Hotairballoon has selected important information from the cryptocurrency market, financing situations, as well as on-chain data from popular tracks like LSD and RWA. Additionally, it has also compiled a list of recently unlocked projects for reference.

1. Important Information in the Cryptocurrency Industry Last Week

1.1 Policies/Regulations

1. Sichuan Province cracks down on cryptocurrency mining: One county has cleared 191 small hydropower-related equipment since 2021.

On September 4th, according to the news from The Paper, various regions in Sichuan Province have been conducting investigations and rectification work on cryptocurrency mining to prevent any resurgence. The Financial Work Bureau of Liangshan Prefecture recently stated on its official website that in early August, it supervised and inspected the investigation and rectification work related to mining in hydropower stations, and conducted a re-examination of the confirmed shutdown cryptocurrency mining projects, urging townships under hydropower stations to implement the responsibility system for the rectification of cryptocurrency mining activities.

11. The Taiwan Financial Supervisory Commission is expected to announce the "Guidelines for Managing Virtual Asset Platforms and Trading Businesses" by the end of this month.

On September 7th, Yahoo News reported that Taiwan's Financial Supervisory Commission officials confirmed that the commission recently held a public hearing with industry players to collect feedback. It is expected that the "Guidelines for Managing Virtual Asset Platforms and Trading Businesses (VASP)" will be officially announced by the end of this month, and industry associations will further formulate self-regulatory standards.

12. The U.S. Department of the Treasury and the Internal Revenue Service (IRS) issued a proposal regarding reporting requirements for cryptocurrency brokers.

On September 7th, according to Cointelegraph, the U.S. Small Business Administration (SBA) Advocacy Office revealed that the U.S. Department of the Treasury and the IRS recently issued a proposal for reporting requirements for cryptocurrency brokers. The proposal requires brokers known as "digital asset intermediaries" to provide information on profits and losses during the sale of cryptocurrency assets. However, this requirement will take effect on January 1, 2026, or later.

15, Hong Kong Web 3.0 Association suggests that the government establish an inter-departmental working group to study and implement the necessary policies, laws, and measures for the development of digital assets.

On September 8th, according to Hong Kong News Network, Mr. Chan Tak-lam, President of the Hong Kong Web 3.0 Association, submitted a proposal in the government policy address, outlining four suggestions. They are as follows: (1) Establish a self-controllable and public-trusted open permissioned blockchain public chain in Hong Kong; (2) Enhance the professionalism and technical capabilities of Hong Kong Web 3.0; (3) Speed up the implementation of stablecoins in Hong Kong; (4) Establish an inter-departmental working group to provide specific recommendations on existing laws, policies, and measures.

16, Uzbekistan's President signs legislation amendment on cryptocurrency mining permits

On September 10th, Forklog reported that the President of Uzbekistan has signed legislation amendment, which includes permits for cryptocurrency mining. The statement mentioned that the laws are being supplemented and amended to establish new types and sub-types of licensing activities such as cryptocurrency exchanges, mining pools, cryptocurrency storage, and mining activities.

(II) Project Information

1. dYdX community has passed the proposal of "V4 adoption and migration of DYDX to the dYdX chain."

On September 4th, according to the Snapshot page, the dYdX community's proposal regarding the "V4 adoption and migration of DYDX token to the dYdX chain" has received a 100% voting support.

2. Lido Ethereum staking ratio reaches 32.7%, causing concerns about "weakening Ethereum's decentralization features" within the community.

On September 4th, according to Decrypt's report, Dune Analytics data shows that the total value of staked ETH increased by nearly 95% from slightly over $22 billion to about $41.6 billion. Among them, Lido accounts for 32.7% of all staked ETH on the market, nearly four times the ratio of the second-largest Coinbase at 8.7%. The dominant position of Lido is causing concern among some community members who believe that Lido's growing influence is weakening Ethereum's overall decentralization features.

3. Matter Labs CEO proposes the establishment of an "Ethereum Supreme Court" mechanism to resolve on-chain disputes. 4. OKX: Hong Kong license application enters the final stage, hoping to obtain the license in Q1/Q2 next year. 5. ssv.network launches new testnet Jato-v2 and opens it to the public, Jato-v1 will be closed on September 18th.On September 5th, according to the official blog, Ethereum staking infrastructure ssv.network announced that the new testnet Jato-v2 has been launched and is officially open to the public. This testnet is the same version as the one currently running on the mainnet and provides a test environment similar to the mainnet.

