Original author:Ben Giove

Compilation of the original text: The Way of DeFi

Original author:

Compilation of the original text: The Way of DeFi

Fee-based DeFi applications have been struggling in this bear market. Top protocols like Aave and Curve are looking to in-protocol stablecoins to build new revenue streams and expand their ambitions.

Today, we'll dive into what makes GHO and crvUSD special.

DeFi protocols are taking action

As profits from fee-based business models shrink and on-chain activity dries up, blue-chip DeFi protocols are looking to build other revenue streams to diversify and strengthen their protocols.

We’ve already seen early signs of this expansion, with protocols like Frax building liquid staking and lending products, Ribbon developing an options exchange, and Maker breaking into the lending space with the Spark protocol.

Now, we have a new form of diversification, application-specific stablecoins, which refers to stablecoins issued by DeFi protocols as their secondary products rather than primary products.

These stablecoins are usually issued in the form of credit, and users can borrow their assets directly in the lending market or through DEX to mint stablecoins. Protocols can generate income from this in various ways, such as borrowing interest, minting/redeeming new units, pegged arbitrage, and/or liquidation.

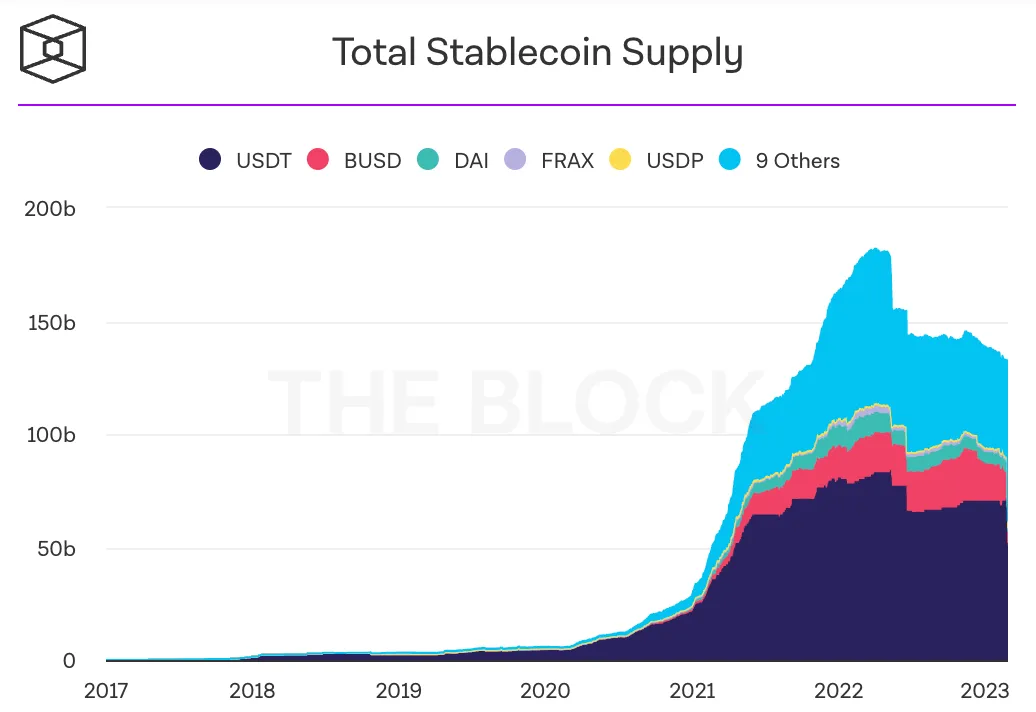

The stablecoin space as we know it is huge. Currently, there are $145 billion in stablecoins in the crypto ecosystem, and the future addressable market will reach tens of trillions.

As regulators target centralized, fiat-collateralized stablecoins like BUSD, a window may open for DeFi protocols to not only diversify their business models, but potentially steal some market share.

Many will point to DAI and FRAX as the most likely candidates to take a slice of USDC and USDT...but could some application-specific stablecoin be a disruptor?

What impact will this trend have on the market and DeFi? Let's find out!

👻 GHO

GHO and crvUSD

Two of the most prominent protocols launching stablecoins are Aave and Curve, which issued GHO and crvUSD respectively. First, let’s take a brief look at these stablecoins.

