Summary

With the carnival of Defi Summer in 2020 and NFT Summer in 2021, more and more people have recently begun to cast their eyes on NFTFi, expecting that this track that combines NFT and Defi can bring a new midsummer to the world of web3 .

Around NFTFi, this article focuses on the following two issues:

Why is NFTFI needed, and what need does it address?

What is the current development of each sub-track of NFTFI?

This article will first analyze the birth background and current situation of NFTFi, and then sort out the whole process from user purchase to holding NFT, and analyze the core of the seven sub-tracks of pricing evaluation, trading, BNPL, lending, derivatives, fragmentation and leasing The mechanism is analyzed, and then the point-to-pool CDP model lending project JPEG'd is selected for key analysis.

The background of the birth of NFTFi

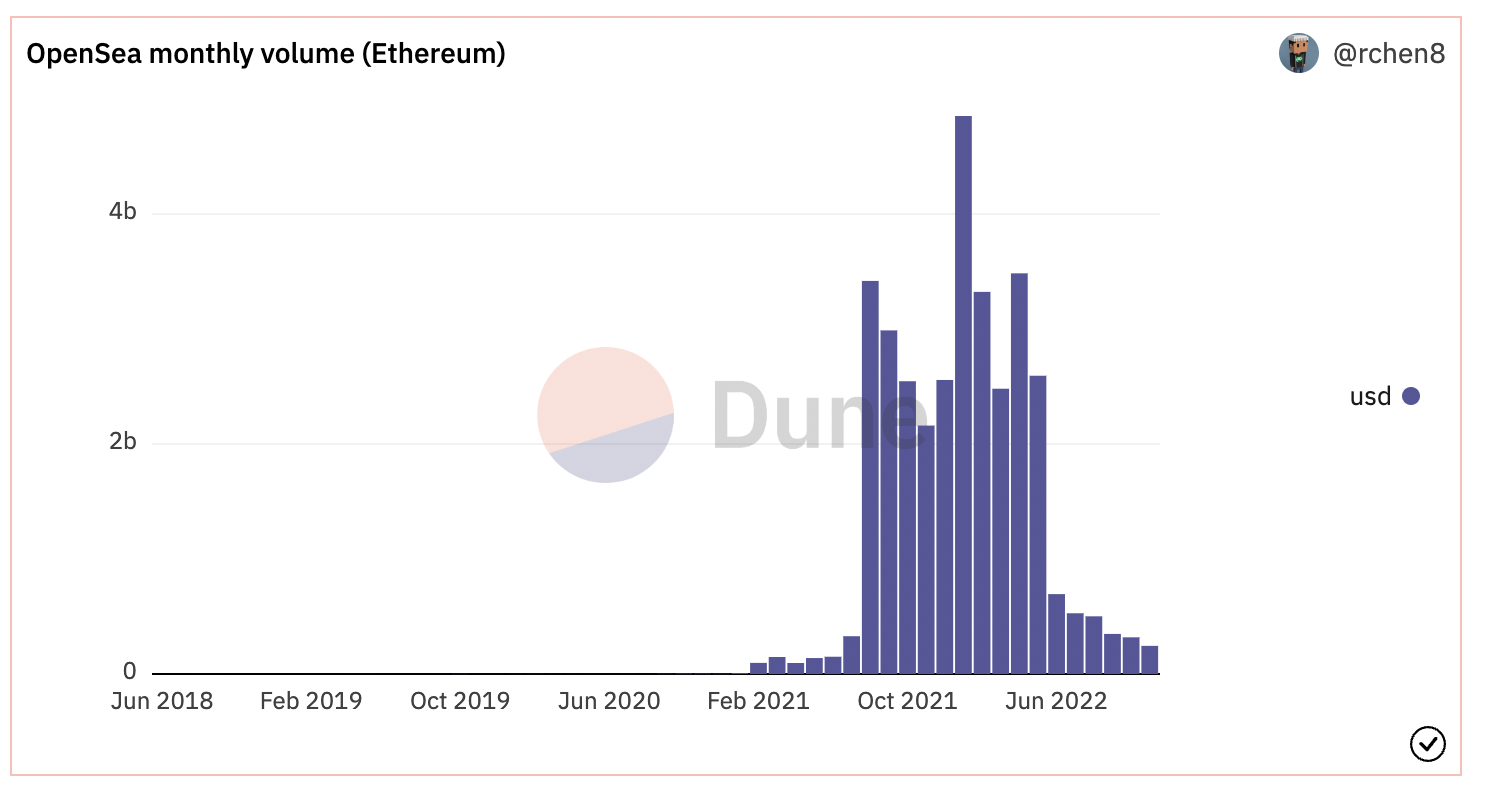

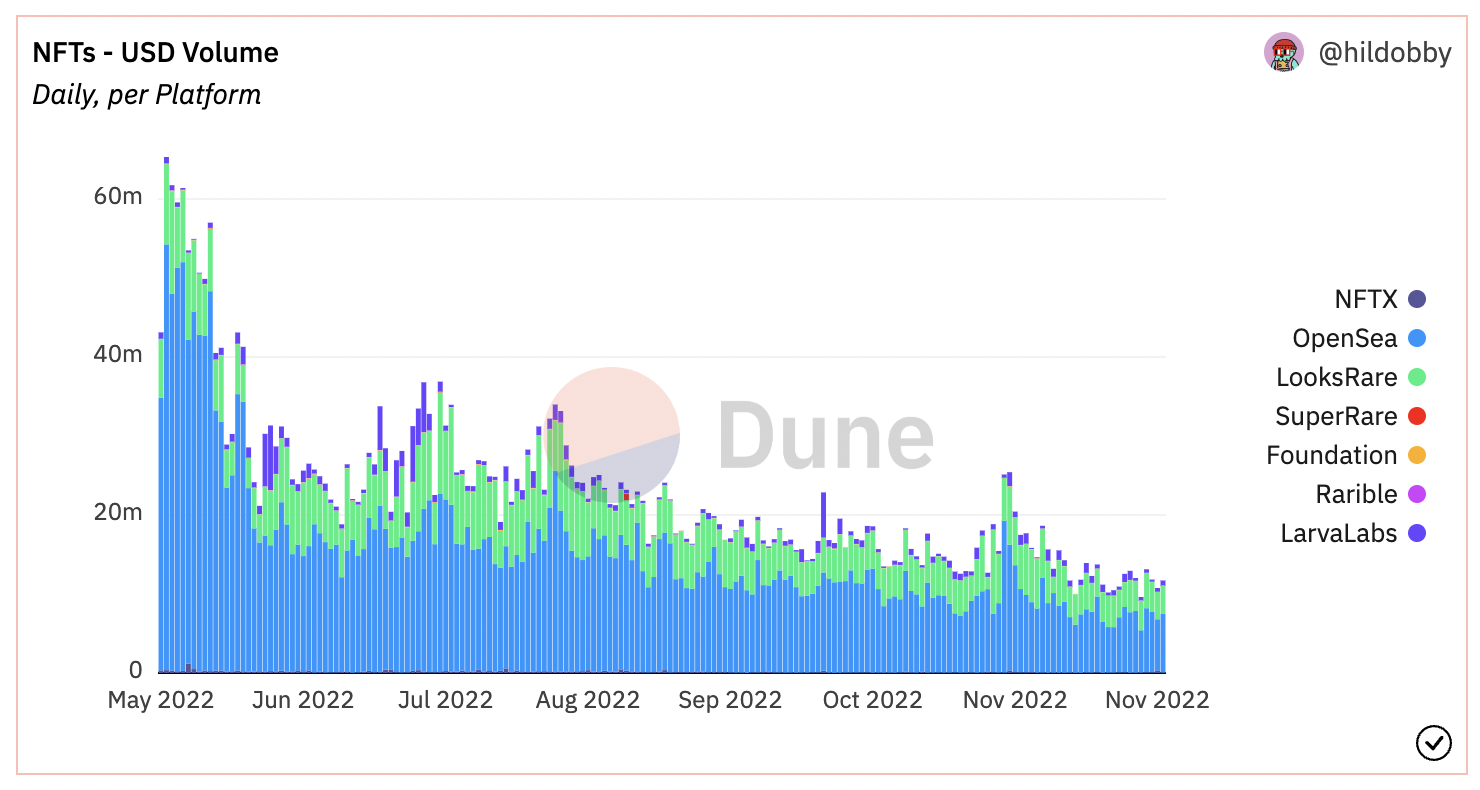

The birth of NFTFI is closely related to NFT. The NFT market began to attract attention in February 2021, and then reached a climax in August, reaching its peak in January 2022, when Opensea's transaction volume reached 4.8 billion US dollars that month. However, as the entire encryption market began to turn downwards, the NFT market was inevitably affected, and the transaction volume and transaction value began to decline rapidly, experiencing a process from skyrocketing to plummeting.

After the bear market, the liquidity problem of NFT became more obvious, which made players who entered the NFT market before get into trouble, and NFT holders were often forced to hodl. NFT without wealth growth effect will lead to a signal of collapse of consensus in the community, which will exacerbate the lack of liquidity and form a vicious circle.

The core problem of NFT at present is insufficient liquidity. The reasons for insufficient liquidity include the following three points:

The web3 environment has become bearish: the Federal Reserve raised interest rates before, and then there were frequent thunderstorms in the encrypted world, and the trust in the encrypted world and NFT has dropped significantly.

High barriers to entry: Blue-chip projects have a high floor price (such as boring apes and cryptopunks are too expensive for most users), and ordinary projects need to spend a lot of time on research and worry about running away.

Lack of application scenarios: The utilization rate of NFT assets by holders is very low, and most holders still buy low and sell high, and other enabling scenarios have not been widely penetrated.

