secondary title

What are ETFs?

ETF (Exchange Traded Fund) is an exchange-traded fund, and its full name is an exchange-traded open-end index securities investment fund. ETFs are usually listed and traded on exchanges and the fund shares can vary. Different from general fund products, the price of ETF needs to track a specific index or asset price and maintain an anchor relationship with it.

The origin of ETF can be traced back to the world's first index investment trust issued by Vanguard in 1975. The product tracks the S&P 500 Index (an index that measures the share price performance of the 500 largest listed companies in the U.S. stock market). However, this relatively passive investment strategy was not widely accepted by the market at that time. For many years thereafter, the development of index investing was very slow.

Until 1993, the world's first ETF tracking the S&P 500 Index - Standard & Poors Depositary Receipts (SPDR) was born on the American Stock Exchange (AMEX). As a long-term investment trust unit, the certificate pays dividends to investors quarterly. Since then, the development of index funds has entered the fast lane in the United States.

secondary title

What are the main characteristics of ETF?

As an innovative product, ETF plays a very important role in the traditional financial system. It has the characteristics of low cost, high efficiency, and transparent operation, and can meet the needs of market asset allocation and risk management. More importantly, ETFs often represent that related commodities or assets have been highly recognized by the market and are an indispensable investment tool in the capital market.

In essence, an ETF is a fund that tracks changes in the underlying index. Investors can buy and sell ETFs to obtain a rate of return that is basically consistent with the corresponding index. Specifically, ETFs can be purchased and redeemed like open-end funds. However, cash is not used when purchasing ETFs, but investors are required to prepare a basket of index constituent stocks according to the "subscription and redemption list" in exchange for a certain number of ETF shares from fund management companies. When the ETF is redeemed, the corresponding shares will be exchanged for a basket of index constituent stocks.

In terms of investment costs, the annual management fee of traditional open-end funds is generally 1.0% to 1.5%, while the fixed fee rate of ETF is significantly lower, ranging from 0.3% to 0.5%. In addition, traditional open-end funds need to pay a handling fee of about 1% and 1.5% when purchasing and redeeming, while ETF transactions only need to pay about 0.2% commission, and there will be no stamp duty.

At the same time, the management of ETF tends to be "passive". Because the index constituent stocks are the fund stock selection of the ETF, the ETF fund manager will not be involved in active stock selection. This transparent mode of operation can allow ETF investors to dispel the concerns of fund managers in terms of ability, style, and morality.

secondary title

ETF market size hits record high

For investors, trading ETFs can not only obtain average returns through the overall market performance, but also use the Internet, new energy, pharmaceuticals, photovoltaics and other industries or theme ETFs to gain profits in structural market conditions. In other words, investors can flexibly use ETFs in different categories to implement corresponding investment plans.

Recently, the Shenzhen Stock Exchange released the "Annual Report on ETF Industry Development (2021)", stating that the scale of domestic ETF products will reach 1.4 trillion yuan in 2021, an increase of 30.55% over the previous year, and the number and scale of products have reached new highs in the past ten years . Among them, non-monetary ETFs accounted for 79.03% of the total domestic ETF products.

In addition, the report also pointed out that in 2021, the global ETF market will continue to inflow funds, and the number of global ETF products and asset scale will continue to grow, with a scale of more than 10 trillion US dollars. Among them, the European and American markets are leading in terms of scale, the US ETF market accounts for 70.2% of the total scale, and Europe accounts for 15.6%.

According to statistics from the official ETF account of the Shanghai Stock Exchange, as of April 11, 2022, the market value of the ETF market on the Shanghai Stock Exchange exceeded 1 trillion yuan. In the Shanghai ETF market, there are a total of 426 ETF products, accounting for 62.92% of the total number of ETFs in Shanghai and Shenzhen, including 15 Sci-Tech Innovation Board ETFs with a total market value of 47.211 billion yuan. According to the data of the last month, the daily turnover of the Shanghai ETF market exceeds 50 billion yuan.

In addition, according to the statistics of the Institute, as of January 2022, there are 16 overseas ETFs tracking the Shanghai and Shenzhen 300 Index, with a total scale of more than 3 billion US dollars.

secondary title

The Rise of Nontraditional ETFs

In the field of ETFs, in addition to traditional ETFs that track underlying market indices, there are also non-traditional ETFs that track derivative indices and strategies, such as leveraged ETFs and inverse ETFs. As an important investment tool in mature markets, no matter what kind of ETF, the ultimate goal is to obtain similar returns to the underlying index or strategy.

At present, non-traditional ETFs such as the Shanghai and Shenzhen 300 leveraged index series, the CSI 500 leveraged index series, and the Shanghai 50 leveraged index series have come out. In each series, there are also three dimensions: forward double, reverse double, and reverse double.

In July 2020, four CSI 300 Index leveraged and inverse ETF products were listed on the Hong Kong Stock Exchange, namely, ChinaAMC Direxion CSI 300 Index Daily Leverage (2x), ChinaAMC Direxion CSI 300 Index Daily Inverse ( -1x), CSOP CSI 300 Index Daily Leverage (2x) and CSOP CSI 300 Index Daily Inverse (-1x).

In terms of product features, the CSI 300 Index Daily Leverage (2x) product tracks the return of twice the daily performance of the CSI 300 Index. In other words, if the Shanghai and Shenzhen 300 rose by 1% on the day, then the increase of the product would be 2%. In addition, the daily inverse (-1x) product of the CSI 300 Index is a return that tracks the inverse doubling of the daily performance of the CSI 300 Index. Assuming that the CSI 300 falls by 1% on the day, it will show a 1% increase.

