This week, Odaily reported on the financial dispute between Gemini and DCG. For more details, please refer to the article ""Gemini's Ultimatum to DCG, Is DCG's Founder Barry Silbert Running Out of Time?".

Today, we will summarize the contents of the lawsuit filed by Gemini against DCG and its CEO Barry Silbert in a New York court, and understand the 5 charges against DCG and the 6 demands of Gemini.

Founder of Gemini's Twitter Message

On June 7th, one of the founders of Gemini, Cameron Winklevoss, revealed on Twitter that, after ineffective warnings, Gemini filed a lawsuit against Digital Currency Group (DCG) and its CEO, Barry Silbert, in a New York court. Gemini accuses Barry Silbert of being involved in fraudulent activities against creditors. According to Cameron, Barry not only played a core role in planning fraudulent acts, but also personally participated in their implementation.

In this tweet, Cameron briefly stated the 12 core "charges" against DCG (which are actually extensions of the five accusations) and said, "The lawsuit tells the complete story." So, what exactly does this 33-page lawsuit contain?

Content of the Lawsuit

The opening statement of the complaint clearly states, "The defendants DCG and Silbert participated in a fraud plan, inducing various depositors to continue lending large amounts of cryptocurrency and dollars to DCG's subsidiary Genesis Global Capital, LLC (hereinafter referred to as "Genesis"), including Gemini users for whom Gemini acted as custodian and agent. This lawsuit aims to recover damages and losses caused by the defendants to Gemini, which were a result of false, misleading, and incomplete statements and omissions made by DCG and Silbert regarding Gemini, as well as the defendants' role in encouraging and facilitating fraudulent activities by Genesis against Gemini.

The style of this complaint is completely different from previous legal documents such as those from the SEC and Coinbase. The style of related legal documents, such as those from the SEC and Coinbase, is very conservative, with professional use of language and legal terminology, even if the allegations are sharp. However, in this complaint against Gemini, there are many colloquial expressions, sometimes even directly venting emotions: "(Genesis claims) are all lies." "Did the defendants or Genesis disclose the enormous risk Genesis assumed in rapidly collapsing arbitrage trades? No. Did they take immediate action to mitigate that risk, increase collateral requirements, and address escalating debt obligations? No." "More lies below."

Highly emotional language

Next, are the various charges stated by Gemini:

1. Genesis did not thoroughly review the borrowers and concealed losses on behalf of the borrowers

The lawsuit claims that DCG and Genesis induced Gemini's Earn users to lend a large amount of money to DCG by claiming to have "strong risk management practices and a thorough review process for lending recipients." However, in reality, they borrowed these funds to counterparties engaged in high-risk arbitrage trading and collected high management fees from it. In 2021, these funds could not be repaid, but Genesis did not disclose these losses or take immediate action to prevent them. They allowed the borrowers to maintain their debt for a whole year and continued to borrow from Gemini and collect huge management fees. At this point, the game has become a Ponzi scheme.

When Three Arrows Capital collapsed, the game couldn't continue. The lawsuit states, "From then on, a series of chain events led to the current situation. Genesis violated its statements about risk management and careful review of trading counterparties... According to Genesis, the overall value of the collateral held by Three Arrows Capital's loan was equivalent to 80% of its exposure to 3AC at the time. CEO Michael Moro made it very clear that these losses would not affect Genesis' operations: "Our potential losses are limited and can be offset through our own balance sheet. We have mitigated the risk and continue moving forward."

However, in reality, the value of these collateral is less than 50% of the outstanding debt. As details continue to emerge from the liquidation process of 3AC, the scale of Genesis's losses becomes clear. When 3AC collapsed, it owed Genesis a staggering $2.36 billion (through 3AC's debt to Genesis's affiliated company in Singapore). Despite Moro's assertion that 3AC's loans had over 80% collateral requirement, Genesis was only able to realize $1.16 billion when liquidating 3AC positions. In other words, by mid-July 2022, the value of the collateral held by Genesis was ultimately less than 50% of the outstanding loan amount, resulting in a loss of approximately $1.2 billion at the start of 3AC's liquidation. Genesis has little hope of recovering any substantial value from the liquidation of 3AC, as the founders of 3AC have disappeared, leaving the liquidator to search for assets to distribute to creditors. This amount has left Genesis financially in the red by hundreds of millions of dollars.

