introduction

In the previous article on CP and Layer 2 StacksTechnical solutions, token value and ecology, we based on their technical characteristics and current ecological token empowerment situation,Provides developers and project parties with corresponding selection ideas. Each party can choose a plan that suits them based on actual needs.

So, from a subjective point of view, what is the current communitys attitude towards this new force in Layer 2? How should major L2s develop their own hyperlink networks? In this article, the author will focus on these two issues.

1. Industry perspective

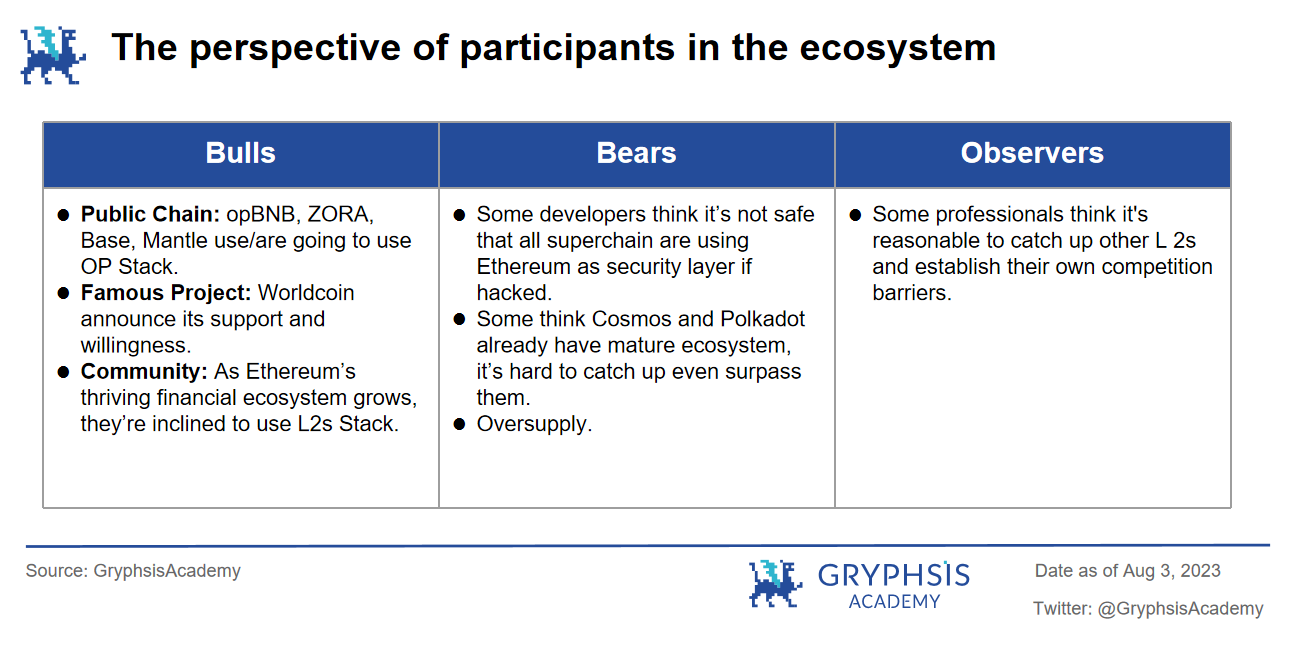

In order to have a more comprehensive understanding of the current market voices, we collected different opinions on the Layer 2 Stacks solution in the industry and summarized them into three categories: Bull, Bear, and Observers.

1.Bulls:

Public chains: such as opBNB, ZORA, Base, Mantle, etc. have all announced that they will be deployed in OP Stack. Among them, BNB announced its support for OP Stack and created its own opBNB as early as February this year. 1.5 months after the testnet was released, there have been more than 7 M transactions, 435972 addresses, and more than 40 Dapp deployments, including the support of well-known projects such as iZUMi Finance, Math Wallet, BaBYGODE, etc. You can see the community and developers The acceptance of opBNB is relatively high.

Project side: Take Worldcoin as an example. In May this year, they expressed their intention to deploy Worldcoin and World App to the OP main network, and began to implement it on the OP hyperchain in July. Worldcoin itself wants to create a global identity and DID system. Combined with the OP hyperlink, any user can freely manage their own identity ID, and it can also assist the OP Collective in on-chain governance. And Debank announced on August 11 that it will launch an exclusive asset social L2 chain on OP Stack. As an old brand that has been developing data asset services for more than 5 years, regardless of whether it is successful or not, we can already get a glimpse of the project side’s intention to deploy L2. The enthusiasm of OP Stack and the positive impact it brings to OP by taking OP Stack as the first choice solution.

Community: The community has a high degree of recognition/consensus for Ethereum, and Ethereum itself is a financial hyperchain with rich application scenarios. Therefore, launching L2 on Ethereum will have greater community awareness than the independently developed Cosmos Polkadot ecology; and it is believed that due to its complete consensus layer, Layer 2 will develop much faster than CP and will complete the super chain ecology faster. Construct.

2.Bears:

Developers: Some developers believe that relying on a single Ethereum for the consensus layer of all hyperchains is too risky. If Ethereum as a single infrastructure fails or is attacked, all hyperchain networks will be affected; compared to CP, security is more thoughtful, and Cosmos allows each chain to customize its verifiers, making verification safer. Safety, even if a failure occurs, it will only be a single chain related chain, and will not affect the entire ecology. Polkadot provides more options. It can share security with the relay chain or customize the security layer like Cosmos. Maintaining the security of this chain by yourself will greatly reduce the risk. So no matter what, the current Layer 2 Stacks should develop more solutions in terms of security.

Project: The hyperchain network of Layer 2 Stacks is slightly over-provisioned. Without taking into account technical differences, the perception is not strong for ordinary projects because it is still Ethereum in essence. And some project parties believe that this industry needs L1 (such as CP), and not all chains are suitable for L2.

