When a decentralized application launches native tokens, it must first consider how to airdrop to users.

Why airdrop tokens to users?

Because it needs to be decentralized (at least officially).

secondary title

text

Most of the initial airdrops were for marketing and expanding popularity.

After Uniswap airdropped tokens worth hundreds of millions to 180,000 users, this NB app that issued iPhones to users quickly went out of the circle and became the product of choice for many newcomers. User.

Afterwards, airdrops of decentralized applications have become the norm, bringing waves of airdrops. The wealth-creating effect of tens of thousands or hundreds of thousands of profits from a single address also naturally makes other users pay attention to the product itself.

Whether it is web2 or web3, attention is one of the keys to the survival of the project.

Newborn applications will airdrop tokens to "predecessor" users, so as to gain the attention of target users as quickly as possible. Sushiswap issued governance tokens earlier than Uniswap to start the incentive plan, and successfully seized 75% of Uniswap's liquidity and users in a short period of time, which drew Uniswap's public condemnation on Twitter. The behavior of X2Y2 and LooksRare airdropping tokens to Opensea users and launching a series of token incentive activities is exactly the same. This practice is known as "vampire attack".

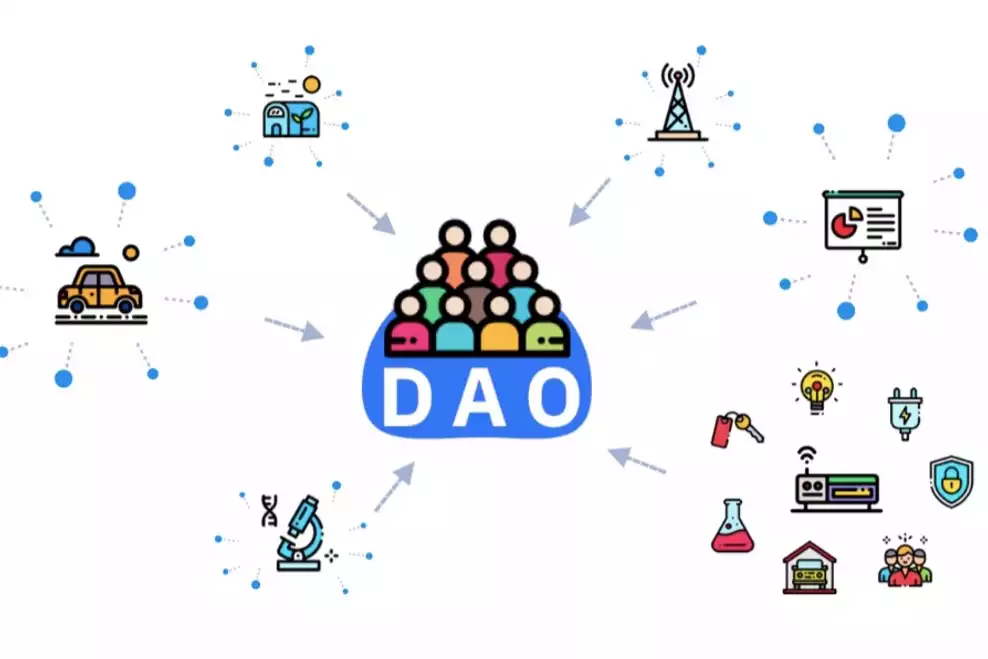

When the web3 concept became popular, airdrop tokens became a prerequisite for the formation of DAO.

Users need to hold tokens to participate in DAO governance.

The project party needs to distribute tokens to more users to achieve decentralization.

Only in this way can real web3 be built.

secondary title

2. Users and witches

In the past, users who found the app could be airdropped.

Spotting hidden witches among users is even more important now.

The early airdrop rules are very simple, as long as the users of the platform will have a similar airdrop share.

Uniswap: Historical users, liquidity providers and NFT holders can all get airdrops.

