Recently, the trading volume of decentralized exchanges (DEX) has continued to rise, gradually eroding the market share of centralized exchanges (CEX). According to CoinGecko's second quarter report, the spot trading volume of decentralized exchanges (DEX) increased by 25.3% month-on-month, and the trading volume ratio of DEX to CEX (DEX:CEX) increased from 13% in Q1 to 23% in Q2, setting a record high. This trend shows that the active on-chain trading ecosystem is putting pressure on traditional trading platforms.

Since 2025, CEX platforms have been competing fiercely for "new coin listings", and Meme assets have become the core explosion point for driving trading volume and user growth. In this battle for traffic and assets, Binance took the lead in launching the Alpha zone, looking for increments through the early project screening mechanism; Gate relied on the Alpha product to explore potential projects on the chain; Bitget used the OnChain product to test the issuance and trading on the chain; LBank and BitMart also launched LBANK EDGE and BitMart Discovery respectively to join this "early asset game", trying to take the lead in the cold start stage of the project.

At the same time, with the resurgence of cross-financial asset exploration such as the tokenization of U.S. stocks, a new round of CEX competition centered on new asset paradigms and issuance paths is accelerating.

CEX spot market: the top is stable and the second-tier is competing

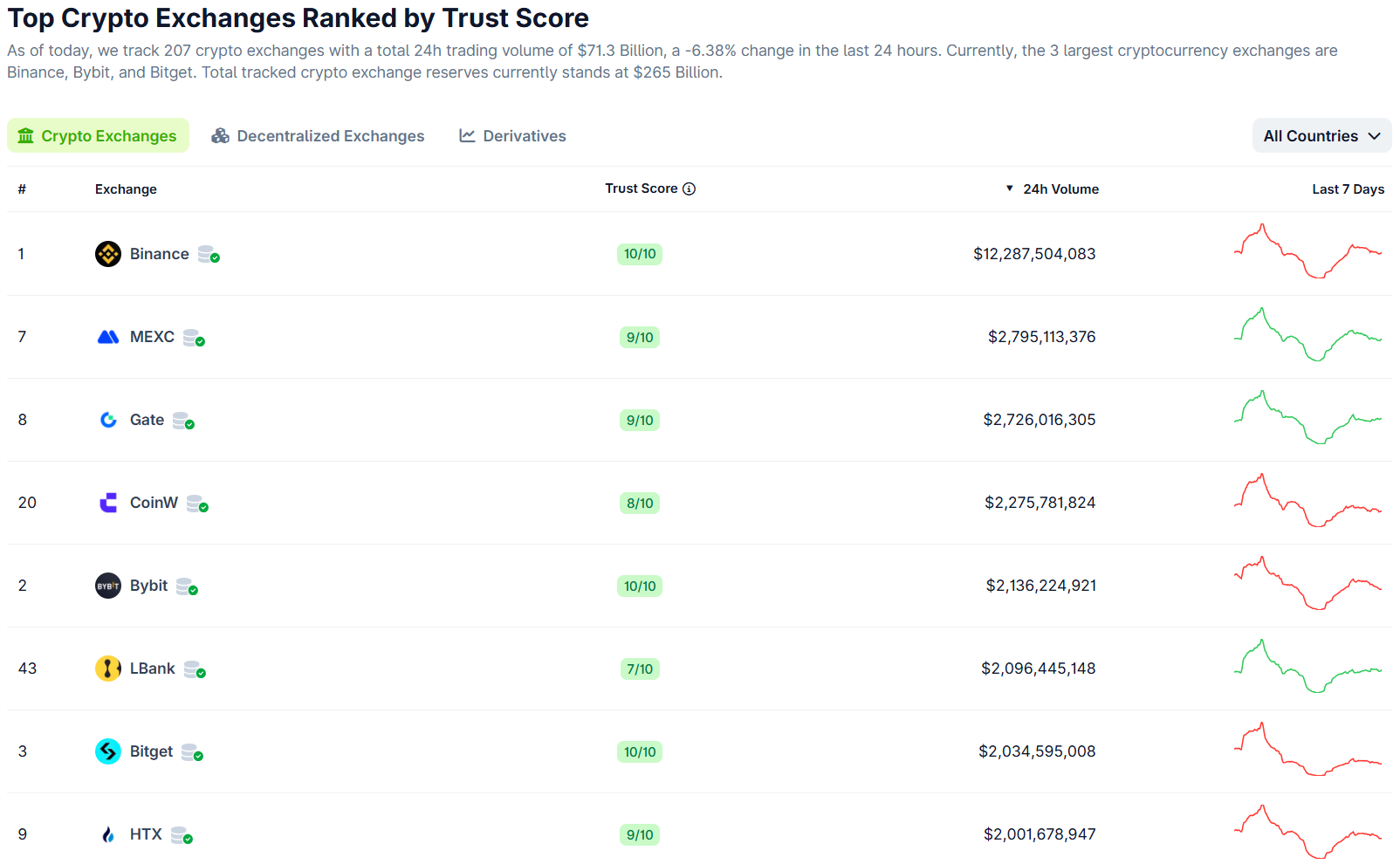

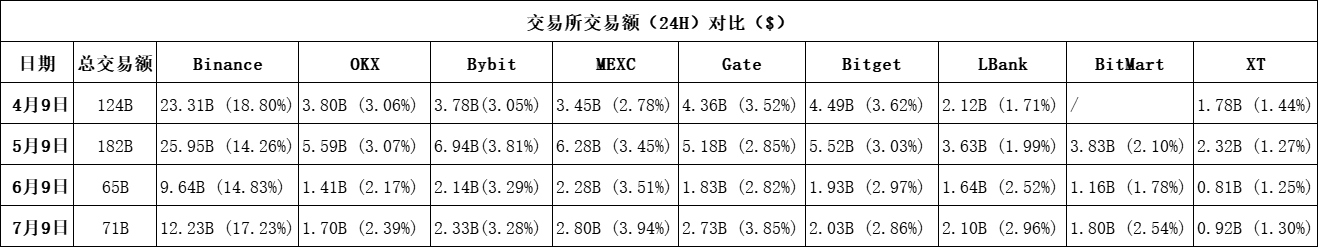

