Compilation of the original text: Bai Ze Research Institute

Compilation of the original text: Bai Ze Research Institute

2022 will be a turbulent year for the cryptocurrency market. The prices of all cryptocurrencies fell sharply in May and June. While it's not known if we've hit a bottom, July-August was relatively stable, with Bitcoin hovering between $20,000 and $24,000.

How does the market downturn affect cryptocurrency criminal activity?

secondary title

scam revenue reduction

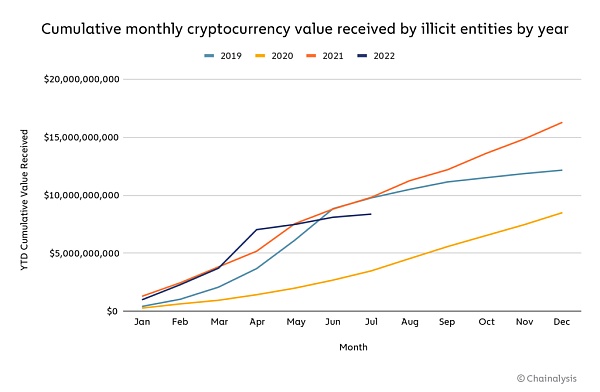

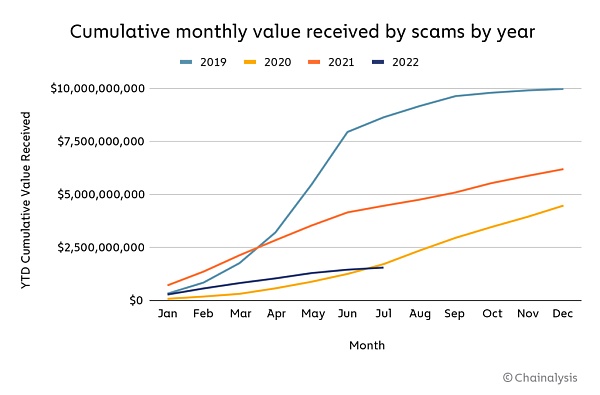

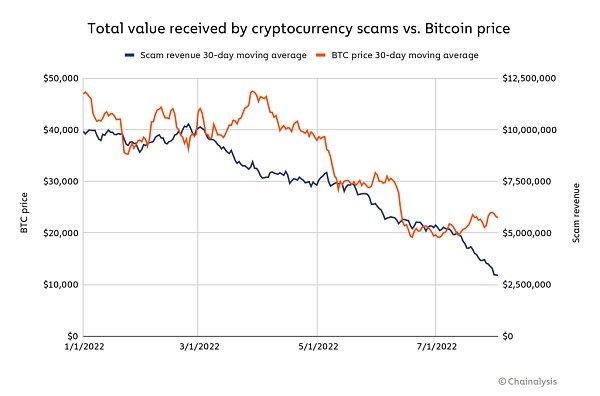

Total cryptocurrency fraud revenue in 2022 is now $1.6 billion, which is 65% lower than at the end of July 2021. This decline seems to be related to the decline in cryptocurrency prices.

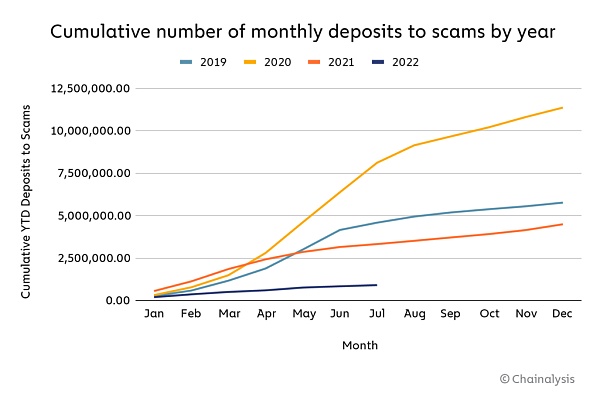

Since January 2022, scam income has more or less followed the Bitcoin price trend. We can see from the graph below that it’s not just scam revenue that’s down, the cumulative amount of funds transferred by individuals to scam wallets is at its lowest level in the past four years.

These numbers show that fewer people than ever are falling for cryptocurrency scams.One reason for this could be that as asset prices fall, cryptocurrency scams, which often promise huge returns, become less attractive to potential victims. Also, since cryptocurrency prices are falling, new, inexperienced users who are more likely to fall for scams are not as common in the market.