It is not difficult to find that such non-traditional ETFs provide the possibility of twice the return of the CSI 300 Index in a single day or the reverse performance, which is convenient for investors to reap greater potential returns in the short-term market trends, and at the same time as a low-cost A-share Hedging financial instruments against market downside risks can induce enthusiasm for directional investment.

secondary title

The "entry" of cryptocurrency ETF

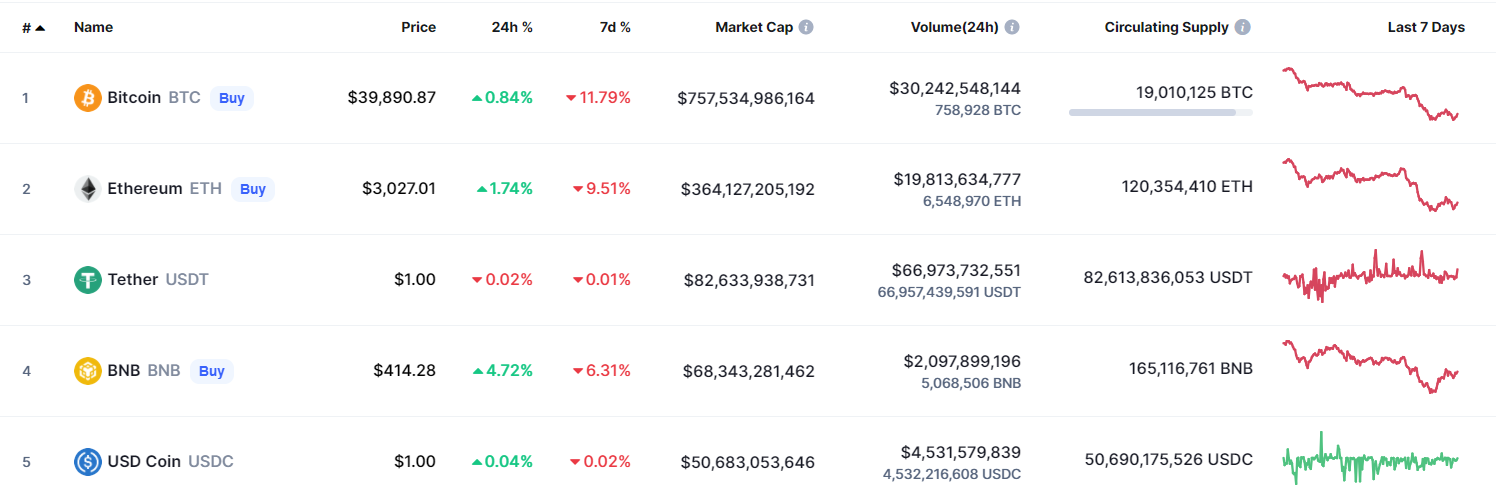

image description

▲Data source: CoinMarketCap – 0413

As mentioned above, ETF needs to track a specific index or asset price, and there is an anchor relationship. The so-called Bitcoin ETF is just an ETF that tracks the price of Bitcoin. Participating in Bitcoin ETF transactions, investors can obtain the same benefits as spot transactions without registering an encrypted exchange account and actually buying and selling Bitcoin.

From this perspective, Bitcoin ETF can allow investors to avoid the relatively complicated cryptocurrency transaction process and the risks that encrypted assets may face in transmission and storage. Therefore, as a simple and convenient way to get in touch with Bitcoin, Bitcoin ETF is generally believed to be able to stimulate more buying and trading demand.

On October 19, 2021, the first Bitcoin ETF, ProShares Bitcoin Strategy ETF (ProShares Bitcoin Strategy, trading code: BITO), was listed on the New York Stock Exchange in the United States. Affected by this, the price of Bitcoin soared that day and broke through 67,000 US dollars, setting a record high. As of press time, this price has become the second highest in the history of Bitcoin. Peak AscendEX market data shows that the highest price of Bitcoin appeared on November 10, 2021, at a quoted price of $69047.33.

On the first day of listing, the ProShares Bitcoin Strategy ETF set a turnover record close to $1 billion. Although this ETF tracks the bitcoin futures price of the Chicago Mercantile Exchange (CME), this is undoubtedly a milestone step in the development process of cryptocurrencies being accepted by traditional financial regulators and gradually approaching the development of formal asset management products.

After BITO, Valkyrie Bitcoin Strategy ETF (Valkyrie Bitcoin Strategy ETF, trading code: BTF) was listed on the NASDAQ stock exchange (NASDAQ), becoming the second Bitcoin futures ETF approved by the SEC. The third is the VanEck Bitcoin Strategy ETF (Bitcoin Strategy ETF, trading symbol: XBTF) listed on the Chicago Board Options Exchange (CBOE). It is worth noting that, compared to the 0.95% management fee of the former two, XBTF’s is only 0.65%.

In addition, Canada also has several Bitcoin ETFs listed, including the Fidelity Advantage Bitcoin ETF (FBTC), a Bitcoin spot ETF listed on the Toronto Stock Exchange (TSX) launched by asset management giant Fidelity Investments. They are traded in Canadian dollars and U.S. dollars under the symbols FBTC and FBTC.U, respectively.

epilogue

epilogue

Reminder: The above content is compiled from public information and is for reference only and does not constitute any investment advice. Please pay attention to investment risks.

Reminder: The above content is compiled from public information and is for reference only and does not constitute any investment advice. Please pay attention to investment risks.