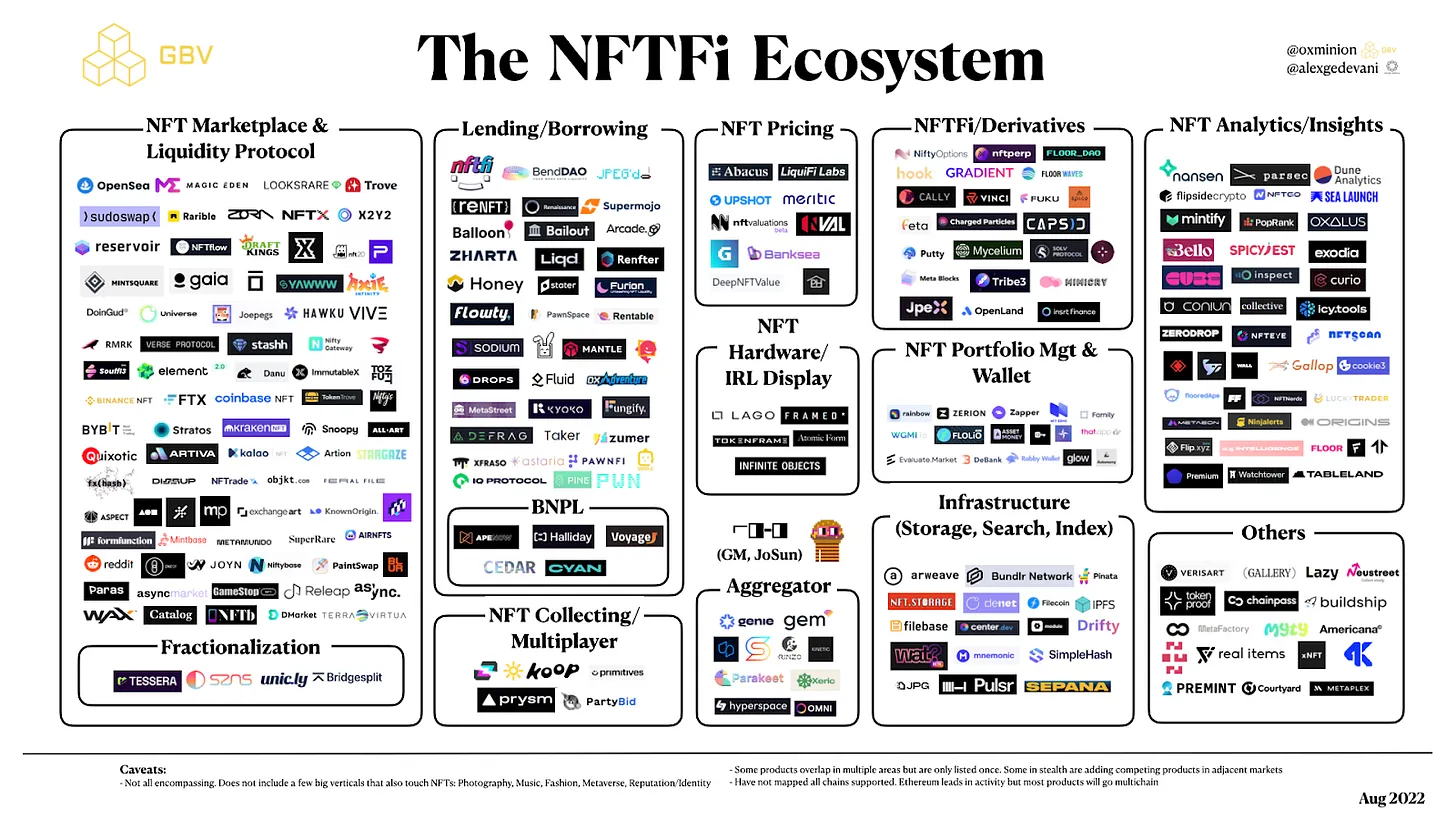

In order to improve the liquidity of NFT, broaden the application scenarios and deal with the current situation of high threshold, NFTFI came into being. There are many definitions of NFTFi. This article believes that NFTFi is essentially a combination of NFT and financial attributes, making the flow of NFT more diverse and efficient, and providing NFT holders with more possibilities for playing. Under the NFTFi ecosystem, various products have also been derived, including layer 1 and layer 2, as well as NFT vertical projects.

Current status of NFTFi track

At present, NFTFi is still in the early stage of development. The market size can be estimated from two aspects, one is the NFT market transaction volume, and the other is the blue-chip valuation of NFT.

a. According to the "NFT Market 2021" report released by Nonfungible.com, the transaction volume of the NFT market in 2021 will be 17.6 billion US dollars, an increase of 210 times compared with 82 million US dollars in 2020, which is the sales volume of the global traditional art market in the same year ( 27% of $65 billion). Track size = 176* 50% (penetration rate) ≈ USD 8.8 billion

b. Based on the valuation of blue-chip NFT, estimate the current track size of NFTFi. In May 2022, the value of major blue-chip NFTs (refer to the floor price and the ETH price is calculated at 2000 USD): BAYC is about $1.72 billion, CryptoPunks is $953 million, Moonbirds is $440 million, Azuki is $273 million, Doddles is $237 million , with a total valuation of about 3.587 billion US dollars. The land types of The Sandbox, Arcade and Decentraland are not included because they have obvious rarity rankings, and it is not suitable to use the floor price for calculation. Taking into account the future upside, the overall market value of blue-chip NFT is about 5 billion US dollars. Track size = 50* 80% (penetration rate) ≈ USD 4 billion

Since the current NFT valuation and pricing are not yet mature, the market is basically concentrated on blue-chip projects & floor price NFTs. It is more reasonable to use the second method on the current track; in the long run, with the expansion of NFTFI projects from blue chips For projects covering more NFTs, the first method can be adopted. But generally speaking, the current development of the NFTFI industry is still in its early stages, and the market size is expected to reach the billion-dollar level. The above calculations can only provide a reference in terms of magnitude. The current market size accounts for about 0.5% of the total market value of cryptocurrencies, with a low penetration rate and a large room for improvement.

NFTFi's track projects

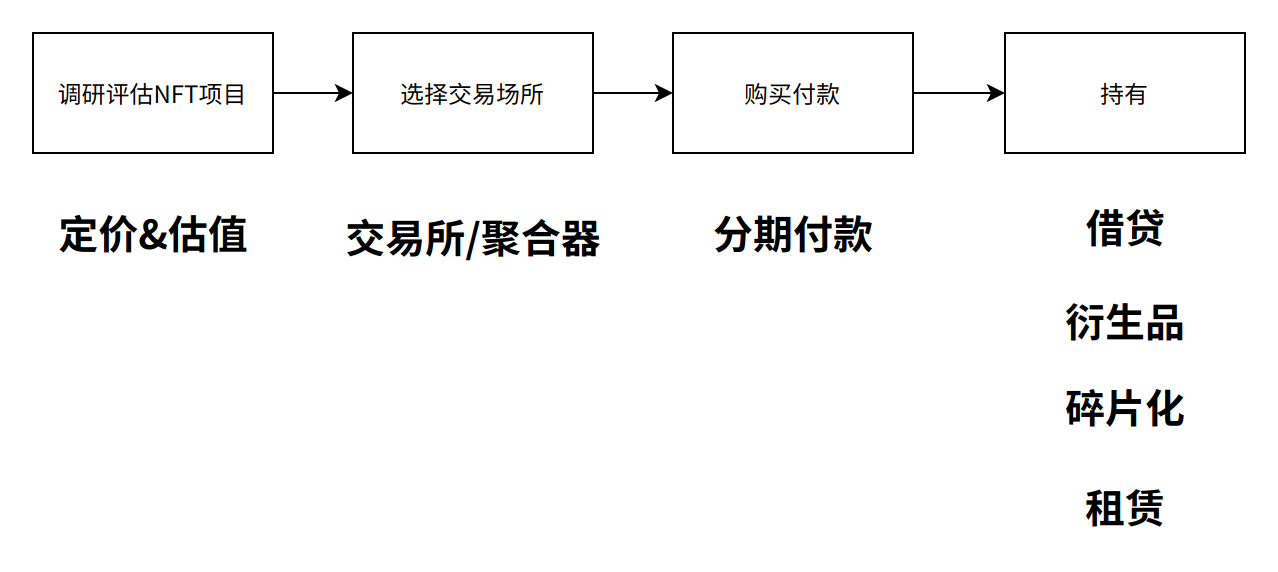

In order to facilitate readers' understanding, this article will break down the whole process from purchasing to holding NFT, and divide it into four stages: project evaluation, selection of trading venues, purchase payment, and holding four stages, involving from pricing evaluation to Transactions, installments to lending, derivatives, fragmentation and leasing.

1. NFT Pricing & Valuation

The pricing and valuation of NFT can be said to be the cornerstone of the entire NFTFi. Whether it is borrowing or leasing, pricing needs to be involved. A good pricing system is very important for the flow of NFT and can promote the development of the entire NFTFi. Currently, this track includes Abacus, NFTBank and Upshot, Banksea, etc.

