Original translation: realgu Xiaogu (X: @0xrealgu)

Translator 0xrealgu's note: Péter Szilágyi, a Hungarian, has been involved in Geth client development since Ethereum's inception, taking over team leadership in 2016 and continuing until 2024. Today, Geth is the most widely adopted execution-layer client for nodes, with a market share exceeding 50%. Geth's stability is significant enough to impact Ethereum's security; any minor software error could result in hundreds of millions of dollars in asset losses. Jeffry Wilcke led Geth for its first three years. After the DAO hack, he developed severe mental health issues and was unable to continue working, handing the reins to his most capable assistant, Peter. (Jeffery Wilcke is also the last co-founder, after Vitalik, to leave the Ethereum Foundation.)

For ten years, Peter used his outstanding engineering skills to make indelible contributions to Ethereum. However, this OG's departure was not a dignified one. In June of this year, Peter released a series of tweets revealing the truth behind his departure: the foundation secretly supported the Nethermind client and suppressed Geth; it also proposed to "buy out" the Geth team for $5 million, allowing them to establish an independent company and find their own way out. After these conflicts arose, the foundation ultimately "fired" Peter for his rebellious behavior.

The following content is originally from Peter’s last speech on Ethereum, which was released on July 23, 2025, titled “Decentralization: Origins and Current State”

A few months ago, I was invited to give a talk here (at the EthCluj event in Romania), and I was a bit torn. I'm a technical person, but a talk that was all about technology probably wouldn't be popular. Then it occurred to me that decentralization is something I care deeply about, but it's so misunderstood, so it was the perfect topic.

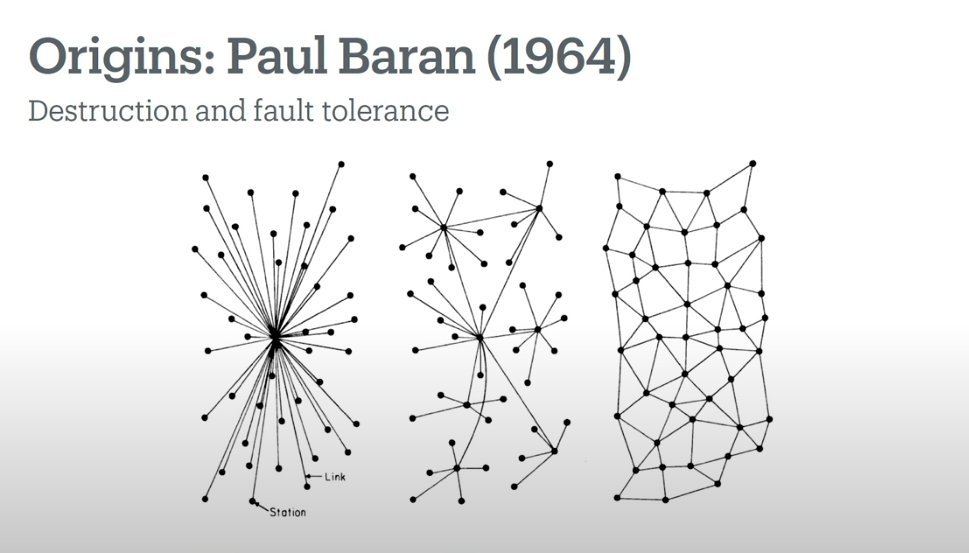

To discuss decentralization, we need to trace its roots. In 1964, Paul Baran published a landmark paper. At the time, people were keen on studying various issues in the context of war, and Paul wanted to build systems that could withstand the test of war. By then, people had already realized the shortcomings of centralized systems (shown on the left in the image above), and that destroying a single node could easily paralyze the entire network.

