This article was originally published on BlockTempo by James Chiu and is published with permission.

The Robin Hood Foundation (Robin Hood Foundation) founded by hedge fund tycoon Jones (Paul Jones) and the largest investment bank JPMorgan Chase held the "Robin Hood Investment Conference 2021" on the previous (16) day.This investment conference invited many industry leaders, including Dario, the founder of the world's largest hedge fund, Bridgewater Fund, the female stock goddess of Ark Investment, SBF, the founder of FTX, and former member of the Federal Reserve, Walsh.The following is the author's arrangement.

This investment conference analyzed the future financial situation from top to bottom from the central bank's monetary policy, overall economy, commodities, investment bank thinking, and future industry trends. Encrypted finance and the blockchain industry were also within the scope of the discussion. Speakers include Ray Dalio, founder of Bridgewater Fund, Cathie Wood, founder of Ark Investment, Sam Bankman-Fried, founder of FTX and other industry leaders.

The author sorted out three symposiums that are relatively related to the overall economy and encrypted market information. They are Dalio's "Is the US Stock a Bubble?" ", "Investment Philosophy and Encryption Forecast" by Goddess Wood, and "Digital Future" by FTX founder SBF.

Are U.S. stocks a bubble?

The FOMC meeting of the US Federal Reserve (Fed) ended yesterday (17). According to the statement after the meeting, the current monetary policy has not changed, the benchmark interest rate and the scale of bond purchases have remained unchanged. It seems that the Fed still believes that inflation is only a short-term phenomenon, really?

According to the interest rate dot chart, 13 out of 18 policymakers expect to raise interest rates in 2023, and 7 of them even think that they will raise interest rates twice, which means that the Fed has gradually changed from dovish to hawkish. From the perspective of economic data, the Fed has to do the same. Both the producer price index (PPI) and consumer price index (CPI) exceeded economists' expectations in May, and overheating inflation has become a problem that the Fed has to deal with.

For ordinary investors, whether it is stagnant inflation caused by rising inflation, or the exit of hot money brought about by shrinking balance sheets, it is likely to lead to asset bubbles, among which US stocks are the leading indicators.