It's also important to remember that fraudulent revenues are often driven by large scams such as PlusToken, which defrauded victims of over $2 billion in 2019, or Finiko, which defrauded victims of over $1.5 billion in 2021 . As of July 2022, no major scams have been detected this year that come close to those levels.

secondary title

Darknet Market Revenue Declines

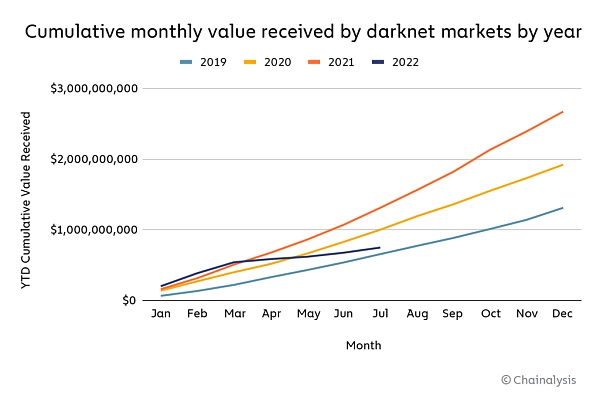

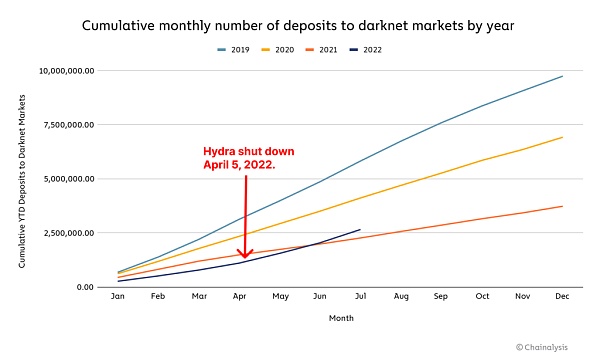

Darknet market revenues are also down significantly in 2022, currently 43% below July 2021 levels, and will drop sharply in April 2022, the reason for the decline is definitely due to the sanction and closure of Hydra Marketplace on April 5th, The market has served as a major darknet marketplace for years, serving as a hub for drug sales, hacking tools, stolen data and money laundering services.

Pictured above is the message displayed on Hydra's homepage after it was shut down by German law enforcement.

Interestingly, while overall darknet market revenue declined following the closure of Hydra, the remaining markets saw a significant increase in transaction volume.

secondary title

Hacking and stolen funds are on the rise

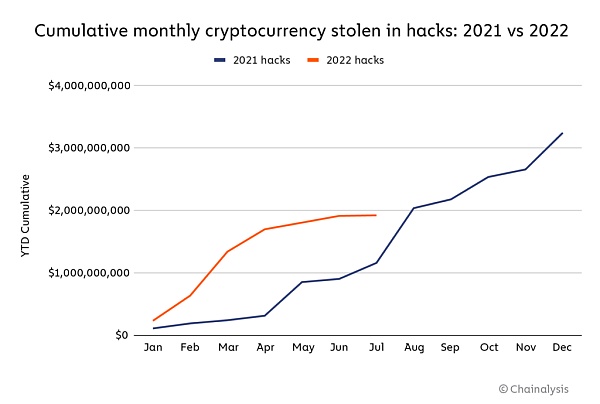

No cryptocurrency-based criminal activity will be able to reverse the trend of declining revenue in 2022, such as stolen funds.

By July 2022, $1.9 billion worth of cryptocurrency has been stolen, compared to less than $1.2 billion at the same point in 2021. This trend does not appear to be reversing anytime soon, as two more things happened in the first week of August:Token cross-chain bridge Nomad was hacked to steal $190 million in funds; hackers stole $5 million in funds from more than 8,000 Solana wallets.(These two events are not shown in the graph above because we chose July 31st as the cutoff point for our study)

Much of this can be attributed to the rise in hackers stealing funds from DeFi protocols, a trend that began in 2021. As we've covered before, DeFi protocols are particularly vulnerable to hackers because their open source code can be researched by hackers looking for exploits (although open source code is inherently more secure). Additionally, most of the assets stolen from DeFi protocols can be attributed to North Korea-linked hacking groups, especially elite hacking groups like the Lazarus Group. We estimate that North Korea-linked hacking groups have stolen roughly $1 billion in cryptocurrency from DeFi protocols by 2022.

secondary title

Crypto crime is down, but not letting up

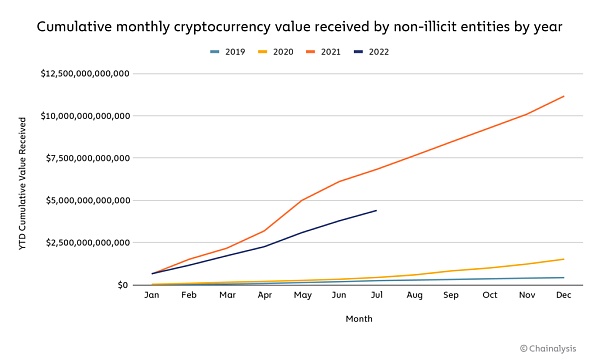

No one likes a bear market, but it’s heartening to see that illicit cryptocurrency activity has fallen along with legitimate trading volume, albeit not by as much.

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.