secondary title

What is USDT?

USDT is a stablecoin pegged 1:1 to the U.S. dollar. It is the world's first stablecoin, also known as a legal asset-backed stablecoin.

The so-called stablecoins, as the name suggests, have little fluctuation in price compared with common cryptocurrencies such as Bitcoin and can basically remain stable. In essence, a stablecoin is a cryptocurrency with an "anchor" attribute, and its goal is to anchor a certain off-chain asset and maintain the same value as it.

secondary title

USDT development history

USDT was first created in July 2014 as Realcoin, jointly launched by Bitcoin investor Brock Pierce, entrepreneur Reeve Collins and software developer Craig Sellers. On November 20, 2014, Tether Ltd., the company responsible for maintaining the Realcoin fiat currency reserve, changed its name to Tether (USDT). Subsequently, Tether officially issued USDT in 2015. In February of the same year, USDT began to be officially traded on the exchange Bitfinex (Tether's parent company). Since then, more and more exchanges have begun to support USDT transactions, and USDT has officially started the road to dominance of stablecoins.

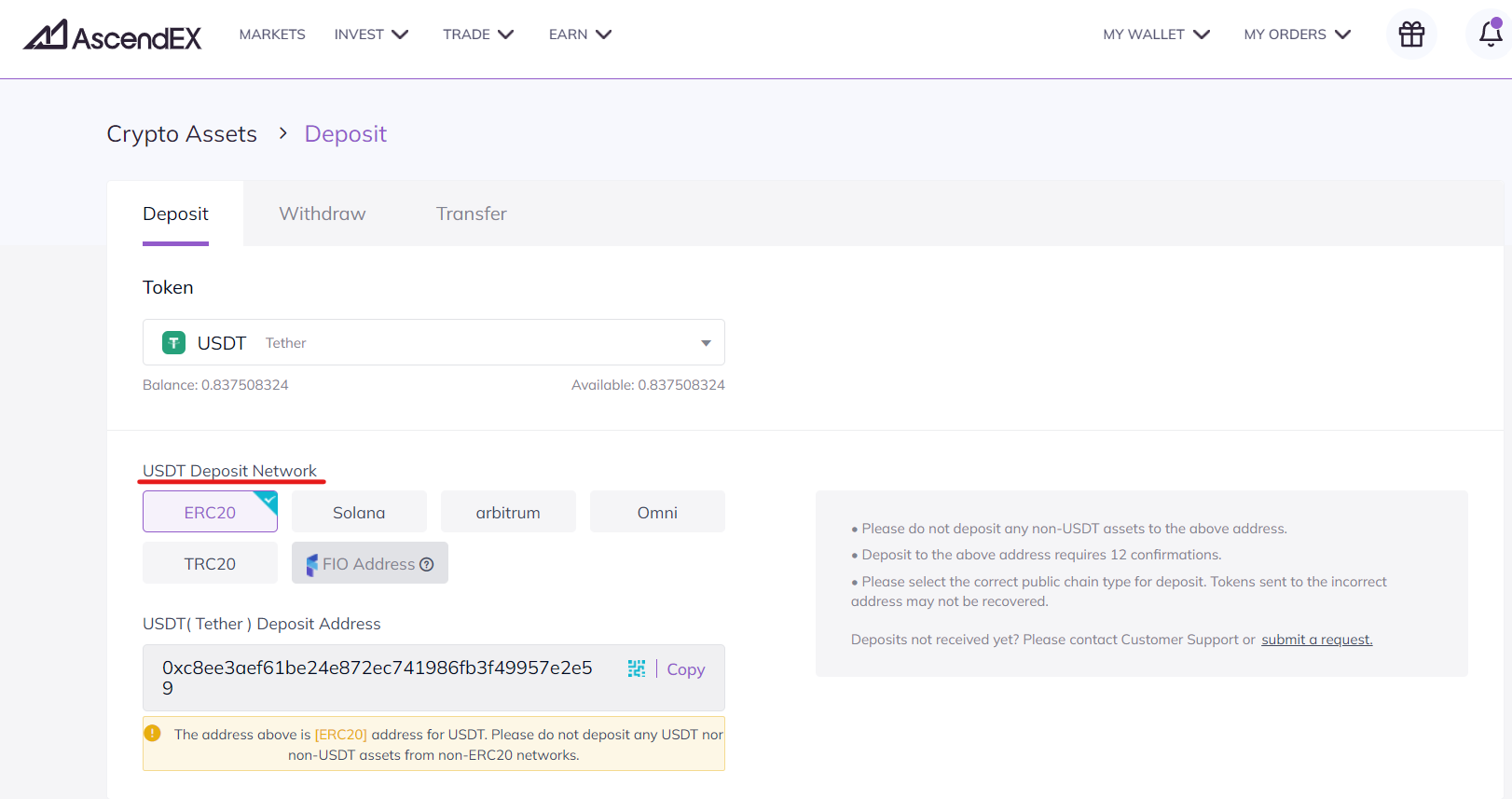

USDT was first issued in the Bitcoin protocol through the Omni layer. Since then, with the continuous development of the encryption market, in order to meet the transaction needs of different chains and users, Tether has gradually migrated and issued USDT on more different blockchains. According to Tether's official website data, as of now, Tether has issued USDT on a total of 9 blockchains other than the Bitcoin chain. The specific chains are: Ethereum, Tron, Solana, Avalanche, Algorand, EOS, Liquid, SLP (Bitcoin Simple Ledger Protocol for Cash).

And this is why we can choose different chains for deposit and withdrawal when we perform USDT deposit and withdrawal operations on the exchange.

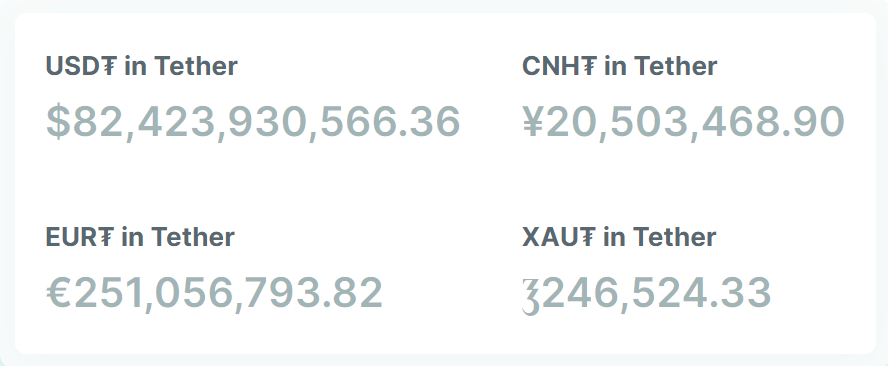

In addition to USDT, a stablecoin anchored to the U.S. dollar, Tether also has several stablecoins anchored to other fiat currencies. details as follows:

