Original title: FTX Trilogy, Part 1: The Prince of Risk

Original: https://www.readthegeneralist.com/briefing/ftx-1#toc-understanding-the-man

In-depth analysis of the four expansion directions of FTX

the second part:Dances with Sharks: A Brief History of Giant FTX

the third part:In-depth analysis of the four expansion directions of FTX

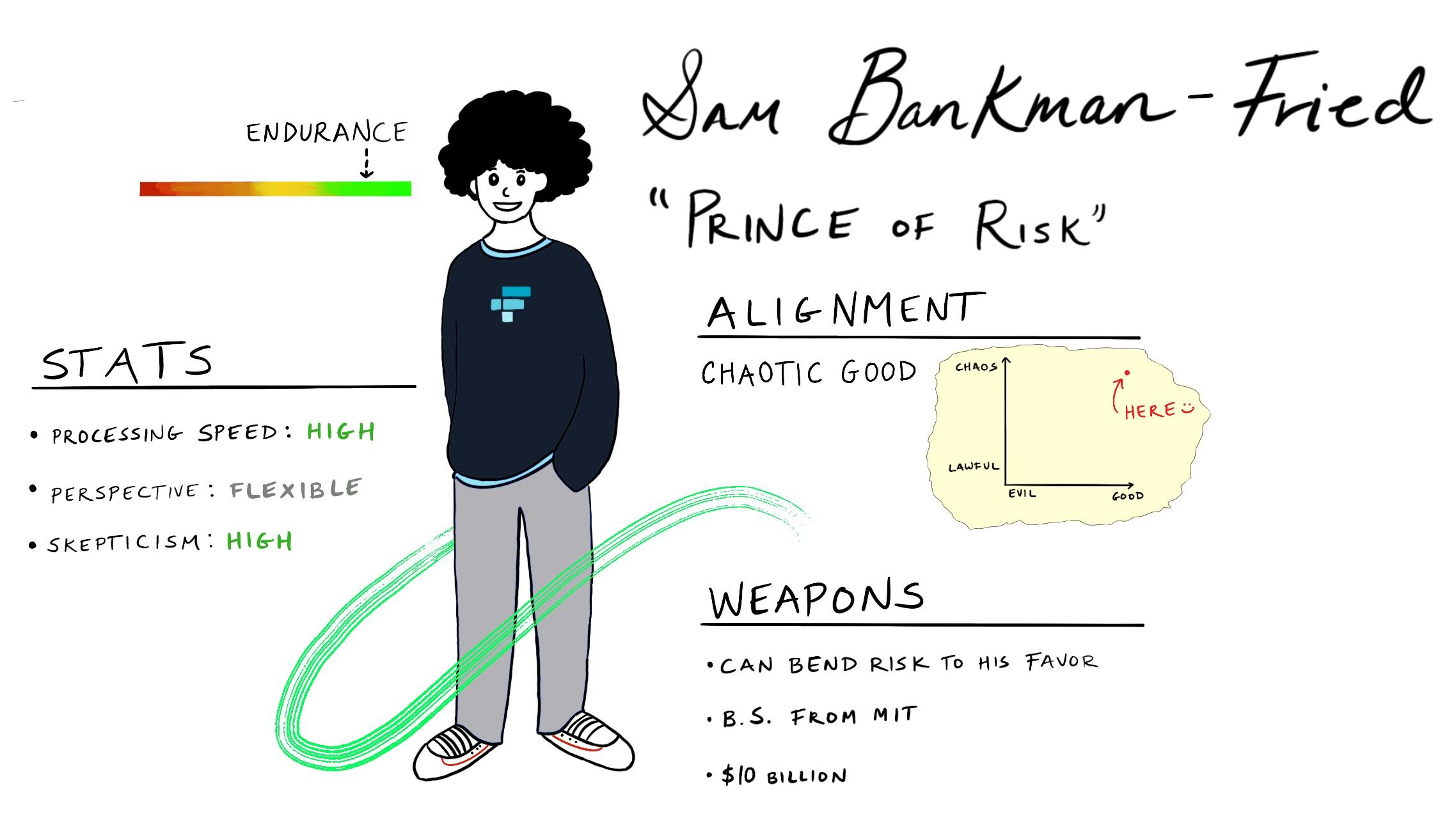

Sam Bankman-Fried (later: SBF) is a risk guru.