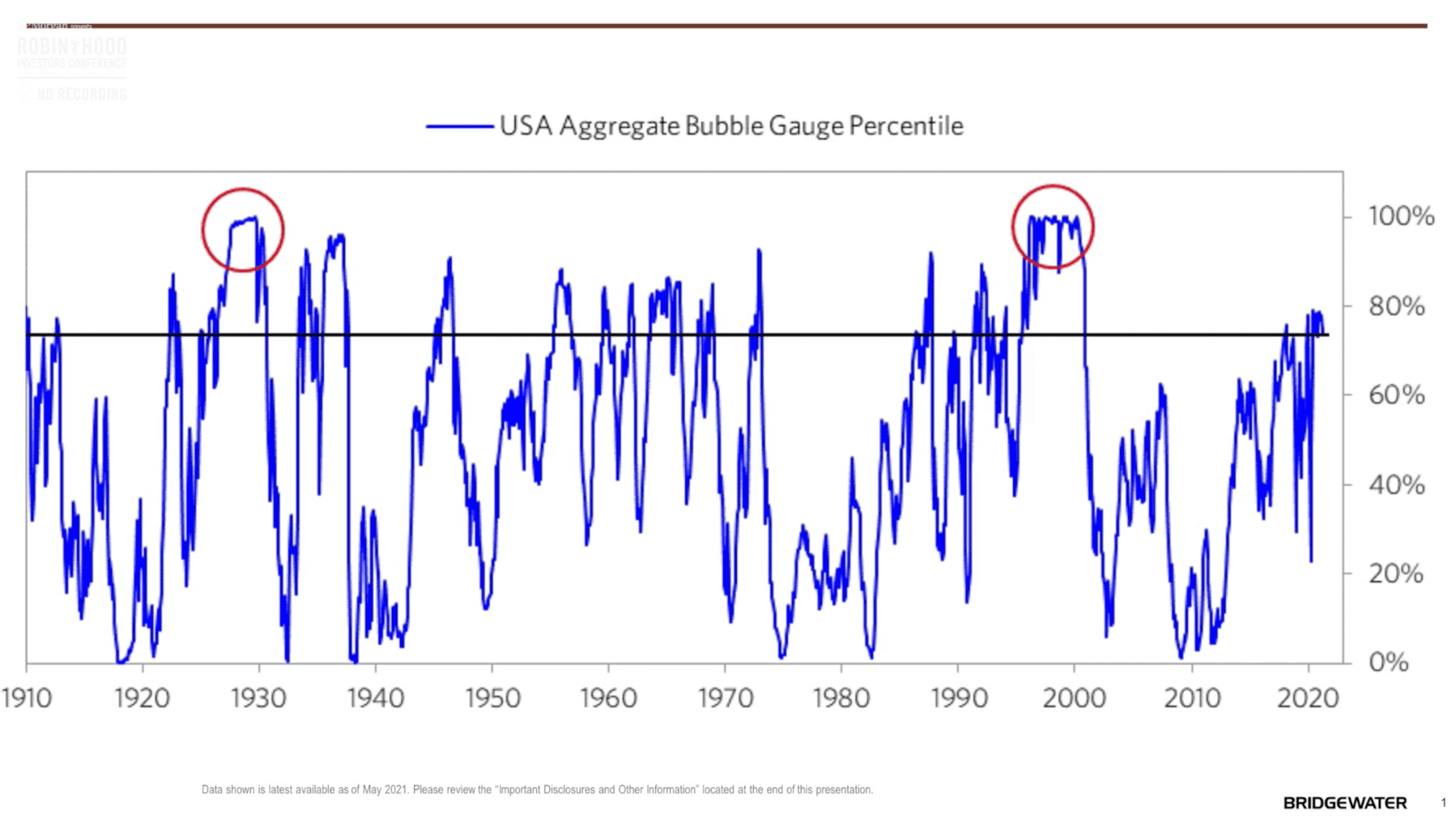

So, is the U.S. stock market a bubble now?

Dario, the founder of Bridgewater Fund, said in an investment conference that in the past 50 years of investment career, he has seen many asset bubbles, and from these experiences, he has derived "six bubble indicators", including:

1. Asset prices are too high by traditional metrics

2. Asset price volatility is high and continues to decline

3. New buyers have entered the market

4. Bullish sentiment is evident

5. Buyers purchase assets with highly leveraged financing

6. Buyers/Transactions Often Late Payments

Dalio pointed out that asset prices are too high, which means that according to traditional valuation indicators, asset prices are significantly higher than valuations, but he also said that asset prices are too high is only one of the necessary conditions for a bubble, and it does not mean that the bubble will burst immediately Lose.

Judging from past experience, asset prices are too high (annual dividends and stock prices do not match) may be maintained for a period of time until the time when the bubble is burst. The next step is to judge based on other indicators. Including high volatility of asset prices (chips change hands violently), shoe-shine boy theory (whether even strangers in bars start talking about stocks), whether investors start to use high leverage to leverage investment to get the maximum benefit, etc.

As far as the current situation is concerned, Dalio believes that US stocks are not in the bubble stage, but some technology stocks (growth stocks) do already meet items 3, 4, and 5.

image description

– Image credit: Bridgewater –

Female Stock God's Investment Philosophy and "Encryption Outlook"

As we all know, the investment philosophy of Ark Investment is to find "disruptive innovation" companies, and the female stock god Wood further elaborated the concept in more detail in the meeting.

Wood summarized five innovation platforms and fourteen new technologies.

The five major platforms include DNA sequencing, robotics, energy storage, artificial intelligence, and blockchain.

Fourteen technologies include deep learning, virtual technology, electric vehicles, self-driving technology, cancer screening, cell therapy, genetic science, 3D printing, cloud computing, big data, bitcoin, digital wallets, drones, aerospace technology .

She believes that these platforms and technologies will begin to integrate in the future to create cross-border advantages.

Taking Tesla as an example, electric vehicles have brought about an energy revolution, and the self-driving cars derived from electric vehicles use artificial intelligence, coupled with big data collection and cloud computing, to assist self-driving technology, and then it will change transportation industry structure.

