Original author: Jason Jiang

Recently, Coinbase announced that Singapore users must provide additional counterparty information when depositing or withdrawing virtual assets from their accounts starting from September 5th. Coinbase stated that these measures are implemented to comply with the travel rule requirements set by the Monetary Authority of Singapore (MAS).

In addition to Coinbase and other private entities, crypto-friendly regions and countries such as Hong Kong, Japan, Portugal, and the United Kingdom have also announced the implementation of the travel rule this year, requiring virtual assets (VA) and virtual asset service providers (VASP) to comply with relevant obligations. So far, more than 30 countries or regions worldwide have legislated the travel rule, and more than 10 countries or regions have started implementing related regulatory rules.

1. What is the travel rule?

When you go to the bank or make interbank transfers through your mobile phone, you are usually required to provide a lot of information, such as the names and contact numbers of both parties, recipient's account, beneficiary bank name, beneficiary bank location, and transfer method. It may seem complicated, but you should be familiar with it by now.

However, in previous virtual asset transactions, all that was required was a wallet address to complete the transfer through an exchange or other channels. The anonymity and convenience of these transactions have made virtual assets popular among many users. But can you still accept it if VASP also requires additional personal identification information during virtual asset transactions?

Perhaps you're not used to it yet, but as the travel rule becomes widely adopted, these requirements are becoming more common.

In 1996, the US Financial Crimes Enforcement Network (FinCEN) introduced the earliest "travel rule" to address money laundering risks in traditional financial markets, requiring US financial institutions to provide proven information about both parties involved in the transfer to the receiving institution when the transfer amount exceeds $3,000.

These rules initially applied only to traditional currency transactions. However, in 2019, FinCEN determined that the travel rule also applied to VASP, which are considered money services businesses (MSB) or money transfer businesses in the United States. The travel rule entered the virtual asset market.

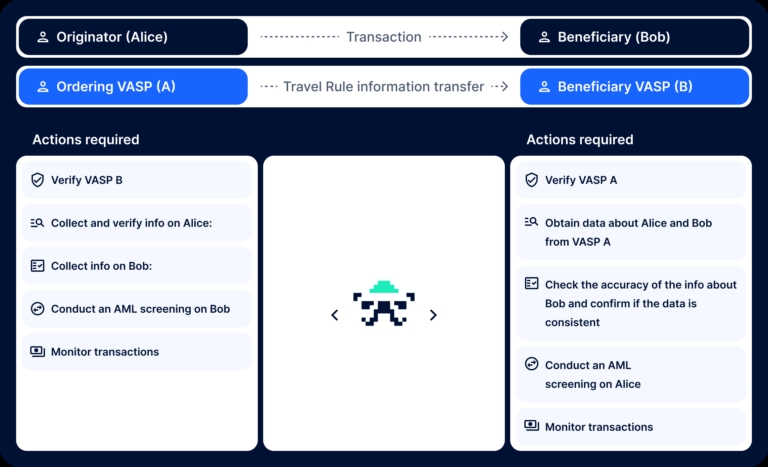

In the same year, the Financial Action Task Force (FATF), a global anti-money laundering regulatory body, proposed regulatory recommendations applicable to any country or region based on FinCEN's travel rule. The FATF travel rule requires VASPs engaged in VA transfers to obtain "the required, accurate originator information and required beneficiary information" and share it with the counterparty VASP or financial institution during or before the transaction.

Among them, the number of information to be collected depends on the amount of the transfer. FATF suggests that countries adopt a minimum threshold of $1,000 for VA transfers.

If the transfer amount is below the threshold, VASP only needs to collect simple information such as the names of both parties and the VA wallet addresses for each transaction.

If the transfer amount exceeds the threshold, VASP must collect more data, including the names of both parties, the accounts (such as wallet addresses) used for processing the transaction, as well as the actual geographical location and identity information of the initiator.

Since the personal data of the parties involved in these transactions "travels" between different institutions along with the transfer, this rule is metaphorically called the "Travel Rule".