2. Genesis claims that its parent company DCG intervened and assumed the losses, but it's just an empty promise.

To appease Gemini and ensure continued lending from Gemini Earn to Genesis, Genesis made false statements that DCG had absorbed the losses from the 3AC loan at the parent company level, and therefore claimed that Genesis's operations were "business as usual."

Former CEO Michael Moro tweeted, "DCG has taken on some responsibility related to Genesis's dealings with this counterparty, to ensure we have capital to support our long-term operations and business expansion."

Matt Ballensweig, former Managing Director and Co-Head of Trading and Lending at Genesis, assured another Genesis depositor on July 18, 2022, "As of now, all losses from 3AC have been absorbed by our parent company DCG, and Genesis's balance sheet remains healthy, and we continue to operate as usual." He added, "DCG has directly assumed the remaining losses."

So, how does DCG actually bear the loss of Genesis? The answer is that DCG only wrote an IOU.

Gemini said, "Behind the scenes, DCG and Genesis entered into a fraudulent transaction: specifically, on June 30, 2022, Defendant Silbert on behalf of Defendant DCG signed an unsecured promissory note, paying Genesis $1.1 billion. This allowed Genesis to list DCG's promissory note as an asset on its balance sheet, allegedly "offsetting" the $1.2 billion loss caused by the collapse of 3AC. However, in reality, the fair market value of the promissory note is only a small fraction of its $1.1 billion face value. The note will mature in 10 years, on June 30, 2032, and accrues interest at a rate of only 1%, far below the market rate for unsecured loans that DCG may be required to pay."

The complaint states that Genesis informed its depositors that the losses of 3AC had been "borne" or "absorbed" by DCG, meaning that Genesis has been compensated for its entire $1.2 billion loss. However, the promissory note did not accomplish this. The note also did not improve Genesis' immediate liquidity position. From a practical standpoint, the note is merely a paper obligation, an accounting maneuver designed to make Genesis appear to have equity and the ability to fulfill its obligations to its depositors without requiring actual financial support from DCG. (i.e., no actual repayment of Genesis' losses with real money.)

This even led to Genesis publishing a series of financial statements, prepared with the knowledge and active participation of DCG, showing that DCG had injected $1.1 billion of short-term receivables into Genesis to enable Genesis to fulfill its obligations to its depositors. (Another charge will be detailed below.)

including the then Chief Operating Officer Mark Murphy, DCG personnel participated in the dissemination of these false statements, and creditors were informed that these statements were prepared with the assistance of DCG and Genesis' financial and accounting teams. However, it later became clear that DCG did not actually cover these losses with its own funds, and Genesis remained severely insolvent.

3. DCG and Genesis conspired to forge financial reports to hide the truth from Gemini and creditors

According to the content of the complaint, as an extension of the short sales contract, DCG and Genesis also released a series of false financial reports, accompanied by false and misleading statements regarding Genesis' alleged support from DCG. These reports and false statements were "intended to conceal the truth from Genesis' depositors."

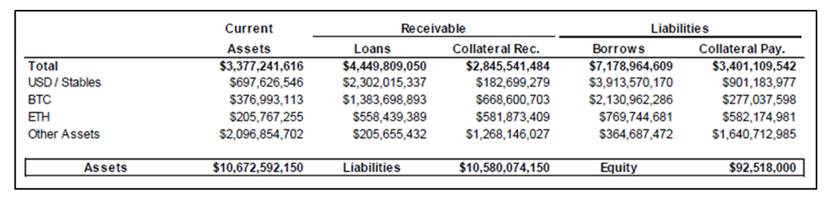

To illustrate this point, Gemini released a financial report in an email:

According to the complaint, Genesis listed the assets on this promissory note as "other assets" in the "current assets". Generally accepted accounting principles in the United States define "current assets" as cash and other resources that are reasonably expected to be realized as cash within one year. Therefore, this term specifically excludes amounts due from related companies that cannot be collected within normal business processes within one year. In this asset,

by including the face value of the promissory note in the "current assets" category, Genesis claimed to have $1.1 billion worth of cash that could be collected within one year on its balance sheet. Not to mention that the value of the promissory note is only a small fraction of its face value, and the promissory note itself matures (and is repaid to DCG) after 10 years. This note is clearly not a current asset, but Genesis falsely listed it as a current asset to entice Gemini to continue with the Gemini Earn program.