Like few others, the FTX CEO has shown an understanding of the magnitude of the danger and the ability to bend it to his knees. Only the world's preeminent investors and founders -- such as Warren Buffett and Steve Jobs -- have demonstrated this talent consistently. While SBF has yet to prove his consistency at this level, his early performances suggest he is a rare talent.

This is just one of the reasons why SBF is well-qualified for the role of founder of a cryptocurrency exchange and the most influential investment company. At the same time, SBF combines the judicial wisdom of a creative regulator, the intuition of an elite trader, and more.

This chain of events resulted in one of the most impressive entrepreneurial experiences in modern memory. In his first three years at the helm of FTX, SBF has managed to balance risk while advancing at an extraordinary speed, which is like walking a tightrope on a Harley motorcycle.

Of course, the company didn't cross the chasm. Few other industries have the level of regulatory risk the crypto industry faces, let alone the speed of change. But in SBF, the company has an ideal leader: a CEO who is conscious of risk but also dares to step on the gas pedal, whose understanding of risk is almost rare. It's perhaps an added bonus that, in his insomnia and idiosyncrasies, he's a fitting avatar for the crypto market he operates.

first level title

Growth of SBF

born

Sam Bankman-Fried (SBF) was born on March 6, 1992 in Santa Clara County, California. The son of two Stanford law professors, Barbara Fried and Joseph Bankman, SBF was raised in a high-quality environment. This had a major impact on his later thinking, as we shall continue.

In 2010, SBF was admitted to the Department of Physics of the Massachusetts Institute of Technology. As he puts it, he came here as "a bit of a math nerd". During his first few years, he considered a career in academia, wanting to become a professor of mathematics. After realizing he had little fun in formal research, he broadened his horizons. Specifically, he looks for things that fit his skills and are worth his while:

"One thing I do know is that I want to know how I can have the most positive impact on the world. I've been studying utilitarianism for a long time, and recently started studying effective altruism, which is basically a movement. …you’re trying to figure out how to impact the world, trying to quantify things, trying to figure out what’s the most effective way to…

I tried a lot of possible careers at first, and these careers are almost everywhere. [I] had some conversations with people, and basically, they said, "You can go and work for these charities or organizations that you think are good, or you can donate to them. Frankly, given your strengths and weaknesses, Maybe you can contribute more by donating something to them than you can by working directly for them." So I thought about it, [and thought] that sounded like a very reasonable argument. "

Convinced that amassing a solid salary and channeling it to philanthropy was the best way to gain impact, SBF interned at Jane Street Capital during the summer of his junior year. A few friends had done internships there before, and they all said "it's not bad".

Founded in 1999, Jane Street has grown to become one of the largest and most respected quantitative trading firms in the world. It has maintained that reputation and size: In 2020, the firm traded $17 trillion in securities.

Pleasant summer work landed SBF a full-time job after graduating in 2014. As it turns out, that's a good fit. SBF revels in being surrounded by a group of "nerds" dedicated to coming up with and executing sharp trading ideas. He focused on international ETFs, a slightly exotic style that foreshadowed some of his later, more high-profile work in Asian crypto markets.

Although he describes Jane Street as a great employer, after three and a half years the young financier decided it was time to build something of his own. He remembered the reason at the time:

first level title

Alameda

No matter how optimistic he was, even SBF must have been surprised by the scale and speed of his success. After leaving Jane Street in 2017, he spent time thinking about potential opportunities. Fascinated by the cryptocurrency craze sweeping the market late that year, he turned his attention to the burgeoning ecosystem.

When he started studying the markets, SBF's trading instincts went into overdrive:

"[Cryptocurrency] has many characteristics, can be a very inefficient system, and has a large demand for liquidity. It is basically: huge demand suddenly, growing very rapidly, large volume, large retail investors, And not a lot of time to build institutions. Not a lot of time to build liquidity...”

