Original author: Chainalysis

Original compilation: Luffy, Foresight News

This article is excerpted from Chainalysis’ 2023 Cryptocurrency Geography Report, which will be released later this month.

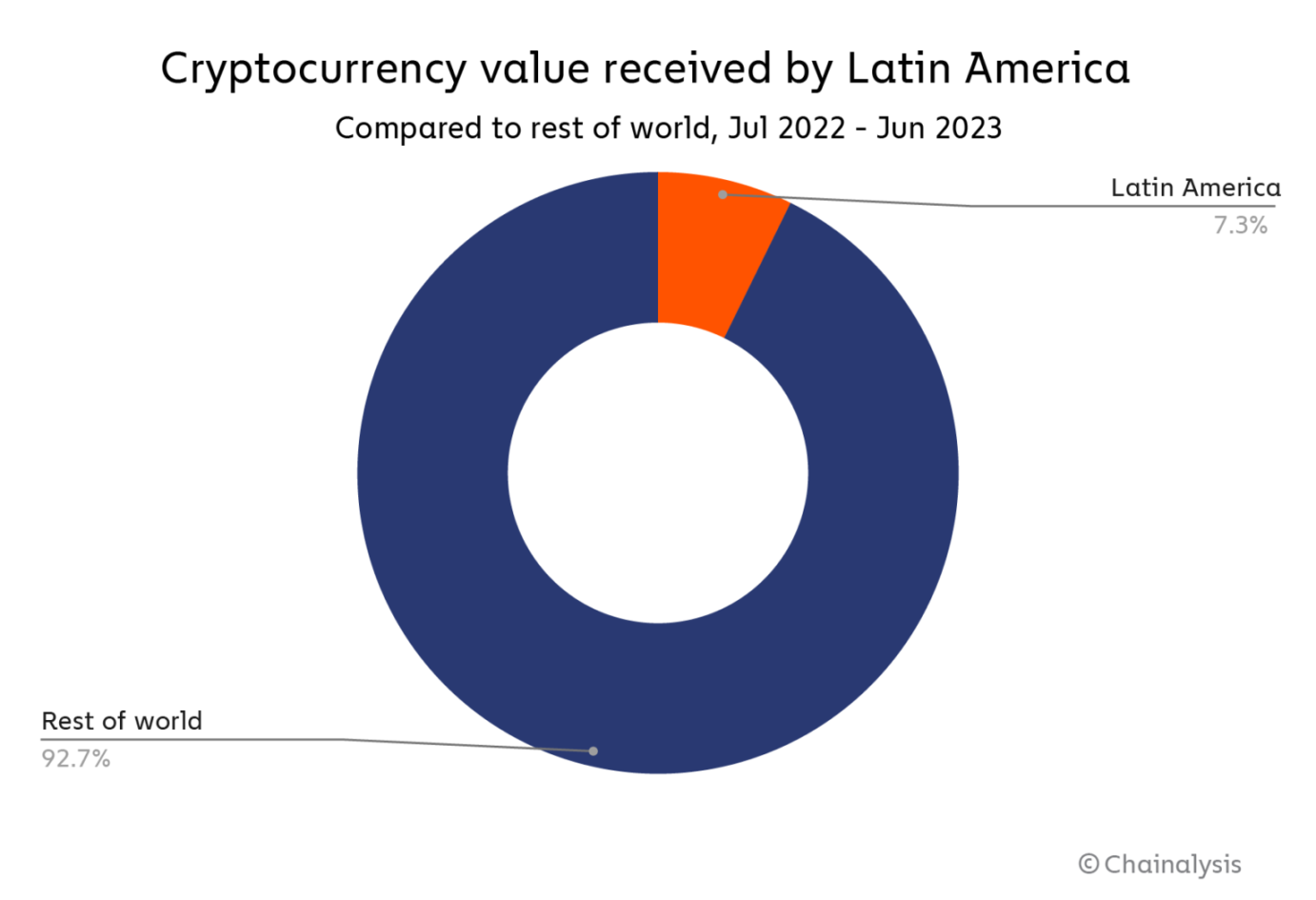

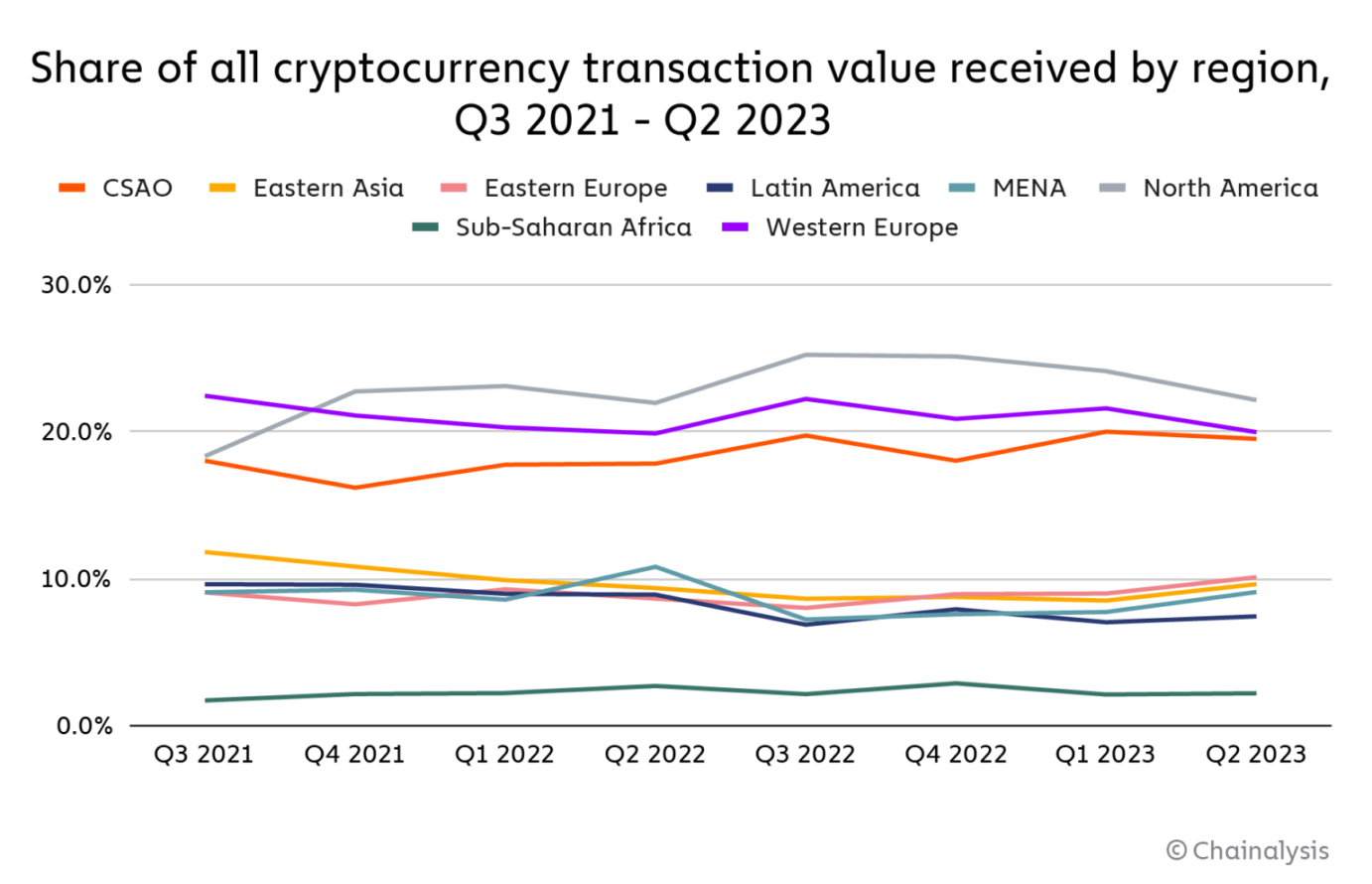

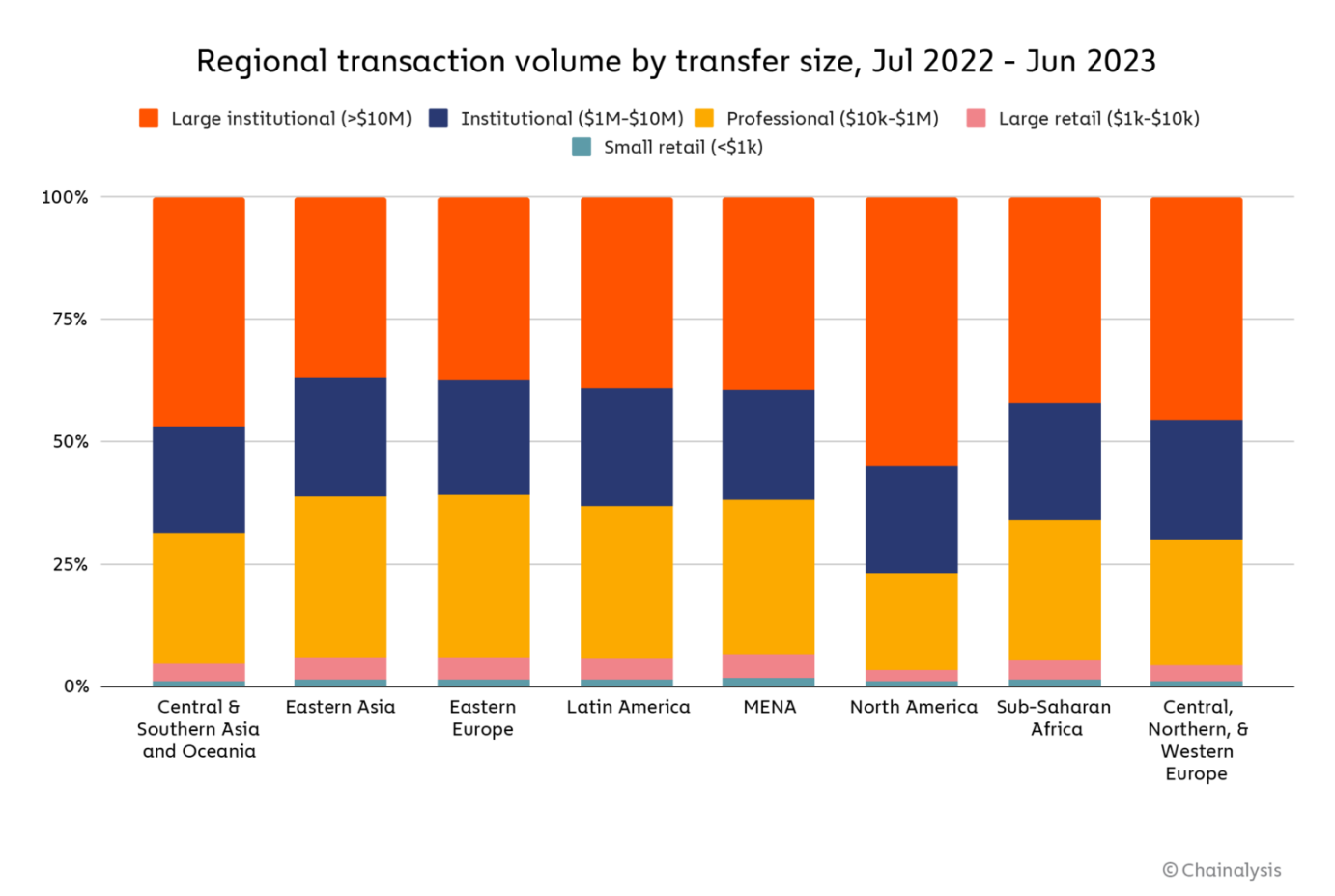

Latin America is the seventh-largest crypto economy among all regions we studied, ahead of only Sub-Saharan Africa but behind the Middle East and North Africa, East Asia, and Eastern Europe. Compared to other regions, Latin Americas position has remained relatively stable over the past two years.

