Original source: Do you understand the world better today?

Original author: Mr. Jason Chen

Binance released the storage chain Greenfield white paper last week: github.com/bnb-chain/gree... But I didn’t see a big hot spot in the industry and it didn’t reflect on the currency price. There are not many studies on the storage field, mainly this There are too few track players, mainly Arweave and Filecoin, but storage is definitely the most important track in the blockchain field.

I will first help you sort out the outline and history of the entire storage system to facilitate the next understanding. I have briefly talked about it before, and people often confuse decentralized storage with on-chain. Blockchain is a distributed ledger. It has the ability to store data, but what we currently refer to in a broad sense, whether it is NFT or Mirror, does not exist on the blockchain.

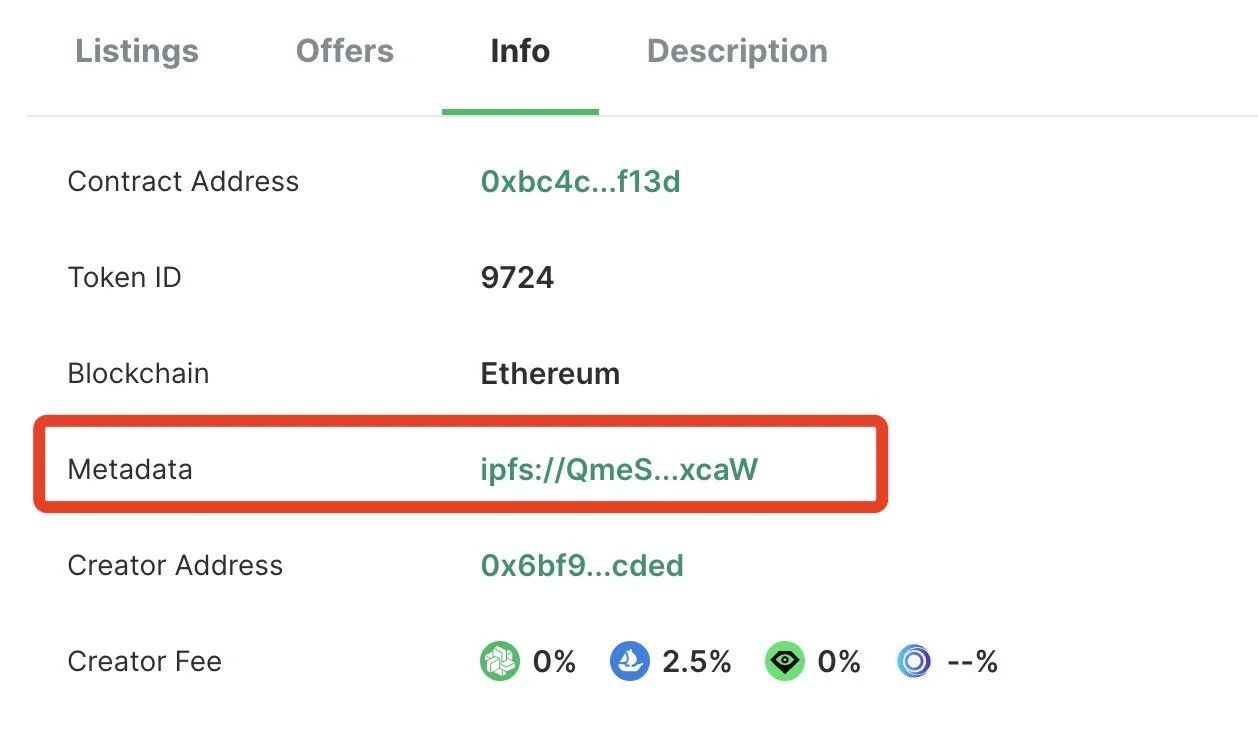

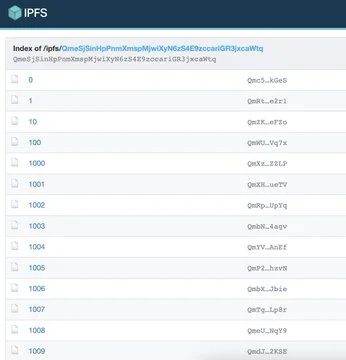

Because each full node needs to be backed up to ensure that the data cannot be tampered with, when there are 10,000 miners, even to store 1 MB of information, the entire network will consume 10 GB, which is very uneconomical, so the proposed solution is Store the data off-chain, and then put the off-chain storage address into the blockchain for indexing. Taking NFT as an example, you can see that the metadata is indexed to an ipfs link, and after opening it is a folder.

