Recently, Gemini co-founder Cameron Winklevoss issued an open letter to DCG founder and CEO Barry Silbert. He also issued an "ultimatum" to Barry Silbert.

Currently, as the "deadline" of the ultimatum has passed, there has been no response from Barry Silbert. This long-lasting "feud" continues...

(For background information, please refer to Odaily's article "Gemini's latest piece exposes how DCG manipulates GBTC" published in January this year.)

What are the latest disputes between the two parties?

Winklevoss once again expressed his intention to trade with DCG on Twitter. "I would like to invite Barry Silbert to join the Twitter Space discussion on our best and final offer. No lawyers, no advisers, just friends. I know Earn users would be happy to hear from you. You can be the first to tell them if you accept this deal. Let me know when you're available." Winklevoss also expressed regret that DCG has yet to provide a satisfactory plan to repay Genesis creditors (including Earn customers of Gemini), and as of now, DCG has not paid $630 million to Genesis.

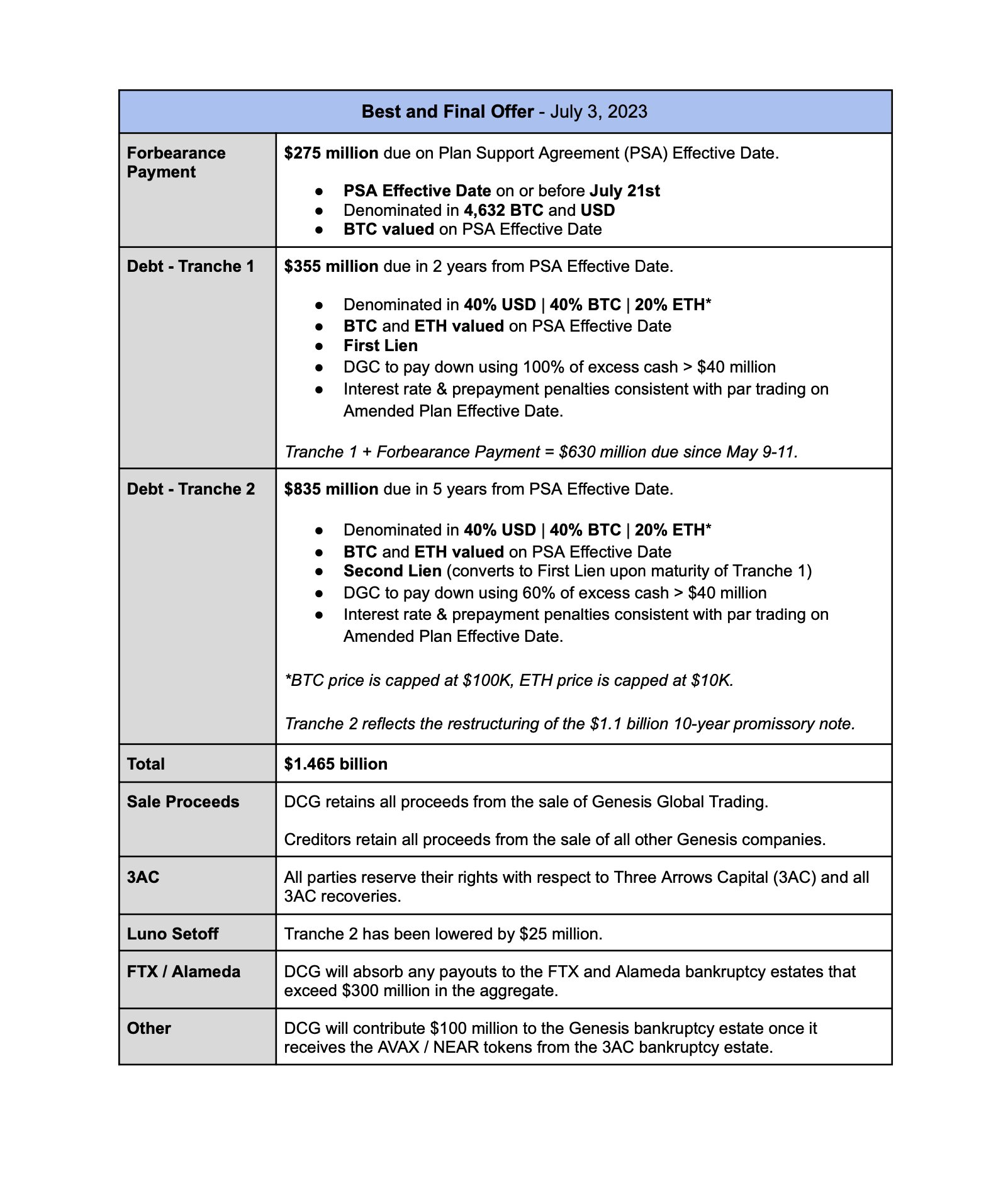

Winklevoss stated that after months of negotiation and mediation, he made a "final offer" for the debt restructuring negotiations with Genesis, which requires a payment and loan valued at $1.465 billion in US dollars, Bitcoin, and Ethereum. He had previously presented a document entitled "Best and Final Offer - July 3, 2023" and outlined a series of plans based on it.

