one,

one,text

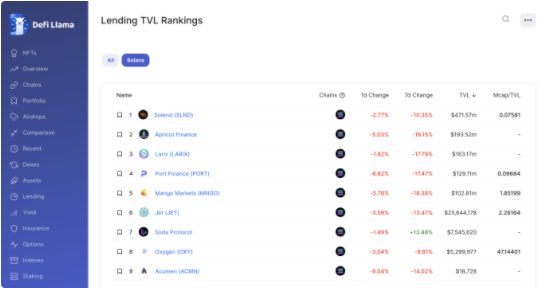

Larix is a one-stop metaverse financial service platform, the scope of services includes NFT mortgage lending, GameFi asset lease auction, virtual land asset loan and crowdfunding, etc. Larix has launched the Solana public chain at present, supports mortgage lending of mainstream currencies such as BTC, ETH, and USDT, and will soon launch LP mortgage lending and leveraged lending. In the future, it will continue to focus on the financial ecological services of Metaverse.

first level title

2. Metaverse Finance

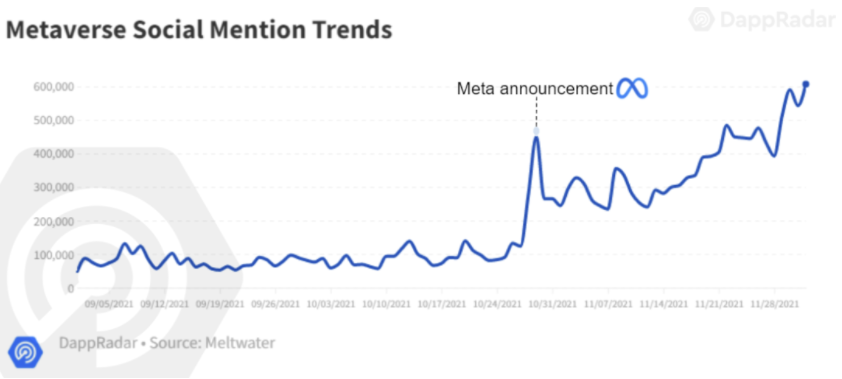

The metaverse has shown a trend of explosion, and products and services in GameFi, NFT, virtual real estate, DAO, finance and other fields are emerging in an endless stream. However, 2021 is just the starting point.

Some people say that artificial intelligence has changed productivity, blockchain has changed production relations, and metaverse (=artificial intelligence + blockchain) has changed the production environment. This is also the charm of the metaverse. It creates a brand new world where reality and reality coexist, where you can live, work, and entertain. Most importantly, you can create more freely and protect your wealth more safely, including your Personal data, cryptocurrency, NFT and other digital assets.

The prosperity of the metaverse is inseparable from the creation, transaction, storage and circulation of digital assets, and the financial ecology built around blockchain technology provides the underlying support for all of this. In a word, metaverse finance is the crowning touch of the grand narrative map of the entire metaverse.

first level title

3. Larix's metaverse financial map

As early as in the first version of the white paper released in May 2021, Larix described its role and mission in metaverse finance, before the term "metaverse" entered the public eye. This kind of super forward-looking makes Larix one step ahead in terms of product design and overall planning.

Financial products have three characteristics: safety, profitability and liquidity, which is also called the "impossible triangle" of finance. The mission of Larix is to realize that all valuable assets in the metaverse can be fully utilized (liquidity) in a safe (safety) and efficient (profitable) way. This requires not only technological and product-level innovations, but also the ingenious design of economic models.

secondary title

1. NFT market

Everything can be NFT, and the essence of NFT is digital property rights, so it is also the key to open the wonderful door of the Metaverse. Technically speaking, the irreplaceability and uniqueness of NFT enables it to anchor specific value and become a bridge to connect scarce assets and services in the real and virtual worlds.