People then tended to design network topologies based on the structure in the middle of the diagram above, because it was hierarchical. While the hierarchical structure wasn't perfect, it was the optimal solution at the time. Paul Baran began analyzing it: How many bombs would it take to destroy a hierarchical network? An entire paper discussed the number of bombs and the number of waves required to destroy the network. It's a very interesting paper, and at the end, he proposed a different approach: instead of creating these hierarchical structures, why not have all nodes communicate with all nearby nodes? (right side of the diagram above)

The really interesting observation from this paper is this: if a network can tolerate bombing, then it can also tolerate (some) of its own failures. In any computing environment, any engineering environment, if you want to make a system more reliable, the cost tends to increase significantly. So the more reliable something is, the more expensive it is. If we have this wonderful mesh network that can tolerate partial bombing, what if we don't aim for 100% reliability anymore? What if we say, okay, let's just make it 50% reliable? Maybe half the network will fail, but if it's significantly cheaper, we win.

The second interesting observation is that if we make the network 10 times cheaper to run, then we can reinvest some of that savings into making the nodes denser, which actually improves reliability by adding more nodes, and then we get into this very interesting cycle: running costs go down, the number of nodes goes up, then even lower costs, more nodes.

This paper described the internet before it existed, and it’s the original definition of decentralization.

This year marks the 10th anniversary of Ethereum. In my opinion, early Ethereum was very close to perfect decentralization. There were a large number of nodes, and everyone had equal opportunity: you had a complete state history, full synchronization, and all data was intact. Everyone could participate in mining and block creation for free. You could mine with your CPU, your GPU, whatever you wanted. If you wanted to trade, you sent it to the transaction pool, and everyone could read and execute your transaction.

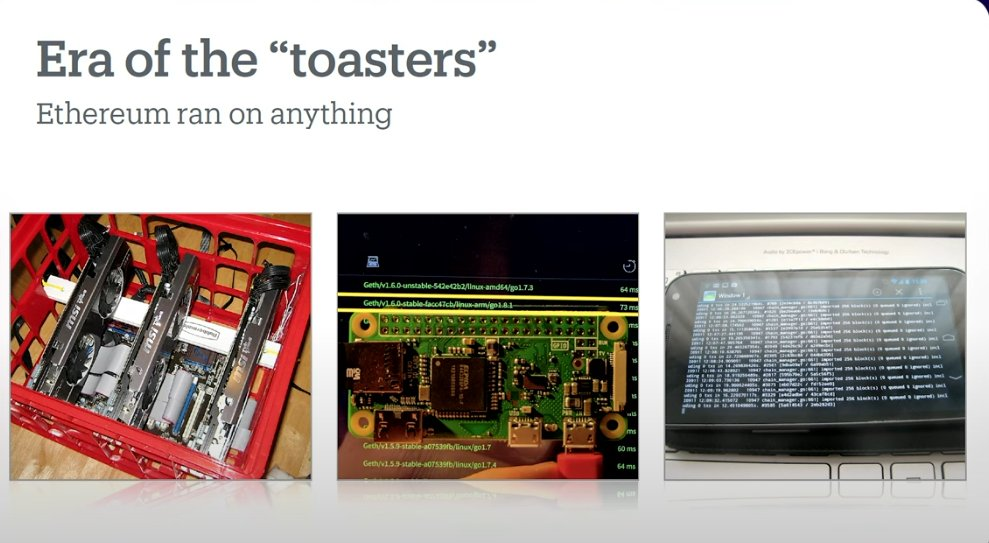

Left: Beer crate; Center: Raspberry Pi; Right: Smartphone

The best part is, the node can run on anything—literally, anything. When Ethereum launched, most people didn't want to buy expensive mining rigs. Some people bought beer crates from the supermarket and tucked their machines into them. The other two pictures are of systems I built myself. One is a Raspberry Pi computer, possibly the most basic Raspberry Pi ever built, but it can run an Ethereum full node. The other is my first smartphone, which also successfully ran a full node.