The current pricing methods mainly include two categories: human pricing (game pricing), algorithmic pricing (oracle machine)

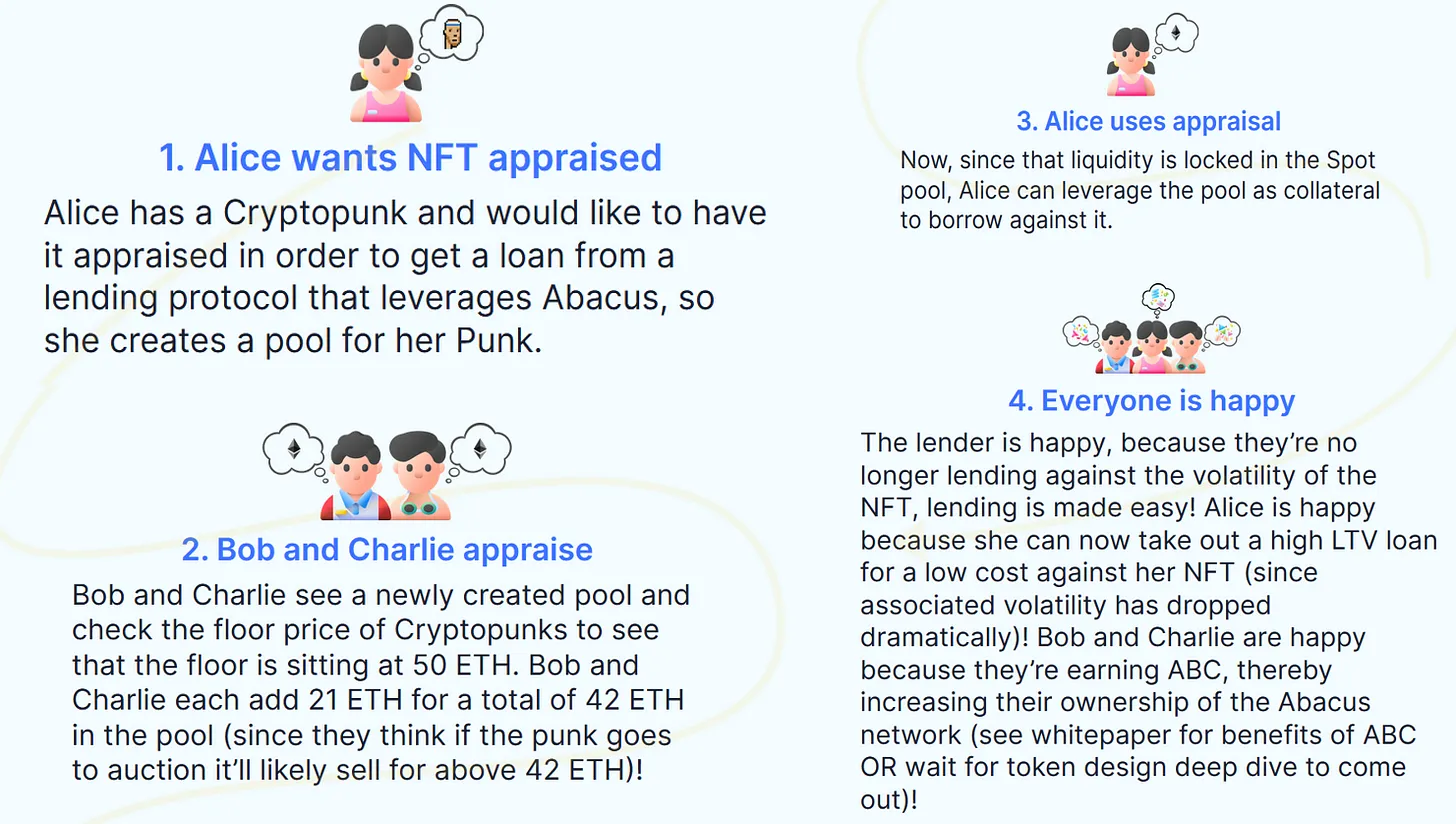

a. In terms of human pricing, the most prominent product is Abacus, which makes good use of game theory. Abacus adopts two pricing models:

ⅰ. Peer incentive pricing: the essence of price is equal to the group's recognition of price

1. Multiple appraisers pledge a certain deposit and evaluate the price of NFT, and then weight the appraiser's price to get the final price.

2. Evaluation calculates the evaluator's income. The closer the bidder is to the evaluator, the higher the income, and the person whose price difference is higher than a certain value will lose. (The general dividing line is that the price difference is higher than 5%)

ⅱ. Abacus spot pricing: Abacus acts as an intermediary in the price game between evaluators and owners

Appraisers act as validators, guessing NFT values and investing their funds in different valuation tiers. In turn, NFT owners are backed by liquidity to use their NFTs as collateral.

1. Example: Xiaohong puts her BAYC with a market price of 60 ETH into the pool and wants to get a loan; then Xiao Gang and Xiao Ming each put 20 ETH into the pool. At this time, if Xiaohong decides to close the pool (it can be understood as selling BAYC), and the BAYC is 55 ETH at this time, then there is a price difference of 15 ETH in the pool at this time, and Xiao Gang and Xiao Ming will share 15 ETH equally. Then if the price of BAYC is 30 ETH when Xiaohong closes, Xiaogang and Xiaoming will bear the loss of 10 ETH difference. (distributed according to the input ratio)

2. Since the operations of appraisers and verifiers are timely (in order to prevent evil, there will be corresponding restrictions), so in this game, an equilibrium price will eventually be reached, that is, the auction price.

b. In terms of algorithmic pricing, it is essentially an oracle. At present, the more mature solutions on this track include Banksea and upshot, both of which estimate nft prices through multi-dimensional data combination algorithms, such as opensea market prices. Among them, in addition to Banksea's nft historical data, they also quoted community, social media data and other indirectly related data to enrich the data dimension.

Comparison of the advantages and disadvantages of game pricing and oracle machines

Game pricing:

a. Advantages: accurate pricing and release of higher liquidity, for example, the pledge rate increased from 30% to 70%;

b. Disadvantages: The pricing process is complicated, and the game mechanism is still imperfect; it is impossible to value multiple projects in large quantities; it is necessary to prevent price rigging.

Oracle:

a. Advantages: Real-time quotation and keeping up with the market.

b. Disadvantage: slightly weaker accuracy

At present, the oracle algorithm pricing has achieved certain results. From the perspective of market demand, after the continuous accumulation of nft historical data and further iteration and optimization of the model, algorithm pricing has a broader prospect.

2. NFT Exchange & Aggregator

Exchanges and aggregators are the places where users buy NFT, and they are also the segments with the largest market share, including centralized trading platforms: opensea, looksRare, aggregators Gem, Genie, decentralized trading platforms: sudoswap, etc. . As can be seen from the figure below, the current main activities of NFTFi projects are still concentrated in centralized trading platforms such as opensea and looksRare

a. Centralized NFT exchange: NFT trading on third-party platforms is currently the most mainstream trading method.

b. Aggregator: Through multi-platform price aggregation, on the one hand, better quotations are provided, and on the other hand, one-click scanning can efficiently save gas fees.

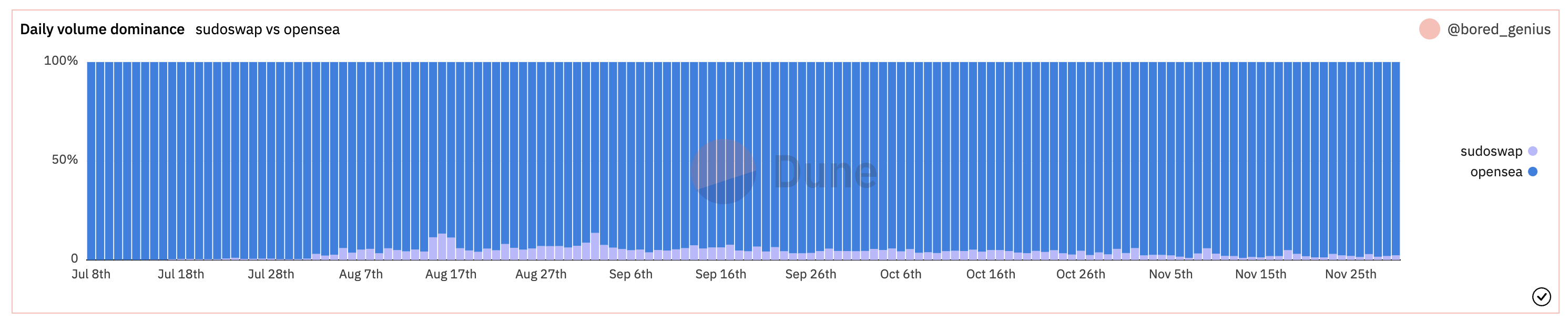

c. Decentralized NFT exchange: The representative project is Sudoswap, and its logic is similar to that of dex.

ⅰ. Sudoswap's AMM model and liquidity provision are also very similar to Uniswap. In terms of liquidity provision, unilateral NFTorETH can be provided, and trading pairs can also be provided to obtain transaction fee income.

ⅱ. But since NFT is indivisible, it is different from the curve of x*y=k. Sudoswap adopts three other curves: including linear curve, exponential curve and XYK curve (newly added). Users can choose

1. Linear curve:

newprice=olderprice+delta*buy_number-delta*sell_number

2. Index curve: Logically, multiply by delta when buying, and divide by delta when selling.

3. The XYK curve was added in September, but it was vaguely written on the official Twitter and the white paper, without a clear explanation and no discussion.

Comparison of the advantages and disadvantages of centralized NFT exchanges and decentralized NFT exchanges, decentralized NFT exchanges (taking Sudoswap as an example):

a. Advantages: market matching and timely pricing can help long-tail projects; no royalties, which is beneficial to buyers; low handling fees;

b. Disadvantages: The difference in rarity is lost, and the value of the same series of NFTs converges, which is only suitable for long-tailed or highly homogenized NFTs; no royalties cause dissatisfaction among creators.

Centralized exchanges:

a. Advantages: Provide a large number of NFTs, and the pool that users can choose from is large; one price for one NFT

b. Disadvantages: high royalties and high handling fees

Judging from the current daily trading volume comparison between Sudosap and Opensea, it is basically maintained at a status quo of 3% VS 97%, and the proportion is relatively low. Since PFP itself has the uniqueness of each token, it naturally has the characteristics of low liquidity and subjective pricing, so that the frequency of changing hands cannot be as high as that of tokens, and the advantages of Sudoswap in enhancing liquidity have not been fully utilized. This is the difference between Sudoswap and uniswap. Where is the difference.