It feels like something that is likely to have very large volume and price variances.

This interest turned into an obsession when SBF recognized an arbitrage opportunity between the US and Asian crypto markets. Currencies such as bitcoin trade at much higher prices in South Korea due to differences in demand. This so-called "kimchi premium" sometimes reaches 50%, which seems like a once-in-a-lifetime opportunity. In theory, at least, an investor could buy bitcoin for $5,000 on a U.S. exchange and instantly change hands for $7,500 in South Korea.

While others discovered this inefficiency and tried to exploit it, SBF quickly realized its limitations. Since the Korean Won is a restricted currency, the size of the opportunity is limited. You can certainly make money, but repeatedly deploying hundreds of millions of dollars is not feasible. He looks for something bigger.

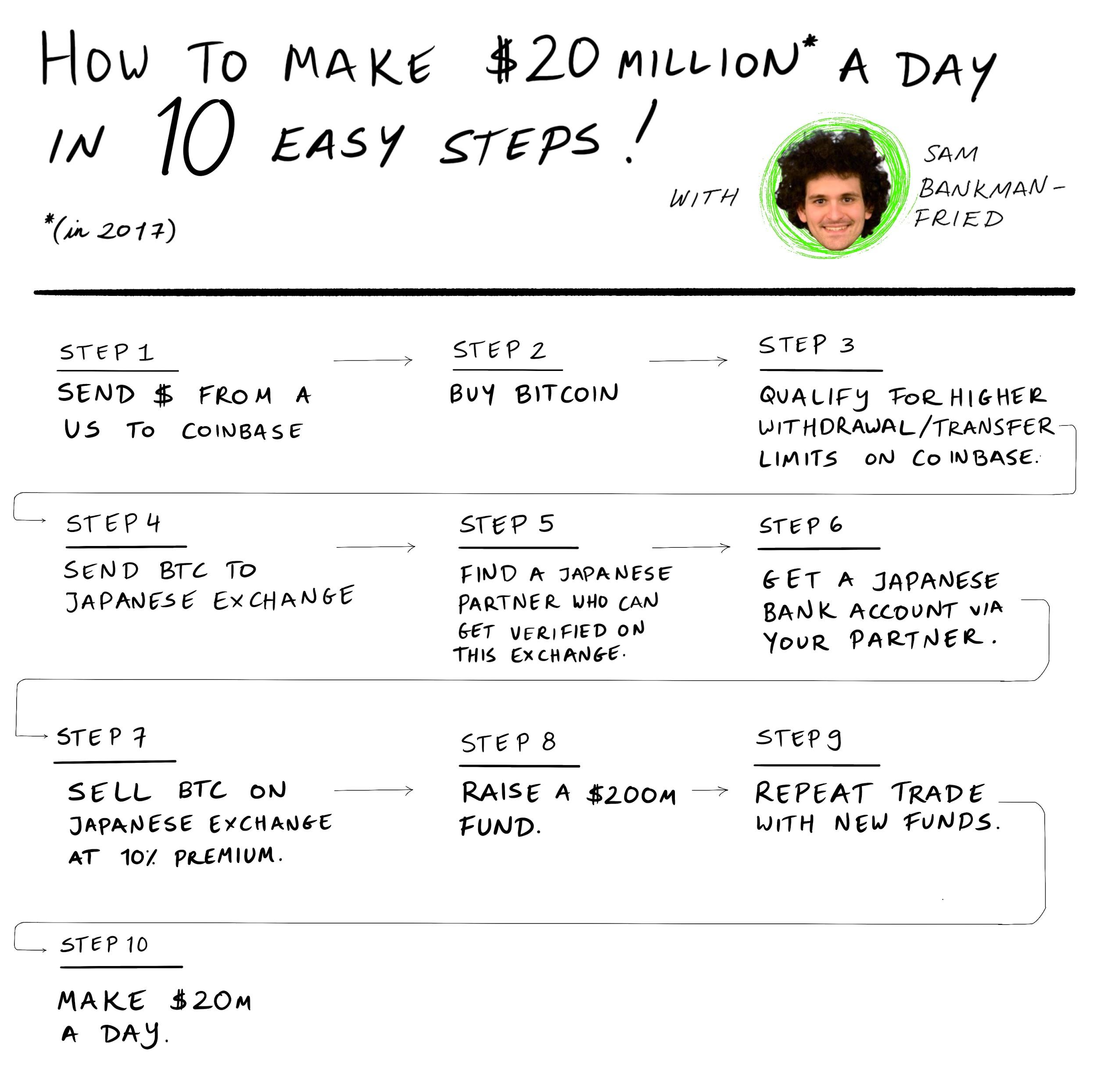

image description

Based on SBF Odd lot interview

Seeing an opportunity to earn “10% every weekday” by buying Bitcoin in the US and selling it in Japan, SBF acted quickly. SBF raised funds to start Alameda Research, a quantitative trading firm, with ex-Google engineer and MIT alumni Gary Wang and Nishad Singh, a recent Berkeley computer science grad and met in high school. Essentially, this is Jane Street in cryptocurrency.

The benefits of Japanese arbitrage are as expected by SBF. With $200 million in capital, Alameda deploys and redeploys that capital into the Bitcoin market, earning 10% or $20 million a day.

But SBF wasn't content to just count his winnings and get away with it. About a year after starting Alameda, he and his team began thinking about a bigger opportunity: building a cryptocurrency exchange.

SBF believes that the exchanges at that time were not professional enough. In the process of running Alameda, he came to realize how much room for improvement in the underdeveloped crypto world. Indeed, despite the hype that Coinbase and others may have made at the time, true institutional-grade trading was a long way off, especially for those interested in more complex securities. For example, BitMEX offers derivatives trading, but like many others, it is prone to outages and other performance issues. With their hands-on experience, SBF believes that the Alameda team can create an exchange for professional investors like themselves.