6. Vitalik: Future Ethereum upgrades may allow full nodes to run on mobile phones

On September 5th, during the Korean Blockchain Week, Vitalik Buterin, co-founder of Ethereum, said, "In the long run, we have plans to maintain fully validating Ethereum nodes that you can run on your phone."

7. MetaMask launches "Sell" feature that allows cryptocurrencies to be exchanged for fiat currencies

On September 5th, MetaMask announced the launch of its latest feature "Sell," which allows users to exchange cryptocurrencies for fiat currencies through MetaMask Portfolio and send the fundsTo bank account. The feature is currently available in the United States, United Kingdom, and some parts of Europe, initially supporting ETH on the Ethereum mainnet and planning to soon expand to native gas tokens on Layer 2 networks.

8. LayerZero launches on the Zora Network mainnet, allowing users to mint the commemorative NFT "LayerZero Zorb" for free.

On September 5th, LayerZero Labs announced on Twitter that LayerZero has launched on the Zora Network mainnet, enabling users to mint the commemorative NFT "LayerZero Zorb" for free. Additionally, applications built on LayerZero can now be extended to the Zora Network, and Zora Network developers can integrate with other parts of the LayerZero network.

9. Coinbase launches a crypto lending platform for institutional customers, raising $57 million.

On September 6th, according to CoinDesk, Coinbase has launched a new crypto lending service for institutional customers in the United States, filling the gap between Genesis and Bloc.kFi and other companies left behind after bankruptcy. According to a document from the U.S. Securities and Exchange Commission (SEC), as of September 1st, Coinbase has raised $57 million for the platform. According to an insider, customers can lend funds (primarily cryptocurrency) to Coinbase and receive collateral worth more than the loan value.

10. dYdX will launch a decentralized order book exchange on Cosmos, and dYdX on Ethereum will be shut down in a few months.

On September 6th, according to Cointelegraph, CEO Charles d'Haussy of the dYdX Foundation stated at the 2023 Korea Blockchain Week that dYdX plans to provide a "purely decentralized" order book exchange when migrating its ecosystem from the Ethereum network to the cross-chain network Cosmos.

11. Base Ecosystem Fund announces six investments.

On September 8th, Coinbase's L2 blockchain Base officially announced the Base Ecosystem Fund, which includes six investments.

system Fund has completed investments in six projects, namely: Avantis, a synthetic derivative protocol based on oracle; BSX, a decentralized limit order book; Onboard, an on-chain self-custody service (participated in a $1.9 million financing round); OpenCover, an L2 insurance aggregator in collaboration with Nexus Mutual and other underwriters (participated in a $4 million seed funding round); Paragraph, an on-chain creator platform; and Truflation, an on-chain financial oracle. Base will work with the respective teams to promote the development of the Base ecosystem and onboard more builders and users to the blockchain. 12. MakerDAO has once again increased its RWA assets by $50 million through BlockTower Andromeda. On September 8th, according to Makerburn data, MakerDAO increased its RWA assets by $50 million through BlockTower Andromeda, primarily investing in short-term US Treasury bonds. The annualized interest rate of these assets is 4.5%. Additionally, the total RWA assets of the protocol currently amount to $2.513 billion. 13. Stargate DAO has passed the proposal to "reduce the block confirmations and increase fees for the cross-chain bridge, Aptos Bridge."9th September, Snapshot page shows that the proposal for "reducing the number of block confirmations and increasing fees for the cross-chain bridge Aptos Bridge" has been approved with a support rate of 92.21%. The proposal states that Stargate DAO now owns Aptos Bridge, becoming the largest cross-chain bridge to Aptos. Therefore, the proposal suggests reducing the cross-chain block confirmations to 260 (approximately 1 minute). Additionally, the proposal recommends charging a fee of 0.07% to prevent the bridge from being used for free transfers. 14. Linea Leader: Ethereum EIP-4844 expected to reduce rollup costs by 10 times. According to Cointelegraph, Nicolas Liochon, the leader of Consensys' zkEVM Linea, stated that danksharding (EIP-4844) is expected to further reduce Rollup costs by 10 times. Proto-danksharding, also known as Ethereum Improvement Proposal (EIP) identifier EIP-4844, aims to lower Rollup costs. Rollup typically processes off-chain transactions and data in batches and submits computational proofs to the Ethereum blockchain. I apologize for not being able to preserve the structure and tags of the original content.m ln lo lp lq lr ls lt lu lv lw lx ly eo bj" data-selectable-paragraph="">15, Synthetix will extend the OP incentive program for perpetual contract trading by five weeksOn September 9th, the Synthetix Treasury Council announced that starting from September 13th, the OP incentive program for perpetual contract trading will be extended by five weeks, with a weekly distribution of 100,000 OP, totaling 500,000 OP. The reward will be capped at the total generated fees.

