Original title: FTX Trilogy, Part 2: Speedrun

Original: https://www.readthegeneralist.com/briefing/ftx-2

These previously undisclosed figures shed light on a low-key giant in the cryptocurrency world.

the third part:

the third part:In-depth analysis of the four expansion directions of FTX

******

MrCheeze is having a rough July.

A year ago, this player made a bet that no one would ever finish The Legend of Zelda: Ocarina of Time in under seven minutes. This is simply impossible.

secondary title

Why would anyone compete with these?

Savestate and MrCheeze belong to the "speed party" - players who seek to complete the game as quickly as possible (often hoping to set a new record). "Speed Party" records exist in a variety of games, such as "Super Mario 64" (1 hour 38 minutes 21 seconds), "Sonic the Hedgehog" (54 minutes 17 seconds) seconds), "Grand Theft Auto V" (5 hours, 49 minutes, 8 seconds).

Although what the Speed Party is after is clear at a glance: ultra-high speed, but speed alone is not enough to succeed. In addition to flexible fingertip operation, the challenge of extreme speed also requires a clear understanding of which parts can be ignored and which can be missed, but in the end it can still pass the level smoothly. The goal at this time is not to fill up the protagonist's treasury and complete all side missions at the end of the game, but just to pass the level smoothly.

image description

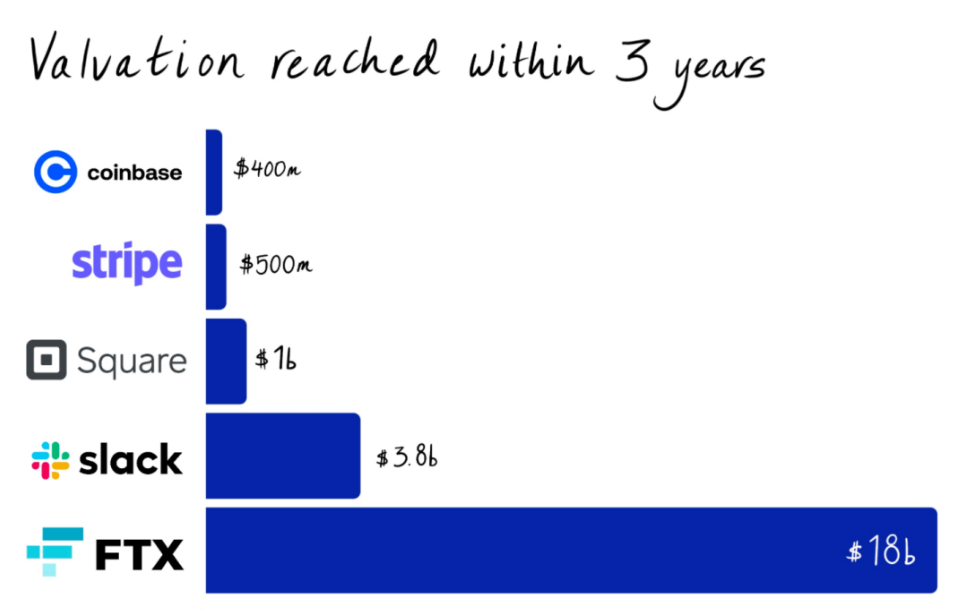

The valuation volume achieved by each company within 3 years

But, like every speed challenger, FTX had to make some compromises in order to achieve that speed. In particular, the exchange has been responsive and slick in its regulation, brushing aside allegations of conflicts of interest and largely ignoring retail traders.

These missteps can be costly. Backers will find that the company appears to have the money, connections and will to solve its most important problems. Of course, we can only wait and see whether FTX can effectively make up for these shortcomings.

Today, with the help of never-before-seen business data, we will explore different dimensions of the FTX empire. Our investigation will involve:

● Start-up stage: FTX's rapid start and subsequent product-market fit.

● Product: How FTX differentiates itself in terms of reliability and innovation.

● Client base: Earn approval from serious traders from all over the world.

● Indicators: In-depth analysis of the attractiveness of FTX.

● Competition: How FTX compares to Coinbase, Binance, BitMEX and other exchanges.

● Worst case forecast: FTX's possible crisis.

secondary title

Start-up review

It can be difficult to understand what a company looks like in its early days. Thanks to Chris McCann of Race Capital, readers were able to gain insight into how FTX looked in the eyes of early investors. Race’s team agreed to share their investment memo with The Generalist, the first time the memo has been made public.

Even at this early stage, the contours of FTX appear to be clear. As the memo emphasizes, this is a team with strong execution capabilities, and the product-market fit is very high. In less than two weeks, FTX’s daily trading volume has grown from $50 million to $150 million. Two weeks later, daily trading volume jumped to $300 million.

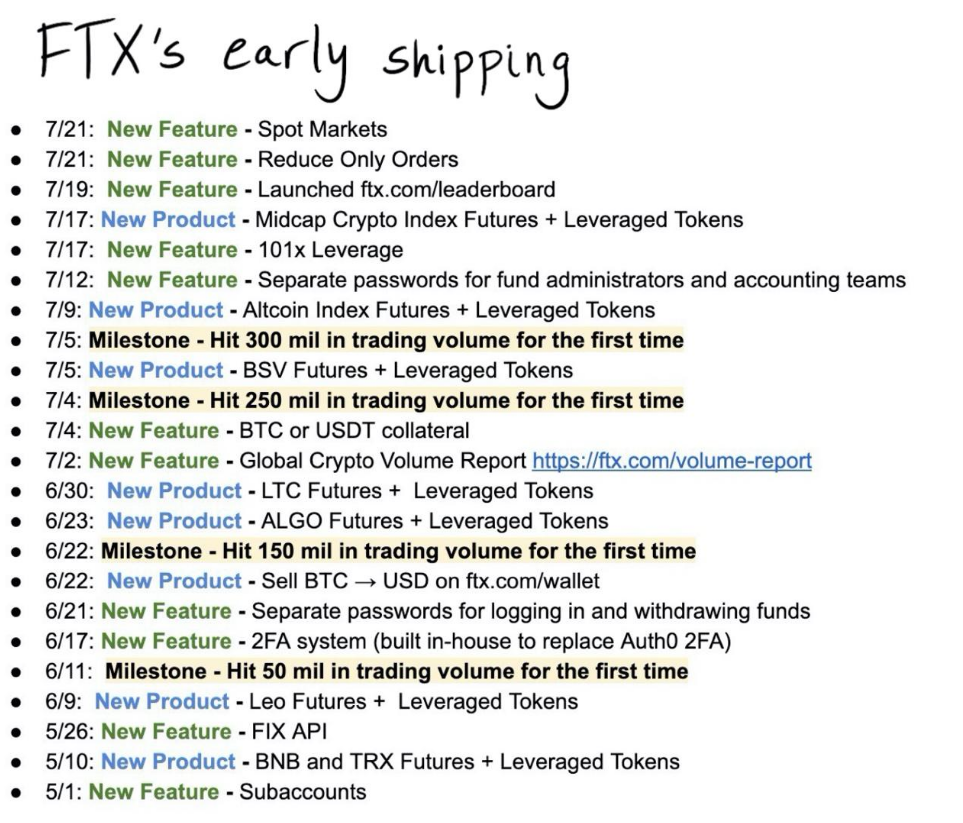

The level of product innovation is also striking. A snapshot in the memo outlines the pace of its development.

From this list alone, FTX's products display admirable creativity, as well as an insane love of risk. A more cautious exchange like Coinbase will not offer futures on altcoins in the first few months of operation; nor will they offer 101x leverage, because such investments are simply too risky.

Considering the FTX market, this product design is not difficult to understand. Race Capital summed up the state of the market in 2019, pointing out that while the volume of trading in the cryptocurrency futures market is comparable to that of the spot market, there is still much less competition in the futures market:

On July 25, 2019, the total trading volume of the spot market was 10 billion US dollars per day, and the total trading volume of the futures market was 11 billion US dollars per day. In the futures market, however, there are far fewer competitors, with the top 3 exchanges (BitMEX, Huobi, OKEx) typically trading 3x more futures volume than their corresponding spot volumes.

FTX got a chance to attack. Turmoil was seen on BitMEX, one of the dominant exchanges in the futures market. The exchange saw a “surge in net outflows” amid a Commodity Futures Trading Commission (CFTC) investigation into the exchange serving U.S.-based customers. FTX took advantage of this opportunity to gain a foothold in the futures market.

Race Capital led the $8 million round, with participation from Lemniscap, One Block, FBG and others. So far, that trust has paid off extraordinarily. Below, we'll analyze the company from the ground up, trying to make sense of its $18 billion valuation. First, we need to explain what we mentioned"FTX "secondary title

Entity: Aggregation of multiple instances

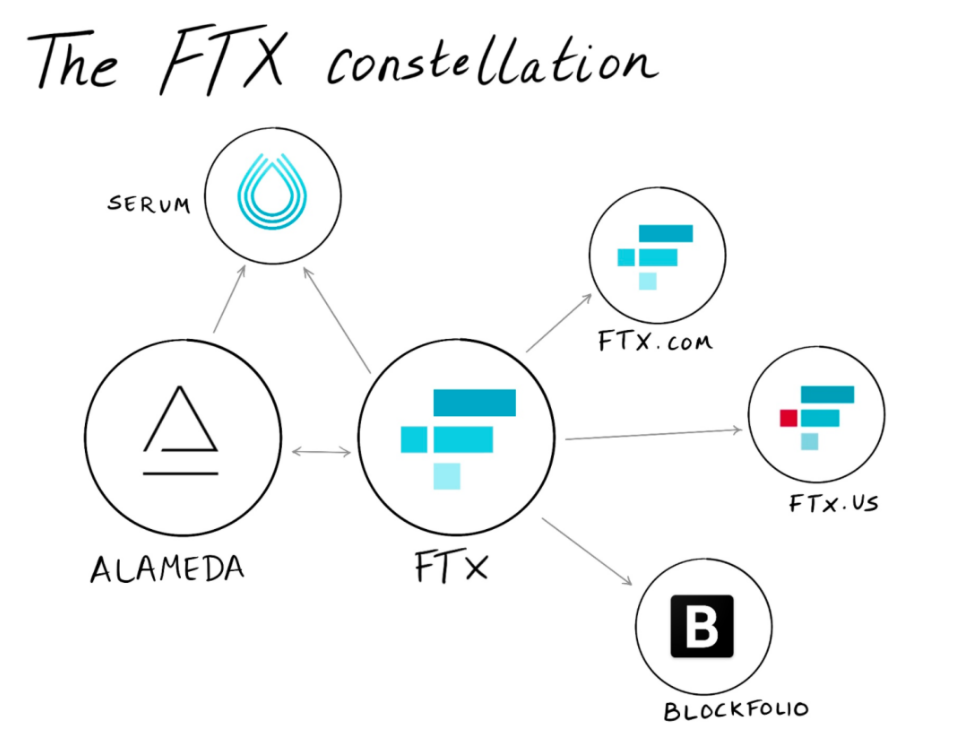

FTX is not a single entity. Unlike most of its contemporaries, the company is actually a collection of distinct entities that are linked to each other, either formally or informally.

The central nodes of this network are Alameda and FTX.

Alameda is a cryptocurrency investment firm founded by Sam Bankman-Fried (SBF), Gary Wang and Nishad Singh to take advantage of arbitrage opportunities that emerged in Asian markets in late 2017. It has grown over the years to become one of the most influential distributors, DIAs, and private companies in the ecosystem. Sources confirmed that Alameda may be the largest single investor in the cryptocurrency ecosystem, trading billions of dollars in assets every day.