FTX

In late 2018, SBF, Wang, and Singh started work on FTX, an exchange "by traders, for traders."

However, there is a problem: the United States is a country that is not conducive to establishing an environment for crypto derivatives exchanges. Domestic U.S. regulators have shown skepticism about the nascent asset class, especially for more speculative investments. For example, the U.S. Securities and Exchange Commission (SEC) dampened the ICO boom in early 2018 (justifiably), warning that it was keeping a close eye on exchanges during the year.

While the team was working on a "plan of attack," SBF made a decision: FTX would be established in Antigua and Barbuda.

That doesn't seem to be slowing down development, though. In May 2019, FTX officially opened for trading. In the two years since, it has grown into an $18 billion business and one of the most popular exchanges in the world.

first level title

get to know this man

simple analysis

There's something bordering on irrational about writing a profile. Not only does it require the writer to pay close attention to the subject matter—writing every stirring phrase with bated breath, listening to every interview that precedes it—it also invites a kind of meddling that sometimes May intersect with deep understanding. How much can we learn from short conversations? How much curiosity is reasonable in a first meeting? What insights can we gain from the deposits of life? Are old tweets, bouncy CNBC sections, long podcasts, surprise poems valuable?

The ends only partially justify the means.

SBF is a very approachable and friendly executive - within a few minutes of chatting on Twitter, we arranged a call. He is generous with his time and information. Rather, it was an acknowledgment that previous reports had outlined his story, setting the narrative. Every article discussing this man goes through the same three steps: He's young and very rich! He sleeps on a beanbag at the office! He cares about the world!

These are true or appear to be true. Predictably, we'll talk about them too. But beneath (and beyond) these descriptions of SBF is the feeling of the vast hinterland. A man with a deep intellectual and emotional life that is difficult to tap even for those close to him.

