The infrastructure on the chain makes the public chain prosperous like a kingdom, and these encrypted kingdoms jointly build the encrypted world.

The public chain can be divided into Layer1 and Layer2. Layer 1 (one layer) such as Ethereum and Solana have their own native tokens (ETH, SOL) and use this currency as a settlement token for handling fees.

Layer 2 (Layer 2), such as Arbitrum and zksync, which is an "extended chain" developed to solve Ethereum's congestion problem, is attached to the main chain and uses the main chain's native tokens to settle the transaction fee.

Different from the infrastructure on the chain, the public chain needs to build its own ecology and user base, requires strong development capabilities and strong funds, so the financing of most new public chains has reached tens of millions of dollars. On the contrary, if it airdrops tokens, its value is far better than other tracks.

1. Layer2

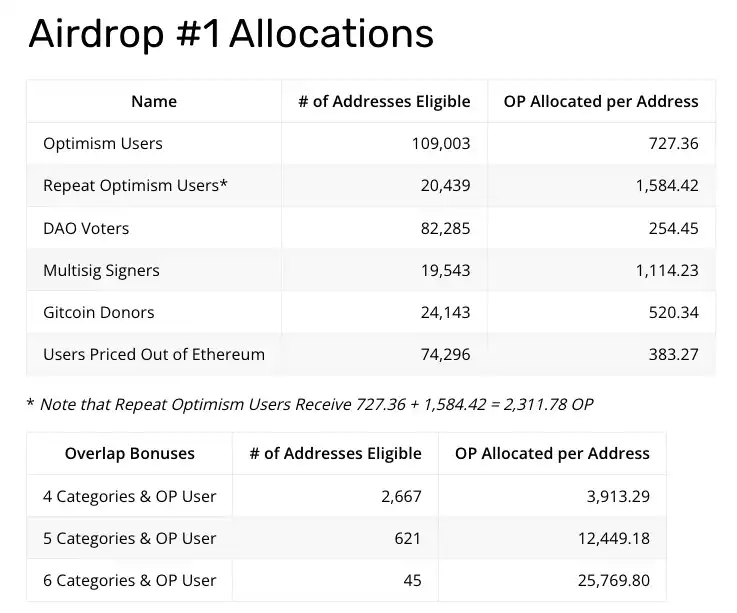

Optimism is currently the only Layer 2 that issues coins. We refer to its rules, the first thing is the interaction on the chain, but it does not strictly limit the amount and number of interactions, but pays more attention to the time period of the interaction. Secondly, as an extension of the main chain, a lot of weight is given to users of the main chain.

Users of Gitcoin, Snapshot, and Safe all have double weights, reflecting that the project party values those users who have contributed to the main chain construction and have experience in governing DAO.

Although Optimism has issued tokens, there are still two rounds of airdrops yet to be issued. Mostly interact and participate in official activities on the optimism chain, such as the recently opened OP version of Ossaid, and those native projects. At present, most of them have not issued coins (a collection will be introduced later), interact more and strive to kill two birds with one stone. .

Link:https://app.optimism.io/quests

1.Arbitrum:https://arbitrum.io/

At present, Layer 2 has the largest market share, and has completed hundreds of millions of financing early. A few months ago, the official announcement of the Ocside event was probably to avoid Optimism’s on-chain incentive plan. It went online after a few months of delay, but due to the sluggish market, the GAS on the chain once exceeded the GAS on the main network, and then the event was closed. Run to develop the new Nova chain and upgrade the main chain.

Now that the main chain has also been upgraded, it should restart activities in the fourth quarter or issue coins directly? Its new chain Nova is developed for frequent interaction projects such as social networking and GameFi. It is a bit of a Layer3 flavor. You can try it out, but the liquidity of the token pool is not very good now.

Arbitrum is of course more important. In addition to interacting with some multi-chain applications, there are also many native applications worth interacting with. Similarly, to interact in different time periods, to participate in long-term application release activities on the chain, it is best to interact with the applications of each track, such as exchange, cross-chain, lending, NFT, etc.

2.zkSync:https://wallet.zksync.io/

Using expansion technology different from Optimism and Arbitrum, it was confirmed early that Token will be issued, but the token model has not been announced. On 10.28, when the 2.0 mainnet is launched, tokens may be issued to start the token incentive plan like Optimism, to rob the TVL of Arbitrum and Optimism.