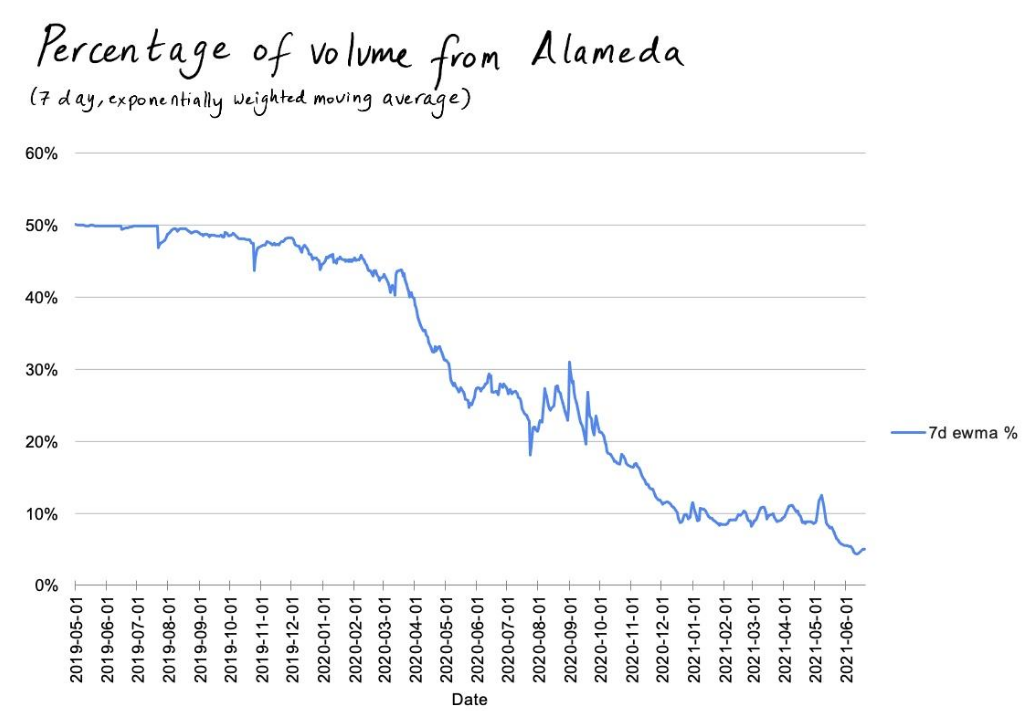

As we mentioned earlier, Alameda was the main market maker of FTX in the early days, providing it with liquidity. Now Alameda's share of FTX trading volume has been greatly reduced, as we will see later.

FTX is a cryptocurrency exchange incorporated in Antigua and Barbuda. FTX includes two subsidiaries: FTX.com and FTX.us.

For most people, when the name "FTX" is mentioned, FTX.com is what comes to mind. It's the company's most feature-packed product yet, but it's not available in the US for regulatory reasons. When we discuss the product suite later on, when we refer to FTX we will primarily refer to FTX.com.

FTX.us is an eclectic version of the FTX International platform, and its relationship to FTX.com is similar to that of BinanceUS to the better-known international offering, the Binance exchange.

But now things are starting to get more confusing. Last August, FTX acquired Blockfolio, a cryptocurrency news and portfolio tracking app. We’ll discuss the implications of this acquisition in more detail later. But just last week, FTX said it was rebranding Blockfolio to...FTX. Well, it's even more dizzy now.

For the sake of presentation, we will refer to Blockfolio by its original name, and unless explicitly stated, FTX refers to FTX.com.

FTX issued its own token: FTT for use in various scenarios. Like Binance’s BNB, FTT holders get fee discounts and other benefits. If you choose to pledge FTT, you can get a series of benefits such as higher voting rights, NFT rewards, airdrop rewards, and higher rebates. FTT can also be used to meet the collateral requirements of the account, which we will elaborate on later. To maintain scarcity and maintain its price, FTX "buys back and burns" FTT.

Finally, there is Serum, a decentralized exchange (DEX) that was built and advised by FTX founder SBF in the early days. Unlike Uniswap or Sushiswap, Serum is built on Solana instead of Ethereum, which allows for faster throughput.

Why start a cryptocurrency exchange?

Product: Power Center

Why start a cryptocurrency exchange?

When SBF considered entering the cryptocurrency space, serious competitors abounded. Coinbase has raised more than $500 million in funding, Binance has a daily trading volume of over $1 billion in good times, and BitMEX is taking the lead in the derivatives market.

As we said before, SBF’s decision was largely out of dissatisfaction with the products in the market at the time, but it also reflected the power in the cryptocurrency ecosystem. Despite fierce competition, exchanges represent the heart of the industry, they are the industry's on-ramps, capital centers and sources of data. If SBF desires greater influence, the best option is to create an exchange.

secondary title

high performance core

In my interviews, this was brought up repeatedly: FTX's performance is fantastic. SBF and his team have taken inspiration from Alameda's expertise to build an exchange that is perfect for serious traders.

The first is reflected in its reliability. A source (non-investor) pointed out that FTX is the most reliable exchange on the market, keeping it open even during peak periods when other exchanges are closed due to excessive trading volume. This is managed by strictly budgeting API calls for users: about 20 transactions per second can be made on the platform. This is a limitation for some - to accommodate this, FTX adjusts this budget value based on account size and activity.

Sources also expressed their love for FTX's liquidity and risk control engine. Although high liquidity can obviously effectively reduce transaction rollbacks (the loss is borne by the customers of the exchange, such as the competitor OKEx platformwhat happened), but Wind Engines got the most praise in my conversations.

Unlike other exchanges, FTX accepts "Cross Margin". This means including USD, BTC, ETH, AAVE, XRP and othersDozens ofhigh leverage

high leverage

FTX’s popularity is partly due to the leverage it offers traders. Thanks to the above-mentioned risk control engine, compared with other exchanges, FTX can provide higher margin with simpler and more convenient operation steps.

Although it has not been around for long, FTX has been offering 101x leverage not long after its inception. Hypothetically, this means that if a trader has $100,000 in their account, they can invest $10.1 million. While winning trades can make a ton of money because of this leverage, losers can also quickly lose money due to poor bets.

disclosedisclose, leveraged trading accounts for a relatively small proportion of the trading volume on the platform. According to SBF, the average margin investment at the time of announcement is 2 times.

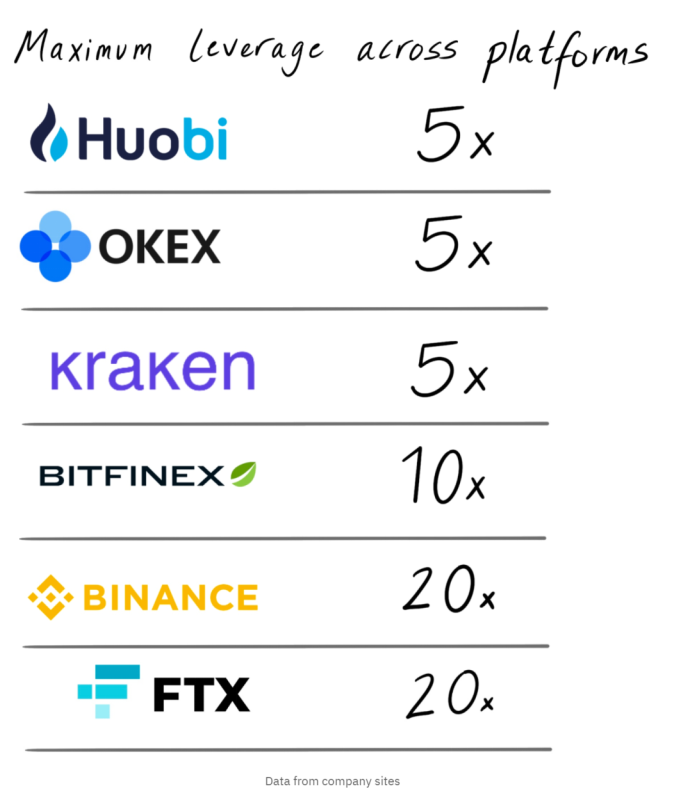

While the change is said to encourage “responsible trading,” the 20x leverage limit still puts FTX at a premium. Huobi recently reduced the available leverage from 125x to 5x, and OKEx and Kraken also lowered the maximum leverage to 5x. Bitfinex provides up to 10 times leverage.

Of course, FTX is not alone in this high position. Binance also followed up shortly after the announcement of SBF, and also chose a limit of 20 times, the original maximum was 100 times. BitMEX still offers 100x leverage on some contracts.

secondary title

Unique trading market

If Coinbase is a typical cryptocurrency exchange, FTX is not afraid to lead the trend. Yes, the platform offers (cryptocurrency) spot and futures trading, but it also caters to those with more eccentric tastes.

Want to get involved in timber contracts? very good.

Want to bet on Trump's 2024 campaign? no problem.

Interested in hyping up an upcoming IPO? This way, please.

FTX is an extremely creative exchange that seems to be constantly looking for new opportunities to offer new products. For example, that timber market launched just a day after FTX received user requests. According to reports, it took only 2 hours for the market to go live. FTX’s corporate culture strongly encourages experimentation, and with market makers like Alameda readily available to provide liquidity, it’s a no-brainer.

In addition to spot and contract trading, FTX also provides the following trading markets:

Equity certificate:Investors can gain exposure to public securities through FTX’s “equity tokens” without having to switch to Robinhood. These tokens synchronize the prices of related securities such as Tesla, Robinhood and Alibaba, and can be traded 24/7, allowing investors around the world to participate. Binance also offers a similar product.

Leveraged Token:Traders can choose to invest in tokens like ETHBULL without having to manage actual leveraged positions and without having to deal with the collateral issues described earlier. This ERC20 asset allows investors to have a 3x long position in ETH, meaning that if ETH rises 10% on a given day, ETHBULL will jump 30%. FTX offers leveraged long and short tokens for ETH, BTC, DOGE, MATIC, EOS, and more. FTX is the first exchange to offer this product, giving investors another way to easily leverage.

Volatility tokens:Another ERC20 — Volatility Token does exactly what you’d expect: Tracks the volatility of the underlying market. It is equivalent to the cryptocurrency version of the VIX (the index that measures CBOE (Chiba Stock Exchange) volatility). The panic index token (BVOL) tracks the 1x volatility of BTC, while iBVOL is the inverse BTC volatility token. So far, FTX has only offered volatility tokens in BTC.

Forecasting products:Now, speculators can bet on two presidential election products: Donald Trump 2024 and Jair Bolsonaro 2022. These are contracts that expire for delivery at $1 if said candidate wins the election, and drop to $0 if they lose. In the last election cycle, Trump 2020 products traded heavily in the final campaign. The category appears to be trading very little at the moment, with less than $40 in the first 24 hours at the time of writing.

Fiat market:Users can trade between fiat currencies, for example, converting dollars to euros. Other currencies supported include the British pound, Canadian dollar, Brazilian stablecoin (pegged to the real), and Turkish lira stablecoin, among others.

secondary title

Expansion footprint

FTX's latest moves seem to be displaying the boldness that is typical of the company. While the many exchanges mentioned above represent its core offerings, FTX is not resting on its laurels.

