This article comes fromCointelegraphOdaily translator |

Odaily translator |

first level title

1. What does the Fear and Greed Index mean?

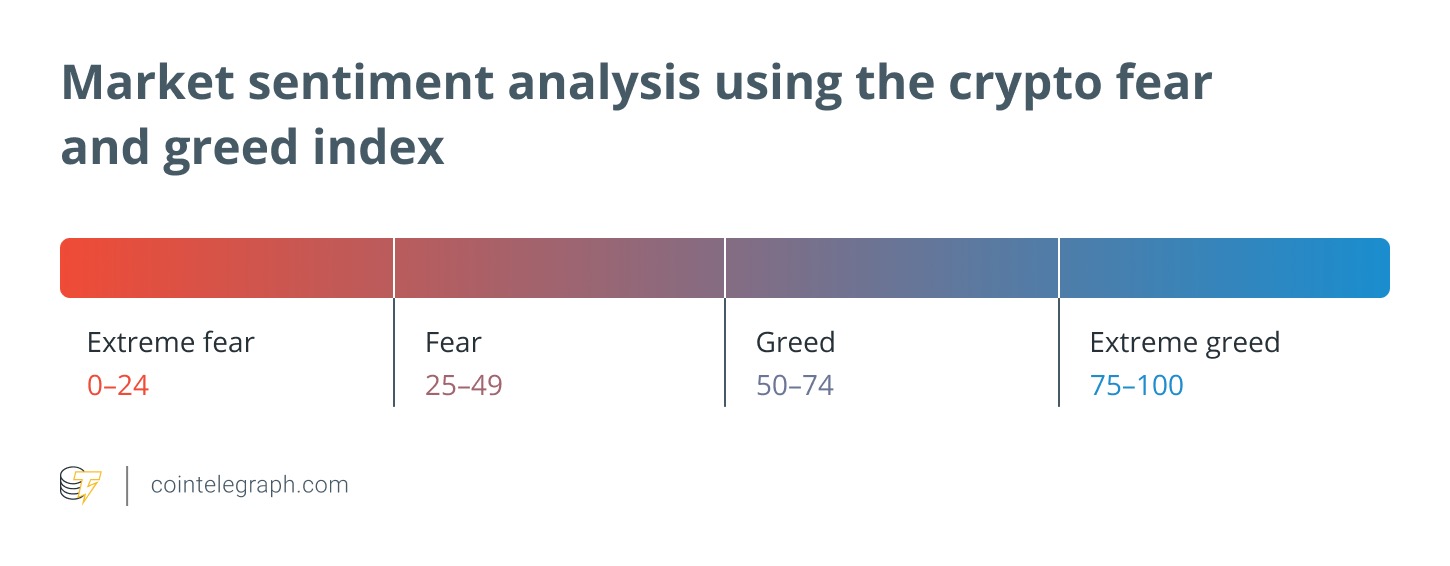

The Panic and Greed Index is Bitcoin's panic and greed index, which is a value between 1 and 100. If the value = 1, it means that the Bitcoin market will fall because people are experiencing severe fear and selling Bitcoin. On the other hand, the highest value of 100 means that the market will be corrected, and people will generate extreme greed (i.e. buy more assets). So, how does the Fear and Greed Index work?

Sentiment drives the cryptocurrency market. When the market goes up, people get greedy, leading to fear of missing out (FOMO). Also, when people see numbers in red (0-24), they often sell bitcoin impulsively.

first level title

2. How is the Fear and Greed Index calculated?

Factors affecting the fear and greed index of traders' behavior include: volatility (25%) + market trading volume (25%) + social media popularity (15%) + market research (15%) + Bitcoin's overall market share Proportion (10%) + Google hot word analysis (10%).

25% of the index is made up of market volatility. It compares Bitcoin's current price to its price movement over the past 30 to 90 days to determine market volatility. Additionally, volatility is used as a "fear" indicator for the index.

Market volume refers to the market's ability to maintain price trends over time and accounts for 25% of the index value. This examines the robustness and direction of the market.

Social media popularity has a 15% impact on the index, and things like hashtags, engagement, topics, and exposure on social media are all taken into account.

In addition, the fear and greed index also takes into account some other factors, such as market surveys, which account for 15% of the index value. Surveys with more than 2,000 participants drive the index higher, signaling greed among investors.

Knowing the greedy trend of the market is mainly by examining the trending search phrases. For example, a high volume of searches related to Bitcoin indicates a high level of greed among investors. This factor accounts for 10% of the index value. Historically, increased Google searches for "bitcoin" have been correlated with extreme volatility in the cryptocurrency's price.

first level title

3. How to trade with panic and greed?

The Fear and Greed Index is intended more as a daily indicator than as a tool for long-term trading.

Using the index as a trend indicator will help to rationally invest in cryptocurrencies. For example, when the FGI value is low, it could mean that the price of Bitcoin will rise, and you can decide whether you want to buy, hold, or sell. However, when the index value is high, it may indicate that the price of Bitcoin will soon fall, signaling buying. Thus, traders' sentiment drives the market to price rallies or local lows.

Trends tend to reverse when the index enters the zone of severe panic. This is the first sign of fear turning into greed before an outburst of palpable greed.

The index does not contribute to the long-term analysis of Bitcoin. On the contrary, in a long-term bull or bear market, there will be repeated emotions of fear and greed. However, swing traders stand to benefit from this type of market. The speculative strategy in which investors buy and hold assets to profit from expected market movements is known as swing trading.

first level title

4. Can the fear and greed index predict future price movements?

The Fear & Greed Index focuses only on sentiment; technical and fundamental analysis are not affected by the sentiment of market participants and are therefore a better way to predict market movements.

If you're a long-term investor and rely on the Fear & Greed Index, you could be missing out on major price rallies. On the other hand, the Fear and Greed Index is a valuable indicator for day traders who are constantly buying and selling over short periods of time.

If you choose to be a day trader (based on the Fear and Greed Index), then you should also know that any income from cryptocurrency trading is subject to capital gains (short-term) taxation.

Although the Fear and Greed Index is suitable for technical traders, individual traders should do their research on instruments that suit their investment goals.

first level title

5. How to balance panic and greed to become a successful trader?

Keeping your trade size down, having a trading plan, keeping a trading journal, and learning from others will save you from extreme panic or extreme greed.

Notable (or large) trades have less pronounced price swings, making large trades more stressful. Therefore, it is crucial to reduce trading volume to balance your emotions and trading decisions.

Having a clear trading plan is the way to become a successful trader. Without a plan, you can lose money by over-leveraging your cryptocurrency portfolio.

Keeping a record of your trading activity and knowing what works for you and vice versa helps you to make a rational decision. A trading journal can help you learn from your mistakes and learn from your mistakes!

It is very important to analyze the transaction activities recorded in the log, eliminate irrelevant content and polish valuable content. If you want to be a successful trader, do it with emotions out of the way.

Learn from your peers or successful investors like Warren Buffett. But make sure to avoid the herd strategy as it can affect emotions which can lead to losses.