2. In addition to the Travel Rule, you may also need to know about the "Sunrise Problem"

If we see a wonderful concert, an intense game, or a breathtaking sunrise, we always want to share the joy with our loved ones or friends in a timely manner. Thanks to technological advances, we can easily do this, even if the other person is on the other side of the world.

However, this global connectivity is difficult to achieve in the virtual asset market: because of the significant differences in regulatory environments and attitudes among countries, the virtual asset market is experiencing increasingly serious "delay" issues despite its rapid growth. The communication barriers and expected differences between compliant and non-compliant institutions, regions, and countries are known as the "Sunrise Problem".

Let's take an example. Suppose Country A has implemented the Travel Rule while Country B has not. When VASP institution C, operating in Country A, processes relevant transactions and submits a request for customer transaction information to VASP institution D, operating in Country B, in accordance with the Travel Rule, what do you think will happen?

- Institution D may not respond to institution C's request due to the need to comply with different regulatory rules, and institution C may lose customers or engage in non-compliant behavior as a result.

How to solve the sunrise problem and better serve global users with virtual assets?

If the virtual asset industry wants to become a truly compliant industry, it must ensure that all parties involved can understand and participate in regulation synchronously and frictionlessly. This means that the most direct way to solve the sunrise problem is to have more VASPs and countries/regions adopt and implement the travel rule.

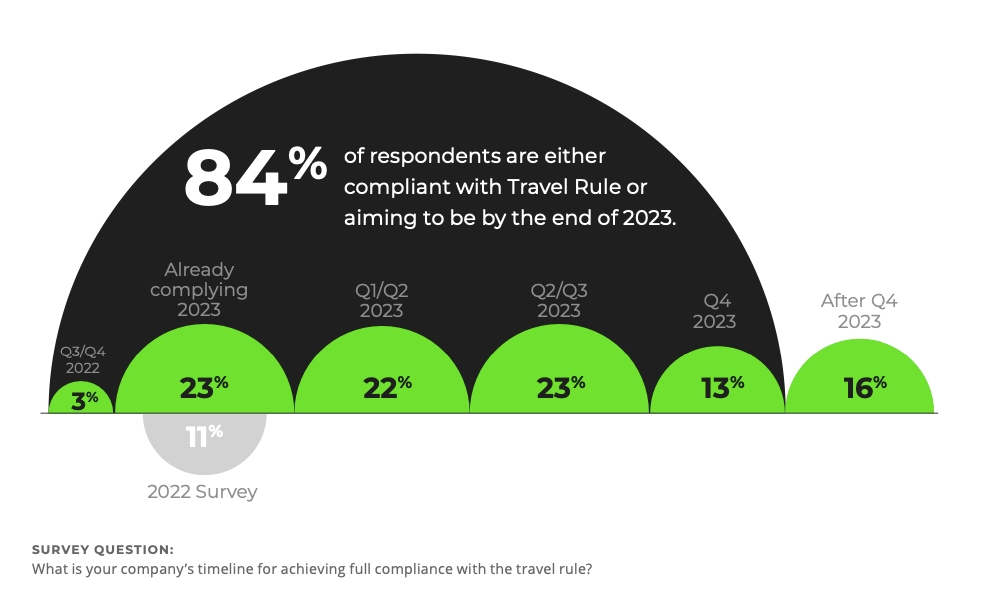

According to the annual Cryptocurrency Travel Rule Status Report by Notabene, the willingness of the cryptocurrency industry to adopt the travel rule is increasing, and the majority of VASPs aim to achieve full compliance by 2023.

Currently, exchanges like OKX, Coinbase, Coinone, BitFlyer have announced their support for the travel rule. Among them, OKX announced its integration with Notabene in July of this year and will gradually implement travel rule measures to ensure global compliance standards.

Furthermore, the market needs more suitable and interoperable technical solutions or solution combinations to meet FATF travel rule and local compliance obligations. The Onchain AML compliance solution launched by OKLink provides security for virtual asset transactions by meeting the travel rule requirements and customizing services according to regional regulatory requirements.

Among them, Onchain AML's transaction monitoring product KYT currently supports transaction screening that needs to comply with the Travel Rule, helping VASPs better meet regulatory requirements.