I've tried my best to play "peeping tom". But I have no clear explanation, no magic key that can unlock the mind of SBF. Just trying to understand him, however flawed the task. In particular, I wanted to investigate four traits that I believe influenced his character:

1. Messy but good moral alliance

2. Fast processing speed

3. Doubts about conventional wisdom

4. The rare ability to switch perspectives

secondary title

messy but good moral union

Given his interest in fantasy games like League of Legends, I have reason to believe that at some point in his life, SBF played Dungeons & Dragons. For those who haven't spent an afternoon, an evening, and a night in an RPG, the basic gameplay of the game is to create a character of yourself and then go on quests with other members.

image description

WYNC

Someone like Captain America is a prime example of a character with a legitimate alliance of good. He plays by the rules and is motivated by philanthropy. In contrast, someone like the Joker is an example of chaotic evil. He just wants to watch the world burn.

SBF is probably the most chaotic kind founder on this Odaily. It's clear, at least in some ways, that he's driven by altruism. But the way he runs FTX shows that he is willing to play fast within the boundaries.

Let's start with the good and decipher his positioning on both axes.

As previously stated, SBF showed a genuine interest in altruism that preceded his wealth. Before founding Alameda, he served as director of the Center for Effective Altruism for several months. Today, FTX pledges to donate 1% of its net fees to charity, an amount that has surpassed $10 million to date.

SBF's moral philosophy can be traced back to his parents. Both scholars show a strong interest in ethics in their work, although it is particularly prominent in the writings of Barbara Fried. In one of her most famous essays, "What Does It Matter?" ..., she dissects the limitations of one of the moral philosophy memes: the trolley problem. Although fully disentangling Fried's argument would represent too many detours, this work is consistent with our discussion of probability in moral decision-making. There's a symmetry here: Just as her son has proven adept at explaining the invisible world of financial risk, Barbara Fried has demonstrated expertise in resolving ethical ambiguity.

During our discussion, SBF pointed out his interest in the work of Peter Singer and early utilitarian Jeremy Bentham. SBF's decision to become a vegetarian echoes a utilitarian approach to the analysis of morality:

"It's a chicken that's been tortured for six to eight weeks, and then we can spend half an hour eating it. It's pointless."

The ethos of SBF is not just abstract or disconnected from the world he operates in. He has also demonstrated a sense of responsibility for the crypto ecosystem, most evident in his willingness to assume an interim leadership role at SushiSwap. When decentralized exchange creator “Chef Nomi” fled the project with tokens, SBF entered a power vacuum and steadied the ship. When I asked him this question, he called it "something that takes time." He added:

"The community is going through a tough time with Nomi getting out. I'm just helping to put it in the right place. Let it stand on its own. I'm really excited about what the team is doing."

It's easy to over-judge SBF's motives in the face of his kind actions. Much of the media has portrayed his story as a quasi-messianic quest within a capitalist framework. But that's not good for the realities of company building. While having a higher calling helps, the long hours and constant stress are hard to sustain if not driven by a genuine interest. While SBF has an admirable moral sense, we don't need to burden his company with the kind of mantle of sanctity that bullshit peddlers like the founders of WeWork or Goop love. FTX is a business, run by merchants.

The second part of the SBF's "Chaos Good" alliance is, of course, a preference for Chaos. This manifests itself on an individual and organizational level.

SBF seems to thrive on disorder. On the day I spoke to him, he mentioned that I was his sixteenth meeting of the day. He told me about them:

1. Media interview

2. Media interview

3. Discussions related to potential venture capital

4. Discuss with potential FTX Pay partners

5. Contact an Investment Bank

6. Internal meeting on licensing issues

7. Internal meetings on regulatory issues

8. Internal meeting on potential NFT products

9. Talk to potential new VC partners

10. Discuss regulatory issues in another jurisdiction with a lawyer

11. Internal reporting on regulatory issues

12. Discuss a company that is considering an acquisition

13. Legal and Compliance Internal Meetings

14. Discuss potential VCs to support FTX Pay

15. Discuss FTX endorsements with sports franchises

16. Interview with The Generalist

Summed up, this included four legal discussions, three interviews, two investment reviews, a potential acquisition, and a few other things.