Here I want to expand IPFS for everyone. It is a point-to-point distributed storage system with content addressing. The opposite of content addressing is address addressing. For example, when we store photos in the cloud disk, the computer needs to know when downloading The IP address and domain name of the photo, so that the data can be found in the corresponding place, but if the copy does not exist or the server is down, the file is also lost.

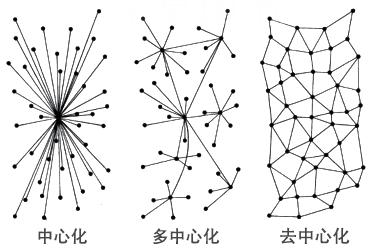

But maybe someone has downloaded this photo before and stored it in the computer, but your computer doesn’t know that the other party has this photo, so to solve the problem of decentralized storage, you need to solve the problem of searching by content rather than by address, so that you don’t have to You need to tell the computer where to get the photos, but tell the computer what the photos you need look like, and then the computer asks everywhere who has such photos, and if you have them, send them to me, but the content may be very large. Direct brute force retrieval is very time-consuming, so the hash value is stored as the file name after the file content is hashed, so that only other hash values that are the same as the hash value of the photo can be retrieved very quickly, and then let the other party retrieve it after finding it Send me a copy of the photo, so that the efficiency will be very fast. The above is the general principle of IPFS. Storage has gone through three stages of centralization, multi-centralization and decentralization.

Therefore, although IPFS is similar to the blockchain in thought, it has no direct relationship with the blockchain itself. However, if it wants to run stably, many users need to contribute their storage space and the network to become nodes, so the following Filecoin is inspired by Bitcoin. , is an incentive layer built on top of IPFS to incentivize nodes that store data,So what everyone must understand is that no matter what kind of storage method, there is still a physical hard disk in the end. Decentralized storage is a kind of sharing economy, and those who have spare hard disk resources can contribute it.

In fact, when I was talking about blockchain + AI with you yesterday, some people also mentioned computing power sharing. I have already played with Keyun and Jirouting very early, but I will talk about it with you when I have time. share this.

But after all, Filecoin is a layer after the emergence of IPFS to motivate storage service providers, but Arweave integrates storage and chains more thoroughly. It has specially developed blockweave, which is compared with traditional blockchains. In this structure, each block is linked to the next block and the previous two blocks: a previous block and a historical recall block. Nodes must perform access proofs when producing blocks.

This is different from the POW calculation proof. By accessing the older random blocks in the blockweave history, new blocks can be mined to get rewards, so that miners who store rare blocks can get greater returns in the long run. Through this set of mechanisms In order to allow nodes to store as much historical data as possible, it will not consume a lot of resources like POW, so the originality and permanence of Arweave are higher than Filecoin.

I just said that the blockchain itself also has information storage capabilities, and some people call the blockchain a decentralized database, but in fact the most important responsibility of the blockchain is to undertake the decentralized ledger of recording transactions rather than the database, storing a large number of Data is not the core of the blockchain in terms of segregation of duties.