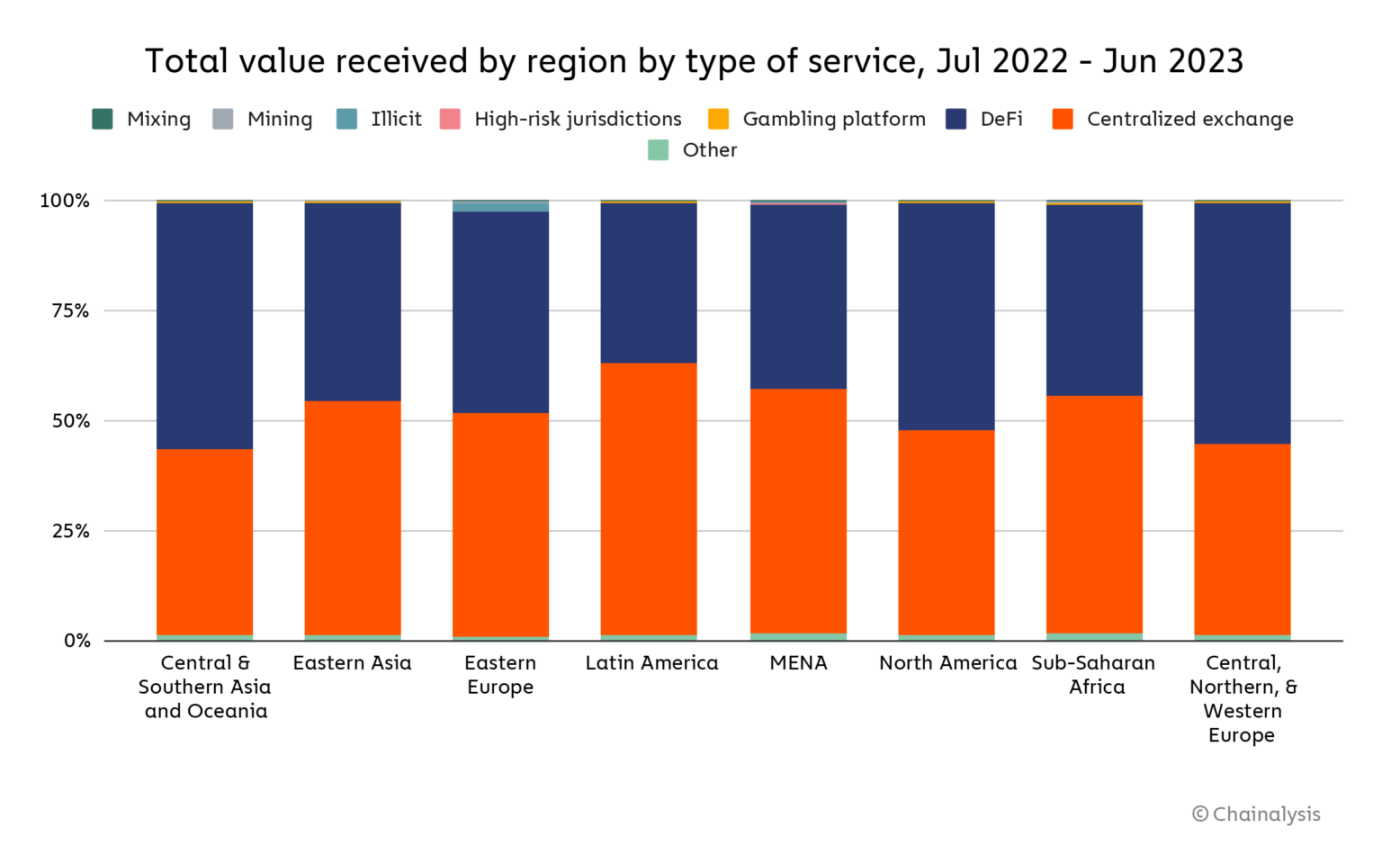

Of all the regions we studied, Latin America has the highest preference for centralized exchanges and the least institutional activity compared to other regions.

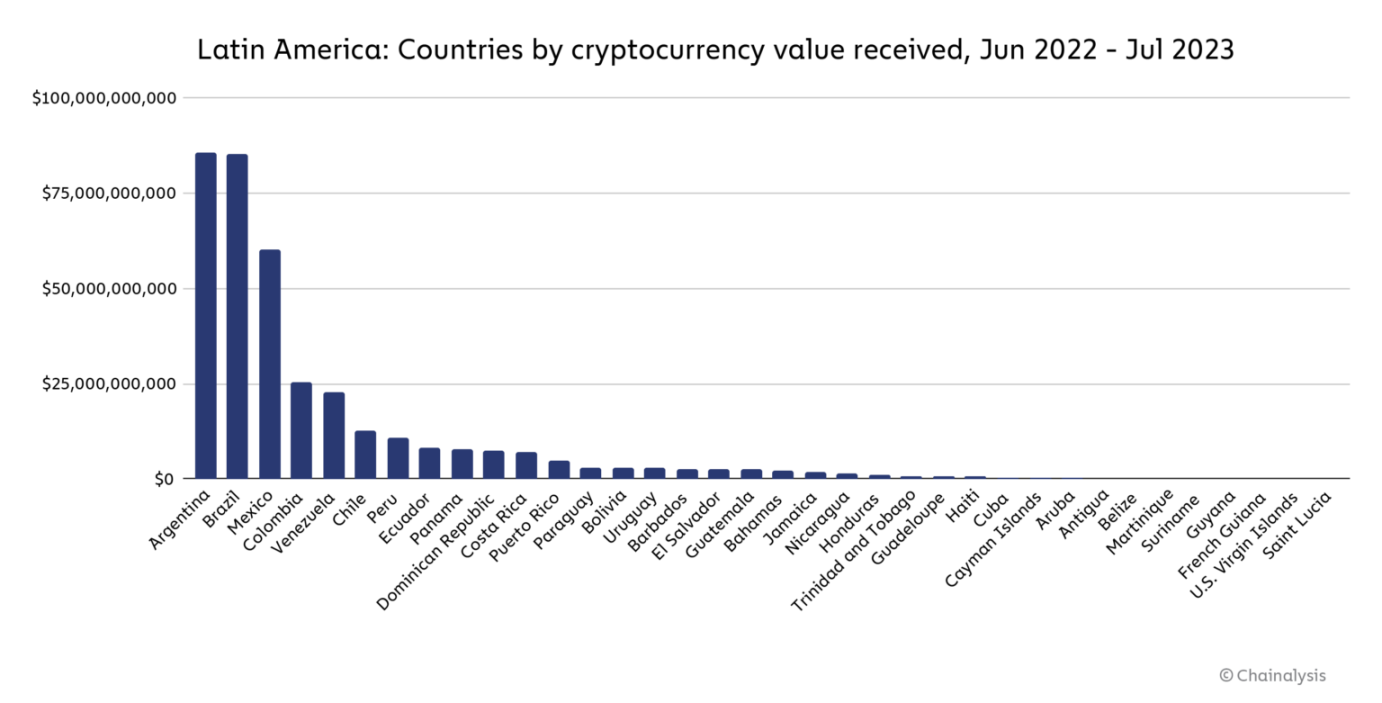

While Latin America’s crypto economy is smaller than most other regions, grassroots adoption is strong, with three countries ranked globallyCrypto Adoption IndexTop 20: Brazil (9th), Argentina (15th) and Mexico (16th). Cryptocurrencies have become an important part of daily life in many countries in the region, especially those facing currency devaluation.