According to Coingecko data, the total daily transaction volume of the cryptocurrency market on July 9 was approximately US$71.3 billion. Among them, Binance, MEXC and Gate ranked the top three with transaction volumes of US$12.2 billion, US$2.8 billion and US$2.73 billion respectively.

It is worth noting that the most significant increases in market share are MEXC and LBank. MEXC's market share surpassed OKX and Bitget, ranking second in the world. LBank ranked among the top six centralized exchanges for the first time. Bybit's market share is relatively stable. In contrast, OKX, Bitget and XT's market share declined to varying degrees.

OKX: Market share dropped from 4.37% to 3.70%, a drop of 0.67%; growth was weak and market share ranking declined.

Bybit: The market share has been maintained in the range of 3% – 4% for a long time, with no significant fluctuations.

Bitget: Market share dropped from 3.86% to 3.10%, a drop of 0.76%, making it one of the platforms with the most obvious decline.

MEXC: Market share increased from 2.78% to 3.94%, an increase of 1.16%; surpassing OKX and Bitget, and daily trading volume rose to second place in the world.

LBank: The market share increased from 1.71% to 2.96%, an increase of 1.25%, making it the exchange with the largest increase; the daily trading volume reached US$2.1 billion, ranking among the top six global CEXs for the first time, with strong growth momentum.

Gate: Market share increased slightly from 2.49% to 2.82%, an increase of 0.33%; it remained stable in the upper echelon.

XT.com : Market share fell slightly, from 1.14% to 1.00%, a drop of 0.14%; performance was stable, but there was no growth momentum.