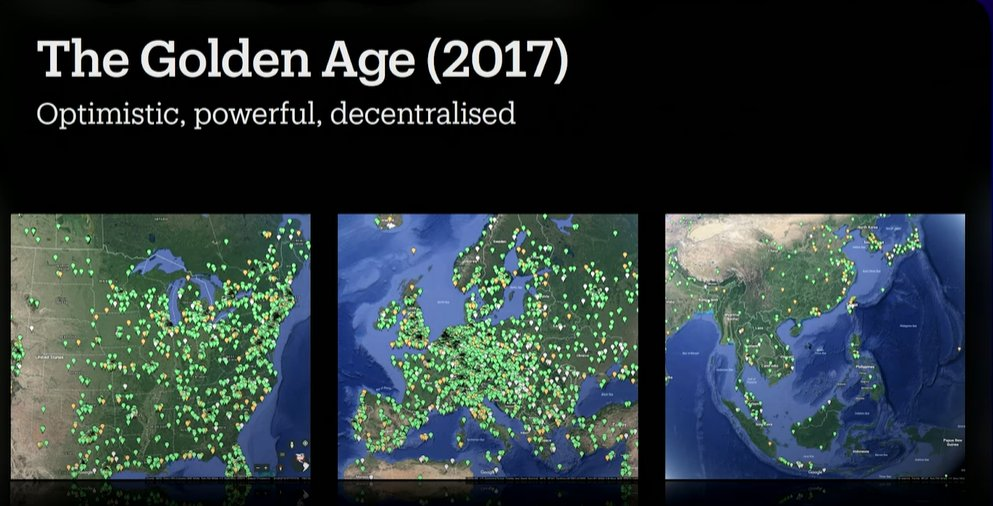

In 2017, Ethereum had tens of thousands of nodes scattered around the world, all of which were essentially equal. Of course, some were more powerful, some less so. If a war broke out and someone tried to destroy the Ethereum network, they would find that no node was important enough to destroy. This was Ethereum's golden age—and this isn't just my opinion. If you look at the price action, it was only 7% away from overtaking Bitcoin in market capitalization.

Unfortunately, after this, we entered the era of "not enough": you could say Ethereum transactions weren't fast enough, not cheap enough, finality wasn't fast enough, and there were a ton of different properties you could criticize. Yes, it wasn't fast enough, it wasn't cheap enough, it wasn't everything. But the question was, how do you fix it? That's complicated. Fixing a decentralized system is incredibly difficult. If we were a little more centralized, the fix would be much simpler and more natural. So we started down a somewhat less-than-ideal path.

Just now, I listed four attributes that I think are super important:

- Every node is equal

- Everyone can mine

- Everyone has access to transactions

- Everything is cheap

After the golden age, we saw a series of incremental innovations. One small step was the block explorer. You could check address balances on Etherscan without running your own local node; the process was natural and completely harmless. Then people realized, wait, what if programs and applications could use something similar? Instead of maintaining their own local nodes, they could connect to services maintained by others. Thus, Infura and other RPC providers emerged. The technology evolved step by step, and today, we are pursuing stateless verification, where the entire state is stored by external operators, and even validators should rely on external services.

Another topic is MEV. In the early days, all transactions were public, and then people started abusing it, with sandwich attacks, front-running, and all sorts of other manipulations. These were collectively known as MEV, and everyone agreed that MEV was bad. So what did we do? We lowered the barrier to entry for MEV. We made it so easy that now that anyone can do it, it's not as bad. In my opinion, this is a bad solution because we didn't fix the problem, we made it worse. People didn't want to be sandwiched, so private trading pools and private order flows were created. As a miner, you can no longer see these transactions in the public trading pool, so miners are forced to rely on the services of others.

From a miner's perspective, we can see a similar trend. After Ethereum launched, mining pools quickly emerged. While somewhat centralized, they were still constrained by the physical world: GPU availability and electricity. With the switch to proof-of-stake, staking pools replaced mining pools, and physical constraints disappeared. Now, you can quickly move all your staked ETH from one pool to another, giving staking pools even more power. Then came liquidity staking, another technology that has gradually expanded, until now. When any researcher discusses adjusting Ethereum's issuance, the primary question is whether Lido will veto the proposal, and the secondary question is whether it's best for the network. This is a very bad situation. Incidentally, Lido is a very good player. I don't want to discredit them, but they do have the potential for vetoes, and people need to be aware of that.

