This article is from Bishi, the original title is "FTX: No Downtime at Critical Moments, Creating a Trader's Paradise", reposted with authorization.

secondary title

Trader's Paradise

FTX was established in May 2019, and it has only been two years since then. However, the market environment when FTX was first built was not an ideal moment. At that time, the encryption market had just stepped out of the lowest point of the last round of bear market, and the market had entered a small bull market before the BTC halving. However, the structure of the exchange industry has initially taken shape. "HBO (Binance, Huobi, OKEx) + Coinbase" has become the leading platform in the global encryption exchange industry, and the competition between second- and third-tier exchanges is extremely fierce.

FTX can go from being surrounded by big powers to the fourth largest cryptocurrency exchange in the world. The total trading volume in April reached 400 billion U.S. dollars, and the average daily trading volume exceeded 14 billion U.S. dollars. It must have its unique means of attracting fans.

When talking about the vision of FTX, SBF once said, "We do everything possible to integrate all types of assets into trading products, so that FTX can provide any product that users want to trade." In other words,What FTX wants to create is a trader's paradise, so that every trader who comes to FTX can be satisfied.

In order to realize such a vision, the professional and international management team behind FTX has contributed a lot. The boss, SBF, graduated from the Department of Physics of the Massachusetts Institute of Technology (MIT), and then joined Jane Street, a well-known quantitative trading company on Wall Street, as a trader. He has a deep understanding of various products in the financial market.

Its management team also mainly comes from Jane Street, UBS, Deutsche Bank, Blackstone, Google and other financial or technology companies. It has a profound background in trading, risk control, product development, etc., and has a deep understanding of various financial derivatives. Understanding and rich experience in technology research and development. Just in May of this year, FTX hired Jonathan Cheesman, the former head of foreign exchange sales at HSBC, and Brett Harrison, the senior technical director of Citadel Securities, as important positions in the company to further strengthen the company's management team.

It is such a senior management team with rich financial experience that enables FTX to continuously launch innovative encrypted trading products, bringing more cutting-edge and innovative elements to the entire encrypted market to meet the needs of different traders.Mike Novogratz, founder of crypto investment banking giant Galaxy Digital, once commented on FTX as "the most innovative exchange."

At present, the product line of FTX Exchange is rich and complete. In addition to spot and futures contracts, it is also equipped with options, volatility products, leveraged tokens, forecasting markets, equity tokens and other financial derivatives and spot leveraged lending product. Judging from this product line, FTX can be said to have led the development direction of the encrypted secondary market in the past two years. Most derivatives are the first in the market, or launched ahead of most exchanges, providing investors with a variety of investments tool.

The non-liquidated leveraged tokens, mixed margin contracts, and USD stablecoin wallets, which are very popular in the market recently, were first introduced to the market by FTX, and were followed by other exchanges after they were recognized by investors. Through leveraged token trading, users can trade long/short with 3x leverage without margin. The mixed margin contract transaction saves the user from the inconvenience of depositing margin in different currencies. By default, all positions of the user use the same margin pool. In addition, FTX allows users to deposit USDC, TUSD, PAX, BUSD, HUSD and other compliant USD stablecoins into its USD Wallet for replenishment, and perform 1:1 exchange with USD. When the above stablecoins are deposited into the wallet, FTX will automatically identify and deposit them into the FTX USD stablecoin wallet.

In terms of equity certificates,FTX introduces popular US stocks into the encrypted market, allowing users to participate in the trading of popular US stocks at all times 7*24, At the same time, it can also attract US stock users to enter the currency market, which also makes FTX the most important exchange for equity token products.

The prediction market is called the potential next outlet of the encryption world by Vitalik, and FTX is the first leader to open up this market among centralized exchanges.The emergence of the forecasting market not only allows users to participate in the discussion of major public events, gain early insight into the trends of major events, but also have the opportunity to participate in them.During the 2020 US presidential election, FTX’s Trump contract prediction product has received extensive attention from the market and has become an effective tool of public opinion.

The launch of more specialized derivatives such as options and volatility contracts (MOVE) demonstrates FTX's professional capabilities in product development. Although most of these tools are more frequently used by institutional investors, with the promotion of investor education, these specialized tools are becoming more and more popular with ordinary investors.

secondary title

No downtime at critical moments

To judge whether an exchange is reliable, the core factor is reflected in its security. Whether the exchange has sufficient technology and equipment support to ensure no downtime under extreme market conditions is a very important safety factor.

The volatility of the encryption market is often very violent. Under extreme circumstances, the downtime of exchanges has also been a problem that has plagued the industry for many years. During this round of 5.19 slump, major exchanges such as Binance, Coinbase, Gemini, etc., and even the encrypted bank Revolut experienced downtime, while FTX was running smoothly without any downtime and the overall liquidation rate was extremely low .The following is the downtime of major exchanges on 5.19 when the market plummeted, compiled by Twitter V @Mr.Whale, FTX is not included.