In the long run, Sudoswap and Gamefi's prop NFT (single homogeneous, high-frequency trading) are a perfect match. In the future, starting from the gamefi ecological cooperation may produce new breakthroughs. On the other hand, in July this year, the product leader of Uniswap NFT said that uniswap will integrate sudoswap for NFT transactions, which is also a great benefit for the future development of sudoswap.

3. NFT Installment Payment (BNPL)

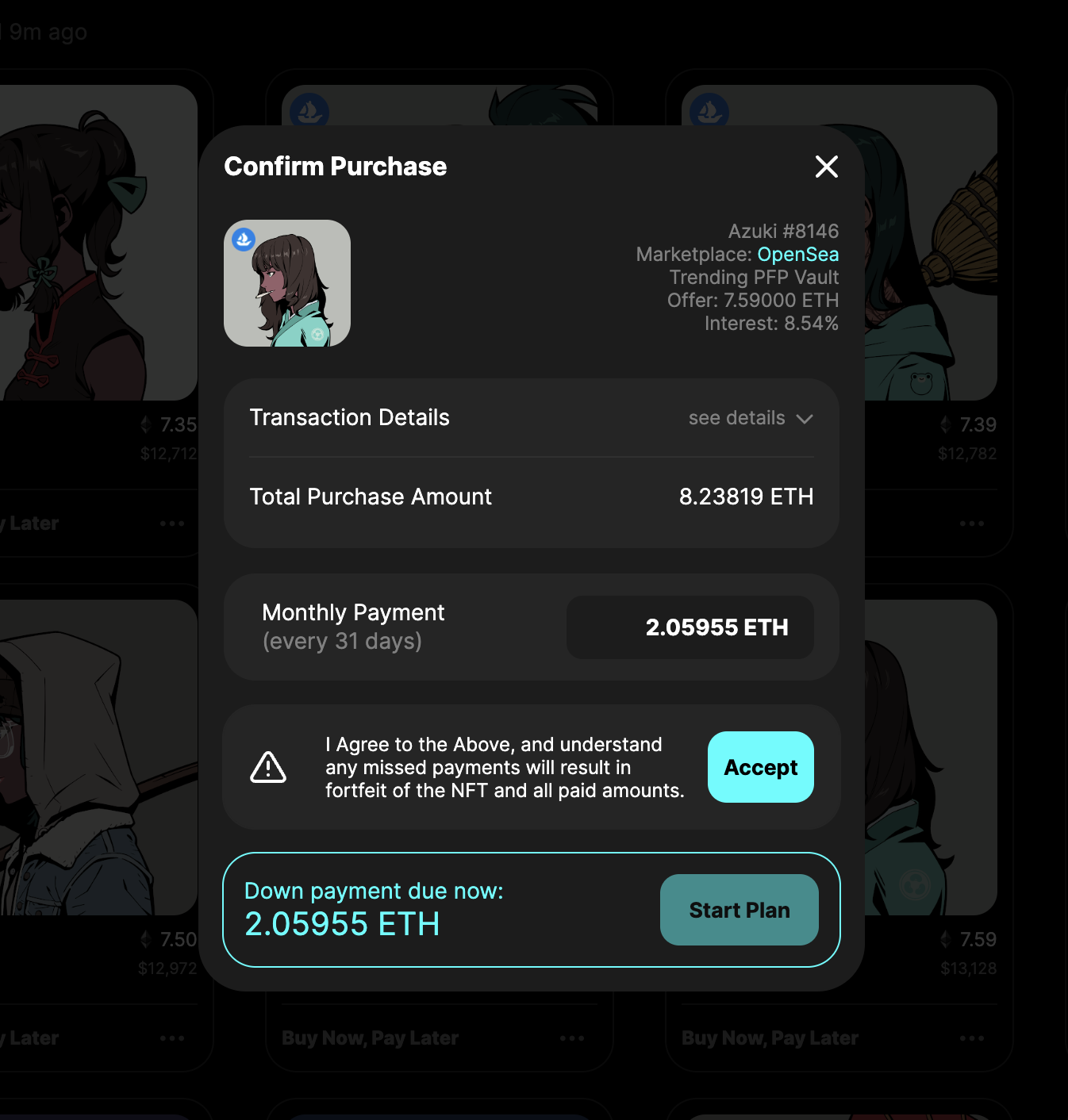

The core of the appeal of “buy now, pay later” is to overdraft future consumption capacity to solve the current shortage of funds. This payment scenario has also been extended from web2 to the world of web3. In order to meet the consumption habits of Generation Z, the builders of web3 have also begun to use this payment method Applied to the NFT field, including Cyan, Cedar, Teller and other products.

The models of BNPL products are basically similar. Take the representative product Cyan in the BNPL agreement as an example:

a.Cyan will list the blue-chip projects they recognize as whitelist projects.

b. Players then initiate a BNPL program on Cyan to purchase NFTs that are currently on the Cyan whitelist.

c. Next Cyan provides the user with an installment payment plan, including the term and interest rate of the installment repayment. Under the BNPL model, buyers only need to pay a certain down payment to lock the price of the NFT for three months. If the NFT price rises during the process, you can repay in advance to earn the rising price difference. However, the interest will not be reduced, and the user still has to complete the payment according to the agreed plan.

d. After the player accepts the plan, he will receive ETH from the Cyan treasury. When all installments are completed, the NFT goes to this address. If a late payment is considered a default, the NFT will remain in the Cyan treasury for liquidation.

e. Regarding Cyan’s profit model, it mainly uses lending services, and users mortgage NFT to obtain loans.

BNPL is a very attractive solution for the Z era with weak consumption ability but strong consumption willingness. The overall gameplay is currently relatively monotonous, and it is basically a BNPL+ loan model. And its borrowing has a strong demand for pricing and valuation. For example, Cedar cooperates with SPICYEST to provide NFT with accurate prices to supplement. Currently, Cyan is leading the NFT BNPL submarket, with various competitors playing similarly, such as Teller's ANPL, Ceda and Pine Loans, and Halliday.

4. NFT lending

Lending as a financial infrastructure has a broad space for development. The core mechanism of NFT lending is to use NFT as collateral to obtain loans. The core element is risk control, which requires the market to have a consensus on the NFT price. Since the current pricing and valuation project is relatively early, risk control is currently mainly carried out from two aspects: project type (blue chip) and loan-to-value ratio (Loan to Value). Like defi, lending is also an early project type in NFTFI. Currently, NFT lending projects include: BendDAO, NFTfi, JPEGd, Pine Protocol, Arcade xyz, etc. The current NFT lending can be mainly divided into two types: peer-to-peer and peer-to-pool.

peer to peer

a. The borrower places an order to show his needs, and then the lender browses all the borrowing needs on the platform, selects an interested order and discusses the interest rate and term with the borrower to complete the loan.

b. When the loan is repaid on schedule, the NFT will return to the original owner; if it cannot be repaid, the NFT will belong to the other party.

NFTfi and Arcade xyz currently use a peer-to-peer mechanism.

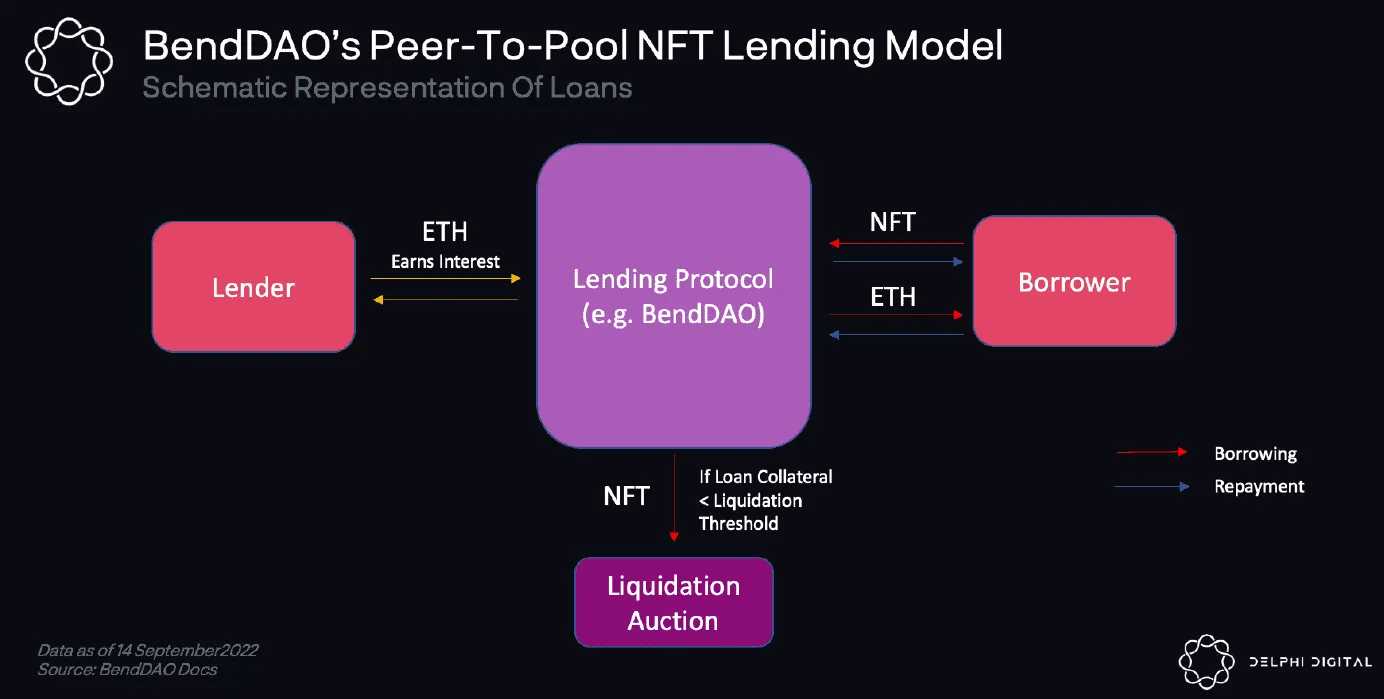

peer to pool

a. NFT holders can obtain loans after mortgaging NFT, which is similar to the logic of Aave and Compound in defi. Lending funds through over-collateralization requires paying interest at the same time.

b. Borrowers inject currency to earn interest.