16, Data: The total amount of Ordinals inscriptions has exceeded 30 million

On September 10th, according to Dune data, the total amount of Ordinals inscriptions in the Bitcoin NFT protocol has exceeded 30 million, currently reaching 30,329,662 inscriptions. The current total transaction fees are 1,998.1707 BTC (approximately $51,681,834).

(III) Others

On September 7th, CCData data showed that the total trading volume of cryptocurrency spot and derivatives contracts in August shrank by 11.5% to 2.09 trillion US dollars. The spot trading volume of centralized exchanges has declined for the second consecutive month, dropping by 7.78% to 475 billion US dollars, the lowest level since March 2019. The derivatives trading volume has dropped by over 12% to 1.62 trillion US dollars, the second lowest since 2021, and the share of derivatives in the total market activity has continued to shrink for the third consecutive month to 77.3%.

4. Survey: Cryptocurrency market weakness and regulatory risks did not prevent asset management companies from investing in cryptocurrencies.

On September 7th, according to CoinDesk, a report released on Wednesday by Coalition Greenwich, a subsidiary of Indian credit rating company Crisil, and cryptocurrency data provider Amberdata, showed that the ambiguous regulatory environment and the weakness of the cryptocurrency market did not suppress the interest of asset managers in digital assets. The report, titled "Digital Assets: Managers Driving Data Infrastructure Demand," showed that nearly half of the 60 professional buyers surveyed from US and European asset management companies and hedge funds actively manage digital assets during the period from May to June.

2. Last week's investment and financing situation

1. LSD platform Infinimos completed a $3 million seed round of financing with a valuation of $10 million, led by DG Capital.

Infinimos, a liquidity staking derivative platform in the Cosmos ecosystem, announced the completion of a $3 million seed round of financing with a valuation of $10 million, led by DG Capital. The funds will be used to accelerate the platform's development, expand the team, and establish strategic partnerships.

2. Privacy DEX project Brine Fi completed a $16.5 million financing round with a valuation of $100 million, led by Pantera Capital.

According to CoinDesk, DEX project Brine Fi completed a $16.5 million financing round with a valuation of $100 million. The round was led by Pantera Capital, with participation from Elevation Capital, StarkWare Ltd, Spartan Group, Goodwater Capital, Upsparks Ventures, and Protofund Ventures.

2. Web3 domain name and TLD provider Freename completed a $2.5 million seed round of financing, led by Sparkle Ventures

Web3 domain name and TLD provider Freename announced the completion of a $2.5 million seed round of financing, led by Sparkle Ventures, with participation from Blockchain Founders Fund, Golden Record Ventures, Abalone Asset Management, and Sheikh Mayed Al Qasimi.

3. Blockchain intellectual property protocol Story Protocol completed a $25 million Series A financing, led by a16z crypto

According to Businesswire, blockchain intellectual property protocol Story Protocol announced the completion of a $25 million Series A financing, led by a16z crypto, bringing Story Protocol's total funding to over $54 million.

4. Pop Social completes $4 million financing, with participation from Chainlink and others.

Web3 AI social infrastructure platform Pop Social announced the completion of a $4 million seed round and strategic financing, with participation from Fundamental Labs, Ceras Ventures, Chainlink, Cointelegraph, Fusion Labs, Promatrix Capital, as well as angel investors from Binance and OKX former executive teams.

(III) NFT/Chain Games

1. Chain game project BlockGames completes Series A financing and is selected for Google Cloud Web3 Startup Program.

Chain game project BlockGames is selected for Google Cloud Web3 Startup Program and completes Series A financing. The investors and specific financing amount have not been disclosed.

2. Indian gaming and sports media platform Nazara completes $49.2 million financing, plans to invest in blockchain games

According to Techinasia reports, Indian diversified gaming and sports media platform Nazara Technologies Limited has completed a $49.2 million financing round, with participation from SBI Mutual Fund, SBI Magnum Global Fund and SBI Technology Opportunities Fund.