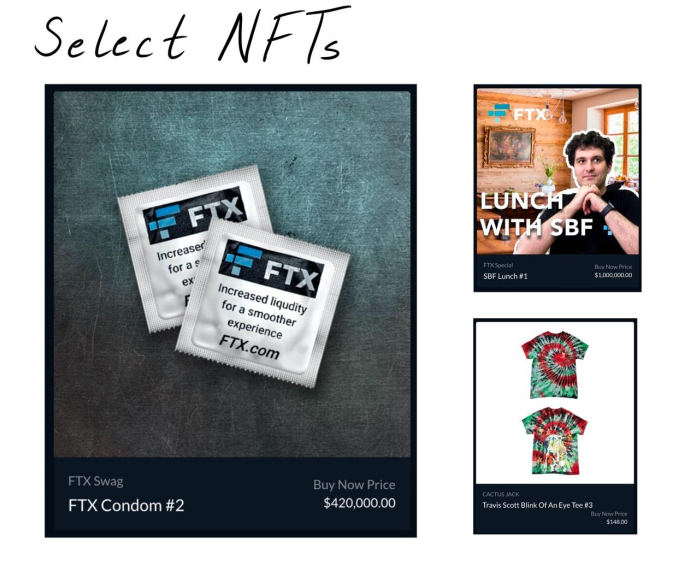

One of the latest moves is the platform’s experimentation with NFTs. FTX provides creators with a system to upload and sell their creative products. Judging by the state of the page, this appears to be a relatively new endeavor - most of the items for sale are FTX-branded, including hoodies, water bottles, hats, and of course a set emblazoned with "Higher mobility only for Silkier experience" FTX condoms. oops this...

(At least the buyer can be sure that this is one of the few contraceptives that is 100% effective: anyone who sees it is sure to run away (too expensive to use).)

text

Are these NFTs?

Good question. Most of the items on the NFT page don't appear to be truly unique and deviate from NFT's most popular form of collectibles and digital artwork.

Does this indicate that FTX has broader ambitions? Could this page be a sort of Craigslist for the cryptocurrency world? This seems unlikely. Right now, the company’s NFT product feels like a rough first release. Over time, FTX may hope it can rival professional NFT platforms like OpenSea.

FTX Pay is also still early days, although it would benefit from a clearer product concept. FTX seems eager to pick up where Stripe left off. The Collison brothers, founders of Stripe, decided to end support for Bitcoin payments in 2018. Although there are rumors that they will re-support, FTX hopes that their expertise in the field of cryptocurrencies will help them advance FTX Pay.

FTX Pay represents FTX's first foray into the payments space. With a simple widget, users can accept payments in fiat or cryptocurrency, receiving funds in a digital wallet. Of course, FTX notes that the use of corporate accounts is "recommended," which perhaps bodes well for its broader commercial functions.

secondary title

Client: Dances with Sharks

“It’s a shark-infested market,” one source said of FTX.

When I asked what this meant, they explained that unlike Coinbase etc., the majority of users on the platform are serious traders, usually professionals. This means that, especially when it comes to more baroque polyphonic investments, users should be wary of the importance of the counterparty in a particular transaction.

pointed outpointed out, FTX has a "disproportionately large proportion of large traders," and most of the trading volume comes from users who trade more than $10 million per day.

secondary title

Institutional traders and retail traders

As of June 17 this year, FTX counted a total of 1.25 million retail traders, of which 130,000 were active monthly (10%). There are also 2,700 institutional clients using the platform, of which 1,017 institutions trade monthly (38%).

As you might imagine, there is a significant gap between retail and institutional users in terms of trading volume, but not much difference in exchange revenue contribution. Retail investors contributed to an average monthly trading volume of $372 billion, with exchanges generating $43 million in monthly revenue. Institutions bring in an average monthly trading volume of $446 billion, while exchanges generate $23 million in monthly revenue.

From this data, we can deduce that the average active retail trader trades approximately $3 million per month and contributes $337 in revenue. Active institutions trade an average of $439 million per month, bringing in $23,000 in revenue.

secondary title

whale and small fish

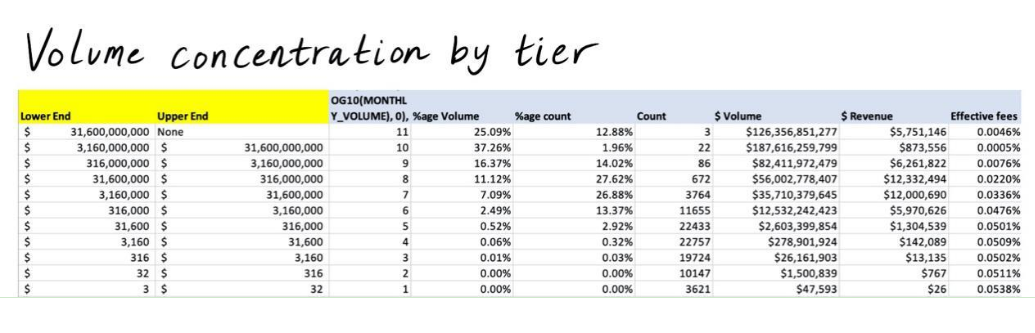

By looking at the concentration of trading volume, we can get a clearer picture of whether FTX is powered by a specific group of whales, or a small group of fish.

A rather strange chart shared by FTX sheds light on this.

The two columns on the left are what we're trying to figure out. FTX essentially divides its trading volume concentration into 11 tiers, each tier being the decimal logarithm of the previous category capped at $30 billion.

Don't worry if you don't understand at all. The easiest way to understand this data is to ignore the logarithm and look at the range on the left.

Level 11, for example, represents approximately $30 billion or more in monthly trading volume in the FTX business. Level 10 represents transaction volumes contributing between $3.16 billion and $31.6 billion per month. Tier Nine represents volumes contributing between $316 million and $3.16 billion per month, and so on.

It is indeed unusual to present this information in this way, but it has a different meaning: it is useful to know how much of an exchange's trading volume comes from each customer group of different sizes (each customer group has a difference of 10 times). of value.

secondary title

Geographical basis

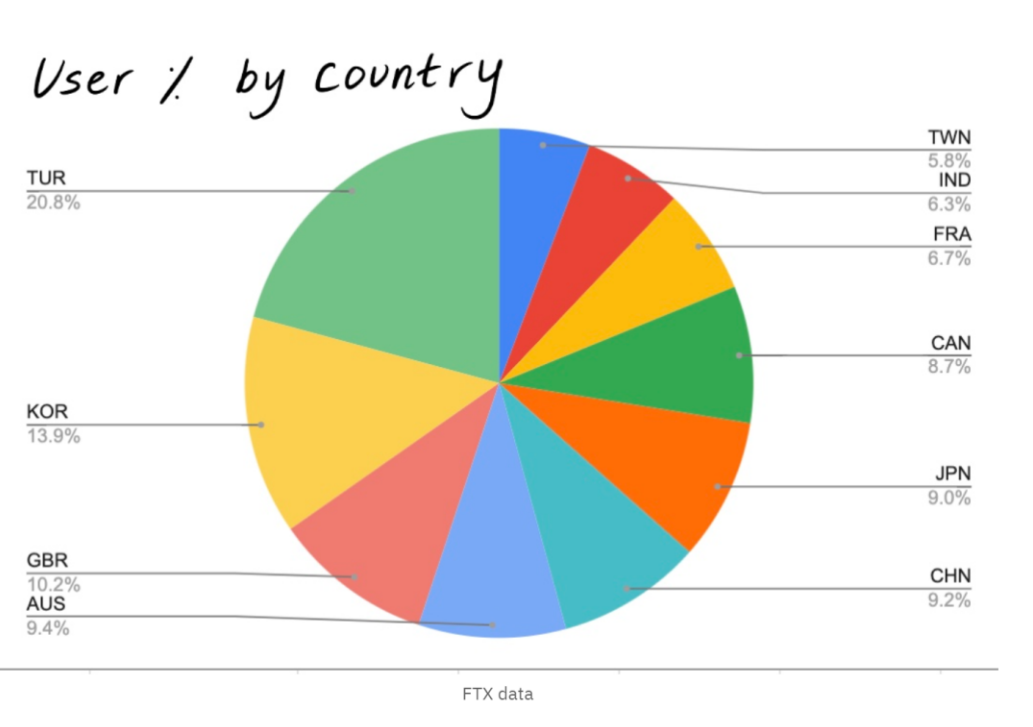

The presence of the Turkish Lira in FTX’s fiat trading zone indicates that FTX’s user base is spread across the globe. Looking back at the data from March this year, Turkey is actually FTX’s largest market from a user base perspective, with more than 20% of users coming from the country. Other countries in the top ten include South Korea, Gibraltar, Australia, China and Japan.

(By the way: we can't confirm that "GBR" in the chart below refers to Gibraltar, but since the UK is not included in this count, this seems like the most likely conclusion)

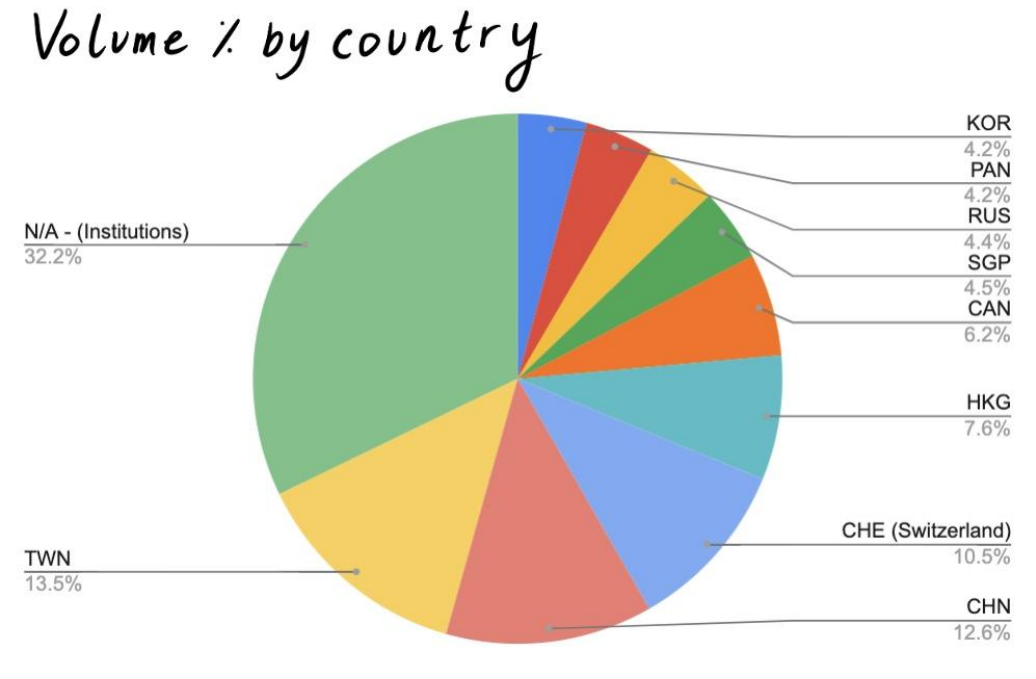

These shares change when analyzing by volume. Most of the volume comes from institutions, which FTX does not break down for each country. But beyond that, most deals came from Taiwan, followed by China and Hong Kong. This breakdown shows that FTX’s energy base is indeed in Asia, with Singapore and South Korea among them.