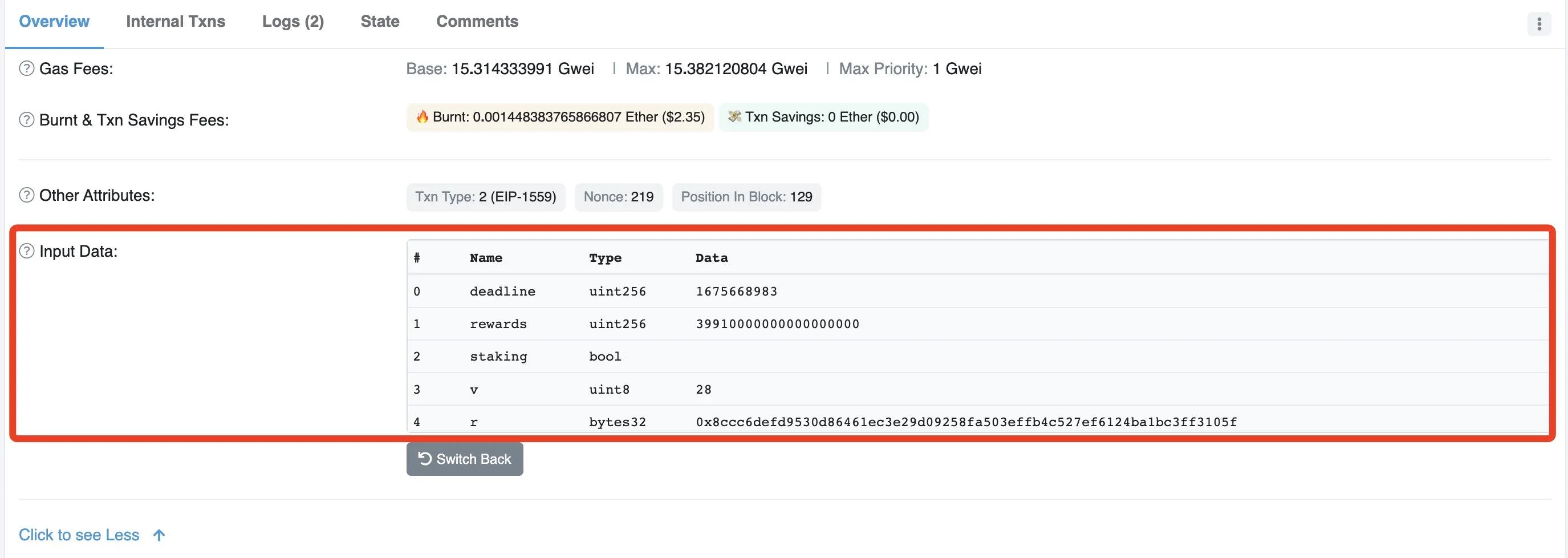

If the blockchain is compared to a computer, although there is memory to store a small amount of data, it needs an external hard disk to store a large amount of data instead of stuffing it all into the memory, so decentralized storage assumes the responsibility of an external hard disk. As long as the stored things can interact with the computer and the memory and remain unchanged, as you can see in etherscan, the Input Data in each transaction of Ethereum is the information written into the blockchain, but it can only be simple field data of the key value type, so it is still necessary to connect an external "hard disk" to supplement it.

The above is the explanation of the entire storage system and the principles of the two storage leaders, Filecoin and Arweave. After talking about it, everyone should be very deeply aware of the importance and complementarity of storage in the blockchain, so this is why Binance wants to One of the reasons for becoming an entrant is that such a large track and such a concentrated competition head effect, the entry of Binance's volume should have caused an uproar, but there was almost no movement.

I think the main reasons are:

Storage is the lower layer far away from users, and it is difficult for users to perceive and understand, and the current storage is also toB and then toC. For example, Mirror is connected to Arweave. We write articles on mirror, but we don’t know that Arweave exists

On the day when the Greenfield white paper was announced, it happened to hit the big hot spot of Nostr, which was as unfortunate as Wang Feng.

Storage track, not yet broken out

The premise of storage is to have content, but now the web3 application layer is scarce and has no source of content production. For example, the largest track defi has nothing to do with content at all. A small picture needs to be stored. After thinking about it, there are not many applications with a large number of "content storage" scenarios like web2, but there are not many applications in web3, so the storage track is far away from users and there are few.

However, with the explosion of the application layer of web3, a large number of UGC products with C-end interactivity will be produced, and there will naturally be a demand for a large amount of content storage, so we can see the end, but the problem lies in the milestone of the end process. I can't see it for the time being, so I will share my investment logic here.

