Disclaimer: This article is only used as an industry research discussion and does not represent any investment advice.

Disclaimer: This article is only used as an industry research discussion and does not represent any investment advice.

first level title

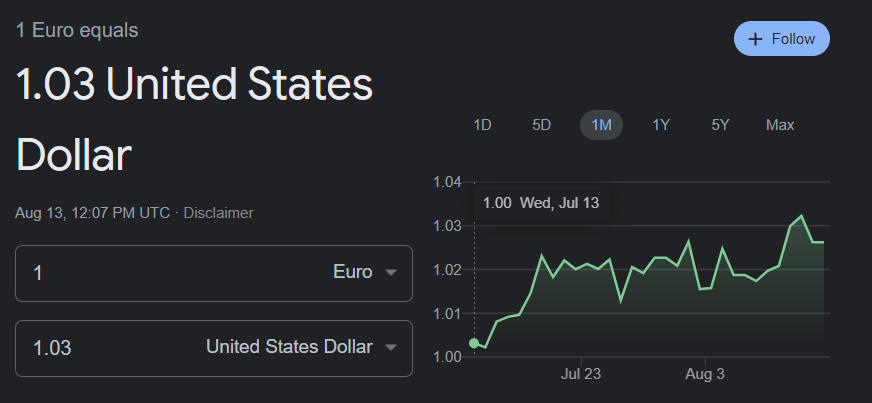

On July 13, 2022, the exchange rate between the US dollar and the euro reached 1:1, which is undoubtedly a moment to witness history.

Since the 2008 financial crisis, the U.S. dollar has continued to strengthen against other countries’ fiat currencies, and any short-term U.S. dollar weakness has also been caused by the Fed. According to Brent Johnson of Santiago Capital in "Dollar Milkshake Theory" (Dollar Milkshake Theory): This shortage of dollars is the result of foreign governments and companies borrowing dollars to expand capital access, even though income in other countries is in non-dollar units, But when governments and companies in other countries want to repay debts denominated in U.S. dollars, their demand for U.S. dollars continues to exist; however, there are not enough U.S. dollars in circulation to support these debts, which is one of the incentives for the "big release" , and even accelerated inflation to some extent.

first level title

Based on this situation, not only the traditional financial market, but also the cryptocurrency market increasingly needs stablecoins anchored by the US dollar. Currently, USDT and USDC are the most widely circulated "centralized" stablecoins in the market, which are characterized by legal mortgages under the chain, directly with banks or other regulated third-party custodians with corresponding assets1: 1 Guarantee implementation, although this can give users protection, the cost of casting and redemption may be high, the operation, audit and compliance costs of the custodian, and the slow and expensive connection with the traditional banking system, the centralization of the custodian The nature also creates a single point of failure that is open to review. In addition, users cannot directly share benefits or participate in governance from the agreement, which is inconsistent with the original intention of Crypto and even DeFi. Therefore, decentralized stablecoins led by MakerDAO have emerged. This type of agreement uses the form of cryptocurrency mortgages to generate stablecoins, converts the concept of legal mortgages into cryptocurrencies, transfers the minting and redemption mechanisms to the chain, and brings There is an incentive mechanism to maintain the anchor, and it has the characteristics of decentralization and anti-censorship. Of course, the most attractive thing is that this kind of decentralized stablecoin protocol can give users enough respect.

