This article comes fromThe GeneralistThis article comes from

This article is the third part of the "FTX Development History" series, and will discuss the future development of FTX and new developments.

the second part:the second part:

Dances with Sharks: A Brief History of Giant FTX

It’s amazing to think back now that Amazon was once just a bookstore.

A young Jeff Bezos left the hedge fund industry without looking back and did a lot of research on whether his online shopping site should sell CDs or videos.

Selling books looks like a good option. The durability, portability, and especially the variety of books are ideal for selling online. And so it turned out.

Later, Amazon gradually expanded its sales area and became a "universal" store, a shopping website that only you can't think of, and there is nothing you can't buy.

Today, FTX has successfully followed its development roadmap and has become an important cryptocurrency exchange in the industry. We can look back at its early days.

Through dialogues with leaders, investors and people in the cryptocurrency circle, as well as internal strategic documents, this article outlines a FTX business picture. FTX is not only a cryptocurrency product, but also a product that can be bought and sold the location of the asset. Whether this lofty goal can be achieved, we can look forward to it.

The article will analyze the development trajectory of FTX from four aspects, involving company development and mergers and acquisitions. Focus on the following areas:

Bet on the sports track. Why FTX's sponsorship may herald more plans to come in the industry

Encrypted currency business territory expansion. How can FTX strengthen its institutional and consumer crypto offerings?

Get involved in social media. Should FTX buy a social network? It probably offers the best chance of attracting a large number of customers and mainstream cryptocurrencies.

secondary title

The World of Sports: Appearing in the Sports World

FTX's decision to spend more than $500 million to sponsor the Miami Heat, Major League Baseball, and TSM, a well-known American e-sports club, has some people scratching their heads. Why would a cryptocurrency exchange waste the equivalent of a growth round on this kind of sprawling, aimless marketing? How many avenues has the company overlooked in order to generate profits for the sports world and fans?

If marketing is often a game of sniper and scalpel, FTX appears to be rushing into the fray with a shotgun. Indeed, why haven't more established entities like Coinbase or Gemini made similar high-profile moves?