3. Blockchain game BulletChain completes $2 million private placement financing, will begin internal testing on September 11th

BulletChain, a blockchain game, announced the completion of a $2 million private placement financing, with specific investors undisclosed. The new funds will be used to expand operations. In addition, BulletChain will launch a Beta test from September 11th to 18th, and players can apply for internal testing through an application form.

4. GAM 3 S.GG (formerly Polkastarter Gaming) completes Seed financing of $2 million, led by Mechanism Capital

Polkastarter Gaming announced its rebranding as GAM 3 S.GG and also announced that it has completed a $2 million seed financing round led by Mechanism Capital, with participation from Polygon, Double Peak, ArkStream Capital, LD Capital, ROK Capital, Hyperithm, Snackclub, and Emurgo Ventures.

(IV) Asset Management

1. Cryptocurrency payment startup Kotani completes $2 million pre-seed financing round led by P 1 Ventures

According to TechCrunch, cryptocurrency payment startup Kotani has completed a $2 million pre-seed financing round led by P 1 Ventures, with participation from DCG/Luno, Flori Ventures, and others.

2. Cryptocurrency lending company Trident DigiTrident Digital Group has completed an $8 million seed round financing. WhiteStar Capital and New Form led the investment, with participation from CMT Digital, Joint Effects, and Permit Ventures. Trident CEO Anthony De Martino, who previously served as Risk Strategy Director at Coinbase, focuses on DeFi and derivative trading. 3. RWA credit agreement Helix has completed a $2 million pre-seed round financing, led by Saison Capital and Superscrypt. According to The Block, RWA protocol Helix has completed a $2 million pre-seed round financing, with co-leadership from Saison Capital and Superscrypt, and follow-on investments from Emurgo Ventures, Comma 3 Ventures, Outlier Ventures, Emoote, and others.4. The UK digital bank Zopa has completed a £75 million funding round, with IAG SilverStripe as the lead investor. According to TechCrunch, the UK neobank Zopa has announced the completion of a $93 million (£75 million) debt financing round, with IAG SilverStripe as the lead investor. The company has raised a total of £530 million to date. (5) Other 1. The fintech platform GenTwo has completed a $15 million Series A funding round, with Point 72 Ventures as the lead investor. The Swiss fintech platform GenTwo has completed a $15 million Series A funding round, with Point 72 Ventures as the lead investor. GenTwo will use this funding to expand internationally and develop its platform. GenTwo's PRO platform allows investors to securitize any asset or investment strategy in the form of bankable securities and bring them to the market.I require the HTML translation to English for the given content. Please wait a moment while I process the request.