As SBF told me, he loves this level of activity. "It's intentional," he says, "and there's a lot of stuff going on." He manages the chaos thanks to his natural talent, as well as his fraught work schedule. Part of SBF's biography is that he sleeps only two hours a night, curled up in a beanbag chair scattered around the office. In the corner of our Zoom call, a blanket is strewn across one of the beds. As one of his investors told me, "He's answering my texts 24 hours a day."

The permanence of this lifestyle aside, SBF's penchant for chaos feels particularly suited to the market he operates in. As he explained while executing a Japanese cryptocurrency arbitrage with Alameda, he is at his best when things are volatile. As the rest of the world seeks to restore balance and struggles in the process, the SBF sees it clearly. He has a talent for assessing the scrimmage, picking a path in the scrimmage, and moving quickly.

Just as SBF is content to live his personal life on the fringes, he has shown a willingness to run his company in the same way. As he noted during our conversation, "Most of life is lived on the edge." Presumably, SBF believes that business opportunities exist alongside it.

From the day FTX was founded, he has been willing to take controversial actions to achieve his goals. Of course, the good of chaos comes with its downsides.

The SBF effort is necessary, but it does not appear to be sustainable. Only people with genetic abnormalities can continue to function without sleep. Is SBF one of them? Old friends and family know best. Given that coverage of this issue seems to come exclusively from FTX, I don't think he's in the sleepless minority.

While overly macho investors often insist that founders torture themselves by overcoming this pesky physical limitation, our biological needs often catch up with us. The stress of building a generational enterprise business only exacerbates the potential for burnout.

Perhaps the bigger risk is that SBF flies FTX too close to the sun. The concern is that in his desire to succeed, SBF steers the company across some real or perceived line. For example, when I asked a cryptocurrency investor about FTX's regulatory risks, they responded, "Will they face penalties at some point? Probably." Trajectories have little effect.

secondary title

fast processing power

Part of the reason SBF is able to manage these constant feeds of information is that he seems to have elite processing power. I get the feeling he's happy to have 16 meetings in one day, partly because his brain almost...needs it? While the rest of us might be happy to have a few projects to grab our attention, SBF seems eager to have a dozen or more compared to us.

SBF talked about his capabilities in this regard, and also explained the tradeoffs. In a tweet from February of this year, he shared some of his thinking:

"According to this fool's understanding, there are two kinds of computer memory: RAM and hard disk.

RAM access is fast, expensive and small.

Hard drives are slow, cheap and have a lot of capacity.

The computer I'm using now has 64GB of RAM and 500GB of disk space.

Also, RAM is cleared every time the computer is restarted; the hard drive is still there and can save state.

Regardless, I find this a useful way of thinking about how *I* remember things.

And, in general, I think I have a lot of RAM and a relatively small hard drive. "

The tradeoff, in his estimation, is not that the SBF has "relatively small hard drives." In fact, this became clear in later posts. Explaining why he plays League so often, SBF noted:

Why?

Why?

Well, there is an answer, and it's obvious. The most common thing about League of Legends (LoL) is that everyone who plays it says they wish they hadn't...

Maybe this is the answer. Maybe not, but...

[When] I'm really, really tired, why do I sometimes instinctively open League of Legends?

Sometimes when I'm physically tired, I just sleep.

But sometimes my exhaustion is mental. My mind would spin and my RAM would be filled with stuff that was important to me.

Because I don't have much disk space and don't trust it too much. I live in my RAM.

Even if I wanted to empty it, I couldn't.

For better or worse, thoughts that are worth enough to my active memory don't leave it. .

For most people, short-term memory is reserved for things that you will soon forget.

But my mind is filled with things to remember, to do, and to think about, and those thoughts will linger for a while.

sometimes forever.

Because once they made the transition from RAM to hard drive, they basically disappeared. The world exists only as long as I remember them.

So, anyway, sometimes my mind is too full, or stuffed with demanding, tiring tasks. I want it to calm down.

I'll try getting my stomach on the beanbag, but that won't help. My mind is still spinning.

Cling to its circular thinking.

I lay awake, insomnia again...

