Compilation of the original text: Deep Tide TechFlow

Compilation of the original text: Deep Tide TechFlow

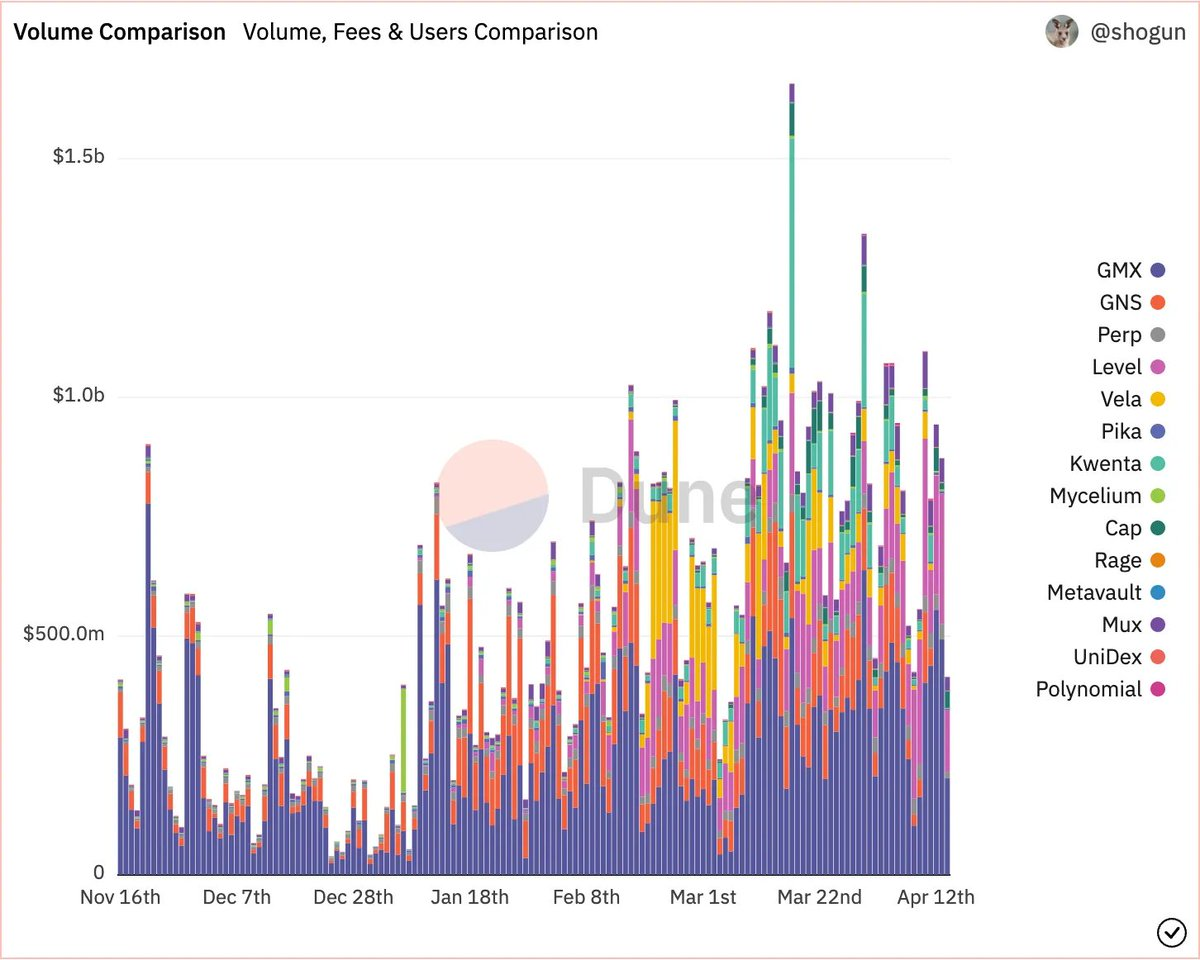

Since the collapse of FTX, more and more traders have turned to on-chain perpetual DEX, and its market size has also continued to expand.