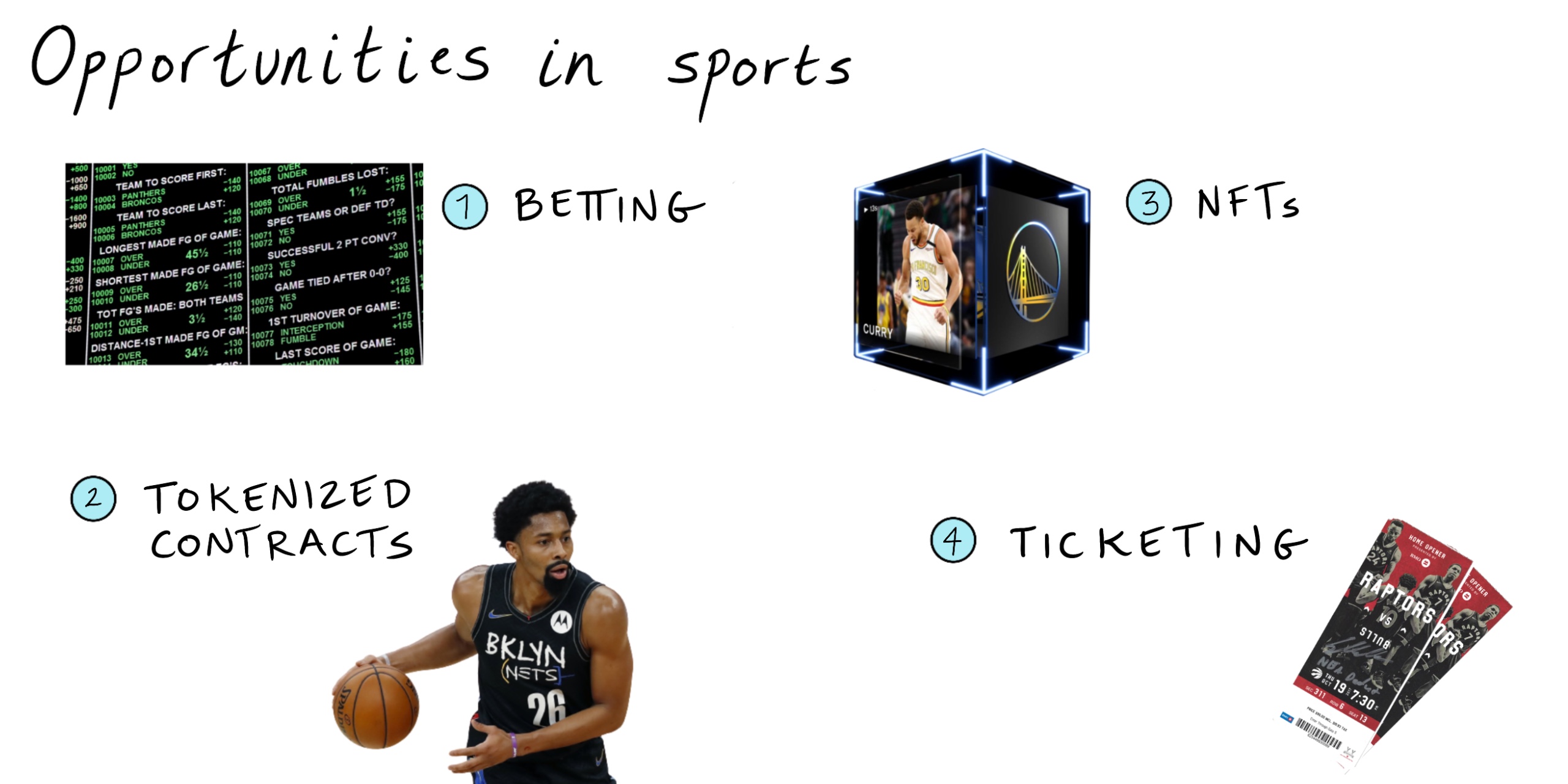

When you start to think that FTX's unconventional path may have a purpose, it is no longer a random event, but FTX's goals are different from ordinary people. In the next few years, we may see FTX play a big role in guessing, tokenized contracts, NFT and ticketing systems.

When you start to think that FTX's unconventional path may have a purpose, it is no longer a random event, but FTX's goals are different from ordinary people. In the next few years, we may see FTX play a big role in guessing, tokenized contracts, NFT and ticketing systems.

The most obvious first step is sports betting, and of course traditional sports and esports.

When I asked SBF about FTX's foray into sports, his response was businesslike: "Maybe."

Although not confirmed by FTX leadership, on paper the move makes sense. Many believe that last year showed a link between retail investors and sports betting. While casinos and sports leagues shut down during the lockdown, trading platforms such as Robinhood and Coinbase thrived, and the frenzy of adventurous football fans caused chaos in the market.

FTX has been catering to this thrill-seeking user by offering highly leveraged products. But so far, it has only attracted those who can take a high risk and who are also crypto-savvy. But this is only a small part of the huge user experience.

Entering the sports betting industry will change that. FTX will find itself serving not only academic traders, but also ordinary people who dare to take risks. Of course, players on the platform can also meet their own guessing needs and increase the average revenue per user (ARPU). There's a reason internal documents list DraftKings, an American online sports social gaming company, as a competitor.