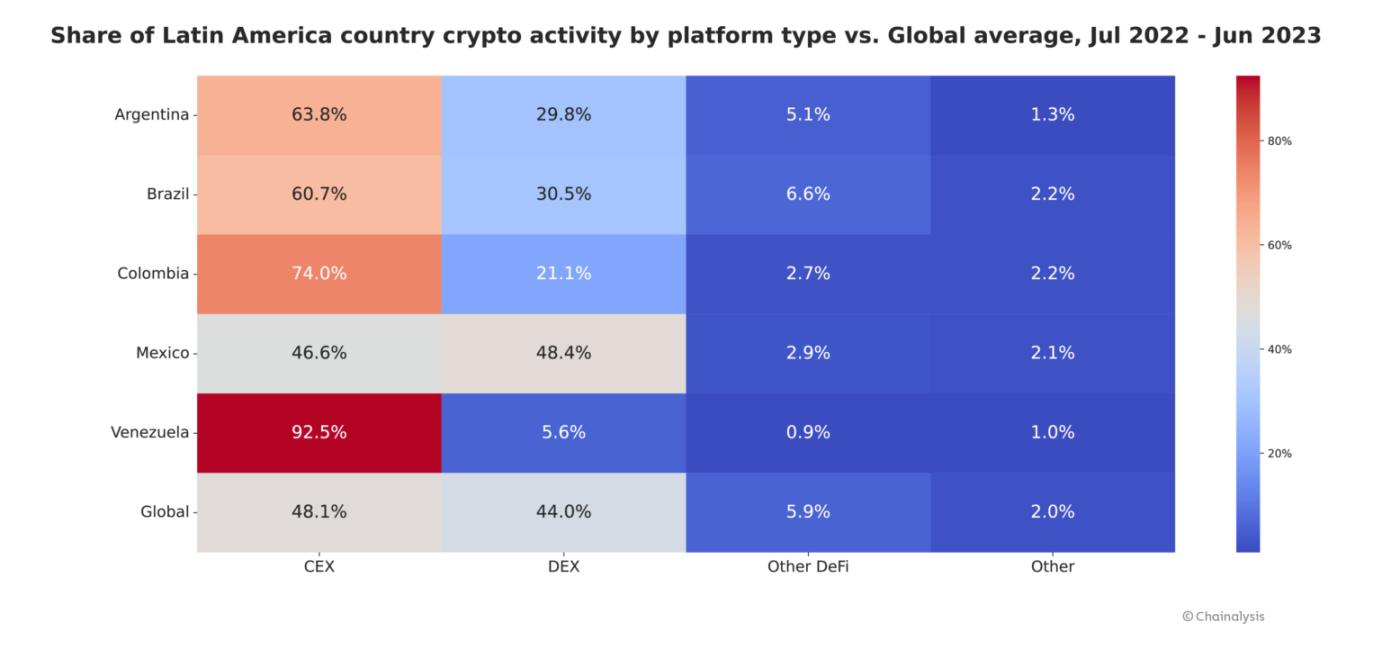

There are clear differences in cryptocurrency adoption patterns between Latin American countries. The heat map below compares some of the largest cryptocurrency adoption countries in the region by preferred platform type.

Almost every country in the region has a centralized exchange market share above the global average. In Venezuela, a whopping 92.5% of cryptocurrency activity occurs through centralized exchanges. However, Mexico is the only exception (more in line with the global average), with nearly half of the trading volume being conducted through decentralized exchanges. This is probably why Mexico will prefer investing in altcoins, as the number of assets listed on decentralized exchanges is much higher than on centralized exchanges.

An important country to watch is Mexico, which accepts cryptocurrency-based remittances. Remittances are an important sector of finance, and cryptocurrency advocates have long touted the technology as making them faster and cheaper. Mexico is the second largest recipient of remittances in the world, with approximately$61 billionIt flows into the country from overseas, mostly from the United States. Daniel Vogel, CEO of Mexican exchange Bitso, said that his company processed more than $3.3 billion in cryptocurrency remittances sent from the United States to Mexico in 2022, accounting for 5.4% of the entire market.

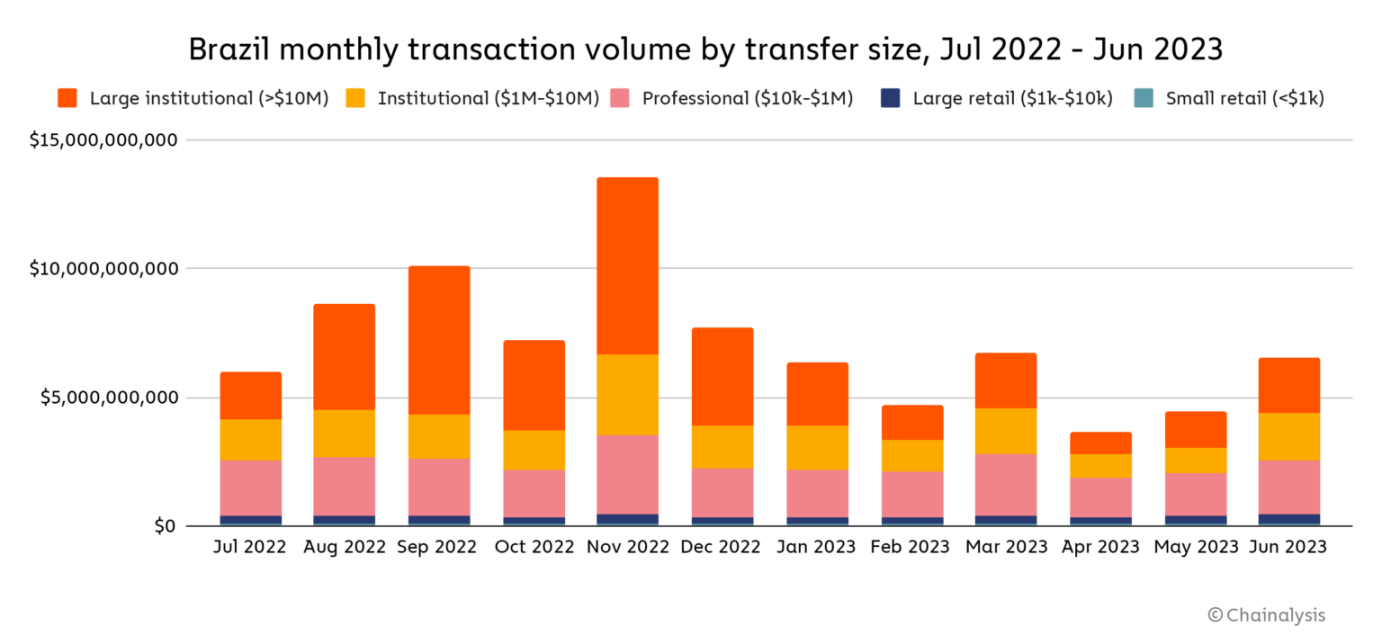

Brazil is another unique market in Latin America. In previous editions of our Crypto Geography Report, we’ve profiled Brazil’s developed institutional crypto market and the country’s embrace of DeFi and other innovative crypto platforms, bringing it closer to wealthy regions that have early adopted crypto. , such as North America and Western Europe. The Brazilian market still has these characteristics, but not as much as in previous years. For example, as we can see below, large institutional transfer sizes have declined, leading to an overall downward trend in cryptocurrency activity.