Community: Layer 2 As an expansion plan for Ethereum, it will be difficult to exist independently from Ethereum in the short term, so how to deal with the economic model of ETH and native tokens is a difficult point. Compared to Cosmos, which has been connected to 246 chains, and Polkadot, which has a market capitalization of 6.5 Billion, it will be a little weak to compete with CP without a complete community drive.

3.Observers:

Some developers believe that Layer 2 Stacks is all about attracting more developers to create an ecosystem. After OP, Arb and other leading L2s announced the idea of hyperlinking, taking proactive measures can be seen as an act to cater to market enthusiasm, which is understandable. . And since L2 itself only processes and packages transactions (execution layer), when hyperlink L3 packages transactions to L2, L2 then repackages the packages... forming a recursive compression, which greatly expands throughput, which is not necessarily a bad thing. Its just that in order not to fall behind, we did not examine the current on-chain ecology and economic incentives, which was a little too hasty.

The author believes that based on the current situation, the Stack solution, especially the OP Stack, is a good direction. BNB, Base, ZORA, Mantle, Worldcoin, Debank, etc. are backed by top exchanges and well-known Web2 giants. These capital bonuses make OP Stack at the forefront of Layer 2, and it is likely to become the first choice for one-click chain issuance of big-name projects in the future. It also shows that the market and industry recognize the logic of L2 Stacks and that it can already be put into practice.

But in the long term, the Ethereum ecosystem built by ETH and Layer 2 will become more and more prosperous, but there are also some problems within the ecosystem. For example, how Layer 2 handles the relationship with Ethereum, how to capture value from the multi-chain system it builds, how to establish core competition barriers, or how to jointly create an L2 hyperchain network with other Layer 2, will all be Layer 2’s problems. The situation 2 will face next, and every step taken thereafter will greatly affect the future direction of Layer 2.

2. How to develop

1. Technical optimization

In the development process of traditional public chains, there are the impossible triangle problems: scalability, security, and decentralization. The emergence of L2 has alleviated the scalability problem, and the respective Stacks launched respectively take the hyperlink network as the main goal and solve the scalability of most underlying facilities. So apart from this, what kind of problems will arise in the development of Layer 2 Stacks?

1) Structural safety:

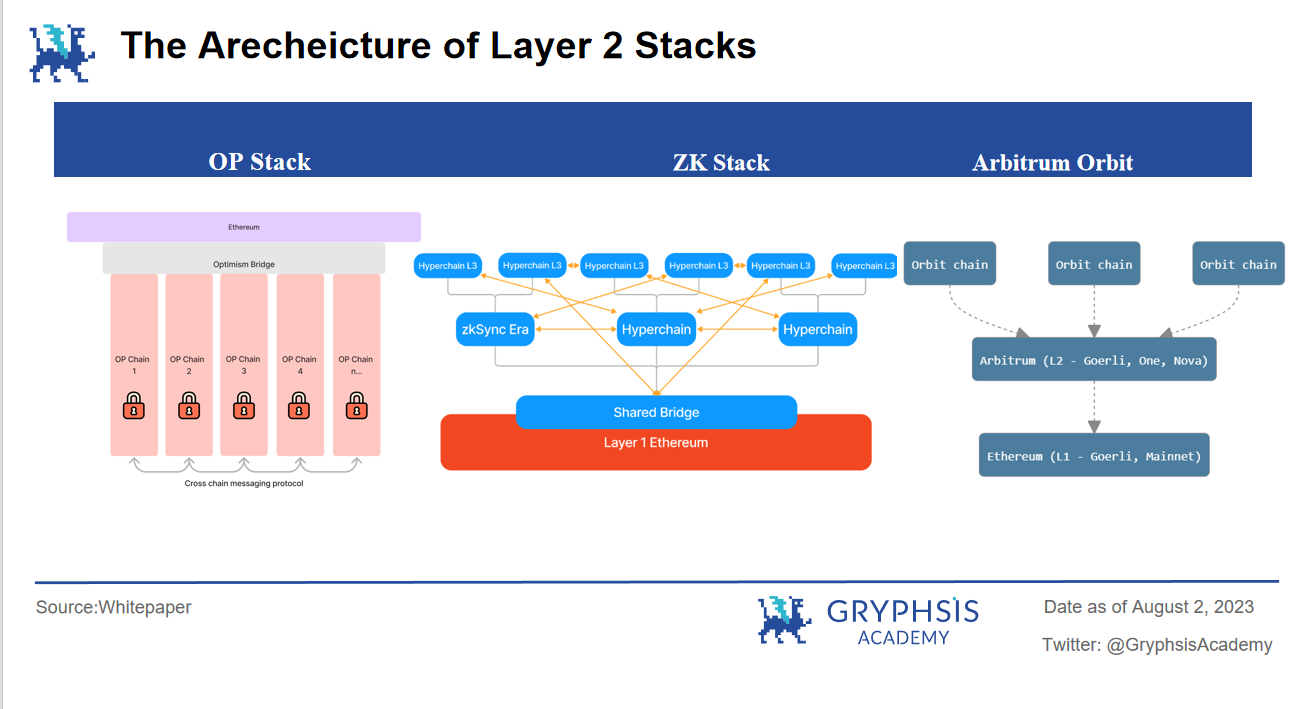

The emergence of hyperlink structure has undoubtedly increased the complexity of Layer 2, so can the L2 Stacks framework support the concurrency of a wide variety of application chains? We gathered Optimism, zksync, and Arbitrum of the published Stack framework to do a structural layer analysis.

OP Stack uses shared cross-chain bridges for asset transfer, and all OP Chains (1-n) created using the Stack solution are at the same level as OP Mainnet. The underlying structure of ZK Stack Arbitrum is similar, but it supports the additional issuance of L3 and L 4 to form an scalable hyperchain network; Polygon 2.0 (not listed in the table as a side chain for the time being) uses Ethereum as the pledge layer, and now there are Polygon The zkEVM public chain and hyperchain operate in parallel and share the interoperability layer.