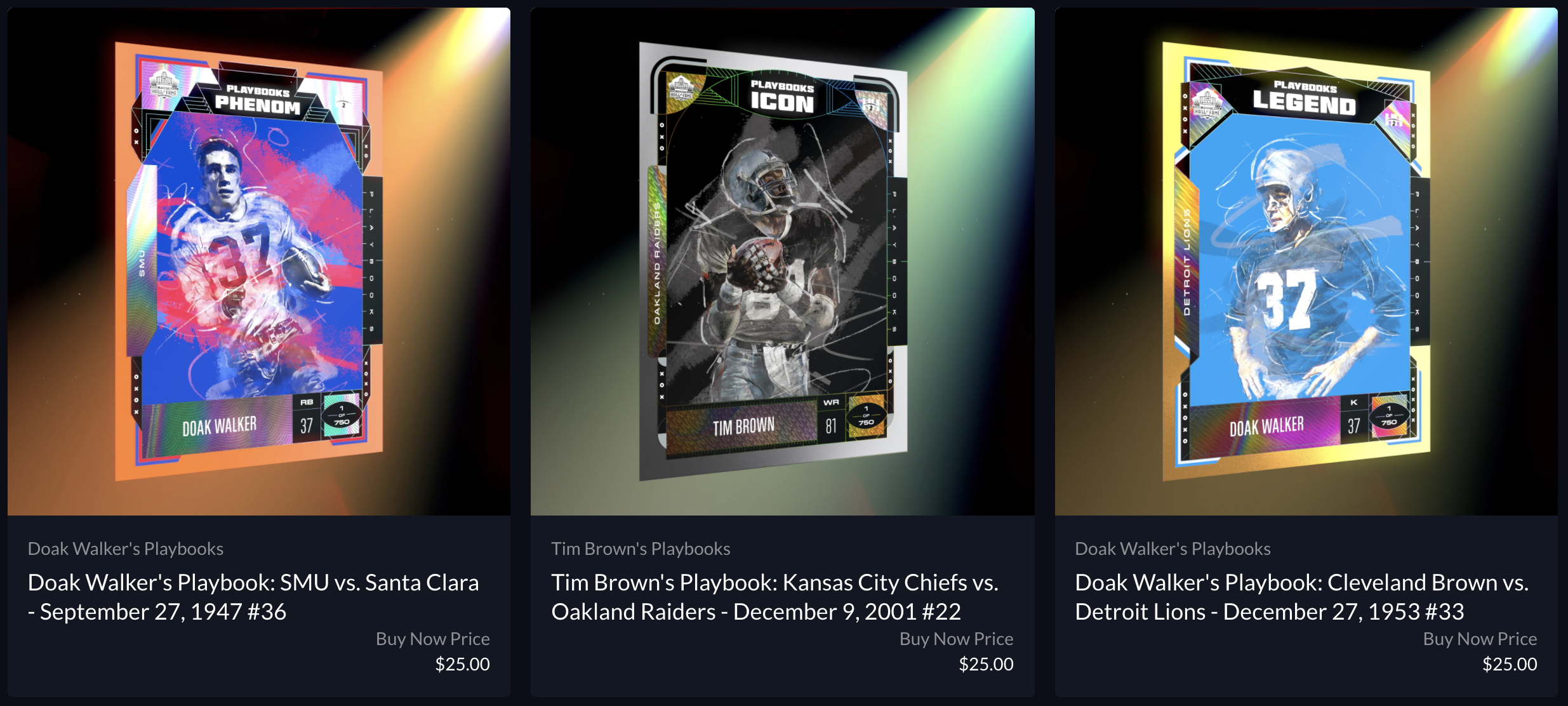

FTX is probably the only exchange that is willing to experiment with tokenizing contracts and treat them fairly. What would happen if thousands of fans invested in the supermax contract of NBA player Luka Dončić, perhaps using that money in exchange for favors? What status do these investors get, perhaps through NFTs? And, once a saturated market is established, can these positions be traded like other assets? This hints at a third opportunity: sports NFTs. FTX’s U.S. NFT page shows that the company is interested in the opportunity, with NFL player cards taking up most of its inventory.

image description

FTX’s NFTs

It is difficult to judge how these assets should be structured. In many ways, they look like a visual "space," a filled space waiting for better options to emerge.

This may be an area best addressed through acquisitions. There are already plenty of NFT exchanges out there, and while FTX will point to the vast customer base it has amassed, it’s unclear whether traders necessarily want to buy NFTs from where they’re exchanging tokens. If one's motive is financial gain, the other's motive is status. Branding and aesthetic issues are important, and FTX is not good at either.

In terms of M&A, FTX may take two paths:

Purchase of NFT creation tools;

Buy NFT marketplace.

Dapper Labs is the most famous company for creating NFTs, with the NBA Top Shot as its main asset. Considering that Dapper is currently valued at $7.5 billion, the company may well have outgrown FTX. Sorare, an ethereum fantasy football game that sells football NFT trading cards, is another option, though it also has a $3.8 billion premium. Moreover, the latter probably won't help FTX win the key U.S. market, given soccer's relative lack of popularity in the U.S.

Of course, FTX would be better off focusing on the NFT marketplace rather than a specific NFT creation tool. In many ways, it makes more sense given the company's current business positioning. "The world's largest NFT market" Opensea was recently valued at $1.5 billion. This could strain FTX's resources. Because Opensea will bring considerable sales and moderate brand influence. Opensea has run the gamut from offering trading cards to music and sports NFTs, all of which seem to align in spirit with FTX. The Rarible NFT platform, which has raised $14.2 million, could be much cheaper and give FTX brand power.

While on the surface NFT crypto art trading platforms like SuperRare and Foundation are small in scale, such a market may represent other advantages. Both companies are known for their high, elegant aesthetics, reminiscent of art galleries rather than cluttered bazaars. Whether this will match FTX's needs is still worth thinking about.Interestingly, SBF has noticed a lot of interest in sports-related NFTs, albeit in a form unlike any we've mentioned so far. In particular, he pointed to the potential of ticketing. SBF describes the significance of NFT, emphasizing that tickets (tickets) have digital representation, value, and may be interesting collectibles.