Although centralized exchanges such as Binance are still the main places for derivatives trading, as decentralized technology continues to mature, it is expected that more funds will flow into the decentralized perpetual contract market in the future.

first level title

Decentralized Perpetual Contract Market Overview

In the first quarter of 2023, the total transaction volume of on-chain perpetual contract exchanges is 164.2 billion US dollars.

While this is a massive increase from before, Binance generated $4.5 trillion in derivatives trading volume in the first quarter alone.

Since the collapse of FTX, more traders have moved on-chain and several new protocols have emerged.As the market matures, I have no doubt that the cumulative transaction volume of on-chain perpetual contracts will grow into trillions of dollars every quarter.

The table below shows the total transaction volume and generated fees of the leading on-chain perpetual swap exchanges. Two things stand out:

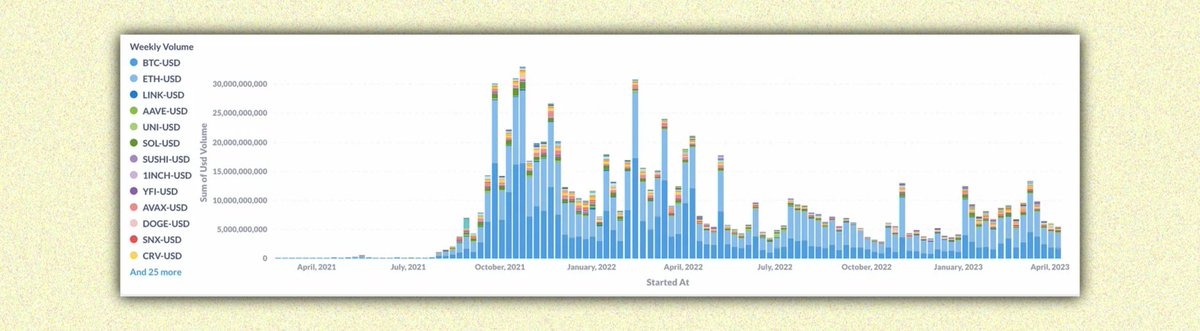

• dYdX still attracts significant trading volume;

first level title

dYdX

Total transaction volume: $913 billion;

14-day trading volume: $12.15 billion;

14-day cost: $3.24 million.

dYdX currently runs on a custom zk-rollup designed by Starkware, but will move to the appchain in the Cosmos ecosystem later this year (dYdX V 4 ).

first level title

GMX

Total volume: $100.5 billion;

14-day trading volume: $4.93 billion;

Total Fees: $148.2 million;

14-day fee: $7.43 million.

Last year, GMX sparked the on-chain perpetual contract narrative. Despite many new entrants over the past few months, GMX continues to grow in daily transaction volume, user count, and fees.

GMX V2 will introduce the ability to trade synthetic assets (not just cryptocurrencies).

• Use Chainlink low-latency oracles for better real-time market data;

• Each trading pair will have separate liquidity to isolate risks;

• Phase out GLP tokens after V2.

first level title

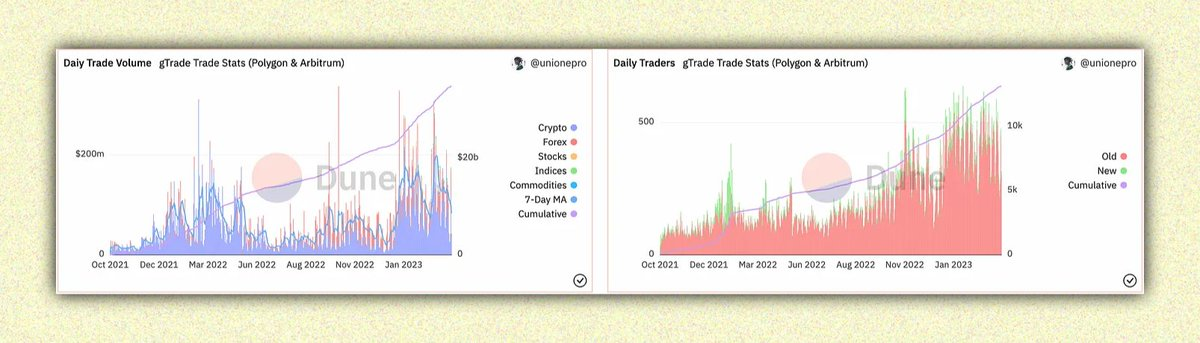

GainsNetwork

Total transaction volume: $35 billion;

14-day trading volume: $1.8 billion;

Total fees: $254 million;

14-day fee: $1.6 million.