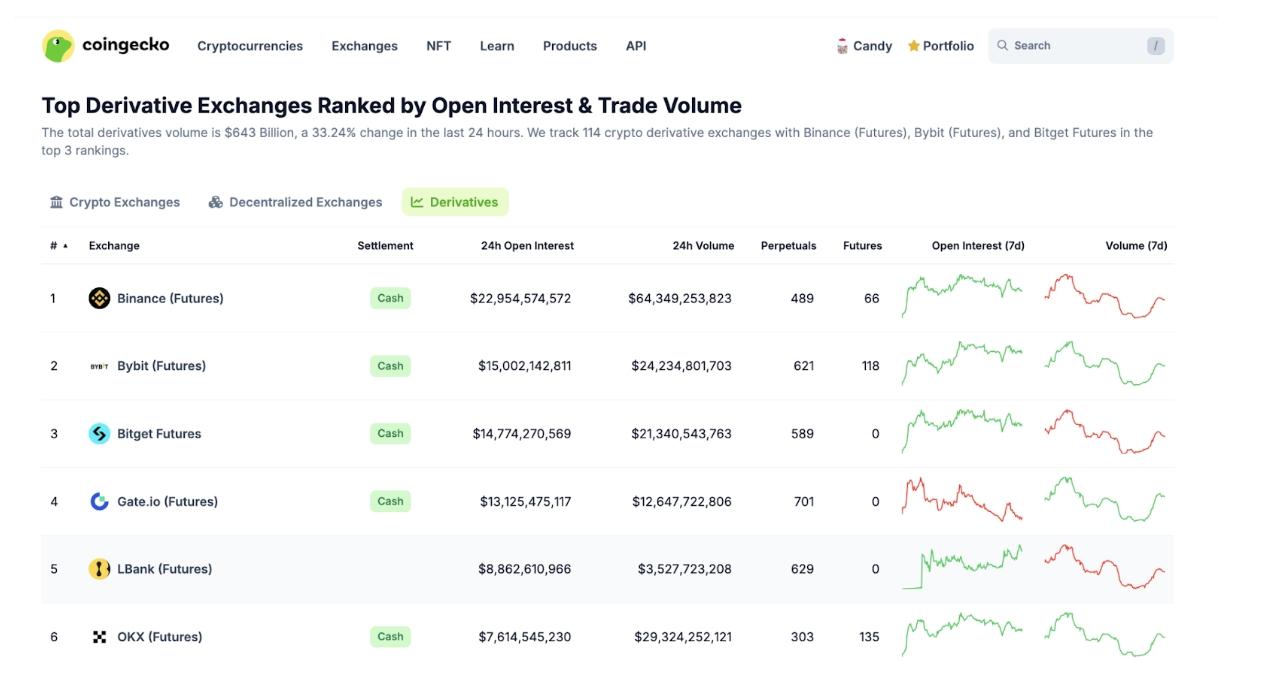

CEX contracts: Open interest hits new high, market share stalemate remains unresolved

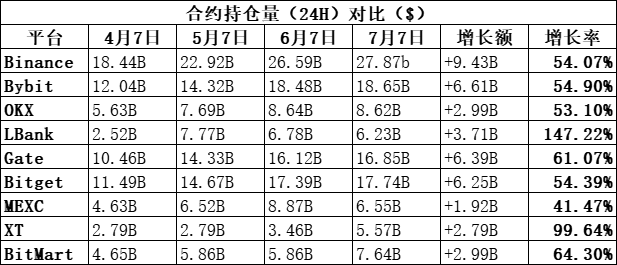

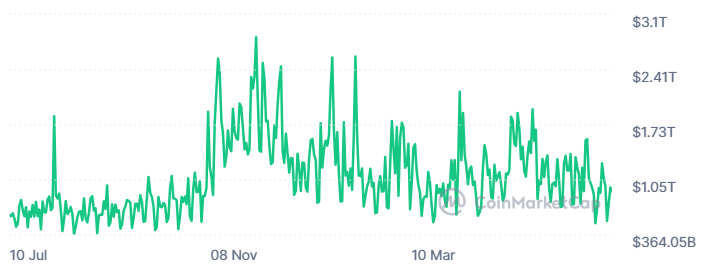

CoinMarketCap data shows that the current total amount of open interest (contract holdings) has reached US$798.3 billion (July 9), an increase of US$462.3 billion, or 127%, compared to US$336 billion on April 7. This value also exceeds the historical peak of US$746.35 billion on January 6, 2025, setting a new record for the total amount of open interest.

In the past three months, the open interest volume (24 hours) of major exchanges has almost achieved an increase of more than 50%.

In terms of growth volume: Binance increased by US$9.43 billion, Bybit increased by US$6.61 billion, Gate increased by US$6.39 billion, Bitget increased by US$6.25 billion, OKX increased by US$2.99 billion, BitMart increased by US$2.99 billion, and MEXC increased by US$1.92 billion.

In terms of growth rate: LBank had the highest increase, reaching 147.22%; BitMart and Gate increased by 64.3% and 61.07% respectively; Binance, Bybit, OKX and Bitget all increased between 53% and 55%; MEXC increased by 41.47%.

This shows that the contract market is recovering across the board, funds are continuing to flow in at an accelerated pace, the trading sentiment of institutions and retail investors is heating up simultaneously, and more and more users tend to hold long-term positions in perpetual contracts. Among them, the open interest of LBank, which had the highest increase, once reached US$8.8 billion, and the daily trading volume exceeded US$3.5 billion, ranking among the top five in the world for the first time.

In terms of contract daily trading volume, there has been an overall downward trend in the past three months: the total trading volume on July 9 was US$902 billion, a significant drop from US$1.16 trillion on April 7. The contract daily trading volumes of OKX, Gate, Bitget, MEXC, XT and BitMart have all declined to varying degrees.