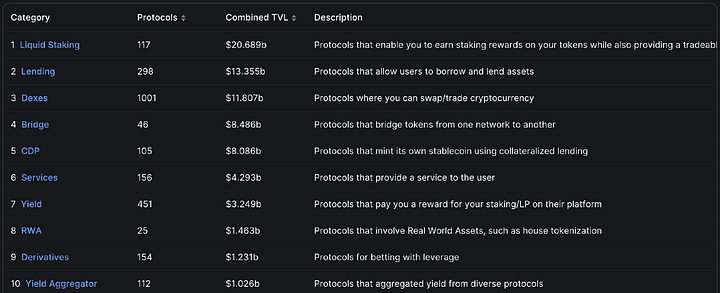

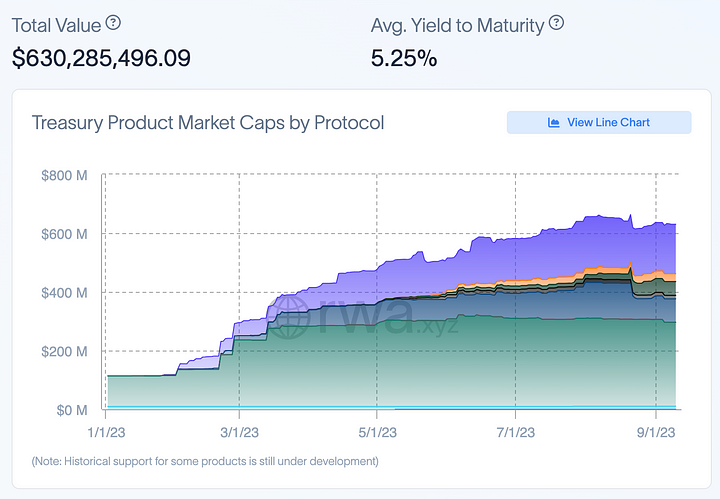

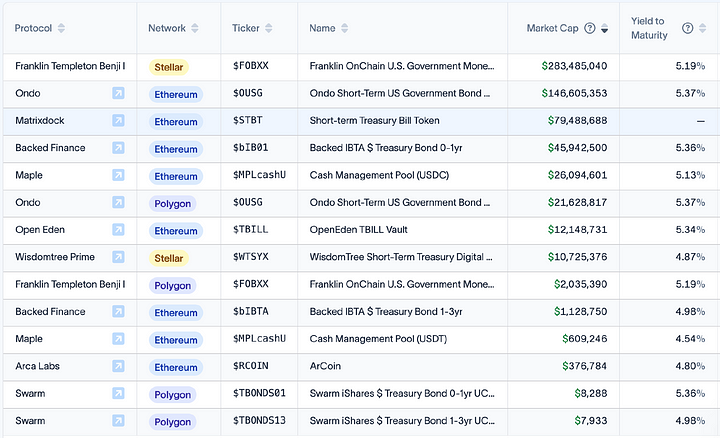

In these RWA (Real World Asset) tokenization projects, including the tokenization of US Treasury bonds and real estate, among others.

According to data from rwa.xyz platform, the tokenization scale of US Treasury bonds reached $630 million, with an average yield of over 5%.

Among these tokenization projects of US Treasury bonds, the Franklin Templeton Benji Investments Market Cap on Steller has the highest market value, reaching $283 million, with a yield of 5.19%.

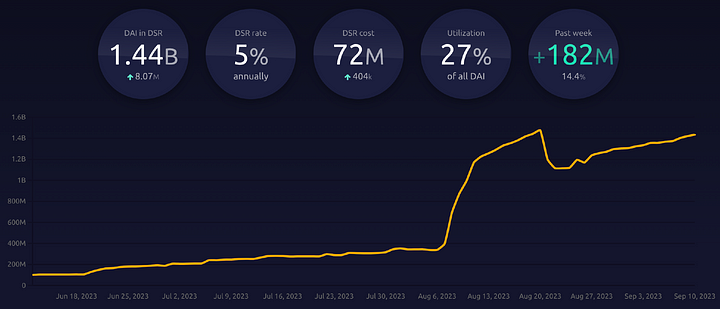

MakerDAO

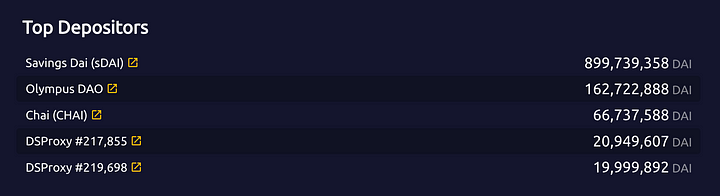

As of the time of writing, the DSR in Dai has increased by 182 million, reaching 1.44 billion, slightly growing compared to last week. The total supply of Dai has increased to 5.33 billion, slightly growing compared to last week. Currently, the DSR accounts for 24.5% of the total supply of Dai, and the DSR deposit rate is 5%.

Among them, sDAI has reached a supply of 899.7 million, slightly increasing compared to last week.

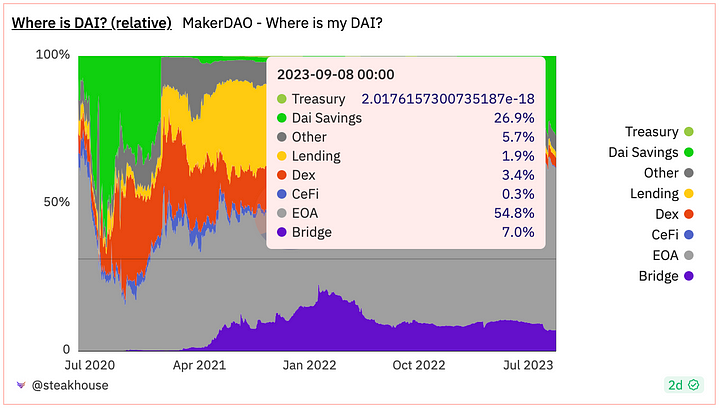

Let's take a look at the distribution of DAI.

DEX and Lending's share of DAI has been declining since October 2022, while the holding rate of DAI in EOA accounts has been increasing, reaching 54.8%, slightly lower than last week. Since the adjustment of the DSR interest rate, the share of DAI in Savings has been growing, currently reaching 22.9%, an increase of two percentage points compared to last week.