Since FTX has exclusive naming rights to the Miami Heat stadium for 19 years, the company has plenty of time to take advantage of it. Over time, fans may bring FTX's NFT into FTX Stadium to watch the players they invested in the contract play, as well as their digital representation of the players.

secondary title

Cryptocurrencies: Chasing Users and Financial Institutions

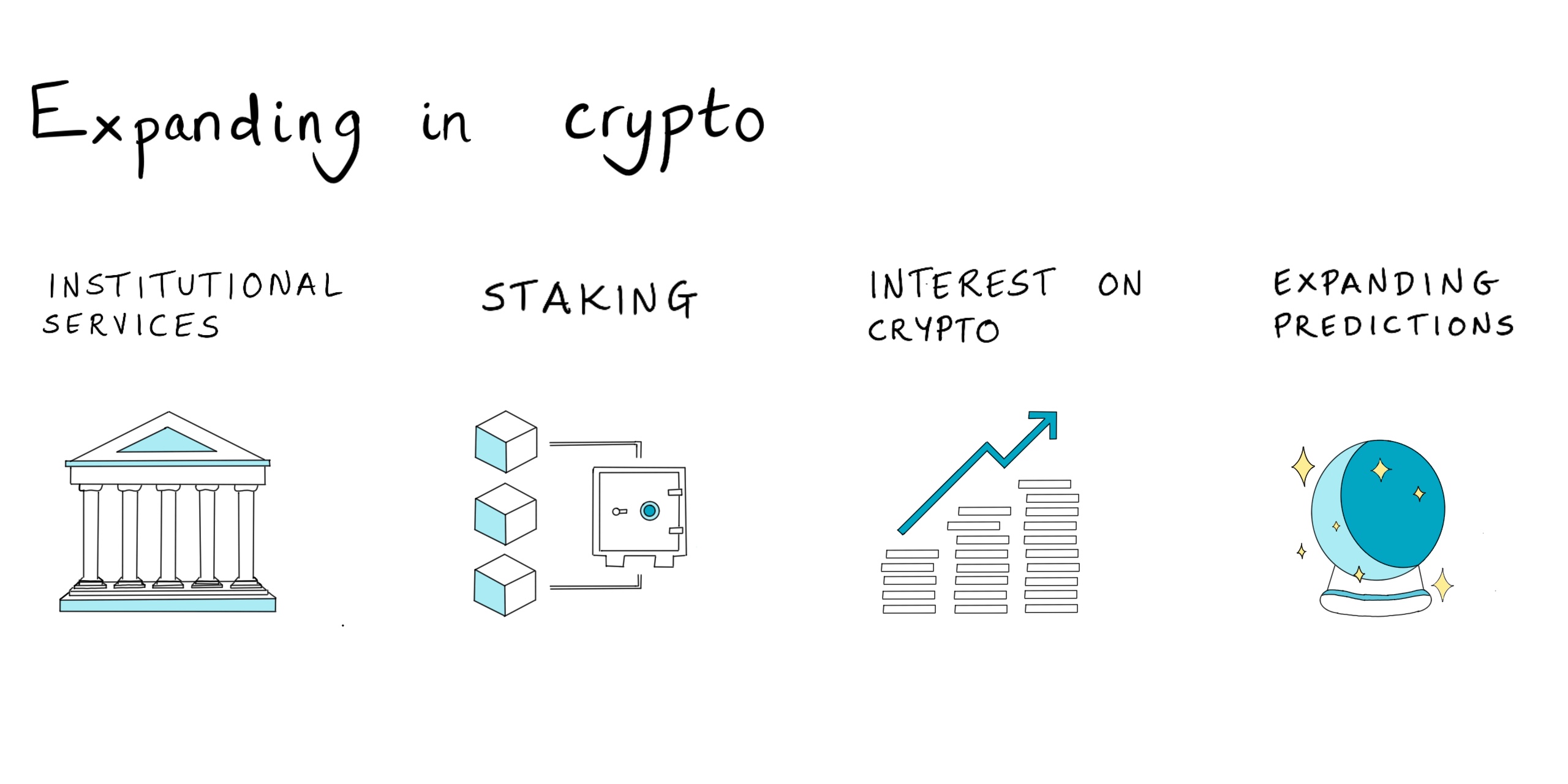

If you don't want to take too much risk, FTX may focus on developing in cryptocurrency. In the next 1-2 years, we can expect service bureaus to improve, offering more mature staking products, and more consumer-friendly products. We may also see the company detail its current prediction market offering.

If you don't want to take too much risk, FTX may focus on developing in cryptocurrency. In the next 1-2 years, we can expect service bureaus to improve, offering more mature staking products, and more consumer-friendly products. We may also see the company detail its current prediction market offering.

Despite attracting a large number of large "whales", FTX's institutional business is relatively immature. For example, we noted last week that the company has 2,700 institutions involved, a small fraction of Coinbase’s total. Earlier this year, the U.S.-based exchange Coinbase reportedly surpassed 8,000.

As interest in cryptocurrencies increases, institutional investment is likely to increase. Investors in the space have taken note that allocations to the sector have increased significantly. FTX will want to ensure that it is positioned to attract an influx of users.

