This article comes from Forbes, original author: Steven Ehrlich

Odaily Translator |

Odaily Translator |

Before he was 30, FTX co-founder Sam Bankman-Fried profited from the cryptocurrency industry and amassed a fortune of $22.5 billion—but he doesn't seem to value wealth very much, but hopes that when he acquires enough wealth, he will be Donate it.

On a hazy late summer night, Sam Bankman-Fried walked into a "clean, crisp" restaurant called Electric Lemon on the 24th floor of the five-star Equinox Hotel on Manhattan's Hudson Yards. The 29-year-old cryptocurrency billionaire flew in from Hong Kong to visit the home to co-host a private party, but the shy man didn't socialize much, instead sneaking into the room to avoid being Note the corners.

Sam Bankman-Fried's standard attire—a black hoodie, gray khakis, battered New Balances sneakers—is ubiquitous on the streets, but in a sea of cufflinks and cocktail dresses, he's in this Dress up to be more eye-catching than Obi Toppin. (Odaily Jun Note: Obi Toppin is the NBA New York Knicks star, six feet nine inches tall)

Sure enough, it didn't take long for Sam Bankman-Fried to be "sieged" - can you recommend me some cryptocurrencies? What do you think of the latest cryptocurrency crash? How about Instagram photos?

Perhaps that's part of Sam Bankman-Fried's life/work as one of the world's wealthiest under-30s. FTX, a trading platform launched by Sam Bankman-Fried, allows traders to more easily buy and sell digital assets such as Bitcoin and Ethereum. In July this year, FTX successfully completed a financing of US$900 million at a valuation of US$18 billion. Investors include SoftBank and Well-known investment institutions such as Coinbase Ventures. Today, the monthly transaction volume of global encrypted derivatives (mainly futures and options) is about 3.4 trillion US dollars, of which FTX handles 10% of the transaction volume. In addition, FTX will charge 0.02% of each transaction, making it Earned approximately $750 million in revenue and $350 million in profit over the past 12 months. Not only that, but Sam Bankman-Fried’s crypto trading firm Alameda Research also made a profit of $1 billion last year.

Recently, Sam Bankman-Fried also went on TV to give his opinion on industry issues such as Bitcoin price, regulations and the future of digital assets. He said this:

"It's a very strange, awkward in-between time for the industry, with a lot of uncertainty in half the world."

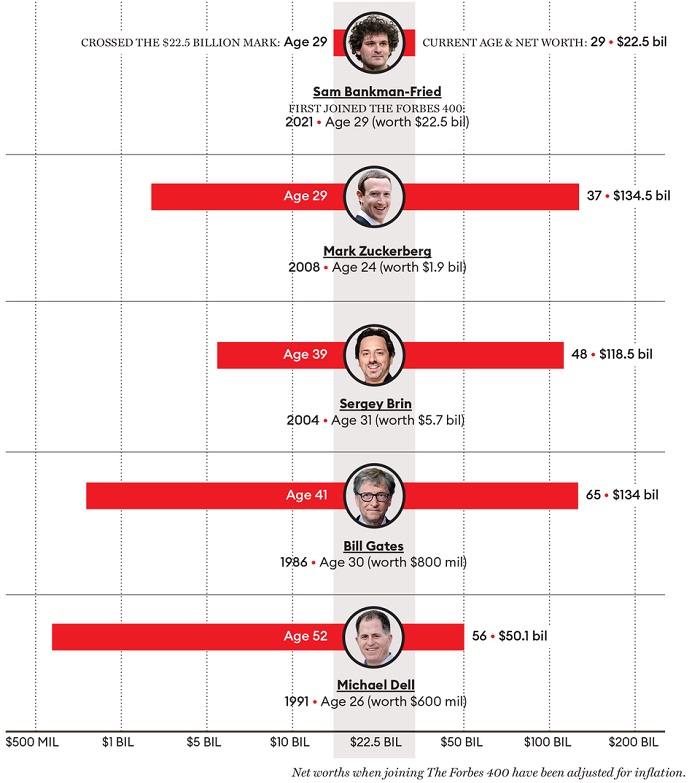

Four years ago, Sam Bankman-Fried hadn't bought a single bitcoin, but now, five months before his 30th birthday, he debuted on the 2021 Forbes 400 list with a net worth of $22.5 billion, Ranked 32nd. Except for Mark Zuckerberg, no one in history has become so rich at such a young age. The irony here - Sam Bankman-Fried isn't an evangelist or even a believer in crypto, he's like a mercenary trying to make as much money as possible (although he doesn't really care how to make money), and donate the wealth (although he does not yet know to whom or when).