Currently BendDAO, JPEGd, and Pine Protocol use a peer-to-peer pool mechanism.

Among them, the design of JPEGd is similar to MakerDAO, and PUSD (an over-collateralized stablecoin) is minted by mortgaging NFT for circulation and use.

Peer-to-peer and peer-to-pool comparison

Peer-to-peer lending:

a. Advantages: The scope of borrowing is wider, and there is no need to use oracle machines.

b. Disadvantages: The transaction cycle is long and inefficient.

Peer-to-pool lending:

a. Advantages: high efficiency

b. Disadvantages: The rarity of NFT is underestimated; when the market is not good, lenders panic collectively, leading to the drying up of liquidity, which can easily form a death cycle.

For example, in the bank run phenomenon of BendDAO in August, a large number of NFTs were facing liquidation, and because the liquidation threshold was very close to the low price, no one was willing to buy it. Users frantically pumped liquidity, and ETH deposits once plummeted from 15,000 ETH to 12.5 ETH. Later, BendDAO launched an emergency self-rescue vote to shorten the auction time from 48 hours to 4 hours, and canceled the first bid limit of 95% of the reserve price, and gradually began to recover up.

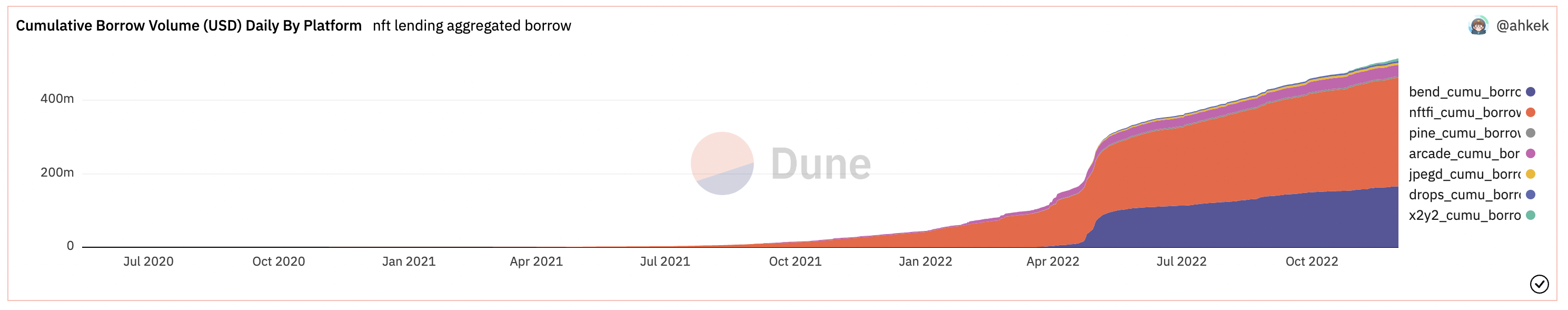

From the data on Dune, we can see that in the current NFT lending market, NFTFi accounts for 58%, BendDAO accounts for 32%, and other types account for about 10%. Generally speaking, NFTFi and BendDAO still occupy an absolute leading position as the leader of peer-to-peer and peer-to-peer pools.

In general, the development of NFT lending is closely related to the overall NFT market on the one hand, and is also closely related to the development of pricing and valuation projects. Since the development of pricing and valuation is still in its early stage, the current peer-to-peer project NFTfi is in the more leading edge. However, with the development of various oracle machines, P2P pools also have a lot of room for imagination. But on the whole, due to the problems of large price fluctuations and difficult pricing, the proportion of NFT loans in the market is still relatively small. The rapid development of NFT loans is basically strongly bound to NFT pricing and valuation.

5. NFT derivatives

NFT financial derivatives are mainly divided into two categories: option contracts and prediction markets.

a. Option contract: Similar to traditional options, the option issuer creates the right to buy or sell NFT at a certain strike price at a certain time and collects the option fee. The buyer of the option buys or sells the NFT at the strike price before the agreed date by paying the premium. Projects include: Nifty Option, Putty, Hook, OpenLand, etc.

ⅰ. At the same time, a perpetual contract project is derived, which is similar to FT's perpetual contract. There is no fixed delivery date, and the contract price and spot price are anchored through capital costs. When the futures price is higher than the spot price by a certain value, multiple parties pay to The short side (or the multi-party fee increases and the short side fee decreases); otherwise, the short side pays the long side. Projects include: NFTperp, injective.

b. Prediction market: A new way of playing, predicting and betting through mint, secondary and renting NFT. For example, in this World Cup in Qatar, you think the German team will win, you can buy/rent the German team with mint/secondary NFT, and finally distribute the bonus according to the winning situation of holding NFT or the holding time. For example, Reality Cards distributes bonuses based on the holding time of the corresponding NFT; like OKX, distributes according to the winning situation of each game in the World Cup and the proportion of NFT in the bonus pool.

Derivatives are a relatively mature type in the traditional financial market. At present, the gameplay of NFT is basically just changing the underlying assets, and there is no new breakthrough. At present, NFT derivatives are still in a very early stage, NFTperp is still in the testnet stage, putty’s transaction volume is also in double digits, and all types of projects are in the early stage. Explosive growth. On the contrary, projects such as prediction markets are fresh ways of playing, and they are new models brought by NFT. If you make good use of major events such as the World Cup and the Olympics, there will be some room for innovative imagination in the future.

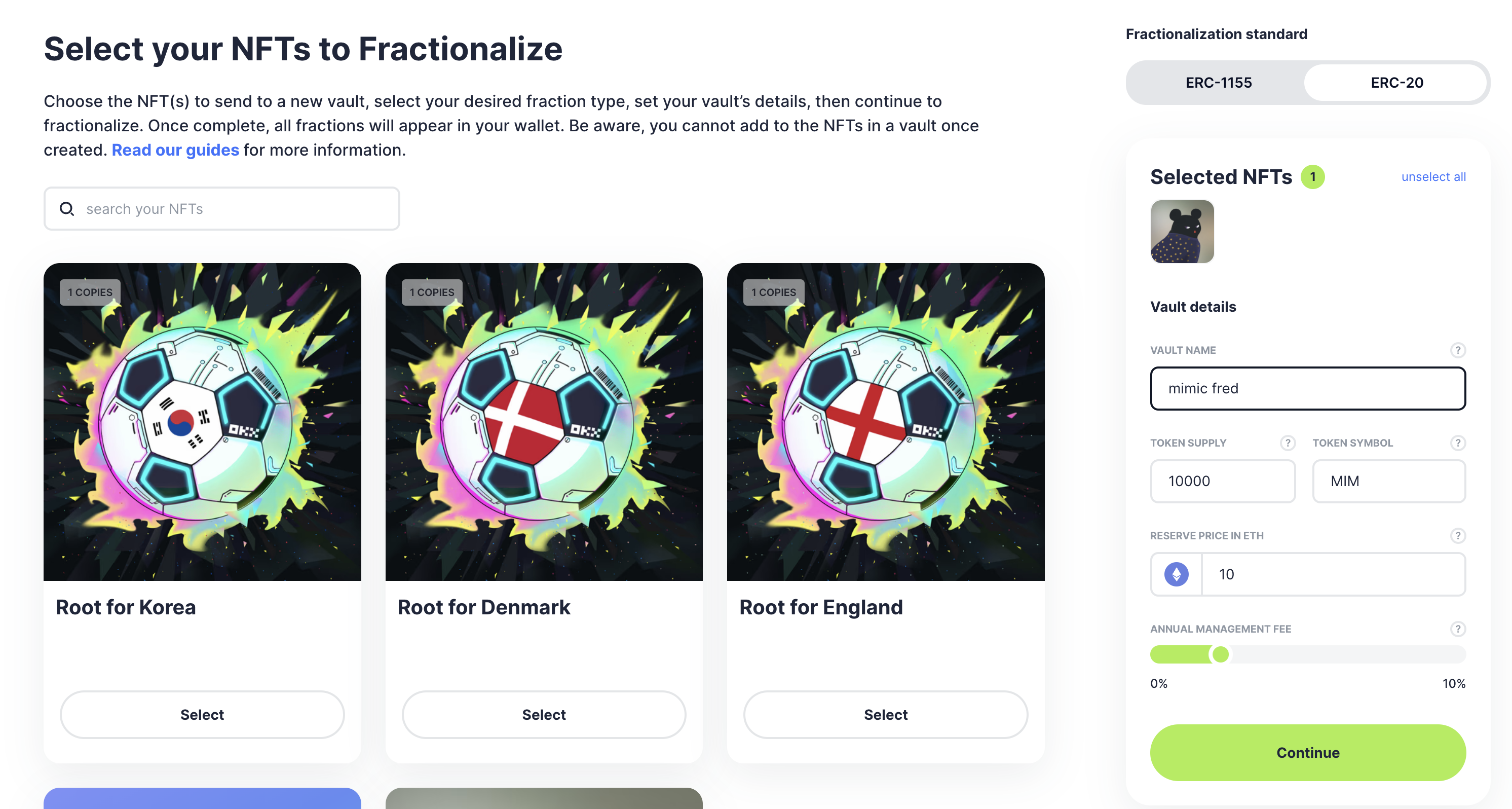

6. Fragmentation

Due to the non-homogeneous nature of NFT, it cannot be divided like FT, which limits the natural liquidity. Fragmentation converts NFT into multiple FTs by dividing ownership. thereby improving mobility. It is a bit like splitting a high denomination stock into multiple shares, so that buyers can buy part of the shares. Representative projects under the NFT fragmentation track include Fractional.art, Unic.ly

After fragmenting NFT, you can activate more ways to play in Defi through FT, such as trading in uniswap, borrowing in aave, and so on. Similarly, users can also buy out NFT.