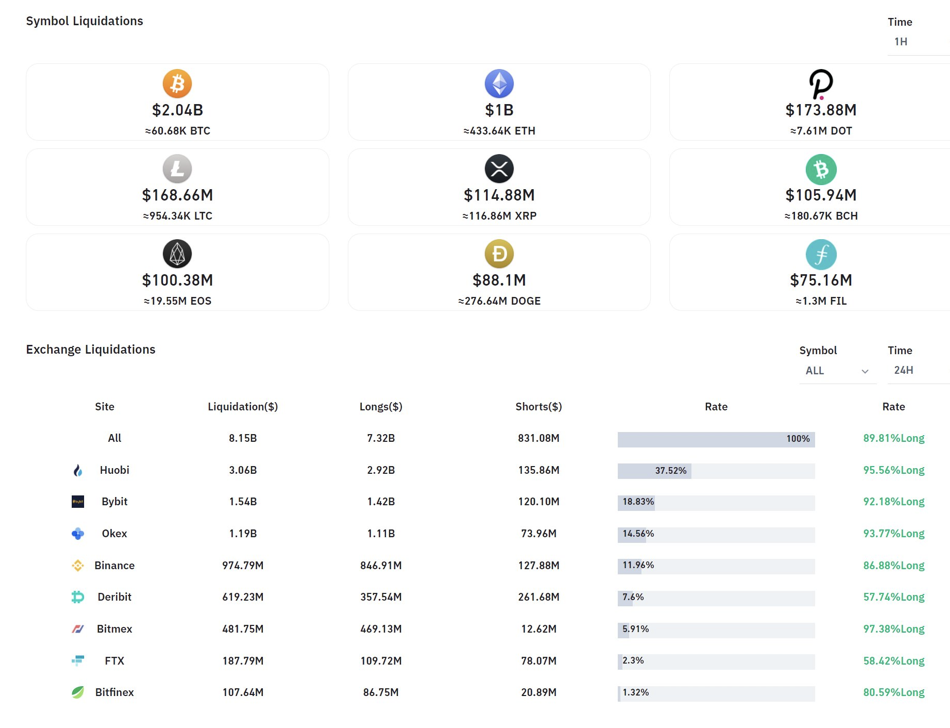

According to the contract data of the encrypted data platform Skew, the contract transaction volume of the entire network on May 19 was 241 billion U.S. dollars, and FTX was 14 billion U.S. dollars, accounting for 5.8%, but the liquidation rate was only 2% of the entire network liquidation amount. In comparison, the liquidation rates of the "Big Three" that we are familiar with during the crash are not low.

In terms of liquidation mechanisms, crypto market users often have an added layer of potential risk compared to investors in traditional financial markets. If market volatility intensifies and there is a significant loss of positions, most encrypted derivatives trading platforms will adopt an apportionment mechanism. Although most exchanges currently set up risk margins to make up for the loss of the position, a large part of the user's funds will still be used to make up for the loss of the position.FTX adopts a "three-level liquidation model" to avoid apportionment to the greatest extent and ensure users' benefits.

In terms of liquidation mechanisms, crypto market users often have an added layer of potential risk compared to investors in traditional financial markets. If market volatility intensifies and there is a significant loss of positions, most encrypted derivatives trading platforms will adopt an apportionment mechanism. Although most exchanges currently set up risk margins to make up for the loss of the position, a large part of the user's funds will still be used to make up for the loss of the position.FTX adopts a "three-level liquidation model" to avoid apportionment to the greatest extent and ensure users' benefits.

First of all, FTX will also monitor user positions and margin rates in real time. However, unlike other platforms, FTX will send a frequency-limited liquidation order when the user’s margin rate is lower than the maintenance margin rate to close out the position below the margin. In this way, the largest forced liquidation position on the FTX platform will follow the number of liquidation orders. increase and decrease. That is to say, FTX will not liquidate too quickly in a short period of time to prevent market volatility or even collapse due to large order liquidation.

Once the market fluctuates on a large scale and the normal clearing order in the FTX order book may not be able to close the position in time, FTX's liquidity support program will start. In this case, the liquidity alliance will automatically intervene in the account in danger of bankruptcy (explosion), take over the entire position, and remove the risk of position liquidation. In this way, in an emergency, through the operation of the liquidity provider, liquidity can be quickly injected into FTX, so as to realize the rapid processing of the positions of accounts that are about to explode, and prevent bankruptcy and the situation of positions becoming negative assets.

Finally, FTX has a risk insurance fund that can pay for the loss of the platform due to position loss. But the most important thing here is the role of liquidity provider. Because even if the net loss of a large position (such as hundreds of millions of dollars) can be covered by the risk guarantee, if the position is not liquidated, once the market continues to decline rapidly, the risk guarantee cannot be paid all the time. Therefore, the liquidity provider plays the role of the guarantor here. By liquidating positions in a timely manner, it can solve the problem that the risk guarantee fund cannot solve.