For example, after I analyzed the LSD track before (see previous articles about Lido and SSV), I deduced that as Ethereum switches to POS, first of all, these low-threshold pledge service providers such as Lido will emerge, resulting in a large number of Verification nodes, but the centralization of operators will greatly damage the security of the Ethereum network, so the end result must solve the problem of operator centralization. After seeing the end result, I will find 3 more milestones, and the 20th beacon chain will go online , POS merger on 22, Shanghai upgrade on 23, the purpose of finding milestones is to let you have a psychological expectation of the moment when the finale arrives, and to find a suitable opportunity to enter the market, otherwise you will wait for a few years if the ambush is too early, 2023 Shanghai upgrade withdrawal Afterwards, the enthusiasm for staking was greatly stimulated, and the problem of operator centralization was exposed. Therefore, the first half year of Shanghai’s upgrade is a good time to enter the market. Otherwise, the first milestone in 2020 will be a two-year wait.

I can see the end of de-save, but I still can’t see through the milestones in the middle. However, with the improvement of the infrastructure, and I also saw that socialfi and other application layers began to roll out this year, I think this end will not come too late, maybe it can Trying to deposit a small amount of related assets does not represent investment advice, everyone DYOR.

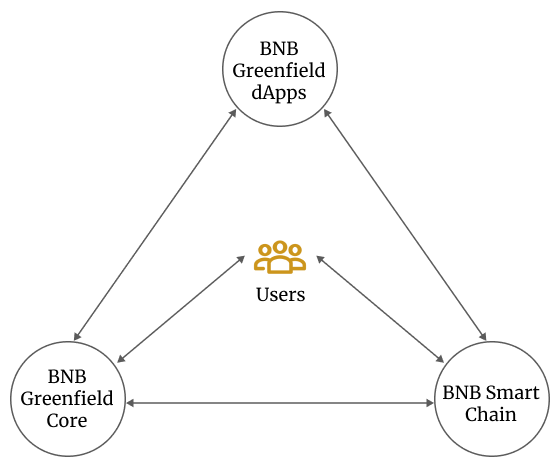

Well, back to Greenfield, as mentioned at the beginning, its ecology is a trinity architecture around users: BSC chain, Greenfield and dapps. Binance has a transaction chain, and then a storage chain. The dapp developed by developers based on these two forms a self-contained system, and Greenfield is a side chain with a native cross-chain bridge with BSC, using BNB as a token. This set of combined punches will complete the Binance ecosystem.

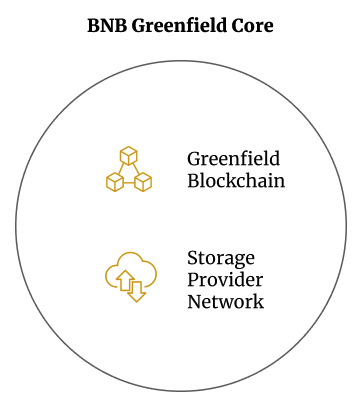

Therefore, on the one hand, the storage track is large enough to arouse Binance’s interest in doing it in person, and on the other hand, it is also an important part of complementing Binance’s ecology. By reading the white paper, we can see that the core of Greenfield is a storage chain and storage node network. In fact, it is very similar to Arweave. The storage chain has its own governance logic and incentive system, which stores metadata, block status data, account information and permissions, data such as billing.

It is worth noting that the metadata exists on the chain, and there is a separate object storage system that stores the object data off the chain. Taking NFT as an example, the metadata of the metadata is placed on the chain instead of IPFS, but the most space-consuming in the metadata The picture itself is still stored off-chain. This design may be due to Binance’s consideration of performance and cost. When using data, the on-chain metadata is used to lead to off-chain object data.

As the native token of the storage chain, BNB is used for governance and payment of GAS, and can flow between BSC and Greenfield, so from this perspective, it has found another value empowerment for BNB, but I personally don’t think the price of BNB will be affected by it. There are many dividends in the storage track, because the price of BNB is a complex, and storage empowerment is only one factor that affects the price. If you want to invest in the storage track, I think BNB is not a good bid. It is better to directly invest in storage token, because the empowerment of these tokens is 100% from storage dividends, of course everything is DYOR.

It is also worth noting that the Greenfield format is fully compatible with the Ethereum EVM, so it is also convenient for existing products to access. What is more interesting is that the management of the authority group is more detailed, which can control the data operations of each account such as adding, deleting, modifying and checking. Permissions, this is very useful.

Challenge proofs are introduced for data integrity. Similar to the OP, challenge transactions can be submitted to nodes, and Greenfield will also randomly send challenge events similar to sampling checks. If the challenge is accepted, the verifier will perform a check on the challenged nodes. Check, if the challenge is successful, the initiator will be rewarded, and the node will be punished. If the challenge fails, the data will have a freezing period and will not be challenged again, so as to avoid waste of resources.