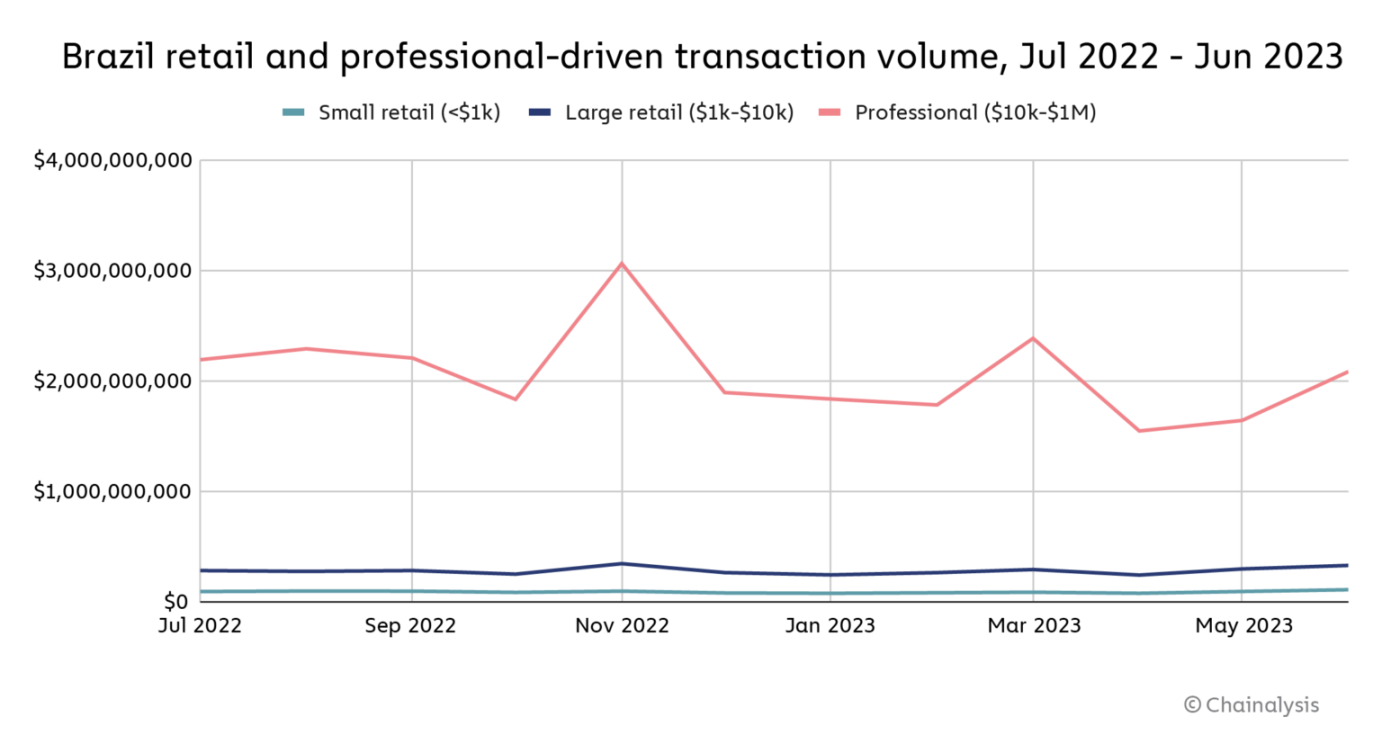

However, there are still positives for Brazilian cryptocurrency enthusiasts. First, while large institutional trading has generally been on a downward trend, it appears to be picking up, having increased for three consecutive months as of June. Furthermore, even in the months when a decline in large institutional transfers led to an overall decline in cryptocurrency activity, trading volumes for both professional and retail investors have remained relatively flat, as shown in the line chart below.

The data paints an optimistic picture for the Brazilian cryptocurrency market. Even during the cryptocurrency winter, the so-called “middle class” of high-value cryptocurrency traders, as well as retail investors, persisted in using crypto assets. If they continue to trade, it is not unreasonable that when we enter a bull market, institutional users in Brazil will return and perhaps even exceed previous levels.