Steve Jobs is obsessed with stylish and simple products, Elon Musk declares that colonizing Mars is to save mankind, and Sam Bankman-Fried's philosophy seems to be "vulgar"-only money can be given. It was this philosophy that drove him into the cryptocurrency gold rush, with Sam Bankman-Fried first becoming a trader and then a creator of trading platforms, simply because he knew he could get rich quick by doing so. Asked if he would ditch cryptocurrencies if he thought he could amass more money doing other things — like trading orange juice futures — Sam Bankman-Fried answered without hesitation: “I would, yes.”

However, Sam Bankman-Fried's "effective altruism" (that is, a perfect investment concept influenced by utilitarianism) is still in the theoretical stage, because so far, he has donated only $25 million, which is about half of his wealth. 0.1%, making it the "least philanthropic" member of the Forbes 400. Of course, Sam Bankman-Fried has promised that eventual donations will increase by at least 900 times, but for now will continue to ride the crypto wave instead of rushing to cash out.

"My number one goal is to make an impact," says Sam Bankman-Fried.

But to get there, for Sam Bankman-Fried, who moved to Hong Kong in 2018 and the Bahamas in September, the first thing that needs to be done is surviving the current environment of increased regulation, and then Find money-making opportunities in boom-and-bust crypto cycles that can not only generate huge fortunes at breakneck speeds, but wipe out investors just as fast.

Shark Tank star Kevin O'Leary, who recently invested in FTX and became a paid spokesperson for the exchange, said of Sam Bankman-Fried:

"The guy is a genius, he's accomplished a lot so far, he's got the respect of a lot of investors -- I'm one of them -- but he's just getting started."

The son of Stanford law professors, Sam Bankman-Fried grew up reading Harry Potter, watching the San Francisco Giants and listening to his parents talk politics with West Coast academics throughout his childhood. After graduating from a small private high school in the Bay Area, Sam Bankman-Fried bluntly said, "It would be great if I was more hippie and didn't like science," but he still got into MIT "as his parents wanted" College to pursue a degree in physics, but Sam Bankman-Fried did not seriously study at MIT. Instead, he spent a lot of time playing video games such as StarCraft and League of Legends. Although he thought he might eventually become a physics professor, he From the heart, I prefer ethical and moral things. As a vegetarian, Sam Bankman-Fried once said: "There is a chicken that has been tortured for five weeks in a factory farm. It eats, which is hard for me to justify."

Sam Bankman-Fried delved into the philosophy of utilitarianism, where he found himself particularly drawn to effective altruism, an idea championed by Princeton philosopher Peter Singer and inspired by Facebook co-founder Dustin Moskovitz. (Dustin Moskovitz) and others, the basic idea is: use evidence and reason to do the absolute best thing. Often, people give their lives to popular causes or causes that have had an impact on them personally. An effective altruist uses data to decide when and where to give to a cause, and makes decisions based on impersonal goals, for example, every dollar you donate needs to make it possible to save the most lives or Generate the most income. Obviously, one of the most important variables of this philosophy is that you need to have a lot of money to donate to begin with. So, Sam Bankman-Fried chose to "shelter" his idea of becoming a physics professor and start trying to build a fortune.Except for Facebook founder Mark Zuckerberg, no one in history has become so rich at such a young age. Ironically,

Sam Bankman-Fried himself is not an evangelist of encryption technology - he is not even a believer, but plays the role of a mercenary.

After graduating from MIT in 2014, Sam Bankman-Fried got a high-paying financial job, trading ETFs for quant firm Jane Street Capital, with a six-figure salary, but he gave most of his income to charity cause.

Sam Bankman-Fried pays little attention to cryptocurrency’s early bumps such as —

In 2013, the FBI shut down the Silk Road illegal online marketplace that sold various contraband in exchange for Bitcoin;

In 2014, cryptocurrency exchange Mt. Gox collapsed after losing 850,000 bitcoins, worth about $460 million at the time.

But in late 2017, when the cryptocurrency market entered its first major bull run and bitcoin jumped from $2,500 a coin to nearly $20,000 in just six months, Sam Bankman-Fried saw an opportunity. Noting the inefficiencies of emerging markets: he can buy Bitcoin in the US and sell it in Japan for up to 30%, he explained:

"I came into this industry without knowing what a cryptocurrency was, and it seemed like there were a lot of good deals going on in there."

