The Treehouse Fixed Income Protocol has officially launched its TGE. Its native token, TREE, has been launched on the Ethereum mainnet and listed simultaneously on multiple centralized and decentralized exchanges. The Token Generation Event (TGE) is named "Gaia," symbolizing the beginnings of a thriving ecosystem. The first wave of staking rewards includes up to 75% APR for pre-deposited staking, and a large-scale airdrop will be launched to reward community members who have actively participated in the ecosystem's development over the past year.

Treehouse TGE — GAIA Officially Launched

Treehouse, a decentralized fixed-income protocol, officially launched its Token Generation Event (TGE) today, with its native token, TREE, now live on the Ethereum mainnet. This TGE, named "Gaia," symbolizes a new starting point for the Treehouse ecosystem. Gaia, the Earth Mother in Greek mythology, is considered the source of all life and the starting point of nature, signifying that Treehouse will take deep roots and flourish from now on.

Airdrop Eligibility Explanation: Who can claim TREE?

Anyone who participated in Season 1 of GoNuts (Treehouse's points program), accumulated a certain number of Nuts (Treehouse points) and badges, or holds a Treehouse NFT ( Treehouse Squirrel Council ) will be eligible for the TREE airdrop. Users can connect their wallet to the Gaia Foundation's airdrop checker to confirm eligibility.

To learn more about Treehouse airdrop eligibility, read the Airdrop Inspector blog and official documentation .

Treehouse: Focused on building DeFi fixed income infrastructure

Treehouse is building a decentralized fixed income protocol layer (Decentralized Fixed Income Layer), dedicated to solving core problems in the current DeFi world, such as large income volatility, opaque interest rates, and lack of interest rate standardization.

In traditional financial markets, the market size of fixed-income assets reaches tens of trillions of dollars and is crucial for supporting the stability and liquidity of global capital markets. However, in the DeFi world, the immature fixed-income infrastructure, lacking a unified benchmark interest rate and stable return mechanism, makes it difficult for investors and protocol developers to effectively manage risk and reward.

Treehouse aims to fill this gap through a standardized interest rate mechanism and composable income assets. The overall structure consists of two core products:

tAssets

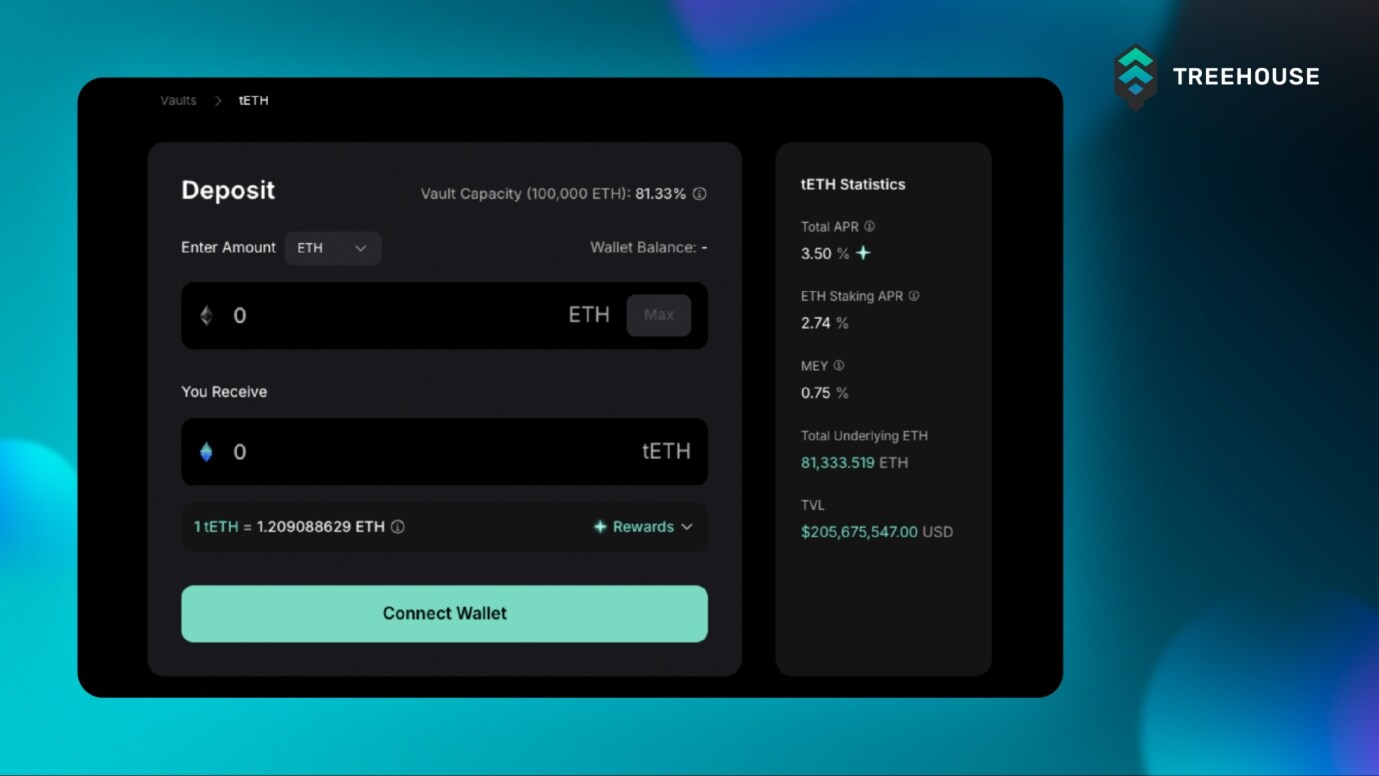

tAssets is a next-generation liquid staking token with a built-in yield strategy. In addition to providing basic staking returns, it also offers users higher staking returns by arbitrage between lending and staking rates. For example, using tETH, users can exchange ETH or stETH for tETH and earn an annual yield of approximately 3.5-5%. tAssets is currently available on Ethereum, Arbitrum, and Mantle, with plans to launch on more chains in the future.

In addition, by integrating multiple DeFi protocols (Aave, Balancer, Compound, Curve, Pendle and Silo, etc.), tAssets has strong liquidity and composability, allowing users to continue to obtain returns while still being able to freely participate in various DeFi ecosystems.

Try tAssets now and save your ETH! Earn stable income on the Treehouse dApp .

DOR (Decentralized Offered Rates)

