Original source: Ouke Cloud Chain Research Institute

Author: Matthew Lee

The authors recent report - exploring whether PayPals issuance of stablecoins will follow Facebooks mistakes - was recently published by the Financial Times (Chinese version) of the UK. Since the report has received a good response within Ouke Cloud Chain Research Institute, let’s briefly analyze the main content of this report.

*This article mainly consists of two parts: comparative analysis (abridged) and the authors opinion. It does not restate the content that has been published. If you want to learn more about the original report, you can view the original text through the FT Chinese website.

According to data provided by Ouke Cloud Chain Research Institute, as of August 27, 2023, the issuance of PayPals stable currency PYUSD on the chain has exceeded 42 million. Half a month has passed since its initial launch, and the current issuance scale is not enough to fully prove that stablecoins are officially accepted by the market. As a former strategic partner of Facebook, PayPals experience in issuing stablecoins has also cast a shadow on this strategic adjustment.

Therefore, this article mainly compares the issuance of stable coins by PayPal, Circle and Facebook, and explores the feasibility of PayPals issuance of stable coins this time.

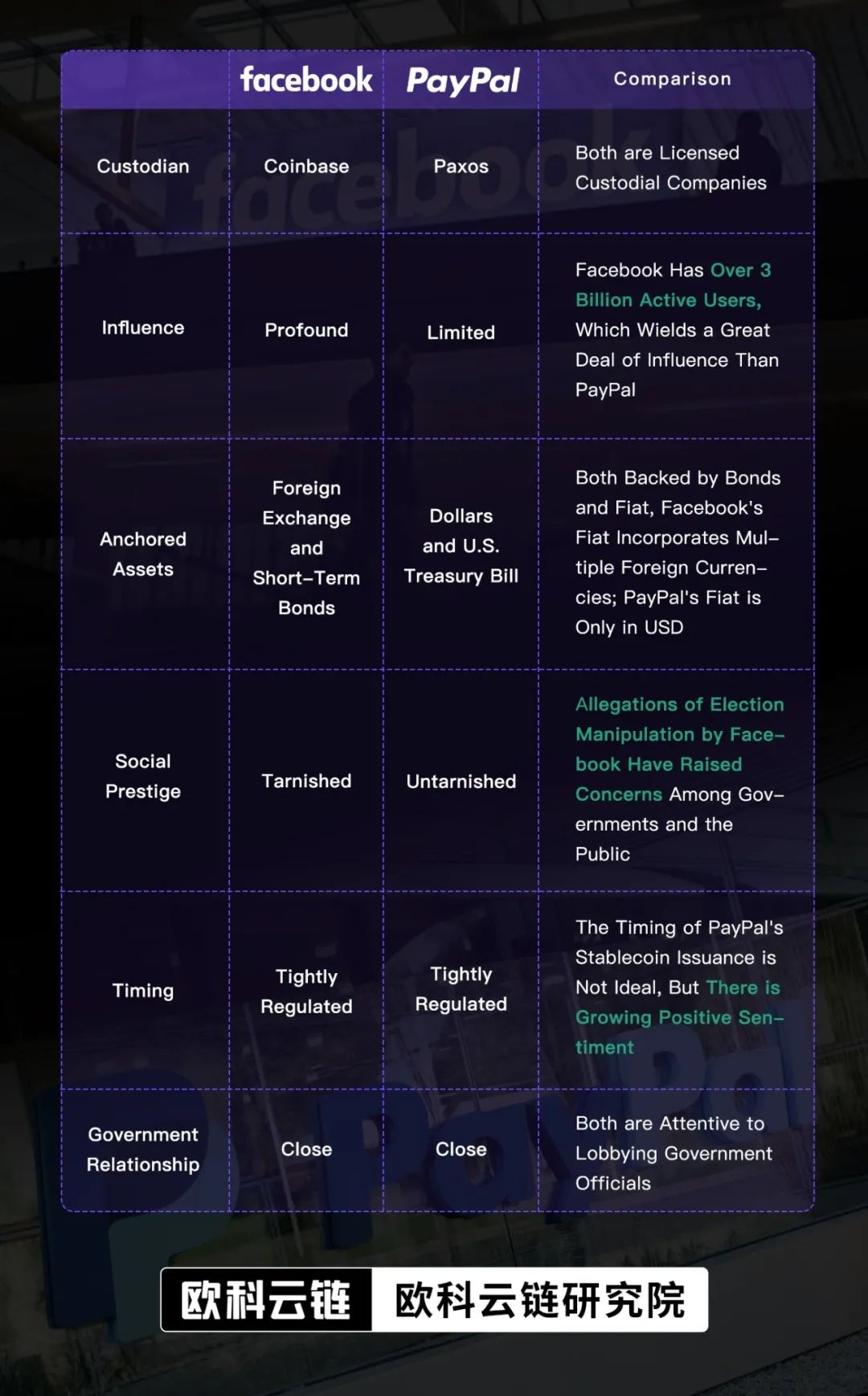

The above are the factors that the author has compiled that are most likely to affect the issuance of stable coins. Among them, the author believes that Facebooks influence and social reputation are two important factors that restrict its issuance of stable coins.

Facebook has nearly 3 billion monthly active users. Its extensive penetration in the social media field gives it the potential to evolve its platform into a global financial institution with billions of users. If there are any loopholes in Facebooks stable currency issuance plan, it may Potential threat to global financial stability. Facebook has also faced serious challenges to its reputation. In 2018, it was accused of stealing user data to manipulate election results, and suffered widespread social skepticism. This caused people from all walks of life to have serious doubts about its stablecoin plan, and worried that Facebook might abuse user data again.