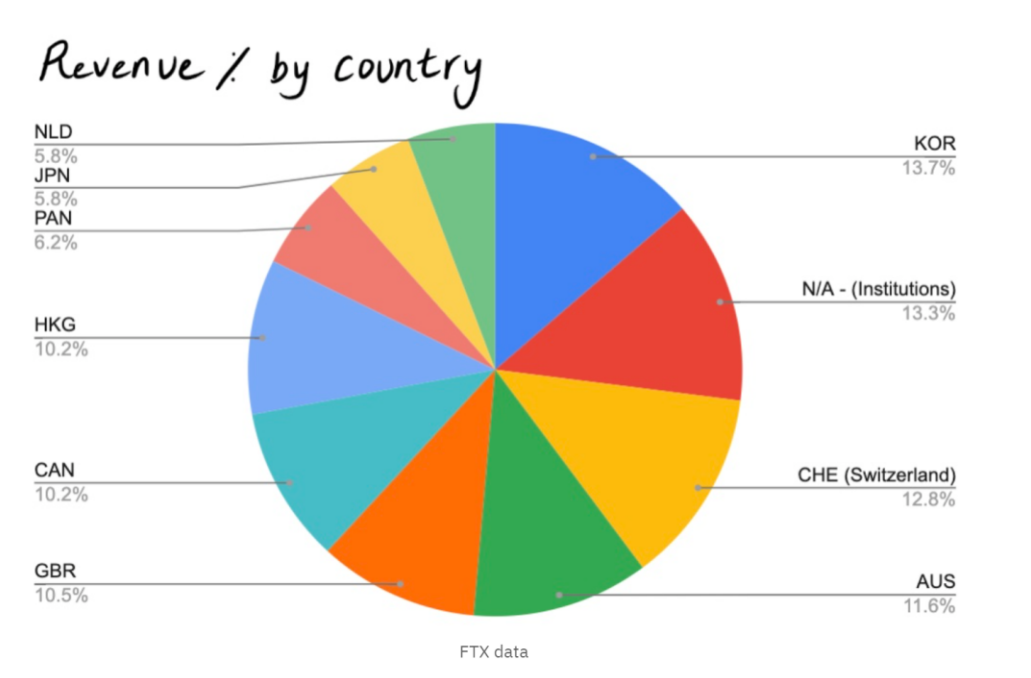

Finally, looking at the income contribution by country, we see the other side. For example, South Korea is the largest revenue contributor despite having fewer users than Turkey. Switzerland, Australia, Gibraltar and Canada round out the top five. We can assume that users in these countries are relatively active and the transaction costs involved are high.

secondary title

Management: Leverage Master

Given the intensity of SBF's schedule, it might be speculated that the rest of FTX's divisions would also be running high. "I've never seen a team that loves their work so much. They work so hard," one source said.

secondary title

key person

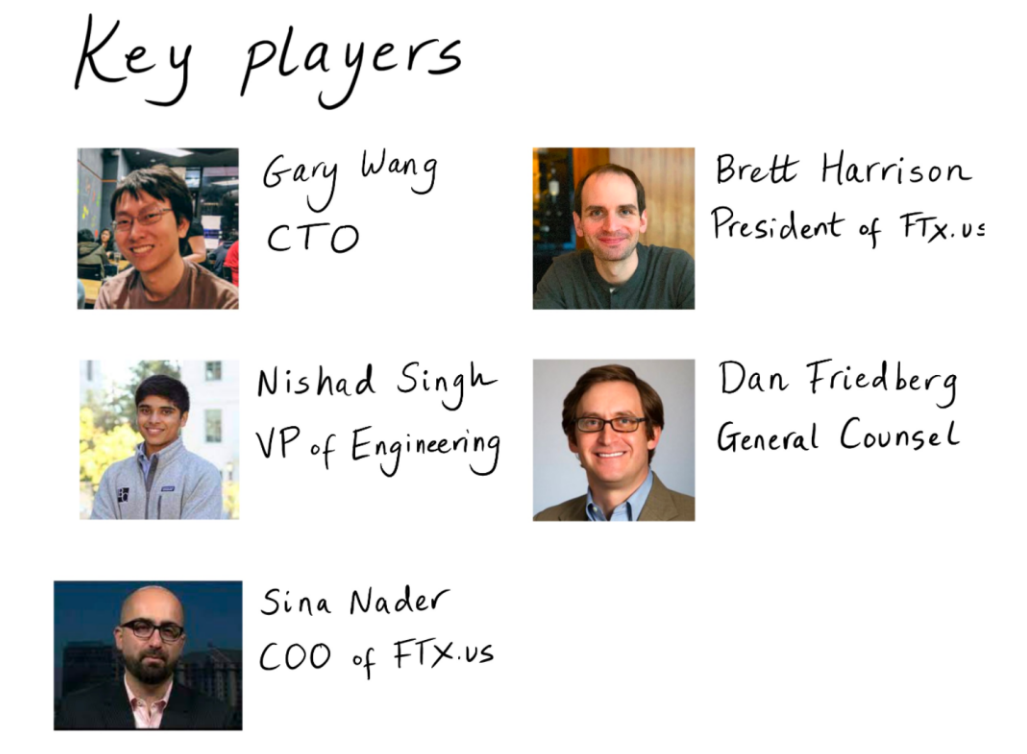

Besides SBF, the most important leaders of FTX are Gary Wang (CTO) and Nishad Singh (VP of Engineering).

According to an FTX employee, Wang was SBF's roommate at the Massachusetts Institute of Technology (MIT), where the two formed a strong friendship. After graduation, Wang took a job at Google, building the company's flying machine products. Sources say Wang actually joined Google after his travel startup was acquired, but we couldn't confirm that.

Regardless, that experience gave Wang experience building high-traffic, low-latency systems—experiences that certainly benefited building exchanges.

According to FTX employee Zane Tackett, Wang was an introvert who earned the respect of others through the quality of his work. An "expert" engineer, Wang is known for launching FTX's risk engine in a matter of weeks, an insane feat. The core of the system is still in use today.

Nishad Singh provides a solid balance. If Wang is an introvert, Nishad Singh is more practical. Wang often works alone, while Nishad Singh is in charge of the entire engineering team.

As mentioned in the previous article, Nishad Singh attended the same high school as SBF, although it is unclear what their relationship was during that period. From an early age, Nishad Singh displayed an uncommon determination and ambition, which are necessary traits to work at FTX. In fact, Nishad Singh set a world record in the 100-meter race for a 16-year-old when he was young.

Both Wang and Singh are said to be interested in SBF's effective altruism, giving the three of them certain worldviews in common.

In addition to Wang and Singh, the FTX functional leadership team consists mainly of Sina Nader (Director of Operations at FTX.us), Brett Harrison (President of FTX.us), and Dan Friedberg (General Counsel).

Before joining FTX, Nader was mainly in charge of the cryptocurrency department of online brokerage Robinhood, and his job-hopping was a bit like a coup. While Nader was initially expected to manage FTX's US subsidiary, he ended up as head of trading instead. As we’ll discuss further later, FTX has thus embarked on a rather high-profile BD spree, with partnerships with major sports leagues like MLB, most of which have been spearheaded by Nader.

The position of FTX.us head that Nader "vacated" was filled by Brett Harrison. He was also at Jane Street (Jane Street Capital) before, and it is reported that he was the "old boss" of SBF. Given his experience building trading systems at Jane Street, Headlands Technologies, and Citadel Securities, he seemed a good fit for the role of head of FTX.us.

The less dramatic addition of Dan Friedberg, but hiring him as general counsel could prove crucial. While FTX has kept a low profile so far, its size (and high-profile ad deals) mean it is likely to attract formal regulatory attention, so the former Fenwick & West law firm partner will also spend the next few years There will be a lot of work to do.

culture

culture

To understand the culture of FTX, you must first understand how different the company is, and most notably, the SBF company is vastly different from Coinbase.

Over the past few years, Coinbase has managed to build user trust in it. By growing slowly and carefully, while keeping its app simple and easy to use, Coinbase has become the best-known exchange in the United States. In many ways, it's like a typical large Silicon Valley company, drawing talent from an elite corporate pool like Facebook, Google, Airbnb, and others.

FTX is speed-oriented, and everything the company does seems to be aimed at this purpose. FTX prefers young Wall Street talents who are eager to succeed compared to senior engineers of big technology companies who are used to the rational and balanced working status of mature enterprises. In addition to being willing to work very hard, these individuals benefit from their work environment. SBF emphasized this during our conversation: FTX has a strong preference for hiring people who really understand the product and who really understand the trade. As a result, its corporate culture is more akin to East Coast quant funds than Silicon Valley start-ups.

This preference for employees who understand the job content is also reflected in the organizational structure. SBF stated that he is"Project Manager" similar roles hold"skeptical” attitude. He explained that he prefers to give management authority to those who are specifically involved in a task, rather than someone who is only responsible for an abstract plan, because this may cause miscommunication or misdirection. Without an adequate understanding of the problem, it is difficult to provide sound advice.

secondary title

leverage effect

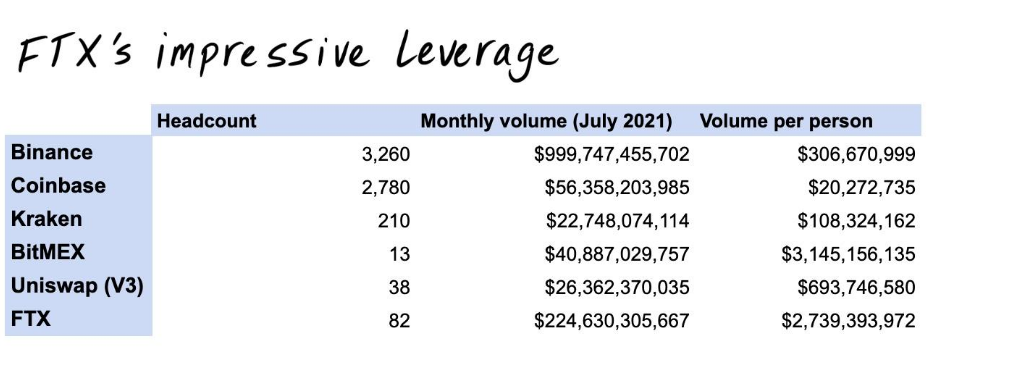

Perhaps the most astounding aspect of FTX's management is the energy-efficient leverage it has achieved. With just 82 employees, the company manages to run one of the world's largest cryptocurrency exchanges, launching new products at a pace only Binance can keep up with, and signing a string of hot partners.

This is simply jaw-dropping. Take a look at this table for comparison:

FTX is surprisingly efficient, equivalent to supporting a transaction volume of $2.7 billion per month per employee. This number is more than 110 times that of every Coinbase team member, eclipsing Binance, Kraken, and Uniswap as well. Only BitMEX, which has 13 employees, surpasses FTX in this regard.

Perhaps what's even crazier is that FTX's entire technical team has only a few engineers. how much?

six.

Yes, I didn't mistype the numbers, as shared by FTX staff, that's their actual developers.

The establishment and maintenance team behind a platform with a monthly throughput of hundreds of billions is only equivalent to the number of players on an ice hockey team.

secondary title

Metrics: Breakthrough at Scale

text

Business growth

Like other cryptocurrency market participants, FTX has benefited from a bumper year for the industry, with a surge in users, trading volume and revenue.