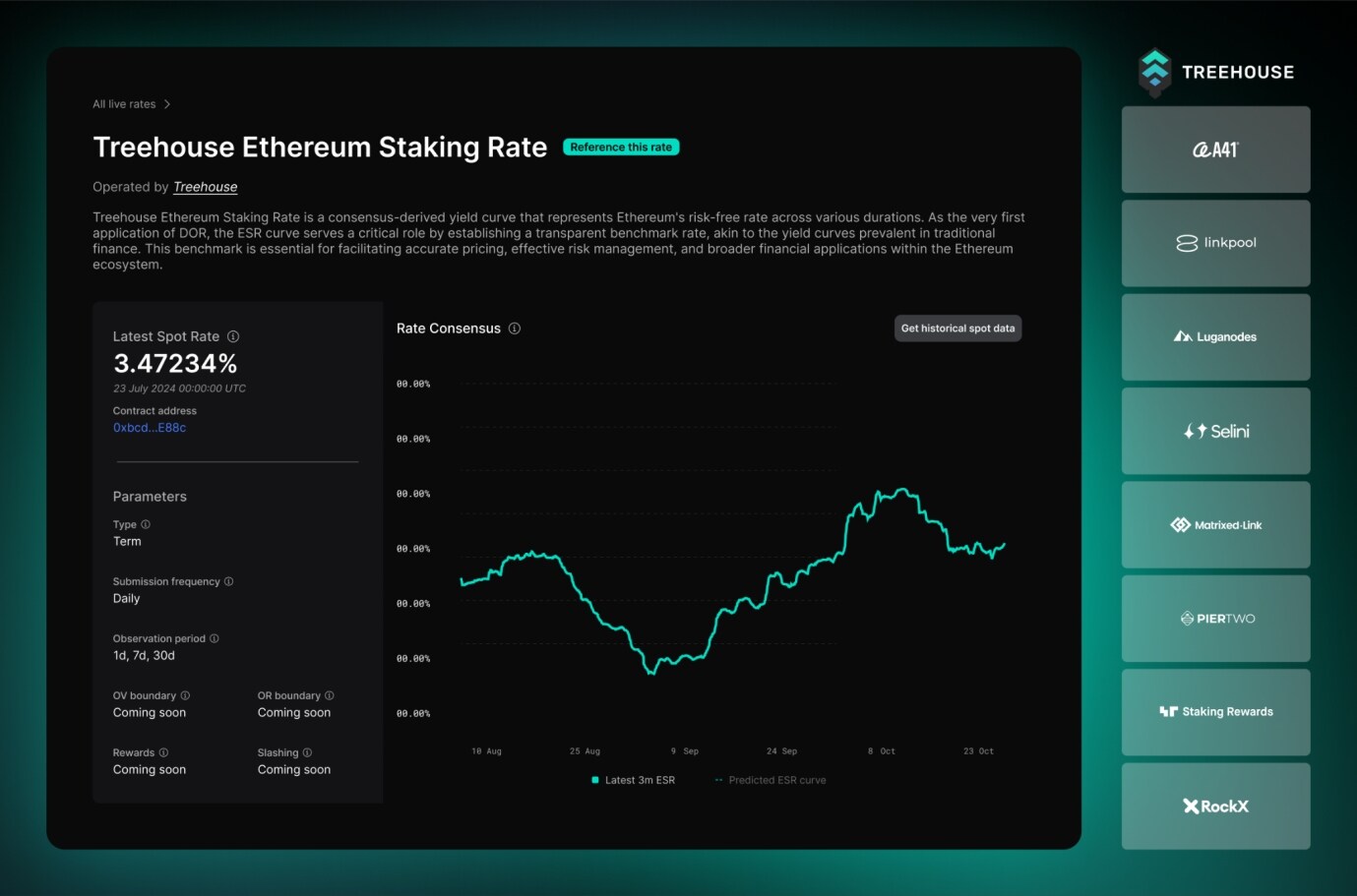

DOR is a decentralized interest rate consensus mechanism that provides a benchmark interest rate framework similar to LIBOR and SOFR in traditional finance. By collaborating with multiple staking service providers, market makers, and exchanges (which Treehouse calls Panelists), DOR provides a reliable source of interest rates for fixed income products, structured financial instruments, and interest rate derivatives in the DeFi space, enabling scalable development.

As mentioned above, the DOR rate isn't determined solely by Treehouse. Instead, it's determined by independent forecasts from a panel of experts. Using proprietary models and data, these experts submit their predictions for 1-day, 7-day, and 30-day market rates at a fixed time each day. The system then consolidates these predictions into a consensus rate. This process ensures the decentralized nature of the interest rate source and transparency for all users.

DOR’s first benchmark interest rate is the Treehouse Ethereum Staking Rate (TESR) , a protocol-native interest rate curve specifically designed for Ethereum staking. By providing a clear interest rate standard, TESR enables staking product issuers and users to obtain a predictable staking interest rate curve, thereby achieving more stable financial product design.

Currently, Treehouse has more than 43,000 independent users, with a total locked value (TVL) exceeding US$550 million (approximately 140,000 ETH), and has established strategic partnerships with multiple mainstream DeFi protocols, gradually building a complete DeFi fixed income interest rate layer!

TREE Token Usage and Ecological Value

TREE is the native token of the Treehouse ecosystem. Through multiple design features, it drives protocol growth, achieves decentralized governance, and encourages active user participation. As a core component of the DOR protocol, TREE has the following key uses within the ecosystem:

- On-chain query fees: On-chain contracts or institutions that wish to use DOR data must pay a fee, similar to the concept of an oracle. This fee is returned to the Treehouse ecosystem to ensure fair data use.

- Panelist Staking: Panelists (individuals or institutions providing interest rate data or forecasts) must stake TREEs or tAssets to participate in the DOR rate setting process, incentivizing submission of accurate data and maintaining a sense of stake.

- Consensus Payouts: Based on the accuracy of predictions, TREE will reward the expert group and delegators (stakeholders who entrust assets to the expert group to fulfill the DOR's responsibilities) to incentivize them to provide reliable data and actively participate.

- Governance: TREE holders have the right to govern the protocol and can vote on Treehouse's development path and participate in decision-making.

- DAO Grants: The Treehouse DAO allocates funds for project collaborations to incentivize product development within the Treehouse ecosystem, drive innovation, and expand data sources like the DOR mechanism.

Additionally, Pre-Deposit Vault Staking is TREE's first use case since the launch of Gaia. Designed as an early staking tool for the DOR protocol, this vault allows holders to stake with a trusted panel of experts based on historical performance and earn returns of up to 50–75% APR. Due to the limited vault supply, it's recommended to participate early through the staking page to secure high TREE rewards.