Doing so requires a strong business development and sales team. The sales cycle for this type of agency enticement is long and often requires multiple touchpoints. As a newcomer to the space, and a company known for being bold and avant-garde, FTX will have a lot to prove.AnchoragePlatform advancements will help. For now, institutional crypto custody service companies

Clearly a first-class player, serving the establishment and the ultra-wealthy. The company has raised $137 million to date and offers advanced, secure custody solutions, insurance, easily auditable data, and robust transactions. Will FTX be able to form a partnership with it?It is impossible for FTX to acquire all interested crypto companies, even though market maker Alameda Research (FTX parent company) invested in most of them. For now, it wants to focus on acquisitions that expand its user base.AnchorageInstitutional Crypto Custody ServicesAnchorageThe deep integration of the service can serve both parties and give FTX the opportunity to convince institutions of its maturity, while at the same time bringing institutional crypto custody services companies

assets into custody. Will get more development over time.

FTX should include equity as part of its institutional upgrade. Investing in shares allows customers to obtain returns on entrusted assets, similar to interest. While the company offers equity in its proprietary token, FTT, it still has a long way to go. In recent years, Coinbase has upgraded its capabilities in this space with the acquisition of Bison Trails, which the company reportedly acquired for more than $80 million. In Alameda’s portfolio, Coin98 appears to be a comprehensive DeFi solution that might help with this, though it appears to be more user-focused.

It is wise for FTX to offer similar products to retail investors, whether through equity or other means. Companies like BlockFi have attracted a lot of customers by offering interest on crypto assets. While this is achieved through lending rather than staking, the end user's return is similar despite a different risk profile.

Competitor Nexo has raised about $50 million (a tenth of BlockFi's), and despite having 2 million customers, it could sell for less. The funding came from Arrington XRP Capital, a fund linked to the Ripple encryption project that has also had issues with U.S. authorities. FTX shouldn't let these issues deter its plans, but in this case, perhaps inventing itself might make more sense than acquiring.

In addition to these larger moves, FTX is looking to expand a number of other product lines, enhance its tools for quant traders, and bring options trading to a less sophisticated audience, a move that could carry the same risks and criticisms that Robinhood faced, And increase the number of markets it offers.

Just as sports betting allows FTX to appeal to risk enthusiasts outside the cryptocurrency space, a robust prediction market will facilitate speculation independent of any party’s interest. Although it might be rather dystopian. It's another way to encourage guesswork, but it fits with the philosophy of being the place where everything is traded.

secondary title

Banking: Defensive and offensive tactics

In SBF’s view, the distinction between traditional finance and cryptocurrencies is an artificial one. When I asked him about the future of FTX, he immediately started talking about his vision of building a full-fledged financial powerhouse, a currency super app that could handle payments and custody, and of course, investing across asset classes.

FTX has indicated that it will prioritize the development of stock trading and payment functions.

As we detailed last week, FTX provides a marketplace for tokenized shares, meaning users can buy synthetic shares of Tesla 24/7. While this is a compelling add-on, it's unlikely that true stock market junkies will turn their volume to FTX. To compete, we should expect FTX to launch a "Robinhood opposite." In the same way that free exchanges add support for cryptocurrencies to strengthen their core business, FTX can take over traditional trading.

Getting regulatory approval can take time, and patience is neither FTX nor the market's strong suit. Therefore, an acquisition is the most likely outcome. In past interviews, SBF has said a takeover of CME Group, the world's largest derivatives exchange, is "not out of the question." Its current market cap could be $75 billion.

What does Miami International Holdings (MIH) mean for FTX?

Admittedly, FTX would have raised eyebrows if it had acquired a company in the most crypto-friendly city in the United States, let alone where its hottest sponsors are located. What's more, MIH is the owner of the Miami Exchange (MIAX), the Minneapolis Grain Exchange (MGAX) and the Bermuda Exchange (BSX), and is known for its impressive technology has won praise. Within its portfolio, MIH offers some valuable products that FTX finds interesting, including agricultural contracts and volatility indices. A market for commercial real estate derivatives is coming.

Whatever moves FTX makes here, SBF clearly wants to unify trading across asset classes on the platform, we'll see.

FTX Pay revealed other key benefits of the company. While the product is currently designed to process online purchases, it is expected that FTX will expand into payments, impacting both businesses and individuals. The company has already launched the FTX card jointly with Visa. While only partially mature, it illustrates how FTX sees a limitless future of money and wealth where users can pay with dollars, bitcoin or other tokens and are convenient for merchants.

Blockfolio, a crypto asset management tool acquired by FTX last year, could play a key role in expanding these capabilities. This is by far the most mobile and consumer-friendly offering from FTX. Will it be the basis for a real world wallet or peer-to-peer payment product? Blockfolio has 6-7 million users, basically the same as Cash App's user base in 2017, which is a good place to start.