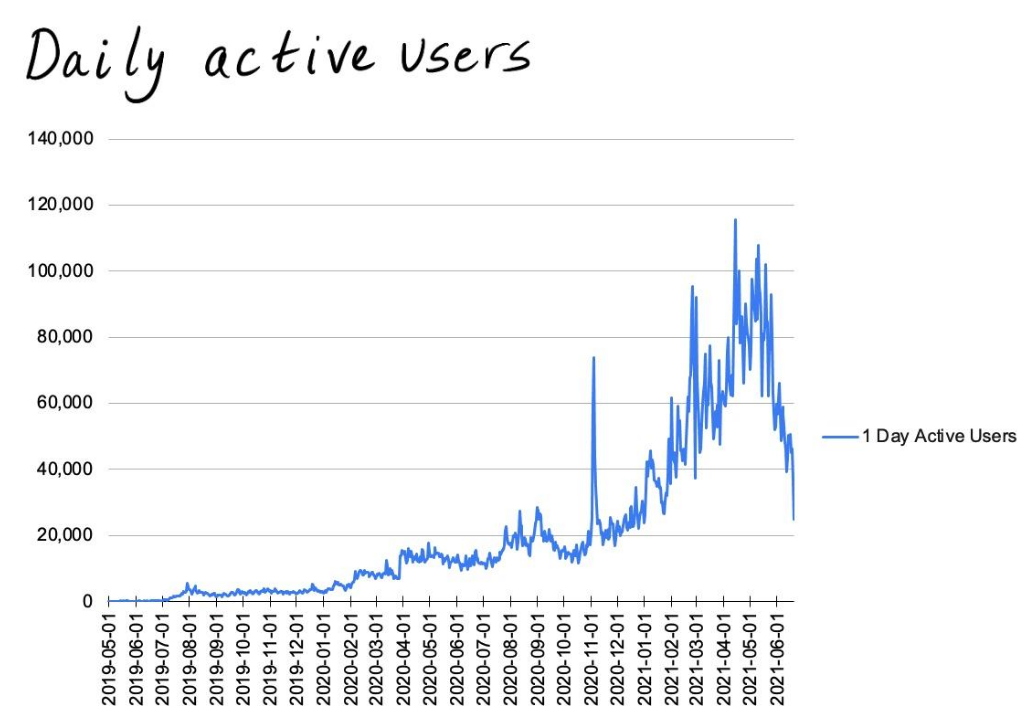

Daily active users rose from an average of 2,032 in 2019 to 14,922 in 2020, a staggering 634% increase. The company has managed to maintain its rapid pace in 2021, averaging 60,753 daily active users, a 2,890% increase from 2019 and a 307% increase from the 2020 average.

Weekly and monthly active users are also growing rapidly. Of course, this is also due to the massive growth in total registrations. In June 2020, the number of FTX users was 74,000, and it reached 1.2 million a year later, with a growth rate of 1521%. This is indeed a rather incredible growth.

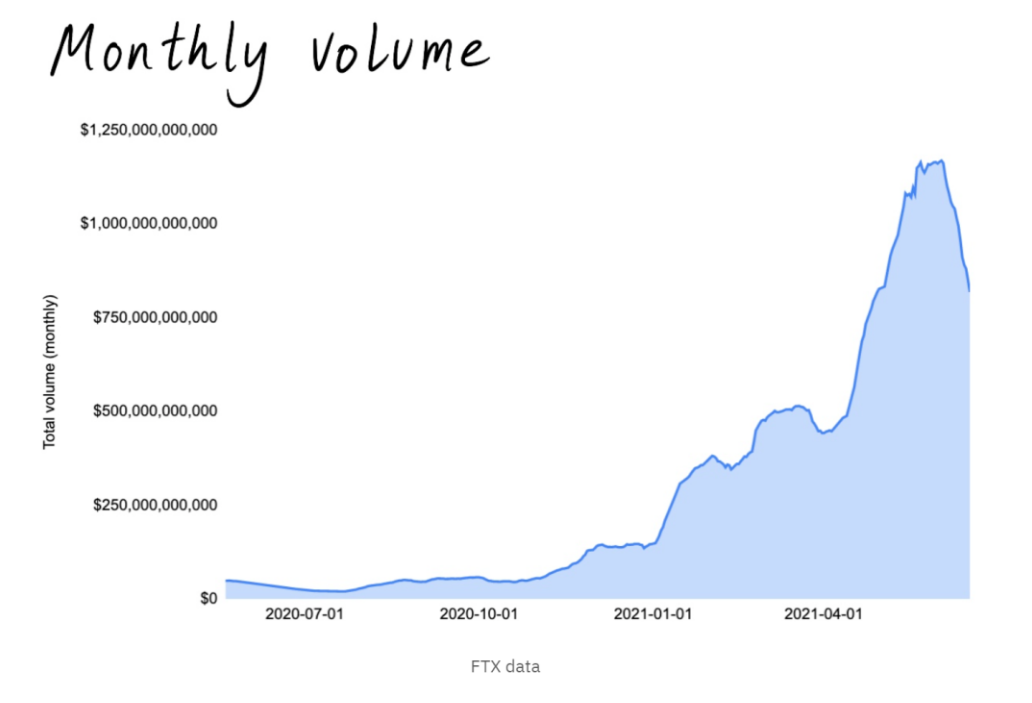

Naturally, transaction volumes are also growing in tandem. Between 2019 and 2020, the average daily transaction volume has increased by nearly 600%, surpassing $1 billion. In 2021, on this basis, it will effectively double by 11 times, reaching an average daily trading volume of 10.9 billion US dollars.

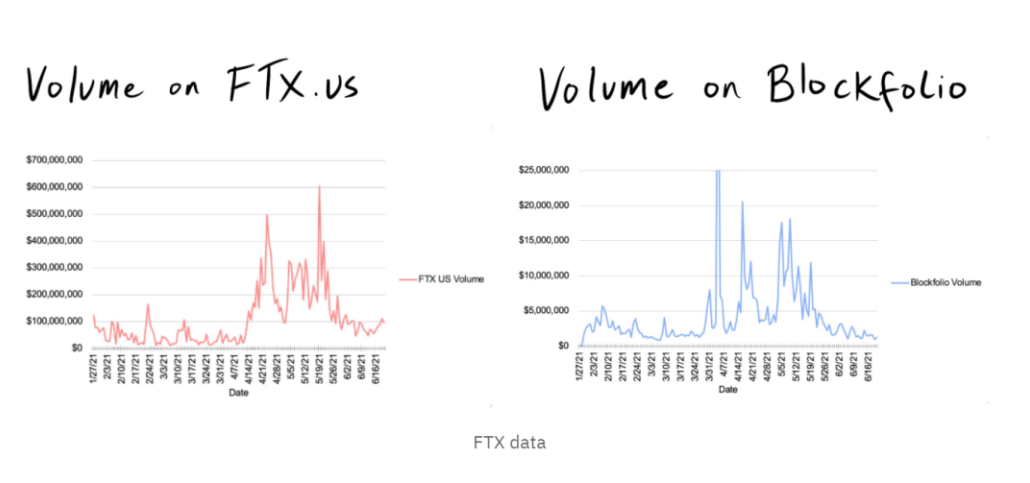

This traffic flows between different platforms of FTX. The company separates out FTX.us and Blockfolio trading volumes, giving us an idea of how traffic flows to these platforms. Note here that the time span of this data is relatively short, from late January to mid-June this year.

We can see that during this period, Blockfolio’s peak daily transaction volume was only $25 million, indicating that a feature it only added in 2021 is still fairly new. FTX.us has a much higher daily trading volume, peaking at $600 million.

Neither had much impact on total transaction volume. During the period shown above, FTX.us contributed less than 1% of trading volume, while Blockfolio contributed 0.036%. At least for now, the vast majority of FTX's business is outside the United States.

An interesting point in FTX's trading volume is the declining share of Alameda. At the start of 2020, about 45% of flows came from the fund -- a share that has fallen rapidly since March of that year. As of June 2021, Alameda only contributed 5% of the traffic, which fully demonstrates that FTX has successfully diversified its liquidity sources.

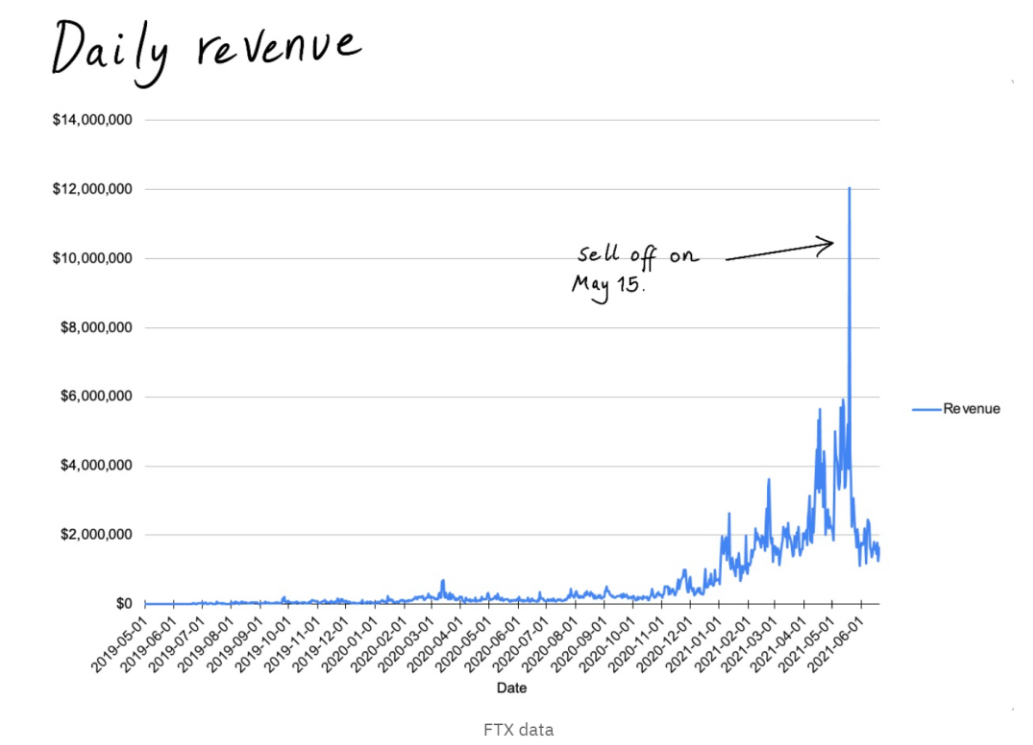

Finally, let's look at the income situation. In 2019, FTX’s average daily income was $40,437, which increased to $237,616 the following year. By 2021, it has exceeded 2.2 million US dollars, with a growth rate of 840%. That brings the business to $803 million in annual revenue, before factoring in further growth. Although it is unlikely that FTX will continue to grow at such a high rate, the management will certainly not relax. SBF has publicly stated that he expects revenue to exceed $1 billion in 2021.

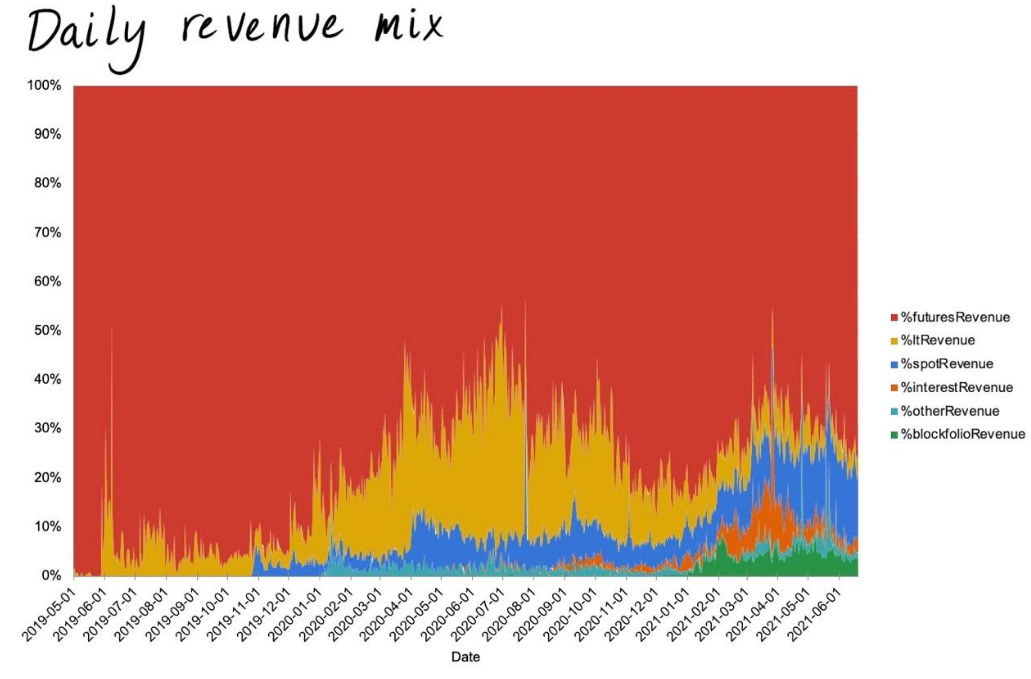

income mix

Where do these incomes come from?