To learn more about how to participate in the Pre-Deposit Vault, please read the Pre-Deposit Vault blog and official documentation .

Pre-Deposit Vault Staking: The Pre-Deposit Vault is designed for the DOR consensus mechanism. Each expert group (an individual or institution that provides interest rate data or predictions) has its own staking vault. TREE holders can choose a trusted expert group based on historical data and stake their stake. After staking for 9 months, they can receive a return of ~50-75% APR.

TREE Token Economy

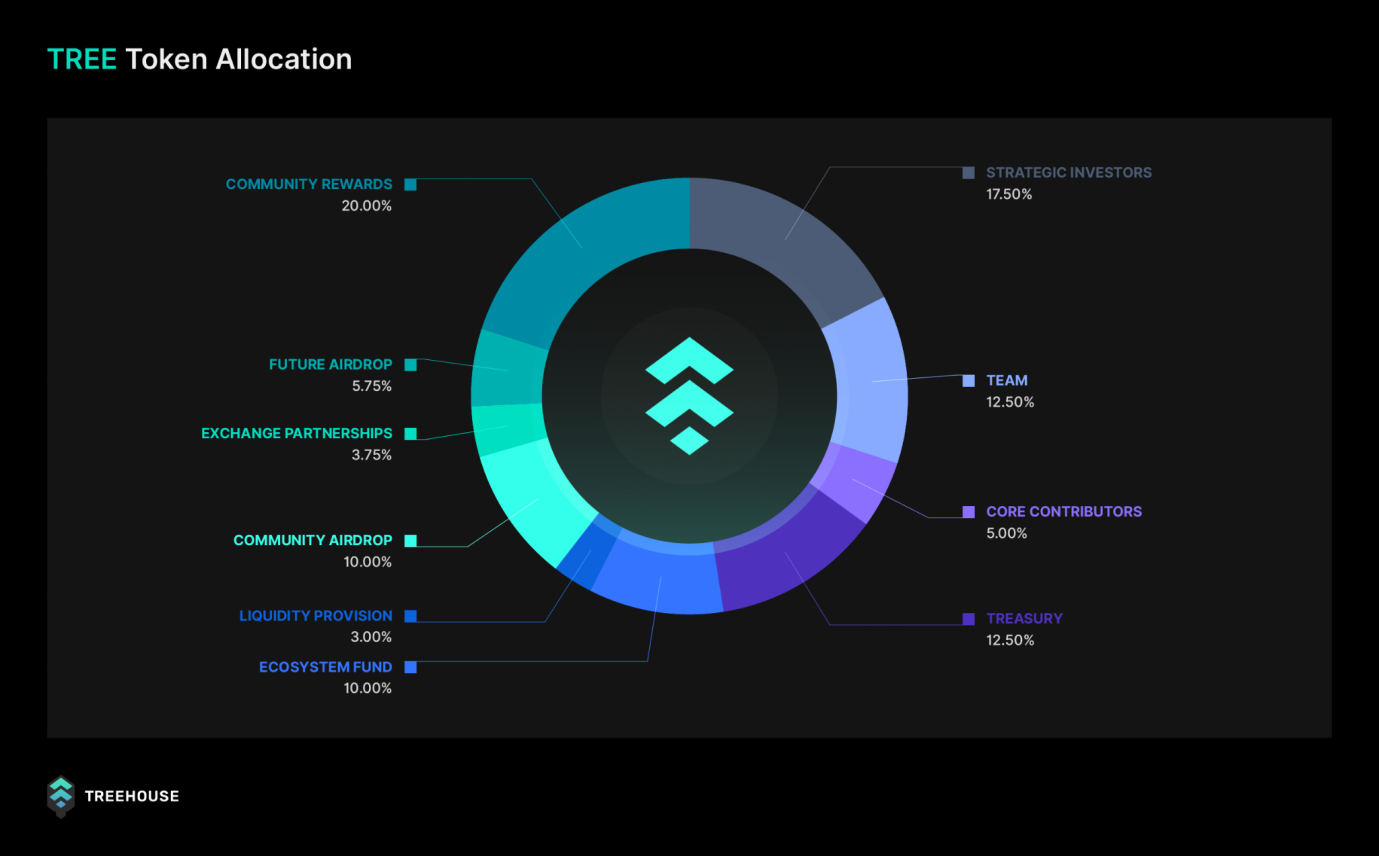

The total supply of TREE is 1 billion, of which 18.6% will be unlocked for circulation during the TGE. This distribution design is centered around "community first," aiming to ensure that users who truly participate, contribute, and support the Treehouse Protocol will be the greatest beneficiaries.