Finally, due to technical reasons, the switch to proof-of-stake raised the minimum stake required for mining to 32 ETH, which is worth around $100,000. This was a bad decision, significantly raising the barrier to entry for anyone running a node. Initially, people said, "Don't worry, we'll fix it." Later, they said, "Let's just assume everyone who wants to become a miner has at least $100,000, so let's just leave it that way." Later, they assumed that nodes had high-speed fiber optic internet; after all, if you have $100,000, you should have fiber optic internet. Today, Vitalik states that validator nodes need to have a power supply capacity of at least 10 kWh per hour, which is, after all, the average household's electricity consumption. These are Vitalik's exact words. However, in Romania (where the speech was held), if you live in an apartment, your electricity consumption is capped at 4 kWh per hour. If you live in a house with single-phase electricity, you're legally limited to 9.9 kWh per hour. Yes, achieving 10 kWh per hour requires a bit of luck.

In all of these examples, everyone was genuinely trying to improve the system and make it more efficient, and no one was maliciously trying to undermine decentralization. But time and again, little issues kept popping up, and they said, "Okay, we know this isn't the best for decentralization, but you know we can improve it later and fix it over time, so let's do it this way."

We all want to create a global settlement layer, and we want to replace SWIFT, the "evil" bank settlement system. But how many of you know the ins and outs of SWIFT?

Before the 1970s, banks settled transactions via telegraph—not the kind you see on your phone, you know, but telegraphs using good old Morse code. It was a completely decentralized system. A bank in New York could send a message to London, and a bank in London could settle transactions in Shanghai. It worked reliably, albeit a bit clunky, a bit expensive, a bit slow, and so on. Some smart people said, "We should make it more efficient." The SWIFT project was born from this pure, good-hearted desire to make things more efficient. And they succeeded. After more than 20 years of hard work, a group of smart people made the SWIFT system the global settlement layer.

In 1992, the US government realized that SWIFT was storing too much valuable information and demanded access. Their request was immediately denied. SWIFT was a European company headquartered in Belgium, and the US had no jurisdiction over it. So the US waited 10 years until 9/11, when the floodgates opened. The US had enacted anti-terrorism laws that allowed almost anything to be done in the name of counter-terrorism. Even though they had no jurisdiction over SWIFT, SWIFT did have a backup data center in Arizona. Game over! US government agents walked into the Arizona data center and told them, "From now on, we want access to your data, and you can't tell anyone."

For the next five years, the US government quietly studied all the data on the global payment network without anyone knowing.

In 2006, the EU discovered this secret and tried to stop it, but failed. It was a major uproar. I remember a European Commission minister saying that American ambassadors were like door-to-door salesmen, visiting EU officials day after day, trying to convince them, "No, you can't remove our access." The US used its power to pressure the EU, ultimately forcing them to back down. In 2012, SWIFT was finally weaponized. That year, the US government forced SWIFT to remove Iran, effectively using an "economic nuclear bomb" against Iran—a term coined by an official who was enforcing sanctions that year.

Once upon a time, we had a beautiful decentralized system. Over time, we wanted to make it more efficient, and no one wanted to disrupt it or let it fall into the wrong hands. The SWIFT team was made up of good, smart people, spanning 200 countries and 11,000 institutions, collaborating to create a better payment network. Yet, 30 years later, governments seized control of it, and another 10 years later, they weaponized it.

Back to Ethereum: We're still early. "Still early" is a great slogan. Ethereum's 10th anniversary is coming up in a few days. In my opinion, while we're starting to follow a similar path to SWIFT, we're still a long way from being in real trouble.

History doesn't simply repeat itself, but it does rhyme. I'm reminded of a quote from Joe Biden, in his speech on the 80th anniversary of the Normandy landings: Democracy is not given; every generation must preserve it, defend it, and fight for it. To me, decentralization is eerily similar to the concept of democracy versus authoritarian government. If you look at China or Dubai, their governments run things very efficiently and smoothly. If you look at the elections in Europe and the United States over the past few years, it's been a complete mess, a chaotic mess. But somehow, we tend to prefer chaos to super-efficient systems. Decentralization will never be as efficient, cheap, or fast as centralized systems. To keep Ethereum independent for the next three or four decades, we have to make a trade-off.

I want you to remember: as we pursue higher technical indicators, every small step forward should be aligned with the overall system. Remember to examine where we started, where we are today, and where we are going. Maintaining this mindset may help us avoid being eaten alive by the world.

Thank you everyone