Currently, the highest proportions are: EOA, DAI Savings, Bridge.

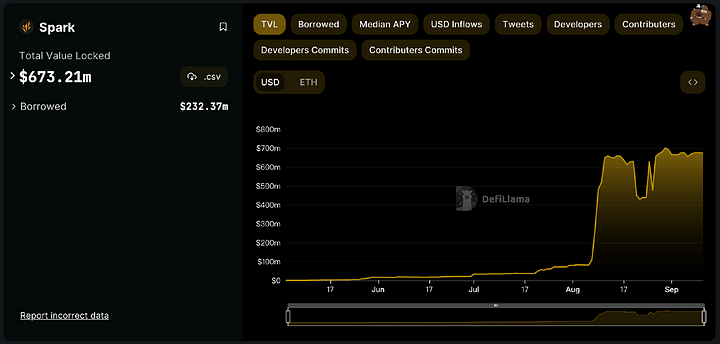

Maker's own loan agreement Spark's TVL reached 670 million, a slight increase from last week.

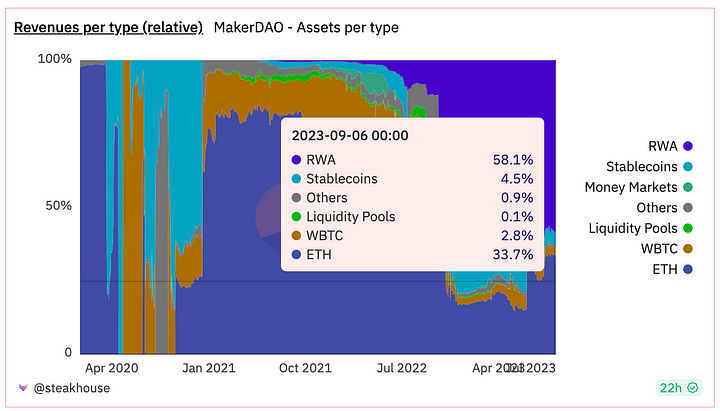

According to data from the dune platform, the proportion of RWA in MakerDAO's revenue has reached 58.1%, which is very high. This is related to MakerDAO's strong layout in the RWA track, and it has slightly increased compared to last week.

(2) LSD

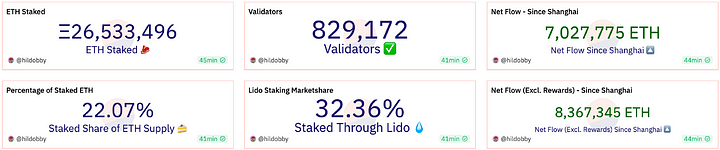

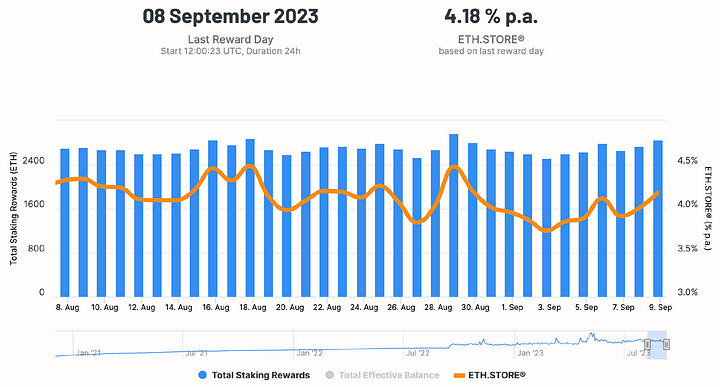

Currently, the amount of ETH staked in the beacon chain has reached 26.53 million ETH, a slight increase from last week, accounting for 22.07% of the total supply of ETH, with nearly 830,000 nodes.

At present, the ETH staking yield rate is approximately 4.18%, and the yield rate is decreasing as the quantity of staked ETH increases.

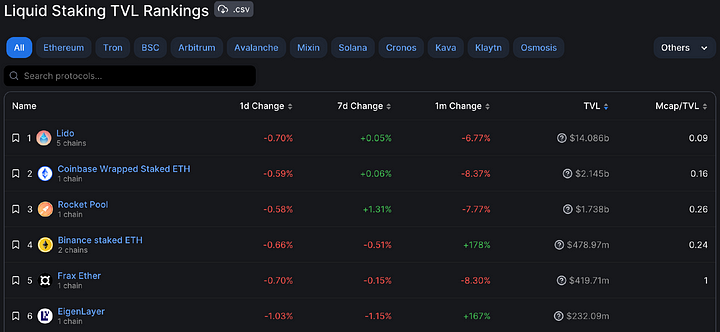

Among the three protocols, in terms of ETH staking quantity, Lido has increased by 0.05% in the past week, Rocket Pool has increased by 1.31%, and Frax has decreased by 0.15%.