To this end, over a third of the total token supply is directly returned to the community:

- 20% will be used for community incentives to reward long-term contributors who continue to participate in the construction of the Treehouse protocol.

- 10% will be distributed as community airdrops to thank early users for their support and participation in the early stages of Treehouse's development.

- 5.75% is reserved for future airdrops and promotional activities, allowing more users to share in the fruits of the protocol's growth.

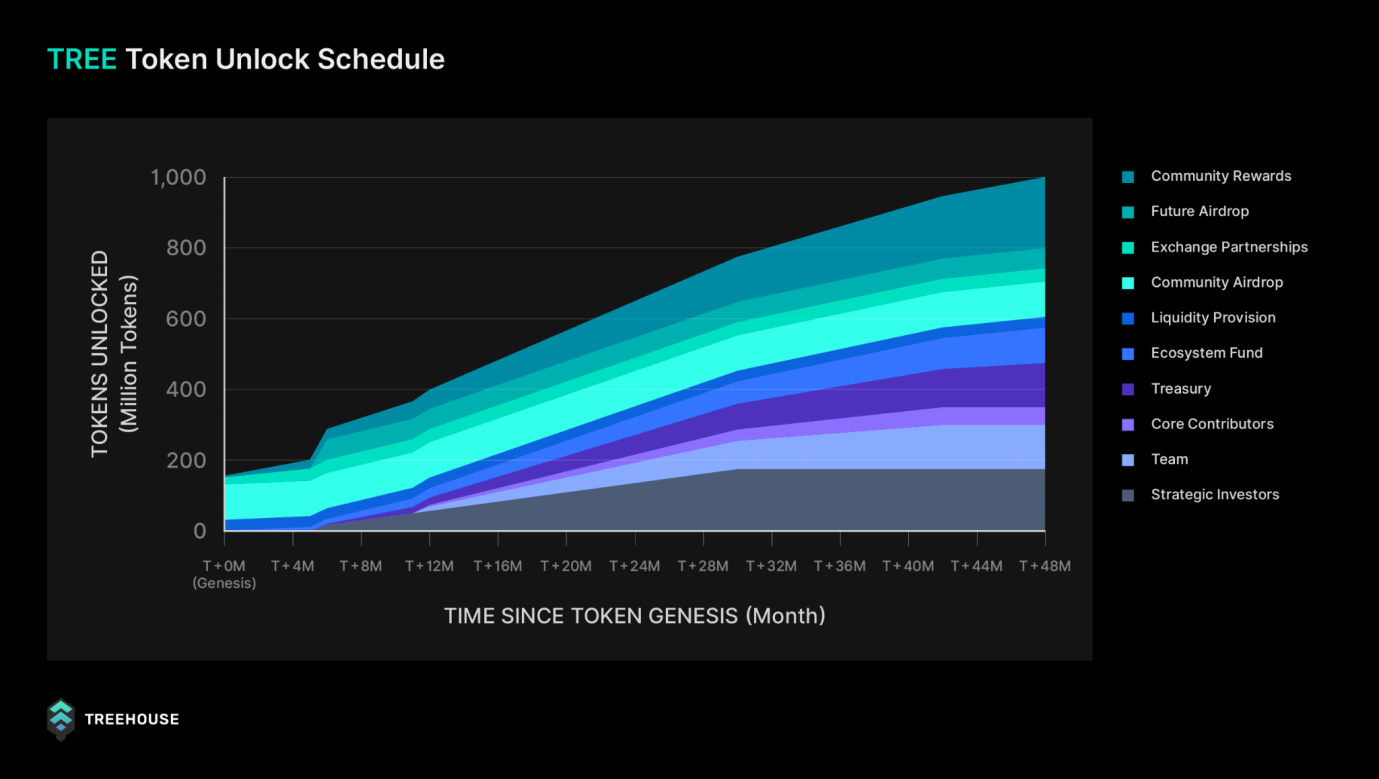

The total number of tokens will be unlocked gradually over four years and will be governed through smart contracts and DAO mechanisms to achieve a transparent, long-term and decentralized incentive system.