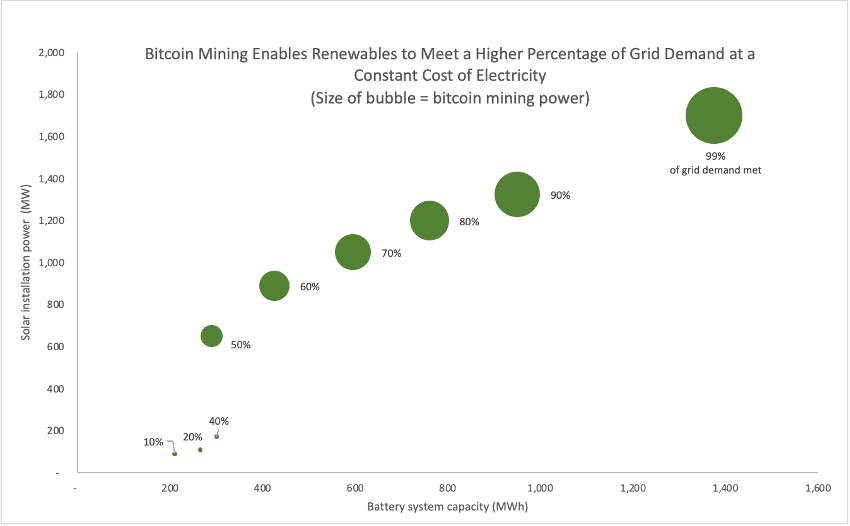

When discussing the blockchain industry, Wood defined Bitcoin as the "Reserved currency" in the encrypted market, because Bitcoin is the most secure of all encrypted currency networks, even though the price of Bitcoin has been affected recently. The interference of energy issues has caused many companies to suspend the purchase of bitcoin, but this is not necessarily a bad thing for bitcoin.

Wood said that the high value of Bitcoin will allow more investors to start investing in green energy industries such as solar energy, and mining activities and renewable energy will therefore grow mutually beneficially.

In fact, the investment in ArkTest model(below), they believe that the Bitcoin mining model can convert intermittent power resources into power stations with a certain load capacity, so power companies may be able to turn Bitcoin mining into one of the service items, so that Renewable energy can be used more efficiently.

image description

– Image credit: Ark Investment –

SBF's forecast for the blockchain industry

After talking about Bitcoin, it is time to talk about asset digitization and the future development of the blockchain industry.

Paul Jones, the host of the investment conference, holds 5% of cryptocurrency in asset allocation, so he also attaches great importance to industrial development.

Regarding the future development of DeFi, FTX founder Sam Bankman-Fried admits that he cannot predict, but he does understand that many commodities and assets are being digitized, and the world is indeed trying to create new digital application experiences, including value storage or payment function,

“I would be surprised if you told me that in the future all the world’s goods will be digitized and traded on the blockchain, but I do think that if the blockchain technology continues to improve, the industry’s There is great potential for digital application development.”

In addition, he also mentioned the biggest advantage of DeFi: composability. Since DeFi or other applications are open and transparent open source programs, this allows engineers to connect and build applications, just like Lego, blockchain applications are highly composable, and DeFi is even more so, it is easy to connect After that, new functions and new ecology have been formed. The past year has also proved that DeFi is extremely malleable.

In addition, he also mentioned the biggest advantage of DeFi: composability. Since DeFi or other applications are open and transparent open source programs, this allows engineers to connect and build applications, just like Lego, blockchain applications are highly composable, and DeFi is even more so, it is easy to connect After that, new functions and new ecology have been formed. The past year has also proved that DeFi is extremely malleable.

"This kind of composability is almost difficult to exist in the world outside of DeFi. (In traditional finance) every time the applications of the two parties need to be integrated, the process is very long and cumbersome. This is not a good user experience."

However, SBF believes that it will take some time to really reach that step. The problem to be overcome at present is the "scalability" of the blockchain.

SBF said that as long as large enterprises, such as Twitter, Facebook, VISA, Master Card, New York Stock Exchange, CME, etc., require huge transaction throughput, it may require millions of transaction throughput per second It is obvious that the current blockchain performance is still not enough, and Solana may be closer.

"If about 1% or more of the world's industry is moved to the blockchain, millions of transactions per second may be required. However, the current transaction volume per second of the blockchain cannot be achieved. Require.

And Solana may be the blockchain that comes closest to this requirement at present. Currently Solana's TPS peak value is 50,000 (capable of 50,000 transactions per second), and this peak value will continue to increase. "