Looking at the price performance of the three protocols, LDO has fallen by 3.3% in the past week, RPL has risen by 6.62%, and FXS has fallen by 0.15% compared to last week.

(Three) Ethereum L2

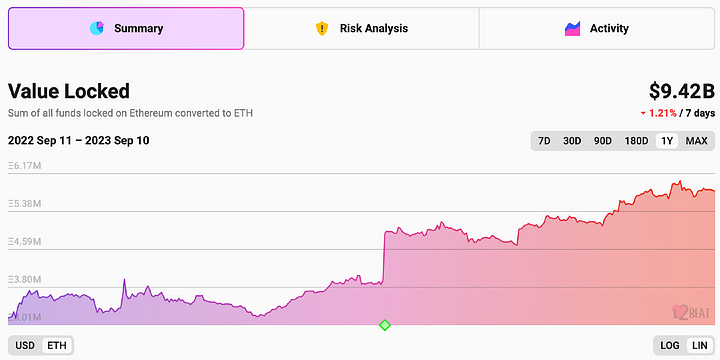

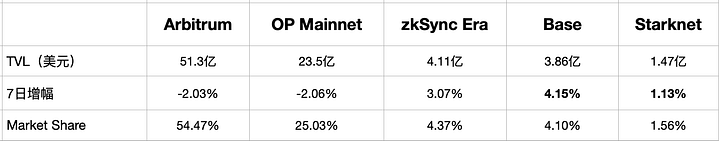

According to the data statistics of the l2 beat platform, Ethereum Layer 2 TVL has decreased by 1.21% in the past week. The current TVL is $9.42 billion, and one of the reasons for the TVL decrease is the decline in ETH price.

In Ethereum Layer 2, Arbitrum still has the highest TVL, accounting for 54.47%, and Base is undoubtedly the fastest-growing recently. The TVL has increased by 4.15% in the past week, reaching 386 million US dollars. Compared to last week, the growth rate has clearly slowed down.

(4) DEX

TVL

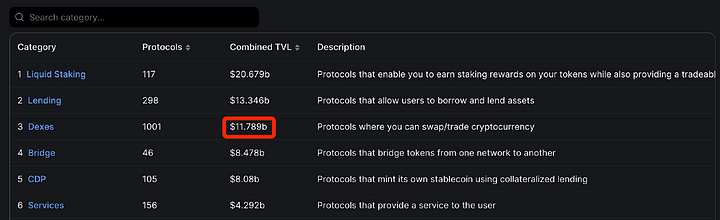

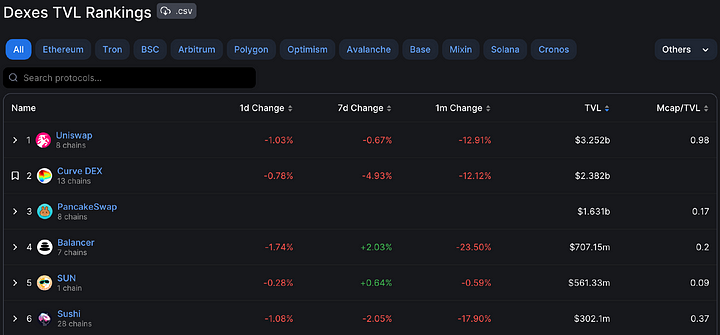

According to defillama's data statistics, the total locked value in the DEX sector is 11.8 billion US dollars, slightly lower than last week.

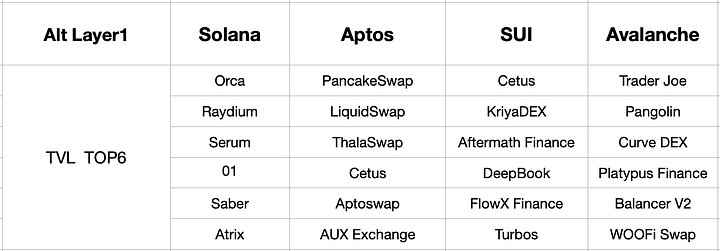

The highest locked volume is Uniswap, followed by Curve, PancakeSwap, Balancer, SUN, and Sushi. Most DEXs' TVL has decreased compared to last week.