After gTrade was deployed on Arbitrum in January, daily trading volumes increased significantly.

first level title

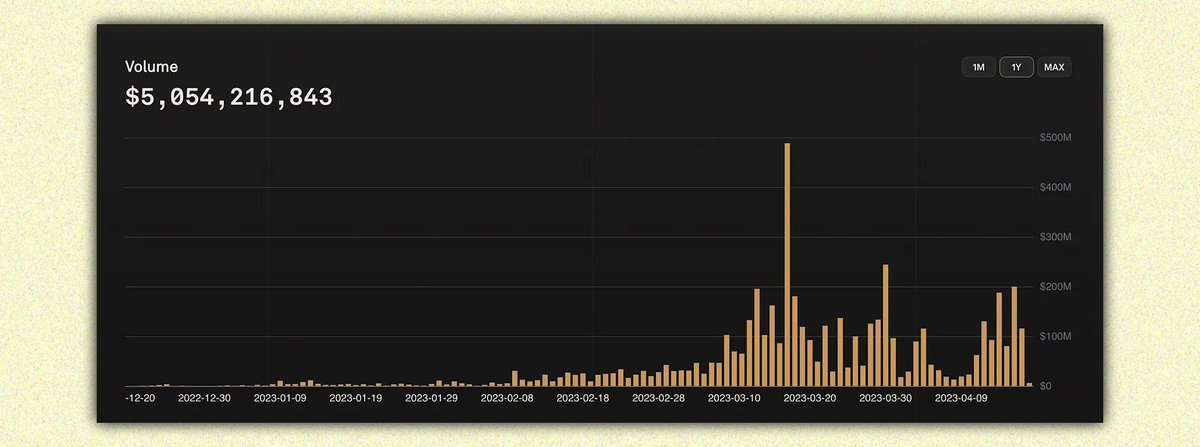

Kwenta

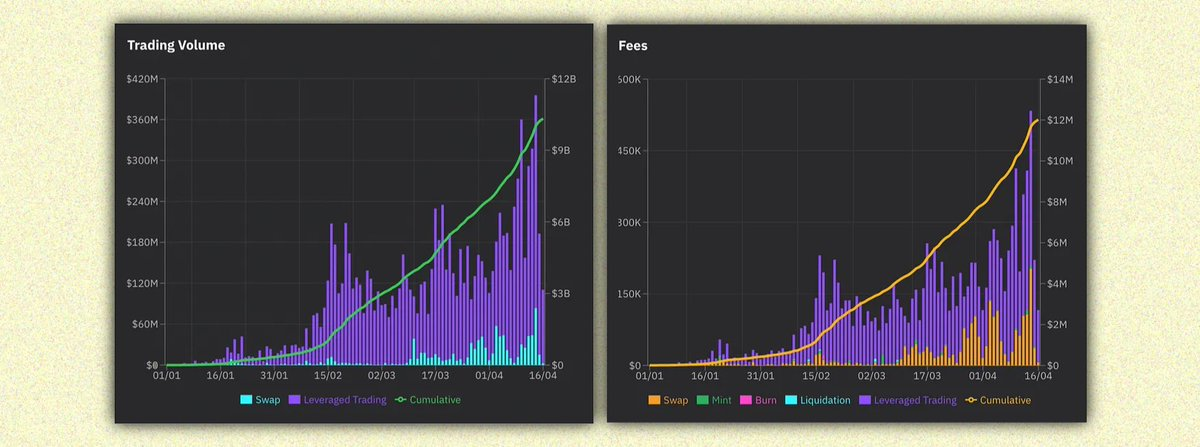

Total volume: $6.4 billion;

14-day trading volume: $500 million;

Total Fees: $12.6 million;

14-day processing fee: $800,000.