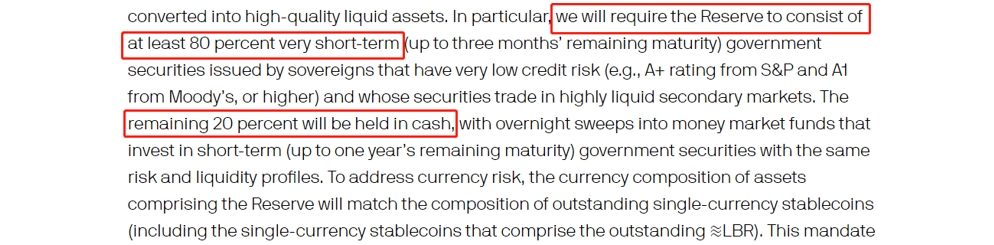

Some institutions believe that Facebooks lobbying of the government and the design mechanism of the stablecoin are also factors that lead to unfavorable issuance. The author does not agree with this. Employees of Facebook’s stablecoin project all have mid- to high-level government backgrounds, and their political resources are no less than those of PayPal. In terms of the design mechanism of stablecoins, since the anchored assets include foreign currencies other than the U.S. dollar, many people believe that users purchasing Libra will deposit their national currencies into banks in other countries, which will directly lead to an increase in stablecoins in circulation and indirectly affect monetary policy. . But according to the description of its stablecoin white paper,

Image source: Libra white paper

The anchored cash of Facebooks stablecoin only accounts for a small proportion (and more than 50% will be in US dollars), and most of it is held in short-term bonds, which has minimal impact on the currency.

How does it compare to the Circle distribution?

Compared to Facebook, Circle, which was founded in 2013, had a relatively weak background, but Circles launch of stablecoins was much smoother. In addition to the market demand for compliant stablecoins at the time, it was also because Circle was more determined and lighter to enter the field of stablecoins.

The picture below shows the important events in Circle’s development compiled by the author:

In the early days, Circle explored a variety of virtual asset businesses, covering multiple fields such as exchanges, wallets, payments, and investment banks. Based on the observation of Circle’s development trends in recent years, the company has not only given up its traditional business, but also eliminated its virtual asset business except stablecoins. This kind of “lightness” and focus on business can help avoid negative impacts on the financial market. .