Taking Fractional.art as an example, once more than 50% of the token holdings start to set the auction reserve price, the NFT enters the auction stage, and the highest price wins; when the auction stage is not started, Users can buy out NFT at a price not lower than the reserve price.

Fragmentation's bright spots and pitfalls

Highlights:

1. As a method to improve liquidity, it can bring higher capital efficiency (borrowing, liquidity mining, etc.)

2. Lower the Barriers to Participation

3. Promote higher exposure

Dilemma:

1. Only for high-value NFTs

2. There is still the long-standing problem of pricing

3. Fragmented FT will also face liquidity problems

4. How to distribute various rights and interests such as airdrops after fragmentation also needs to be resolved

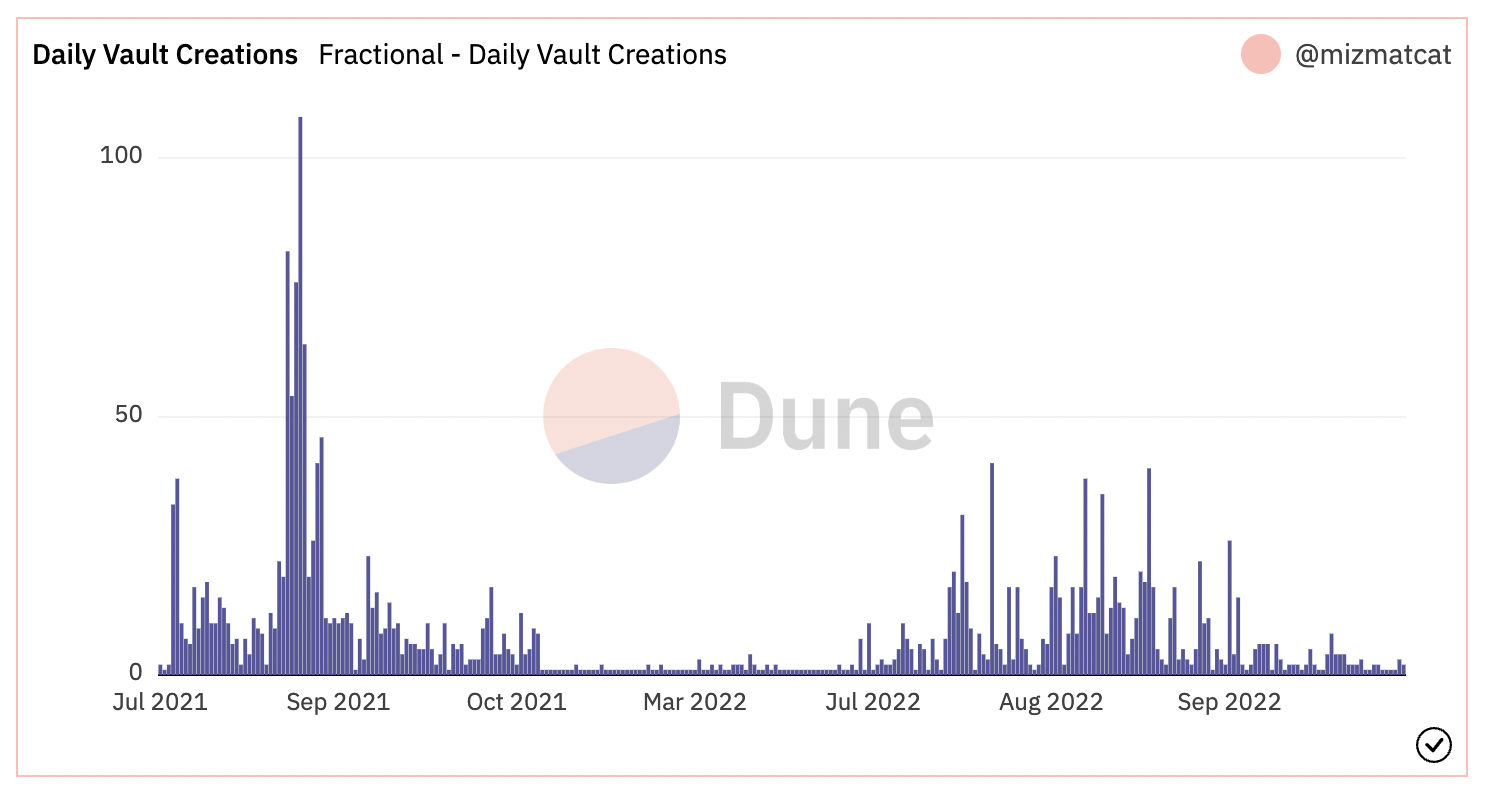

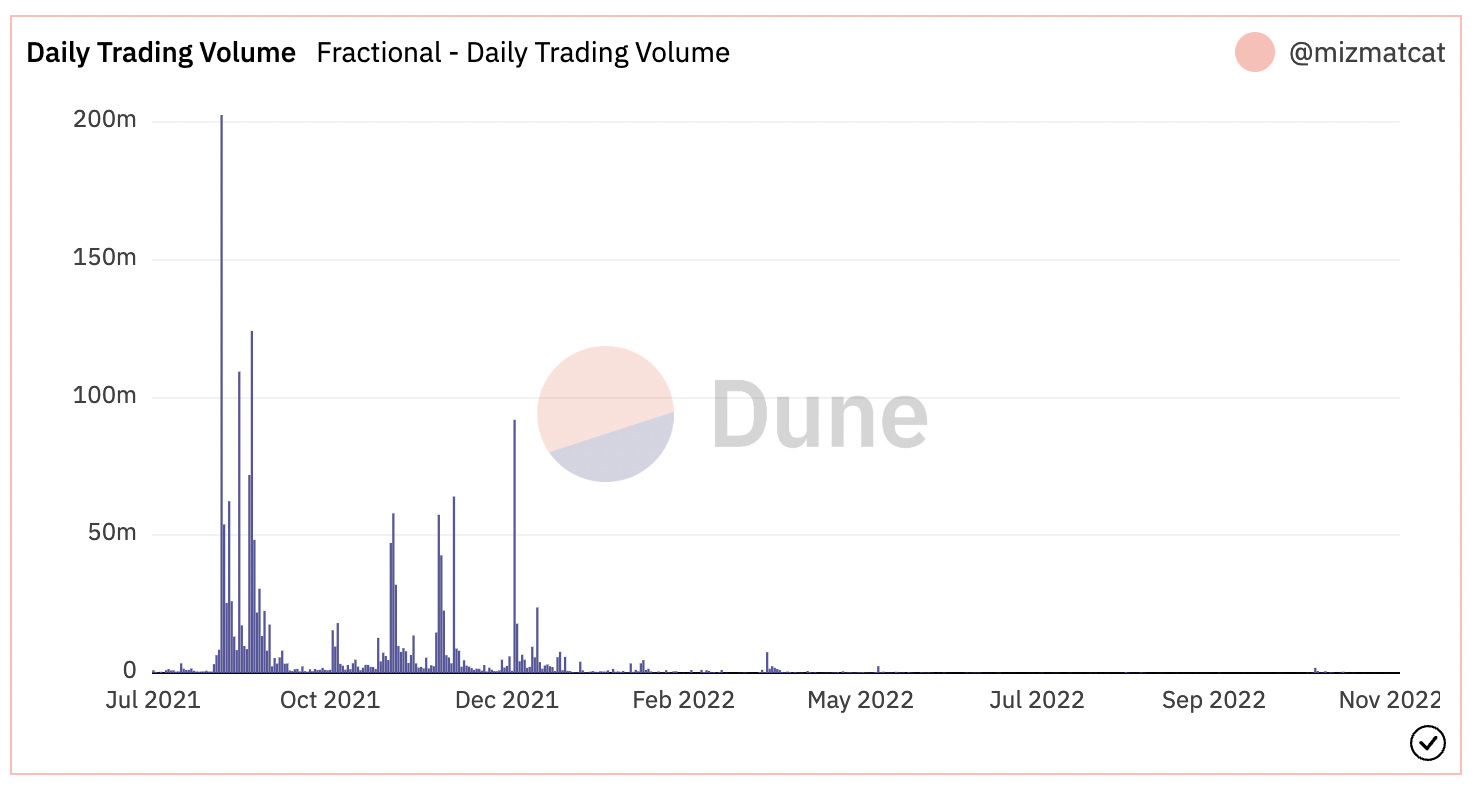

As a fragmented top player, Fractional.art has a great influence on the future development of this segmented track. The figure above shows fractional’s daily transaction volume and daily treasury increments. From the perspective of transaction volume, the project was extremely popular in the early days, but it continued to cool down after 22 years; the daily treasury increments are at There have been new ups and downs since 22. It can be seen that the appeal of NFT fund creators is still there, but with the cooling of the web3 environment and NFT, as well as issues such as pricing, equity, and FT liquidity, the transaction volume has not produced new fluctuations. In general, since fragmentation projects are only applicable to high-value NFTs, they will be closely related to the market popularity of NFT blue-chip projects. As a prominent liquidity provider. Fractional.art could be booming again when the next blue-chip NFT boom kicks off.

7. Leasing

Through the leasing of NFT, on the one hand, the idle NFT of the holder can generate greater income, and on the other hand, the lessee can obtain the right to use the NFT for a period of time without paying a high price. Among them, the development of Gamefi, metaverse land and equity NFT also boosted the development of NFT leasing

1. Gamefi: Due to the high entry barriers of many gamefis, loan players can quickly enter the game by renting NFT, or obtain corresponding game rewards. For example, during the hot period of Axie, the price of the three elves for the admission ticket is very expensive. If you rent it, you can quickly enter the game.