At the end of 2017, Sam Bankman-Fried decided to quit his high-paying job and founded Alameda Research, a quantitative trading company. Most of the $1 million raised when he started his business came from his own savings, as well as the support of friends and family members. He shared an Airbnb with several fresh graduates in Berkeley, California. College graduates work together and start working hard on arbitrage trading. At times, he and his staff had to stop all work to visit foreign exchange sites because they needed to quickly convert yen to dollars. At its peak in January 2018, Sam Bankman-Fried said he was trading as much as 2,500 bitcoins worth of bitcoin per day. Ten thousand U.S. dollars.

Soon, however, Sam Bankman-Fried became frustrated with the quality of service of the major cryptocurrency exchanges, which, while making it easy for individuals to buy and sell a few bitcoins, were not equipped to handle professional transactions that moved large sums quickly. At this time, Sam Bankman-Fried found a business opportunity, and he decided to build a trading platform himself.

So far, Sam Bankman-Fried has earned far more than he has donated, and while he has donated $25 million so far, that's a drop in the bucket for the 29-year-old American.

In 2019, Sam Bankman-Fried took some of the money he had previously earned at Alameda Research, raised $8 million in funding from several smaller venture capital firms, and launched FTX. Later, Sam Bankman-Fried sold a part of FTX's shares to Binance, the world's largest cryptocurrency trading platform, for about $70 million.

FTX wasn’t growing fast at first, with a dozen employees toiling away at WeWork desks in Hong Kong, trying to attract people to their trading platform. Soon, though, Sam Bankman-Fried found a niche market—derivatives (such as Bitcoin options or Ethereum futures), a market for more sophisticated investors, and many derivatives traders interested in cryptocurrencies. There is little ideological conviction - like Sam Bankman-Fried, they just want to make money.

In this case, derivatives traders tend to make larger trades than the average retail investor, and the transaction value is also higher, which leads to FTX's income fee, because the trading platform takes 0.005% from each trade. 0.07% fee. FTX is also one of the few exchanges offering tokenized traditional stocks — for example, they offer crypto tokens representing Apple shares, and since the business has almost no overhead, the margins are high: around 50%.

But the problem is that Sam Bankman-Fried did not have a license to operate in the derivatives market in the United States, so he chose to do business in Hong Kong, and another reason for choosing Hong Kong was that he was attending a Bitcoin conference in Macau. Choosing Hong Kong helped Sam Bankman-Fried win customers in Asia. After all, the Asian market has been a hotbed for cryptocurrency transactions in the past few years, but with the increase in regulatory intensity, Sam Bankman-Fried announced in September this year that it would move FTX headquarters to the Bahamas, where it has Clearer encryption regulations, and there are no very strict epidemic travel restrictions. (Sam Bankman-Fried also owns a smaller trading platform in Chicago, USA)

In the two years of providing services to mature traders, FTX has become bigger and bigger, and the average daily derivatives trading volume has reached 11.5 billion US dollars, making it the fourth largest encrypted derivatives exchange in the world, second only to In Bybit ($12.5 billion), OKEx ($15.5 billion) and industry leader Binance ($61.5 billion). In 2020, FTX had only 200,000 users and a transaction volume of less than $1 billion, but now its user base has surged to 2 million, which also "forced" Sam Bankman-Fried to expand servers and further strengthen customer service quality and compliance issues.

Anatoly Yakovenko, the founder of the public chain Solana, commented on Sam Bankman-Fried:

"Through the power of Sam Bankman-Fried's character, he can advance engineering timelines by an incredible amount."

Sam Bankman-Fried's agility and speed of execution has attracted plenty of investor attention, with crypto venture capital firms including Pantera Capital and Exnetwork Capital valued at $1.2 billion in January 2020, according to PitchBook. Injected $40 million into FTX. By July 2021, it seemed like every blue-chip VC in the world wanted to invest in FTX, prompting Sam Bankman-Fried to successfully raise a whopping $900 million and push its valuation to $18 billion. FTX is now valued at a higher value than Carlyle Group or Nippon Steel, and they have only been around for 29 months.