What's interesting is that it is not only used for data storage, but also supports the creation of economic value based on data. For example, the data permission just mentioned can also be cross-chained to BSC and become the digital asset of BSC. This is interesting, my data is valuable , It is also valuable for my data to operate.

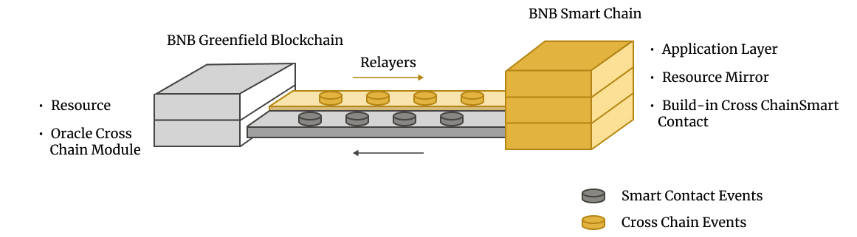

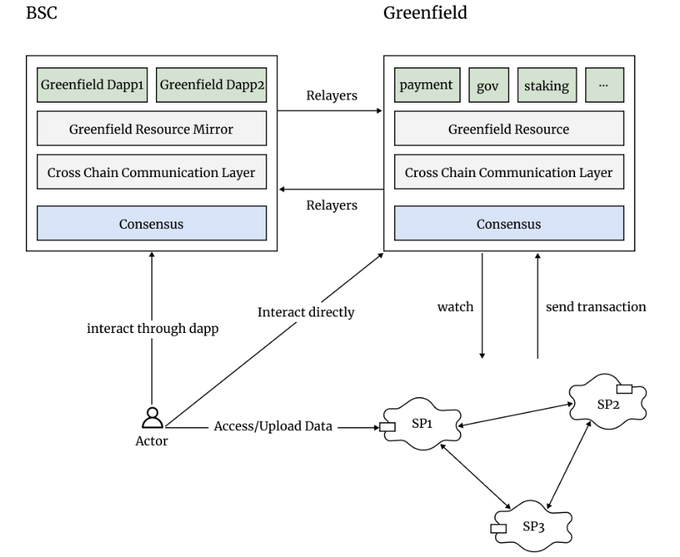

The participants in the entire Greenfield ecosystem are as follows. BSC is responsible for dapp deployment, data resource mirroring, cross-chain and consensus. Greenfield is responsible for payment, data resources, cross-chain and consensus. Note that Greenfield also has its own governance mechanism, etc., so It also has its own consensus and then SP nodes interact with Greenfield for data. The picture on the right shows the network structure, which is very similar to the OP's set of verifiers with elections.

The account system in Greenfield is independent, and its format is compatible with BSC and Ethereum, so it also has the conditions for the wallet to support Greenfield in the future. What is interesting is that Greenfield as a chain is developed based on Cosmos, and Cosmos is the position of Layer 0 big brother It seems to be getting more and more stable. The recently popular Canto is also based on Cosmos, but I personally think that the Canto set has a bit of luna shadow, DYOR.

The trouble with Binance is that BSC is a fork of Ethereum. Unlike aptos and solona, which do not have their own independent technical system, it is difficult to cultivate their own developer groups. This problem is also a problem encountered by many EVM chains. The developer’s storage chain, how to establish developer loyalty needs to be worked hard, so Binance needs to switch the stock dapps to Greenfield first, and then attract incremental dapps to access.

It took almost a day to give everyone a look at the storage track based on Binance Greenfield. Personally, I am quite optimistic about the storage track. I look forward to the outbreak of more truly usable application layer products. In terms of infrastructure, regardless of smart wallets And account abstraction to lower the entry threshold for users, or aptos and layer chains to improve performance, the infrastructure for the application layer explosion has been laid, and it is waiting to build a nest to attract phoenixes. The content may be subjective and biased. If there are mistakes, please wait. Forgive me, welcome to exchange and discuss.

"Welcome to follow my Twitter @jason_chen 998" to learn about the latest and most complete information, and to discuss and communicate with me