Like other exchanges, FTX’s sources of income include contract transaction fees, spot transaction fees, and interest. We can see that the company has managed to diversify its revenues over time, for example, growing spot revenues. Even the recent Blockfolio purchase seems to be bringing in revenue, which certainly exceeded expectations given its modest volume. "Other" revenue includes smaller portions such as NFT sales.

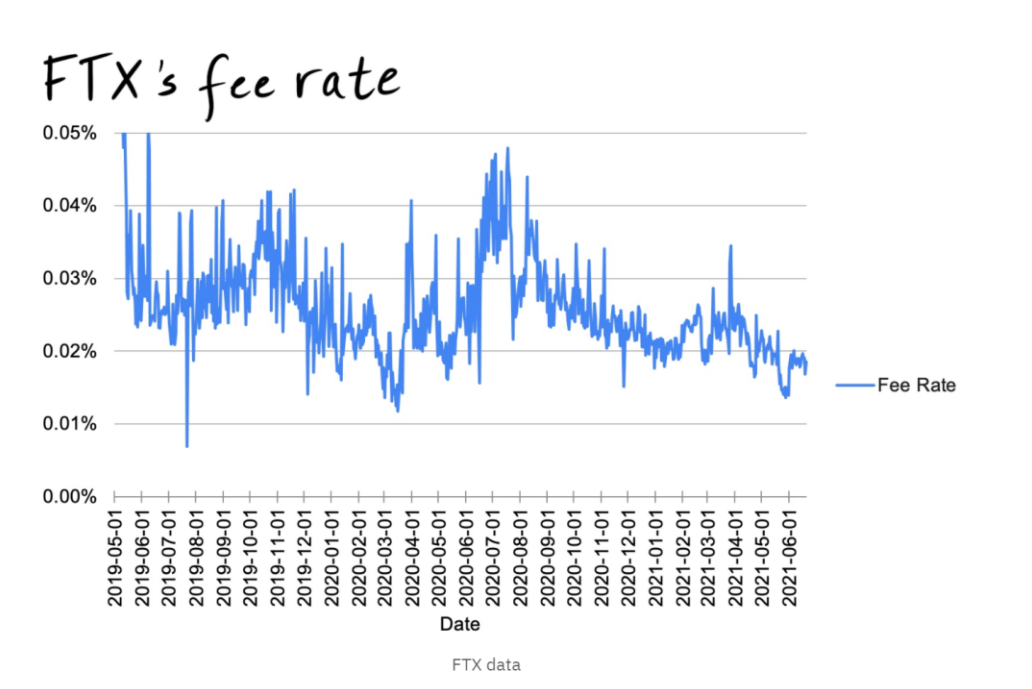

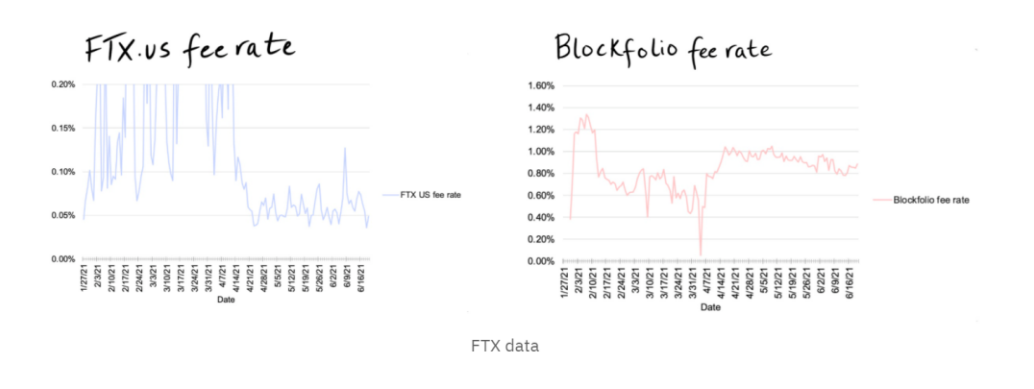

Following the revenue mix shown in the above figure, FTX shared its handling fee-related data. Over time, the company appears to have reduced fees on its global platform to roughly 0.02%.

It is worth noting that the FTX.us fee is usually 5-10 times this figure, which is about 0.2%. Blockfolio’s fees are higher at around 0.8%. This partly explains why it appears that Blockfolio's share of revenue is higher than its share of transaction volume.

user retention

user retention

In my conversations with SBF, he was most aggressive when asked about user retention. He replied emphatically:

"We want to never lose a customer. If we lose a customer, we're a failure. I want to understand why or why they chose another platform and how we can improve and do it better."

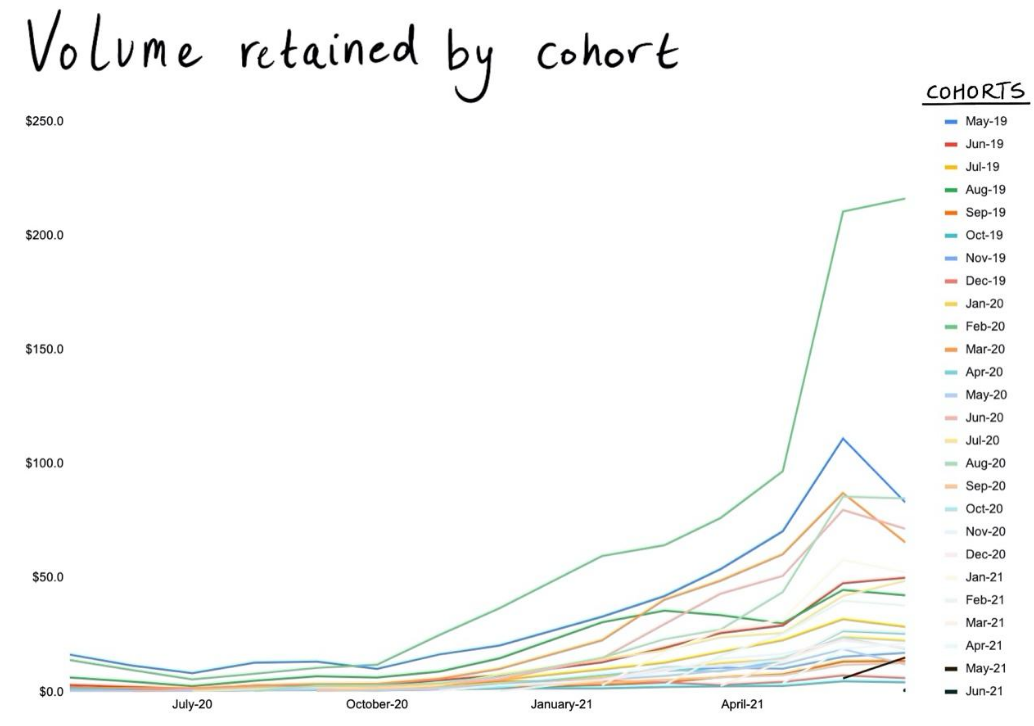

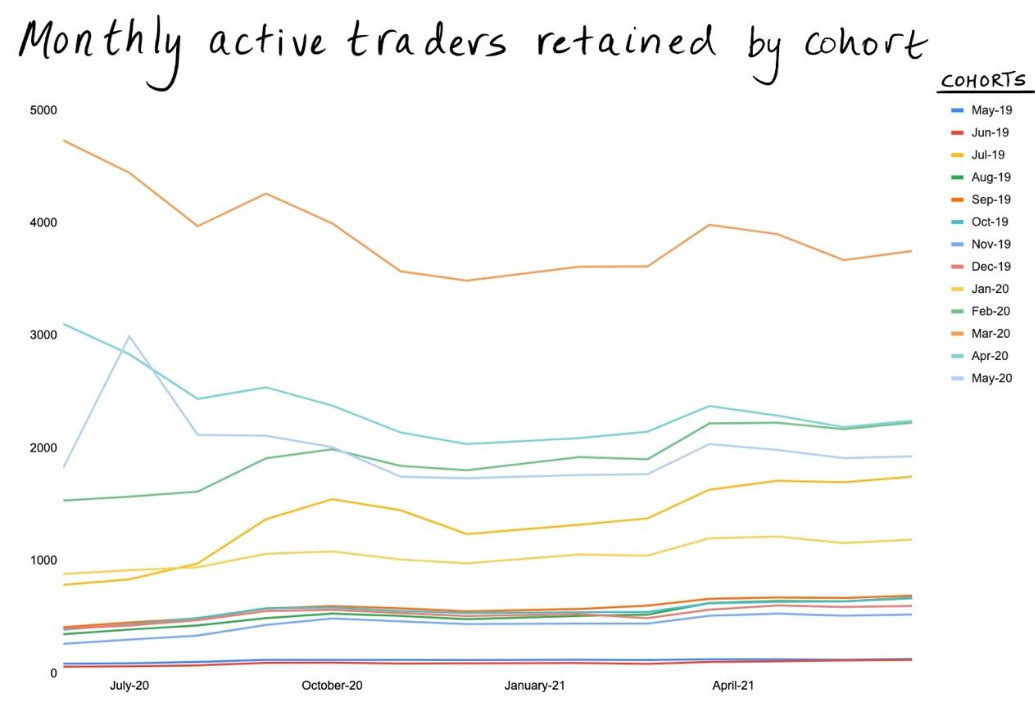

Data from FTX suggests that persistence is paying off. Most user bases, especially those in 2019, have seen their transaction volume grow over time, often by a large amount. For example, for the May 2019 group, May 2021 has 580% more transactions than May 2020.

Is this continued increase in transaction volume due to widespread user retention, or are whales transacting more via FTX? Judging from the retention rate of monthly active traders, it should be the latter.

secondary title

expenditure

SBF has previously stated that FTX has the ability to sustain growth while being self-financing. While The Generalist has limited information on this, we have some indications of this.