In terms of this financial report, the value of this promissory note represents one-third of its current assets.

Gemini also includes other evidence that shows that Genesis has "beautified" the period notes on accounts receivable and loan term data, deceiving Gemini into continuing to open the Earn plan for Genesis.

4. Defendant Barry Silbert (CEO of Genesis' parent company DCG Group) personally deceived Gemini

This is also a point that Cameron previously mentioned on Twitter, and has even sent an open letter. The complaint states that the defendant Silbert personally made great efforts to deceive the creditors and continue to spread the lie that DCG has "absorbed" the loss of 3AC. For example, after learning in mid-October that Gemini had given a 30-day notice to terminate the Gemini Earn loan program, Silbert personally contacted Gemini's founder Cameron Winklevoss, and Silbert and Cameron Winklevoss had a lunch meeting in New York City on October 22, 2022. At that lunch meeting, Silbert said a lot, aiming to make Gemini not stop the Earn plan, even though Silbert had already realized that Genesis was insolvent.

Actually, what Silbert is doing goes far beyond this fraudulent intentional omission. He told Gemini that despite the "complexity" of Genesis' loan portfolio, the crisis could be resolved within a reasonable time frame. In other words, Silbert told Gemini that Genesis only faced a short-term mismatch in loan portfolio times, concealing the massive loopholes and inability to fulfill obligations to Gemini and others on Genesis' balance sheet, because DCG actually did not bear the loss of 3AC. Based on reliance on Silbert's false statements, Gemini decided to delay terminating the Gemini Earn program and did not explore the possibility of faster termination or other remedies that Gemini would have taken if Silbert had stated the truth.

5. DCG and other executives of Genesis were also involved in fraudulent behavior and repeatedly concealed the truth from Gemini and other creditors

The entire convertible bond program demonstrates that Barry, DCG, and Genesis were all involved in this fraudulent behavior. Its design and execution require the full participation and cooperation of Barry, DCG, and Genesis, and it can only "work" by hiding it from the creditors.

Gemini One provided more evidence. On July 19, 2022, then-COO Mark Murphy reiterated the false story shared with depositors in the "Three Arrows Post-Analysis" document previously sent by Genesis to Gemini. Murphy stated that DCG intervened and absorbed the losses from Genesis' 3AC transactions, and that these losses were offset in DCG's balance sheet. He further stated that with DCG's support, Genesis had sufficient capital for normal operations in the future. He assured depositors that Genesis was a vital part of the DCG empire, and DCG had significant plans for Genesis' future business, promising continued support for Genesis to enable its continued growth.

Genesis' Managing Director and Co-Head of Trading and Lending, Matt Ballensweig, provided detailed information about Genesis' approximately $1.8 billion in loans to affiliated entities, which had been previously disclosed in Genesis' reports. Ballensweig claimed that Genesis had an outstanding loan from DCG of approximately $922 million, deliberately omitting the $1.1 billion promissory note that was attempted to be concealed from Genesis' depositors. At the same time, Ballensweig falsely stated that DCG "assumed a loan of $1.1 billion on June 30, 2022," in an attempt to make depositors believe that Genesis had been compensated for the losses incurred from the 3AC loan. This was completely fabricated, but Murphy made no effort to correct Ballensweig's false statements. Similarly, Ronald DiPrete, DCG's Special Projects Head and CFO, was copied on the email, but he also did not correct Ballensweig's false statements.

At the same time, DCG and Genesis executives have been repeatedly copied on related emails, but "no action has been taken to correct this error."

Gemini's demands

Gemini makes six demands in the lawsuit:

A. Actual damages, as determined by the relief requested in this lawsuit;

B. Punitive damages, as determined in the trial based on the relief requested in this lawsuit;

C. Declaration ruling, confirming the defendant's liability for any future damages resulting from the relief requested in this lawsuit;

D. Reasonable attorney fees;

E. Costs of this lawsuit;

F. Any other remedy deemed fair and appropriate.

The outcome of this case will have significant implications for the cryptocurrency industry, and Odaily will continue to report on it.