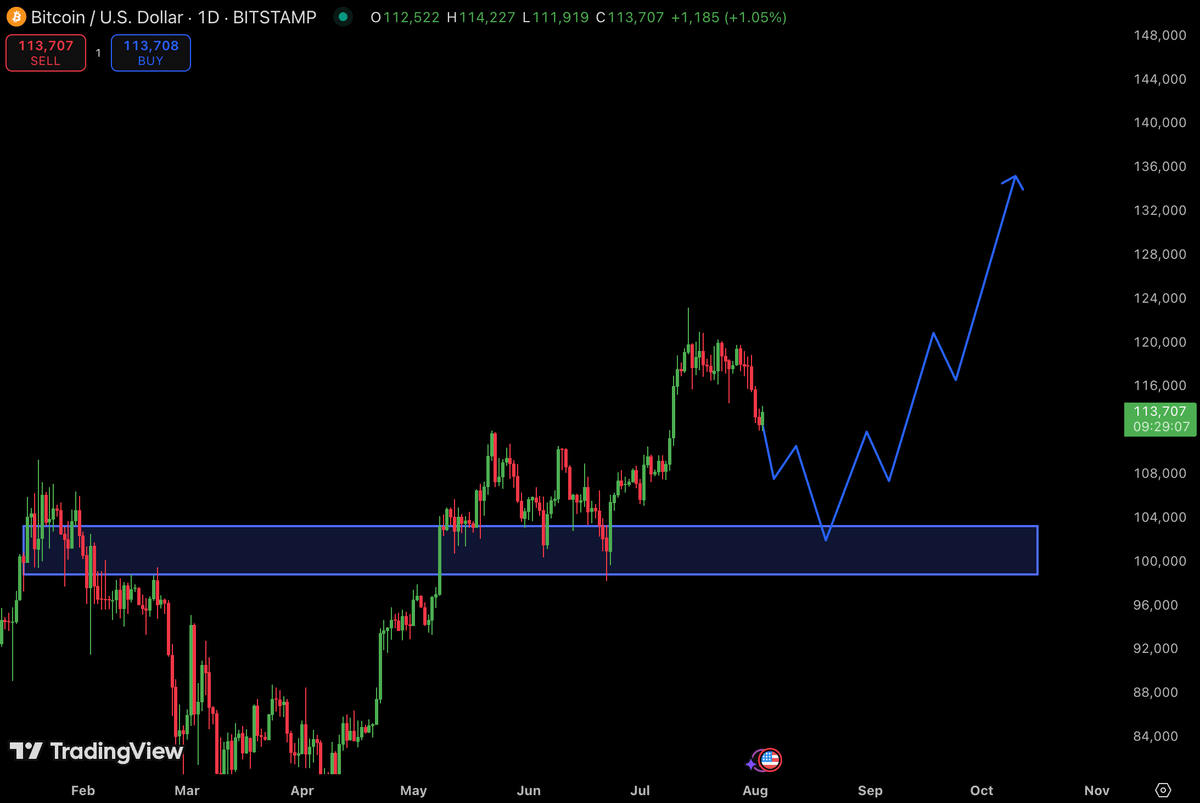

So, what is my judgment on the market outlook?

My current view is based on the recognition that macroeconomic pressures are continuing to accumulate . No major economy is currently able to generate sufficient credit growth to support sustained GDP expansion .

My key support levels are: $110,000 for Bitcoin and $3,200 for Ethereum.

