Original title: Weekly: Constructive Outlook

Published: February 2, 2024

Highlights

We believe that some of the technical factors driving downside performance in crypto markets are beginning to deplete, which could position crypto markets for a more supportive trading environment in the coming weeks.

We expect U.S. interest rate cuts to begin in May, with tapering of quantitative tightening shortly thereafter, coinciding with special events such as the Bitcoin halving and creating positive expectations for the broader asset class.

Solana airdrop season continues, with Jupiter, the Solana ecosystem’s high-profile decentralized exchange aggregator, launching the first of four airdrops on January 31.

Author of this article:

David Duong, Director of Institutional Research

David Han, Institutional Research Analyst

market

Stronger macroeconomic backdrop

In our view, many of the technical factors specifically weighing on Bitcoin (and cryptocurrencies more broadly) are starting to run out. This can be seen with the liquidation of FTX (such as the disposal of their Grayscale Bitcoin Trust, GBTC) and the emergence of some large defunct entities from bankruptcy. In fact, last week U.S. spot BitcoinETFNet inflows average over $200 million per day (total net inflows since January 11th), with a daily trading volume of 1.35 B. Therefore, we expect macro factors to become more relevant to the digital asset class in the coming weeks, which may provide some support to the crypto market.

In the United States, a soft landing appears more likely than a few months ago as it is clear that only minimal trade-offs are being made between economic activity and inflation. The core PCE inflation rate (the Feds preferred price indicator) was 2.7% year-on-year, consistent with the long-term goal of 2%, and various recent economic indicators have also been quite resilient. We have previously explained that part of this mix has to do with pro-cyclical government spending and personal consumption levels remaining buoyant, although we do not believe these drivers will persist in the coming months.

Not only is the U.S. budget deficit widening, but the labor market is cooling. Many American households are saving less, as the U.S. personal savings rate fell to 17.6% the previous year (December 2023). Thats despite unexpected signs of an uptick in retail sales over the past six months relative to the median survey forecast. But ultimately, we expect the economy to slow, probably in the first half of 2024, and while the odds of avoiding an outright recession seem very high, the situation with New York Community Banks (NYCB) and its impact on regional banks is concerning.

This week, there are some signs of how the Fed will interpret the situation. Federal Open Market Committee (Federal Open Market Committee)FOMC) meeting said that risks to achieving (the boards) employment and inflation targets are balancing out, but the board did not believe their confidence in inflation trends would be as high as needed before the March meeting. Discussions on scaling back the quantitative tightening (QT) program were postponed to the next meeting on March 19-20.

Overall, this suggests that the easing cycle is likely to begin on May 1, with the Feds balance sheet reduction program likely to begin in June (although it is possible that it will begin at the same time as the rate cut). We believe the deflation trend is unchanged and expect the Fed to cut interest rates by 100 basis points this year, compared with 75 basis points implied in the dot plot and federal funds futures priced at nearly 150 basis points. Its also consistent with the typically aloof stance policymakers take in an election year.

Ultimately, this will coincide with special drivers such as the Bitcoin halving in late April and may have a supporting effect on BTC and other crypto assets in the second quarter of 2024. Additionally, we expect greater advertising by ETF issuers and the impact of spot BTC ETFs being included in asset managers’ portfolios to unlock increased liquidity in the space.

On-chain: Solana airdrop season

On January 31, Jupiter, Solana’s impressive decentralized exchange aggregator, began an airdrop, one of the largest ever. This represents another continuation of Token issuance events for major (and long-term) participants in the Solana ecosystem (Pyth launched Token in November 2023, Jito in December). Throughout the second half of 2023, the Solana ecosystem’s Attention increased again.

This trend will continue for at least a few more months, as some other high-profile Solana projects still have not launched tokens, and there are three Jupiter airdrops of equal size yet to be released. We believe that the launch of these Tokens is expected to become the foundation of an iterative Solana ecosystem, which, coupled with the increasing rate of stablecoins flowing into Solana (up 13.7% in the past week to $2.19 B), may make this ecosystem more vulnerable to what may have previously been a concern. On-chain liquidity is increasingly attractive to developers.

