This article comes fromTwitterThis article comes from

, the original author: SBF, compiled by Odaily translator Katie Gu.

On August 16, SBF, the founder of FTX Exchange, tweeted to discuss the influence of the US dollar in cryptocurrencies and the regulation of cryptocurrencies.

Here is the content of the tweet:

What is the 24-hour trading volume of FTX exchange?

According to the API interface of CoinGecko data, it is 205,706. That number is a bit unusual for anyone in the industry at this point, shouldn't it be around 10B?

Over the past 24 hours, FTX has traded around 200,000 BTC worth of assets. But so far, BTC-denominated volume has all but disappeared. Instead, this time from CoinGecko's website, you're looking at U.S. dollars.

No matter where our IP is located, it is denominated in US dollars as legal tender.

To see what would happen, I tried a Japanese IP address and set the language to Japanese. Then, CoinGeko showed me still in USD!

In fact, almost all cryptocurrencies are quoted in USD, regardless of the country or coin. Volume, price, and market capitalization are all quoted in US dollars.

If you ask anyone what BTC is trading at, they'll probably say 47k. Even if they spend different currencies when they go to the store.

Perhaps most importantly, this is not just a question of how to use cryptocurrency.

This is also the way of trading.

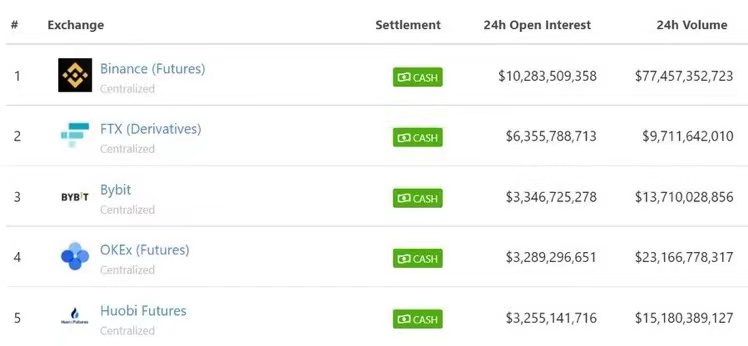

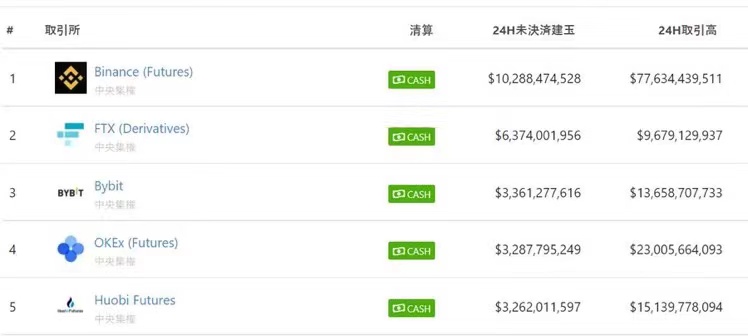

Binance is the largest crypto venue in the world and is the top 10 market for trading volume of USDT or BUSD, both stablecoins denominated in USD.

Every futures contract on the top 5 futures exchanges is quoted in U.S. dollars. With the exception of some small traditional futures on BitMEX, the Japanese JPY spot market, and the Korean KRW spot market, every major crypto market is quoted in USD.