Specifically, the average spending data for 2021 is $428,610 per day, and the annual spending is $156 million, an increase of 421% compared to 2020. FTX appears to be living within its means, at least by these rough numbers, considering its trading volume has grown 11-fold and revenue has grown more than 8-fold.

secondary title

Marketing: Attracting the Masses

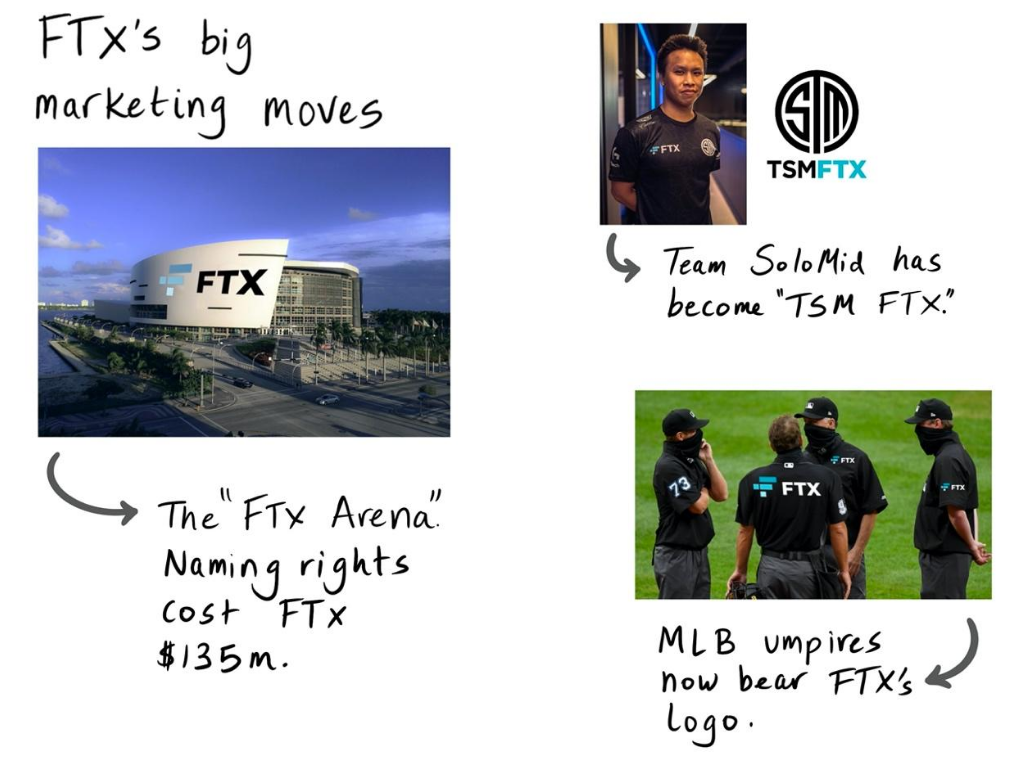

On June 4th, the FTX team made an announcement: They had just bought the naming rights to the Miami Heat's stadium. In 2021, the venue previously sponsored by American Airlines will become"FTX Stadium"。

If the $135 million payout represented a statement of intent, FTX’s actions afterward were even more revealing. Two days later, FTX acquired the naming rights to esports team Team SoloMid for $210 million,""TSM" suddenly had three more letters and became TSM FTX. Only three weeks later, FTX signed an agreement with Major League Baseball, becoming the first cryptocurrency company to cooperate with it. Now the league's referees' jerseys have Marked with the FTX logo.

FTX is now very interested in the US market. Realizing that it entered the market late and Coinbase has already established a relatively mature brand, FTX is willing to be proactive and use simple and rude methods to increase its popularity. There are also some analyzes explaining why the company chose this approach for marketing. The main points are as follows:

● FTX wants to go mainstream. About US$500 million in marketing expenses can have more and more targeted marketing programs. Obviously, FTX pursues a bigger goal - to attract the masses. In FTX’s view, it resembles Robinhood, an online brokerage, more than Gemini, a cryptocurrency exchange.

● FTX is interested in sports. Of course, advertising at NBA and MLB games will certainly reach a wider audience. But we should not interpret FTX's domain choice as accidental. Sports betting is exactly the market FTX might want to tap. We'll discuss this further in next week's article.

● FTX is enhancing its soft power. And what better way to get in the good graces of America's regulators than to be a supporter of America's favorite pastime? Given its origins, Binance may never be able to do so, and in this way, FTX is embedding American culture into its corporate image. This may make FTX look more local.

In addition to bold moves like sports sponsorship, FTX is complemented by more modest moves. Despite positioning FTX’s philanthropic work as"Marketing” is slightly cynical, especially given the founders’ visceral interest in effective altruism, but they nonetheless influence how users perceive their business.

In this regard, FTX seems to have taken inspiration from online payment provider Stripe. FTX has also created a climate program of its own, similar in structure to the Paris Climate Initiative, supporting research and innovative technologies.

Additionally, FTX has made a donation pledge to donate 1% of net fees to worthy causes. As you might imagine, this seems to be based on effective altruism, focusing on effective but not-so-glamorous issues like deworming. In this regard, FTX has also done a good job of mobilizing users to participate. The company not only donates money itself, but also encourages others to participate. Users have donated nearly $7.5 million so far, accounting for 66% of total donations. This suggests that the community may have adopted FTX's values as their own.

secondary title

M&A: Acquisition of Blockfolio

"Crypto practitioners think more about technology, while Sam thinks about customer acquisition cost (CAC)"。

The acquisition of Blockfolio confirms this assessment of the source. By acquiring Blockfolio for US$150 million, FTX not only increased its customer base, but also realized the diversification of its customer base, making preparations for better serving retail users in the future.

First, let’s take a closer look at Blockfolio’s offerings. The company, which started in 2014 as a simple track of cryptocurrency prices and the value of individual holdings, has over time transformed into a more full-featured app featuring cryptocurrency news. It raised $17.5 million in financing before being acquired by FTX.

After being acquired, Blockfolio has further enriched its functionality. Foremost among these is the addition of trading functionality, allowing users to buy and sell cryptocurrencies directly through the app.

From this perspective alone, Blockfolio does not seem to have brought FTX any benefit. Price and portfolio tracking are the exchange's main strengths, and while Blockfolio's well-built mobile app does have its value, FTX would likely need far less than $150 million to build a similar app.

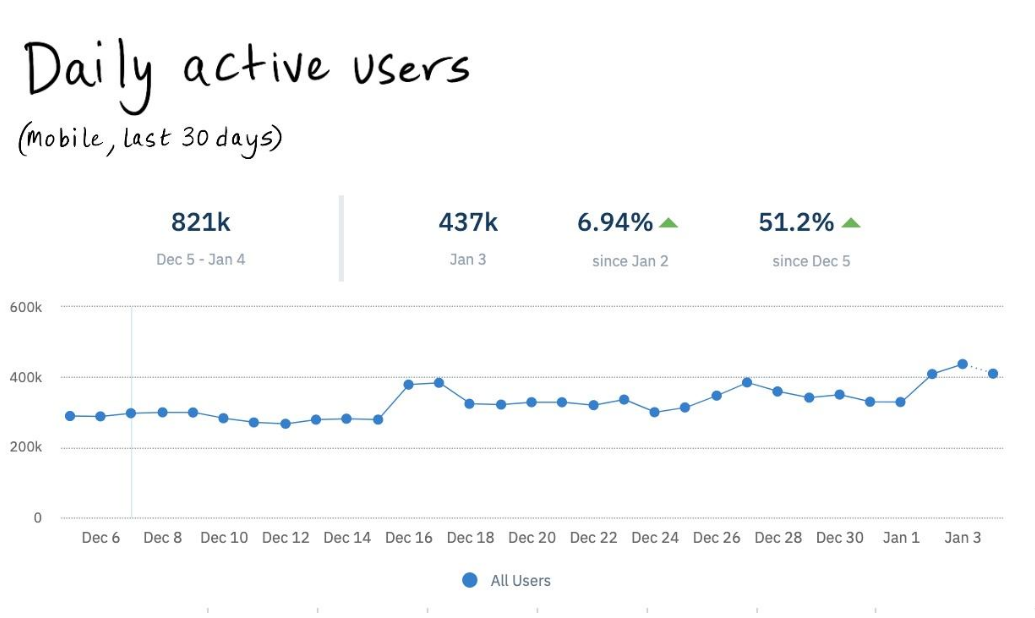

But from the perspective of Blockfolio's user base, this acquisition is indeed a wise move. First, Blockfolio has a large number of daily active users (DAUs). Although FTX’s daily active users in 2021 exceeded 60,753, Blockfolio’s average daily active users from December 2020 to January 2021 was 821,000.

This user group has a very high viscosity. As FTX noted in an internal document,"Blockfolio users generally use the app multiple times a day with very short intervals"。

Blockfolio has a combined user count of 6.5-7 million (floating differences due to tracking differences), with approximately 1.75 million active users in 2020.

The point is, the geographic spread of this user base is not the same as FTX's user base. FTX has a high usage rate in Asia, while Blockfolio's users are mainly from North America and Europe. The United States is its largest stronghold, accounting for 18% of the number of users. The other top five countries are the Netherlands (6.41%), the United Kingdom (5.96%), Germany (5.74%) and Russia (3.74%).

What does it all add up to?

FTX essentially bought 6.5 million users for $150 million—a user acquisition cost of $23 per user. Although we can’t expect Blockfolio to increase FTX’s trading income immediately, we know that the average monthly income contributed by each retail trader in FTX is $337. If Blockfolio can reach this figure, then this transaction will be very cost-effective. A total of just two days into the payback period. Even if we assume that FTX only utilizes Blockfolio’s 1.17 million US users, the cost of customer acquisition is a respectable $128.

From this we can see the outline of an interesting M&A strategy. Companies that have amassed a large number of users often struggle to monetize effectively. Sure, a company like Blockfolio could add advertising or content subscriptions, but the margins would certainly not be as high as a deal. After that, we may see FTX take down more companies with large user bases but low ARPU (average revenue per user). We'll discuss this in more detail in next week's article.

secondary title

Competition: Battle of the risk touts

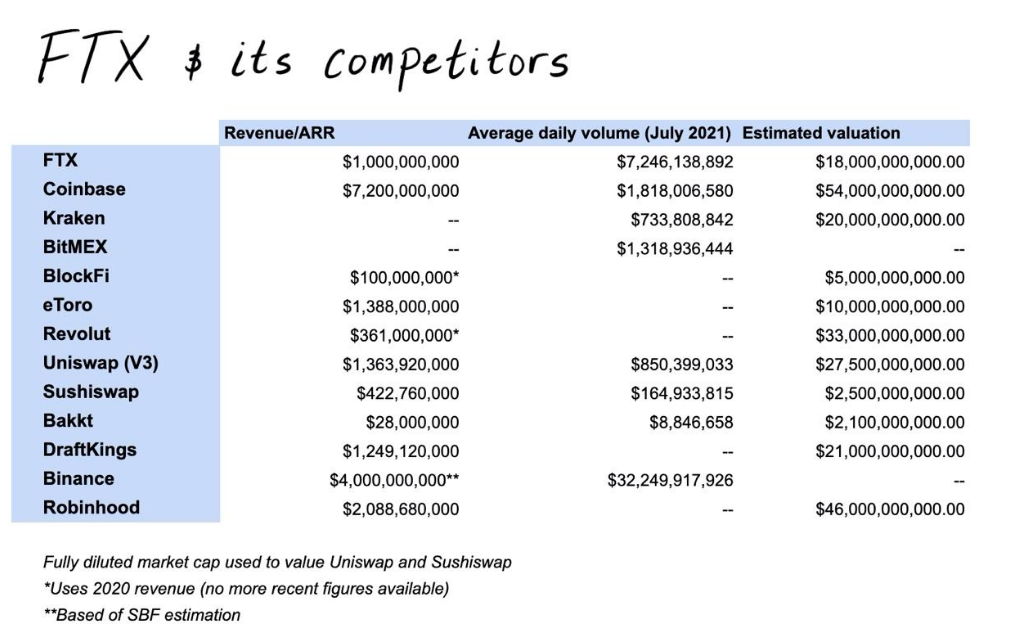

An internal document shared by leadership shows us what FTX considers its biggest competitor. Many were expected, but others also gave us a glimpse into FTX's future plans.