In our opinion, an underrated but important outcome of this airdrop is the “real world” stress test that the airdrop represents for the Solana blockchain. Although some single nodes were overloaded, resulting in several instances of poor user experience and transaction timeouts, there were no large-scale outages.

Solana is approaching its first full year without downtime (the last outage was on February 25, 2023), demonstrating significant ecological progress, especially with that multi-day outage. Compared with machine history. Solana’s recent 1.17 mainnet release for validators on January 15th is also timely in terms of improving overall node performance and stability. They also recently announced the spin-off of Solana Labs into a new legal entity, Anza Technologies, which may further increase diversification and enhance the networks resiliency.

That said, the increase in airdrop activity does reveal some limitations to Solanas performance. Obtaining clear indicators of transaction failures caused by overloaded nodes is a known reporting gap, as such transactions are neither recorded on-chain nor stored in mempools like Ethereum. Ultimately, it makes little difference to end users, especially non-technical users, whether their transactions fail due to regressions in on-chain execution or due to leaks or delays in the node broadcast phase. The lack of data collection and tools on such infrastructure issues makes it harder to replicate, test, and resolve, which can lead to significant differences between actual user experience and pure on-chain transaction statistics for a long period of time.

Additionally, during the initial airdrop launch period, average priority fees sometimes spiked more than 100x, from $0.001 to over $0.1. While this is significantly lower than crowded Ethereum, it highlights the incompleteness of Solana’s pseudo-localized fee market and its prioritized fee mechanism, where high-fee transactions only have probabilistic guarantees of block inclusion. The Solana Labs team is currently doing some rework on the charging mechanism, and we may see an initial fix for this in version 1.18 (as early as April), although the final resolution mechanism has not yet been determined. Still, in addition to a temporary drop in user experience on-chain, the surge in fees highlights the importance of various scalability methods in this space.

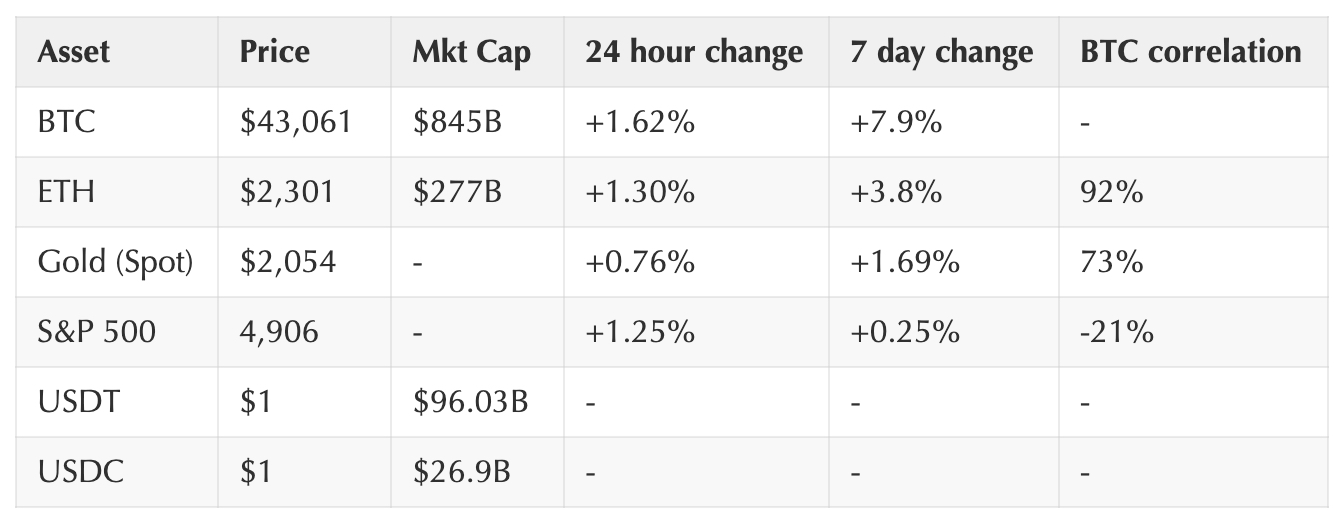

Market Performance of Crypto and Traditional Sectors

As of Jan. 18 at 4 p.m.