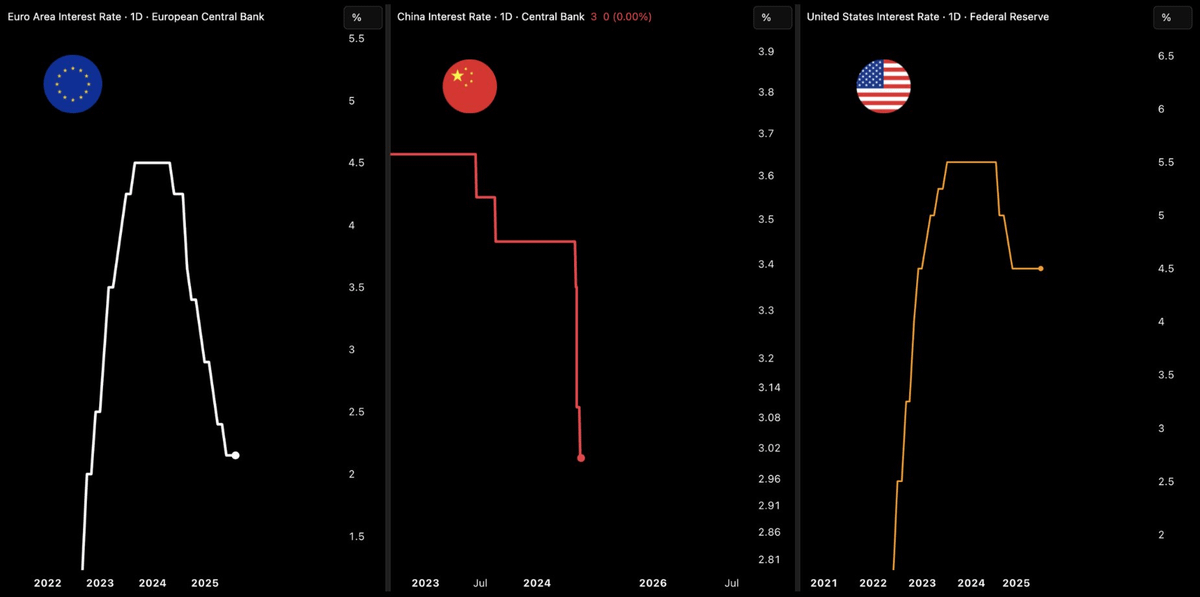

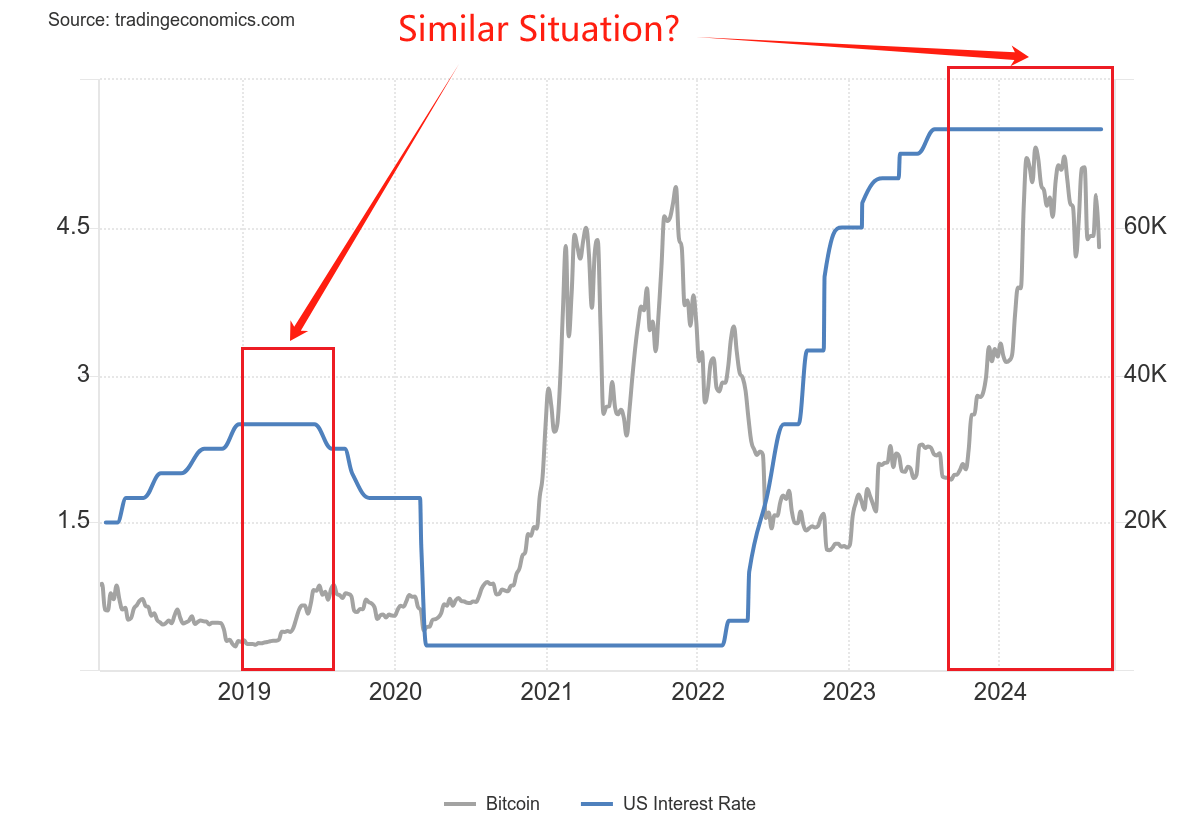

I predict that by September the Fed will have no choice but to start cutting rates to re-stimulate the market :

- Inflation data has declined significantly;

- The job market is under pressure;

- Powell seems intent on delaying the decision to cut interest rates.