2. Metaverse Land: As more and more offline brands enter the Metaverse, there is a demand for renting venues in Decentraland for layout/art exhibitions. (Similar to real world rental venues)

3. Equity NFT: Leasing NFT allows tenants to obtain the corresponding benefits of each project community at low cost.

From the perspective of the lessee, the lease of NFT can be divided into two types: mortgage lease and unsecured lease.

Mortgage lease: You need to provide collateral (such as ETH, BTC) before you can rent NFT. Representative project: reNFT, which adopts a peer-to-peer leasing method.

Leasing without collateral: Double Protocol proposed ERC-4907 and designed doNFT, which represents an NFT with a valid duration and ensures the expiration time. For projects that cannot upgrade the contract (making NFT have two roles), a way to wrap NFT (wNFT) is also provided. The logic is similar to wETH. Users will not receive the real NFT, but the wrapped NFT. It has the same characteristics as the original NFT and is supported by the original NFT. When the lease time is up, the wrapped NFT will be destroyed, such as IQ Protocol.

However, due to the high price of mortgage leasing on the one hand, on the other hand, there is a risk that the borrower will not return the NFT. The financial risk of unsecured lease is lower and safer. With the launch of the final version of ERC-4907 in June this year, leasing projects have basically turned to the direction of unsecured property leasing. At present, reEFT is also an unsecured leasing method.

Key Project Analysis: JPEG'd Lending

Project Introduction

JPEG'd is a novel decentralized lending protocol launching on April 27, 2022. As a peer-to-pool lending agreement, NFT holders can use NFT as collateral for loans.

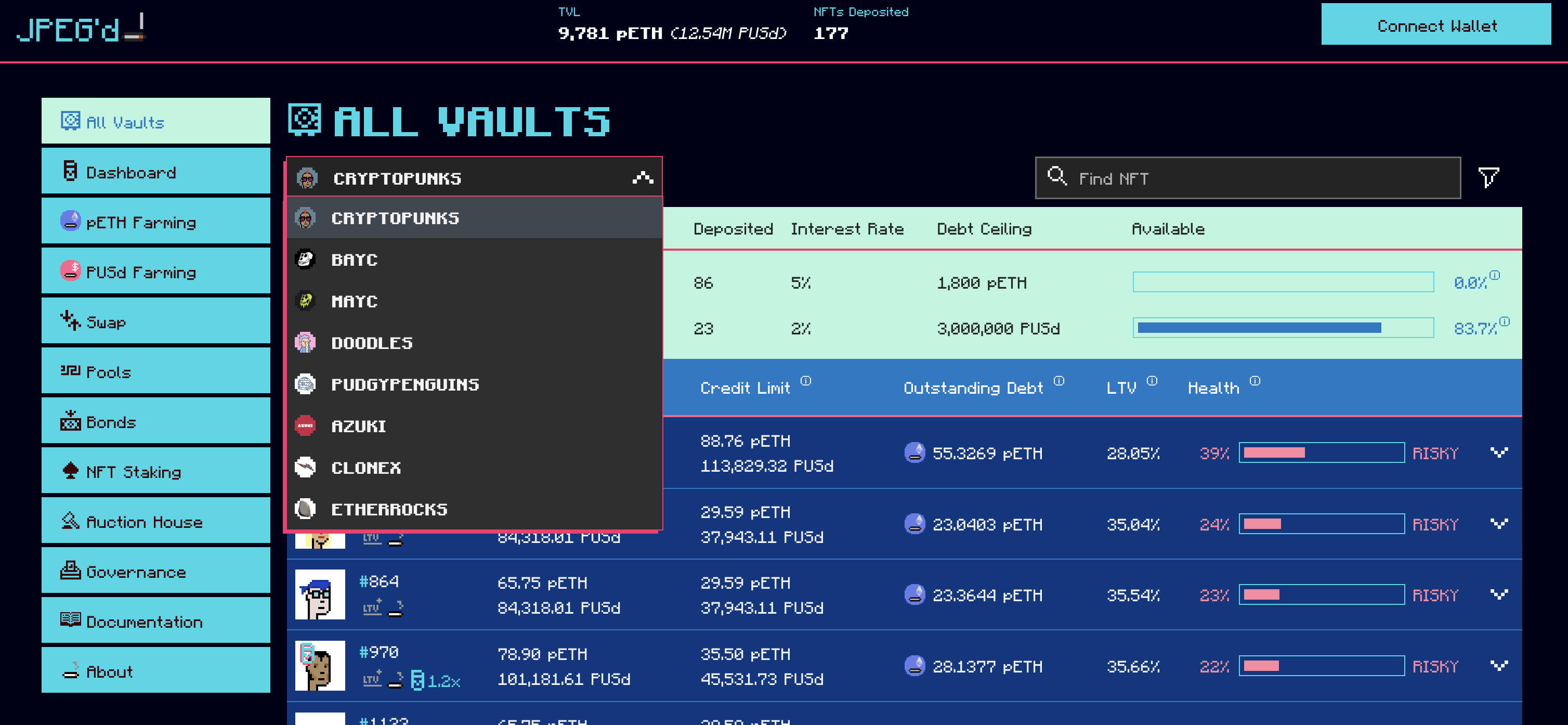

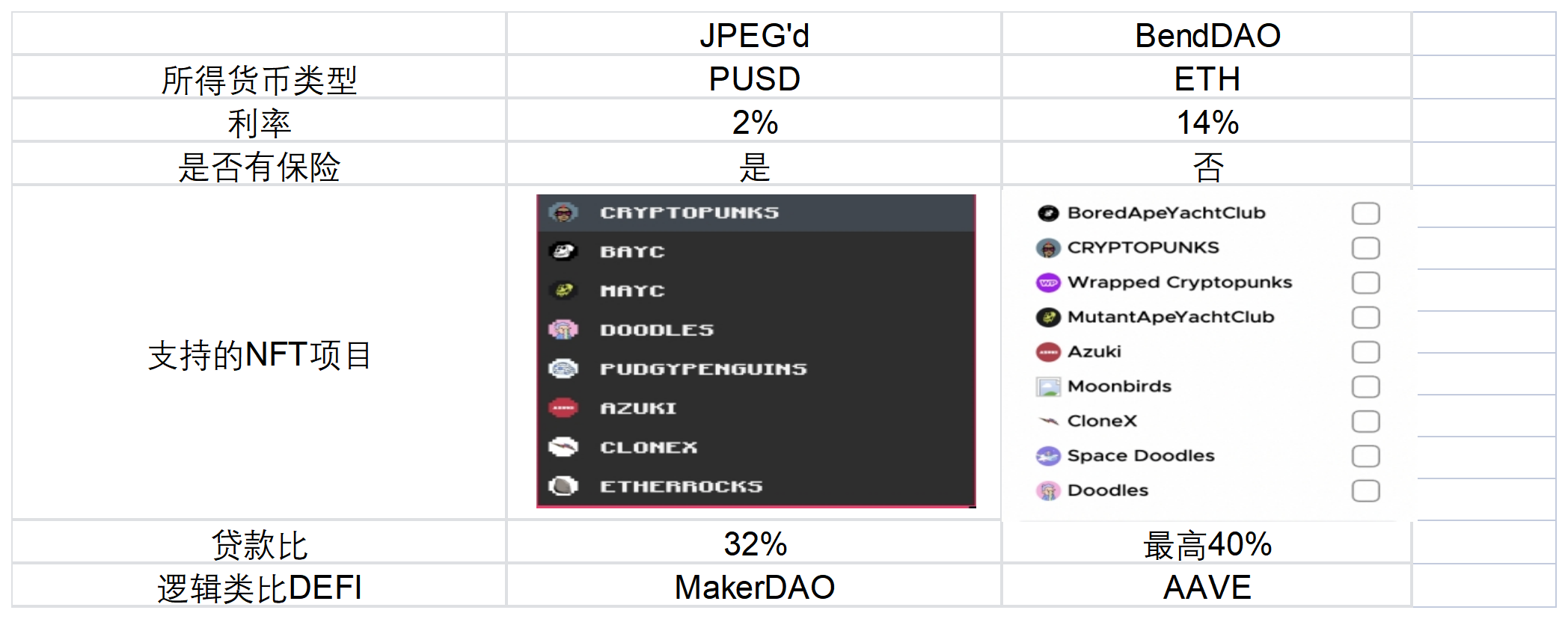

Compared with other peer-to-pool lending protocols such as BendDAO, JPEG'd adopts a method similar to MakerDAO, obtaining the native stable currency of the protocol through mortgage for subsequent use. From the very beginning, only cryptopunks were supported as collateral, and now it supports many blue-chip NFTs including cryptopunks, BAYC, Azuki, Doodles, etc.