Blockfolio, a crypto asset management tool acquired by FTX last year, could play a key role in expanding these capabilities. This is by far the most mobile and consumer-friendly offering from FTX. Will it be the basis for a real world wallet or peer-to-peer payment product? Blockfolio has 6-7 million users, basically the same as Cash App's user base in 2017, which is a good place to start.

Over time, we may see FTX trying to build a truly new banking industry. Doubting FTX is generally a dangerous idea, but one can cast doubt on the company's capabilities in this space.

Of course, SBF hopes that the business will become an all-round financial platform, but what do users want?

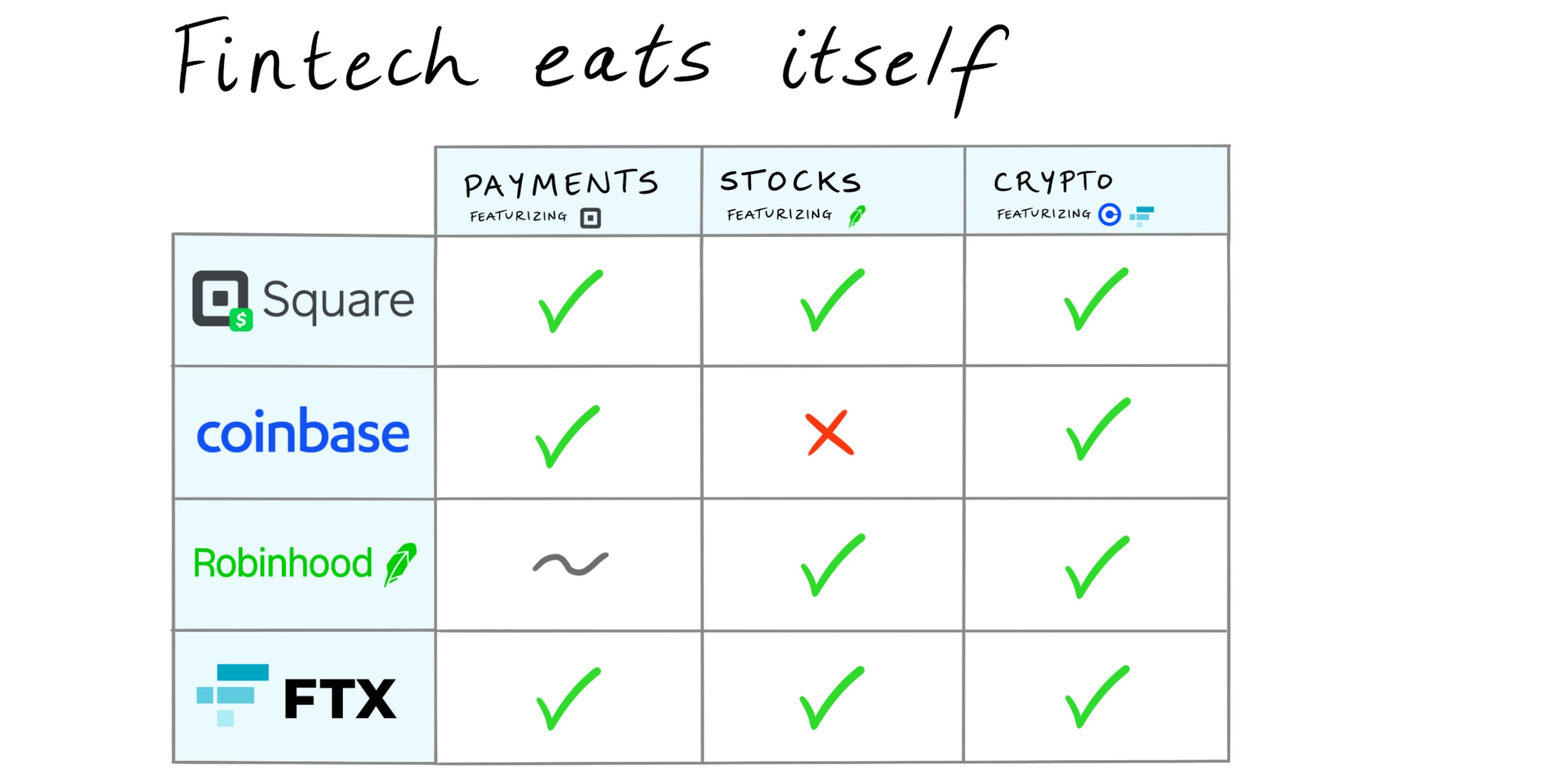

Fintechs are converging, with market leaders frequently showing each other their unique characteristics. Payments giant Square has done the best job of this, with its Cash App beating Venmo's payments, Robinhood's stock and Coinbase's cryptocurrency space, while its recent acquisition of Afterpay revealed the "buy now pay later" Operations may exist. Everyone wants to play this game, everyone wants to beat their opponents.