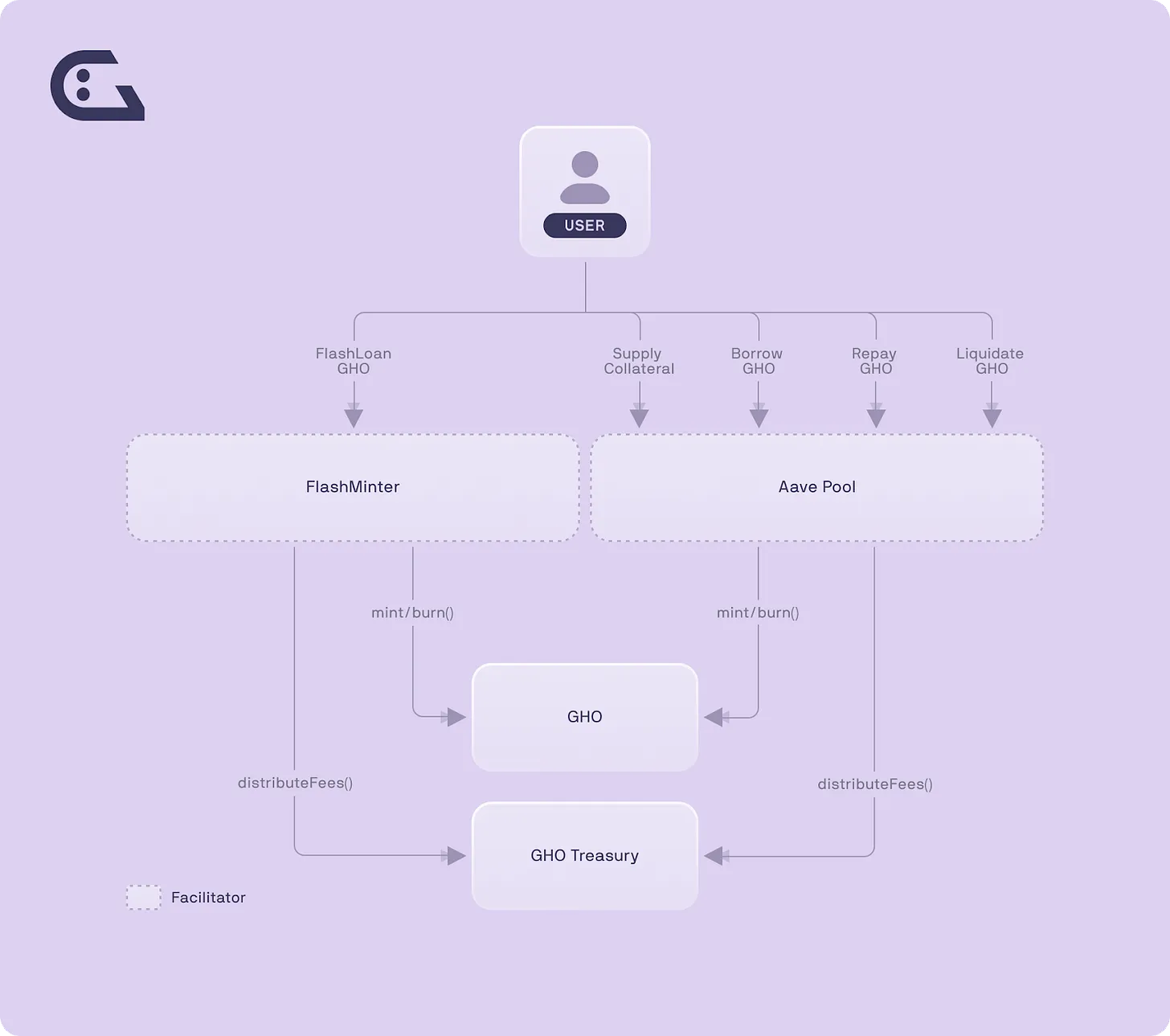

GHO is a decentralized stablecoin issued by Aave. GHO is over-collateralized, backed by deposits from Aave V3, and users can mint stablecoins directly on the money market.

GHO is unique in that unlike other assets in Aave whose interest rate is determined algorithmically, its borrowing rate will be manually set by the governor. This gives Aave complete control over the cost of minting/borrowing GHO, making it possible for the DAO to undercut its competitors (more on that later).

In the future, GHO will be able to mint coins from venues other than Aave V3 through whitelisted entities called "facilitators". These "facilitators" can mint GHO against various types of collateral, including delta-neutral positions and real-world assets.

💸 crvUSD

We have seen similar stablecoin designs, such as Frax's lending AMO and Maker's D 3 M. But GHO's growth prospects are strong, thanks to Aave's built-in user base, brand, team's business development skills, and a sizeable DAO treasury worth $130.9 million (albeit mostly in AAVE tokens).

GHO is currently live on the Goerli testnet and is scheduled to launch later in 2023.