Project core content and highlights

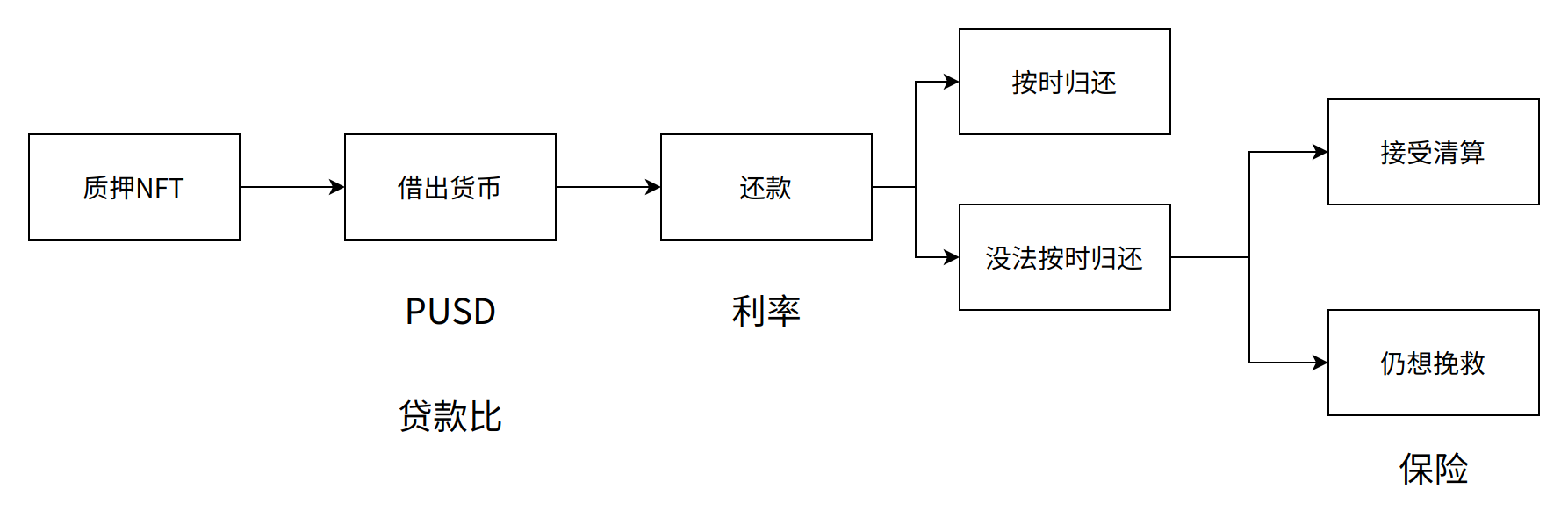

This article sorts out the entire process of lending NFT. As shown in the figure above, from the perspective of the use process of NFT lending, JPEG'd has novel designs and highlights in many aspects.

a. Users mortgage NFT to exchange for PUSd (an over-collateralized stablecoin)

b. In the link of lending currency, the annual interest rate of borrowing PUSD in JPEG'd is 2%, which is the lowest interest rate in the market, while that of BendDAO is about 14%. JPEG'd has a significant advantage in terms of interest rates, allowing withdrawals of up to 32% of the collateral value, and liquidation if higher.

c. Before liquidation, JPEG'd provides a novel link - insurance. Users can choose 1% of the amount to purchase insurance when mortgaging. If they are liquidated, they can pay an additional 25% after repaying the debt + interest % liquidation penalty, recover the NFT. The period is 72 hours, if the payment is overdue, the insurance is void.

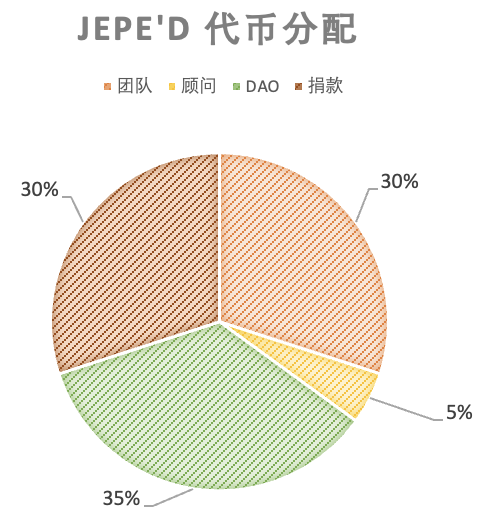

Project Token Economics

JPEG is a governance token without much economic value, with a total supply of 69,420,000,000. From the data on Coinmarketcap, it can be seen that JPEG'd had a small climax when it was first launched, and then remained stable, approximately equal to $0.0005.

The JPEG token distribution is for the protocol team, its advisors, the DAO and the public donation campaign, the total distribution will be:

Team: 20,826,000,000

Consultants: 3,471,000,000

DAO : 24, 297, 000, 000

Donation: 20, 826, 000, 000

The proportion details are shown in the figure below:

JPEG'd VS BendDAO

In order to better understand JPEG'd, this article makes a further comparative analysis with BendDAO, a representative project of peer-to-peer pool lending.

Compared with BendDAO's liquidation mechanism, the loan ratio set by JPEG'd is lower, causing mortgagers to only lend less money to ensure that the order will not be liquidated in the future. From the perspective of the mortgagee, there is less buffer space and the risk of being liquidated is high, thereby shortening the mortgage loan cycle. From the perspective of the platform, on the one hand, this means that the collateral flow on JPEG'd is faster, on the other hand, as long as the floor price drops slightly, the mortgager will be forced to redeem or enter liquidation, reducing the risk of bad debts.

Future development prospect:

1. Advantages:

a. Low interest rate + insurance

As a novel NFT lending system, JPEG'd adopts MakerDAO's CDP (collateralized loan stable currency) model in the lending mechanism. On the one hand, it provides the lowest interest rate in the market to attract more NFT holders to participate in lending. On the other hand, the insurance settlement mechanism provided provides users with a new sense of security in the case of large fluctuations in the value of NFT.

b. Pay attention to the market and keep up with the facts

In response to the BendDAO bank run in August, JPEG'd DAO passed a proposal to provide free insurance for eligible NFTs that migrate from Bend DAO to JPEG'd within two weeks.

2. Weakness: PUSD VS ETH

On the other hand, in terms of disadvantages, for example, compared with direct ETH loan of bendDAO, PUSD of JPEG'd loan still needs to go to Curve for transaction in exchange for mainstream tokens. From this point of view, for users who want to pledge NFT to re-scan NFT, it is more suitable for bendDAO (sweep goods directly after obtaining ETH); and for defi users who want to make stable investment, they can consider using JPEG PUSD with a lower exchange rate on 'd, and earn income through stablecoin mining and other operations.

3. Recent trends: cooperation with leading oracle machine projects

For NFT lending projects, the importance of pricing and valuation does not need to be emphasized too much, but just this month (November 2022), JPEG'd cooperated with Chainlink, a leading oracle project, to provide services for pricing and valuation. The development of JPEG'd will help a lot.

4. Future Outlook: Analogy to DEFI

Regarding the endgame of JPEG'd and BendDAO, it can be compared to MakerDAO and AAVE in defi to some extent, both of which are currently in the head position (and the TVL from MakerDAO is close to twice that of AAVE). Going back to the field of NFT lending, it is also possible for JPEG'd to go hand in hand with BendDAO.

Conclusions and reflections

1. In order to solve the problem of insufficient liquidity of NFT, NFTFi was born. Explored from pricing valuation, trading, BNPL, lending, derivatives, fragmentation and leasing. Judging from the analysis of multiple sub-tracks of NFTFi, the development of various NFTFi projects is highly dependent on NFT pricing and valuation, which can be called the cornerstone of NFTfi. However, NFT pricing and valuation is still at an early stage, which also affects development of the entire industry.

2. Judging from the project characteristics of NFTfi, an important scene in the future may lie in Gamefi. Game props NFT have certain characteristics of homogeneity and high-frequency trading, and the demand for fast, cheap and safe NFT transactions and leasing, It is very consistent with the characteristics of NFTfi, such as Sudoswap, which can take advantage of its high liquidity.

3. From the perspective of user participation, the current user threshold of NFTFi track is relatively high. On the one hand, users need to hold blue-chip NFT, and on the other hand, users need to be familiar with the gameplay of DEFI (because the current NFTFi gameplay is basically They are all borrowed from Defi). It belongs to the field that needs to understand NFT and DEFI at the same time (missing the conversion rate and screening out another layer from defi), and compared with NFT and gamefi, it is a relatively more professional track, and it is difficult to have explosive growth in the short term .

thank you

DAOrayaki, a decentralized media and research organization, publicly funded THUBADAO to conduct independent research and share results publicly. The research topics mainly focus on Web3, DAO and other related fields. This article is the fourth sharing of funding results.

DAOrayaki is a fully functional decentralized media platform and research organization representing the will of the community. It aims to link creators, funders, and readers, and provide multiple governance tools such as Bounty, Grant, and prediction markets, and encourage the community to freely conduct research, curate, and report on various topics.

THUBA DAO is a decentralized organization initiated by members of the Tsinghua University Blockchain Association (THUBA). THUBA DAO is committed to bringing the Web3 world to every student, becoming a bridge connecting blockchain communities at home and abroad, and cultivating the best next-generation Web youth and pioneers.

Video link: https://www.bilibili.com/video/B V1 y 24 y 1 U 7 uc/? spm_id_from= 333.999.0.0

Early sharing can refer to:DAOrayaki & THUBADAO|Media in the Web 3.0 Era: On-Chain Media Platform, On-Chain Self-Media and Media DAODAOrayaki & THUBA DAO |Multi-case analysis of token economy design ideasDAOrayaki & THUBA DAO |Web3 Social Genre Dispute: Domestic Case Study Analysis

References

https://web3 caff.com/zh/archives/42115

https://web3 caff.com/zh/archives/33567

https://mp.weixin.qq.com/s/VRz-gkhZHllKzCI_JtoHaQ

https://dune.com/rchen 8/opensea

https://mp.weixin.qq.com/s/vXnkNF 0 e 1 ki 3 ER 2 nC-U 9 yA

https://www.chaincatcher.com/article/2078471

https://viewdao.mirror.xyz/6 CGlYphepRspxrFoTGcESaDvH 7 rVrz 4 pvGzONaHy 4 V 8

https://www.cnbc.com/2022/03/10/trading-in-nfts-spiked-21000 percent-to-top-17-billion-in-2021-report.html

https://web3 caff.com/zh/archives/17958

https://m.mytoken.io/news/413428

https://docs.usecyan.com/docs/bnpl

https://web3 caff.com/zh/archives/30121

https://www.panewslab.com/zh/articledetails/59 k 04 csy.html