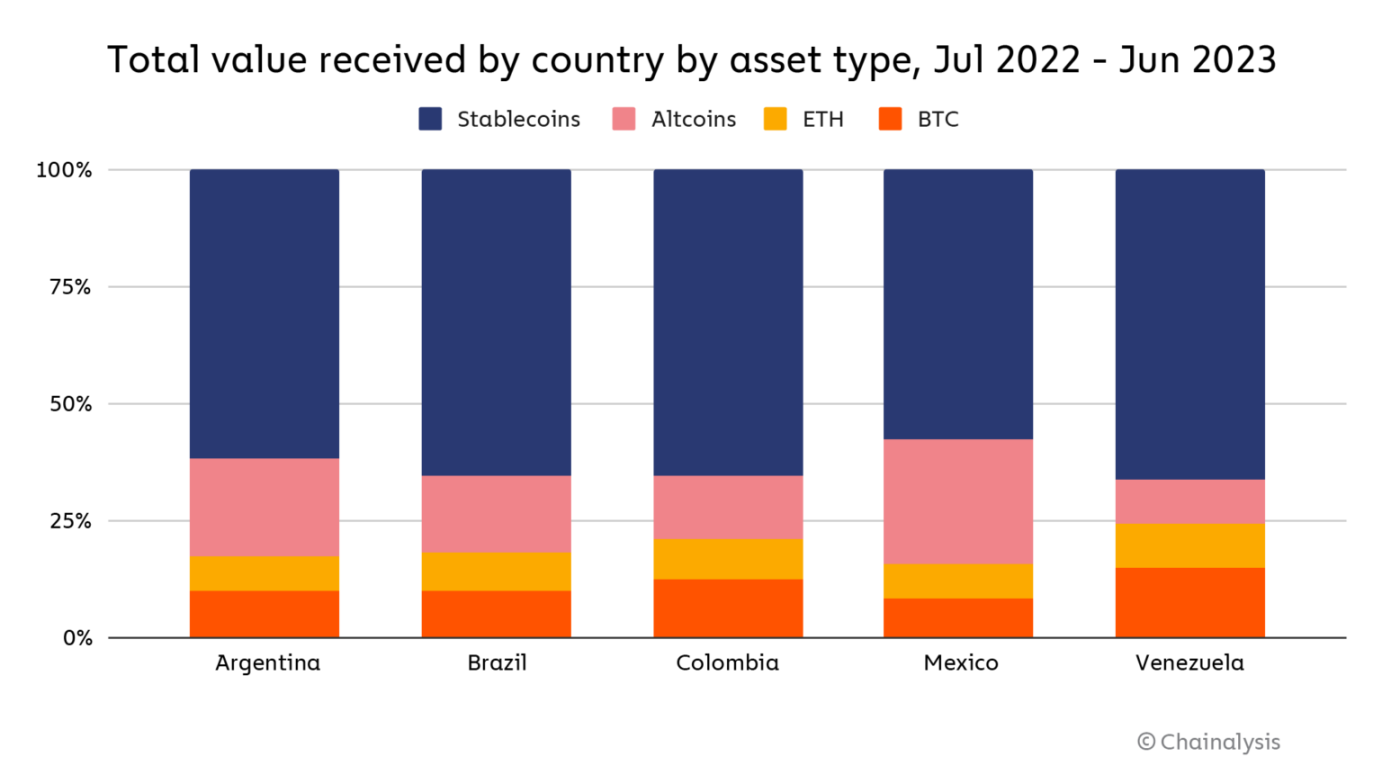

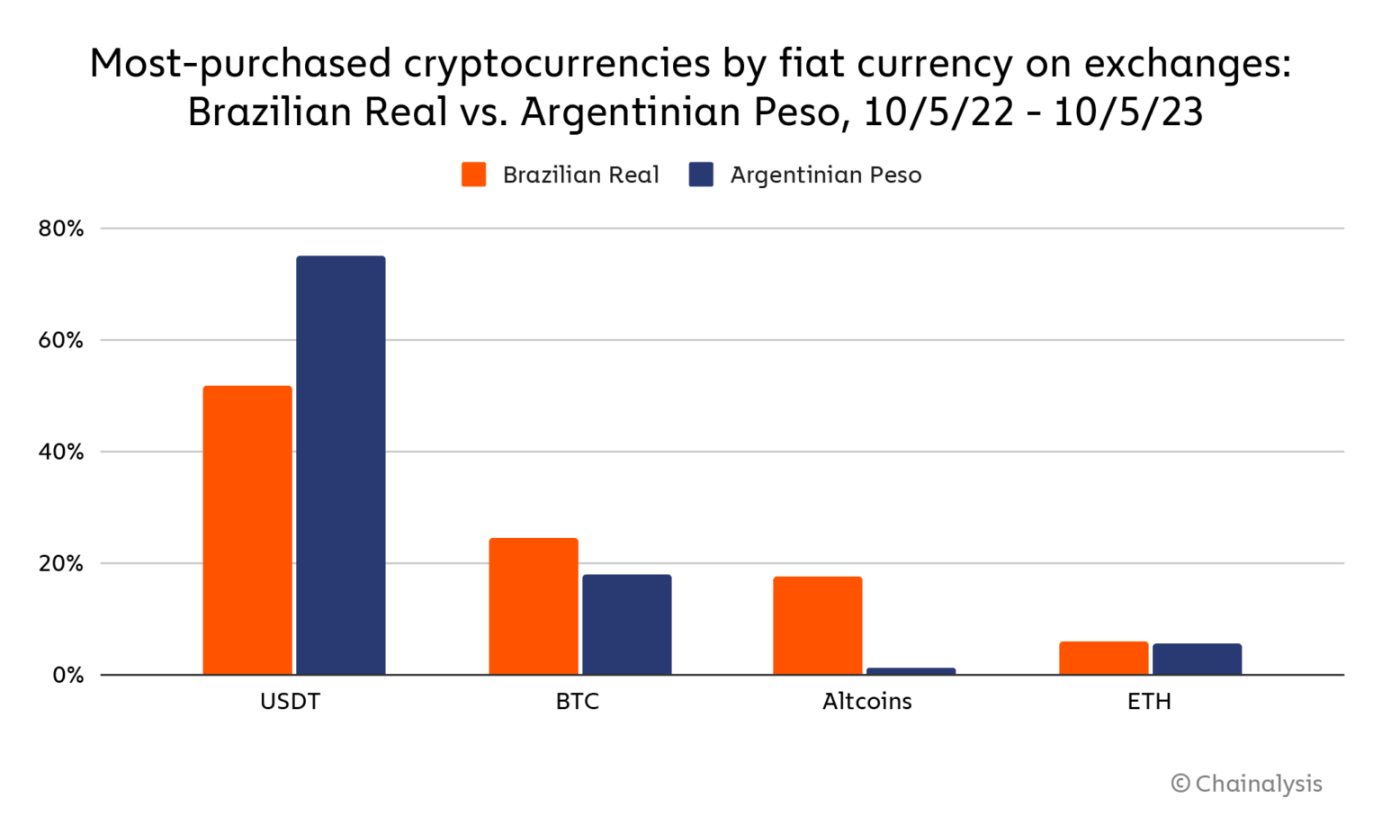

Even with its institutional problems, Brazils market remains very different from its less economically stable neighbors. This is especially evident when we look at exchange order book data. Below is a look at the assets most purchased with Brazilian Real, compared to those most purchased with Argentinian Peso, on several popular exchanges in Latin America. Argentina has faced severe currency devaluation in the past year, while Brazils currency has been stable.

Data shows that demand for stablecoin USDT is much higher in Argentina than in Brazil. This is due to the recent currency devaluation that Argentina has faced. At the same time, Brazilians have shown higher demand for Bitcoin, especially altcoins, which are more commonly used for long-term investment and speculation.

Argentina: How Cryptocurrencies Can Ease Currency Crisis

Argentina has faced economic hardship for decades, with extreme currency depreciation periodically damaging residents ability to save and making day-to-day financial activities difficult. Unfortunately, Argentina is in the midst of another such cycle, with the Argentine peso losing approximately 51.6% of its value in the year to July 2023. But during the same period, Argentina led Latin America in cryptocurrency trading volume, at approximately $85.4 billion, and ranked second in the region in terms of adoption by the average resident. We spoke with Alfonso Martel Seward, head of compliance and anti-money laundering at Argentinian cryptocurrency exchange Lemon Cash, to learn more about the factors driving cryptocurrency adoption in Argentina.