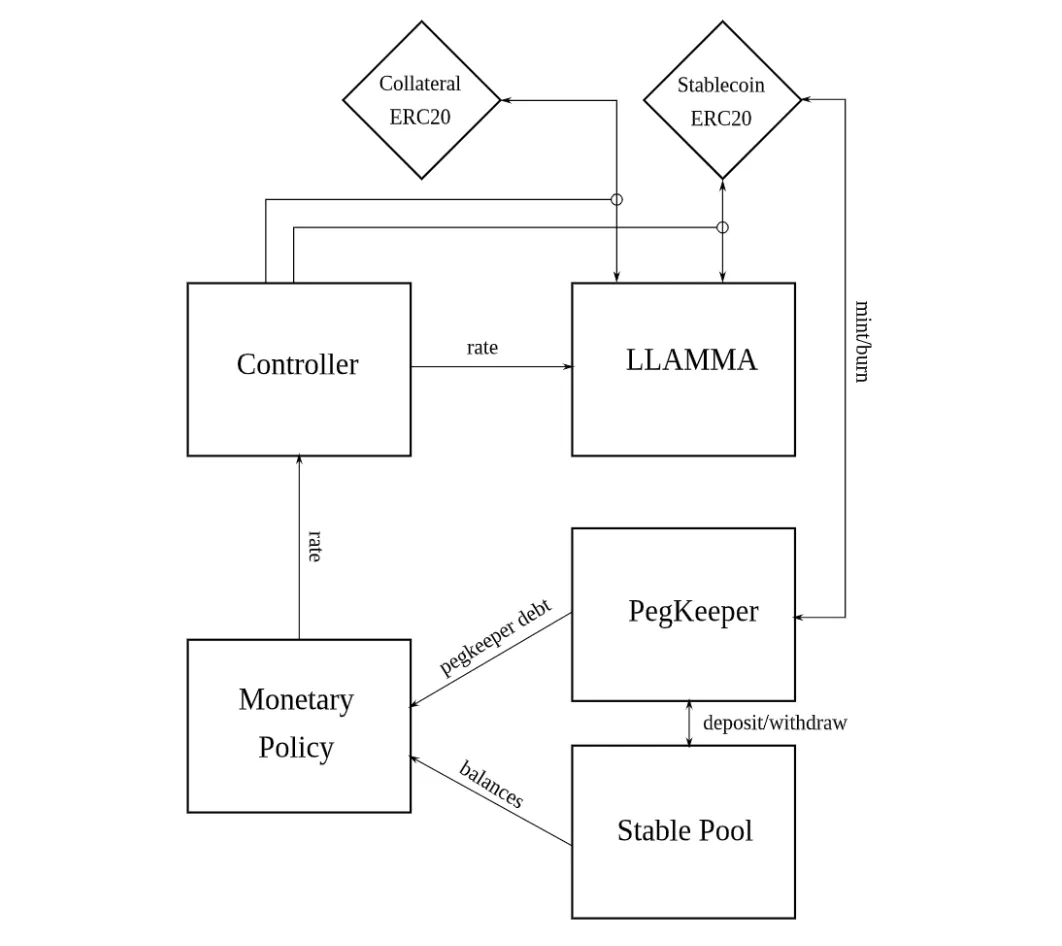

crvUSD is a decentralized stablecoin issued by Curve. Many details surrounding the stablecoin have been kept under wraps, but we do know that crvUSD will utilize a new mechanism known as the Lending and Liquidation AMM Algorithm (LLAMA).

LLAMA adopts a "more benevolent" liquidation design. When the value of the user's collateral declines, the user's position will gradually be replaced by crvUSD instead of a one-time complete liquidation.

All in all, LLAMA should help reduce punitive liquidations, and this improved user experience for borrowers may increase the attractiveness of opening crvUSD-denominated CDPs.

Few details have been given yet regarding the type of collateral supported and crvUSD’s role in the ecosystem, but it’s likely that the stablecoin will be minted by Curve Pools’ LP tokens. This will help improve the capital efficiency of providing liquidity on the platform, as LPs will also be able to benefit from deploying crvUSD into DeFi.

crvUSD should also benefit from Curve's guage system, which is used to distribute the release of CRV, and by doing so, distribute the DEX's liquidity. It is highly likely that some of these released tokens will be allocated to the crvUSD pool, or crvUSD will become part of the base pair of other stablecoins to help it easily build deep liquidity.

market impact

Now that we have an idea of the state of stablecoins for specific applications, let’s take a deeper look at how this will impact the market.

Increase in Issuing DAO Revenue (Theoretical)

The party most directly affected by application-specific stablecoins is the issuing protocol itself. In theory, creating a stablecoin strengthens the distribution protocol's business model, as it provides it with an additional revenue stream.