The list of competitors is:

● Coinbase

● Kraken

● BitMEX

● BlockFi

● eToro

● Revolut

● Uniswap

● Sushiswap

● Bakkt

● DraftKings

The most surprising thing is that there is no Binance on the list, nor Gemini and Robinhood. And the listing of the much smaller Bakkt as a competitor is also unexpected. From the list above, we can see that FTX has interest in traditional banking (Revolut), crypto equity accounts (BlockFi) and sports betting (DraftKings).

direct competitor

direct competitor

resignresigntook the CEO position of BinanceUS. As the former head of the U.S. Office of the Comptroller of the Currency, everyone expected Brooks to steer Binance toward compliance. And Brooks' departure due to "differences in strategic direction" suggests progress has not been smooth. FTX is hoping for a smoother transition to compliance.

As a derivatives-focused exchange, BitMEX is another interesting comparison. You may still remember the memo from Race Capital (FTX’s first financing lead investment institution). Derivatives trading was the initial track of FTX, but it gradually expanded its business scope.

Although BitMEX was established in 2014, 5 years earlier than FTX, its current trading volume is less than 1/5 of FTX. The company has also been plagued by regulatory issues, with founder Arthur Hayes being jailed for failing to prevent money laundering.about to faceFederal indictment. This is a warning for FTX, but it also gives it more leeway in the moment.

Coinbase, Kraken, eToro, Bakkt, Robinhood can also be considered direct competitors, although they are not an exact match. Only some of these companies offer cryptocurrency contracts, and Robinhood is of course best known for stock and options investing.

For brevity, we focus on Coinbase. As the top exchange by revenue, the company feels like a particularly interesting foil for FTX. Perhaps most notable is the fact that FTX has a much richer offering. While Coinbase could once consider itself a true innovator, it has gradually fallen behind over the past few years. Have you launched any meaningful new products in the past year or so? In terms of listing tradable assets, the company lags behind many less established players. Many old-fashioned digital currency-related products are not yet online. But the leadership doesn't seem to care about that, which only compounds the problem.

This is perhaps the second most important difference between Coinbase and FTX: governance. Although Brian Armstrong has done a good job in many ways, many people have doubts about his ability to manage a company of Coinbase's size. His lack of control has been exposed several times in the company's history, allowing ambitious lieutenants such as Balaji Srinivasan and Asiff Hirji to do as they please. This is also due to the fact that Coinbase does not have a clear plan for the next ten years or more.

While we might worry about the durability of SBF (in the face of sustained high-intensity work), or high risk tolerance, no one would complain that the founders of FTX lacked vision, or the guts to make it a reality.

Where FTX falls short compared to these exchanges is the design. Although the transaction volume is large, the FTX page is relatively monotonous and boring. This may be the downside of hiring Wall Streeters rather than ex-Google employees. Both Coinbase and Kraken have beautiful, intuitive consumer-facing apps, and FTX still feels a bit crude by comparison. The Blockfolio acquisition could help improve the design, but the entire product would need to be recolored and the process improved.

text

DEXs

Both Uniswap and Sushiswap are decentralized exchanges (DEXs), alternatives to FTX and direct competitors to Serum. Will DEXs replace centralized exchanges like FTX, Coinbase, and Kraken? Seems possible, though at least a few years away. The creation of Serum shows that FTX thinks this is possible and is happy to hedge its bets. But as it stands, Serum is still far behind the biggest DEXs. According to Coinmarketcap rankings at the time of writing, Serum is ranked 23rd by daily trading volume, behind BakerySwap and ahead of PancakeSwap. The daily trading volume of Uniswap V3 is US$1.7 billion, while that of Serum is only US$21 million.

Of course, there is still time to make up for it, although FTX is still an inconspicuous role in the niche field of DEX.

gaming

secondary title

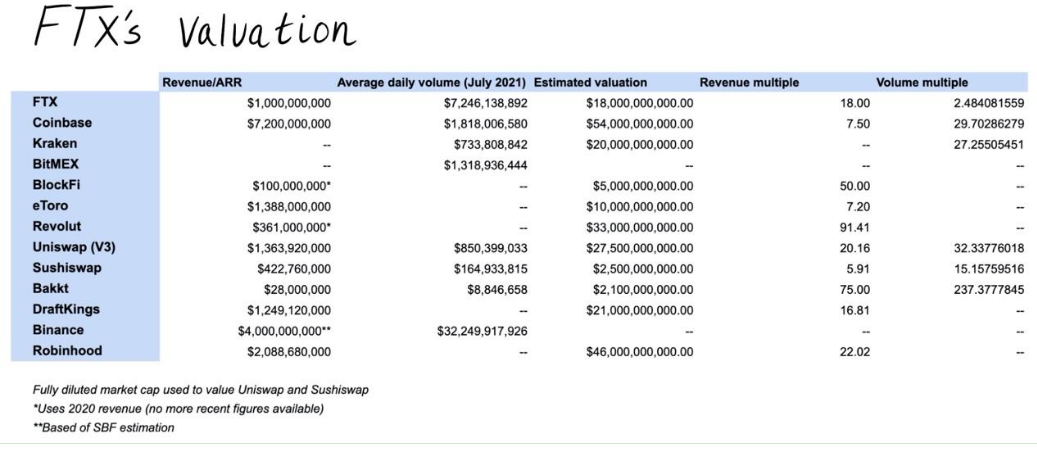

Valuation: Another way

Using the data provided in the previous section, we can compare FTX to its peers by valuation.

Valued at 18 times its annual revenue, in the peer valuation comparison table, FTX looks quite reasonable, at least at first glance. While this is a sizable gain compared to Coinbase, it is a pleasing valuation compared to Bakkt (75x), Uniswap (20x) and BlockFi (50x).

Do these companies have higher profit margins than FTX? Are they growing faster? While we can assume that all companies are benefiting from the cryptocurrency boom, FTX's growth rate has been insane — 840% year-over-year in average daily revenue. It is hard to imagine that the market performance of Bakkt, which does not seem to have such a clear product-market fit, will surpass FTX.

A look at valuations relative to average daily trading volume reveals more. While this metric may not be very interesting in isolation, it can be used to make interesting comparisons. For example, FTX is valued at 2.5 times average daily trading volume, while Coinbase is valued at just under 30 times.

What is causing this difference?

Clearly, revenue-wise, Coinbase has managed to generate more revenue from the transaction volume it facilitates. This may be down to its high fees, at least in large part. Kraken’s valuation-to-volume multiple is comparable to Coinbase’s.

Can FTX Maintain Its Transaction Volume While Raising Its Fees? possible. But the fee income may be snatched away by competitors. The company seems to be going the other way. FTX seems to want to bring as much trading volume as possible to the platform, and then make money in various ways, instead of focusing on the transaction fee. (In this respect, it’s playing the same way Brazil’s digital bank Nubank is playing in the neobanking space). We believe that if FTX has the strongest and most liquid exchange, it will naturally expand to various other financial relationships, including stock trading, savings, payments, and more.

secondary title

Worst-case scenario forecast: A possible crisis for FTX

Of course, FTX still might not live up to its potential. While its many aspects are impressive, no company is immune to risk. Because of its strategic decisions, it has become more dangerous in many ways. Like the unlucky speedster, FTX may find it's going so fast that it forgets to pick up an item that needs to be used later. At some point, a company may find that its resources are scarce and it faces unpayable debts.

Supervision

Supervision

"I don’t know why there is no regulatory action against them,” one source said. The cryptocurrency investor’s confusion is mainly that FTX doesn’t seem to be playing its cards according to common sense.

An example cited by the source is the equity token offering issued by FTX. Depending on the jurisdiction, shares (even synthetic shares) can only be issued by properly regulated businesses. According to the person, FTX does not appear to have such a license in any major market.

Can FTX manage to correct this oversight before regulators get their eye on them?

wild west"wild west". Many in the industry are bracing for tougher rules and more scrutiny.

More recently, other regulators have also shown a willingness to act. In July, the New Jersey attorney general slammed BlockFi for ceasing its operations in the state. The attorney general said the firm sold securities to clients in New Jersey without complying with its securities laws.

Will other institutions follow suit? FTX's large, high-stakes product suite and the nature of its offshore company could expose them to scrutiny.

For now, FTX appears to be doing everything it can to reduce the risk of sparking regulatory displeasure. The latest funding round appears to be motivated at least in part by a desire to court some of the most influential financial institutions in the world, such as Sequoia Capital, SoftBank and Third Point. These funds have deep experience navigating regulatory uncertainty and should provide important guidance for FTX.

SBF himself seems to be taking it to heart, and almost everyone can tell he's taking it seriously. In a recent interview, he mentioned that he spends 5 hours a day dealing with regulatory issues and is eager to work with different regulators. He hired several senior leaders to work together on regulatory issues, notably GC Dan Friedberg. This proactive approach is in stark contrast to BitMEX’s Arthur Hayes, who has historically viewed these regulators as mischievous butlers.

donatedonate$5.2 million, making him the second-largest donor to a sitting president after Michael Bloomberg, the founder of Bloomberg News.

PR disaster

PR disaster

In a year or so, Robinhood "successfully" went from "rebel darling" to everyone's disdain in the field of public opinion. Once lauded for its innovative zero-commission model, the online exchange has since faced waves of criticism.

Lessons from its failures include: the gamification of trading, providing leverage to amateur investors, and a business model that relies on high-risk, high-frequency investing. The company, once seen as empowering a new generation of investors, is now increasingly seen as a social product that “hijacks dopamine.” It doesn't matter whether the two statements are fair; even the darlings of the tech world are not immune to a one-vote veto.

FTX needs to be careful not to fall into the same trap. In many ways, FTX still bears the stamp of its overarching goal of rapid growth. The firm offers highly leveraged, speculative investing with little to no knowledge required from traders. It's reaching the mass market, especially based on its sports partnerships. It's not hard to imagine how this combination of product and target audience could create problems for unsophisticated investors, tempted by leverage to make ill-informed financial decisions with disastrous results.

To prevent this, FTX should invest in user education and structure its product in such a way that unprofessional investors understand the risks of their bets.

market changes

Like all companies in the industry, FTX's meteoric growth is highly correlated with the success of the entire cryptocurrency space. Anyone who has observed the field knows that this is a highly volatile market that can change completely from hot to freezing in a matter of hours. And the next winter may last for a long time.

Unless the industry completely collapses, FTX should be able to survive this extreme situation. The company is well capitalized and appears to have been living within its means. As such, it should hold out until the next cryptocurrency industry pick-up. In fact, it may even take advantage of this industry cooling-off period to suck volume from smaller exchanges and acquire distressed assets that can expand its product suite. However, this is just a possibility.

In this regard, FTX appears to be actively repositioning itself. I will share more ideas in the next briefing, for example, entering the sports betting space, will untie the company's strong correlation with the cryptocurrency industry, ensure a stable income stream, so the bitcoin price will no longer be a big concern for the company have a big impact.

Perhaps even more worrisome is the possibility we mentioned earlier: users switching to DEXs. Probably. After all, a fundamental tenet of cryptocurrencies is a belief in decentralization. As the market matures, why should believers who hold large amounts of cryptocurrency rely on and empower a traditional entity?

For now, FTX seems to be on the right track. And, thanks to Alameda's extensive investment practice, FTX is always on the lookout for promising companies being created to foster innovation in their own business—whether through imitation or acquisition.

******

FTX is a company built to transcend time.

In its first two years of existence, it has accumulated a large number of loyal users, completed a huge transaction volume, and generated considerable revenue. The exchange has driven innovation in the cryptocurrency space and now appears poised to teach its gospel to a wider audience.

But what if company building wasn't a race to the bottom?

What FTX needs to learn over the next few years is how to strike a balance between speed and control, replacing chaos with deliberation, and occasionally slowing down to ensure the long-term development of the company.