By comparing the data of multiple exchanges, it is found that LBank is one of the few platforms that has achieved growth in contract trading during this period. On July 7, LBank's contract trading volume reached US$5.361 billion, showing a steady growth momentum. The counter-trend daily trading volume reflects the increase in user trading activity, as well as the continued improvement in platform liquidity and user participation.

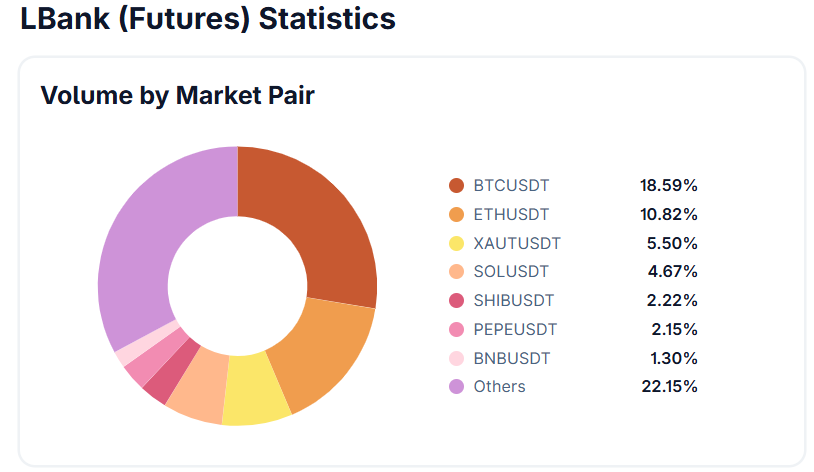

In terms of transaction volume structure, the contract transactions of mainstream currencies (BTC + ETH) on the LBank platform accounted for only 29.4%, significantly lower than Binance's 47%, MEXC's 49.38%, Bitget's 60% and Gate's 74%. This proportion structure also indirectly shows that LBank's contract growth relies more on the wide coverage and active transactions of altcoins and long-tail assets.

At the same time, the data of LBank's Q2 quarterly report confirms the diversified structure of its contract growth. LBank launched 329 new assets in the second quarter, covering popular tracks such as Meme, AI, and Layer 2, of which the first-time projects accounted for 29%, with an average return rate of up to 912%. There are 187 new Meme assets, and outstanding Meme projects can usually achieve fast contract launch. Users can participate in these new contracts and "dig" with small investments and high-frequency transactions, thereby capturing higher early profit opportunities.

Behind the reshaping of the CEX landscape: the struggle between products, traffic and territory

The fluctuation of market share deeply reflects the strategic differences among platforms. Multiple factors such as Alpha Zone, Meme assets, on-chain transactions, and compliance policies are reshaping the growth path and competition rhythm of centralized trading platforms. The following is an overview of the strategies of major platforms and an analysis of the reasons for the changes:

Binance: Alpha 2.0 continues to attract attention, received $2 billion investment from the Middle East, and released its globalization strategy in Dubai. Binance Alpha 2.0 was launched at the end of March. With the points mechanism, it quickly stimulated community activity. Multiple Alpha projects were simultaneously launched in the derivatives area, and the linkage effect drove the platform's popularity up. In March, Binance received a $2 billion strategic investment from MGX, and with the help of funds and policy endorsements, it accelerated its localization and compliance layout in the Middle East market.

Among them, Binance Alpha reached its highest trading volume on June 8, 2025, with a daily trading volume of over 2 billion US dollars. However, with the increase in participants and the intensification of market competition, some users turned to other opportunities, and the popularity of the platform declined. Despite this, Binance still firmly maintains its position as the leader in the trading market with its strong ecosystem and user base, demonstrating its continued competitive advantage.

OKX: Compliance strategy strengthens trading security environment, growth is weak in confrontation. In 2025, through compliance commitments, a safer encryption environment will be created, and an on-chain investigation and compliance team of more than 150 people will be formed to significantly strengthen its KYC, customer risk rating (CRR) and anti-money laundering system (AML). At the same time, OKX also actively complies with the Travel Rule (International Transfer Rules) and securely transmits user information to other crypto asset service providers when necessary.