Despite his success, Sam Bankman-Fried has very little cash at his disposal among the 50 wealthiest people in America (let's set aside Swiss bank accounts or a balanced stock and bond portfolio), because Sam Bankman-Fried Nearly all of that wealth is tied to his roughly 50% ownership of FTX and more than $11 billion worth of FTT tokens — tokens that can be used to make payments or trade discounts on the FTX exchange, similar to gift cards or mall credits , in addition to Sam Bankman-Fried also holds billions of dollars worth of other cryptocurrencies.So it’s no surprise that Sam Bankman-Fried’s giving so far has been modest—his $25 million gift includes a handful of causes in areas like voter registration, global poverty reduction, and AI safety—but the That's a drop in the bucket for the entire fortune the 29-year-old American has.

Sam Bankman-Fried stated frankly:

"I still have a lot of work to do. Donating is not a short-term goal, but a long-term persistence."

So far, Sam Bankman-Fried's profits have not been used for charitable causes, including his previous 1% net fee income will be donated to charity (only about $13 million in charitable funds for FTX and its employees), Instead, it continues to expand its own business. For example, in July this year, Sam Bankman-Fried spent $2.3 billion to repurchase Binance’s 15% stake in FTX—of course, the more you earn, the more money you will invest in charity in the future. More, if Sam Bankman-Fried continues to amass his wealth, perhaps he can have a greater philanthropic impact later on.

In fact, finding a balance between making money and philanthropy has been a problem that plagues many billionaires. Warren Buffett also had numerous spats with his late wife Susan over whether to donate their fortune during their lifetimes. Susan won, and in 2006 Buffett announced he would give away nearly all of his fortune.

Chuck Feeney, the 90-year-old co-founder of Duty Free Shoppers, also said in 2019:

"I see no reason to delay giving when there are more benefits to be gained by supporting worthy causes."

Another question: Is making money from cryptocurrencies antithetical to Sam Bankman-Fried's philanthropic mission? After all, cryptocurrencies have relatively serious environmental problems, and the energy consumption of mining for one year is almost equivalent to the energy consumption of the entire country of Belgium.

Sam Bankman-Fried explained:"These concerns are real, but sometimes a bit overblown.”

If you look at the carbon emissions from economic activity in dollars, cryptocurrencies don't use a lot of energy, maybe 2 or 3 times more energy than a normal company, but certainly not 20 or 30 times.

Currently, FTX has purchased carbon credits to offset carbon emission consumption, and will also invest $1 million in carbon capture and storage schemes.

However, the biggest challenge Sam Bankman-Fried is currently facing may be the future development direction of FTX. Specifically, he needs to find a way to maintain FTX's rapid growth while ensuring that it does not conflict with government regulators.

At this stage, cryptocurrencies are either outright banned or facing severe restrictions in countries such as China, Bolivia, and Turkey. In the United States, Congress has proposed at least 18 bills that directly affect the development of the encryption industry this year. As an example, Coinbase CEO Brian Armstrong (Brian Armstrong) recently had to abandon the product launch after a dispute with the US Securities and Exchange Commission over the launch of Lend, an encrypted lending product.

Sam Bankman-Fried, meanwhile, has been hoping to make the most of its recent $900 million fundraising as it expands its user base while seeking licenses to operate in other major jurisdictions. In August, FTX announced that it would acquire LedgerX, a New York-based trading platform that has been licensed by the U.S. Commodity Futures Trading Commission to sell crypto derivatives, meaning FTX may soon become the No. The first major cryptocurrency exchange offering derivatives products, ahead of Binance, Coinbase and Kraken.

What's more, Sam Bankman-Fried kicked off a mainstream marketing effort:

In March of this year, FTX reached a $135 million deal with the NBA’s Miami Heat to acquire the naming rights to the stadium;

In June, Sam Bankman-Fried agreed to pay $210 million to brand FTX on esports league TSM;

In August, FTX signed a $17.5 million contract with the University of California, Berkeley for naming rights to the school's football stadium.

Most recently, Sam Bankman-Fried also launched a $30 million ad campaign promoting FTX through ambassadors such as Shark Tank's O'Leary, NFL legend Tom Brady and NBA superstar Steph Curry, all three of whom own FTX's equity.Sam Bankman-Fried's goal: to position FTX as a safe and mature company.

Because, if your company becomes part of people's daily conversations, it's very difficult for regulators to shut it down forcefully.

Sam Bankman-Fried's "ambition" is not limited to cryptocurrencies. In 2021, he led FTX into the prediction market, allowing transactions to bet on the results of real-world events such as the Super Bowl and the presidential election. He even looks at broader business expansion : Wants clients to one day be able to trade "everything," from ethereum call options to Microsoft stock, or FTX's mutual funds.