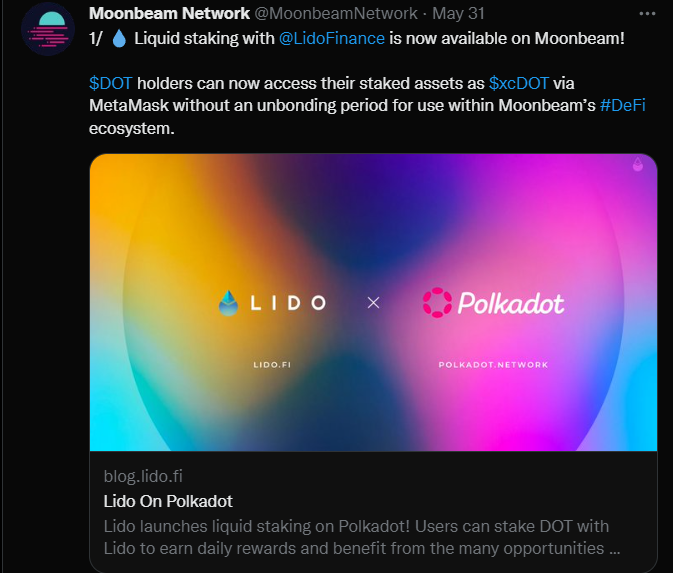

As of the beginning of August, the current market value of the entire Crypto market is about 1.1 trillion US dollars, of which BTC, ETH, USDT and USDC together account for about 58% of the overall market value, and the vast majority of DeFi protocols and services revolve around ETH carried out. According to the real-time data on Defi Llama, the top two TVL rankings are currently MakerDAO and Lido. One of the important reasons for the success of these two protocols is that they are based on users' strong demand for ETH. Liquidity is released, but this model does not apply to everyone. In addition to the above mainstream assets, the holders of nearly 40% of asset types have no way to enjoy the same type of service agreement, especially the users of the Polkadot ecosystem. As a star project ranked among the Top 10 in the entire Crypto encryption market by market value, Polkadot has attracted much attention once it was launched. Friends who have really understood Polkadot also know that the current DeFi development of Polkadot is indeed seriously underestimated. The reason may be that Polkadot currently lacks DeFi head protocols such as MakerDAO and Lido. But is this really the case?

first level title

From the beginning of this year, Lido officially announced that it will be deployed on Moonbeam (the EVM chain in the Polkadot parachain), so as to provide liquidity services for users of the Polkadot ecosystem after XCM goes online. The much-anticipated launch to Moonbeam at the end of May did not deliver the expected performance. Lido, as the head project with one of the best TVLs on Ethereum, did not perform well after launching on Moonbeam. The fundamental reason why Lido can have such a considerable TVL on Ethereum is that the stETH sent by Lido to users has a good application scenario and better liquidity than similar competing products, but in the Moonbeam ecosystem, stDOT is not very good. Application scenarios.

DAM is here.

So how to provide users with such services while meeting users' needs for stablecoins and liquidity while also combining the actual situation of the Polkadot ecosystem?

first level title

What are DAMs?

DAM (dPRIME Asset Modules Finance, referred to as "DAM Finance" or "DAM", hereinafter referred to as "DAM") is a liquidity protocol built on Moonbeam, allowing users to lend the platform in an overcollateralized manner The stable currency - dPRIME, enables users to release their own liquidity without selling any existing assets, so as to more fully participate in Moonbeam and even the entire Polkadot ecosystem.

Moonbeam, as the "Ethereum" in the Polkadot ecosystem, carries the important task of issuing smart contracts. It is a chain with the most ecology among Polkadot's many parallel chains, and has the largest number of XCM (Polkadot inter-chain communication format) integrations; at the same time In terms of community, it is user-centered and has a good record of delivering high-quality dapps; in addition, it has also obtained official cooperation with leading Ethereum projects such as Curve, Lido, and Sushi in terms of resource cooperation.

Moonbeam founder Derek Yoo said: "Existing cross-chain methods suffer from low asset utilization and fragmented liquidity." DAM is a good example of a new cross-chain DeFi protocol that utilizes connected contracts on Moonbeam to Acquiring assets from multiple blockchains can aggregate liquidity safely and more efficiently, providing an excellent user experience.

Looking at the entire Moonbeam ecosystem, there is currently no native stablecoin. At the same time, based on the vision of the entire Polkadot chain being unified, dPRIME, as a multi-asset collateralized stablecoin, chooses to deploy on Moonbeam, whether it is to provide lending services for users of the Moonbeam ecology now, or to release the flow of long-tail assets in the entire Polkadot parachain in the future Sex is central to the entire ecology.