Among them, the DEXs with the highest TVL on the Ethereum mainnet are Uniswap, Curve, Balancer, Sushi, and Loopring.

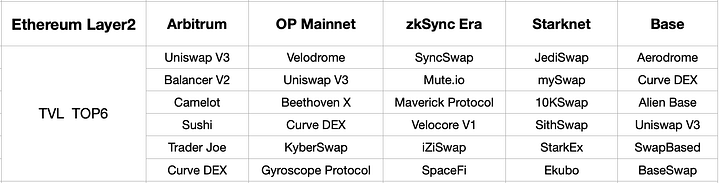

The top 6 DEXs in terms of TVL on Arbitrum, OP Mainnet, zkSync Era, Starknet, and Base chain.

The above is a list of the top 6 DEXs on Layer 1 in terms of TVL.

Trading Volume

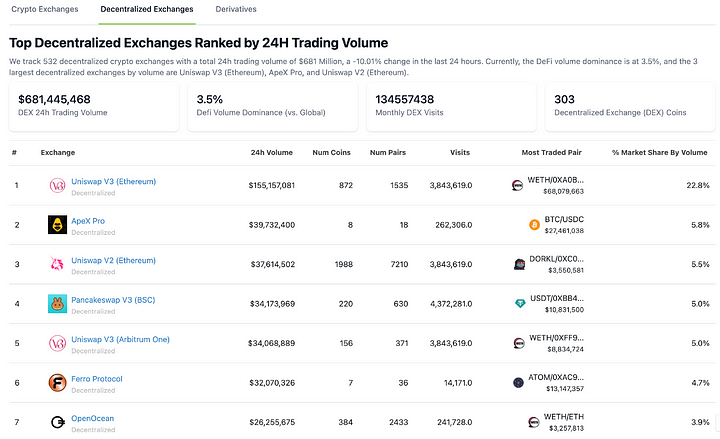

Decentralized exchanges (DEX) have seen a trading volume of nearly $680 million in the past 24 hours, a decrease from last week. The total trading volume for cryptocurrency exchanges worldwide in the past 24 hours is $19.3 billion, with DEX accounting for only 3.5%.

Within DEX, the top trading exchanges in terms of volume include Uniswap, ApeX, Pancakeswap, Ferro, and others.

(V) Derivative DEX

Total Value Locked (TVL)

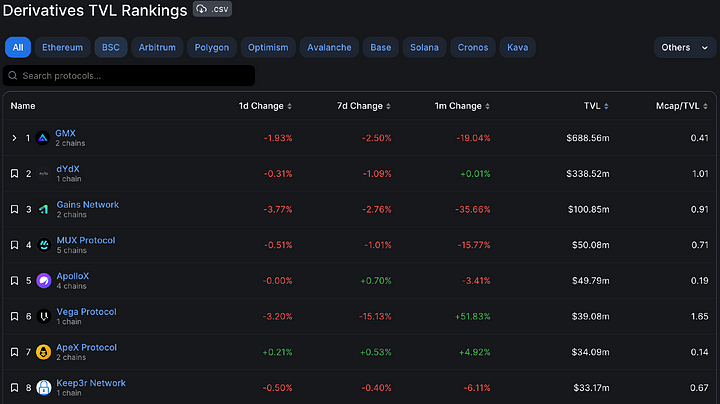

According to the data from defillama, the TVL of derivative DEXs has mostly been declining recently, partly due to the drop in token prices and partly due to the overall decrease in trading volume in the derivative sector.

In the derivative sector, GMX has the highest TVL, followed by dYdX, Gains Network, NUX Protocol, and ApolloX.

Trading Volume

According to Coingecko's data, the decentralized derivative trading platform with the highest trading volume is dYdX, which reached USD 250 million in the past 24 hours, followed by GMX with a trading volume of USD 79.39 million in the past 24 hours.

4. Recent Token Unlocking

Recently, there are 7 token unlocking events worth attention. Among them, the token APE of the ApeCoin project has a relatively large unlocking amount. The amount of unlocked tokens this time reached $40.6 million, accounting for 11.02% of APE token circulation.

Follow @HotairballoonCN on Twitter for more industry news: https://twitter.com/HotairballoonCN