Fintechs are converging, with market leaders frequently showing each other their unique characteristics. Payments giant Square has done the best job of this, with its Cash App beating Venmo's payments, Robinhood's stock and Coinbase's cryptocurrency space, while its recent acquisition of Afterpay revealed the "buy now pay later" Operations may exist. Everyone wants to play this game, everyone wants to beat their opponents.

What should FTX do?

FTX is hoping it can move faster than its competitors and claim their “territory” before they reach their cryptocurrency fertile ground. This is a game of offense and defense. Can FTX do it? Clearly, FTX has some strengths, namely the explosive growth of its start-up sector and its impressive team. But it is largely competing with other well-run, impressively innovative organizations.

FTX's ambition to dominate the financial world is admirable, and time will tell us the answer.

secondary title

Entering Social Networking: Thinking in the CAC (User Acquisition Cost) "Equation"

There's a crazy idea running through my head: FTX should buy Reddit.

Please listen to me.

We mentioned in a previous article that Reddit has been terrible at monetizing its user base. This is reflected in the platform's valuation, which is valued at 1/18th of Facebook's daily active users (DAU). While the brand new $10 billion valuation reflects the uptick in the company's advertising platform, which brings in $100 million per quarter. But it's still under-leveraged for now.

FTX has shown a talent for acquiring a large number of users and effectively monetizing them through trading. As we outlined last week, the company acquired Blockfolio’s user base at a cost equivalent to $23 per user, and then ramped up its cryptocurrency investments. With an average revenue per user contribution of $337, this acquisition pays off quickly.

Could something similar happen to Reddit? It would be an incredible move, but it might make sense.

Reddit has 430 million users, 50 million of whom are active every day. It is arguably the most crypto-savvy major social network.

Of course, Reddit is also the base of the Wall Street Bets (WSB) forum behind the retail "anti-killing" institutional drama in the GameStop incident. These are exactly the potential users that FTX could make money from. Not only are they accustomed to frequent trading operations, but they also seem to be inclined to trade options with higher profit margins.

What if this community could transact from the same dedicated interface they use to chat, fight pictures, and "make things happen"? How powerful will this online cultural force be? How much profit can be gained from it?