When the time point approaches, the market is expected to start an upward trend again.

Historical patterns show that after every similar FUD (fear, uncertainty, and doubt), the market will experience a strong rebound .

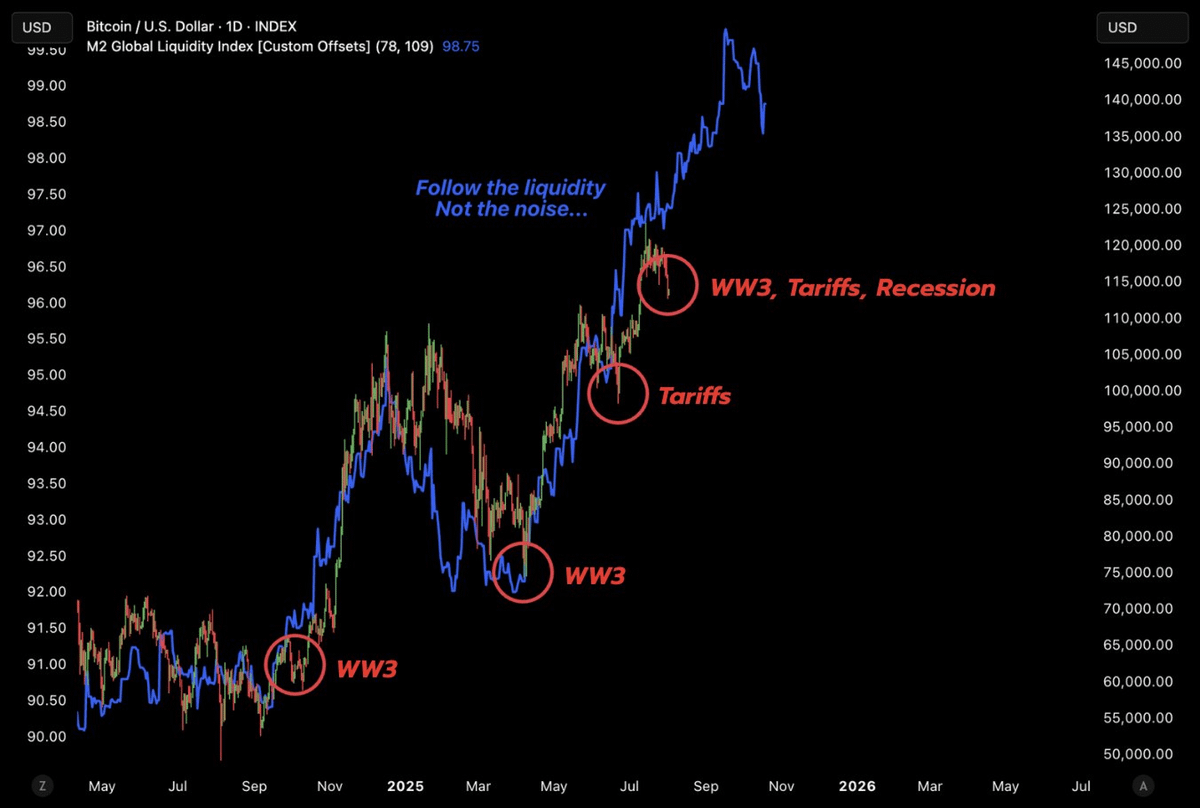

Referring to the correlation chart between M2 money supply and Bitcoin price, the conclusion is clear: market trends follow liquidity, and the overall global liquidity environment remains loose .

Therefore, the current volatility is essentially still a global market game superimposed with FUD .

Looking ahead to autumn, with the start of the interest rate cut cycle, I expect major funds to flow back on a large scale, thus starting a real "altcoin season" .

At that time, it will be a critical window period to actively lock in profits .

This is exactly the direction I am currently planning.

In this adjustment, I focus on the continuous accumulation of three types of assets: BTC, SOL and E TH .

TH .

I am particularly bullish on ETH's technical potential and fundamentals , and I've noticed growing institutional interest . This was evident on August 3rd when a wallet associated with Shraplink added another $36 million worth of ETH.

In summary, the strategy is clear: view the current volatility as an opportunity to accumulate positions.

The market landscape is evolving, and the buying window at this low level may not last long . Now is a good time to gradually build a position, stockpile chips, and wait for the market to develop from October to December .