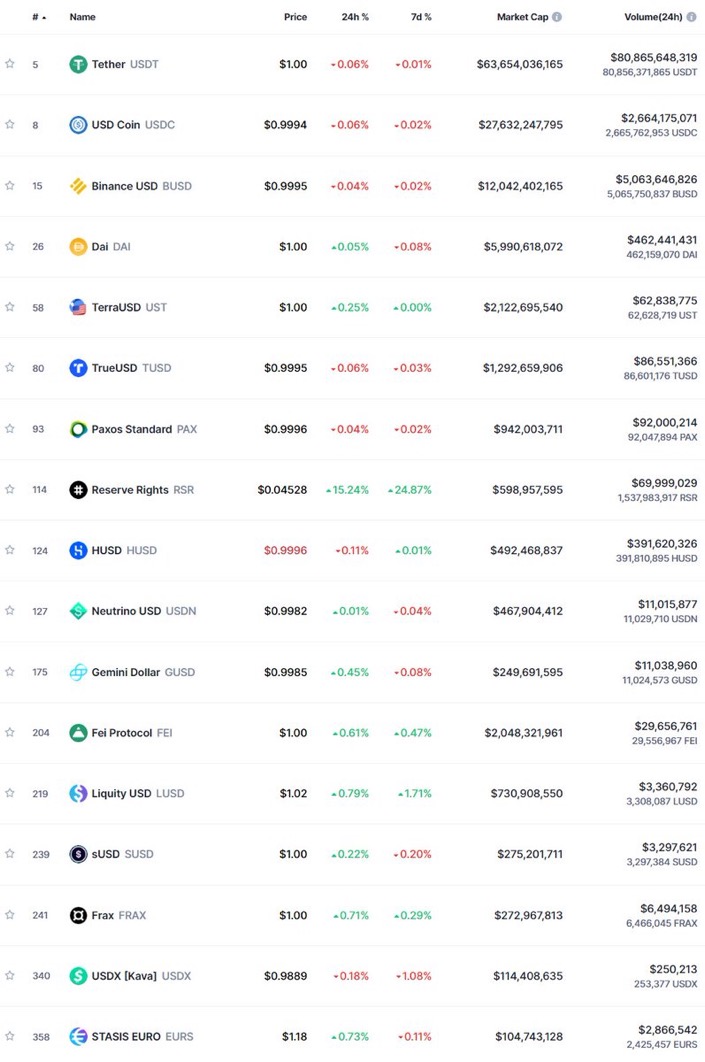

Let’s talk about stablecoins next.

Stablecoins are the settlement currency for cryptocurrencies. The vast majority of transactions, whether spot, over-the-counter or futures, are not via BTC or bank wire transactions, but via stablecoins.

So, who are the biggest stablecoins?

The answer is dollars. Almost exclusively USD, more than 99% of the time. The dollar is the world currency and now it is also a cryptocurrency.

Occasionally someone asks why there aren't more euro stablecoins. Actually, it's not a problem, and it doesn't actually make much sense.

Standardized units are practical and transparent, and the dollar is the standard unit.

When trading cryptocurrencies, no one is primarily concerned with fiat-to-fiat volatility while doing transactions about fiat on the blockchain. Of course, you can adjust to dollars, euros, or yen, whatever.

Now, when it comes time to cash out, people do care about volatility! Because they have their income, and they want what they spend. If you don't live in the U.S., neither of these currencies may be the U.S. dollar. But in the crypto space, using dollars is fine. There is currently no pressing need for a different stablecoin standard.It all reminds me of this article from Bloomberg:

After 50 years off gold, the dollar must move to cryptocurrencies

Now, I don't want to make a too strong statement on Twitter! However, cryptocurrencies are also doing something very good for the United States now that the crypto industry has accepted the U.S. dollar as its pricing and transfer unit.

I think it's kind of awesome! But it's not forever. This could be reversed if another country created a more productive regulatory framework than the US.

That's one of the reasons you're starting to see some places, like Singapore, trying to build regulatory structures. This is yet another reason why I appreciate parts of the U.S. regulatory framework for cryptocurrencies. U.S. spot cryptocurrency exchanges still lead the world in terms of security and frictionlessness (frictionlessness).

We are in the early stages of cryptocurrency regulation.

oneone

A strong, clear licensing system is necessary for the entire world to trust the system. A flexible approach to understanding is a necessary condition for innovation.

In the simplest cases, this is instead a regulatory balance conundrum that cryptocurrencies cannot help solve. The industry is growing rapidly and displacing parts of the financial infrastructure.Also, some early cryptocurrency players are not entirely welcoming of regulators. But it underscores the importance of getting regulatory issues right.

If any regulators want to hear about what I know about cryptocurrencies, I'm happy to chat.