Martel Seward said that cryptocurrencies can protect ordinary residents from the depreciation of the Argentine peso and are the main driving force for cryptocurrency adoption in the country. “We have very high inflation and there are a lot of restrictions on buying foreign currencies. This makes cryptocurrencies a valuable savings option.” Martel Seward said stablecoins are particularly popular, providing a way to satisfy locals’ long-term interest in the U.S. dollar. New ways to demand. “You can walk up to any Argentinian and ask how many pesos a dollar costs and they all know it,” explains Martel Seward. “As cryptocurrency adoption grows, many people here receive their paycheck and immediately convert it into USDT or USDC.

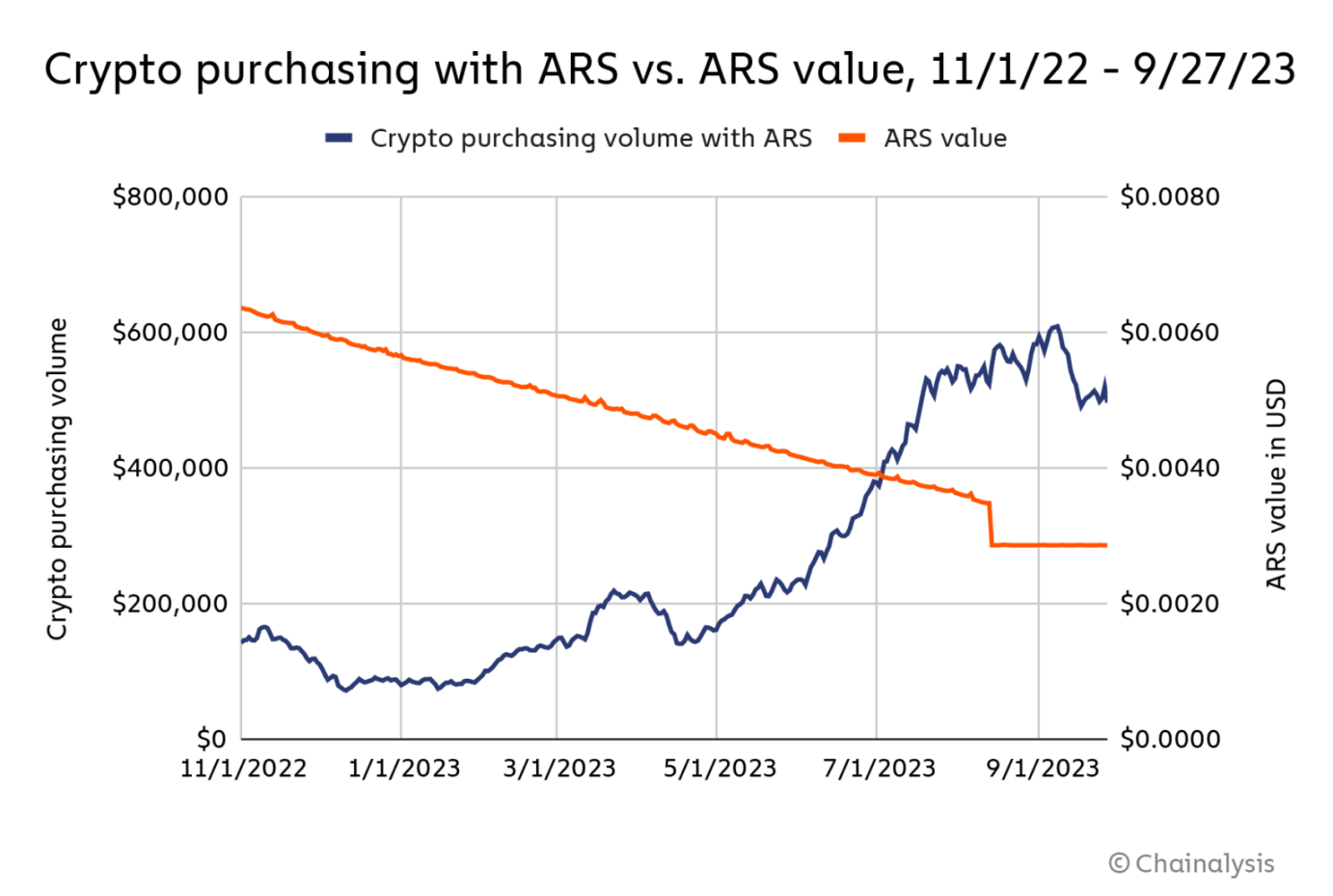

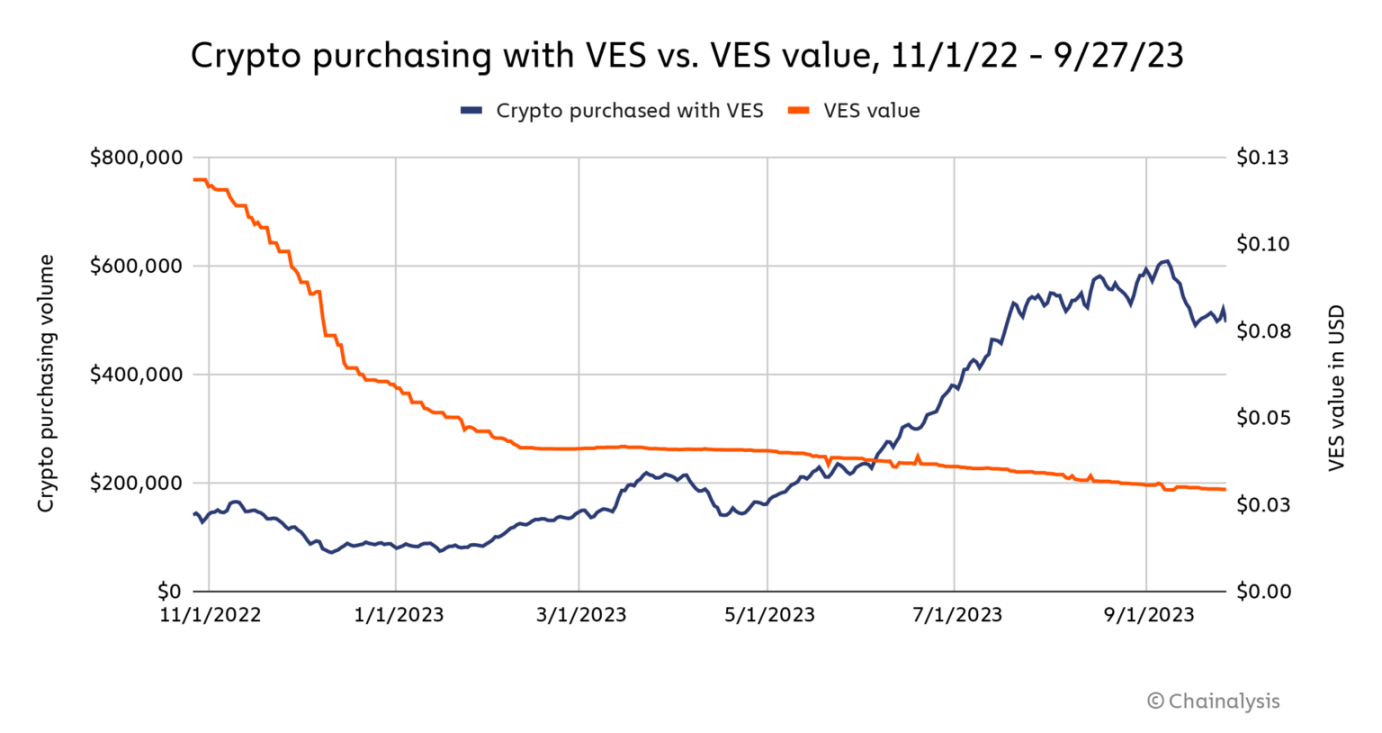

We can see evidence of the role cryptocurrencies are playing in Argentinas fight against currency devaluation in the chart below, which uses order book data from Argentinas major exchanges to compare the value of the Argentine peso over time to the value purchased using the currency. Cryptocurrency quantity.

Cryptocurrency purchases continued to rise as the Argentine peso continued to lose value, culminating in a surge in mid-April when Argentina’s inflation rate topped 100% for the first time in 30 years. We also saw a small decline in cryptocurrency buying starting in September, shortly after the peso’s value stabilized.

The economic situation in Argentina not only affects citizens savings, but also makes basic day-to-day commerce difficult, as the value of the peso can change in a matter of hours. To this end, Lemon Cash offers users a debit card that allows users to use their cryptocurrency account to pay at any retailer that accepts the debit card. Once the card is swiped, the cryptocurrency is immediately sold from the users account, and the business receives the payment in local currency. These products have helped Lemon Cash become a leader in the extremely active cryptocurrency market. “Cryptocurrency has become mainstream in Argentina, with approximately 5 million people (out of a total population of 45.8 million) using it, 2 million of whom use Lemon,” Seward said. The growth of Lemon Cash and the general popularity of cryptocurrencies in Argentina is a testament to the asset class’s unique ability to provide relief during difficult economic times.

Venezuela: Cryptocurrency is a weapon against dictatorship

Like Argentina, Venezuela has experienced serious economic problems and a devalued currency. However, Venezuela has one key difference from Argentina: the country is ruled by a dictatorship. Under the regime of Nicolás Maduro, Venezuelans have faced severe human rights abuses and political repression, as well as a lack of access due to government corruption.

How can cryptocurrencies improve the lives of people suffering from poor economic conditions and abuses by authoritarian regimes? We spoke to Venezuelan opposition leader Leopoldo López to find out. López is the founder of the Venezuelan political party Voluntad Popular. He became a political prisoner after leading protests against the Maduro regime in 2014, and finally left the country in 2020. López is a close associate of Venezuelas former exiled president, Juan Guaidó, and is working with Guaidós interim government to vie for Maduros presidency. Since leaving Venezuela, López has continued to promote Venezuelan democracy abroad and embraced cryptocurrency as a tool to further this process.