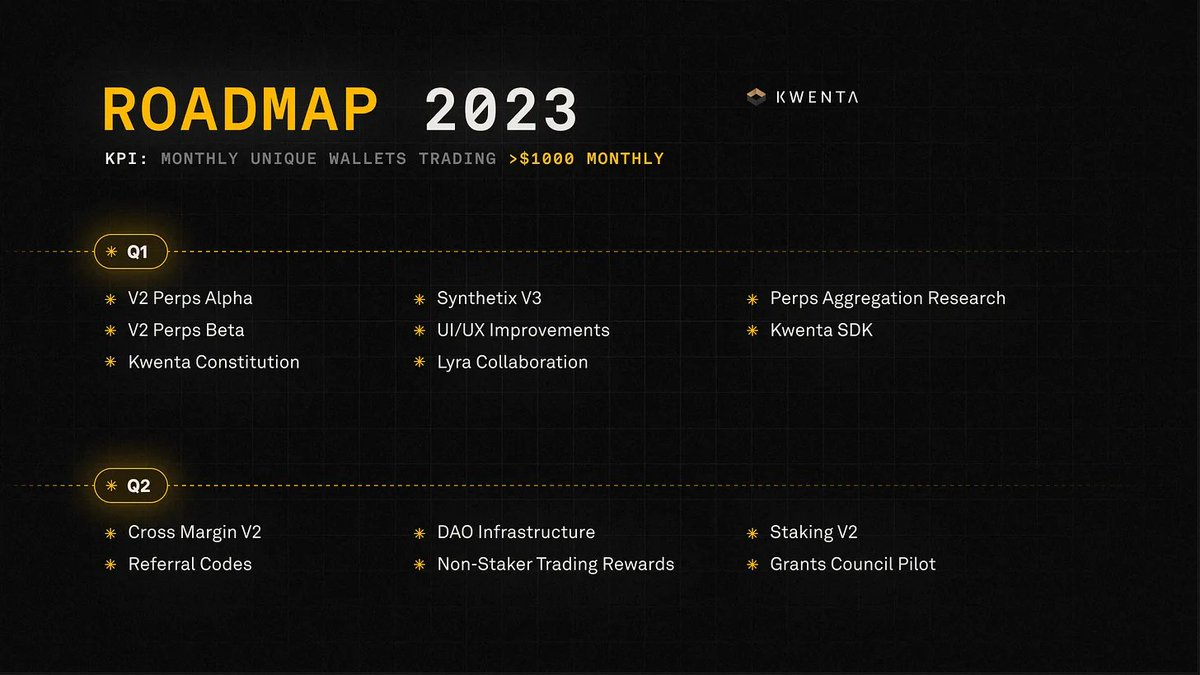

Kwenta launched its V2 version in February with a host of new tradable assets, and has seen a huge increase in trading volume since then.

Kwenta leverages Synthetix as a liquidity layer for perpetual derivatives trading. As Synthetix V3 rolls out more collateral assets as collateral for sUSD, we may see deeper liquidity on Kwenta.

first level title

Level

Total volume: $10.3 billion;

14-day trading volume: $3.2 billion;

Total Fees: $12 million;

14-day fee: $3.9 million.

Level is the largest perpetual contract exchange on the BNB chain, providing four trading pairs of ETH, BTC, BNB and CAKE.

first level title

comparative analysis

The table below shows recent transaction volume, fees, and native token valuations.

The lower the FDV/volume and FDV/fee ratios, the better the valuation. Note that there is a large discrepancy between calculating these values based on market capitalization and FDV.

Based on these numbers, GNS and GMX have the best valuations (also because their FDV is closer to market cap). Based on market capitalization, DYDX is the most valued token. However, it is important to be aware of future token unlocks.

It’s also worth noting that both Kwenta and Level incentivize traders through native token offerings. Will they continue to grow as token issuance decreases?

Personally, I am very concerned about $DYDX and $GMX as they will have catalyst events (like version updates, new products, etc.) later this year.

In short, I firmly believe that there will be a lot of liquidity flowing into the market in the future. If transaction volume grows 10-20x in the future, many of these tokens could rise significantly from their current prices due to this additional growth.

Original link