Through the above method,secondary title

The epitome of changing times

Objectively speaking, the rapid rise of FTX is inseparable from changes in the global macro economy and the rapid development of the industry. The encryption market is undoubtedly a new growth point in the future financial market. If many people are unwilling to admit this before 2020, it has become a consensus as many traditional financial institutions and entities enter the encryption market.

Just as SBF said when it first entered the encryption market, "Compared with the traditional financial market, the cryptocurrency market is still in its early stages and is not mature enough. There are many opportunities for secondary quantitative transactions, so I am here."Although times have changed, under the background of institutions entering the market, the encryption market undoubtedly still contains huge development opportunities. The multi-category trading and secure trading system provided by FTX will undoubtedly attract more trading enthusiasts to enter the encryption market. In this regard, FTX has become a bridge between emerging and traditional markets.

In addition, as a representative of "New Money", FTX is also showing its influence to the traditional world with a confident and positive attitude.

In May of this year, FTX signed a stadium naming agreement with the Heat of the NBA, and bought out the naming rights of the Heat's home stadium for the next 19 years at a price of 135 million US dollars. Starting next season, footage from the FTX Arena will appear on NBA broadcasts. As soon as the news came out, some American media worried that an encryption company that had just been established for two years could really sign the Heat's arena naming rights for the next 19 years? In this regard, SBF just said in a slightly Versailles tone, "This year is still a good year, we just don't need to wait another 18 years to repay this sponsorship."

From American Airlines Arena to FTX Arena, fans (or the public) just remember a name change, but if you look at it 19 years later, this may be a sign of the times. Under the big waves, emerging industries will always replace yesterday's glory. This does not mean that the traditional industrial division of labor is no longer important, but that the ranking of core technologies and social collaboration methods in different eras has changed.

secondary title

FTX logo

If FTX is going to be the symbol of the era of transformation, then SBF is the symbol of FTX.

Most users in the currency circle understand SBF from the photo of him lying on the lazy sofa in the office and falling asleep. But if you really see SBF for the first time, it may be hard to believe that this is a financial tycoon with a net worth of tens of billions. Fluffy, curly short hair, easy smile, perennial T-shirts, shorts dress seems to be a programmer from any IT company.

Since leaving Wall Street to enter the currency circle in September 2017, SBF first founded the encrypted market maker Alameda Research, and then established the encrypted exchange FTX. After FTX successfully gained a foothold, SBF stepped up the pace of investment: Solana public chain, Serum Dex, a decentralized exchange, and the $150 million acquisition of Blockfolio, an encrypted asset management tool, are all his masterpieces. This seemingly "ordinary" big boy is on the road to becoming an idol, building his own encryption empire in the currency circle.

Since leaving Wall Street to enter the currency circle in September 2017, SBF first founded the encrypted market maker Alameda Research, and then established the encrypted exchange FTX. After FTX successfully gained a foothold, SBF stepped up the pace of investment: Solana public chain, Serum Dex, a decentralized exchange, and the $150 million acquisition of Blockfolio, an encrypted asset management tool, are all his masterpieces. This seemingly "ordinary" big boy is on the road to becoming an idol, building his own encryption empire in the currency circle.

Even with such success, SBF seems to maintain a "hard times" style of work, at least as far as the employees in the FTX office are concerned, none of them seem to have seen the boss come home.

In the 24/7 encryption market, it is absolutely important to be sensitive and vigilant to the market at all times. For this 24-hour standby working method, SBF once explained that his brain is like a computer, which has a lot of memory (RAM) but only a small amount of hard disk storage space. Staying in the office can ensure that he can quickly return to the computer. Working status, because he did not really "shut down", the RAM does not need to be restarted.

If you want to explore why SBF works so selflessly, it may be traced back to his "altruism" thought.

Perhaps it is because he has accepted a lot of public welfare ideas since he was a child, and came into contact with the Effective Altruism (effective altruism) movement during the MIT period. SBF believes that "Earning to Give (earning money is to give)" is a kind of justice. Working hard, putting more money into donations, and providing the greatest happiness to the greatest number are the roots of SBF's altruistic beliefs. That’s why he donates 50 percent of his earnings to organizations working on issues like animal welfare and the potential threat of artificial intelligence.

Both selfless work and philanthropic altruism are the distinctive spiritual labels of SBF, and this is also subtly influencing and guiding the development direction of FTX, and it is also the spiritual foundation for their success in the encrypted world.

The development of FTX in the past two years has shown us the best development path for an innovative encrypted asset exchange. The development of the capital market will always experience ups and downs, and the market will always experience bulls and bears, but companies that insist on innovation and continue to innovate will definitely reap the rewards of the historical process. We look forward to SBF and his FTX continuing to bring more to the market in the future The innovative elements, and wish them to continue to grow in this emerging industry.