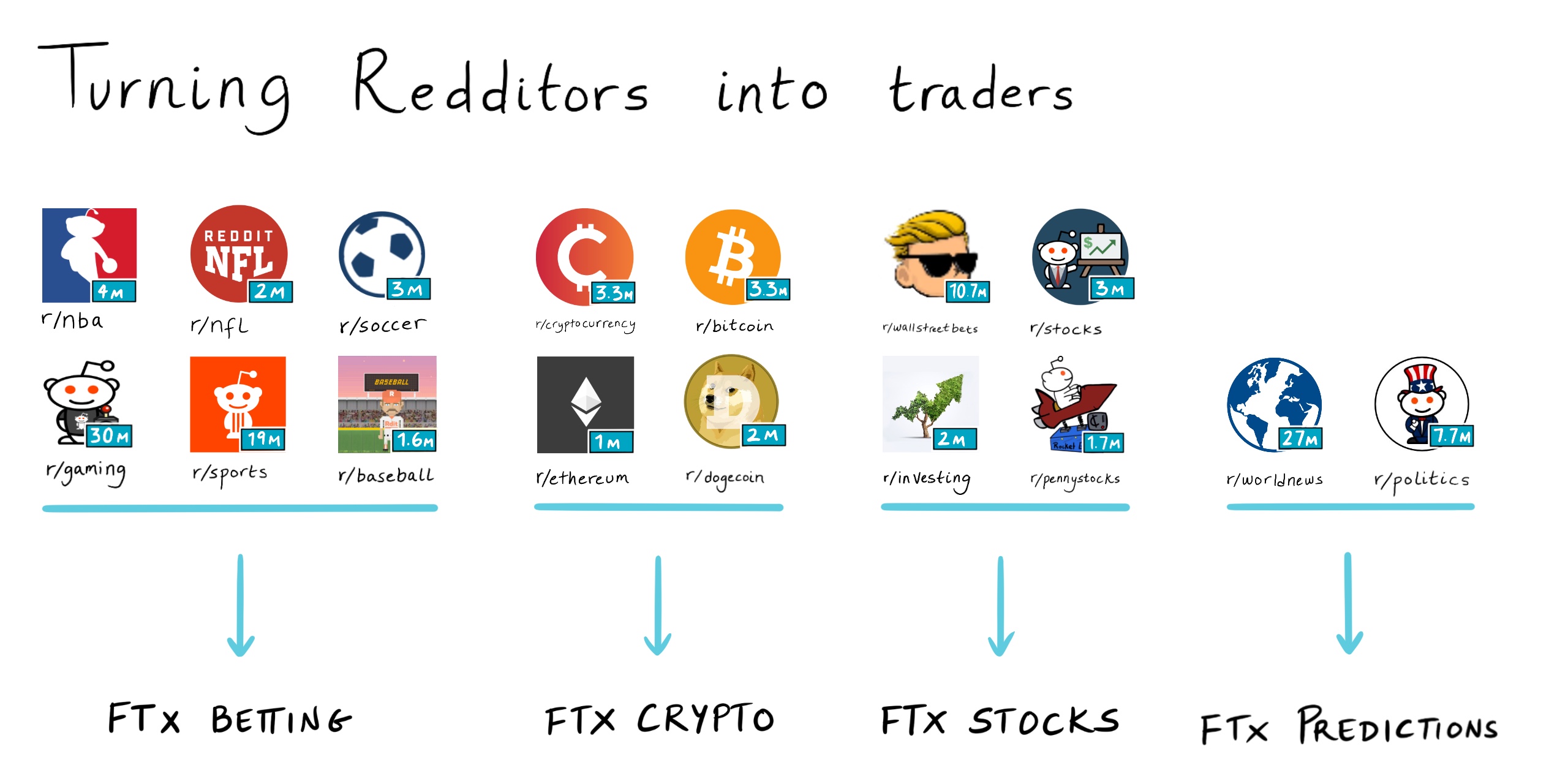

This is only the beginning of the possible combinations of functions. What if Reddit/politics combined with prediction markets, or Reddit/NFL player cards were inserted into the sports betting industry? From the perspective of a company like FTX, users on Reddit are like a group of traders waiting to be tapped.

A sticker price can make such a purchase difficult. But if FTX can effectively structure this deal, it can secure a minimum user acquisition cost very similar to what Blockfolio manages. Reddit's 430 million users, valued at $10 billion, cost just $23.

Of course, there are many reasons to think this is unwise. Reddit is notoriously weary and wary of governance, which means new ownership could spark a big storm, especially in a larger community like Wall Street Bets. Additionally, Reddit's user base is largely anonymous, a status that doesn't sit well with the principles of financial exchange. While it is possible for users to maintain their anonymity, they still have to provide more information to the platform itself.

While the acquisition of Reddit may be the boldest move yet and create a true social and monetary network, there are many other ways FTX may pursue its vision of a mass-market business. Partnering with Reddit or Twitter is an option, and maybe a good one to try. Twitter CEO Jack Dorsey was one of the first major executives to embrace the cryptocurrency "red-pill", suggesting he may be supportive.

While doing so would do little in terms of bringing cryptocurrency mainstream, it could also seek deals or partnerships with industry-specific social platforms. Despite its substandard mechanics and unsavory history, social network Bitclout has attracted attention and money for its “crypto Twitter.” However, its user numbers won’t grow significantly (Bitclout had about 300,000 registered users as of the end of June), and its poor reputation may hinder FTX’s regulatory efforts.

More interesting strategies may come from other products. While the ethereum game Axie Infinity isn’t really a social network, the “play to earn” game could open the door to non-crypto user acquisition. According to one source, roughly 50% of Axie’s 1 million daily active users (DAUs) had never touched cryptocurrencies before signing up, and those are the people FTX is trying to attract.

Will FTX or Alameda be able to hold a strong presence in Axie and drive cross-platform spread? It's unclear if FTX's user base will be attracted to the game, though Axie's loyal players and creators will likely learn from storage SLP and AXS Tokens and benefit from exchanging them for other currencies.

It will also add an interesting feature to the FTX board, offering participants a digital realm to spend their winnings. In this regard, it may change its nature so that FTX is no longer just an exchange, but more like a real economy, an economy with unimaginable trading volume and user activity.

We can look forward to how FTX will put these ideas into action in the future.

When I asked SBF about a potential partnership with the social network, he said: "We'd love to. We're doing research."

For those who think "in CAC (User Acquisition Cost) thinking", social networking may be the best opportunity to acquire a large number of potential customers in the future.FTX started out as a crypto derivatives exchange, but that doesn't mean this will be its final state.

Just as Amazon CEO Bezos believes that books are the best trump card to dominate the early e-commerce market, SBF seems to have understood that cryptocurrencies represent the most dynamic component of the financial revolution.

FTX has proven that it is a company willing to innovate and experiment, looking to expand its business landscape beyond cryptocurrencies, expand into sports, banking and social media, and become a trading place that can trade everything (exchange everything).