Their structural frameworks are similar, and they all face the same problem, that is: all hyperchains rely on the underlying Ethereum as a security consensus, so if Ethereum is attacked, are the hyperchains safe? The mutual coordination of hyperlinks in Layer 2 is basically through a shared communication bridge. So when there is a problem with the bridge, how should we solve it? For such a single undertaking solution, Layer 2 should adopt multiple alternatives or directly optimize the framework to solve it.

2) Risk assessment

There is no doubt that Ethereum is highly secure, but whether Layer 2 can fully inherit the security of L1 is a question. As Layer 2 with Rollup as the mainstream, its most important function currently is to transition the execution operation to this chain. However, when users initiate transactions on the L2 chain, although the cost is greatly reduced, can security be guaranteed? Woolen cloth? Is there a corresponding escape hatch mechanism to protect user assets in a timely manner?

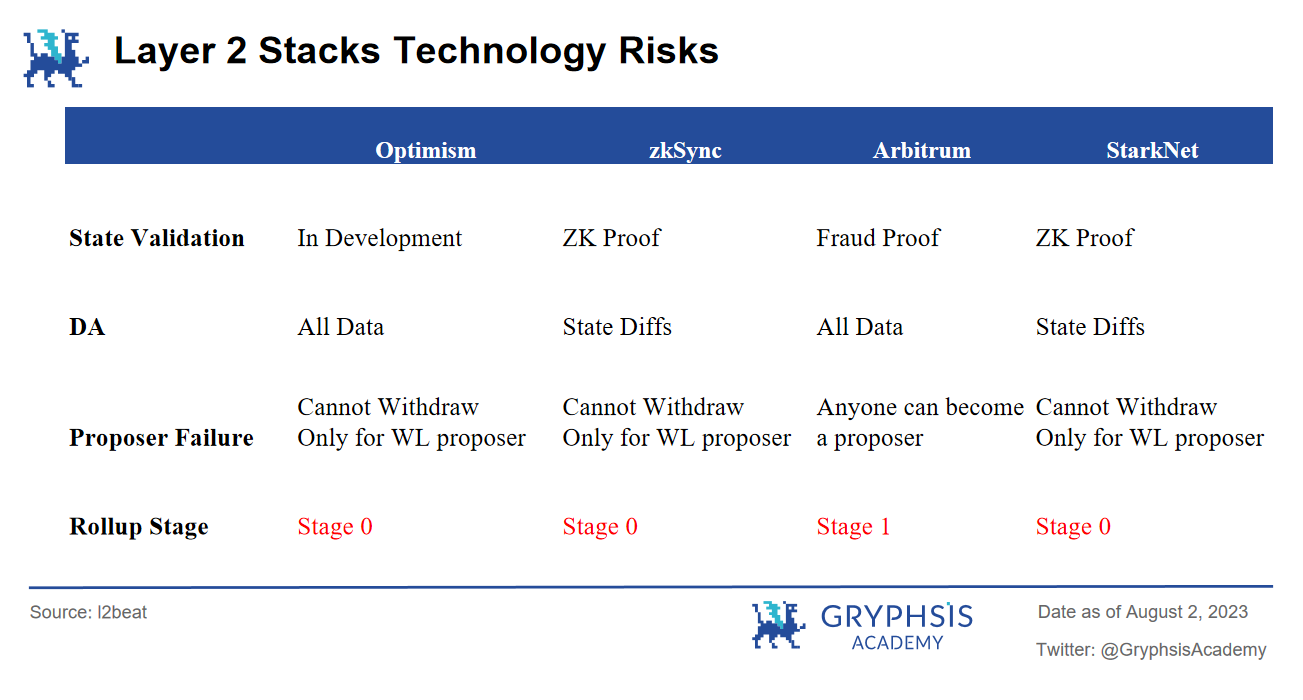

In this regard, we have sorted out several important indicators from the l 2b eat website to evaluate the current risk flaws of Layer 2:

State Validation: State validation refers to what mechanism Layer 2 uses to verify the correctness of transactions. From the table, we can see that the verification mechanism of the Optimism network, which was the first to use OP Rollup, is still not fully developed at this stage. In contrast, Arbitrum already has a fraud proof mechanism for verification, and the development progress of the Rollup Stage is also higher than that of Optimism. It can be said that Arbitum has an advantage in terms of transaction security/correctness.

In addition, zkSync and StarkNet both use ZK Proofs, and the Rollup Stage is at the same stage.

DA: Data availability has slightly different definitions on the market. Let’s analyze it based on l 2b eat’s interpretation. l 2b eat believes that data available in data availability means that as long as the correctness of the status transformation is announced to the outside world. There is no need to broadcast complete transaction data, which actually violates user privacy. And all this data must be uploaded to the chain, so that people who have the ability to verify state transformation can verify it on the chain.

We can see from the table that the current L2 data are all On-Chain. The OP Rollup chain uploads all the data of the transaction to L1. In contrast, the ZK Rollup chain only uploads the state variables Sent to the chain, greatly reducing transaction fees and block congestion.

Proposer Failure: Proposer failure means that a node/proposer is unable to complete the task for some reason. This will not only cause network errors or interruptions, but may also cause transaction failure and node data loss. This way users cannot withdraw their assets from L2 to L1, also known as the escape hatch mechanism.

In fact, all L2s currently on the market have not fully implemented the escape hatch mechanism. As can be seen from the table, all L2s are Whitelist Proposers, and only they have the right to submit the state root of L2 to L1. So once they are attacked, users are helpless and their assets can only be frozen.