OKX's compliance strategy ensures that transactions are secure and traceable, but it also limits its pace of expansion in some markets to a certain extent and slows down its global expansion. In early July, users complained on social media that their accounts were frozen for no reason and questioned how OKX implemented its compliance measures. In response, OKX CEO Star Xu admitted that the compliance process had a high rate of misjudgment and poor user experience, and promised to optimize the process. Despite this, OKX's compliance efforts have also brought it positive progress, such as obtaining a Dubai VARA license, a Singapore MPI license, and relevant licenses in the Bahamas, showing its continued investment in global compliance layout. In addition, market rumors say that OKX is preparing to go public in the United States. If successful, it may become the first native crypto exchange to IPO on the U.S. main board, further consolidating its position in the industry.

Bitget and Gate: Actively explore on-chain layout, but in the short term, it will have a certain impact on the spot market share. Bitget OnChain was launched on April 7, providing users with a frictionless on-chain transaction solution, trying to capture on-chain user traffic and create a buffer for the main site to list coins. This also directly led to the diversion of spot transactions of Bitget ecosystem users, and the market share declined significantly. Gate also launched a similar product, upgrading "MemeBox" to "Alpha" in May to help users explore emerging projects in the Web3 world.

LBank: It stands out with its Meme strategy and has the fastest market share growth in spot trading. It has grabbed a new 1.25% market share in 3 months, and its 2.96% market share ranks sixth in the world. This is mainly due to the strategic layout of taking root in the Meme track. New ecological Meme projects such as $B, $USELESS, and $LAUNCHCOIN were first launched by LBank, and then led the market, attracting a large number of Meme players to gather on the platform, further promoting trading activity and market share. In addition, on June 12, LBank also launched the 100x coin zone LBANK EDGE to meet users' pursuit of early dividends.

BitMart: New products broaden the user base and the transaction structure is gradually optimized. The transaction volume of BTC and ETH on the BitMart platform accounts for more than 78%. Since the launch of BM discovery in May, more currencies have been added, greatly broadening the target user base.

A systematic competition from asset strategy to ecological structure

Data from the past three months show that the share of DEX has surged, the market share of CEX spot has become more polarized, and the competition for contracts has become more intense. The competition among exchanges is evolving from a single-dimensional "battle for trading volume" to a multi-level ecological confrontation. The increase and decrease of market share is not only a short-term game of liquidity, but also a deep reflection of asset strategy, product structure and globalization capabilities.

As of July 11, Binance still maintains an overwhelming advantage in the spot and derivatives markets. In the spot market, Binance is far ahead with a market share of over 17%. The second echelon consisting of platforms such as Bybit, MEXC, Gate.io, and Bitget is in fierce competition, and the second place on the list changes frequently. OKX and Upbit maintain a steady market share competitiveness with their compliance advantages, while platforms such as LBank and BitMart are actively seeking differentiated breakthroughs.

Competition in the contract market is even more intense. Calculated by open contracts, Binance ranks first with a market share of 3.03%, followed by Bybit and Bitget with 2.16% and 1.95% respectively. Many second- and third-tier platforms account for between 1% and 2%. In terms of transaction targets, platforms such as Gate, LBank, and CoinW have certain advantages in asset richness, becoming an important support point for differentiated competition.

The overall route of the leading platforms is to be compliant, stable and expand the ecosystem. Although Binance and OKX are firmly in the forefront of market share, their growth momentum has slowed down. Binance tried to leverage trading enthusiasm as a "new project validator" with Alpha, but was limited by the short life cycle of the project and the gap in user expectations. OKX focuses on global compliance, strengthens the KYC and anti-money laundering system, and builds an institutional moat, but also faces certain growth bottlenecks.

Gate.io, Bitget and others have taken positive steps in exploring on-chain businesses, but this has also led to a phased diversion of users and trading behaviors. Bitget OnChain and Gate Alpha reflect their intention to capture on-chain assets. Platforms represented by LBank, which focus on such assets, have achieved breakthroughs in the market share competition through differentiated paths. LBank has become one of the platforms with the fastest market share growth by quickly responding to market hotspots. The core of its strategy is to seize the trend of long-tail assets such as Meme, and to increase user activity and transaction depth through high-frequency new coin launches and the construction of high-potential asset zones. This strategy has led to an increase in user high-frequency transactions and participation stickiness.

In early July, as the popularity of altcoin trading declined, liquidity stratification became a real challenge faced by most platforms. Some exchanges, such as Gate, Bitget, and LBank, began to explore cross-financial categories such as US stock tokenization to broaden the scope of assets and extend trading growth space. In the medium and long term, compliance cost pressure, on-chain integration capabilities, and the evolution of user asset preferences will jointly dominate the next stage of competition.