Insights from Coinbase Exchange and CES

Traders are becoming more and more constructive in the market. BTC has found good support at its 100-day moving average and the CME OI has stabilized. Additionally, traffic to the ETF has been very positive, with more than 1.5B entering the product in the past week and nearly 1.5B since launch. Together, these data points make market participants more willing to hold and increase long crypto asset exposure. However, even with the overall positive sentiment, ETH still seems to be lacking in attention. It has dropped from the second most traded asset on the exchange to the third most traded asset, with trading volume only slightly higher than SOL.

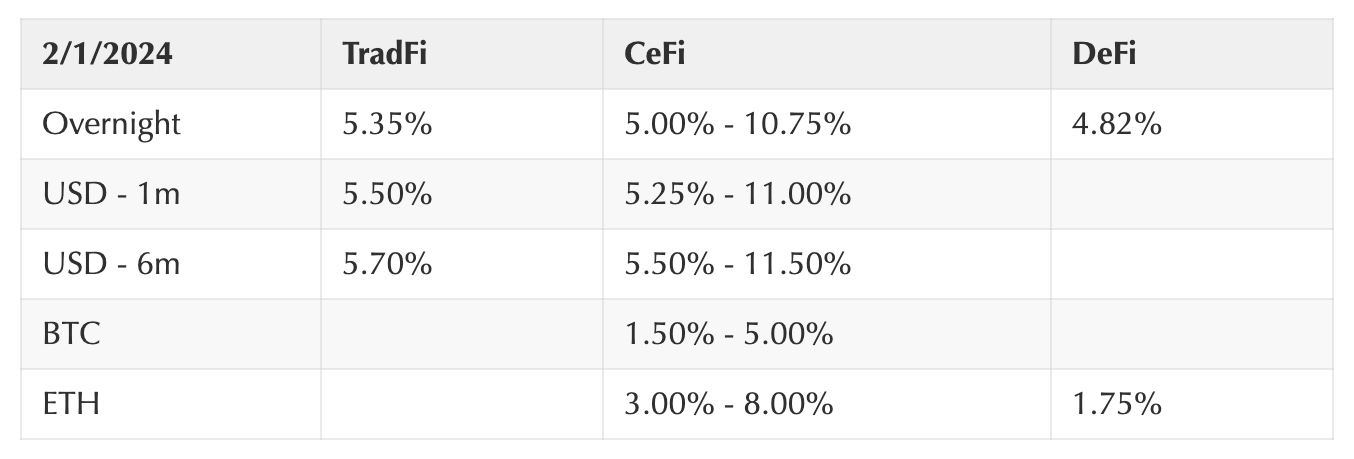

Funding interest rate

Notable Crypto News

mechanism

FTX expects to repay customers in full, abandons restart of exchange (Bloomberg)

Supervision

SEC may approve spot Ethereum ETF on May 23: Standard Chartered (The Block)

How the crypto industry is respondingFinCENProposed Mixer Rules (Coindesk)

comprehensive

Vitalik Buterin details four ways Crypto and AI overlap: “More and more use cases” (The Block)

Coinbase

The Current State of Asset Bridge (Coinbase Blog)

Coinbase Advanced now offers fee upgrade plan for large-scale traders (Coinbase Blog)

global vision

Europe

The Bank of England and the UK Treasury have published their response to last years consultation on a potential digital pound, determining that further research is needed before a final decision is made on whether the UK needs a CBDC, but that they are optimistic about the potential design. Exploration will continue. (The Block)