So I'll open League of Legends.

Also, I don't hesitate to jump into the game, pick a hero, and start...

There was no room to think about anything else.

So my mind shifted to a new, very different loop of thoughts, obsessed with final game hits instead of accountability.

And the old thought cycle—the exhausting one—was forced out of my active awareness, to spin by itself. kill time.

it will come back. A few minutes later, super minions will take over my thoughts, and my mind will ditch League of Legends thoughts and welcome back old ones.

But I've bought myself 30 minutes of calm and given myself time to do the things that usually happen during sleep:

Give my mind some time to rest and breathe.

Time to process my thoughts, solidify them, and make peace with them. Then, it started working again. "

secondary title

Doubts about conventional wisdom

One of my favorite quotes comes from Machiavelli's The Prince:

"A prince who is not wise cannot get wise advice...good advice depends on the intelligence of the prince who seeks it."

SBF is a great example of this approach. You'll feel like every idea has been constructed from scratch rather than just casually borrowed from previous teachers.

For example, at one point during our conversation, he mentioned how he was persuaded by the mantra, "It's better to be safe than sorry."

is that so?

As SBF asked rhetorically, "Does your idea and proposal bring value to the world?"

This is a small anecdote, but it speaks to the way SBF thinks and solves problems. He displays a healthy skepticism of conventional wisdom and works from first principles. This is a feature highlighted by one of FTX's investors, Kyle Samani from Multicoin Capital. Samani repeatedly reiterated that SBF is exceptional in this regard, showing an obsession with "first order correctness". On the subject, Samani remembers a conversation where SBF considered building Serum on Solana instead of Ethereum.

During a short 30-minute call with Samani and Solana founder Anatoly Yakovenko (who remembers this fast processing power), SBF carefully considered the needs of the new system, analyzing factors such as optimal throughput and acceptable latency. In the end, he made his own decision: Serum will use Solana.

secondary title

Ability to switch perspectives

Perhaps the highlight of my conversation with SBF was his disappearance down a rabbit hole of perspective. We've been talking about his favorite thinkers, and the question isn't exactly comfortable:

“[It’s not just one person.] I try to piece together the dots from different people. In many cases, people get really important insights that I miss. And then they also have a lot of really stupid ideas.”

He speaks, with delightful frustration, of people often offering advice when they are in a state where they cannot. They may think they have a grasp of the situation and its various intricacies, but in reality lack useful context. This, he points out, is one of the obstacles to running a cohesive team: Sometimes employees cling to issues they think have been ignored but have actually been considered.

SBF finds this irritating, and it tells us something about him. Whenever he listens to someone, SBF seems to be mentally balancing between their views and those of dozens of others.

Again, Samani calls this ability a special gift. Like anyone he's ever met, SBF is able to jump between details and then to the macro perspective. He knows the ins and outs of every trade possible on the FTX platform, while also being able to play against competitors. He also seems able to move freely between the functional perspectives of his team members.

As with the previous trait, this flair may cause slow decision making in others, but not in SBF. Perhaps a more reasonable risk is that SBF expects the rest of his team to see a similar panorama, and gets frustrated if they don't. It is difficult for anyone else in the organization to have his insight, especially between different entities. Will this cause unrest? It seems unlikely that there will be a problem that will have an impact.

After studying Sam Bankman-Fried, it's hard not to be impressed. In my interviews with investors, crypto experts, and himself, I was struck by the fact that this is a special executive and an unusual individual. One source put it in all seriousness, "SBF is the most capable person I've ever met. This should be explained as broadly as possible."

Simultaneously open and mystical, practical and intellectual, ethically principled and operationally flexible, SBF displays a rare set of personality traits that make him almost ideal for his field of work. Like everyone else, he seems able to navigate the chaos, calculating and calibrating the changing landscape of risk.

At FTX, he has found his cathedral. The fastest growing exchange in the crypto industry is creative and bold. That's not to say it wasn't controversial. In part two, we explore the company's victories and its weaknesses. But for now, we know for sure that it has a proper ruler.