Different from MakerDAO's model that can only generate DAI by staking ETH (Single-Collateral DAI, SCD), the service is developed with ETH holders as the main target group, and the credit endorsement for DAI is based on the credit of Ethereum; DAM is aimed at the Polkadot ecosystem. The long-tail assets on the parallel chain are pledged to generate dPRIME (Muti-Collateralled), such as GLMR, ACA, ASTR, etc. DAM pays more attention to the ecology and its assets in each parachain on Polkadot, and provides liquidity release services for every user participating in the Polkadot ecology. It releases liquidity for multiple assets in Polkadot's many parachains and increases Application scenarios.

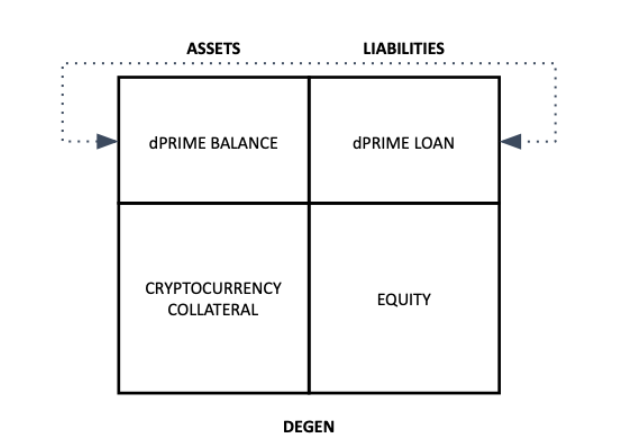

DAM is essentially a lending platform on Moonbeam. Different from the traditional lending model of Moonwell, generating stable coins can bring users less liquidation risk and create rather than transfer purchasing power. Its core is the two tokens surrounding the platform, namely the multi-collateralized stablecoin — $dPRIME, and the platform governance token — $DAM.

dPRIME can be obtained through the mainstream and long-tail assets in the over-collateralized parallel chain. The borrower deposits the collateral approved by the agreement into the linked-multi-collateral-vault of DAM (“LMCV”) according to the total portfolio value and asset quality of the borrower. ”), the borrower only needs to pay the mint fee once.

Holders of dPRIME can mint, obtain dPRIME as a reserve asset in the secondary market, or convert it into other assets to seek better investment opportunities.

Since it is a DeFi lending platform, there will naturally be a liquidation mechanism. When the borrower's vault situation becomes unhealthy, the liquidator can obtain a part of the collateral, plus a bonus to pay the borrower's vault fee on time.

The platform governance token $DAM can be used for regular community governance, voting, agreement revenue determination, and later DAM DAO governance. It can also be used as a mortgage asset on the mint platform—users can deposit $DAM in a stableswap pool to obtain An LP Token (pledge certificate). LP Token can be pledged on Curve and other similar venues, and then a corresponding amount of ddPRIME will be obtained. ddPRIME can be used for mint dPRIME or other mortgageable assets as an incentive to encourage users to participate ecology. Its design has the following characteristics:

dPRIME is over-collateralized, it is a type of debt.

DAM hopes to provide ddPRIME holders with more sustainable benefits, namely sharing protocol revenue.

In the process of communicating with the DAM team, we saw this group of BUIDLERS' love for the industry and their professionalism. Regarding the future planning of DAM, I think that DAM, as the first platform on Moonbeam to support over-collateralized long-tail asset lending, will use Moonbeam as the foundation to expand the application to all Polkadot parallel chains step by step, providing each Polkadot Ecological users provide services equally. At that time, not only the Polkadot ecology, we believe that DAM will open a new outlet for the long-tail asset market in the multi-chain field, so that each asset owned by each user can "run".

financing information

DAM. Finance recently completed a $1.8 million pre-seed round of financing, jointly led by two funds, Jsquare and DFG, Arrington Capital (its Moonbeam ecological fund), Ledgerprime, D1 Ventures, 11-11 Capital and Stacker Ventures and other institutions Participate in voting.

first level title

secondary title

Reference

1. https://dam.finance/

2. https://www.youtube.com/watch?v=Lv9nGQpiJbE

3. https://hackernoon.com/stablecoin-models-evaluating-centralized-vs-decentralized-architectures-wn1y35tc

text

secondary title