According to the outline, apart from 14.65 billion US dollars, it also involves Three Arrows Capital, FTX, Alameda and other so-called "bankruptcy sectors" brothers in difficult times.

Best and final offer

Winklevoss expressed fiercely, "I am writing to inform you that your game is over. In addition to delaying payment, their (referring to Genesis) professional service fees have soared to over 100 million US dollars, and all these money is paid to lawyers and consultants, which are borne by creditors and Earn users." In a court document in January, Genesis listed over 3 billion US dollars of claims to its top 50 creditors. According to Winklevoss, they owe Earn users approximately 1.2 billion US dollars.

In the letter, Winklevoss also set a deadline for Barry Silbert. If this transaction is not agreed upon by 4:00 PM ET on July 6, further actions will be taken, including:

Filing a lawsuit against DCG and Barry Silbert on July 7.

On the same day, file a motion for turnover, asking the Genesis special committee to put DCG in default and immediately pay 630 million US dollars.

Proceed with the non-consensual plan, and DCG's contribution will be sued.

When it comes to UCC litigation, lawsuits have been filed to investigate and gather evidence on the various corporate loans and transactions between DCG and Genesis entities.

What happened to Genesis?

Currently, Genesis has been unable to make withdrawals for over 230 days. However, since Genesis closed, it has been unable to reach a global, negotiated solution with its creditors and Earn users.

For a long time, DCG has been a heavyweight in the crypto world, with its business spanning numerous areas. DCG was founded by Barry Silbert in 2015 and owns well-known brands such as Grayscale, Genesis, and Coindesk, among others. It has also invested in hundreds of projects. Among the subsidiary companies of DCG is the protagonist in this crisis – Genesis.

Winklevoss stated that DCG incurred losses of about $1.2 billion due to the collapse of Three Arrows Capital. Since November last year, Barry Silbert has been actively working to raise funds to resolve this bad debt. However, DCG's financial situation has not improved.

In late 2022, a rumor exploded in the market, becoming the prelude to the DCG crisis. Market rumors suggested that Genesis might have solvency issues. To fill the gap, DCG, the parent company of Genesis, is even considering dissolving GBTC and ETHE issued by Grayscale.

GBTC is a star product in the crypto world, with excellent profitability and brand. It is not difficult to understand the severity of the crisis if DCG is already planning to dissolve GBTC. What's even worse is that as the Genesis crisis intensifies, the discount on GBTC continues to widen. And DCG, which leveraged GBTC, added to its financial crisis, making it one of the main reasons for the crisis.

Winklevoss has no solution

Currently, with the gradual recovery of the market, the price of the currency has been rising. However, Genesis and Gemini, which have experienced financial crises, have been unable to recover the billions of dollars they have lost.

The crisis of DCG did not begin today. Due to its reckless risk management and use of high leverage, it is questionable whether the company can survive the next bull market.

Recently, a series of veteran capital giants have submitted, renewed, or modified applications for Bitcoin ETFs, including BlackRock, Fidelity, WisdomTree, Invesco, Valkryie, and ARK Invest. As the "compliance" storm sweeps through the crypto world again, how many of the native institutions in the crypto world, like Genesis, with their reckless nature, have the ability to compete with traditional institutions in the next bull market?

Since the start of this heated "war of words", Winklevoss has still been closely targeting DCG and launching attacks. Just recently, he wrote an article accusing that if an approved spot Bitcoin ETF is not obtained, American investors will be pushed towards "toxic products" like Grayscale GBTC. The trading price of such products is far below their net asset value (NAV), and they charge astronomical management fees.

He does not hide his strong criticism of the SEC, stating, "It is a complete disaster for American investors. The SEC is a failed regulatory agency."

"Perhaps the SEC will reflect on its frustrating track record instead of trying to exceed its statutory powers. The SEC should act as a gatekeeper of economic activity, focusing on fulfilling its mission to protect investors."