Currently, protocols like Curve and Aave rely on transaction fees and utilization-based loan interest, respectively. The low-quality nature of these revenue streams has become apparent in this bear market, as reduced trading and lending activity and fee compression due to increased competition have led to sharp declines in revenue.

The issuance of stablecoins within the protocol changes this dynamic, as protocols will now be able to access additional revenue streams to support their top line. While interest income is still cyclical as it depends on borrowing demand, it is generated much more efficiently (i.e. has a higher TVL rate of return) than transaction fees or access to money market spreads.

While this interest income could also be subject to similar fee compression (more on that later), it is still theoretically possible to diversify the income mix and strengthen the moat of the underlying protocol through other means such as minting / Redemption fees, pegged arbitrage and liquidation.

Potential value accumulation for token holders

Another party that will benefit from the application-specific stablecoin boom is token holders of issuing protocols.

While this depends on each individual protocol, any revenue share increases the yield available to holders of staked or locked tokens.

In a bear market, we have seen revenue sharing assets like GMX and GNS outperform, a protocol that issues a stablecoin and then shares revenue with holders will make its tokens more attractive and more likely to outperform.

For example, Curve will likely share crvUSD revenue with veCRV lockers, meaning lockers will receive transaction fees, governance bribes, and a share of stablecoin-based cash flows.

Given the regulatory risks associated with this approach, it is also possible that the distribution protocol could add utility to its tokens in other ways. For example, AAVE stakers will be able to borrow GHO at a discount relative to other users on the platform.

Bribery and Liquidity Fragmentation

One of the most critical factors for the success of stablecoins is to have deep liquidity. Liquidity is the lifeblood of any stablecoin — not only does it enable low-slippage transactions, but it also helps facilitate integration, as liquidity is required for lending platforms to liquidate and secure valuable infrastructure like ChainLink oracles .

This need for liquidity in application-specific stablecoins is likely to help boost the governance bribery market.

Driven by the Curve wars, stablecoin issuers can bribe, or pay token holders, to ensure their votes in guiding token releases to pools of choice, for their tokens to go on Curve and Balancer et al. Build liquidity on centralized exchanges.

Through bribes, issuers are able to rent liquidity for desired scenarios on an as-needed basis. An abundance of application-specific stablecoins could lead to more DAOs getting into the game and bribing those token holders.

In turn, this should increase yields for CRV and BAL, as well as CVX and AURA lockers, who through meta-governance control the majority of releases on Curve and Balancer, respectively, and receive most of the bribes.

Another beneficiary of this bribery spree is marketplace platforms like [Redacted] Cartel's Hidden Hand and Votium, which facilitate these transactions.

However, this bribe will cost end users in the form of liquidity fragmentation. In a crypto market that shows few signs of inflows, liquidity could become more fragmented across a variety of different stablecoins, leading to poorer execution for whale traders.

credit boom

The growth of application-specific stablecoins could also catalyze the DeFi credit boom by leading to the proliferation of low lending rates.

To compete with existing stablecoins like USDC, USDT, DAI, and FRAX, stablecoins like Aave and Curve will likely have to offer GHO and crvUSD at low borrowing rates, thereby attracting users to mint new units to increase their circulating supply.

In theory, this low interest rate-driven credit craze could stimulate the DeFi and crypto markets broadly, with both farmers and degens able to leverage and borrow at incredibly low interest rates. Additionally, it could open up interesting arbitrage opportunities between Crypto and TradFi, as users could potentially borrow stablecoins at rates far below US Treasuries.

We’ve seen early signs of adapting to this new model from stablecoin issuers such as Maker, which will offer DAI lending at a 1% Dai Savings Rate (DSR) via Spark, the Maker-controlled fork of Aave V3.

While this lower borrowing rate could hurt the bottom line of distribution protocols like Aave and Curve, it could help feed a credit-hungry market in 2022 following the implosion of CeFi lenders. With interest rates significantly higher than possible borrowing rates for stablecoins like DSR and GHO, Crypto will be one of the cheapest credit markets in the world.

DeFi's Wildcat Era

Wildcat banks were a period in American history when each bank issued its own currency. As we speak, DeFi is running financial history at an accelerated pace, and — with stablecoins like GHO and crvUSD — it seems about to start on a similar trajectory.

While they are unlikely to overtake stronger incumbents like DAI and FRAX, GHO and crvUSD could carve out a niche market benefiting from integration with their distribution protocols.

In theory, these stablecoins will help strengthen their issuers' business models and accrue value to token holders, but there is a "race to the bottom" where issuers will undercut each other on interest rates in order to pay Borrowers offer the cheapest credit, and they are less likely to do so.