The slightly better thing about Arbitrum is that it allows anyone to apply to become a Proposer about a week after discovering the inactivity/failure of a node/proposer. Such a mechanism does provide a certain degree of protection, but a mechanism like Whitelist Proposer is essentially a closed system, which violates the decentralized and open nature of the blockchain.

Although users can apply to become Proposers, this process still has a high technical threshold. To become a node/proposer, users may need to have basic equipment, and such a solution is not actively applied in the market, and there are no corresponding incentives. Mechanism is given to these Proposers.

Therefore, overall, the current Layer 2 asset emergency measures are not perfect enough.

Rollup Stage: Stage 2 is the end point of all L2 inherited security, but currently, it seems that among all L2s, only Arbitrum is the safest and has the most complete risk mechanism.

And it takes into account its upcoming BOLD mechanism, a new permissionless authentication scheme by hardening its dispute protocol to defend against a form of denial-of-service attack known as a delay attack. It may further accelerate the pace to achieve more decentralization.

3) Inter-chain security:

Taking OP Stack as an example, its goal is to provide a unified modular development stack with seamless communication between hyperlinks. The modular architecture allows any developer to use the framework to develop their own blockchain, but it also means that anyone can develop and message requests. And OP Stack allows developers to easily abstract different components of the blockchain and insert different modules to modify it.

A simple understanding is that if you want to replace your fraud proof with a validity proof, or if you want to replace the data availability layer with another, OP Stack allows you to implement it. Then we will face a problem: when diffusion turns into division, when the OP Stack module no longer becomes a system, and OP is used as a bottom-level chain-issuing tool, how to manage the security between different chains?

4) Cross-chain coordination:

As Polkadot founder Gavin Wood said, shared chains/bridges are essentially separate communications. Although chains can communicate with each other, it is actually a single chain + bridge model, but Polkadot combines parallel chains with each other. Communications are conveyed through a chain of relays. Then corresponding to Layer 2 Stacks, OP, ZK, and Polygon are all shared cross-chain bridges.

So how to achieve seamless communication and interaction between chains? Although the current communication framework of Layer 2 Stacks has some shortcomings, is it also a development opportunity for some cross-chain protocols or even public chains? Here, we list several possibilities:

Public chains that lack growth drivers: such as Celo and Pantom, their market value is only 1/10 compared to the current EVM L2, and their ecological activity is low. If its ecology can be integrated into Stack, relying on the underlying super financial chain ETH and rich parallel hyperchains, whether it is ecological cooperation or interaction needs between Dapps, it will undoubtedly bring new growth to it. And there are already public chains that are starting to deploy early:

Celo has launched a vote in July this year, and the L2 proposal to transform from the original EVM L1 to the OP Stack solution has been passed;

Pontem Network plans to use OP Stack to develop a new Move VM L2

DApps with high cohesion and low external coupling: such as derivatives exchanges, GameFi, Socialfi, etc., the types of transactions that occur internally are complex and diverse, with high frequency, and have less dependence on external assets or projects. For these applications that do not have high cross-chain requirements but have high efficiency in internal transaction processing, Stack may be the best place for their development.

Cross-chain protocol: For example, Owlto Finance, which has been gaining popularity recently, is a Defi protocol for cross-chain interaction on the L2 Rollups public chain. It currently supports the inter-crossing of all ETH Layer 2 chains; in addition, there is Socket Protocol (which is more Bungee (known as Bungee) is committed to developing the cross-chain protocol Stack. If it can be deployed in the OP Stack, it will undoubtedly play a vital role in the communication of assets and information between hyperchains.

2. Ecological incentives

In addition to attracting technical support from developers and users, Layer 2 can also quickly build an ecosystem through the most direct incentive method. Take the current Optimism Polygon as an example to see what methods Layer 2 may use to build an ecosystem.

OP Grants: As Optimisms ongoing developer incentive program, by funding developers and guiding them to build Dapps and tools on Optimism, it has been tried for many rounds, with an investment of more than $30M.

RetroPGF(Retroactive Public Goods Funding):

In March 2023, RetroPGF Round 2 will provide 10 million $OP to incentivize ecological projects. It is mainly aimed at incentivizing projects in three categories: Tool, Infrastructure, and Education. A total of 195 projects/developers have received rewards.

In June 2023, RetroPGF Round 3 will provide $30 million in OP to incentivize contributors to OP Stack, Collective Governance, Developer Ecosystem, End User Experience Adoption, etc.

OP Warriors Season: Users can obtain NFT rewards by participating in community activities (ecological projects)

Bridging Summer: On August 3, 2023, OP officially funded the Socket cross-chain protocol with 400,000 $OP. Any cross-chain project on Bridging Summer will return a certain amount of $OP. For example, if you perform a cross-chain worth $100 U from Polygon to OP, if you need to pay a fee of $2.5, then at the same time you will receive $2.25 worth of $OP, and you can collect it every month.

It can be seen that Optimism has been continuously launching various activities to enrich the ecosystem and attract more users. Not only that, OP already has a relatively mature incentive mechanism. In the early Grant, many project parties disappeared without a trace after receiving sponsorship, and did not fulfill their commitment to develop in the OP ecosystem. The OP has learned from these experiences and lessons, and has gradually improved the rules in recent grants to ensure that everything is put to its best use.

OPs governance mechanism is becoming more and more complete, and incentive projects are becoming more and more abundant. These can be used for future Stack development, but the original Dapp is replaced by hyperchain L2.