The total number of tokens will be unlocked gradually over four years and will be governed through smart contracts and DAO mechanisms to achieve a transparent, long-term and decentralized incentive system.

Furthermore, tokens held by strategic investors, core contributors, and the team are subject to a minimum six-month lockup period, ensuring long-term commitment and effectively mitigating potential selling pressure during the initial TGE. As can be seen in the unlock curve chart below, the initial circulating supply of tokens primarily comes from community allocations, ensuring a stable launch for the ecosystem.

For more detailed information about the token economy, please read the official token economy documentation .

Receive TREE airdrop

If you participated in Treehouse Protocol’s GoNuts Season 2, you can now check your eligibility for the TREE airdrop and claim it on the Ethereum mainnet!

This airdrop users are divided into two categories:

- Non-Vested users: You can immediately claim 100% of your base quota and 100% of the Treasury Bonus, meaning you'll receive twice as much airdrop! You can also choose to stake your tokens in the Pre-Deposit Vault to receive an additional 50-75% TREE bonus and GoNuts Season 2 bonus .

- Vested users: 100% of their base quota is automatically staked, and 100% of their treasury rewards will be linearly unlocked over a one-year period. They will also automatically receive GoNuts Season 2 bonuses. If you claim your treasury rewards early, you will only receive the proportionate amount of treasury rewards you have unlocked and will lose the bonuses.

For details on user classification, staking instructions, and redemption procedures, please refer to the redemption procedure instructions in the Treehouse documentation .

How to get more TREE?

Don’t worry if you missed out on the Season 1 airdrop! You can still participate in the Treehouse ecosystem and earn TREE in multiple ways.

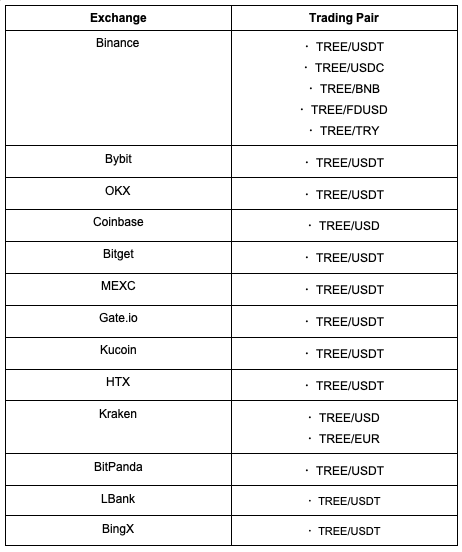

Currently, TREE has been listed on multiple centralized exchanges, allowing users to trade freely, including:

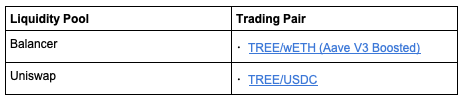

In addition, Treehouse has also established liquidity pools on Uniswap and Balancer, allowing you to quickly exchange TREE through wETH or USDC:

In addition, Treehouse has also established liquidity pools on Uniswap and Balancer, allowing you to quickly exchange TREE through wETH or USDC:

The next wave of TREE airdrops is waiting for you! Join GoNuts Season 2

With the launch of Gaia, GoNuts Season 2 has officially begun. Whether you are entering the Dark Forest for the first time or you are a squirrel who has been working hard every day since Season 1, now is the perfect time to set out again and maximize your profits.

Nuts will continue to accumulate daily by holding tETH, participating in liquidity provision, completing weekly tasks, or using the Treehouse Partner Agreement. Combined with Season 2's new bonus, badge, and level system, even more rewards are available in Season 2.

Read the GoNuts Season 2 guide to learn more about how to efficiently accumulate Nuts.

Treehouse's future development: moving towards more chains and launching more financial tools

As the ecosystem continues to expand, Treehouse is actively deploying tAssets to more Layer 1 and Layer 2 networks, increasing user participation and asset efficiency. DOR will also continue to launch more diverse benchmark interest rates and gradually integrate with more DeFi protocols to build a trusted on-chain interest rate benchmark framework.

At the same time, we will also launch other financial derivative products such as Forward Rate Agreements (FRAs) to support larger-scale institutional and DeFi native application scenarios.

Go to Treehouse now: https://app.treehouse.finance

GoNuts Season 2 Detailed Guide: https://treehouse.finance/blog/s2-nuts-guide

Follow Official X: https://twitter.com/TreehouseFi

Join the Discord group: https://discord.gg/treehousefi