It may also continue to develop silently and delay the issuance of coins. Because Layer2 does not need native tokens to settle fees and maintain network operations like Layer1. In this case, the problem is not too big. In 2.0, a large number of native applications of zkSync will be launched, striving to kill two birds with one stone.

3.zk.money:https://zk.money/

The public chain developed to protect user privacy has received tens of millions of financing from the participation of V God. The 2.0 version was launched in the third quarter, and established lending projects such as Lido and Element were deployed. Due to the centralized packaging mode, the transaction speed on the chain is very slow, and the GAS is not low. It is not recommended to interact with large funds. First, FTX starts tozk.moneyThe address of the proposed funds is used for risk control, and the second is that the ecology on the chain is too small and imperfect. You can deposit Indian funds, experience it, and leave a record.

In addition, the Starknet that has been snapshotted may still undergo a second snapshot, so you can experience it. However, the Layer 2 of public chains such as Matic has not yet been launched, and the possibility of issuing native tokens may not be very large. If you are interested, you can go directly to find out.

Two, Layer1

The biggest difference between Layer 1 and Layer 2 is that Layer 2 can deploy the main network before issuing coins, while Layer 1 needs to determine the token model before launching the main network, because it cannot borrow other people's native tokens to serve as the general token of its own chain. The best example is the airdrop after Aptos goes live on the mainnet.

Personally, I think the currently feasible way to ambush Layer1 is:

1. Node, just to mention, I have not participated in it myself, and I need funds and skills.

2. Play well with other Layer1 and wait for the airdrop. (such as Evmos airdrop to Ethereum mainnet)

3. The testnet removes identity groups and data, rather than deleting data after aimless interactions.

4. Participate in a possible token incentive plan after waiting for the mainnet to launch the token.

5. Be aware of official web2 data collection activities.

Taking Aptos as an example, when the NFT event was launched at that time, you need to log in your own account on the official website, and you need to leave your own data when you apply for a node before, and these web2 data are used and airdropped after deleting duplicate IP users. However, none of the testnet data has been adopted, including Mint NFT records.

1.Sui:https://docs.sui.io/

In 2019, Facebook launched the blockchain project Libra with great momentum, but in the end it was "aborted" due to regulatory issues. The developers could only go their separate ways, launching new public chains of Aptos, Sui, and Linera. Affected by Facebook's reputation, Aptos and Sui have received hundreds of millions of investment, and they are also the most concerned chains in the new Layer1.

Sui has announced that it will issue the native token SUI, with a total supply cap of 10 billion pieces, a part of which will flow when the mainnet is released, and the remaining tokens will be released in the next few years, or distributed as future equity reward subsidies.

Due to the airdrop effect of Aptos, the official DC is currently full, because there are several identity groups that can be rolled up, and the DC channel needs to lead the water, and the test network nodes are still open, these are opportunities to leave your web2 data .

Discord:https://discord.com/invite/sui

2.Aleo:https://www.aleo.org/

Aleo is a privacy-oriented Layer1 that supports smart contracts. Its technical core lies in the two core sections of Zexe and Leo. The Zexe consensus protocol is improved on the original zk-snarks technology of ZeroCash. It can not only encrypt simple token transfer transactions, but also apply Interactive transactions at the level; Leo, as the programming language of the Aleo ecosystem, can modularize the zk-snarks of the Zexe consensus protocol, so that any Dapp operating on the Aleo platform can use zk-snarks.

compared tozk.moneyIn general, Aleo is more like a regular army, and the B round of financing has completed 200 million US dollars. At present, it is also in the testnet stage, and applications are open to developers to establish an ecosystem on the chain. Ordinary users can join Discord to participate in activities and apply for ambassadors to participate in construction.

Token Economics:

Token Economics:

https://www.aleo.org/post/aleo-token-economics

3.shardeum:https://shardeum.org/

The public chain founded by WazirX CEO Nischal Shetty has completed a seed round of financing of 18 million US dollars. EVM-based smart contract platform. At present, the test network has only been deployed, and there are no other activities yet, but the team is very good, and it also has its own advantages compared to other Layer1s. You can add the network now, receive test coins, and wait for the official event on Discord.

In addition to the public chains listed above, there are many public chains that have not yet been launched or launched. The track chapter is mainly to talk about personal ambush ideas and interaction directions. It is just a brief introduction, and there is no expansion. If necessary, I will talk about the native projects deployed on the chain and participation opportunities in detail later.

author:

author:0xtaoist、@0xCryptoUni