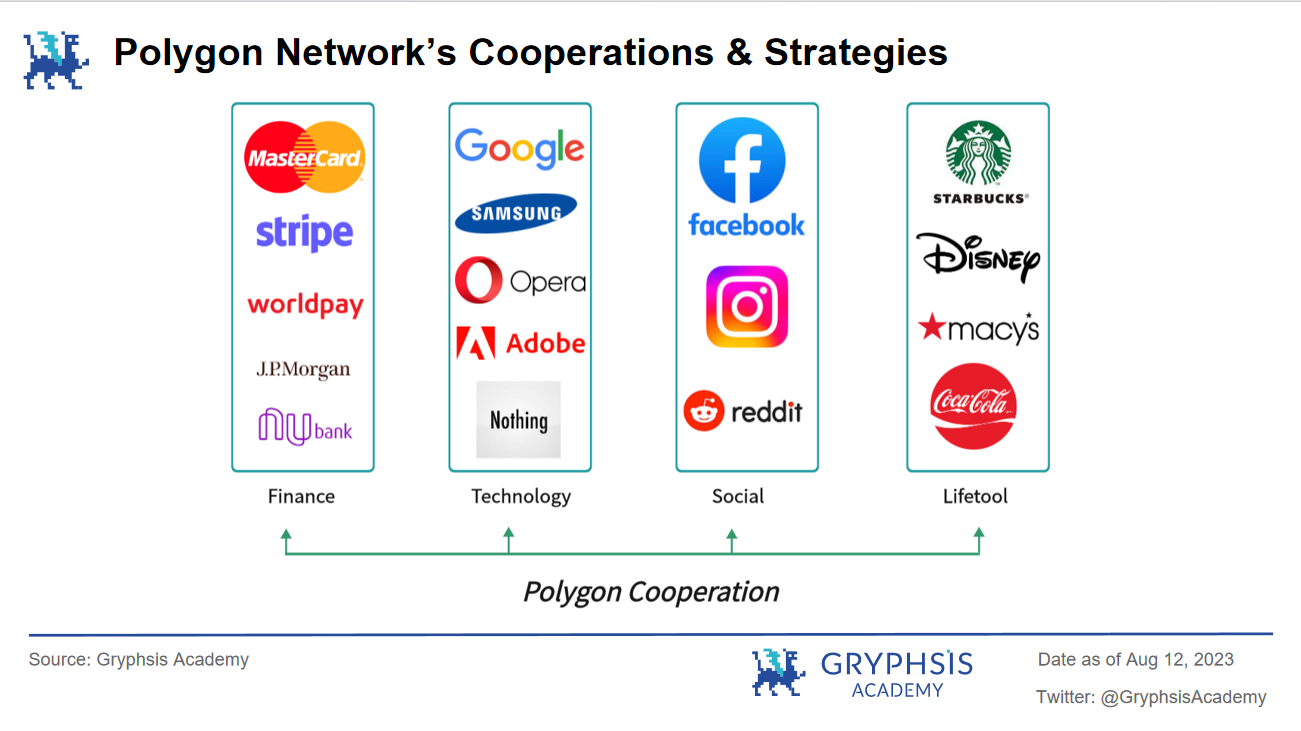

In addition, the way Polygon promotes ecological development through business cooperation is also eye-catching:

Country: Working with India to issue “caste” certificates on Polygon to stop fraudulent claims for government benefits by vulnerable groups; working with Singapore to facilitate cross-trading of digital Japanese yen and Singapore dollars using Polygon and Aave.

Finance: Partnering with MasterCard payment giant to launch MasterCard Artist Accelerator to help music artists learn how to expand their brands by minting NFTs and building online communities; WorldPay (payment giant), as a subsidiary of FIS Group, WorldPay has added support for Polygon USDC support.

Technology: Cooperating with software giants such as Adobe and PS developers to integrate NFT into its social platform Behance; BigQuery, a big data analysis service owned by Google, adds support for Polygon blockchain data; Samsung issued a mobile phone through Polygon that can be used in the Metaverse NFT worn in the platform Decentraland.

Social: Metas Facebook and Instagram plan to develop NFT markets based on Polygon and integrate them into the two platforms, allowing users to create and sell their own NFTs; Reddit launched the NFT series Collectible Avatars on Polygon.

Life: Starbucks launched the loyalty program Odyssey through the Polygon network; became one of the six companies selected for the 2022 Disney Accelerator Program; collaborated with Coca-Cola artists to launch 136 NFTs to pay tribute to the brands 136-year history.

Games, music, entertainment, fashion and beauty, sports, cars, celebrities...

This business approach can actually be applied to its Polygon 2.0 solution. Adapt its hyperchain network to enterprises, invite traditional business institutions to deploy it, and open up the link between the blockchain and the business world. These cooperations can also bring more high-quality projects to Polygon 2.0, promote its ecological development, and form a positive cycle.

Overall, the influence and breadth of cooperation between Polygon and traditional Web2 industry giants is likely to become the preferred blockchain network for web2 users and world enterprises to adopt in the next 10 years. If these resources can be effectively utilized, this is likely to be a potential project party for the future Polygon 2.0 hyperlink network.

3. Token empowerment

When ZK and OP, which use Rollup as their main technology, launch the Stack solution, how should they design an economic model to improve the value empowerment of this token? Compared with L2 Stacks, CP’s token empowerment does not have so many obstacles.

For example, in Cosmos, although each chain has its own ecology and tokens in the initial version, it is difficult for $ATOM to play its role. However, at the Cosmos 2.0 conference, the team decided to use $ATOM as the Hubs Gas charging standard, allowing custom chains to share security with the Hub. In Polkadot, the current $DOT supports network governance, Treasury, and slot auctions. In the upcoming version 2.0, the original auction will be turned into Coretimes market.

This is also the biggest difference from CP, because ZK and OP are both L2 of Ethereum, and their own value is to solve the expansion problem of L1. All transactions need to be verified by smart contracts deployed on L1, and only the confirmed assets are considered Only with real money can users trust L2, so Gas is all ETH.

In other words, L2 adds clothes to L1. It not only helps L1 achieve expansion, but also enhances the credit and value of L1 tokens for every transaction processed, and L2 can never truly break away from L1. This is why, under the vision of hyperchain, how L2 realizes the distribution of tokens is particularly important.