EURT: A Stablecoin Pegged to the Euro

CNHT: A Stablecoin Pegged to the Chinese Yuan

XAUT: A Stablecoin Pegged to Physical Gold

image description

secondary title

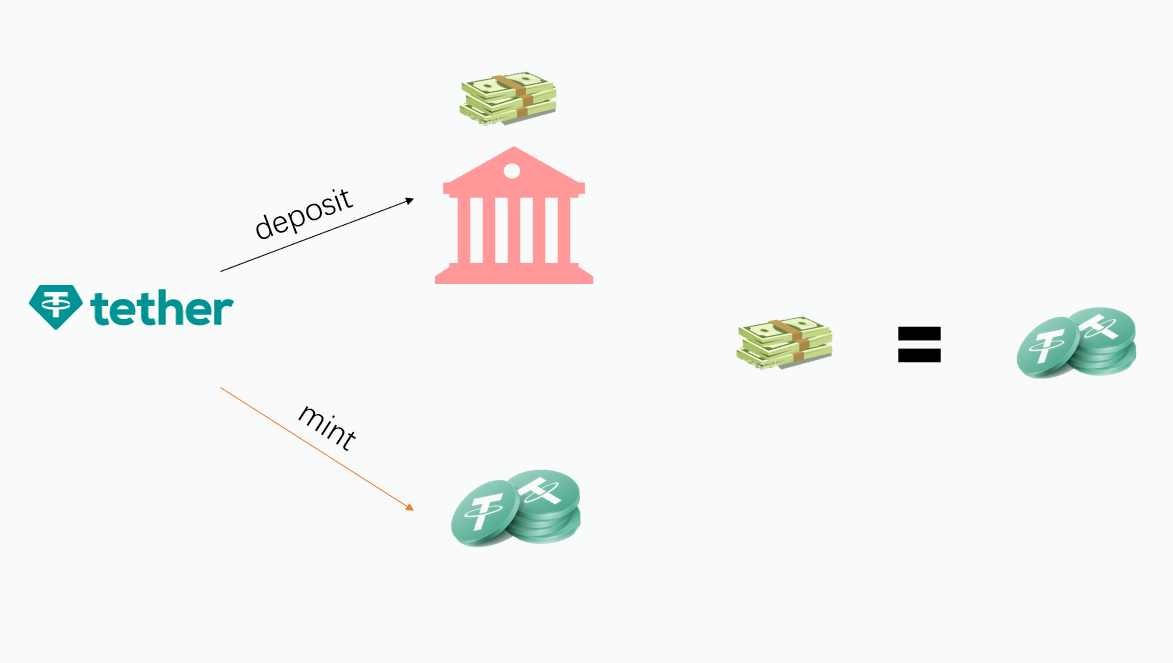

Issuance and circulation of USDT

Unlike Bitcoin, which issues new coins through "mining", USDT is issued directly by its development company Tether. The specific issuance and circulation process is as follows:

1. To obtain USDT (for example, 500,000 USDT), the user must first deposit USD (500,000) into Tether’s bank account;

2. After Tether Company receives the USD deposited by the user, it deposits USDT (500,000) equivalent to the USD amount into the user's Tether account;

3. After users receive USDT, they can trade USDT through cryptocurrency exchanges and over-the-counter transactions, and the circulation will begin;