López explains to us how cryptocurrencies are helping many Venezuelans preserve their savings even as the local currency, the bolivar, loses value. “Venezuela’s hyperinflation rate is over 1 million percent, one of the worst the country has ever seen,” López told us. “Cryptocurrencies, especially stablecoins, have helped many Venezuelans overcome this problem.” We can read more about this at This phenomenon is seen in exchange order book data, where crypto purchases using the bolivar tend to increase when the bolivar loses value. While the relationship isn’t as strong as we’ve seen in Argentina or Venezuela in previous years: there was a slight delay between the largest drop in the bolivar’s value and the surge in stablecoin purchases that began in April, it’s worth noting Yes, other indicators of inflationary factors, such as consumer prices, are indeed surging at this time.

López also told us that cryptocurrencies play an important role in sending money to Venezuela. Remittances have become increasingly important to Venezuela over the past few years. “Until recently, Venezuela was not a country with high immigration rates,” López said, “but since 2014 there has been a mass exodus due to complex humanitarian emergencies. In the past decade, approximately 25% of people have left remittances have become a huge part of the Venezuelan economy, and López told us that many have turned to stablecoins as an alternative way to meet this need.

However, the most unique use case for encryption in Venezuela is how it enables citizens to resist the oppression of the Maduro regime. López recounts an example. During the 2020 coronavirus crisis, Guaidó’s interim government developed a plan to use cryptocurrencies to provide direct aid to the country’s doctors and nurses. Cryptocurrencies are their best option because international aid is difficult to provide through normal means due to the Maduro regime’s corruption and refusal of much-needed financial help for political reasons. “The challenge is how to make direct cash transfers without interference from authoritarian regimes, which have complete control over banks and the financial system,” he explained. The rescue team solved this problem by using cryptocurrency wallets to transfer funds to local trusted individuals (human ATMs), which then distributed them to doctors and nurses. They also conduct KYC checks on recipients against the records of doctors and nurses unions trusted by the interim government to ensure funds go only to medical professionals.

“This program directly helps 65,000 doctors and nurses,” López said. “It indirectly helps hundreds of thousands of people who receive their care. Remember, the average salary for nurses at this time is $3 a month, and for doctors The average salary is $5 per month. This project gives them $100 per month. Equally important is the emotional impact, which lets them know that they are not alone on the front lines during the COVID-19 crisis, which is an important contribution of this program.”

López also told us that cryptocurrencies have become an important tool in resistance to authoritarian governments, not just in Venezuela but around the world. Cryptocurrencies offer democratic activists, NGOs and freedom fighters an alternative to overcome censorship and the closure of civil space, he said. But he stressed that cryptocurrencies themselves are not a panacea. Converting cryptocurrencies into fiat currencies is always difficult in authoritarian countries. “I believe that the true value of cryptoassets in supporting democratic movements will only be realized when they exit completely independent of authoritarian regimes.”

Venezuela’s embrace of cryptocurrency and its role in aid programs led by López and his allies are a reminder of this cutting-edge technology’s potential to promote freedom and improve quality of life.