1INCH: The user trades at least 4 times and not less than 20 US dollars.

Subsequently, the weights are calculated based on the time period, amount, and times, so that there is a gap between the airdrops between users.

ENS: According to the registration time, reverse resolution and renewal time of the .ens domain name, the weight distribution tokens are divided.

Cowswap: limit the number of transactions and the amount, divide the transaction volume into five levels to calculate the weights respectively, and reduce the weight of stable coins. The longer the time interval between the first and last transaction, the greater the additional coefficient.

DYDX: Different levels of users are divided according to the amount deposited and used by users.

When people realize that airdrops have huge wealth, multi-account and automated interactive applications become more and more popular, and the "witch" in the mouth of the project party was born. Airdrop rules also raise the bar and complicate matters. The project party will also use data analysis and on-chain records to check the correlation between addresses, and bounty-based witch hunts are becoming more and more common.

Paraswap: Exclude transaction records above 1M (anti-whale), and then exclude users whose on-chain records are less than 50TX and whose token balance is less than 200U (anti-whale). Transferring between more than 5 parent-child accounts is also considered a "Sybil attack". Then calculate the weight airdrop tokens based on the number of transactions and the transaction amount. Created a precedent for tracking and arresting witches on the chain.

Hop: Compare the "well-known" cross-chain bridge airdrop projects. The basic rules are the same, the number and amount of user cross-chain, and the provider of the LP pool can all get airdrops, but it has created a bounty-style capture of witches on the chain, and the most reports have reached more than 500 addresses for a proposal. Analysis determines whether different addresses are controlled by the same "body".

Optimism: Users who enter funds and use on-chain applications can get airdrops, and users who use it multiple times in different weeks, donate to Gitcoin on the main network, participate in Snapshot governance, and use Safe multi-signature wallets have more airdrop shares. Under the repeated proposals of community members, tens of thousands of "witch" addresses were also screened, but the specific logic was not disclosed.

Safe: Users who generate 1TX get a minimum living allowance. Different weights will be given according to the value of the tokens deposited by the user and the transaction fees generated by the transaction, and more tokens will be allocated. Also under the suggestion of "community enthusiasts", the "witch" bounty activity was launched.

The evolution of airdrop rules: define users - distinguish users - screen witches.

The airdrop "Yigaimu" realized that airdrop is the future trend when the project did not normalize airdrop, and laid out interactive applications to control hundreds or thousands of accounts with one person. After the "epic-level airdrops" such as DYDX and ENS, "legends of getting rich" have been created one after another.

These "legends" made the "second generation" people start to enter the market to find the next "epic airdrop", which led to the exponential growth of the user base of the project party, and also made the project party realize that most people came just for the airdrop. When Paraswap launched its native token, it already had hundreds of thousands of users. Perhaps in order to achieve the best marketing effect, they chose to screen out most users and retained only 10,000 addresses. Facts have proved that both the airdrop value and "reputation" are extremely huge.

So far, the surge of users, the show off of witches, the jealousy of peers, and the marketing effect desired by the project party have together led to the evolution of the rules and the normalization of the witch hunt.

As for the "third generations" who entered the circle after the bear market came, it may take a long construction process to gain something in the next bull market, but the cost required is definitely lower than that of the previous "predecessors", and it is also an absolute must to learn knowledge on the chain. good time.

Projects, users, and witches are in a deformed relationship, coexisting and hostile. When the project delays in launching native tokens, users will question whether they want to deny decentralization and whether they want to keep PUA users. Conversely, the project will think that users just want to urge them to quickly airdrop, then cash out the coins and slip away. And when witches are showing off their huge gains, users and project parties will also fight against each other and try their best to obtain more benefits.

The above are purely personal opinions, not authoritative opinions.

The above are purely personal opinions, not authoritative opinions.

Airdrop sharing blogger: @0xtaoist

Investment Research Sharing Community: @0xCryptoUni