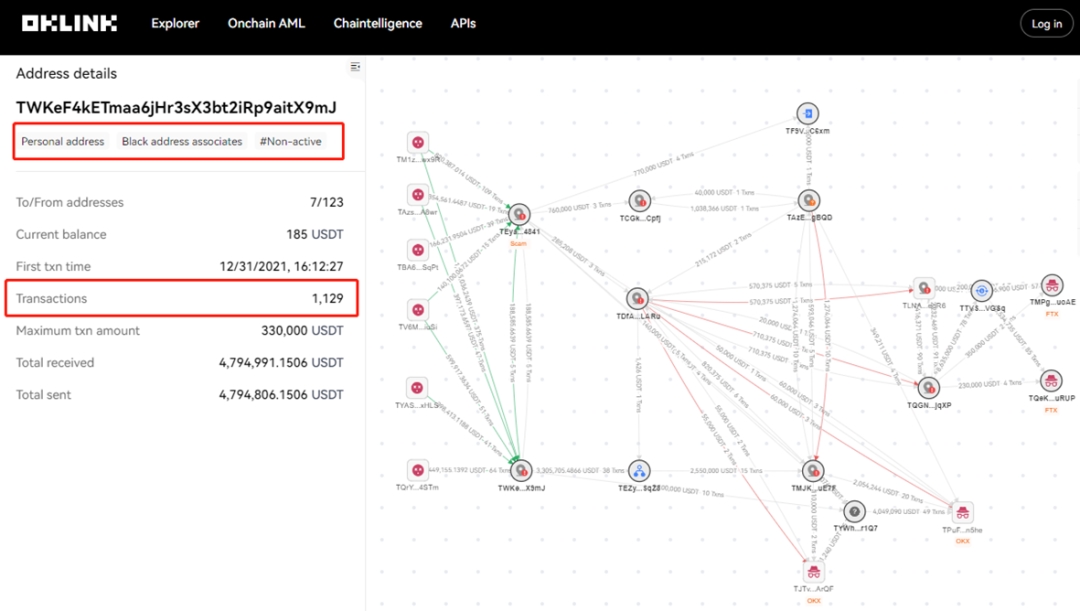

In addition to changes in business direction, Circle has also made great efforts in compliance. Circle once helped relevant departments freeze $100K USDC from a black address (pictured below).

Image source: OKLink Explorer

PayPal and Circle are similar in many ways. Both are strategically based on the payment business, and have obtained Virtual Currency and Money Transmitter licenses from the New York Department of Financial Services (NYDFS) respectively. Their business concentration is relatively high. Compared with Facebook, which spans multiple industries, their influence is Limited, less likely to cause market shocks.

Authors point of view

By sorting out the experiences of Facebook and Circle, the author believes that the potential risks of PayPals stablecoin issuance are lower, which is different from Facebooks experience.