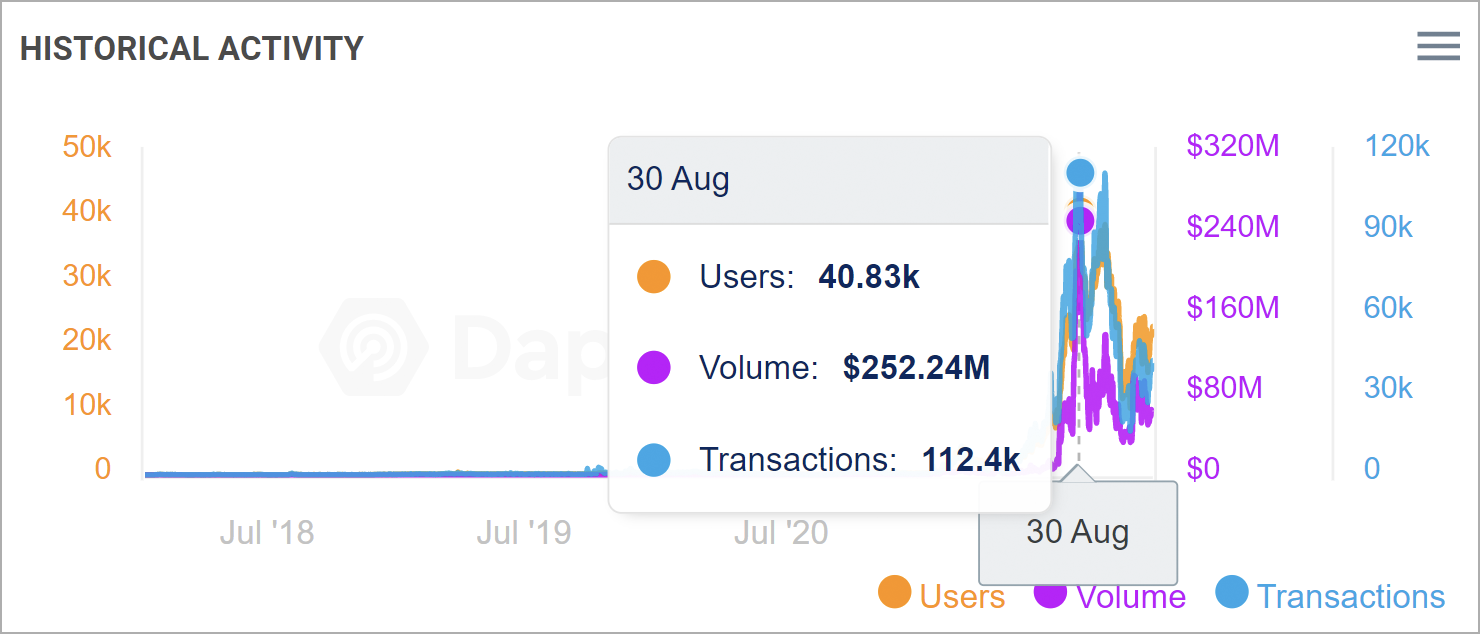

The NFT market has been hot for several months. After reaching a climax in August and September, it began to cool down. With the explosion of the Metaverse, the NFT market heated up again. The following figure shows the trend of daily transaction data of Opensea, the largest NFT trading platform:

However, poor liquidity and idle assets have always been the biggest pain points in the NFT market, and it is also a bottleneck for NFT and even the metaverse to continue to explode in the future.

Larix has seized NFT, an important infrastructure of the metaverse, as an entry point, trying to open up the full circulation process of NFT such as casting, display, trading, auction and mortgage, so as to solve the problem of poor liquidity of NFT.

secondary title

2. GameFi assets

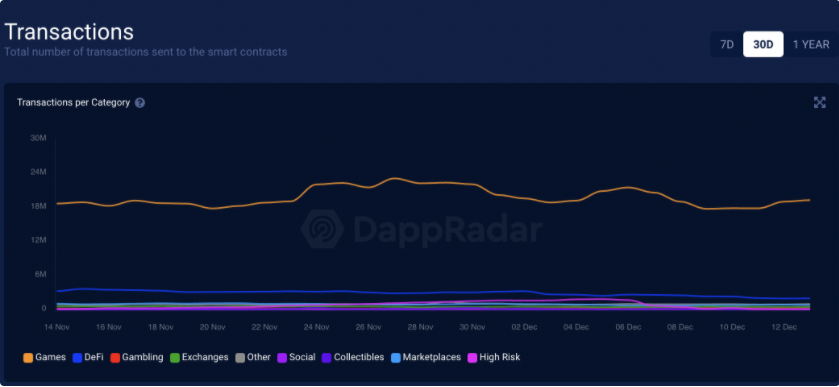

The well-known chain game "Axie Infinity" has a revenue of 334 million US dollars in July 2021, surpassing the traditional mobile game "Honor of Kings" and becoming the game with the highest revenue in the world at that time. South Korean game company Wemade has seen its stock price increase nearly 10 times after it launched the game "Legend 4" with blockchain transaction function. "Thetan Arena", developed by the game developer, has been downloaded more than 500,000 times within one day of launch, and currently has more than 3 million players, ranking first in the App Store game rankings in many countries. From this, the popularity of GameFi can be seen.

GameFi's play to earn mode allows players not only to experience the fun of the game itself, but also to earn money in the game. Through the integration of DeFi and NFT, GameFi is presented in the form of games, becoming a part of the metaverse financial system.

But behind the popularity of chain games, there are also some troubles. For example, how can assets in the form of NFTs such as avatars, skins, props, equipment, and land in GameFi, as well as the native tokens of the GameFi platform, maximize their value? Larix tries to provide more possibilities in the value discovery of GameFi assets.

secondary title

3. Virtual real estate

image description

Decentraland virtual venue. Source: NFTPlazas

According to Dappradar statistics, in the week from November 22nd to November 28th, the total transaction volume of the four major metaverse real estate trading platforms exceeded 100 million US dollars, and the prices of these virtual real estates even surpassed many big cities in the real world housing prices. On December 9, the CEO of New World Development Group purchased one of the largest plots on the metaverse sandbox game platform The Sandbox for US$5 million. On November 28, a piece of land on Decetraland sold for $2.43 million.

Behind the crazy hype, virtual real estate is not just as simple as game props, but also has huge potential realizable value in the future. Traffic economies such as advertisements, live broadcasts, and fees are also feasible in virtual spaces. However, the high price also hinders the entry of ordinary players. Larix uses this as a breakthrough to provide a split and crowdfunding platform for virtual real estate.

Four. Conclusion

Four. Conclusion

As people's time and energy continue to shift from the physical world to the digital world, people's wealth is also accelerating the transfer to digital assets. How will the Metaverse carry people's dreams of wealth in this process? The future of the metaverse is still ambiguous, but there is no doubt that it must be a world where wealth creation and flow are more efficient.