According to the guidelines proposed by the European Securities and Markets Authority (ESMA), crypto companies outside the EU will only be allowed to directly serve customers within the EU under limited conditions to promote fair competition as outlined by the MiCA regulations. (Reuters)

German authorities have seized more than $2 billion worth of BTC that the pair allegedly obtained through unauthorized commercial use and distribution of copyrighted content, making it the largest crypto asset seizure by German law enforcement to date. (The Block)

An Italian startup called BlockInvest plans to tokenize bad loans on the Polygon network through two new projects aimed at addressing the multi-billion dollar bad credit market. (Defiant)

The Swiss Financial Market Supervisory Authority (FINMA) has approved digital asset market provider Taurus to open its platform to retail investors, allowing individuals to trade digital securities and tokenized assets accepted by Taurus Digital Exchange (TDX). (Bitcoin.com)

Asia

Chinese asset manager Harvest Global Investments has reportedly applied for a spot BTC ETF in Hong Kong and has also discussed participating in the city’s planned stablecoin regulatory sandbox. (CoinDesk)

Two Japanese MPs want to develop policies for web3 in the country and have been holding discussions and DAO hackathons to understand stakeholder needs. (CoinDesk)

Thailand’s Securities and Exchange Commission has updated its crypto-asset regulations, removing retail investment restrictions on asset-backed tokens and establishing new rules for custodial wallets and digital business monitoring. (CoinDesk)

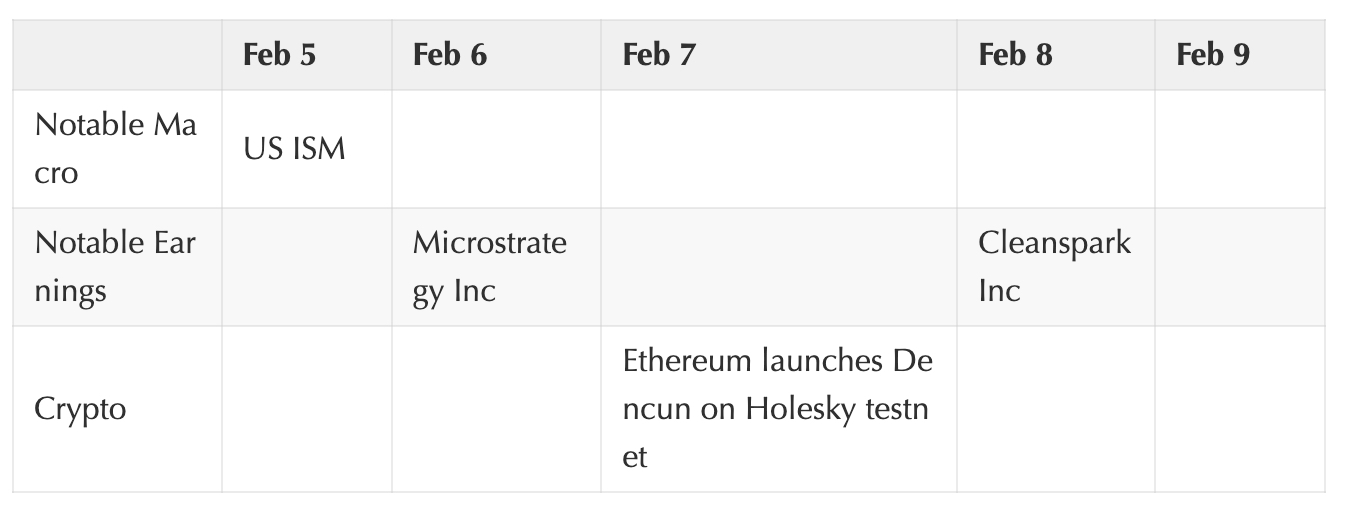

Big events for the week ahead