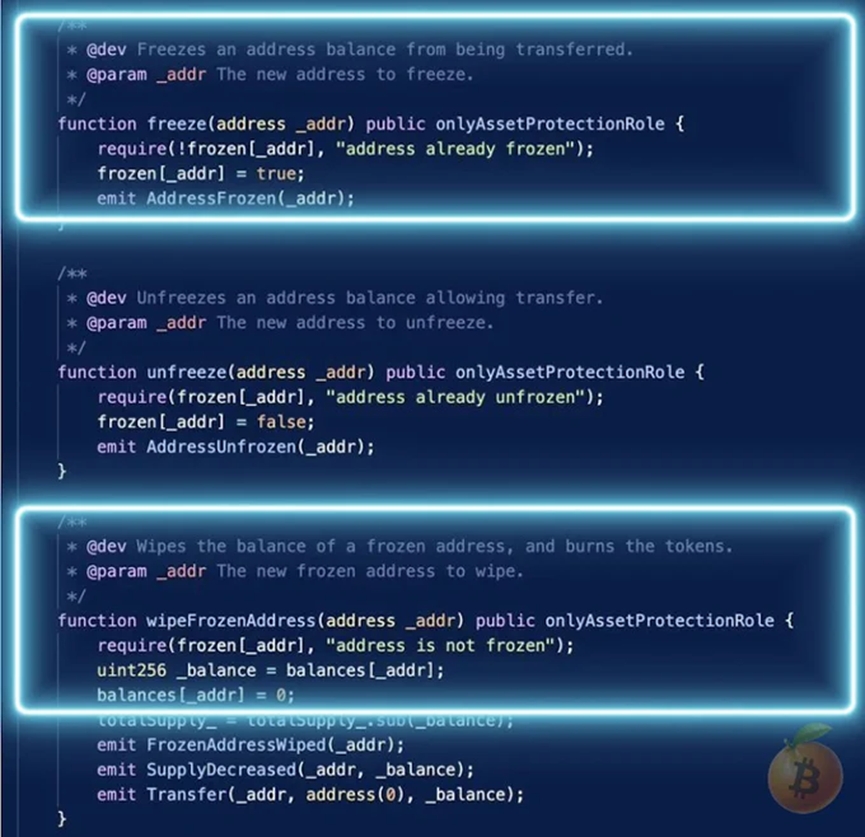

During the research process, the author was surprised that as a traditional payment company, PayPal has a very strict attitude towards on-chain risk control. This stringent risk control strategy is likely to be a positive factor in passing regulatory scrutiny in the future. The following picture shows the code issued by PayPal stable currency,

Image source: from the Bitcoin Twitter account

As you can see, the code in the marked part shows two functions: freezing and clearing frozen addresses.

When criminals transfer illegal funds, entities such as PayPal, Circle or exchanges will eventually be required to perform withdrawal operations. Therefore, the supervision of withdrawal ports is one of the important measures for anti-money laundering. Coinbase was fined $50 million by the SEC for anti-money laundering mistakes. The lesson shows that effective anti-money laundering is very important.

Although the compliance teams of Coinbase or Facebook projects have banking, financial technology and even regulatory backgrounds, they lack understanding of blockchain anti-money laundering. Their ideas have limitations and are easy to fall into group thinking. The methods for identifying money laundering focus on KYC or large amounts. On the transaction. Criminals can use a variety of methods to circumvent traditional anti-money laundering measures, such as hiring money mules, using the money muless accounts as intermediary accounts, and withdrawing funds through physical companies to complete money laundering.

The real situation of on-chain anti-money laundering is also more complicated. As shown in the figure below, criminals conducted high-frequency transactions to avoid on-chain tracking, although they were eventually captured by Ouke Cloud Chains on-chain anti-money laundering tools.

PayPals stablecoin payment port will connect merchants and even expand to Venmo. Anti-money laundering is more difficult than exchanges, so PayPal needs to have stricter compliance controls. PayPal has also cooperated with on-chain data service providers to purchase their label data to monitor gray/blacklist addresses (including interactions with sanctioned addresses or addresses involved in security incidents).

The negligence of many large companies in the field of money laundering shows a certain degree of problems, and the anti-money laundering measures of many of them appear to be too perfunctory. However, as supervision intensifies in various fields, more companies will begin to pay attention to this issue.

Ouke Cloud Chain is aware of the needs in this field, so it has customized On-Chain AML for the project party based on compliance considerations. Based on Ouke Cloud Chains huge underlying data across more than 170 public chains (3.4 billion tag data based on past security incidents), abnormal withdrawal or fund transfer behaviors can be easily identified. Any entity that cooperates with Ouke Cloud Chain can use Ouke Cloud Chains on-chain labeling system to detect addresses with money laundering risks and avoid interacting with the address. Companies also do not need to worry about regulatory penalties for insufficient anti-money laundering measures.

PayPals comprehensive preparedness measures further demonstrate its high level of control over operational and regulatory risks.