4. When the user wants to withdraw, the USDT can be returned to Tether to redeem the previously deposited USD (500,000);

5. Tether Company will destroy USDT after receiving it, and return the USD to the user's bank account.

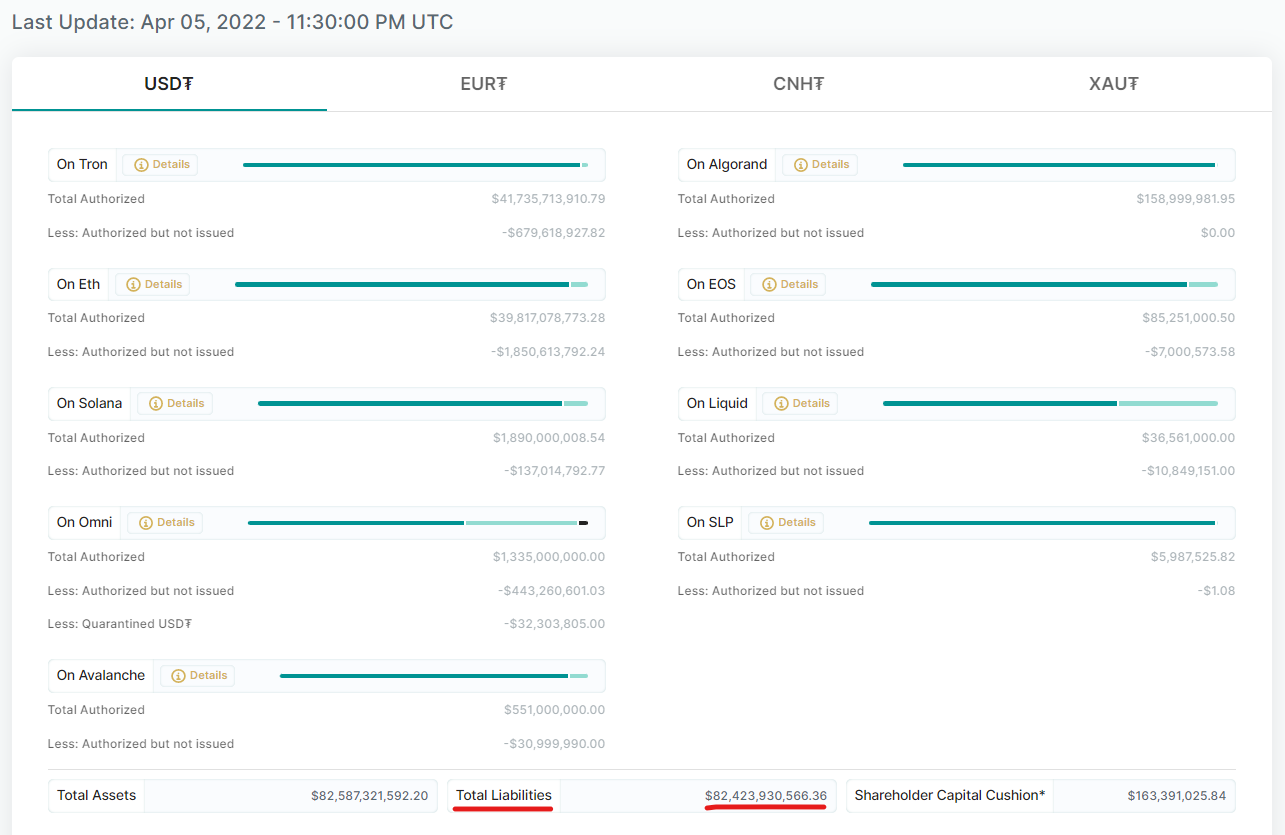

It should be noted that the above process is the general theoretical process of Tether issuing USDT. In fact, in the actual operation process, Tether's issuance of USDT also includes an important process-authorization.

Authorized USDT can be seen as pre-issued USDT. Authorization transactions can be generated in advance and signed by multiple signers involved in the Tether token issuance process. This portion of pre-issued USDT is called "authorised but not issued" tokens. To put it simply, the official will issue USDT in advance and put it into a special fund pool. This part of USDT is usually issued in batches, and the amount is generally relatively fixed. The specific amount of issuance is determined by the needs of Tether customers, which represents the expected demand for USDT by all parties in the market.

There are two main reasons why Tether officially adopts the authorization method to pre-issue authorized USDT in batches: one is to meet the needs of the market and customers in a timely manner, so that when the market demand increases, USDT can be issued in time to avoid delays in the operation process caused by the issuance process; the other is to Minimize the frequency of interaction between Tether signers and private keys, thereby reducing the risk of private key exposure and maintaining the security of the entire system.

According to TetherOfficial website datasecondary title

Advantages and risks of USDT

Since its inception, the USDT ecosystem has continued to grow and become a bridge linking fiat currency and other cryptocurrencies. It can even be said that many novice traders, when they first come into contact with cryptocurrencies, are likely to touch USDT first before they know Bitcoin. The advantages of the stablecoin USDT are mainly manifested in the following aspects:

1. Provide stability to the volatile cryptocurrency market.The natural nature of USDT's stable currency determines that it is more stable than other cryptocurrencies. When the price of cryptocurrency fluctuates violently, or when a bear market comes, USDT is a better choice for investment preservation.

2. Improve the liquidity and trading volume of the cryptocurrency market.As a bridge linking fiat currency and other cryptocurrencies, USDT provides traders with a direct exchange channel for fiat currency, improving the overall liquidity and trading volume of the cryptocurrency market.

3. Support the implementation of efficient real-time transactions and arbitrage strategies.As the earliest stable currency, USDT has been supported by almost all mainstream platforms, which enables efficient and instant transactions for all corresponding cryptocurrency transactions, and also enables some arbitrage strategies to be implemented, because it can be traded in almost any encrypted market , while other stablecoins are difficult to do.

At the same time, the biggest risk of USDT is centralization risk.Because its issuance is completely centralized, and the issuance, acceptance, regulatory risks, and operational risks are all concentrated in its development company Tether. In other words, because Tether failed to produce any audit documents or evidence to prove that it has US dollar reserves equivalent to the issuance of USDT, no one can figure out its so-called real US dollar reserves, and it can only be decided by Tether itself . This is also the source of its criticism.