Although there is currently no detailed solution, the above-mentioned EVM L2 does not yet explain how the native token of this chain will obtain driving force from the hyperchain network. However, you can consider the following points to design an economic model:

Governance of L2 network (refer to Polkadot):

Although it is inevitable to use ETH as the underlying token of the ecosystem, for network governance, the use of L2s native tokens is more acceptable.

To participate in the Stack ecosystem, hyperlinks must hold a certain number of native tokens;

Token holders can participate in network governance, voting, parameter adjustment and other governance activities to add empowerment to the token.

Establish a governance center/treasury: As an ecological governance institution, it will retain L2 autonomy while conducting unified value management;

Hyperchain fee allocation (refer to Cosmos):

When building a cross-chain network, Layer 2 can learn from Cosmos practice of using native tokens to participate in cross-chain fee distribution. Although running smart contracts on Layer 2 still requires ETH to pay gas fees, you can consider using L2s native token to pay for the costs incurred by cross-chain interoperation between hyperchains.

For example, in Cosmos, $ATOM is used to pay IBC cross-chain handling fees, and will also give token rewards to cross-chain validators who participate in verification. Then by analogy, in L2 Stacks, when transferring assets across hyperchains, you can set a certain cross-chain handling fee, which must be paid with native tokens; you can also extract a proportion of the cross-chain income and distribute it to the mortgagors of the tokens ; In addition, the development and verification of some cross-chain functional modules can also be incentivized through their tokens.

This not only maintains the core role of ETH in the Ethereum ecosystem, but also allows the $OP token to play its governance and value transfer functions in the cross-chain network. If designed properly, a positive incentive mechanism can be formed to promote the development of the Optimism cross-chain network.

Rent collection model (refer to Ethereum):

On August 25, Base launched an economic cooperation agreement with OP: Base will provide OP with two models of income, 2.5% of sorter income or 15% of profit (whichever is higher); and OP will provide Base with 2.75% of $OP.

The release of this plan immediately triggered extensive discussions. Based on the issuance and price of $OP, it is inferred that the total value of OP’s tokens to Base is approximately US$177 million. At the same time, the valuation of the Base chain is also used to infer a 15% profit. , approximately US$1.1 billion, equivalent to OP’s 15% stake in Base. Not only that, even if the 2.5% sorter procedure is adopted, it can essentially be understood as rent collection by the OP.

In the past Ethereum network, as a ToB underlying chain, other interactive actions were outsourced to L2, and part of each fee generated on L2 was allocated to L2 as execution fee, and the remaining part was given to L1 as security settlement. Ethereum revenue sources. So this move by OP and Base can be regarded as creating an alternative rent collection model for L2.

Although it is unlikely to use the L2 native token as the gas unit of the hyperchain, ETH is a consensus token after all. However, if L2 is regarded as a contractor of Stack, it is responsible for contracting network construction, introducing investment, and helping to build the ecosystem. What Hyperlink has to do is to deliver a part of the profit. This profit model is backed by a super L2 like OP. Judging from the resources, it is indeed very attractive.

Mutual empowerment with project parties:

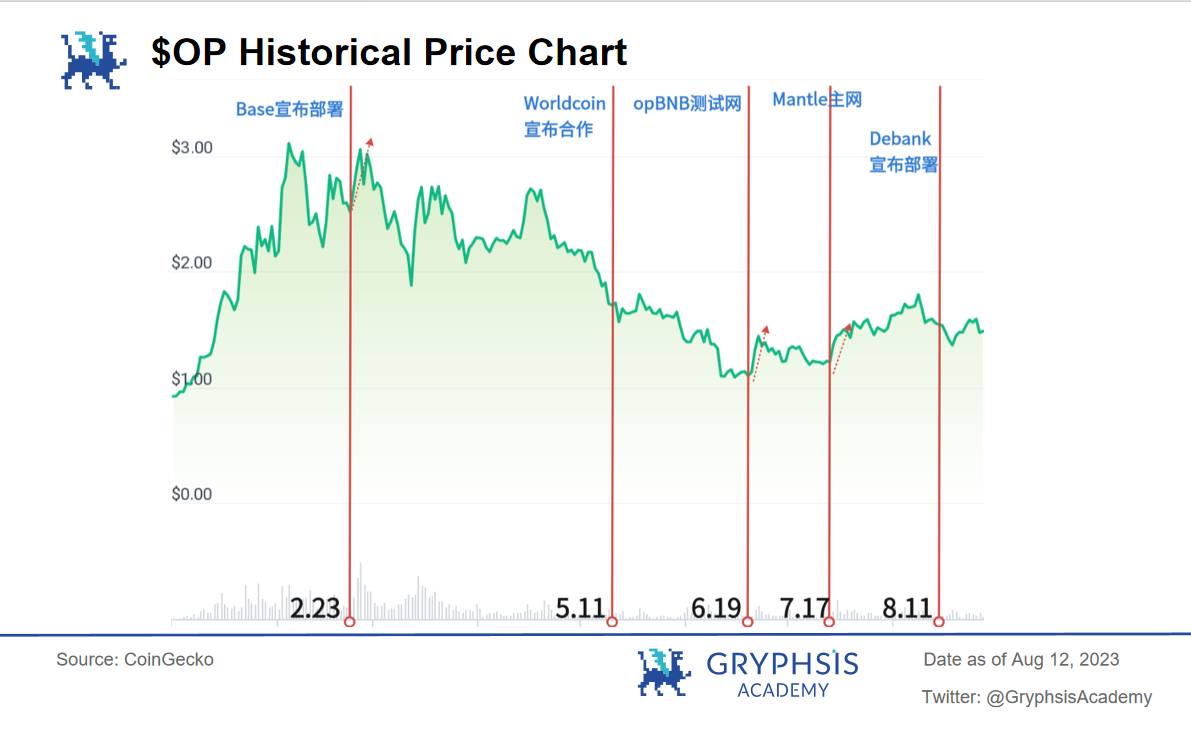

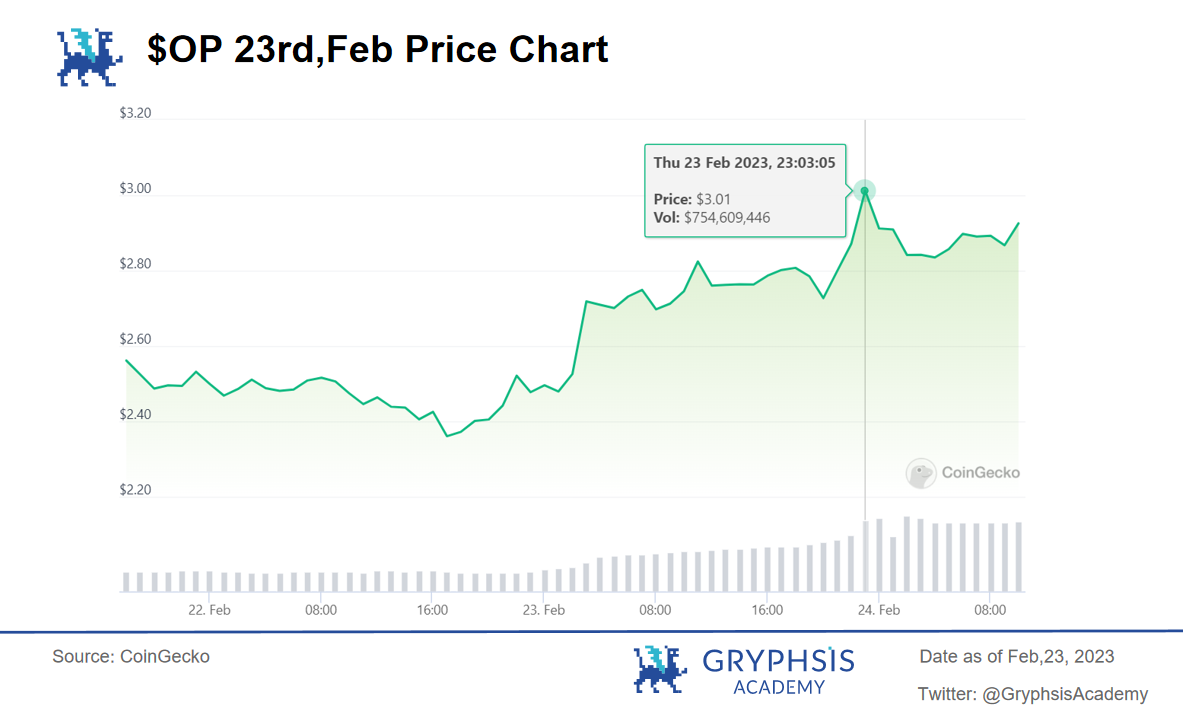

Taking OP Stack as an example, currently opBNB, ZORA, Base, Mantle, Worldcoin, and Debank have joined OP Stack one after another, which has a greater impact on the price of OP. However, due to timeline limitations, it is impossible to intuitively see the growth trend in a single day, so , we temporarily select the price change of $OP on the day Base announced the deployment:

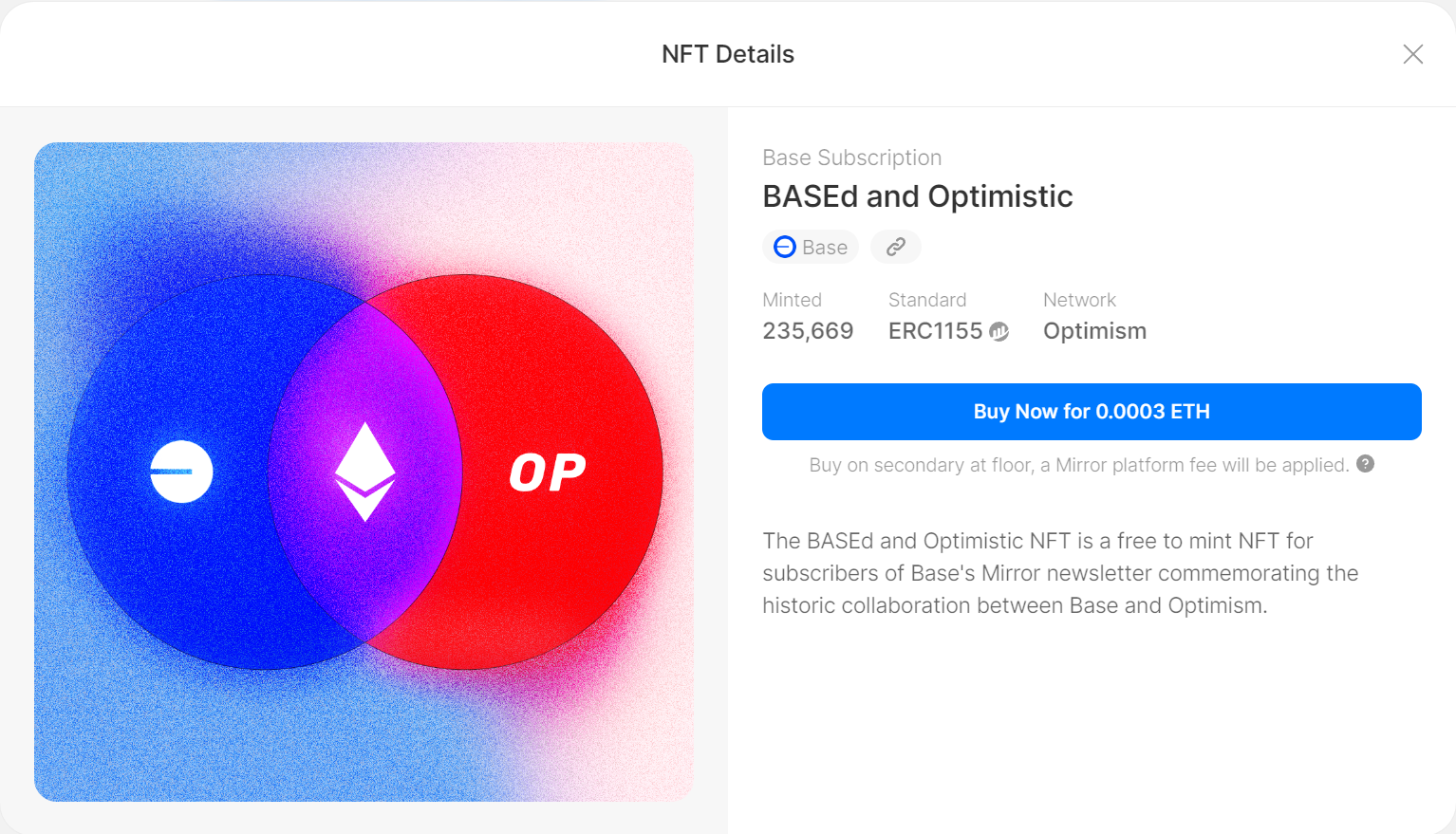

It can be seen that on February 23, the price of $OP rose to $3.01. The high probability is because Base released the cooperative NFT on the OP main network around 10.30 pm, and then the price began to soar to the highest value around 11 pm, and then fell back.

Since Binance announced the concept of opBNB, and with high-quality projects such as Base Protocol, ZORA, Mantle, and Debank joining the OP Stack, it is undeniable that the popularity and halo these projects have brought to OP will attract more project parties. OP Stack generates interest.

When the project party decides to deploy on OP Stack, purchasing and holding $OP tokens is a very reasonable choice, not only to participate in the ecology, but also as a value investment.

$OP will definitely be useful in the hyperchain ecosystem in the future, and holding $OP can give the project party more rights in the future. In addition, because the project party and OP are essentially a community of interests, when more and more projects are deployed on the OP Stack, the value of $OP tokens will increase, which will directly benefit the project party. In order to develop the ecosystem, OP Stack will also actively support/promote project parties, bringing positive exposure and growth to the project parties. This win-win situation will encourage more projects to join and form a positive cycle. And in this regard, the OP seems to be off to a good start.

In this way, both developers and users can fully participate in the ecosystem and enhance their sense of identity and participation in the ecosystem. For L2, it also increases the usage scenarios of tokens and mobilizes network participants more efficiently.

3. Summary

At this point, the CP VS Layer 2 Stacks series of articles is completed, and the entire series of articles will be summarized next.

The battle between CP and Layer 2 hyperchain networks is essentially a hope to better improve the blockchain infrastructure. For a blockchain team, it is very energy-consuming to implement all network and consensus codes, including security, cryptography, etc., not to mention optimizing their own business logic.

If a complete open source code framework emerges at this time, which prepares network, consensus, communication and other elements for you, and you only need to deploy it according to your business logic, then the network technology will be greatly realized. Specialized and supported interoperability also opens up the Roman road to the prosperity of the entire ecosystem.

However, at present, it seems that CPs technology is more mature than Layer 2, but L2s ecological community is more prosperous. However, if L2 wants to develop a hyperlink network based on this foundation, they should focus on how to solve the technical risks of this chain.

In addition, there is another interesting phenomenon, that is, the Ethereum Foundations definition of L2 is very vague. The Ethereum official website also states that there is currently no officially certified L2. We can predict the impact of Ethereums attitude on L2. If we stand from the perspective of L1, we definitely hope to outsource only the execution to L2 and enjoy the rent ourselves. The definition of L2 must certainly be in line with its own interests.

If one day L2s hyperchain network abandons ETH and uses its own token to build a portal, what will Ethereum do?

However, whether it is a L0-L1 multi-chain ecology such as CP, or an L2-L3 multi-chain ecology brought by Layer 2 Stacks, each has its own unique advantages and applicable scenarios. In addition to the possibility of gradually dying out due to their own operational problems, these different multi-chain solutions are more likely to survive, and through different connection methods, they will eventually realize the integration of different public chains and multi-chain ecology. Full chain ecosystem. As for who can capture more market share in such a full-chain future, it depends on how each project operates in the future.

References:

https://medium.com/@eternal1 997 L

https://tokeneconomy.co/the-state-of-crypto-interoperability-explained-in-pictures-654cfe4cc167

https://research.web3.foundation/Polkadot/overview

https://foresightnews.pro/article/detail/16271

https://messari.io/report/ibc-outside-of-cosmos-the-transport-layer?referrer=all-research

https://stack.optimism.io/docs/understand/explainer/#glossary

https://www.techflowpost.com/article/detail_12231.html

https://gov.optimism.io/t/retroactive-delegate-rewards-season-3/5871

https://wiki.polygon.technology/docs/supernets/get-started/what-are-supernets/

https://polygon.technology/blog/introducing-polygon-2-0-the-value-layer-of-the-internet

https://era.zksync.io/docs/reference/concepts/hyperscaling.html#what-are-hyperchains

https://medium.com/offchainlabs

Disclaimer: This report is produced by@sldhdhs 3 , a student at @GryphsisAcademy, in@Zou_Blockand@artoriatechOriginal work completed under the guidance of . The authors are solely responsible for all content, which does not necessarily reflect the views of Gryphsis Academy, nor the views of the organization that commissioned the report. Editorial content and decisions are not influenced by readers. Please be aware that the author may own the cryptocurrencies mentioned in this report. This document is for informational purposes only and should not be relied upon for investment decisions. It is strongly recommended that you conduct your own research and consult with an unbiased financial, tax or legal advisor before making any investment decisions. Remember, the past performance of any asset does not guarantee future returns.